Adyen N.S. (Ticker: ADYEN.AS) began trading on the Euronext Amsterdam on 13 June 2018 and became one of Europe's largest technology initial public offerings (IPOs). Adyen, which means "start over again" in Surinamese soared to a market capitalisation of over €84 billion in 2021 as the COVID-19 pandemic accelerated the shift toward e-commerce and digital payments before crashing almost 75% to €21 billion in 2023.

Why did Adyen experience such a dramatic rise and fall and is it worth investing in today?

Contents

Executive Summary

Overview

Customer Base

Financial Analysis

Competitive Landscape

Management and Incentive Structure

Risks

Opportunities

Valuation

Investment Outlook

1. Executive Summary

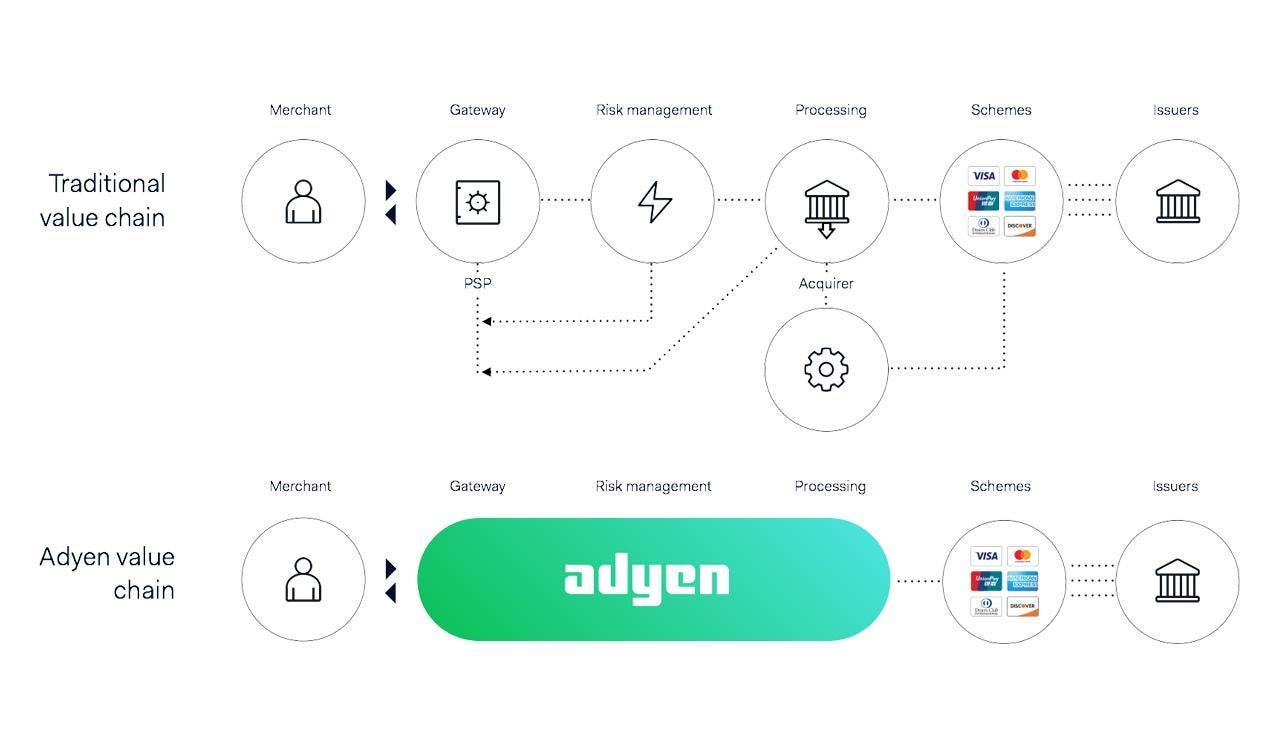

Adyen’s success can be attributed to its ability to solve the complex and fragmented payment processing challenges faced by businesses. Adyen offers a comprehensive platform that simplifies the entire payment lifecycle, including transaction processing, risk management, authentication, and issuing. This solution addresses the problem of businesses having to integrate multiple payment gateways, collaborate with various banks, and manage transactions across different regions and payment methods.

Over the last five years, Adyen has achieved a compounded annual growth rate of 44% in its processed volume, primarily driven by expanding existing customer relationships on the platform. Over 80% of this growth comes from nurturing these strong customer relationships, highlighting the importance of customer retention in Adyen's growth strategy. Adyen's adaptability and tailored payment solutions meet the unique needs of different sectors.

Adyen faces significant competition from various businesses in the payments value chain. This competition comes from both traditional and non-traditional players and includes companies with larger merchant bases and greater financial resources. The risk of commoditization in the payment processing industry, driven by technological advancements, increased competition, and shifting consumer behavior, poses a challenge to Adyen. It may lead to reduced revenue per transaction and difficulties in maintaining profitability.

The digital payment market is experiencing significant growth, driven by factors such as increasing internet penetration, smartphone usage, technological advancements, and the rise of digital wallets. Adyen is well-positioned to capitalize on this growth opportunity by leveraging its innovative approach, supporting emerging payment technologies, and offering versatile payment processing solutions. Adyen has the opportunity to differentiate itself by offering a wide range of value-added services that cater to merchant needs, helping it stand out in a competitive payments landscape.

2. Overview

Adyen is a global financial technology company that provides payment solutions and services to businesses of all sizes and industries. Founded in 2006 in the Netherlands, Adyen has emerged as a leading player in the payment processing industry, offering a comprehensive platform that handles the entire payments lifecycle.

At its core, Adyen provides a wide range of payment processing solutions to businesses. This includes transaction processing, managing gateway services, facilitating risk assessment and management, and ensuring the timely settlement of funds. Adyen's platform is designed to simplify the complexities of payment processing, offering a one-stop shop for businesses looking to accept payments from customers worldwide.

Broadly speaking, Adyen's full-stack payment gateway can be segmented into four main areas: Payments, Risk Management, Authentication, and Issuing.

Payments: Adyen helps businesses accept, process, and settle payments online, in person, and with unified commerce. It supports over 100+ payment methods and offers customization options for B2C, B2B, and subscription models.

Risk Management: Adyen's RevenueProtect product helps businesses detect, prevent, and respond to fraud and disputes, with customizable risk rules and templates for various industries.

Authentication: Adyen's 3D Secure 2 technology enhances payment authentication behind the scenes to improve authorization rates.

Issuing: Adyen offers virtual or physical payment card programs with Application Programming Interfaces (APIs) for custom-branded cards, real-time authorization, and compliance with regulatory standards.

Adyen has strategically established direct connections with both local and global card networks and banking systems. This extensive network allows businesses to tap into a vast customer base and accept payments from different regions and currencies seamlessly. Adyen's global reach is a key driver of its popularity among multinational enterprises.

What Problem Does Adyen Solve?

Adyen solves the problem of complex and fragmented payment processing for businesses. Many businesses, especially those operating in the digital space, face challenges when it comes to accepting and managing payments from customers across different channels, regions, and payment methods. This can result in a cumbersome and inefficient payment infrastructure, which hinders their ability to provide a seamless and frictionless payment experience to their customers.

As an example, before teaming up with Adyen, Etsy grappled with complex payment issues. They had to integrate multiple payment gateways and collaborate with various acquiring banks to handle transactions from different countries, making payment management time-consuming. Additionally, they faced high transaction fees and struggled to offer diverse payment methods.

By partnering with Adyen, Etsy simplified their payment processes. Adyen's platform consolidated payment methods, gateways, and acquiring banks into one, eliminating the need for multiple integrations and providing a centralized view of payment data. Adyen also offered direct connections to card networks and banking systems worldwide, expanding Etsy’s payment reach.

Moreover, Adyen's platform included advanced fraud detection and risk management, ensuring secure transactions and relieving Etsy from payment-related worries. Overall, Adyen's solution streamlined payment processing, improved the customer payment experience, extended global reach, and reduced complexity and costs, allowing Etsy to focus on core business growth.

3. Customer Base

Adyen serves a diverse customer base, catering to both traditional brick-and-mortar retailers and digitally native businesses. This diversity showcases its adaptability and ability to provide payment solutions that meet the unique needs of different sectors. Some of the industries within Adyen's customer base include e-commerce, travel, hospitality, technology, fashion, and more.

Multinational Corporations: Adyen has established itself as a preferred partner for many multinational corporations. Its global reach and capability to handle cross-border transactions make it an attractive choice for large enterprises with operations in multiple countries. These corporations rely on Adyen to facilitate seamless payments in various currencies and regions.

Digital-Native Businesses: Adyen's platform is well-suited for digital-native businesses, including tech startups, e-commerce platforms, and app-based services. These businesses benefit from Adyen's agile and innovative approach, allowing them to quickly adapt to changing customer preferences and emerging payment methods.

Traditional Retailers: Adyen also caters to traditional brick-and-mortar retailers that are looking to transition into omnichannel sales strategies. Its Unified Commerce offering provides these retailers with tools to bridge the gap between online and offline sales, enabling them to compete effectively in the digital age.

Platform Businesses: Adyen partners with platform businesses, which use its technology to offer payment-related services to their own customers. These partnerships extend Adyen's reach and influence in the market. For example, ride-sharing platforms or online marketplaces may use Adyen's infrastructure to handle payments for their users.

SMBs through Embedded Finance: Adyen's expansion into embedded financial products (EFP) enables it to serve small and medium-sized businesses (SMBs) as well. Through partnerships and its EFP suite, Adyen empowers platform businesses to provide financial services to SMBs, such as cash advances, business bank accounts, and card issuing. This positions Adyen to tap into the growing SMB market segment.

The Key Performance Indicator

Adyen reported Processed Volume (PV) of €426 billion in H1 2023, growing 23% year-over-year (YoY) primarily attributed to the expansion of existing customer relationships on the platform. Over 80% of the growth came from these strong customer relationships, and there was minimal volume churn (less than 1%). This highlights the importance of retaining and nurturing existing customers as a key driver of Adyen's growth, which aligns with the company's historical growth patterns. Adyen has achieved a staggering PV five-year compounded annual growth rate (CAGR) of 44%.

The Digital segment, which is the largest, experienced slower growth due to competitive pricing in North America. In the first half of 2023, Digital volumes reached €267.1 billion, accounting for 63% of total processed volume and growing at a rate of 23% YoY.

The Unified Commerce segment continued to grow globally, reaching €109.2 billion in H1 2023, with significant YoY growth of 36%. Unified Commerce volumes made up 25% of the total processed volume.

The Platforms segment saw volumes of €49.7 billion in H1 2023, constituting 12% of total processed volume and growing at a more modest rate of 3% YoY.

While Adyen's top 10 merchants contributed to a larger percentage of total revenue in 2022 compared to 2021 (33% vs. 29%), no single customer accounted for more than 10% of the total revenue in either year. Similarly, in terms of net revenue, the top 10 merchants contributed a slightly smaller percentage in 2022 (18% vs. 20%), and there were no customers individually responsible for more than 10% of the total net revenue in both 2022 and 2021. This diversified customer base reduces the company's reliance on any single customer for a significant portion of its revenue.

4. Financial Analysis

Adyen generates revenue from contracts with customers through four primary sources:

Settlement fees: These are fees paid by merchants for acquiring services, typically as a percentage of transaction value. Adyen charges these fees based on its costs plus a mark-up, and revenue is recognized when payment transactions are completed.

Processing fees: Merchants pay a fixed fee per transaction plus a fee determined by the payment method. Revenue is recognized when transactions are initiated via the Adyen payment platform.

Sales of goods: Adyen sells POS terminals and related accessories to merchants. Revenue for these sales is recognized when control of the terminal is transferred to the merchant, and this is considered distinct from payment services.

Other services: This category includes fees for foreign exchange services, third-party commissions, and issuing services. Revenue for these services is recognized at a specific point in time, while services transferred over time are related to the amortization of deferred revenue for services provided under merchant contracts, including terminal services fees as part of the unified commerce offering.

Adyen’s net revenue grew by 21% YoY to €739.1 million in H1 2023. Adyen has grown net revenue at a five-year CAGR of 35%. However, the growth was impacted by the changing macroeconomic environment and competitive pricing competition, particularly in the North American and online payments sector.

The take rate increased slightly to 17.3 basis points compared to 17.1 in the previous period but was influenced by the overall mix of merchants. Looking back historically, Adyen’s tiered pricing model has resulted in a lower take rate over the years, with take rate falling from a peak of 22.5 basis points in 2018. One way to easily notice this is by comparing the 44% CAGR in PV with the 35% CAGR in net revenue. The declining take rate is a result of the company extracting more value from its customers through its land-and-expand business model.

Net revenue contributions from different regions remained consistent YoY, with EMEA contributing the largest share at 57%, followed by North America at 25%, APAC at 11%, and LATAM at 7%. Notably, APAC experienced the fastest growth at 31% followed by North America at 23%, EMEA at 20%, and LATAM at 13%.

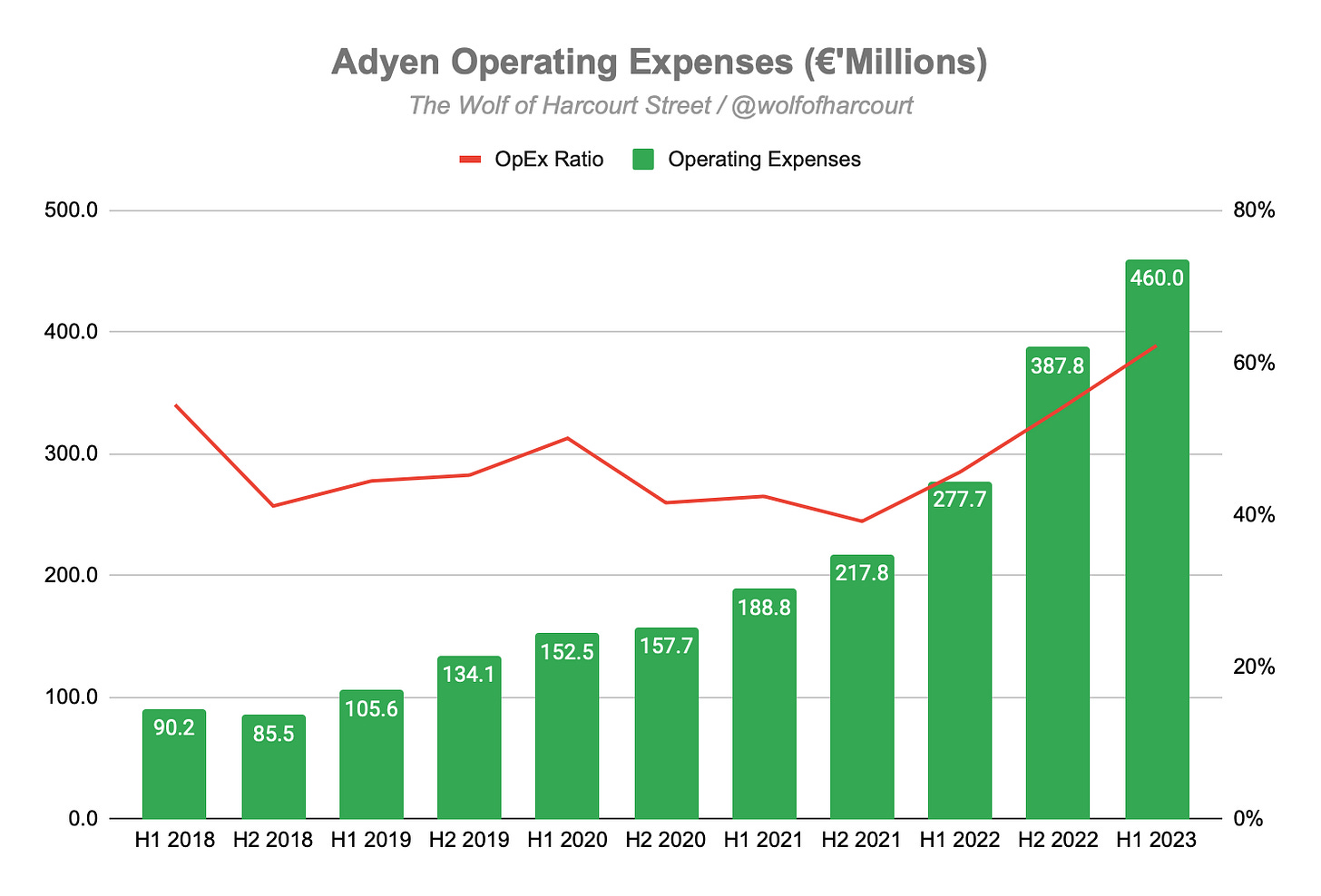

Adyen experienced a significant increase in operating expenses in H1 2023, which amounted to €460.0 million, representing a 66% increase from H1 2022. This increase was primarily driven by investments in expanding their global team in preparation for future growth. As a result of this increase, the Operating Expense (OpEx) ratio has hit a record high of 62%. The average OpEx ratio over the past five years has been 47%.

The majority of the operating expense increase was driven by employee benefits which reached €285.9 million in H1 2023, an 80% increase YoY. This increase reflects both the annualization of hires made in 2022 and ongoing investments in scaling the Adyen team, emphasizing the importance of people in their long-term success.

Sales and marketing expenses in H1 2023 totaled €27.4 million, marking a 13% YoY increase. This increase was driven by various activities, including events and campaigns aimed at generating and accelerating commercial pipeline leads effectively.

The investment by Adyen in expanding its global team resulted in EBITDA decreasing 10% YoY in H1 2023. The EBITDA margin has consequently decreased from 59% in H1 2022 to 43% in H1 2023. Management plans to plans to slow hiring in 2024 when its team would have reached “its next maturity level’. Despite the short-term impact of rapidly building its team, Adyen still maintains a very high level of profitability. The average EBITDA margin over the past five years has been 57%.

Despite some areas of the business experiencing slower growth in H1 2023, management believes that its medium to long-term opportunities remain unchanged. They acknowledge that growth can be non-linear and reiterate their financial objectives:

Financial Position

Over €1.9 billion in cash and cash equivalents net of payables to merchants

Positive working capital of €2.4 billion

Debt to Asset ratio of 64%

Zero goodwill

Zero debt

This is an A+ balance sheet.

Cash Flow Analysis

First off, I would like to draw your attention to the fact that Adyen calculates free cash flow using EBITDA minus capital expenditure (CapEx) and lease payments instead of the conventional method because their working capital isn't typical working capital. Adyen holds cash that needs to be passed on to others, so it's not considered their cash in the true sense, and therefore, they adjust their free cash flow calculation to account for this unique financial situation.

Adyen posted free cash flow of €247.7 million in H1 2023, decreasing by 20% compared to the previous year, primarily due to increased CapEx. The CapEx investment reached €56.1 million, accounting for 7.6% of net revenue, up from 6.6% in H1 2022. The company front-loaded its infrastructure investments in the first half of the year to enhance the efficiency of its single platform at a larger scale. The free cash flow conversion ratio was 77%, down from 87% in H1 2022.

Return on Capital

Adyen has historically achieved high returns on capital. There are two main of reasons for this:

High operating margin: Adyen's payment processing business has historically enjoyed healthy operating margins. This means that a significant portion of the company's revenue translates into operating profits, contributing positively to its return on capital.

Reinvestment runway: Adyen's global presence and its ability to serve merchants worldwide have contributed to its ability to generate higher returns on the capital it employs.

5. Competitive Landscape

The payments ecosystem is a complex web of players, and Adyen competes with several key entities in this landscape. Adyen has positioned itself as a global payment solutions provider, offering a full-stack payment gateway, risk management, and front-end processing services. Here's how Adyen fits into the competitive landscape based on the roles of different players in the payment processing value chain:

Payment Processors: Adyen directly competes with payment processors such as Stripe, Square and Fiserv. These companies provide services to merchants to accept and process payments, including credit card transactions, online and in-person payments, and often offer additional services like fraud prevention and analytics. Most merchants use multiple payment processors to ensure business continuity in the event that one experiences technical issues, a practice likely to continue given the recent Square outage. This reinforces the belief that the payments industry is not a zero sum game.

Payment Gateways: Adyen operates as a payment gateway, allowing merchants to securely transmit payment data for processing. Payment gateways like Adyen are critical in ensuring the security and integrity of payment transactions. Competitors in this space include companies like Stripe and Braintree (a subsidiary of PayPal).

Credit Card Networks: Adyen interacts with credit card networks like Visa, Mastercard, and American Express to route and process transactions. These networks play a central role in facilitating transactions and are not direct competitors of Adyen but rather essential partners.

Issuers: Issuers, represented by banks like Chase or Bank of America, issue credit cards to consumers and assume the risk associated with those cards. Adyen doesn't directly compete with issuers but works with them to facilitate payments.

Acquirers: Acquirers, often referred to as merchant acquirers, enable merchants to accept credit card payments. Adyen can function as both a payment processor and an acquirer, and it competes with other acquiring banks like Wells Fargo and Elavon.

Independent Sales Organizations (ISOs): ISOs, like Wells Fargo and other banks, are intermediaries between merchants, payment processors, and acquiring banks. Adyen competes indirectly with ISOs as it provides end-to-end payment processing services to merchants.

Adyen vs Stripe Comparison

Stripe is Adyen’s closest direct competitor. Based on the 2022 Stripe annual letter, the following comparisons can be made:

Adyen surpassed Stripe in processed in 2022, with $829 billion compared to Stripe's $817 billion. Adyens processed volume grew by 49% YoY compared to 28% for Stripe.

On a net take rate basis, Stripe's 0.34% is double that of Adyen's 0.17%. Adyen's focus on enterprise clients with higher payment volumes results in lower negotiated rates, while Stripe started with SMBs and has higher blended take rates.

Adyen reported a 55% EBITDA margin compared with negative EBITDA for Stripe. Stripe has a larger employee base, but Adyen processes more payment volume per employee, making it more efficient.

6. Management and Incentive Structure

Adyen was founded in 2006 by Pieter van der Does and Arnout Schuijff, both experienced entrepreneurs in the payments industry. The company's inception was driven by its shared vision to create a more streamlined and innovative payment platform that could address the evolving needs of businesses in the digital era.

Pieter van der Does, the CEO of Adyen, had previously co-founded Bibit, a successful online payment platform, in 1999. Bibit was later acquired by Royal Bank of Scotland in 2004. Meanwhile, Arnout Schuijff, Adyen's CTO, had extensive experience in the payments industry, having worked at various companies specializing in risk management and payment processing.

Recognizing the challenges and limitations of existing payment solutions, Pieter and Arnout saw an opportunity to build a more comprehensive and flexible platform that could handle the full payments lifecycle. Adyen follows the Adyen formula, which consists of principles to guide how the company operates and includes the importance of picking up the phone for effective problem-solving, fostering a culture of personal contribution, and maintaining flexible career paths.

Adyen's management is incentivized through a remuneration policy that emphasizes a long-term orientation and aligns their interests with the company's performance and success. In 2022, the Management Board members did not receive variable remuneration, which means they were not awarded bonuses or performance-related pay during that year. Instead, their compensation was solely based on their base salary.

Management Board members receive very little share-based compensation (SBC). In 2022, only two out of the six managing directors received SBC, Mariëtte Swart and Alexander Matthey. This low level of SBC is very unusual, especially for technology companies and it is what sets Adyen apart from its U.S competitors. One contributing factor is the 20% bonus cap in the Netherlands, which prevents financial institutions from awarding bonuses to their employees that exceed 20% of their annual base salary.

The goal of the Adyen remuneration policy is to align management's incentives with Adyen's long-term objectives which include sustainable growth, development, profitability, and the overall financial success of the company. By tying compensation to these goals, the company aims to ensure that management's focus is on the long-term health and prosperity of Adyen rather than short-term gains.

7. Risks

1. Intense Competition

Adyen faces significant competition in the financial technology and payment processing industry. As learned when analysing the competitive landscape, Adyen competes against a wide range of businesses in the value chain. These competitors may have dominant market positions or offer a broader range of products and services to customers that Adyen does not currently provide.

One key aspect of competition that Adyen faces is the size and scale of its competitors. Some competitors have larger merchant bases, higher transaction volumes, greater financial resources, and larger market shares compared to Adyen. These factors can provide significant competitive advantages, such as the ability to invest more in technology, expand their offerings, or negotiate favorable terms with merchants.

Additionally, Adyen is not only competing against traditional payment processors but also facing competitive pressure from non-traditional players and other parties entering the digital payments industry. These new entrants may compete directly with Adyen in one or more functions involved in processing merchant transactions. They might introduce disruptive technologies, innovative business models, or unique value propositions that challenge Adyen's market position.

Intense competition can trigger price wars, where payment processors continually lower their fees to win or retain clients. This can erode the pricing power of established companies like Adyen and result in reduced revenue per transaction. It is worth noting that Adyen does not pursue deals at all costs. It maintains a focus on sustainable pricing and profitability. If pricing is not deemed sustainable, Adyen may choose not to pursue a deal.

2. Commodization of Payments

The risk of commoditization of payments, often referred to as the "Race to Zero," is a significant one for companies like Adyen. Commoditization refers to the process by which products or services become increasingly standardized, leading to intense competition and price pressures.

Payment processing has evolved significantly over time, transitioning from primarily cash-based transactions to the use of credit cards and electronic payments. Payment networks like Visa and Mastercard were established to facilitate these transactions and charged fees for their services. Initially, fees were relatively high, limiting credit card acceptance to larger businesses.

There are three key factors that are leading to commoditization of payment processing:

Technological Advancements: Advances in technology have made payment processing more efficient and cost-effective. This has lowered the barriers to entry for new payment processors and increased competition.

Increased Competition: The payment processing industry has become increasingly crowded with various players, from traditional financial institutions to fintech startups. This intense competition has driven down fees as companies vie for market share.

Consumer Behavior Shift: The rise of e-commerce and digital payments has reshaped consumer behavior. More people prefer the convenience of online shopping and digital payments, which has further fueled competition in the industry.

This trend could impact Adyen negatively in a number of ways. As fees continue to decrease, Adyen may face challenges in maintaining its revenue streams. With fees and charges for payment processing services being driven down, Adyen may find it challenging to maintain profitability. In a commoditized market, clients may be more inclined to switch providers for better pricing or terms. Adyen may experience higher customer churn rates as clients seek cost savings or improved deals from competitors.

8. Opportunities

1. Digital Payment Market Expansion

The digital payment market was valued at $8.36 billion in 2022 and is projected to grow at a CAGR of 11.8% from 2023 to 2027. This growth is attributed to factors such as increasing internet penetration and smartphone usage worldwide. This presents a significant expansion opportunity for Adyen, given the favorable market dynamics and growth drivers.

The widespread availability of the internet, coupled with the prevalence of smartphones, has led to a surge in digital payment adoption. According to the Digital 2022 October Global Statshot Report by DataReportal, over 63% of the world's population has used the internet, providing easy access to online payment methods. Adyen can leverage this trend to expand its customer base globally.

The market's growth is driven by technological advancements, including the development of robust APIs that enable businesses to integrate payment solutions seamlessly. Adyen, known for its innovative approach, can benefit from these advancements to enhance its offerings. The introduction of Near-field Communication (NFC) and QR code payment technologies has boosted the adoption of e-wallets and contactless payments worldwide. Adyen can tap into this trend by supporting these technologies and providing secure, convenient payment solutions.

The use of digital wallets is poised for rapid growth. Digital wallets offer a range of functionalities beyond in-store payments, including online purchases, fund transfers, and the storage of various data types such as gift cards and loyalty cards. This versatility makes digital wallets attractive to consumers across generations, with millennials leading the adoption at 94%, followed closely by Gen Z at 87%, Gen X at 88%, and even 65% of baby boomers using them.

Estimates suggest that more than half of the global population will use mobile wallets by 2025. The use of P2P apps is projected to increase by 21% from 2022 to 2026, with an anticipated 70% of smartphone users using P2P apps by 2026. Adyen can capitalize on this growing trend by offering support for a wide range of digital wallets, enabling merchants to provide convenient and efficient payment options for their customers.

2. Value-Added Services

The commoditization of payments is a real risk for Adyen but it also presents the opportunity for Adyen to differentiate itself through offering additional value-added services which can enhance the overall value proposition for merchants.

Adyen can expand support for Automated Clearing House (ACH) transactions, driven by their projected CAGR of 13.10% to reach $13.91 trillion by 2026. Adyen's platform can enhance ACH transaction efficiency, meeting the demand for faster and more convenient digital payments. Adyen can capitalize on the popularity of real-time payments, with a 69% YoY growth in the US and global adoption, offering businesses access to networks like RTP and FedNowSM for faster and more efficient payment options.

Adyen can partner with hardware providers and retailers to assist the transition to advanced payment technologies, including EMV chip tech and unattended retail systems like kiosks and vending machines. Adyen can promote the adoption of mobile point-of-sale (mPOS) solutions, allowing businesses to accept mobile device payments, benefiting from the anticipated 14.03% CAGR in mPOS transactions.

Adyen can integrate advanced payment security solutions into its platform, such as 3-D Secure 2.0 for enhanced authentication in card-not-present transactions. Additionally, Adyen can leverage biometric technology, including fingerprint scanners and facial recognition systems, to enhance payment processing security and improve the user experience.

Adyen can support emerging technologies like Secure Remote Commerce (SRC), which powers digital wallet solutions like Click to Pay. By enabling customers to store payment information securely and use it across various checkout environments and devices, Adyen can enhance the convenience and security of online transactions.

Maintaining excellent customer service and support can be a differentiator in a crowded marketplace. Ensuring that merchants have a seamless experience with Adyen's services can foster loyalty and trust. The company's technology and solutions are structured to enable swift adaptation to industry trends and customer needs. An example of this agility is demonstrated by Adyen being the first platform to introduce the Apple Tap-to-Pay product in 2022. This showcases Adyen's ability to stay at the forefront of innovation and leverage its technology to differentiate itself from competitors.

9. Valuation

Discounted Cash Flow

I have projected the future cash flows over 5 years using a discount rate of 10% and a terminal EBITDA exit multiple of 17. I am opting to use this multiple based on the quality of the underlying Adyen business notably its growth prospects, margins and cash conversion. For context, Adyen currently trades a forward EV/EBITDA multiple of 19.

I forecast net revenue to grow in the low-twenties driven by the secular industry tailwinds as well as the expansion of the Adyen product offerings. I forecast the EBITDA margin to fall to 44% in 2023 before creeping back up to 55% by the end of year 5. Note that management's long-term guidance is for an EBITDA margin above 65% but I do not expect this to happen over the forecast period given the increased investment that the company is making for future growth.

CapEx has been forecast at 5% annually in line with management guidance. Given the low levels of SBC, I have projected 3% dilution over the entire forecast period.

Based on these assumptions I believe that the fair value of Adyen is close to €866 per share suggesting a potential upside of 24% based on the share price on 13 September 2023 of €700.

Price to Earnings Ratio

Adyen trades at a forward P/E ratio of 31x. Despite the multiple compression over the past year, Adyen still trades at a premium valuation relative to some of its publicly listed competitors.

Adyen commands this premium relative valuation given its superior growth rate and margins. In my view, a valuation of 31 times earnings is reasonable for a company with a 44% EBITDA margin and a 20% annual growth rate.

10. Investment Outlook

Adyen has established itself as a reputable payment processing company with a global presence. Its business model has attracted a wide range of clients, including high-profile merchants. Adyen has historically enjoyed strong margins due to its focus on efficiency. Effective management is crucial for the success of any company, and Adyen has shown its capability in this regard. A well-managed company can adapt to industry changes and position itself for future growth.

Increased competition and the commoditization of payments could put pressure on Adyen's margins. As more players enter the market, it may become challenging to maintain the historically high margins. But, it's not simply about offering the lowest price, as any provider can do that and loose money. Adyen stands out by having the lowest cost structure due to its entirely in-house platform architecture. Its net take rate is only half that of Stripe, yet it manages to achieve an impressive 44% EBITDA margin despite investing heavily, while Stripe operated at a negative margin in 2022. Adyen could compete on price and undercut its competition if it chose to do so, but instead, it concentrates on providing the highest quality product.

One view as to why the Adyen stock price was halved after its H1 2023 results is that the market now doubts the company's terminal value and the sustainability of its competitive edge. Bears believe that margins are permanently affected and won't rebound over the long run, while bulls contend that the decline in margins and return on capital from increased investments for future growth is short-term. My view is the latter.

The valuation appraisal implies that Adyen is undervalued with a modest margin of safety. The analysis assumes conservative margin recovery but if Adyen can return to its long-term target the upside could be even more favourable to investors.

Disclosure: At the time of writing, the author holds a long position in Adyen N.V.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for the write up. Is there a risk that the margins are rapidly shrinking given quarterly operating income has declined. Growth without sustaining margins would not provide stock market returns. Thoughts?

Good work! I'm doing a write-up on the payments industry as well, making more a comparison between Adyen and Braintree. I'm currently leaning positive on Adyen as well.