Airbnb: 2021 provides best financial results in the company’s history

Airbnb Q4 2021 Earnings Analysis

Today, I analyse the Q4 2021 earnings report of Airbnb (Ticker: ABNB), which was released on 15 February 2022.

In this report, I will cover the following:

Key Highlights

Wall Street Expectations

Business Activity

Income Statement

Balance Sheet

Cash Flow

Guidance

Conclusion

1. Key Highlights

Revenue: $1.53 billion +78% year-over-year (YoY)

Gross Profit: $1.24 billion +90% YoY

Net Income: $54.5 million compared to a loss of $3.89 billion YoY

2. Wall Street Expectations

Revenue: $1.46 billion (beat by 5%)

Adjusted Earnings per Share: 0.03 (beat by 60%)

Source: Zachs

3. Business Activity

In Q4 2021, Nights and Experiences Booked of 73.4 million represented a significant increase of 59% YoY and slight a decrease of 3% compared to Q4 2019 levels. Continued strength in Nights and Experiences Booked in North America, EMEA and Latin America have driven significant YoY growth.

Strong recovery in Nights and Experiences Booked combined with higher Average Daily Rates (‘ADR’) drove over $11 billion of Gross Booking Value (‘GBV’) in Q4 2021. Both Q4 and FY 2021 saw significant increases in GBV from a year ago as well as from pre-COVID periods in 2019.

Nearly half of all nights booked in Q4 were for stays of a week or longer. One in five nights booked were for stays of a month or longer. In the past year alone, Airbnb guests stayed in about 100,000 towns and cities around the world, with nearly 175,000 of them booking stays for three months or longer.

4. Income Statement

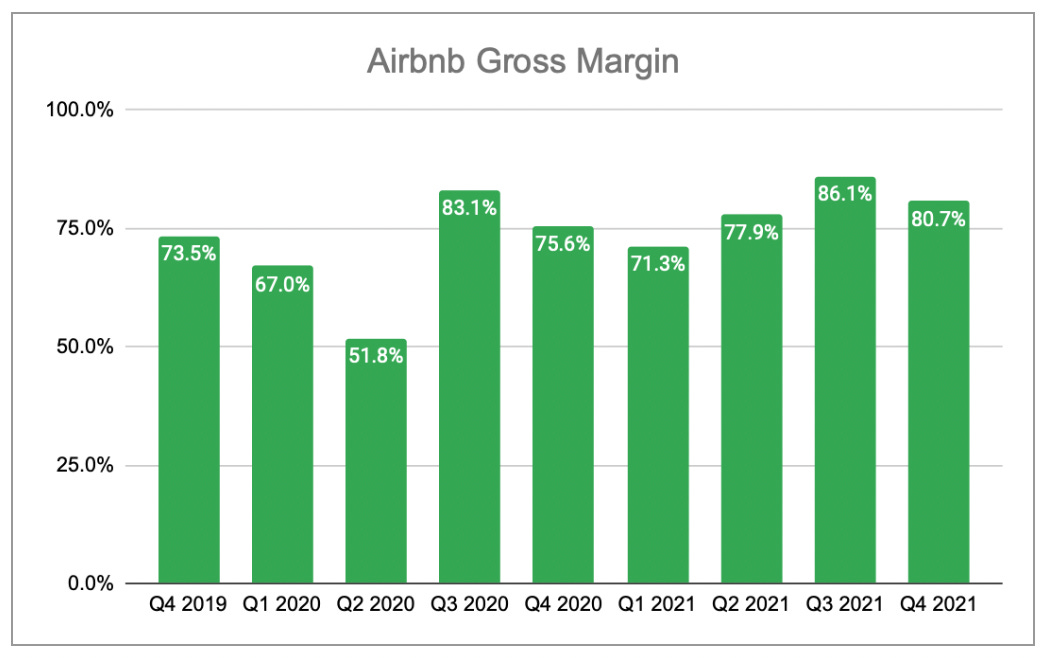

During the quarter, Airbnb grew its top line by 78% YoY. Gross profit is following a similar trajectory and increased by 90%, with gross margin also improving from 76% to 81% YoY.

Operating expenses decreased by 69% to $1.16 billion during the quarter. The main driver here was product development expenses which decreased by 82% to $367 million. In Q4 2020, product development expenses included $1.81 billion related to stock-based compensation (SBC) from one-time IPO-related costs. Excluding the impact of SBC expenses, product development expenses increased 20% YoY.

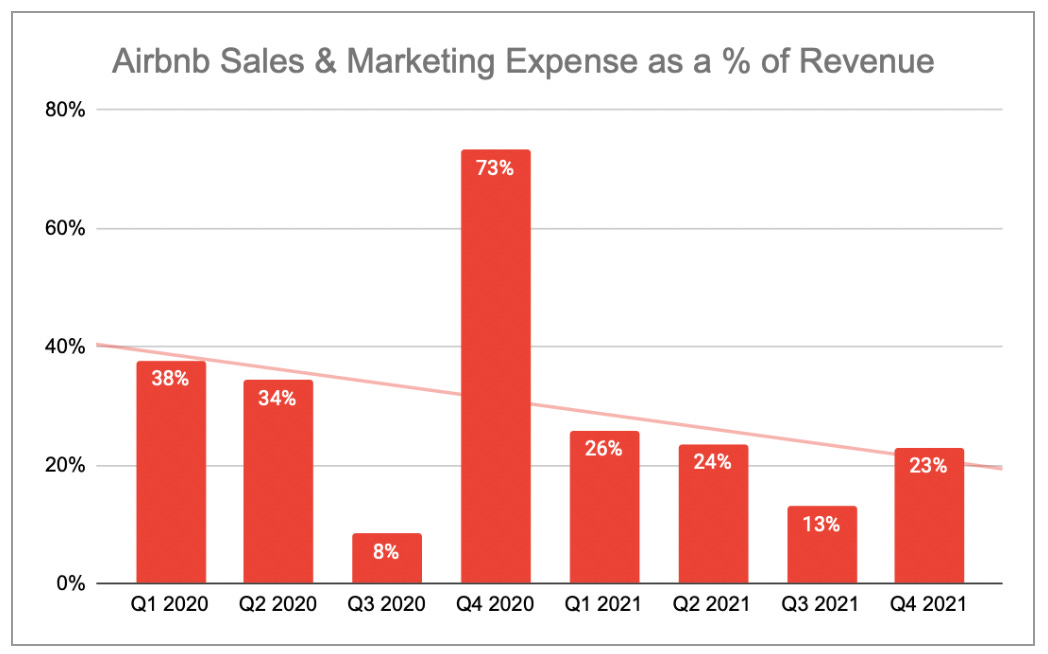

The level of spending on sales and marketing expenses is an area I pay particular attention to. At one stage, Airbnb was spending 73% of its revenue on sales and marketing expenses alone. This was an anomaly in Q4 2020 as a result of one-time IPO-related SBC costs. Overall the trend is moving in the right direction and has decreased to 23% at Q4 2021.

5. Balance Sheet

Observations

Over $6 billion in cash and cash equivalents up from $5.5 billion at Q4 2020

Total Liabilities as percent of Total Assets is 65% down from 72% at Q4 2020

Current Assets to Current Liabilities ratio of 1.95 up from 1.71 at Q4 2020

Goodwill balance making up 5% of total assets, no significant movement since Q4 2020

Long-term debt has increased by over $166 million during 2021

7. Cash Flow

Airbnb operating cash flow has improved dramatically. At year end 2021, cash flow from operations increased from -$639 million to $2.19 billion.

One of the main items in the operating cash flow is stock-based compensation (SBC) expense which decreased by 70% YoY. As mentioned earlier, significant SBC was incurred in Q4 2020 from one-time IPO-related costs.

Airbnb’s YTD investing cash flow resulted in a deficit of $1.35 billion compared to a surplus of $80 million YoY. The key driver here is the significant investment in marketable securities which ties in with the increase we see on the balance sheet.

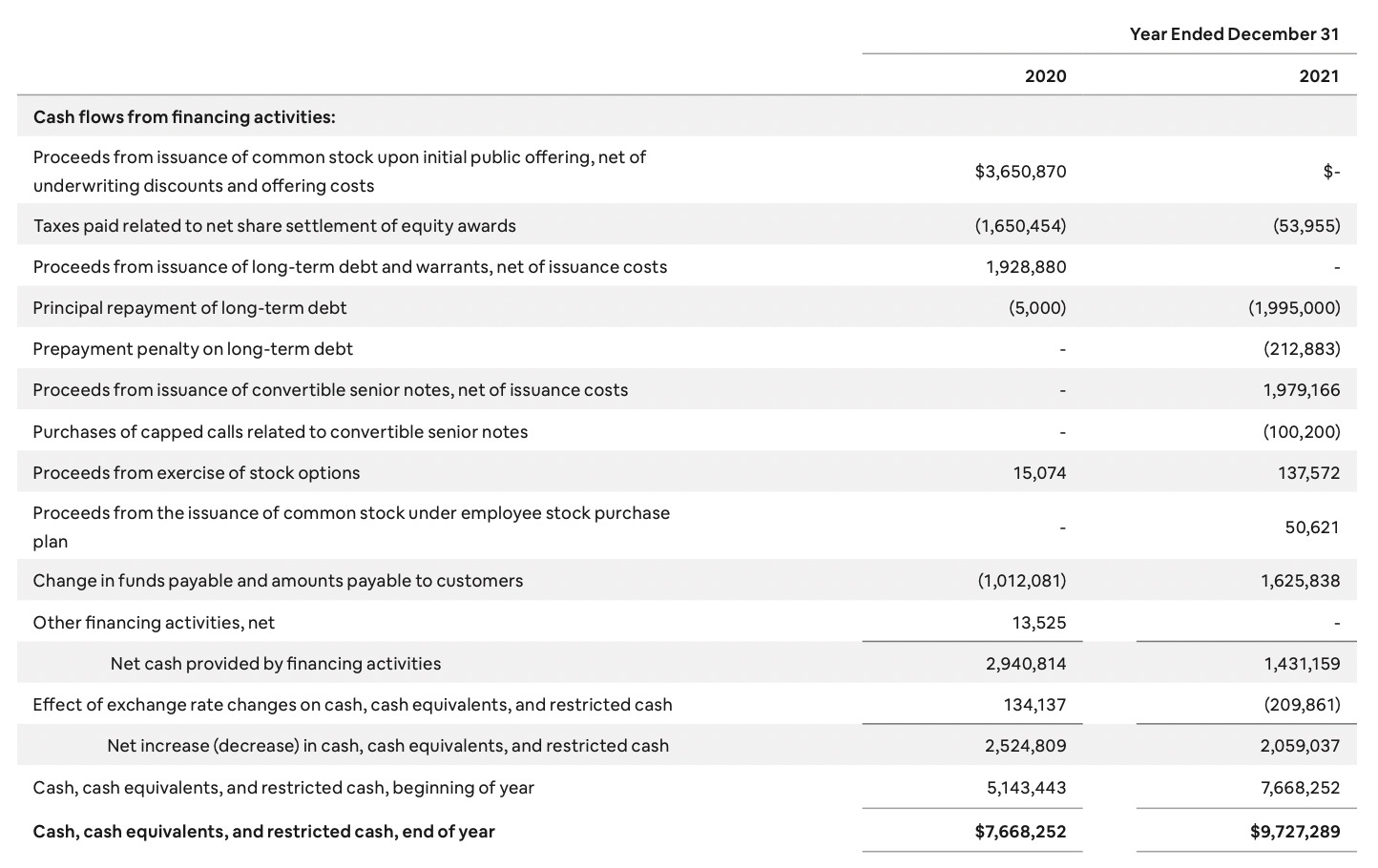

Airbnb’s YTD financing cash flow resulted in a surplus of $1.43 billion compared to a surplus of $2.94 billion YoY. The key driver here is the proceeds from the IPO received in 2020.

Overall, Airbnb produced YTD free cash flow of $2.16 billion compared to a deficit of $667 million YoY. This is a healthy trend.

7. Guidance

Management expects revenue for Q1 2022 to be between $1.41 billion and $1.48 billion. The lower end of this revenue range would represent an increase of approximately 59% from Q1 2020, while the higher end of this range would represent an increase of approximately 67%.

8. Conclusion

Despite a resurgent wave of Covid-19 variants, Airbnb beat revenue and profit estimates once again. The company is heading into 2022 even stronger than before the pandemic which is quite the feat. On the conference call CEO Brian Chesky said:

‘We're in the midst of a revolution in travel because people have newfound flexibility in how they live and work. Our adaptable model and our relentless innovation have allowed us to respond to this moment. And in 2022, we're going to accelerate our pace of innovation and continue to support this new world of travel’

It appears that the best is still yet to come.

On Wednesday 16 February, the day after earnings were released, Airbnb closed the session up more than 3.5%.

Rating: 4 out of 5. Exceeds expectations.

Disclosure: The author holds a long position in Airbnb

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week.

All previous posts are viewable on the website.

If you enjoy what you see, please give it a like, comment below and share.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.