Airbnb: 2024 Financial Model and Valuation Update

Analysing the fair value of Airbnb

Airbnb went public in December 2020 in what was one of the most highly anticipated IPOs of the year. Over three years have passed, and the Airbnb company today is much stronger than it was back then.

In this update, I present the Airbnb financial model and a fair value assessment. Before delving into the financial model, let's remind ourselves about the 2023 earnings.

2023 Earnings Summary

Nights and Experiences Booked

Nights and Experiences Booked totaled 448 million, representing a 14% YoY increase and a 37% increase compared to 2019 levels.

Guest demand remains robust, with the exit from 2023 marking the highest quarterly growth rate of the year for first-time bookers. Momentum in Airbnb app downloads increased, with 55% of gross nights booked in the Airbnb app during Q4 2023, compared to 50% in Q4 2022.

As part of international expansion, Airbnb is experiencing growth in all regions, especially in under-penetrated markets. For example, in Q4 2023, gross nights booked in Brazil nearly doubled compared to the same period in 2019. During each quarter in 2023, Airbnb saw the highest level of growth in Nights and Experiences Booked in Latin America, among all regions, compared to 2019.

Gross Booking Value and Take Rate

Gross Booking Value (GBV) grew 16% YoY to reach $73 billion in 2023. This increase was driven by an increase in Nights and Experiences Booked, accompanied by a modest 2% rise in the Average Daily Rate (ADR) to $164.

During 2023, the implied take rate was 13.5%, slightly up from 13.3% during 2022. Since 2019, the take rate has been on a positive upward trajectory. Airbnb has achieved this through various means, including service enhancements and expansion into experiences. At the beginning of 2024, Airbnb updated their guest service fee to allow for an additional charge for cross-currency bookings, which will be margin accretive and is common for companies operating across different currencies.

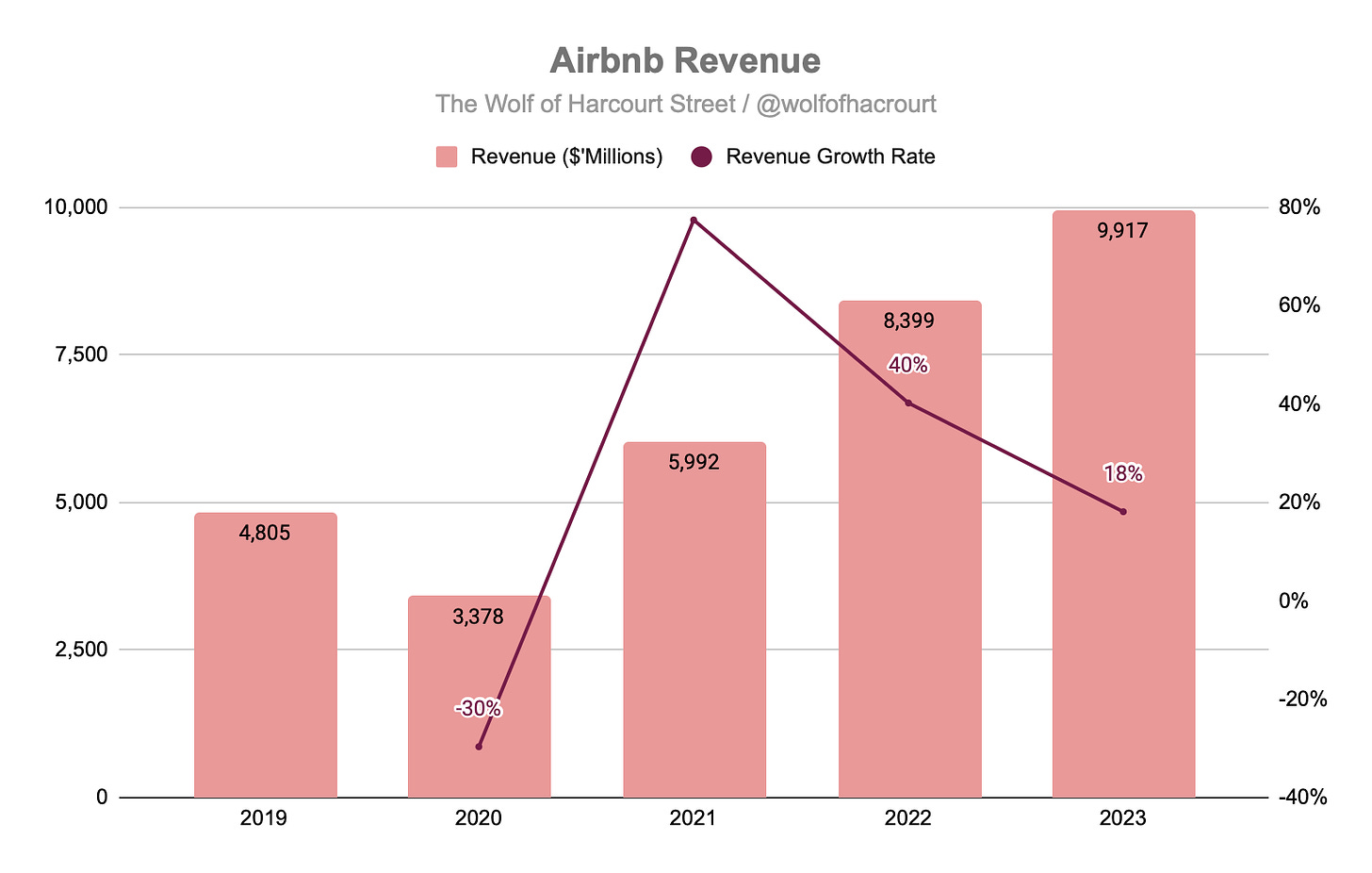

Revenue

Airbnb’s revenue is derived by multiplying its Gross Booking Value by its take rate. Airbnb grew its revenue by 18% in 2023, reaching $9.9 billion. Since 2019, Airbnb has doubled its revenue in just four years, with this period negatively disrupted by the impact of Covid on the travel industry.

Profitability

Airbnb reported operating income of $1.5 billion in 2023, representing an operating margin of 15%, compared to 21% in 2022. Airbnb’s operating expenses in 2023 included the one-off impact for lodging tax reserves and reserves for host withholding taxes to the value of $974 million. Excluding this item would have resulted in an operating margin of 25%.

Airbnb’s net income exploded to reach $4.8 billion in 2023, with the net income margin increasing from 23% in 2022 to 48% in 2023. A significant driver of this was the release of a valuation allowance of $2.7 billion on certain deferred tax assets. Excluding the release of the tax provision and the lodging tax reserves, the net income margin for 2023 is 31%.

Airbnb’s interest income increased by 287%, from $186 million in 2022 to $721 million in 2023. Airbnb benefits from being the Merchant of Record, which means that it is the party that processes and distributes the actual payment for a product or service. When a customer makes a booking on Airbnb, Airbnb receives the cash in advance. This cash is held on behalf of the host and paid out once the service has been provided. With the interest rate hikes over the past year, Airbnb was able to benefit from investing the cash in short-term US Treasury bills before paying it out to hosts.

Free Cash Flow

Airbnb generated over $3.8 billion of free cash flow (FCF) in 2023, resulting in a FCF margin of 39%. Airbnb’s asset-light nature means that it is a very cash-generative business. Airbnb is the world’s largest accommodation provider despite the fact that it owns no real estate.

If we exclude the non-recurring tax withholding expenses and lodging tax reserves, Airbnb would have posted an FCF margin of 49%. This is crucial to consider when modelling future cash flows for Airbnb later in the report.

Discounted Cash Flow Analysis

Future cash flows have been projected over five years using a discount rate of 10%. A terminal growth rate of 2% has been assumed, which is at the lower end of the range, given the potential impact recessions can have on cyclical activities such as travel.

In 2023, Airbnb processed $73.3 billion of GBV through its platform, representing 8.6% of the $856 billion global travel and tourism industry. In 2019, Airbnb accounted for just 4.9% of the total market, meaning that it has almost doubled its market share in four years. This analysis projects that Airbnb can increase its market share to 11.8% by 2028. This results in a revenue CAGR of 11% over the forecast period compared to 20% between 2019 and 2023.

The EBIT margin has been forecast to be 24% in 2024, in line with the adjustment discussed earlier in 2023 as well as the slightly lowered management guidance issued during the Q4 2023 earnings call. As the business continues to scale, an EBIT margin of 30% is assumed by 2028. The key driver of this margin expansion will be the launch of an advertising platform. At the moment, Airbnb earns nothing from advertising, but competitor Booking.com earned over $1 billion from advertising in 2023.

I think it’s a massive opportunity. I think you could imagine easily adding a few equivalent percentage rates of take rate if you were to scale that over time. I think there’s a lot of comparables like Amazon, one of the largest advertising platforms now in the world, Etsy or Alibaba or even Booking.com. This is a big part of their take rate.

- Airbnb CEO Brian Chesky

Rather than banking all of the FCF benefit from excluding the non-recurring tax withholding expenses and lodging tax reserves in 2024, the FCF margin has been assumed as 43% in 2024 before reaching 47% in 2028. A Capital Expenditure margin of 0.5% has been anticipated for all years, in line with the margin from 2023.

The dilution rate has been assumed as 1% per year, resulting in total dilution of 5%.

Based on these assumptions, the fair value of Airbnb is approximately $191.43 per share, indicating a potential upside of 18% compared to the share price on 20 March 2024, which was $161.79.

Conclusion

Airbnb increased its global travel and tourism market share by 3.7% of the total market between 2019 and 2023. This analysis assumes that it will gain another 3.2% by 2028. This feels conservative considering Airbnb only offered short-term stays within 190 countries in 2019. Today, Airbnb offers short-term stays and much more, including experiences in more than 220 countries. Running in tandem, the introduction of an advertising platform could boost the take rate by as much as 2% or 3%, which would be high-margin revenue that could similarly boost operating margins.

The real opportunity with this stock lies in relation to the expectations regarding future FCF. According to the consensus estimates on Koyfin, Wall Street is expecting FCF of $4.04 billion or a margin of 36% in 2024. From what I can gather, analysts are failing to adjust for the one-off impact of lodging tax reserves and reserves for host withholding taxes in 2023. If this hunch is correct, the consensus estimate should be closer to $5 billion compared to the $4.8 billion in this analysis. This discrepancy would explain the undervalued status.

This analysis suggests that the markets growth expectations are too conservative with a relatively wide safety margin.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

I would just like to say thank you for the work you put in! This was an extremely well-written and accessible analysis that left me with a lot of food for thought!

Wolf I think your FCF is overstated because it includes the add back of SBC. I think you have implied that you are accounting for that with a dilution assumption. Is that correct? If so, can you share how you've done do?