In this report, I will cover the following:

Overview

Customers

Capitalisation

Revenue & Margins

Valuation Multiples

Balance Sheet and Cash Flow

Stock Price History

Competitors

Management and Ownership

Risks

Opportunities

Investment Strategy

Airbnb, Inc

Ticker: $ABNB

Sector: Communication Services

Market Cap: $106.8 billion

1. Overview

Airbnb is a company that operates an online marketplace for lodging, primarily homestays for vacation rentals, and tourism activities. Since it was founded in 2007 it has grown to 4 million hosts who have welcomed over 800 million guest arrivals to approximately 100,000 cities in almost every country and region across the globe. Hosts on Airbnb are everyday people who share their worlds to provide guests with the feeling of connection and being at home.

Airbnb’s hosts are the foundation of the community and business. Stays are made possible by hosts. It is their individuality that makes Airbnb unique. From schoolteachers to artists, hosts span more than 220 countries and regions and approximately 100,000 cities. Airbnb enables hosts to provide guests access to a vast world of unique homes and experiences that were previously inaccessible, or even undiscovered. The role of the host is about more than opening their door. A great host enables guests to find a deeper connection to the places they visit and the people who live there.

The community of hosts started by sharing their spare bedrooms on Airbnb in a few large cities. Soon, hosts listed entire homes, cabins, treehouses, boats, castles, and luxury villas — practically any space that you could think of — in big cities, small towns, and rural communities in nearly every corner of the world. Hosts generally fall into two categories: individual and professional. Individual hosts are those who activate their listings directly on Airbnb through the website or mobile apps. They come from all walks of life and list their spaces, including private rooms, primary homes, or vacation homes on Airbnb. Professional hosts are often those who run property management or hospitality businesses and generally use application programming interfaces to list their properties on the platform. These hosts expand the types of listings available to guests. Once there were millions of homes on Airbnb, the company recognized that hosts could share not only their homes but also their interests and talents. From exploring graffiti art in New York City to finding hidden jazz clubs in London, Airbnb Experiences offer authentic activities in over 1,000 cities around the world.

2. Customers

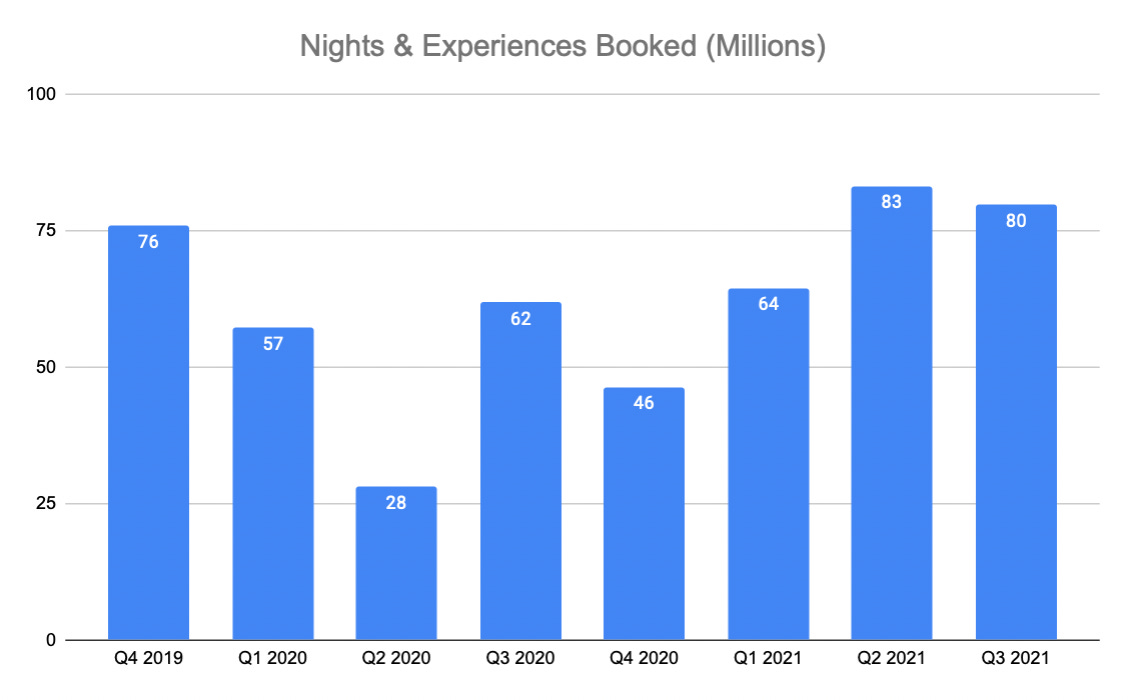

In Q3 2021, Nights and Experiences Booked of 79.7 million represented a significant increase of 29% year-over-year (YoY) and slight a decrease of 7% compared to Q3 2019 levels. Excluding Asia Pacific, global Nights and Experiences Booked exceeded 2019 levels in the quarter. Continued strength in average daily rate (ADR) drove even stronger gross booking value (GBV) performance than Nights and Experiences Booked. In Q3 2021, GBV was $11.9 billion, representing a YoY increase of 48% and an increase of 23% compared to Q3 2019.

Guests

This summer, Airbnb reached a major milestone of 1 billion cumulative guest arrivals as more people got vaccinated and travel restrictions were relaxed.

Hosts

Host earnings reached a record $12.8 billion in the quarter, and active listings continued to grow. This economic empowerment is what continues to attract new hosts to the platform.

Monetisation

The primary source of Airbnb’s revenue comes from service fees from bookings charged to both guests and hosts. Depending on the size of the reservation, guests are required to pay a nonrefundable service fee based on the type of listing—usually between 5% and 15%. A more expensive reservation results in lower service fees for guests because families or groups with larger reservations can save money for other travel expenses.

Hosts are also charged a 3% fee with every completed booking to cover the processing of guest payments. When a reservation is booked, guests pay the service fee—unless the host cancels or retracts the listing. If the reservation is altered, Airbnb adjusts service fees to accommodate users.

3. Capitalisation

Airbnb went public on the 9th December 2020 through an IPO raising an $3.5 billion valuing the company at $47 billion. Shares were priced at $68 but soared to open $146. Airbnb is very recent to the public markets and its story is only getting started.

4. Revenue and Margins

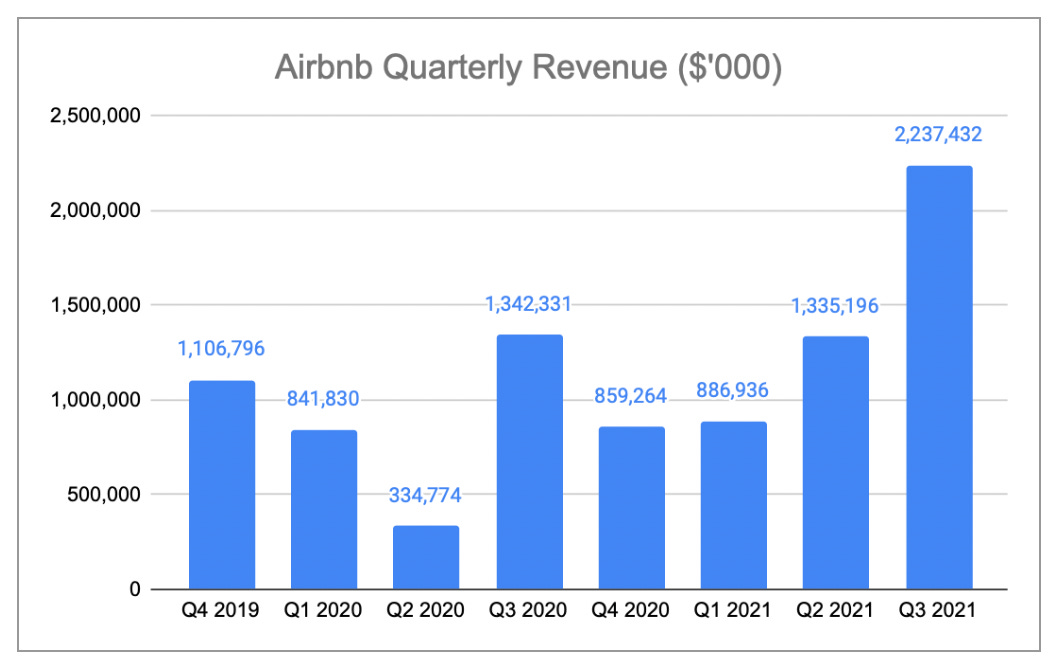

Airbnb has had a very tough start to life as a public company. A global pandemic was always going to have a big impact on a company that operates a travel and experiences platform. However, during its most recent financial results for Q3 2021 Airbnb recorded revenue of $2.24 billion. This was a new quarterly record and represented an increase of 67% YoY. This also surpassed the Q3 2019 pre-covid revenue by 36%.

Gross margin was 86.1% in Q3 2021 compared to 83.1% in Q3 2020. Apart from Q1 and Q2 2020 when the covid pandemic was at its worst, Airbnb has maintained a gross margin in excess of 70%.

Despite being in high growth mode, Airbnb recorded a profit on the bottom line of $834 million during Q3 2021 compared to a profit of $219 million YoY. This represents a net income margin of 37%, up from 16% year-over-year. It is important to point out that Q3 is historically Aibnb’s strongest quarter given the seasonality involved in travel and tourism.

5. Valuation Multiples

Airbnb very much lives up to the characteristics of a growth stock and trades at high valuation multiples. Below are some of the key valuation metrics that I have identified. I have included the PE ratio but despite Airbnb posting a profit in Q3, it does not have a track record of profitability as this is not the focus for the business at this time.

When Airbnb shares hit an all-time high of $219 in February of this year, the P/S ratio hit 38. In July when Airbnb was trading at its lowest since going public the P/S ratio halved to 19. Post Q3 earnings Airbnb now trades at a P/S ratio of almost 30.

But, how does this valuation compare to competitors?

The short answer is that Airbnb is significantly more expensive than its closest competitors. This is not a cheap stock.

6. Balance Sheet and Cash Flow

Commentary

Over $5.9 billion in cash and cash equivalents

Total Liabilities as percent of Total Assets is 67%

Current Assets to Current Liabilities ratio of 1.86

Goodwill balance making up almost 5% of total assets meaning the impact of the risk of impairment is low. This balance is a result of a number of acquisitions including Hoteltonight for $400m in 2019

Quite a bit of debt on the balance sheet with almost $2 billion in long-term debt

7. Stock Price History

After the IPO at the end of 2020 the share price spiked immediately hitting an all time high of $219 in February 2021. Since then, the shares traded downwards into the lock up period, trading as low as $130 in May 2021. The stock then built its post IPO base for a number of months before the recent power earnings gap after crushing Q3 estimates in November. This week the price pulled back to the 200 day moving average in line with the broader market correction in growth names.

8. Competitors

As Airbnb operates an online marketplace, it faces competition for both hosts and guests.

Competition for Hosts

Airbnb competes to attract and retain hosts on its platform to list their homes and experiences, as hosts have a range of options for doing so. Airbnb competes for hosts based on many factors including the volume of bookings generated by guests, ease of use of the platform, the service fees charged, host protections and brand. The pandemic has also meant that a cancellation policy is now a key consideration.

Competition for Guests

Airbnb competes to attract and retain guests to and on its platform, as guests have a range of options to find and book accommodations and experiences. Airbnb competes for guests based on many factors, including unique properties and availability of listings, the value and all-in cost of offerings relative to other options, brand, ease of use of the platform, the trust and safety of the platform, and community support. The pandemic has also resulted in a shift towards competition based on the availability of property close to where guests live and in non-urban markets, as well as the perceived safety and cleanliness of listings on the platform.

Competitors include:

Online travel agencies (OTAs)

Booking Holdings (Booking.com, KAYAK, Priceline.com, and Agoda.com); Expedia Group (Expedia, Vrbo, HomeAway, Hotels.com, Orbitz, and Travelocity); Trip.com Group (Ctrip.com, Trip.com, Qunar, Tongcheng-eLong, and SkyScanner); Meituan Dianping; Fliggy (a subsidiary of Alibaba); Despegar; MakeMyTrip; and other regional OTAs

Internet search engines

Google, including its travel search products; Baidu; and other regional search engines

Listing and meta search websites

TripAdvisor, Trivago, Mafengwo, AllTheRooms.com, and Craigslist

Hotel chains

Marriott, Hilton, Accor, Wyndham, InterContinental, OYO, and Huazhu, as well as boutique hotel chains and independent hotels;

Chinese short-term rental competitors

Tujia, Meituan B&B, and Xiaozhu

Online platforms offering experiences

Viator, GetYourGuide, Klook, Traveloka, and KKDay

Despite all of the competition, Airbnb has the highest Net Promoter Score (NPS) compared to its competitors.

9. Management and Ownership

Brian Chesky is the co-founder and Chief Executive Officer of Airbnb. In 2007, Chesky and Joe Gebbia became Airbnb’s first hosts. Since then, Chesky has overseen Airbnb’s growth to become a community of over four million hosts who have welcomed more than 800 million guests across 220+ countries and regions.

A graduate from the Rhode Island School of Design, Chesky has embedded his creative roots in Airbnb’s culture, product and community. This design-driven approach has enabled a system of trust that allows strangers to live together, and created a unique business model that facilitates connection and belonging.

Chesky is a signatory to the Giving Pledge and has committed to donating the net proceeds of his CEO equity compensation to community, philanthropic and charitable causes. Originally from Niskayuna, New York, Chesky is an Airbnb Experience host in San Francisco.

Brian Chesky appears to be very well received at Airbnb with an 92% approval rating on Glassdoor with the company overall scoring 4.2 out of 5 by its own employees.

In Brian Chesky, Airbnb meets my criteria of being led by a visionary founder.

10. Risks

1. Future pandemics

This risk is pretty obvious. In an attempt to limit the spread of the COVID-19 virus, governments imposed various restrictions on travel, limitations on social or public gatherings, and other social distancing measures, which have had and may continue to have a material adverse impact on business and operations and on travel behavior and demand.

In response to the economic challenges and uncertainty resulting from the COVID-19 pandemic and its impact on the business, in May 2020, Airbnb announced a reduction in their workforce of approximately 1,800 employees. This reduction in workforce would have resulted in the loss of institutional knowledge, relationships, and expertise for critical roles, which may not have been effectively transferred to continuing employees and may divert attention from operating the business, create personnel capacity constraints, and hamper the ability to grow, develop innovative products, and compete. Any of these impacts could materially adversely impact the business and reputation and impede the ability to operate or meet strategic objectives. The reduction in headcount and other restructuring activities resulted in a charge of over $151 million in 2020.

Research from the National Academy of Sciences in the United States suggests that probability of a pandemic with similar impact to COVID-19 is about 2% in any year, meaning that someone born in the year 2000 would have about a 38% chance of experiencing one by now. The report goes on to state that the probability is growing and highlights the need to adjust perceptions of pandemic risks and expectations for preparedness.

2. Failure to retain existing hosts or add new hosts

Airbnb depends on hosts maintaining their listings on their platform and engaging in practices that encourage guests to book those listings, including increasing the number of nights and experiences that are available to book, providing timely responses to inquiries from guests, offering a variety of desirable and differentiated listings at competitive prices that meet the expectations of guests, and offering exceptional hospitality, services, and experiences to guests. Ultimately, these practices are outside of Airbnb’s control. If hosts do not establish or maintain a sufficient number of listings and availability for listings, the number of Nights and Experiences Booked declines for a particular period, or the price charged by hosts declines, Airbnb revenue would decline and business, results of operations, and financial condition would be materially adversely affected.

If Airbnb are unable to retain existing hosts or add new hosts, or if hosts elect to market their listings exclusively with a competitor or cross-list with a competitor, Airbnb may be unable to offer a sufficient supply and variety of properties or experiences to attract guests to use the platform.

As mentioned earlier, Airbnb has over 4 million hosts. If one of these host’s results in a guest having a bad experience, this might irreversibly damage the Airbnb brand image and result in guests using alternatives outside the Airbnb platform.

11. Opportunities

1. Work from anywhere trend

The world is undergoing a revolution in how we live and work. Technologies like Zoom make it possible to work from home. Airbnb makes it possible to work from any home. This newfound flexibility is bringing about a revolution in how we travel. Millions of people can now take more frequent trips, take longer trips, travel to more locations, and even live anywhere on Airbnb.

For centuries, people have been confined to where they work. Then the pandemic hit and suddenly released tens of millions of people from the need to work in specific places at specific times. They can now work from anywhere, travel any time, and stay longer.

This trend towards more flexibility will only accelerate. In recent months, some of the largest companies in the world, including Apple and Microsoft have announced increased flexibility for employees to work remotely, and it is expected that more companies will follow.

Airbnb started out as a platform for vacation rentals. The pandemic accelerated the remote work trend. Airbnb is now also a platform for living. During the Q3 earnings conference call, management noted:

‘Long-term stays of 28 days or more remained our fastest-growing category by trip length and accounted for 20% of gross nights booked in Q3 2021, up from 14% in Q3 2019’

2. Adaptability

One of Airbnb’s most important competitive advantages is its adaptability. Airbnb does not own any physical property meaning it can quickly pivot to any change in travel demand. In comparison, hotels are constrained by supply and cost constraints. Management noted the following on the Q3 earnings conference call:

‘Instead of guests traveling to the same historically popular urban destinations, we’ve seen consistent demand growth in both nearby and rural destinations. Over 40% of gross nights booked in Q3 2021 were within 300 miles of home, up from 32% in Q3 2019, while gross nights booked to rural destinations increased more than 40% in Q3 2021 from Q3 2019. Meanwhile, we’ve seen urban travel gradually returning, but fanning out beyond iconic cities. In Q3 2021, our top 10 cities represented 6% of gross revenue, down from 11% in Q3 2019. During the pandemic, more than 100,000 cities have had at least one Airbnb booking, including more than 6,000 cities and towns receiving their first booking ever’

Over 6,000 cities and towns receiving their first booking ever suggests that there are few if any hotels in some of these locations. If any of these locations takes off and becomes a hipster travel location, Airbnb can leverage the properties already in the area to cater to this demand by enticing new hosts at zero marginal cost. However, this is not as simple for a hotel as the average hotel can take up to three years to build with a significant upfront cost.

12. Investment Strategy

Airbnb has got all the hallmarks of a category defining leader. The platform is scalable with an enormous addressable market. The company has a strong market position, a recognisable brand and a visionary leader in Brian Chesky who has managed the issues faced during the pandemic admirably. Airbnb is a stronger company now than it was before the pandemic due to the actions of its founder which included reorganising the company structure and becoming more lean and efficient.

There is a pent up demand for travel and I can see this lasting past the next twelve months. Heading into 2022 I believe that a lot of people have plans to visit destinations that they couldn’t for almost two years. Layered on top, Airbnb benefits from the work from anywhere trend which is going nowhere.

While the stock is certainly not cheap relative to its peers, the advantages that Airbnb possesses over the competition means that it commands a premium valuation. On 10 December it was announced that Airbnb will be added to the Nasdaq 100 index effective as of the close on 17 December.

Disclosure: The author holds a long position in Airbnb.

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week.

All previous posts are viewable on the website.

If you enjoy what you see, please give it a like, comment below and share.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

I admire your writing. It's to the point, full of facts and I never feel I am being sold into an idea. PS: I do not own ABNB yet.

I admire your writing. It's to the point, full of facts and I never feel I am being sold into an idea.

PS: I do not own ABNB yet.