Executive Summary

Airbnb recorded 111 million Nights and Experiences Booked (+12% YoY), marking its highest growth quarter of the year. Growth accelerated across all regions, led by Asia Pacific and Latin America. While Airbnb operates in 220+ countries and regions, five key markets—the U.S., U.K., Canada, France, and Australia—still account for 70% of bookings, highlighting significant global expansion potential.

Gross Booking Value (GBV) grew 13% YoY to $17.6 billion (+15% FX-neutral), driven by booking growth and a modest 1% increase in ADR to $158.

Airbnb reported Q4 2024 revenue of $2.48 billion, a 12% YoY increase driven by strong growth in nights stayed, a modest ADR rise, and enhanced monetization efforts such as guest travel insurance expansion and a new cross-currency booking fee.

Operating income surged to $430 million, translating to a 17% operating margin—a sharp improvement from -22% in Q4 2023, though last year’s margin was impacted by a $935 million one-off tax reserve charge.

Net income stood at $461 million (19% margin), a stark contrast to the -16% margin in Q4 2023, which was also affected by the lodging tax reserve.

Airbnb generated $458 million in operating cash flow in Q4 2024, leading to $458 million in free cash flow (FCF) after just $8 million in CapEx, representing an 18% FCF margin.

Over the past 12 months, FCF reached $4.5 billion with a 40% margin, up from 39% in 2023. This strong cash flow allowed Airbnb to repurchase $3.4 billion of stock in 2024, reducing its diluted share count from 676 million in Q4 2023 to 658 million in Q4 2024.

CEO Brian Chesky outlined Airbnb’s next chapter, emphasizing a single-app strategy to expand into travel-adjacent services like experiences and host tools. With plans to launch at least one new business annually—some expected to reach $1 billion in revenue—Airbnb enters 2025 with strong momentum but now faces the challenge of delivering on these ambitious growth targets.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $2.48 billion (+12% YoY)

Net Income: $461 million (vs. -$349 million YoY)

Free Cash Flow: $458 million (vs. $46 million YoY)

2. Wall Street Expectations

Revenue: $2.42 billion (beat by 2%)

Earnings per Share: $0.58 (beat by 26%)

3. Business Activity

Nights and Experiences Booked

Building on early-quarter momentum, Nights and Experiences Booked accelerated in Q4 to 111 million (+12% YoY)—making it the highest-growth quarter of the year.

December was the strongest month, with the highest YoY growth in nights booked for 2024. Growth was partly driven by Airbnb’s app strategy, with nights booked on the app increasing 22% YoY in Q4. App bookings accounted for 60% of total nights booked, up from 55% in the prior year. They also saw a notable increase in first-time bookers.

Globally, growth accelerated across all regions, with Asia Pacific and Latin America leading the way.

Airbnb operates in 220+ countries and regions, yet just five markets—U.S., U.K., Canada, France, and Australia—account for 70% of bookings. This represents a significant global expansion opportunity. To drive penetration, Airbnb has implemented a comprehensive strategy with both broad and localized efforts.

North America: Mid-single-digit growth in Nights and Experiences Booked in Q4 2024 vs. Q4 2023, accelerating from Q3 2024. Growth was driven by strong underlying travel trends.

EMEA: Low double-digit growth in Q4 2024 vs. Q4 2023. Sequential acceleration in domestic and cross-border travel, as well as urban and non-urban markets. Growth was seen across all age groups.

Latin America: Low-20s% growth in Q4 2024 vs. Q4 2023. Domestic travel remained the strongest segment (+30% YoY). Growth was seen across all stay durations, including long-term stays. Brand campaigns in H2 2024 raised awareness and helped attract first-time bookers, particularly in Brazil, where origin nights booked grew 20%+ in both Q4 and full-year 2024. Airbnb also introduced Pix, a local payment method in Brazil, boosting bookings and first-time bookers.

Asia Pacific: Low-20s% growth in Q4 2024 vs. Q4 2023. While domestic travel was strong, cross-border travel remains the majority driver. Cross-border nights booked grew 27% YoY, with encouraging signs of China outbound recovery (+25% YoY in Q4 2024).

Gross Booking Value

Gross Booking Value (GBV) reached $17.6 billion (+13% YoY), driven by Nights and Experiences Booked growth and modest ADR increases. On an FX-neutral basis, GBV grew 15% YoY, the fastest growth rate of the year.

Average Daily Rate

The ADR was $158 in Q4 2024 (+1% YoY; +2% FX-neutral). ADR increased across all regions, driven by price appreciation.

North America: +3% YoY, driven by price appreciation and mix shift.

EMEA: +6% YoY (reported and FX-neutral), driven by price appreciation and mix shift.

Latin America: -5% YoY, mainly due to FX. FX-neutral ADR +4% YoY.

Asia Pacific: +1% YoY (+2% FX-neutral) due to price appreciation.

Take Rate

The implied take rate was 14.1%, slightly down YoY due to one-time revenue benefits from unused gift cards in Q4 2023, creating a difficult YoY comparison.

In Q2 2024, Airbnb began charging an additional service fee for cross-currency bookings—affecting only 20% of GBV. Additionally, paid guest travel insurance, first introduced in 2022, is now available in 12 of Airbnb’s largest markets.

Supply

Airbnb ended Q4 2024 with 5 million+ hosts and 8 million+ active listings worldwide. Growth was strong in both high-density urban and non-urban destinations, particularly in Latin America and Asia Pacific.

Airbnb’s supply strategy focuses on:

Targeted acquisition: Ensuring adequate supply in constrained markets.

Calendar availability: Encouraging existing hosts to list more often. The Co-Host Network, launched in 2023, makes it easier for hosts to manage listings, welcome guests, and clean properties.

Quality control: Improving guest experience by removing low-quality listings. Since launching the updated hosting quality system in 2023, Airbnb has removed 400,000+ listings, reducing customer service issues and chargebacks, while improving guest Net Promoter Scores.

4. Financial Analysis

Revenue

Airbnb reported revenue of $2.48 billion, a 12% increase from the prior year and a sequential acceleration. Growth was driven by strong increases in nights stayed and a modest rise in ADR, along with monetization efforts, including the expansion of guest travel insurance and the introduction of an additional service fee for cross-currency bookings.

Operating Margin

Airbnb reported operating income of $430 million in Q4 2024, resulting in an operating margin of 17%, up from -22% in Q4 2023. The Q4 2023 operating expenses included a one-off impact of $935 million related to lodging tax reserves and host withholding tax reserves. Excluding this, the operating margin would have been 20%.

So, what caused the 3% YoY contraction in operating margin on an underlying basis? The answer lies in the allocation of Product Development and Sales & Marketing expenses, which both increased from 19% of revenue in Q4 2023 to 22% in Q4 2024.

Sales & Marketing spend outpaced revenue growth, a trend also observed in Q3 2024. Investments were concentrated in global markets and performance marketing, and this was expected to continue. Looking ahead, CFO Ellie Mertz confirmed that marketing spend as a percentage of revenue for the core business will remain flat in 2025. She also provided insight into Airbnb’s marketing approach:

Brand marketing is fixed and has a baseline spend per market that does not need to scale with revenue growth.

Performance marketing is variable and added surgically rather than increasing dollar-for-dollar with revenue.

Core markets will see modest marketing spend growth, while additional marketing dollars will be allocated toward expansion markets.

Net Margin

Net income amounted to $461 million, yielding a 19% net income margin. As previously mentioned, the -16% net income margin in Q4 2023 was due to the $1 billion lodging tax reserve impact. Excluding this, the net income margin would have been 22%.

A key component of Airbnb’s net income is interest income of $183 million in Q4 2024, down from $192 million in Q4 2023, primarily due to lower interest rates. The significance of interest income is notable—40% of Airbnb’s net income came from interest income.

Cash Flow Analysis

Airbnb generated $458 million in Operating Cash Flow. After allowing for $8 million in CapEx, this resulted in Free Cash Flow (FCF) of $458 million, representing an 18% FCF margin. As the Merchant of Record, Airbnb experiences seasonal fluctuations in free cash flow:

Q1 sees the highest inflows due to booking collections.

Q4 sees the lowest inflows as hosts are paid for completed stays.

Over the past twelve months, FCF reached $4.5 billion, with an FCF margin of 40%, up from 39% in 2023.

This strong cash flow enabled Airbnb to repurchase $838 million of stock in Q4 2024. The company has $3.3 billion remaining under its $6 billion repurchase authorisation, reducing the diluted share count from 676 million in Q4 2023 to 658 million in Q4 2024. Despite repurchasing $3.4 billion worth of stock in 2024, Airbnb’s cash pile (net of funds held on behalf of guests) swelled to $4.7 billion.

5. Guidance

Management expects Q1 2025 revenue between $2.23 billion and $2.27 billion, implying 5% growth at the midpoint, or 8% growth excluding FX impacts.

Q1 2024 benefited from:

The timing of Easter

The inclusion of Leap Day

These create an unfavorable YoY comparison of ~3 percentage points in Q1 2025. Excluding calendar factors and FX headwinds, expected revenue growth would be 11%.

In Nights and Experiences Booked, YoY growth in Q1 2025 is expected to be relatively stable compared to Q1 2024, excluding Leap Day, which contributed to ~1 percentage point of growth in Q1 2024.

For ADR, a slight YoY decline is expected, primarily due to FX headwinds. Excluding FX, ADR would have seen a slight increase.

For full-year 2025, management plans to improve economics and strong FCF generation, while also investing $200 million to $250 million in new business launches. Despite these investments, they expect to achieve an Adjusted EBITDA Margin of at least 34.5% (down from 36% in FY 2024).

6. Conclusion

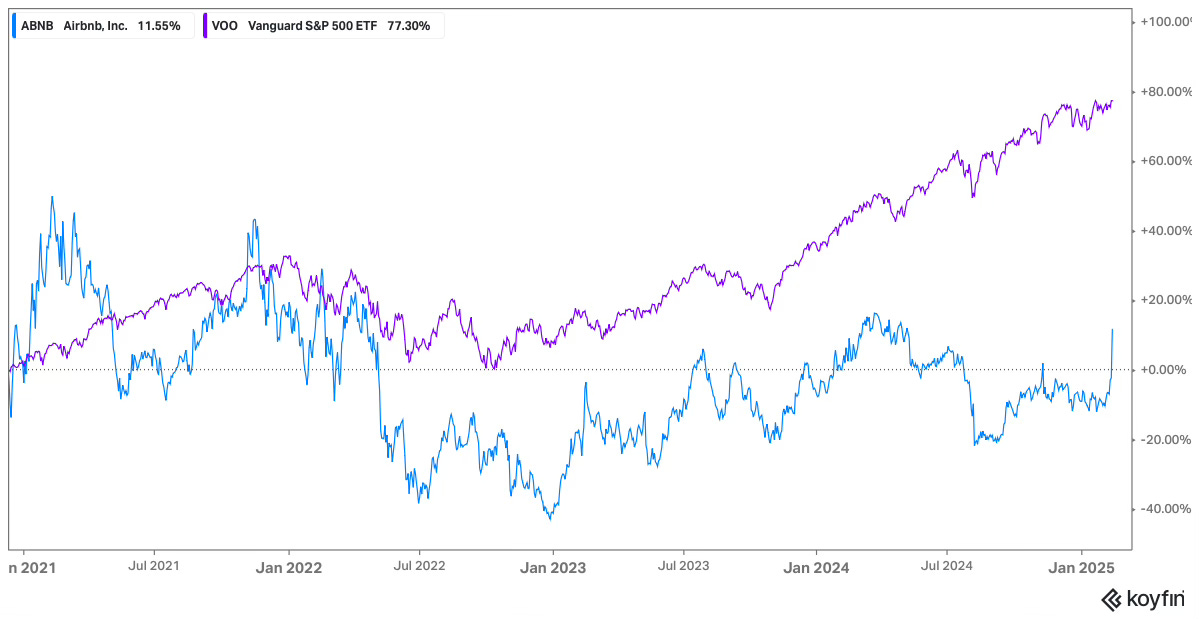

Airbnb is fundamentally stronger than it was several years ago. Since its 2020 IPO, revenue and GBV have tripled, and in 2024, it outpaced the travel industry’s growth. However, despite these achievements—and a 20% stock price surge last week—Airbnb’s IPO investors have only seen a 12% return, significantly lagging the market return of 77%. This is due to Airbnb’s premium IPO valuation being offset by multiple compression.

Looking at the quarter itself, expectations were low given that 2025 marks the start of the next chapter, as signaled by CEO Brian Chesky. The market shared this sentiment, which helped Airbnb comfortably beat top- and bottom-line expectations. The most promising aspect of the report was the acceleration in Nights & Experiences Booked and Gross Bookings Value, driving revenue growth.

Another standout from the earnings release was the Japan Case Study. Despite Airbnb’s presence in 220+ countries and regions, 70% of bookings come from just five markets: the U.S., U.K., Canada, France, and Australia. This highlights geographical expansion as a key opportunity.

Product Localisation:

Highlighting preferred amenities for Japanese travelers

Featuring domestic weekend travel destinations

Prioritizing Japanese traveler reviews to build trust

Enhancing maps with precise rural locations & landmarks

Marketing Localisation:

Brand Messaging – "All types of accommodations, all flavors of Japan"

Outdoor Advertising – Billboards near major cities

Video Ads – Targeting young, urban travelers

Social Media – Using local idioms and cultural insights

While U.S. tourists already use Airbnb in Japan, Japanese travelers were not using Airbnb domestically. This initiative aims to change that and will likely be replicated in other large travel markets.

Looking ahead, CEO Brian Chesky outlined the next chapter for Airbnb. Over the past five years, Airbnb rebuilt its technology stack to support future expansion. Instead of launching separate apps or brands, Airbnb will consolidate all offerings within a single app—similar to Amazon’s approach.

Initial growth will focus on travel-adjacent services (e.g., experiences, host services).

Each new business is expected to take 3–5 years to scale.

Some could reach $1 billion in revenue.

Airbnb plans to launch at least one new business annually over the next five years.

There is plenty of optimism for Airbnb heading into 2025. However, while this quarter exceeded expectations, the company must now capitalize on its momentum and deliver on its $1 billion promises from 2024.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great business with solid numbers. I'm just not sure if future growth justifies the current multiples. Time will tell...

I’m interested in finding the class action suits against Airbnb. You wouldn’t happen to know of them would you because they took a discount out of my payment and did not give it to the guest we’re Looking for a resolve and they have shut us out of the conversation after bullshitting with us for about two weeks