Airbnb: Weak Consumer Raises Travel Concerns

Airbnb (ABNB) Q2 2024 Earnings Analysis

Executive Summary

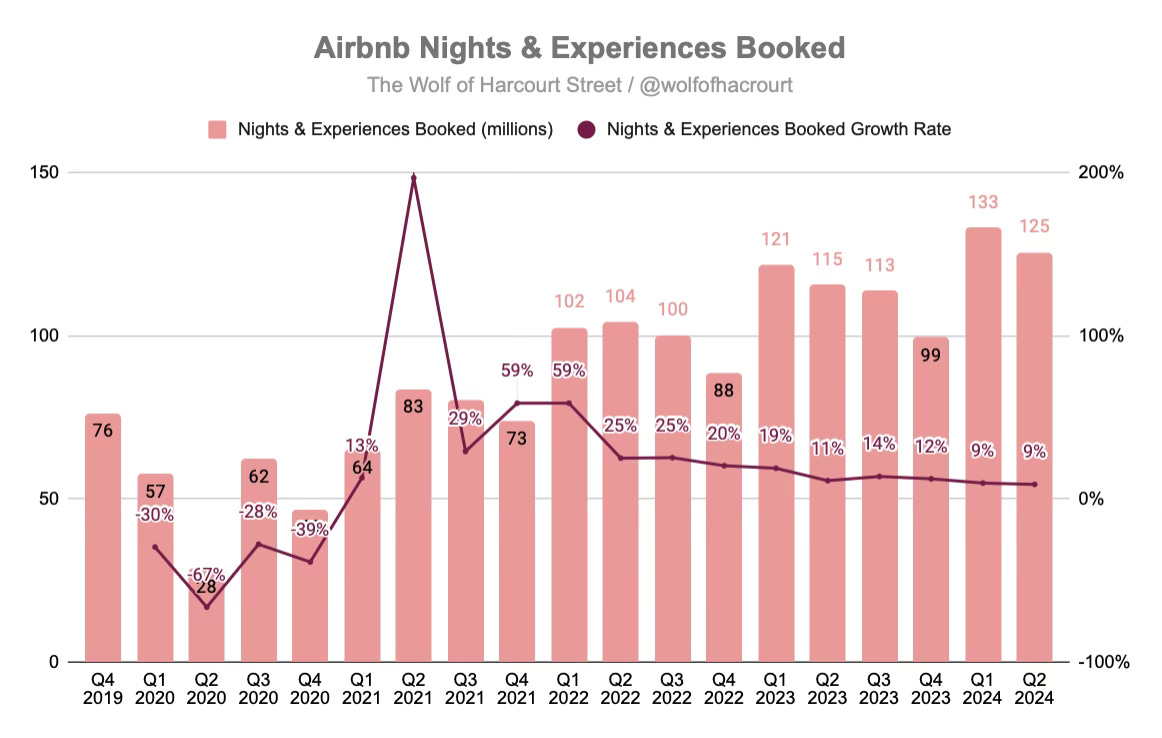

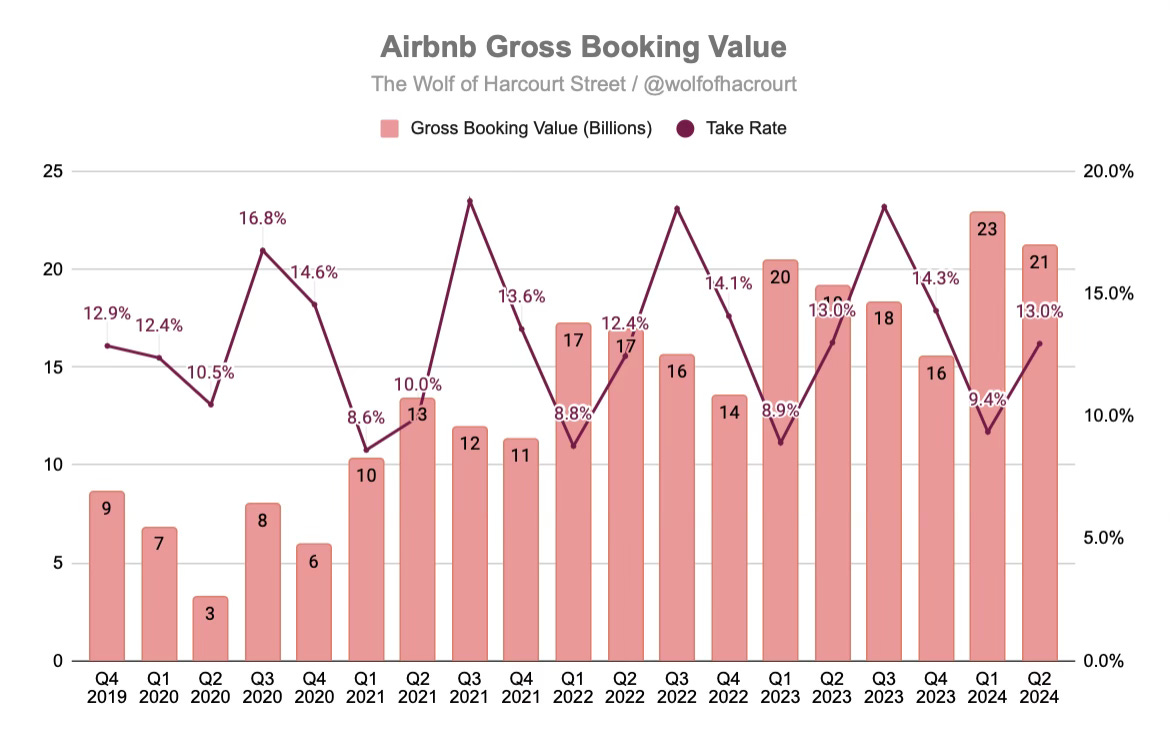

Airbnb set a record with 125.1 million Nights and Experiences Booked, reflecting a 9% year-over-year increase, maintaining the growth rate observed in Q1. Gross Booking Value increased by 11% year-over-year to $21.2 billion, driven by higher Nights and Experiences Booked and a 2% increase in Average Daily Rate, which rose to $170. Despite the new service fee for cross-currency bookings, the implied take rate remained flat at 13.0% due to the offsetting effect of Easter timing earlier in the year.

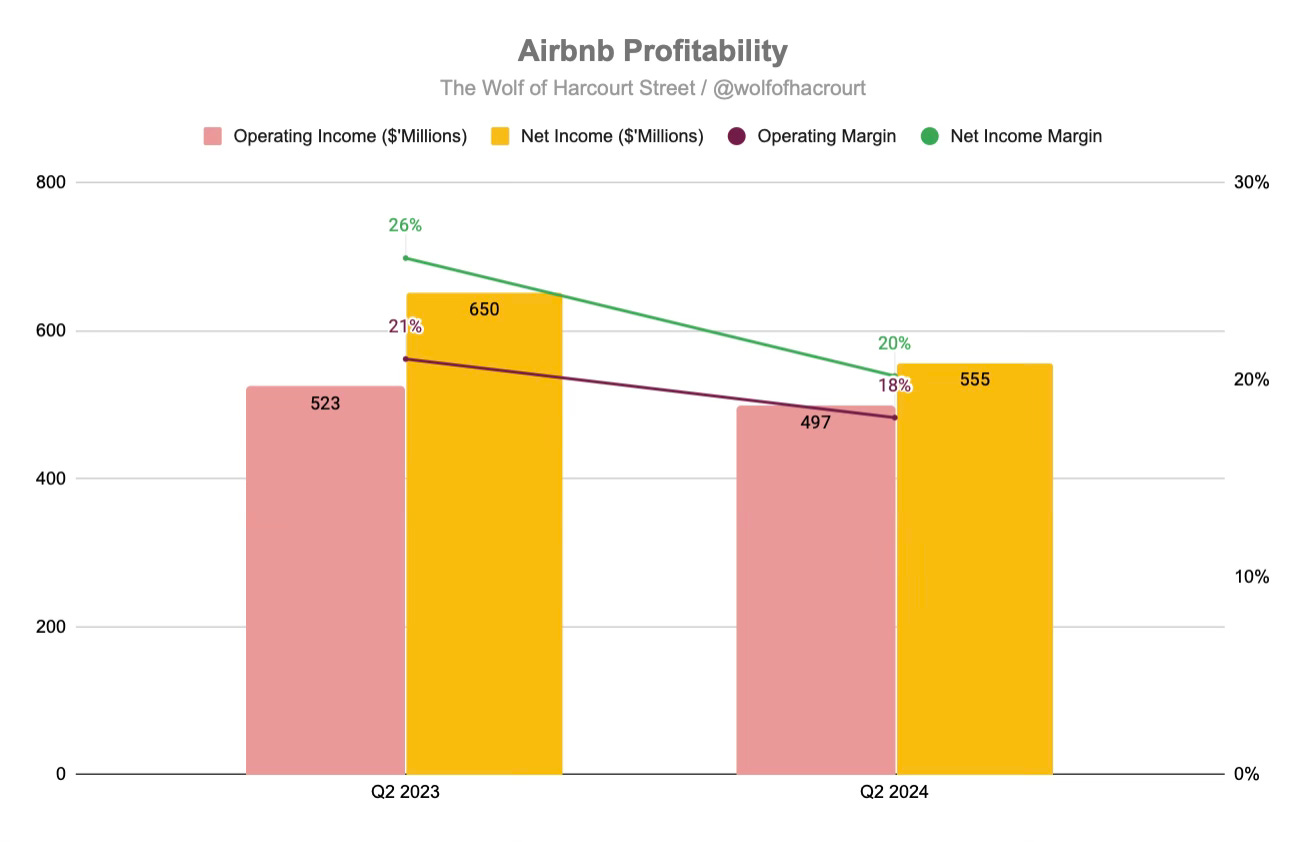

Airbnb’s revenue reached $2.75 billion, an 11% increase from the previous year, driven by higher Nights and Experiences Booked and a modest rise in Average Daily Rate. However, Q2 2024 saw slower revenue growth compared to Q1, influenced by factors such as the timing of Easter and Leap Day. Net income fell from $650 million in Q2 2023 to $555 million in Q2 2024, with the net income margin decreasing from 26% to 20%. This decline was primarily due to higher marketing expenses and increased income taxes following the release and utilization of deferred tax assets, which had provided a one-time benefit in 2023.

Airbnb's stock fell by 13% after Q2 earnings due to weaker-than-expected Q3 revenue guidance (9% growth vs. the anticipated 13%) and concerns about weakening U.S. consumer demand. Domestic travel is under pressure as economic uncertainty makes Americans more cautious about spending. To counteract this, Airbnb plans to increase marketing spending faster than revenue growth in Q3, which may reduce profitability. This issue reflects broader trends observed in other companies like Visa and Booking.com, which are also noting weaker consumer spending and shorter booking lead times.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $2.75 billion +11% year-over-year (YoY)

Net Income: $555 million -15% YoY

Free Cash Flow: $1.04 billion +16% YoY

2. Wall Street Expectations

Revenue: $2.74 billion (beat by less than 1%)

Earnings per Share: 0.91 (miss by 5%)

3. Business Activity

Nights and Experiences Booked

In Q2 2024, Airbnb achieved a record high of 125.1 million Nights and Experiences Booked, marking a 9% YoY increase, consistent with the growth seen in Q1. A focused effort on optimizing the mobile website to drive app downloads resulted in a 25% YoY increase in global app downloads, with particularly strong growth in the U.S. Nights booked through the app grew by 19% YoY, now accounting for 55% of total nights booked, up from 50% in the previous year. Continued growth is being observed in first-time bookers, especially among the youngest age demographic.

North America: There was a slight acceleration in YoY growth of Nights and Experiences Booked in Q2 2024 compared to Q1 2024. Domestic travel continues to dominate, with faster growth seen in non-urban destinations and larger group travel. Nights booked for groups of over five people increased by 16% compared to Q2 2023, marking the fastest-growing segment for the fifth consecutive quarter. The average number of guests per booking is increasing due to the popularity of group travel.

EMEA: YoY growth of Nights and Experiences Booked remained relatively stable compared to the previous quarter. The majority of nights booked were for domestic and in-region travel, with strong growth in non-urban destinations and larger group travel, similar to North America. In the Paris region, nights booked for the dates of the Olympics through Q2 more than doubled compared to the same period last year.

Latin America: Nights and Experiences Booked increased by 17% compared to Q2 2023. Domestic travel remained strong with a 24% increase in domestic gross nights booked. Latin America recorded the highest YoY growth in active listings alongside Asia Pacific.

Asia Pacific: There was an increase of 19% YoY in Nights and Experiences Booked, with a significant improvement in cross-border travel, which rose 22% YoY. The recovery in outbound China travel was noted as encouraging.

Gross Booking Value and Take Rate

GBV increased by 11% YoY in Q2 2024 to $21.2 billion. This growth was driven primarily by an increase in Nights and Experiences Booked, as well as a modest increase in Average Daily Rate (ADR), which rose 2% YoY to $170. Excluding the impact of foreign exchange (FX), ADR increased by 3% across all regions due to price appreciation and mix shift.

Regional breakdowns showed that ADR in North America increased by 4% compared to Q2 2023, or 1% when excluding the impact of foreign exchange (FX) and mix shift. This increase was driven by higher growth in short-term stays and entire homes, compared to long-term stays and Airbnb rooms. In EMEA, ADR also increased by 4% compared to Q2 2023, or 3% when excluding the impact of FX and mix shift.

Airbnb began charging an additional service fee for cross-currency bookings in Q2 2024. This change affects approximately 20% of their GBV and is expected to contribute nearly 20 basis points to the take rate in the second half of 2024. However, despite the introduction of this fee, the implied take rate remained flat YoY at 13.0% in Q2 2024 due to the offsetting impact of Easter timing earlier in the year.

Special Events

The week of July 4th marked the highest single week of revenue ever in North America for Airbnb, with increased guest bookings for major holidays and events.

Major sporting events are significantly boosting bookings.

Paris 2024 Olympics: Nights booked in the Paris region for the dates of the Summer Olympic Games more than doubled YoY through Q2 2024. To meet this demand, active listings in the region increased by 37%, with over 400,000 guests expected to stay on Airbnb during the Olympics.

Euro Cup in Germany: Cities hosting matches saw a more than 20% YoY increase in nights booked on average, with some cities experiencing over 50% growth.

4. Financial Analysis

Revenue

In Q1 2024, Airbnb's revenue reached $2.75 billion, which marked an 11% increase from the previous year. This growth was fueled by a strong increase in Nights and Experiences Booked and a modest rise in ADR. However, revenue growth in Q2 2024 was slower compared to Q1 2024, largely due to the timing of Easter and the inclusion of Leap Day in Q1.

Profit Margin

Airbnb reported an operating income of $497 million in Q2 2024, indicating an operating margin of 18%, down from 21% in the same quarter of 2023. The change in operating income is partially attributed to changes in marketing spend: the 2024 marketing spend allocation is concentrated more in the half of the year, with a heavier focus in Q2 compared to Q1. This was referenced in Q1 2024 as to why margins were higher than expected.

Airbnb's net income fell from $650 million to $555 million in Q2 2024 with the net income margin decreasing from 26% to 20% compared to the same period in 2023. This decline was primarily due to increased income taxes resulting from the release and utilization of deferred tax assets. This was a one off benefit to Airbnb in 2023 which inflated its net income margin.

A key contributor to Airbnb’s net income is interest income. The company saw an 18% increase in interest income, rising from $191 million in Q2 2023 to $226 million in Q2 2024. To put this into context, 40% of Airbnb’s net income came from interest income compared to 60% from the core business operations. In Q2 2023, 29% of Airbnb’s net income came from interest income.

Cash Flow Analysis

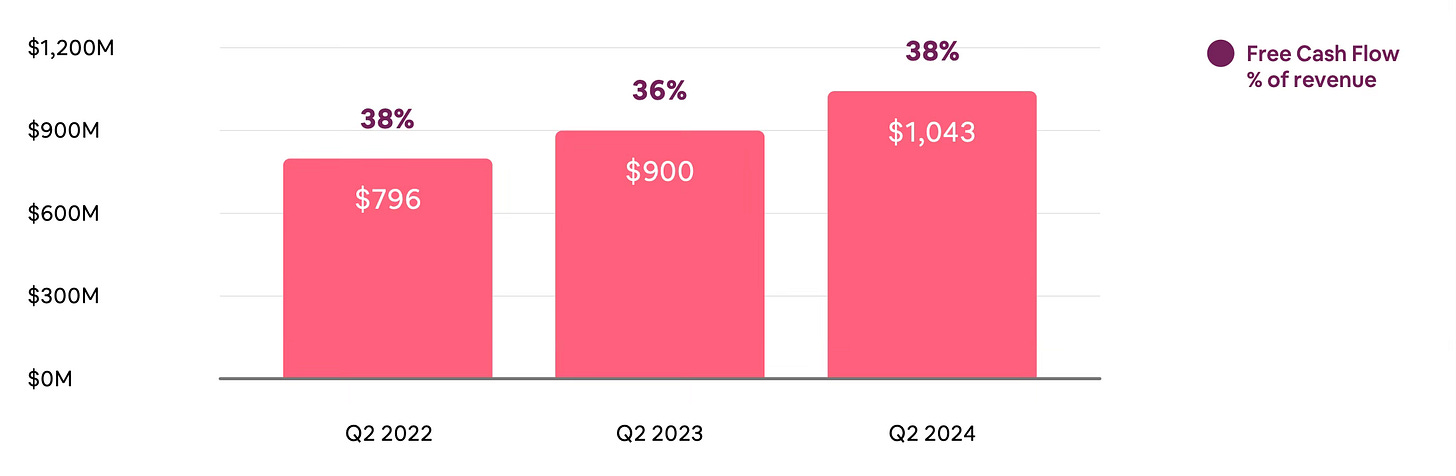

Airbnb generated over $1 billion of free cash flow (FCF) in Q2 2024, resulting in a FCF margin of 38%.

Airbnb experiences seasonal fluctuations in free cash flow due to its role as the Merchant of Record. It collects cash from bookings in Q1 but only recognizes revenue when the stays occur, typically in Q2 or Q3. Consequently, Airbnb has high cash inflows in Q1 but may experience lower free cash flow in Q3 when it pays out hosts for completed stays.

On a training twelve month basis, Airbnb’s FCF margin is 41% which is a more accurate representation of the underlying business performance.

5. Guidance

Management expects Q3 revenue between $3.67 billion and $3.73 billion, reflecting an 8% to 10% YoY growth, despite a minor foreign exchange headwind. The implied take rate is expected to rise YoY, driven by the timing of bookings and cross-currency transaction fees, although this will be slightly offset by increased investments in customer service.

Growth in Nights and Experiences Booked is anticipated to moderate sequentially from Q2 2024. Latin America and Asia Pacific are projected to remain the fastest-growing regions, while there are signs of shorter booking lead times and potential slowing demand from U.S. guests. ADR is expected to increase modestly YoY.

Adjusted EBITDA is expected to be similar to Q3 2023 on a nominal basis, but the Adjusted EBITDA Margin is anticipated to decline. Marketing expenses are projected to grow faster than revenue due to investments in new growth markets.

For the full year, management expects nominal growth in Adjusted EBITDA and an Adjusted EBITDA Margin of at least 35%. The company also aims to maintain a Free Cash Flow margin well above the EBITDA margin, allowing for continued investment in growth opportunities.

6. Conclusion

Airbnb had a solid quarter, but the stock dropped by 13% after earnings due to relatively disappointing guidance. Management's Q3 revenue forecast indicates 9% growth, while Wall Street analysts had anticipated around 13%. They also noted weakening demand from U.S. customers, with domestic travel under pressure as Americans become more cautious about spending amid economic uncertainty. To address the weaker U.S. consumer, Airbnb plans to increase marketing spend faster than revenue growth in Q3, which will likely lower profitability and earnings. This is what has unsettled the market.

In my view, this is a global issue, not just specific to Airbnb. For instance, Visa reported similar concerns about a weaker U.S. consumer in their recent earnings report. Visa’s data is among the best for predicting consumer health. As a discretionary travel company, Airbnb is vulnerable when consumers cut back on spending.

Another supporting metric is the shorter booking lead times observed. In the travel industry, booking lead time— the number of days between reservation and arrival— can indicate last-minute bookings due to increased uncertainty. Competitor Booking.com also reported shorter lead times in Q2, with expectations for further declines in Q3.

Despite these challenges, I don’t see this as a thesis breaker for Airbnb. The company remains vital for accommodating visitors during special events, offering varied and affordable lodging options, and supporting economic growth in cities. Its flexible supply model allows it to capture one-time events, unlike hotels, which require years to build and cannot adapt as quickly to demand.

Rating: 2 out of 5. Below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Aligned. Temporary slowdown, but nothing really changed.

Great article!