Executive Summary

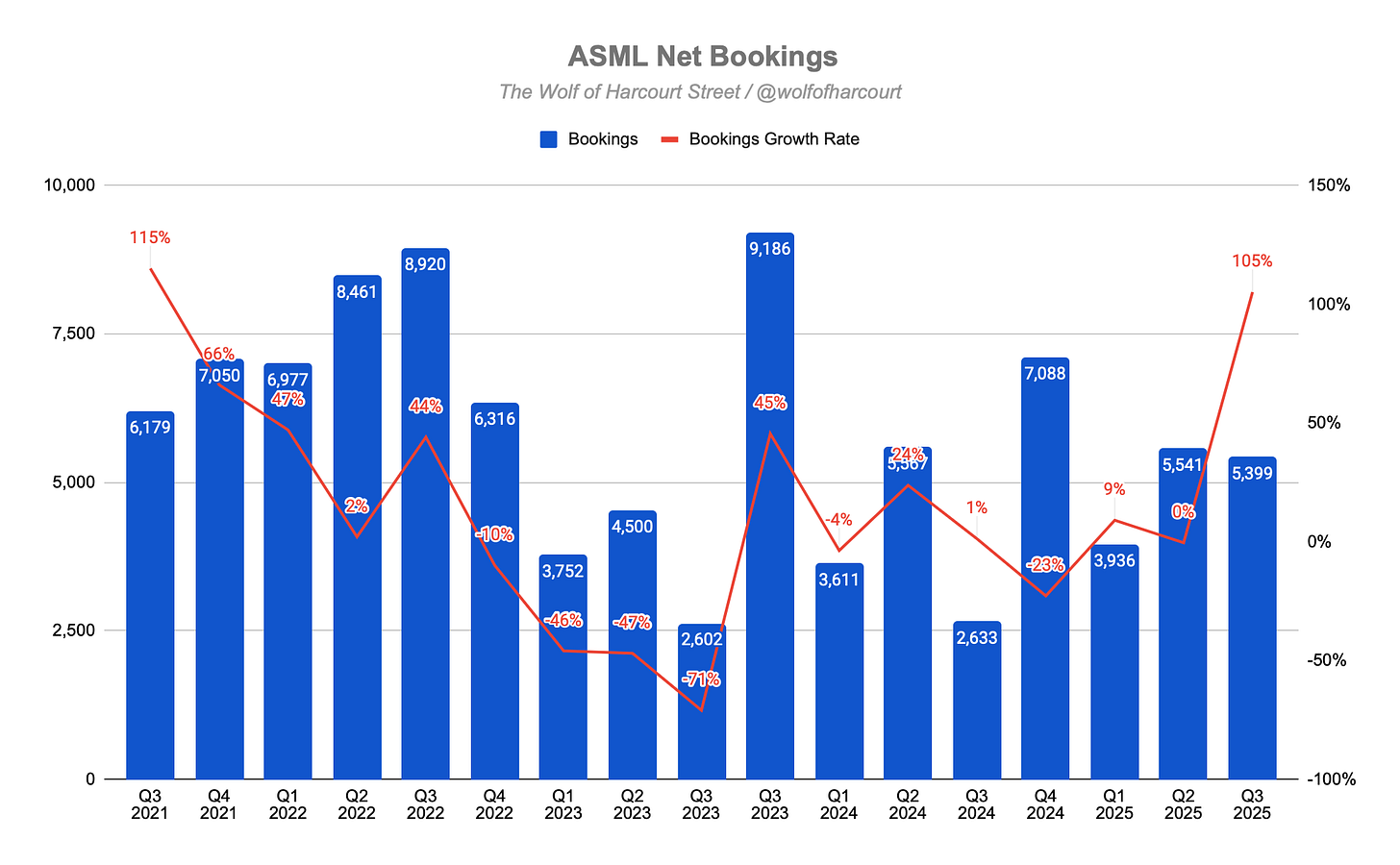

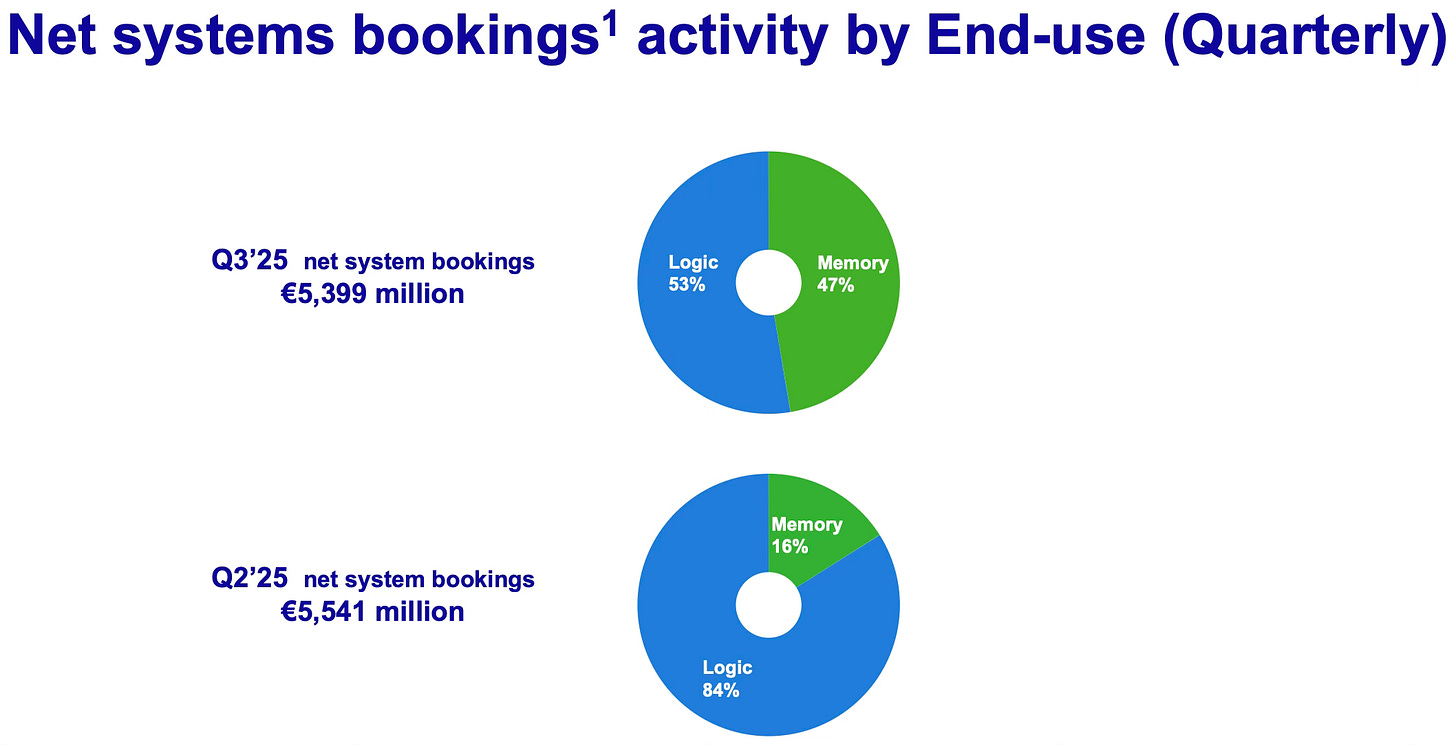

Q3 2025 bookings revealed a clear shift in ASML’s demand mix. Memory orders surged 186% to €2.54 billion, while Logic bookings declined, reducing Logic’s share from 84% to 53%. Of the €5.4 billion total, €3.6 billion came from EUV systems, underscoring continued strength in advanced lithography. This pivot toward Memory reflects broader semiconductor trends as AI adoption drives higher lithography intensity across both Logic and DRAM. Management expects more critical exposures in both segments, suggesting AI-driven workloads may be ushering in the early stages of a new Memory super-cycle.

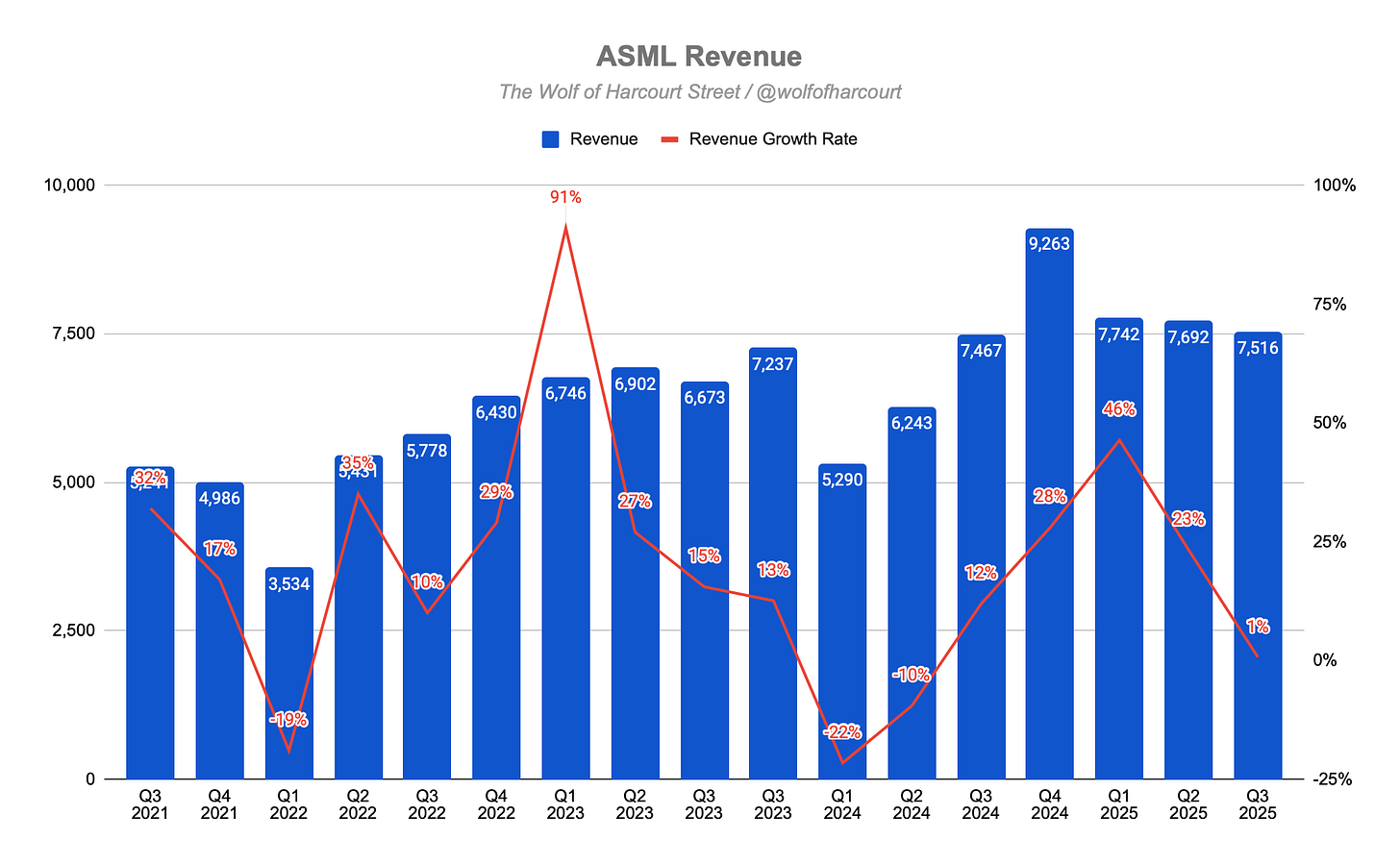

Revenue rose slightly YoY to €7.5 billion, in line with guidance but down sequentially due to timing effects. Net system sales reached €5.6 billion, including one High NA system, while Installed Base Management revenue eased to €2.0 billion (35% of total sales). The revenue mix shifted modestly toward Memory (35%) and geographically toward China, which surged to 42% of net system sales on strong DUV demand. Gross margin contracted to 51.6% from 53.7% in Q2, mainly due to a higher share of lower-margin DUV systems and shipment timing.

Management reaffirmed 2025 guidance, maintaining expectations for ~15% YoY net sales growth (around €32.5 billion) and a 52% gross margin, with a strong Q4 needed to meet targets. The company forecasts Q4 sales of €9.2–€9.8 billion and margins of 51–53%. Looking ahead, ASML refrained from setting explicit 2026 targets but stated that sales will not fall below 2025 levels. While Chinese headwinds are expected to weigh on results, management anticipates this will be offset by accelerating demand for advanced nodes driven by AI adoption.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

Be greedy when others are fearful.

Ask yourself this…

Would you rather have bought Meta shares for $378 in September 2021 or $90 in November 2022? Both purchases would have seen tremendous growth.

A $1,000 investment in September 2021 would be worth $2,014 today. But a $1,000 purchase when Meta pulled back in November 2022 would be worth $8,300.

Sometimes it can pay to wait for a pullback. Rebound Capital identifies high-quality companies undergoing drawdowns to capitalise on their eventual rebound. In the last few months, they have identified ASML (up 23%), Google (up 52%), and AMD (up 61%) as ideal rebound prospects.

1. Financial Highlights

Revenue: €7.52 billion (+1% YoY)

Gross Profit: €3.88 billion (+2% YoY)

Net Income: €2.13 billion (+2% YoY)

2. Wall Street Expectations

Revenue: €7.74 billion (miss by 2%)

EPS: €5.38 (beat by 2%)

3. Business Activity

Bookings and Demand

Bookings in Q3 2025 showed a slight decline in total net bookings compared to the prior quarter, alongside a significant shift toward Memory end use. Of the €5.4 billion in net bookings, €3.6 billion came from Extreme Ultraviolet (EUV) systems.

Logic customers accounted for 53% of bookings, down sharply from 84% in Q2 2025. In absolute terms, Memory bookings jumped 186%, from €887 million to €2.54 billion.

This shift toward Memory reflects broader market trends. The semiconductor industry is gaining strong momentum, driven by the widespread adoption of Artificial Intelligence (AI) across a growing range of applications. AI demand now extends to both leading-edge Logic and advanced DRAM customers, increasing the need for advanced lithography and higher litho intensity.

Management expects more critical lithography exposures for both Logic and Memory processes. My interpretation is that AI workloads are pushing demand for more sophisticated memory solutions, signalling potential beginnings of a Memory super-cycle.

Technology and Product Adoption

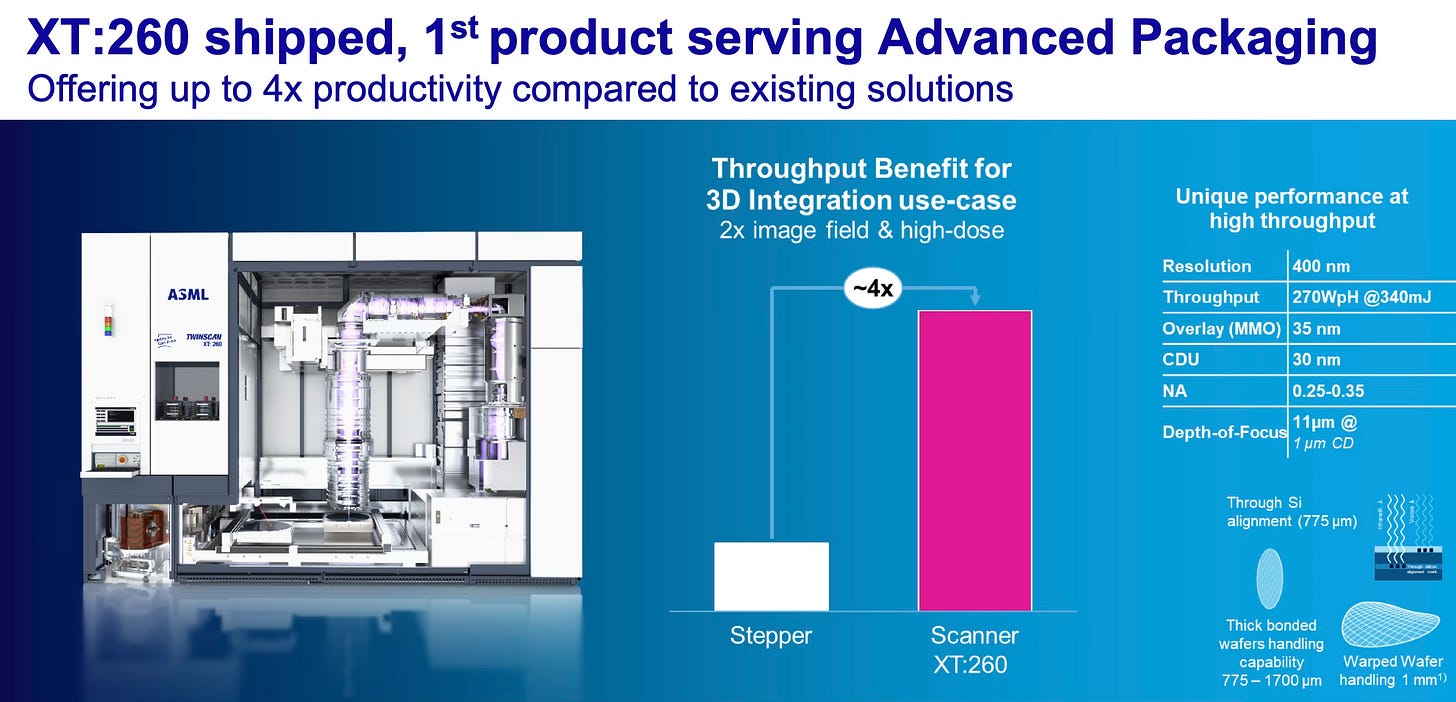

Management highlighted solid progress on the technology roadmap, marked by ongoing EUV adoption, a new product launch for Advanced Packaging, and the growing integration of AI across ASML’s lithography ecosystem.

EUV Technology

Customers have processed more than 300,000 wafers on High NA systems. Maturity levels are currently ahead of where Low NA was at a similar stage. SK hynix has started installing its first EXE:5200 (High NA EUV tool) in production, which is expected to be a key enabler for future DRAM development.

Strong EUV execution continues to drive down the cost of technology at advanced nodes. Management anticipates that the product mix will increasingly favour EUV.

Advanced Packaging and 3D Integration

ASML shipped its first product for the Advanced Packaging market, the TWINSCAN XT:260. This i-line scanner supports 3D integration and delivers up to 4x productivity versus existing solutions.

3D integration is viewed as the “other way to drive Moore’s Law,” complementing traditional 2D lithography. ASML’s holistic lithography technology can be extended to 3D integration to meet customers’ tightening performance requirements.

Integration of AI

ASML entered a strategic partnership with Mistral AI, becoming the lead investor in their Series C round and acquiring roughly an 11% stake. Management expects AI to accelerate product development and reduce time-to-market.

Personally, I believe this Mistral AI partnership is more political than practical, but time will tell whether it delivers tangible value.

4. Financial Analysis

Revenue

Total revenue rose marginally YoY to €7.5 billion, in line with guidance, despite a slight sequential decline.

Net system sales were €5.6 billion, including one High NA system recognised during the quarter. ASML’s quarterly results can appear “lumpy” due to the high unit cost of each system, one machine sale timing difference (for example, between September 30 and October 1) can shift revenue by around €400 million.

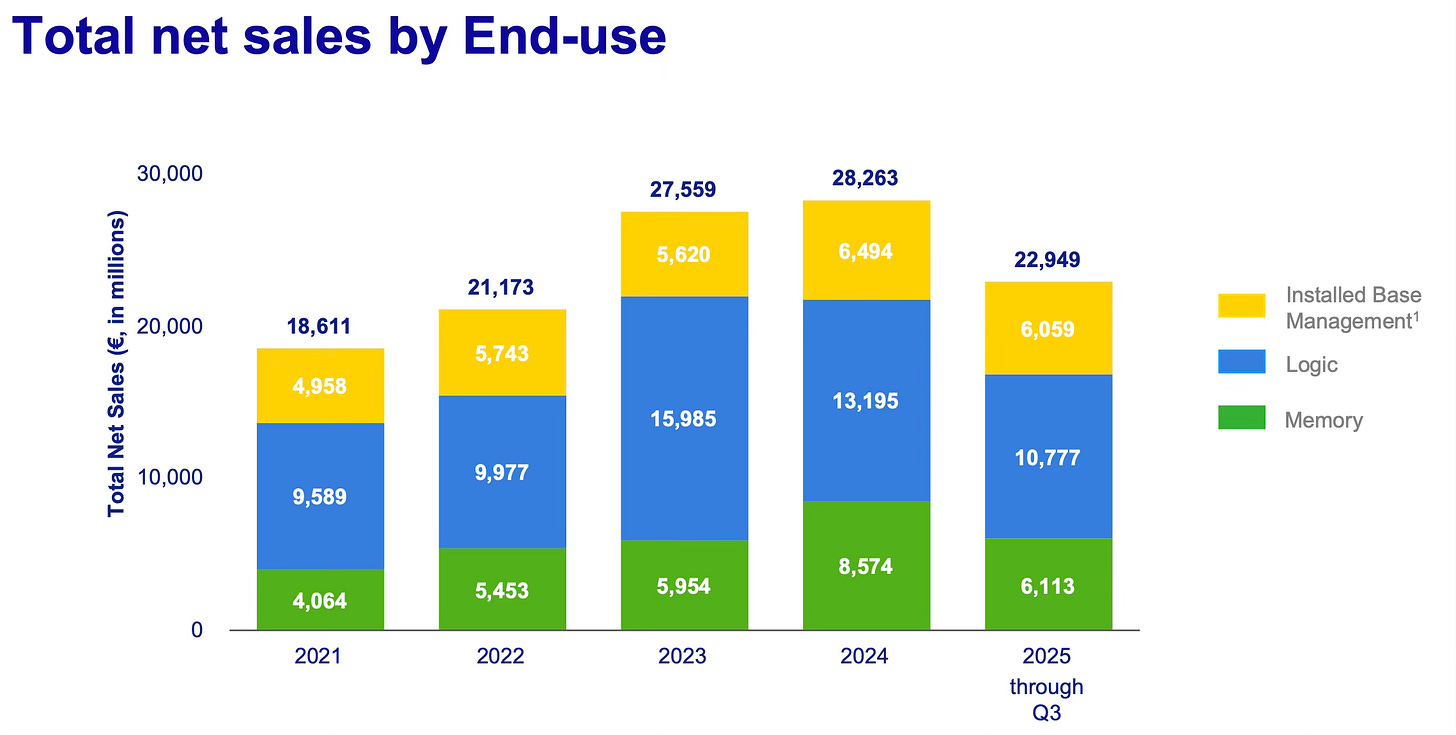

Installed Base Management revenue (service and field options) fell sequentially to €2.0 billion, now representing 35% of total revenue. This recurring stream reflects ongoing productivity upgrades (such as on NXE:3800E systems) and higher service demand from the expanding EUV base.

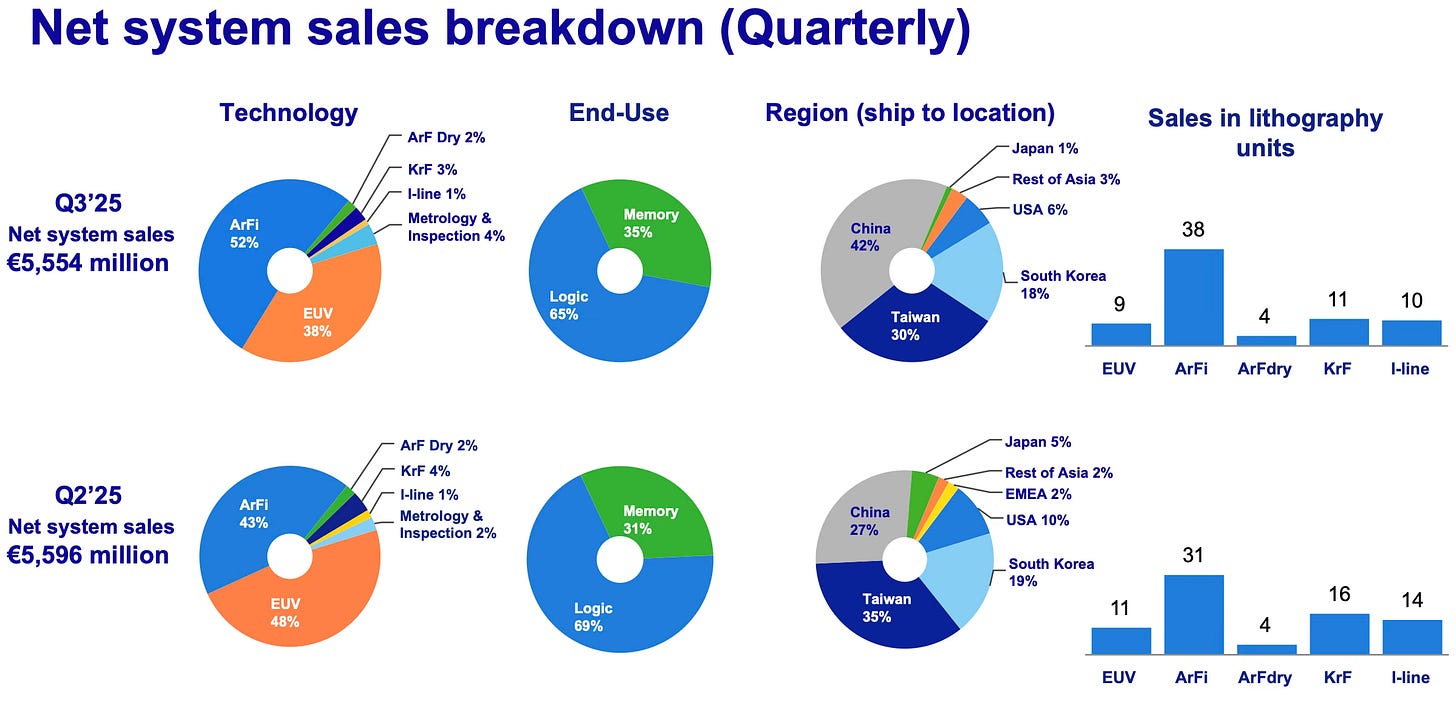

End-use mix: Logic made up 65% of net system sales in Q3 2025, while Memory accounted for 35%. This is a slight shift toward Memory from the Q2 split (Logic 69%, Memory 31%), consistent with booking trends.

Geographic mix: China accounted for 42% of net system sales, up sharply from 27% in Q2. This likely reflects backlog conversion involving Deep Ultraviolet (DUV) systems. Taiwan and South Korea followed, contributing 30% and 18%, respectively. Geopolitical and regulatory risks remain notable factors.

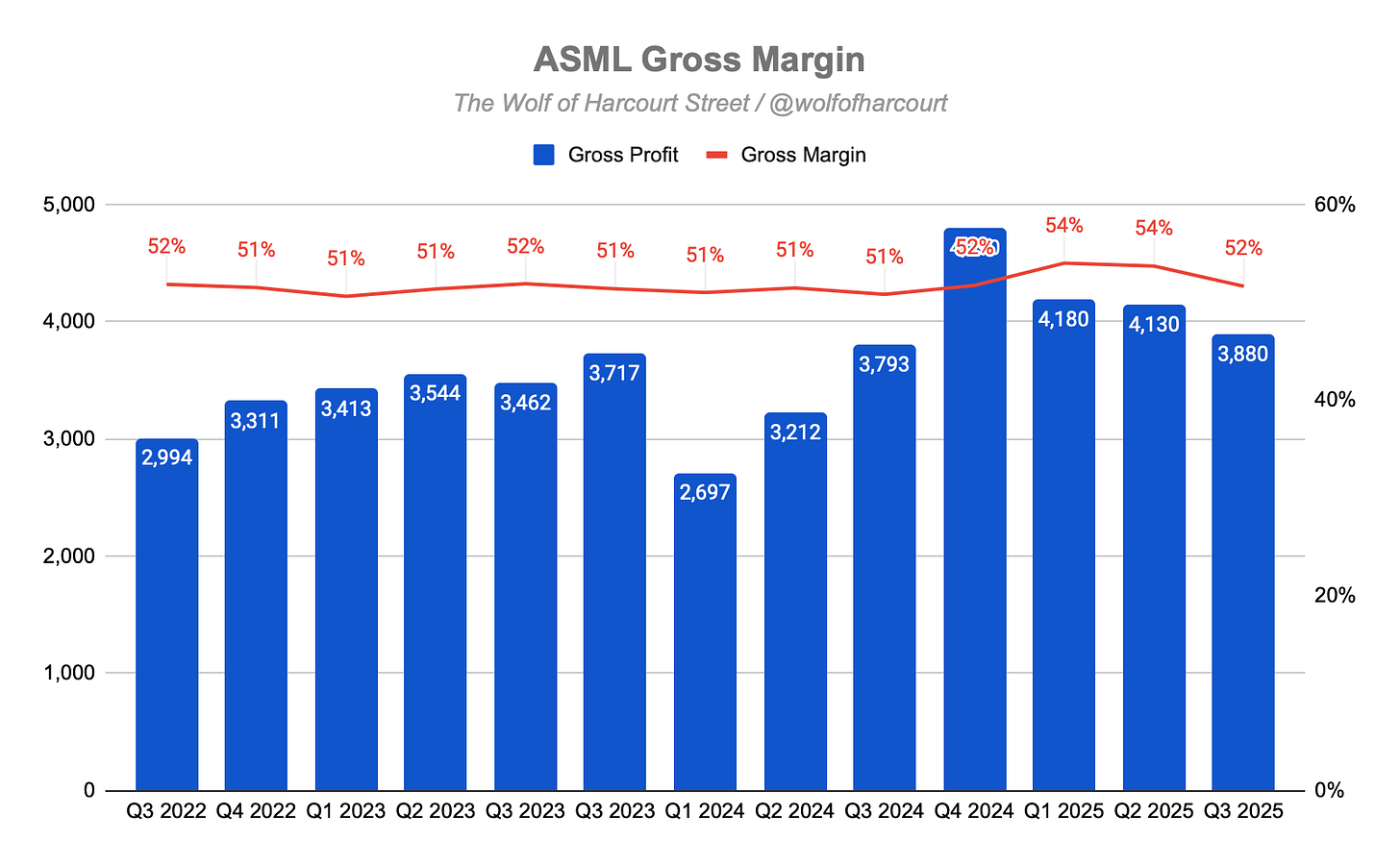

Gross Margin

Gross margin contracted sequentially, as guided, landing at 51.6% (or €3.9 billion in gross profit), down from 53.7% in Q2 2025.

The decline was primarily driven by product mix and cost recognition. While Logic systems still dominated sales (65%), the higher proportion of lower-margin DUV systems sold to China diluted the overall margin. Although one High NA system was recognised, its impact was offset by this DUV-heavy mix.

My view: this contraction was expected and managed, mainly a result of shipment timing and revenue recognition.

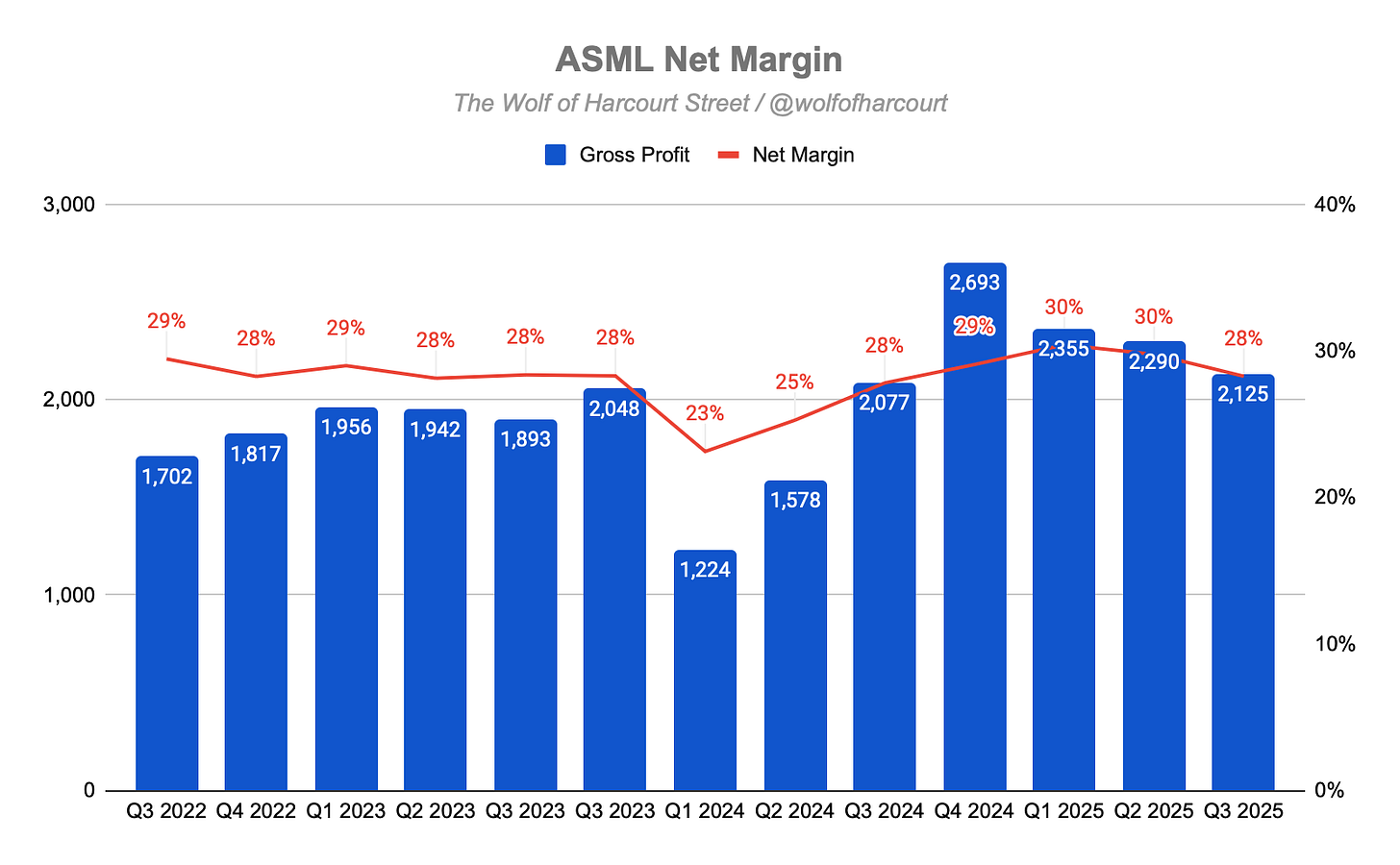

Net Margin

Net margin fell to 28.3% (or €2.2 billion in net income), down 150 bps from 29.8% in Q2 2025.

Operating expenses were broadly stable, so the decline reflects reduced revenue and margin compression:

R&D costs: €1.1 billion, slightly down from €1.2 billion in Q2.

SG&A costs: €303 million, slightly up from €299 million.

Cash Flow

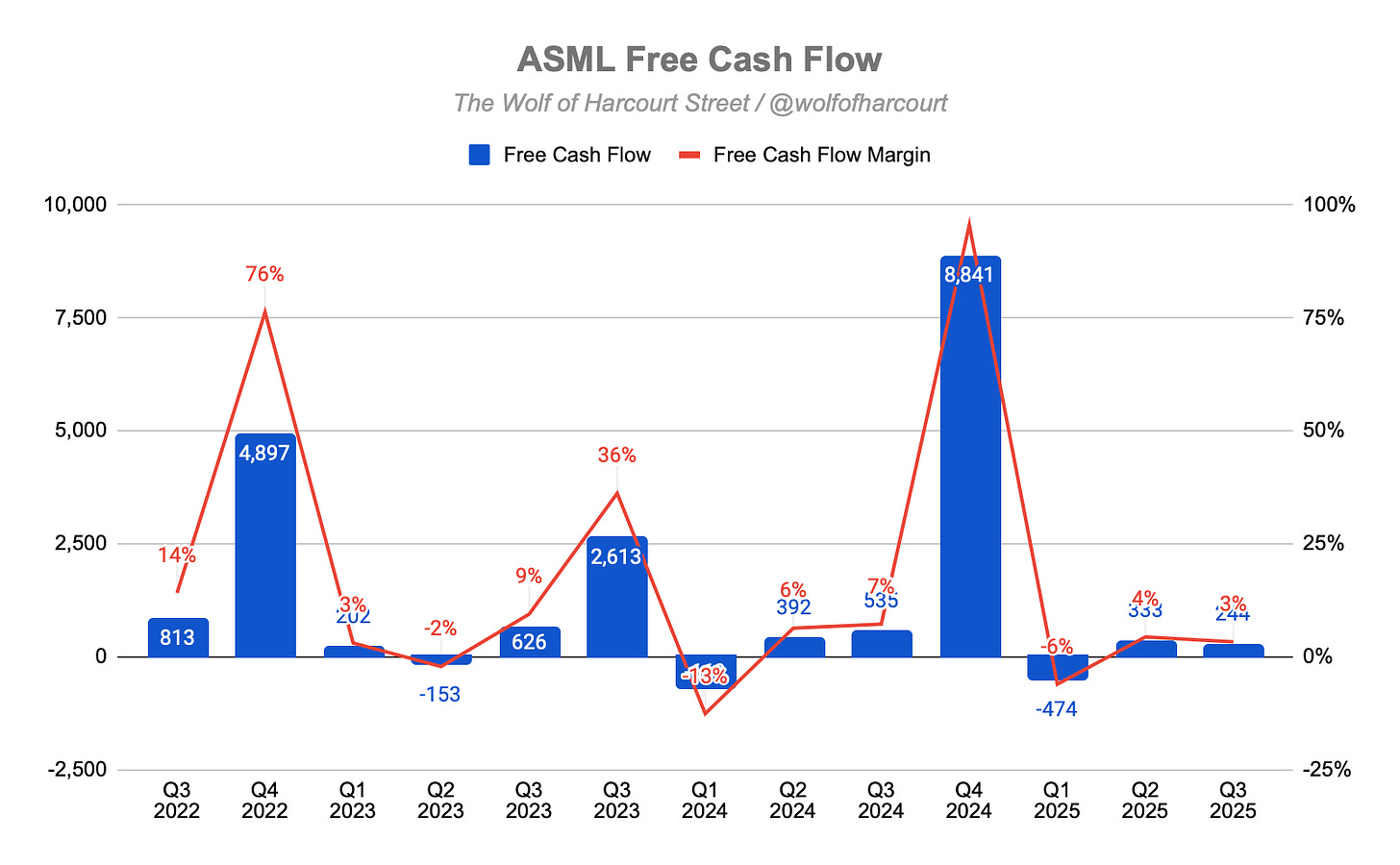

Free Cash Flow was €244 million, down from €319 million in Q2 2025, mainly due to lower operating cash flow. ASML’s FCF tends to fluctuate by quarter given the large-ticket nature of its business.

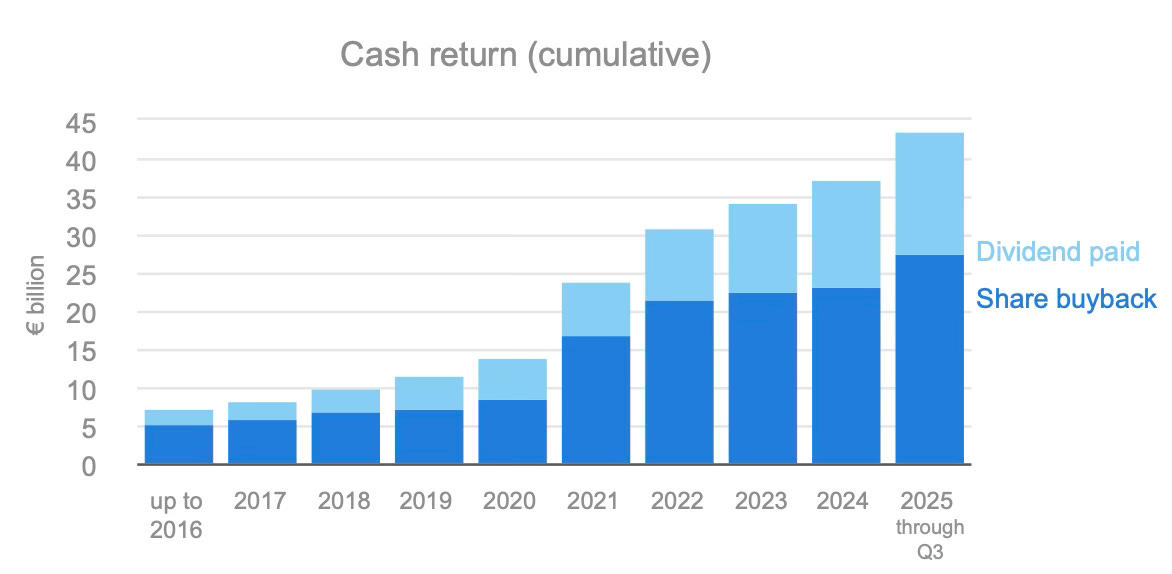

ASML ended the quarter with €5.2 billion in cash and returned nearly €800 million to shareholders through:

An interim dividend of €1.60 per share

Share buybacks of about 218,000 shares for €148 million

5. Guidance

Management reiterated and confirmed its full-year guidance for 2025:

Total Net Sales: ASML continues to expect total net sales growth of around 15% for 2025 relative to 2024. Based on the reported Q3 figures, achieving this target will depend heavily on a strong final quarter. The full-year net sales figure is anticipated to be around €32.5 billion (using the midpoint of Q4 guidance).

Gross Margin: The expectation for the full-year 2025 gross margin remains around 52%.

Q4 Outlook: ASML projects a very strong Q4, with total net sales between €9.2 billion and €9.8 billion, and a gross margin between 51% and 53%.

The most notable update in guidance relates to the initial outlook for 2026. In typical ASML fashion, management avoided explicitly forecasting growth, instead stating that “ASML does not expect 2026 total net sales to be below 2025.”

Management plans to provide more detailed 2026 guidance in January. They noted that while geopolitical headwinds in China will weigh on results, these will be more than offset by growth in advanced technology nodes driven by AI adoption. ASML expects China’s total net sales to decline significantly in 2026, following the exceptionally strong levels of 2024 and 2025.

6. Conclusion

ASML reported solid headline numbers, but this business is best assessed through its multi-year technology transition and order book stability, rather than quarterly performance. Since production slots are allocated months or even years in advance, the most valuable insights lie in structural trends shaping the outlook for 2026 and beyond.

Key Takeaways:

Implicit Backlog Coverage: The implied order backlog exiting Q3 is €33 billion, suggesting 100% coverage for achieving flat revenue in 2026. ASML’s reaffirmation that 2026 sales will not fall below 2025 levels is noteworthy, especially given expected headwinds. This reinforces my belief that committed customer orders substantially de-risk the coming year.

China Headwind: Management expects a significant decline in China’s total net sales in 2026. They have consistently described the high levels seen in recent years as “very high and in no way normal.” This surge was due to ASML “eating into our backlog” to meet pent-up demand. The business is expected to normalise next year, returning to more sustainable levels.

AI as a Structural Growth Catalyst: The confidence that 2026 revenue will hold or grow despite lower China sales is fundamentally bullish. It reflects strong, broad-based investment in AI-related semiconductor demand, especially in leading-edge Logic and advanced DRAM. This trend requires greater lithography intensity and a broader customer base, reducing the risk of supply constraints and supporting long-term capacity growth.

Favourable Product Mix Shift: The expected 2026 dynamic is higher EUV sales and lower DUV sales (due to China restrictions). This shift toward higher-margin EUV systems supports earnings growth even if sales remain flat, highlighting the secular adoption of cutting-edge technology that is less cyclical than DUV.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com