Auto Partner: A Boring Business with Brilliant Results

Auto Partner S.A. (APR.WA) Q3 2023 Earnings Analysis

Auto Partner (Ticker: APR.WA) is a stock I haven't covered before, but I have been researching it in detail over the past month or so since it came onto my radar. This article will encompass a review of the Q3 2023 earnings, which were disclosed on 21 November, 2023.

Auto Partner is a distributor of spare parts for cars, light commercial vehicles and motorcycles based in Poland and listed on the Warsaw Stock Exchange. It operates as a sales and logistics platform managing just-in-time deliveries of spare parts to geographically dispersed customers and providing its services mainly to repair shops and automotive retailers. Its product portfolio includes spare parts for car systems, parts and accessories for motorcycles, filters, oils, car chemicals and accessories.

The company can be categorised as a small-cap stock, given its market capitalisation of approximately €770 million. It remains significantly under followed, and I suspect that the majority of readers may not be familiar with it. The company does not release a recording of its earnings call, but I was invited to participate, and I duly obliged. Consequently, the analysis presented here stands as some of the most unique available.

Executive Summary

Auto Partner's actions reflect a well-planned strategy to strengthen its distribution capabilities, optimise logistics, and strategically position itself for increased competitiveness in both domestic and international markets. The decision to build another hub in Zgorzelec, strategically located near the western border of Poland will reduce transportation times and allow customers to place orders for longer durations.

Auto Partner's revenue growth of +30% in 2023 is a result of a multifaceted approach, including market responsiveness and geographic expansion. Despite wage pressure from inflation, the company's ability to maintain solid margins in 2023 and improve margins in Q3, coupled with the passing of inflation costs onto consumers through higher prices, underscores effective management of economic challenges. The expansion of branches, coupled with a focus on increasing the average revenue per branch, demonstrates an effective use of scale-based economics.

To strengthen its competitive edge further, management is implementing strategies centred around automation. The optimization of warehouse and logistics processes, along with the automation of back-office functions, is aimed at improving efficiency and reducing costs. The emphasis on automating customer interactions through an AI chatbot reflects a forward-thinking approach to enhancing customer service. Auto Partner's preparedness to handle external goods in its warehouses and the focus on automation lay the groundwork for potential expansion into other verticals.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: PLN 956.3 million +27% year-over-year (YoY)

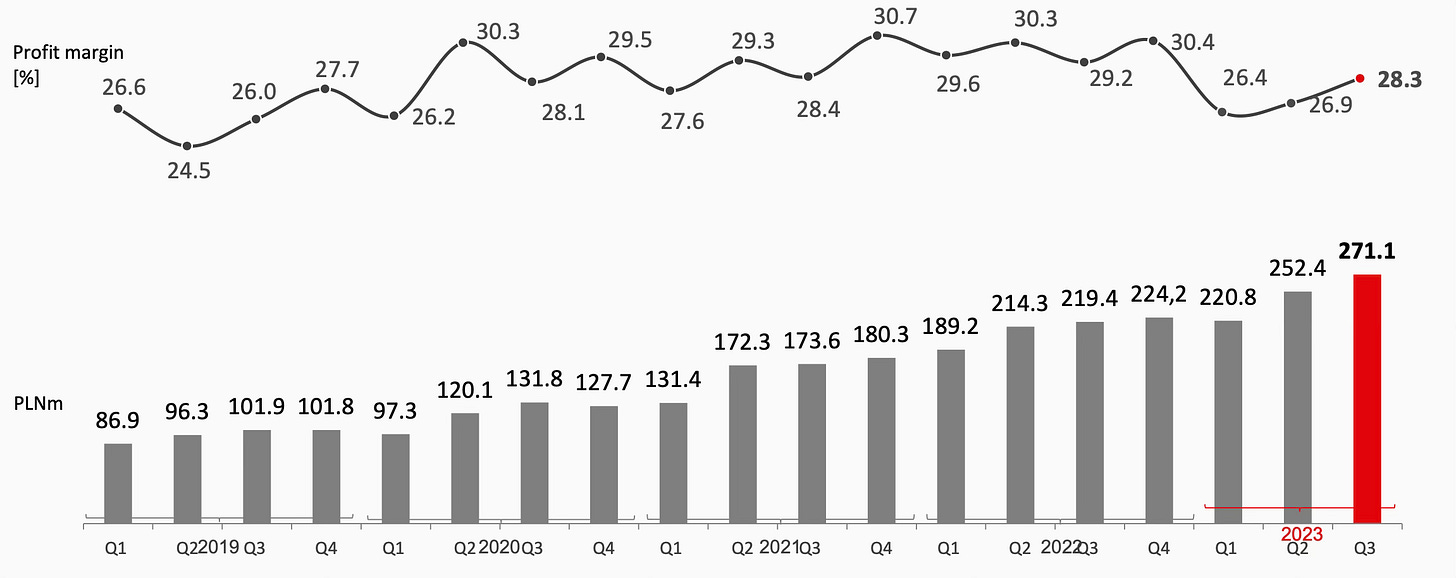

Gross Profit: PLN 271.1 million +24% YoY

Operating Profit: PLN 90.9 million +20% YoY

Net Profit: PLN 65.6 million +22% YoY

2. Wall Street Expectations

While the name is not covered by analysts in the U.S., I was able to obtain consensus estimates from Koyfin. In addition, the company releases monthly preliminary revenue figures, which means that the revenue figure is virtually known before the earnings report is released.

Revenue: PLN 955 million (beat by 1%).

3. Business Activity

Customer Base

Auto Partner is one of the largest distributors of automotive parts in Poland with a 10% market share. International markets have become increasingly important for the company and now account for 50% of sales. About 70% of Auto Partner orders are placed online, but when it comes to international markets, 99% of orders are placed online. Auto Partner’s online presence is supported by integrated IT tools managing the entire supply network and logistic infrastructure. This not only streamlines operations but also caters to the preferences of customers.

When it comes to the domestic market in Poland, repair workshops account for almost two-thirds of all revenue which suggests a strong partnership with the local automotive service industry. In this market, Auto Partner is taking share from smaller competitors who are now facing the issue of succession planning. This indicates Auto Partner's competitive strength and ability to capitalise on market dynamics.

Auto Partners own brand MaXgear offers over 35,000 individual parts and contributes over 21% to total sales. Management believe that this private label brand can provide Auto Partner with a competitive edge.

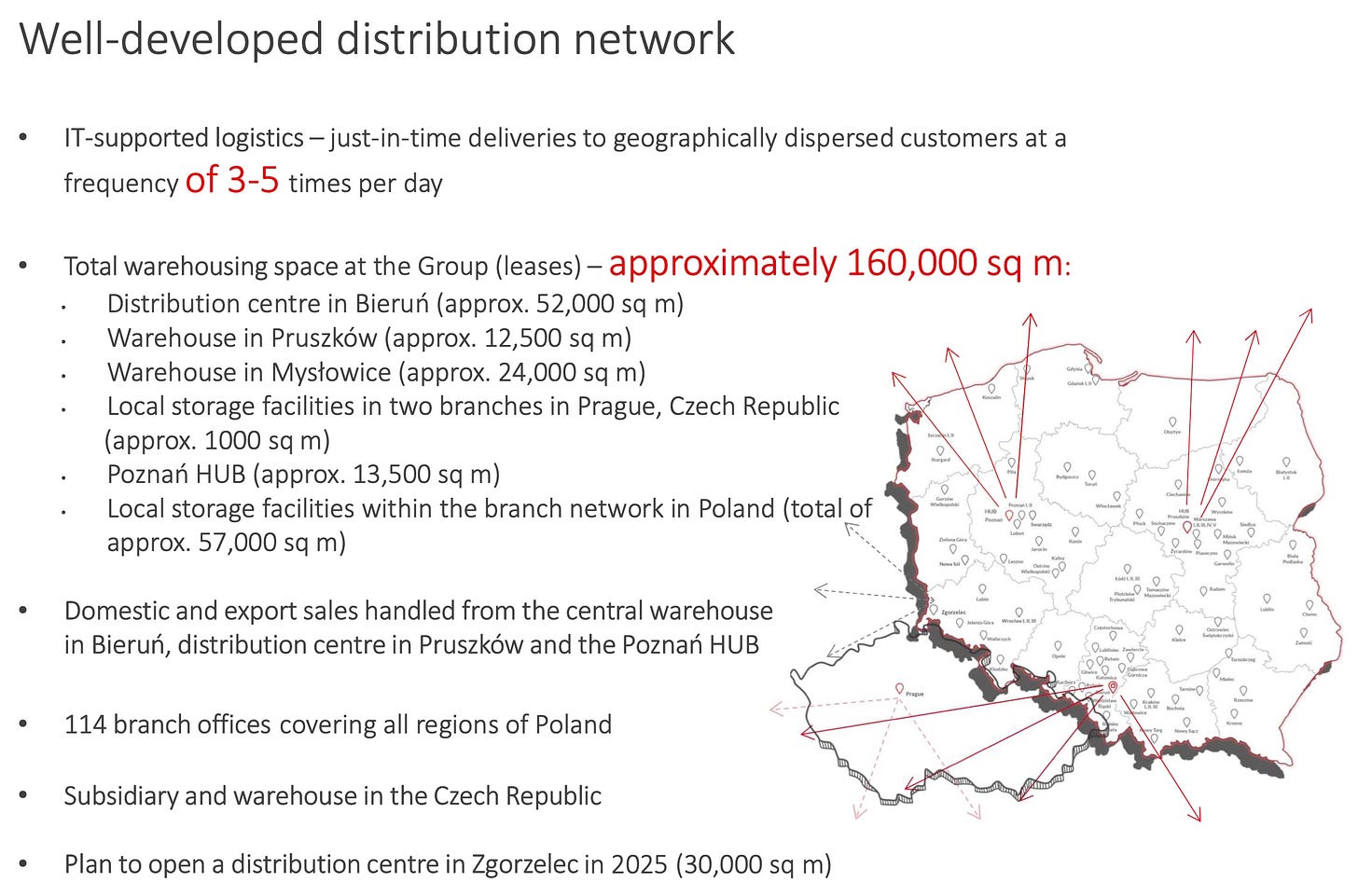

Logistics Network

Auto Partner’s main distribution center is in Bierun, along with two hubs in Pruszkow and Poznan. During the quarter, Auto Partner took over the entire logistics park in Bierun, which it previously shared with two other companies. Auto Partner has increased its warehousing space by approximately 20,000 square meters to 160,000.

Another hub is being built in Zgorzelec and will open in 2025. This is a strategic move as it is located near the western border of Poland. This is significant because it will bring Auto Partner a few hours closer to international markets. Auto Partner will be able to drive further, and customers will be able to order for longer, which will allow Auto Partner to be even more competitive in the international markets.

4. Financial Analysis

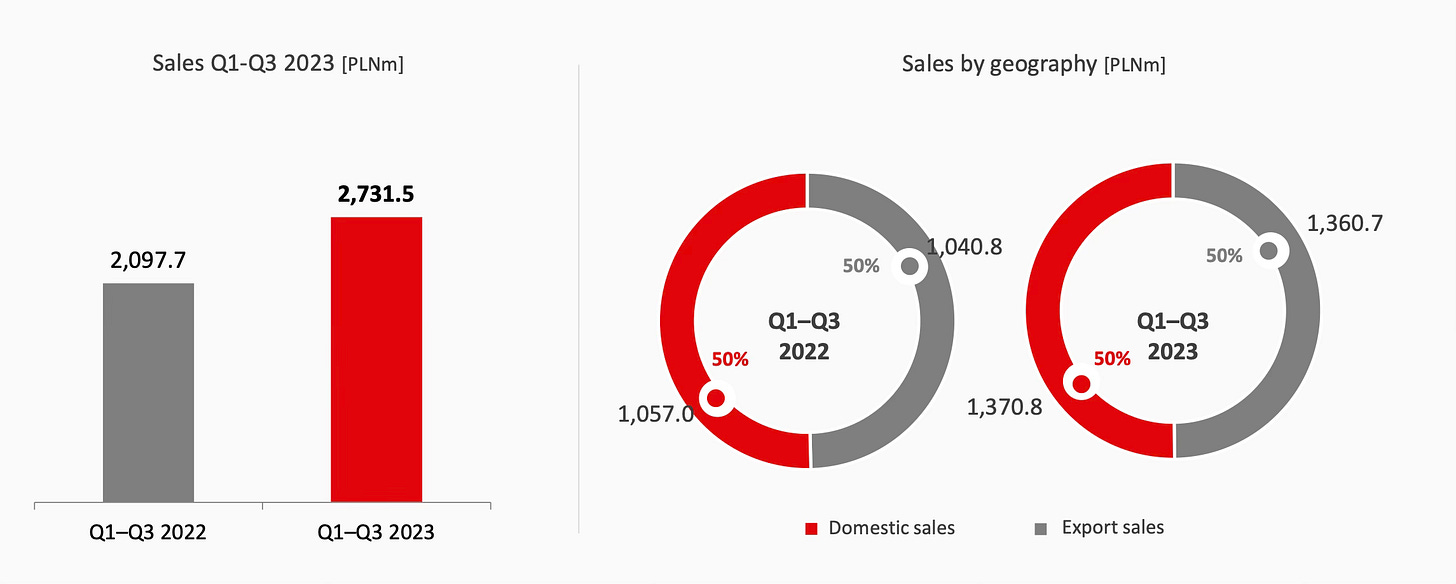

Auto Partner grew revenue by 27% in Q3 2023 to PLN 956.3 million. On a year to date basis, Auto Partner grew revenue by 30% to PLN 2.73 billion. Management attributes this growth to a couple of key drivers:

Strong demand for automotive parts in Poland and abroad.

New export destinations and routes.

Expansion of the product mix and alignment with customer needs within different price segments.

Management revealed on the conference call that in Q3 2023, 7% of revenue growth was attributed to inflation and 20% to volume. This is compared to 10% of revenue growth in the first half of 2023 attributed to inflation and the remaining 22% to volumes. This allows Auto Partner to adapt its strategies effectively, balancing the impact of inflation with sustained volume growth.

Export sales to international markets are becoming an increasingly larger contribution to total revenue. Export sales grew 31% year-to-date (YTD) in 2023, while domestic sales grew 30% during the same period. Since 2017, export sales have increased from 27% of total revenue to 50%. Management expects export sales to surpass domestic sales and believes that this is the future for the company, which is supported by its strategic decision to build a new hub on the western border.

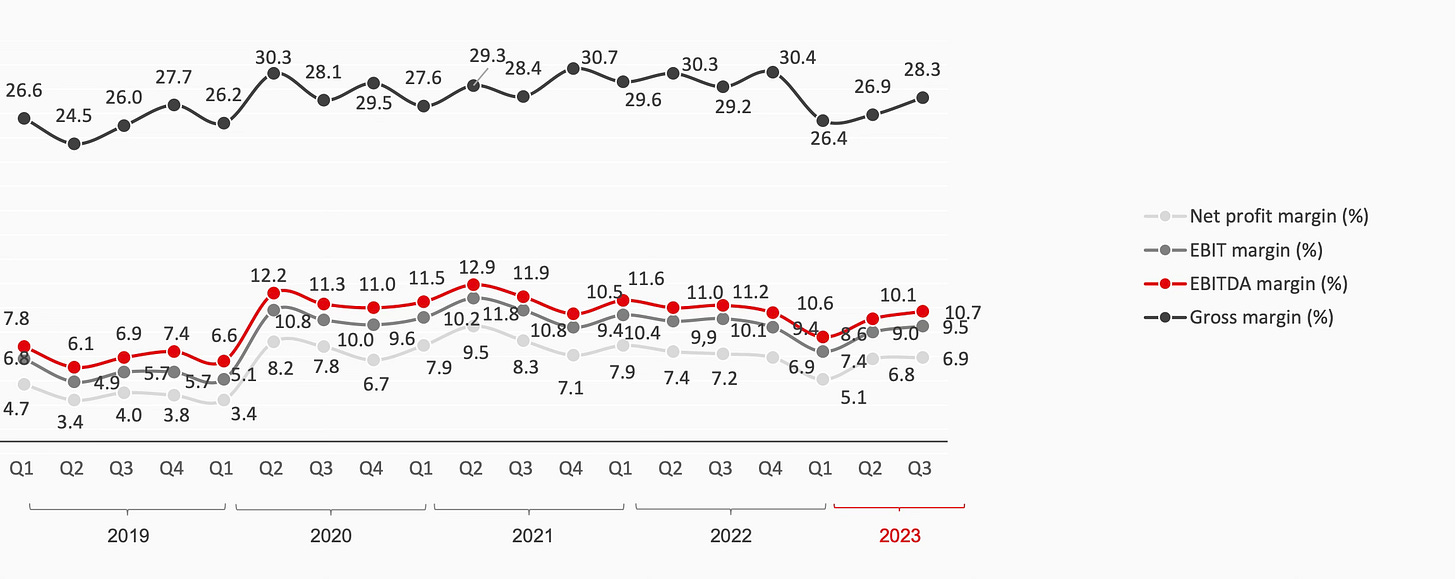

Auto Partner achieved a strong gross margin of 28.3% in Q3, which improved from 26.9% in Q2 2023. On the conference call, management noted that the drop in the first half of 2023 was a result of currency exchange headwinds, which led to more expensive products being bought in the second half of 2022 during a period of depreciation of the Polish Zloty and then had to be sold at a lower price. The nature of exchange rates means there will be volatility; some quarters, Auto Partner will benefit, and some quarters it will be to its detriment.

Despite wage pressure from inflation, Auto Partner has been able to maintain solid margins in 2023 and improved margins in Q3 2023 compared to the first half of the year. Management appears to have handled inflation well and benefited from being able to pass this onto the consumer in the form of higher prices.

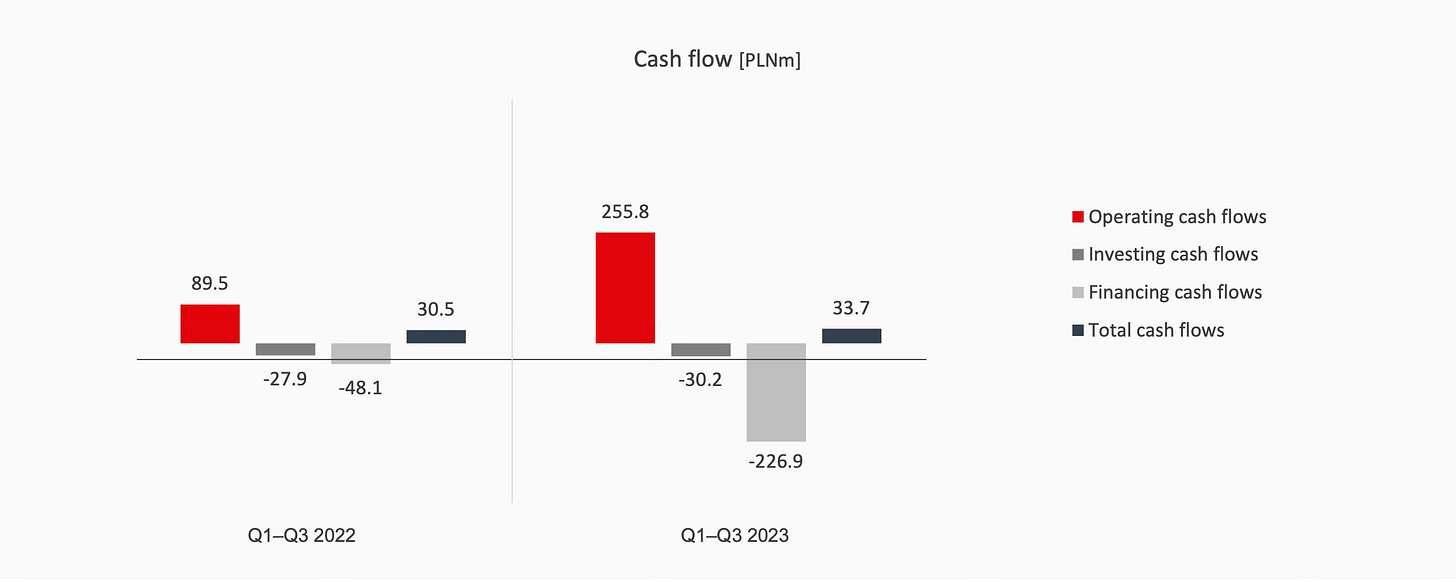

Cash Flow

Auto Partner recorded operating cash flow of PLN 255.8 million for the first 9 months of 2023 representing an increase of over 185% compared to the same period in 2022. Given the elevated interest rates, management decided to repay PLN 154 million worth of debt with the cash generated from operations. As a result of this, Auto Partner’s net debt/EBITDA is 0.8x.

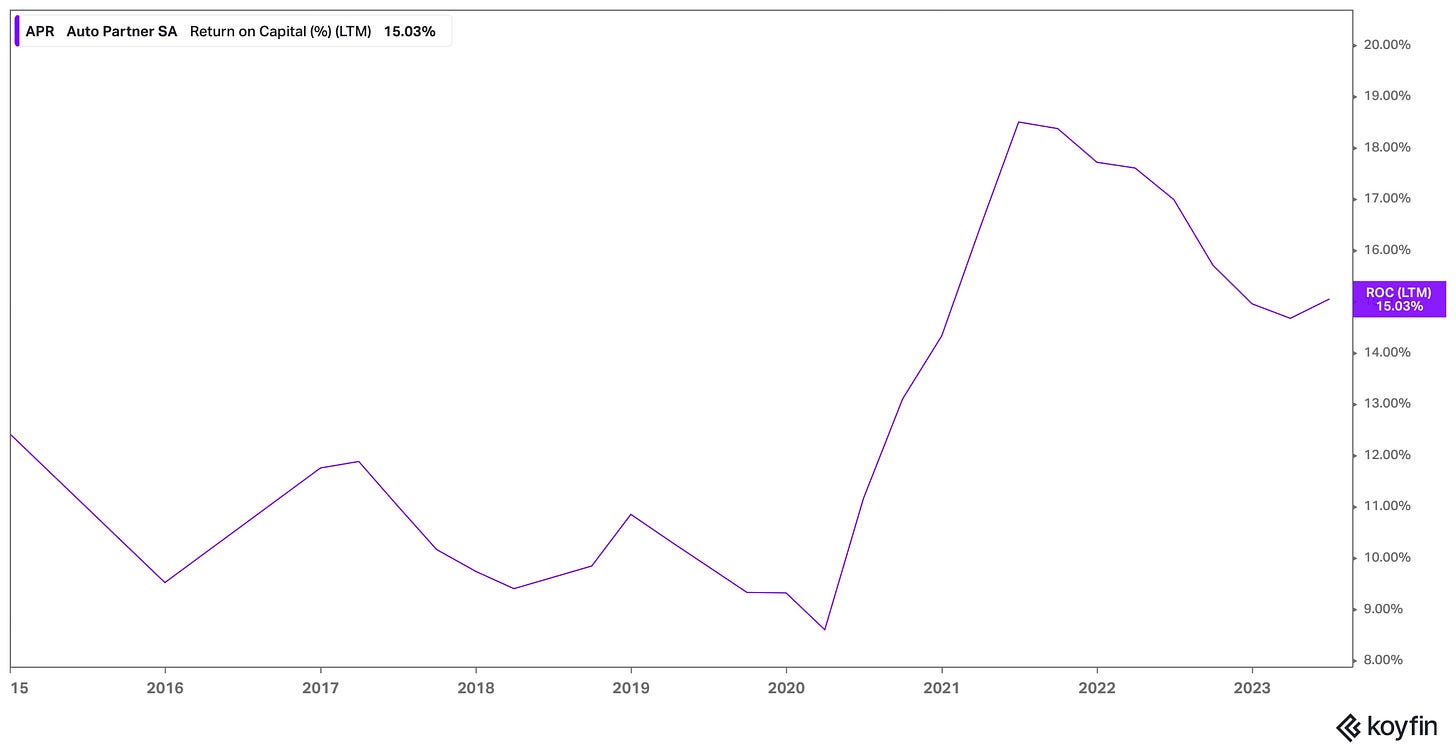

Return on Capital

Auto Partner’s profitability and business model has resulted in a Return on Capital (ROC) of 15% over the past twelve months. The key contributor to the improved returns over the past couple of years is due to Auto Partners utilisation of its branch network.

Auto Partner has grown its branches by 37% from 83 at the end of 2018 to 114 at the end of Q3 2023. During the same period, Auto Partner has been able to grow the average revenue per branch by 119% from PLN 13.9 million to PLN 30.4 million. Not only has Auto Partner been able to increase the number of branches it operates but it has been able to significantly increase the average revenue per branch.

Auto Partner has effectively leveraged scale-based economics to achieve impressive growth. By expanding its branches by 37%, the company has tapped into the benefits of a larger network. This not only provides a wider geographical reach but also allows for economies of scale in procurement, distribution, and operational efficiency. Auto Partner isn't just growing for the sake of expansion; they are optimizing their existing branches to generate more revenue.

5. Guidance

The preliminary revenue for October was PLN 338.7 million, an increase of 33% YoY. This means that Auto Partner has already exceeded PLN 3 billion in revenue for 2023, and revenue growth is accelerating based on the 27% growth achieved in Q3. Looking towards 2024, management is looking to keep up the mean growth rate. While the exact rate was not stated on the earnings call, the mean growth over the past 5 years has been 25% for context.

Management expects the gross margin in the first half of 2024 to be broadly in line with the gross margin achieved in Q3 2023, which is more in line with historic levels. However, it noted that there are many unknown variables in the equation, such as currency exchange rates. In response to an analyst question, management encouraged a more long-term view over several quarters rather than a single quarter. Management also revealed that currency exchange rates do not materially impact operations in the export markets because they purchase in Euro and sell in Euro.

Management expects a several percent increase in operating expenses in 2024 based on the new minimum wage laws in Poland, which will increase by 18% from January 2024.

6. Conclusion

The competitive positioning for Auto Partner remains strong. Auto Partner is experiencing much success internationally over local competitors for a number of reasons:

Delivering in the same lead time or faster than the local provider.

Broader product offering than the local providers.

Management discussed further strategies to strengthen its competitive positioning. The first element of this involves increasing automation in its warehouses and logistics processes. This includes optimizing costs and human work, as management puts a price tag on every touch of the product, generating a cost. The second element is the automation of back office processes. This involves matching customer and product needs 24 hours a day, 7 days a week. The company is working on an AI chatbot to answer as many customer queries as possible.

Management also stated that they are a service company, and thanks to their logistics network, they can send anything and are ready for fulfilment and having external goods in their warehouses, which they have tested before. While they do not need it right now, the business is positioned for diversification. They want to be ready for this and have the processes automated so that they can scale up in other verticals outside of automotive parts.

The Q3 earnings call was the first time that I got to listen to the leadership team, and I found them impressive. Aleksander Górecki, the President and founder, strikes me as a conservative individual and has a lot of skin in the game. Between him and his wife, they own over 47% of the company. This owner operator approach is very much aligned with shareholders and can be evidenced by the long-term view that management gave around the gross margin instead of viewing it in individual quarters.

Auto Partner is the perfect example of a boring business, and this is why it offers an attractive investment opportunity trading at less than 14 times forward earnings. The company has a stable and predictable business model based on scale-based economics with a clear runway for growth. This is summed up by the following quote from the CFO on the earnings call:

We have been growing and growing; it is quite boring actually, nothing changes

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you for this analysis.

If you haven't already done so, I invite you to read Sohra Peak's quarterly reports; the fund manager has written extensively about Auto Partners. You can start with this one: https://sohrapeakcapital.com/wp-content/uploads/2023/07/Sohra-Peak-Capital-Partners-Partnership-Letter-Q2-2022.pdf

Thank you, it's a very helpful report. It's also good to know that they have investor calls.