Auto Partner: A Temporary Setback or a New Normal?

Auto Partner (APR.WA) Q3 2024 Earnings Analysis

Executive Summary

Auto Partner's 11% Q3 2024 revenue growth, reaching PLN 1.061 billion, was volume-driven, supported by its branch network's operational efficiency and expansion into new markets. Despite slight price declines, growth was fuelled by higher utilisation of its existing branches, with average monthly revenue per branch rising 10% YoY to nearly PLN 3 million.

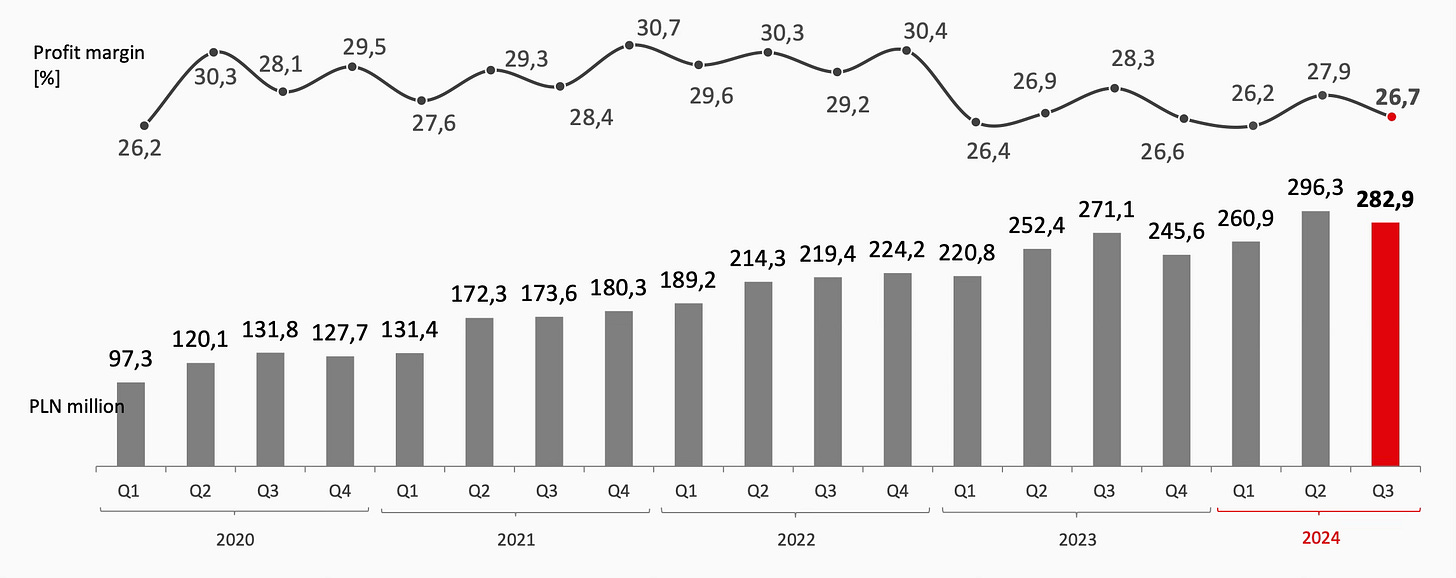

Gross margin decreased to 26.7% in Q3 2024, down from 27.9% in Q2 2024 and 28.3% in Q3 2023. This was driven by sales of inventory purchased during weaker PLN exchange rates and ongoing margin pressure from lower EUR/PLN and USD/PLN rates, alongside modest commodity price reductions.

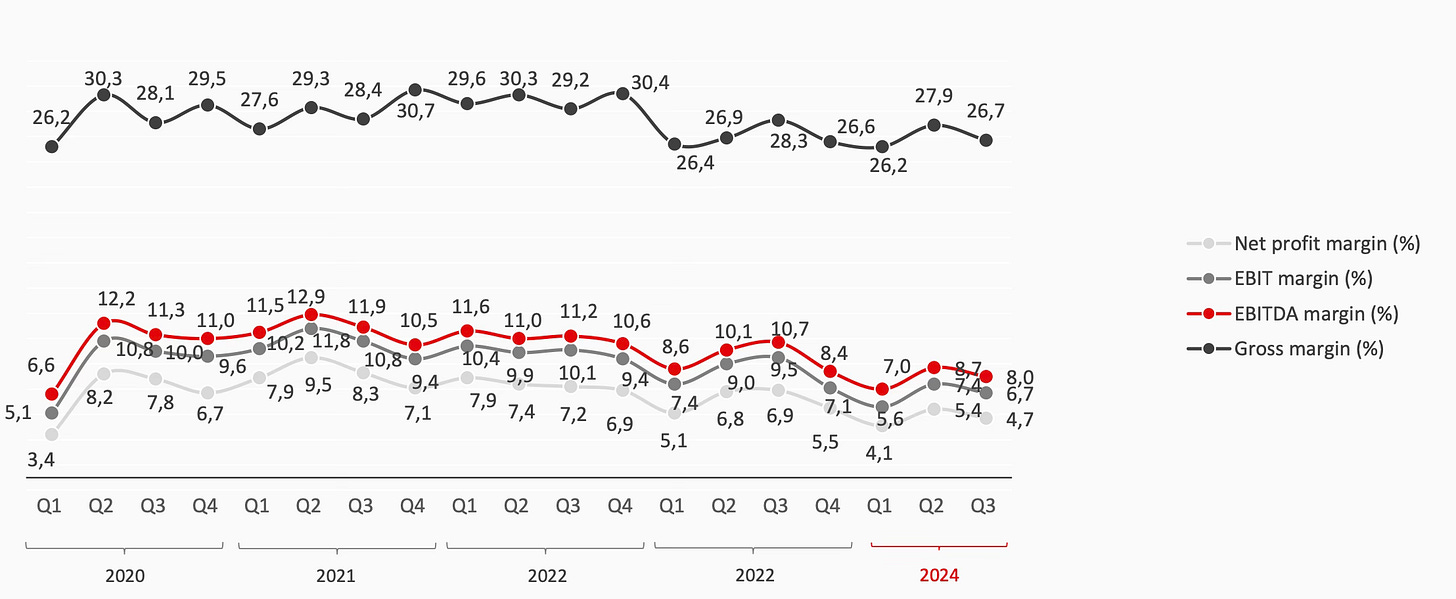

The operating margin followed a similar trend, dropping to 6.7% in Q3 2024 from 7.4% in Q2 2024 and 9.5% in Q3 2023. Key factors include a sharp (20%) increase in the minimum wage, raising salary costs and external service expenses, as well as a PLN 2 million loss from flood-related damages at the Kłodzko branch, though this will eventually be reimbursed by insurance.

Contents

Financial Highlights

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: PLN 1.061 billion +11% year-over-year (YoY)

Gross Profit: PLN 283 million +4% YoY

Operating Profit: PLN 71 million -22% YoY

Net Profit: PLN 50 million -24% YoY

2. Business Activity

Logistics Network

Auto Partner's main distribution centre is located in Bierun, supported by additional hubs in Pruszkow and Poznan. A new hub is under construction in Zgorzelec, near Poland’s western border, and is expected to open in late 2025 or early 2026. This strategic expansion enhances the company's competitiveness in international markets. By the end of Q3 2024, APR operated 118 branch offices across Poland, an increase of one from Q2 2024 and four from Q3 2023.

Market Environment

The 14% rise in new passenger car registrations in Poland reflects robust demand for vehicles, potentially driving future demand for auto parts and services as these vehicles age.

An increase in the median price of used cars (+PLN 1,901) underscores sustained demand for second-hand vehicles. This is a positive indicator for Auto Partner, as older cars typically require more frequent maintenance and part replacements.

The average age of imported cars in Poland and the EU is 12.3 years, highlighting significant demand for maintenance and repair services. This aligns well with Auto Partner’s business model, which is centered on servicing older vehicles.

With Poland's unemployment rate at 5.0% (up from 4.9% in Q2 2024) and the EU's at 5.9%, consumers are likely to maintain disposable income for vehicle maintenance and repairs.

Poland's GDP growth of 2.7%, three times the EU average of 0.9%, indicates a favorable economic environment for Auto Partner’s operations. This stronger economic backdrop may also support the company's efforts to expand its export business to other EU markets.

3. Financial Analysis

Revenue

Auto Partner achieved an 11% revenue growth in Q3 2024, reaching PLN 1.061 billion. This growth was driven by expansion into new export destinations, diversification of its product mix, and the opening of four additional branches in Poland compared to Q3 2023.

Notably, this revenue growth was volume-driven rather than inflation-driven, with a slight decline in prices for certain goods.

On a YTD basis, Auto Partner's revenue grew 14% YoY, with a balanced contribution from both export and domestic sales. Each segment accounted for 50% of total revenue and grew by 14% YTD.

A key strength of Auto Partner's business model is its branch network. Products are distributed from central warehouses to branch offices, which then deliver directly to customers. While Auto Partner added four new branches compared to the prior year, the primary driver of revenue growth was the increased utilisation of its existing network. Average monthly revenue per branch rose 10% YoY YTD in 2024, reaching nearly PLN 3 million. Since 2020, APR has doubled this figure, though the rate of improvement has slowed significantly since 2023.

Gross Margin

The gross margin declined to 26.7% in Q3 2024, compared to 27.9% in Q2 2024 and 28.3% in Q3 2023. This decrease was influenced by the sale of goods purchased in late 2023 during a period of weaker PLN exchange rates. Additionally, current lower EUR/PLN and USD/PLN rates, coupled with slight commodity price reductions from some suppliers, exerted downward pressure on margins.

Operating Margin

Auto Partner experienced a decline in its operating margin, mirroring the trend seen in its gross margin. In Q3 2024, the operating margin fell to 6.7%, down from 7.4% in Q2 2024 and 9.5% in Q3 2023. This margin pressure primarily stems from a sharp increase in the minimum wage (approximately 20%), which raised salary expectations for a substantial portion of employees and drove up the cost of many external services.

In addition, the company incurred a loss of approximately PLN 2 million due to the flooding of its Kłodzko branch during the September 2024 floods in southwestern Poland. While the damage will be fully covered by insurance, Auto Partner is still awaiting compensation.

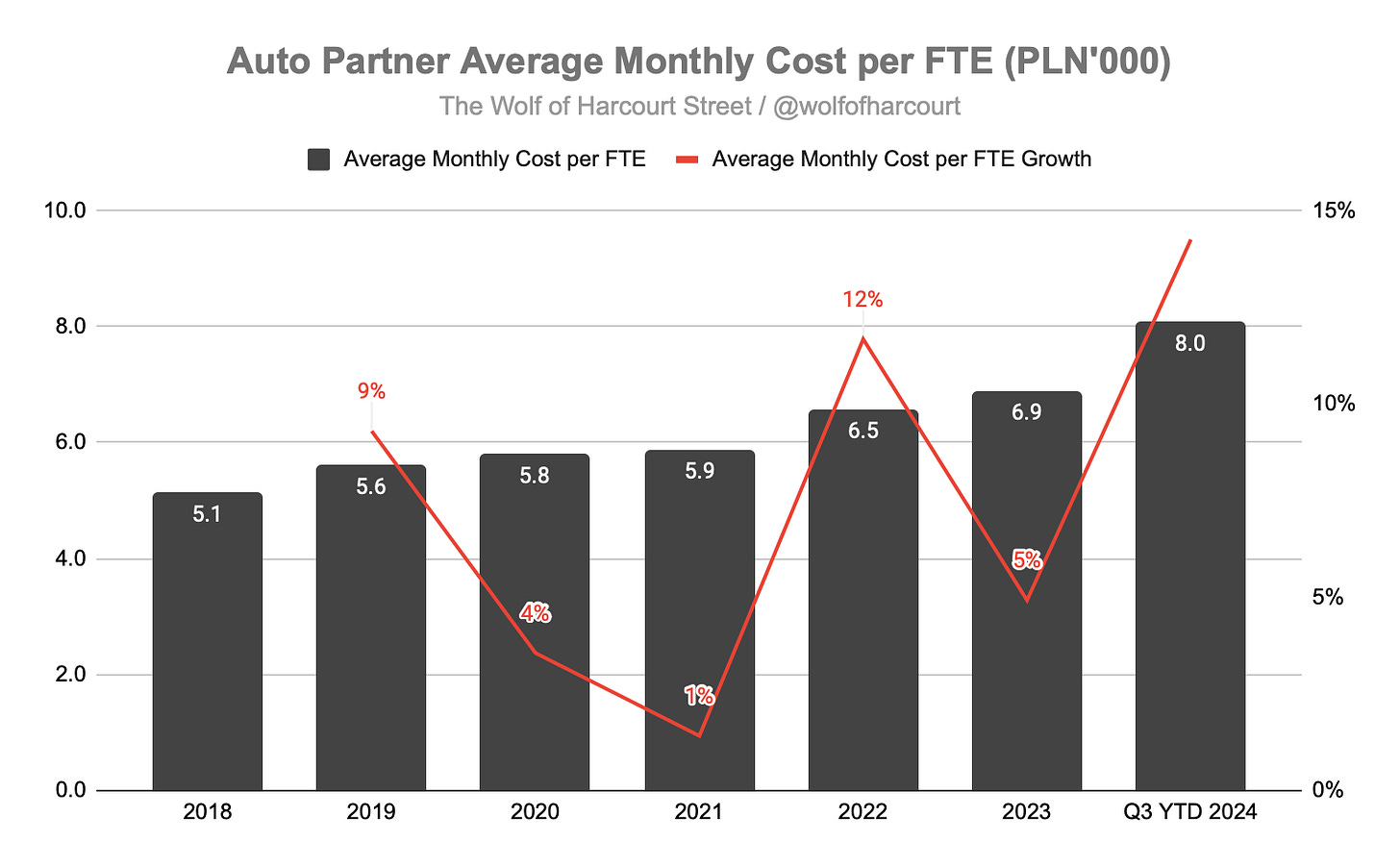

The company continued to expand its workforce in 2024, albeit at a significantly slower pace than in recent years. Full-time equivalent (FTE) employees increased by 7% YoY—a slower growth rate than even 2020, which included disruptions from COVID-19 lockdowns.

One of the main drivers of the slower hiring rate is the sharp rise in costs per FTE, which increased by 14% in 2024, reaching PLN 8,000. This increase was largely driven by the minimum wage hikes. Looking ahead, management plans to focus on optimising human resource utilisation and investing in process automation where it is economically viable.

Cash Flow Analysis

Auto Partner reported operating cash flow of PLN 160 million YTD in 2024, compared to PLN 256 million in the same period of 2023. This decline was primarily driven by increased working capital requirements, particularly inventory.

While closing inventory rose by 13% YoY, inventory turnover improved from 134 days at the end of Q3 2023 to 129 days at the end of Q3 2024, indicating effective working capital management.

4. Guidance

Preliminary revenue for October 2024 was PLN 381 million, reflecting a 14% YoY increase.

5. Conclusion

Revenue growth remains robust despite a challenging environment, with both exports and the domestic market contributing equally. The company continues to maintain a relatively low level of debt, with a net debt-to-EBITDA ratio of 1.2.

However, margins remain a concern, as much of the improvement seen in Q2 was reversed this quarter. That said, it’s important to assess the overall trend rather than focusing on a single quarter in isolation. While the minimum wage increases are entirely beyond management’s control, they present a significant challenge that requires active management. One part of their strategy appears to involve slowing hiring, but the sustainability of this approach is questionable. For Auto Partner to grow, it needs more labor, as this is a critical input for its business. Unlike a software company, this is a distributor of physical goods.

Looking at the margin trend over the past six years raises the question: was the company over-earning in 2021 and 2022, and are we now seeing a reversion to the mean?

It is still too early to answer this question definitively, as the minimum wage increases only took effect in 2024. The company will need time to adjust its strategies accordingly, and clearer answers are likely to emerge in 2025.

Rating: 2 out of 5. Below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

After a 20% yoy increase in the minimum wage in 2h2024, the minimum wage is only expected to increase by 10% in 1H2025. Won’t this help Auto partners absorb wage inflation and restore part of the margin decline that it saw in 2023 and 2024? The minimum wage in Poland doubled over a 5-year period (15% cagr) so a slowdown in the rate of wage increases should help the company get back to normalized margins. The situation should get better in 2h2025 as no minimum wage increase is expected after January 2025