Auto Partner: Driving Margin Improvement

Auto Partner (APR.WA) Q2 2024 Earnings Analysis

Executive Summary

Auto Partner achieved 13% revenue growth in Q2 2024, reaching PLN 1.062 billion, driven entirely by increased volumes. A critical driver of success is Auto Partner’s branch network, which saw a 13% increase in average monthly revenue per branch, reaching nearly PLN 3 million. Since 2018, the average revenue per branch has nearly tripled.

Auto Partner achieved a notable improvement in gross and operating margins in Q2 2024 after two consecutive quarters of decline. The gross margin rose to 27.9%, benefiting from diminished currency impacts and an improving operating environment. Deflation has negatively affected gross margins, reversing the company's typical inflationary advantage due to its inventory turnover cycle. On the operating side, margins improved to 7.4%, but wage inflation—driven by a 14% increase in costs per full-time employee—continues to pressure profits.

Auto Partner reported strong operating cash flow growth of over 9% in H1 2024, despite a decline in net profit margin, primarily due to effective inventory management. Looking ahead, Auto Partner may benefit from future inflation, driven by factors like rising demand and Poland's faster-than-average GDP growth, allowing them to increase prices on pre-purchased stock and improve both revenue and margins.

Contents

Financial Highlights

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: PLN 1.062 billion +13% year-over-year (YoY)

Gross Profit: PLN 296.3 million +17% YoY

Operating Profit: PLN 78.4 million -7% YoY

Net Profit: PLN 56.9 million -11% YoY

2. Business Activity

Logistics Network

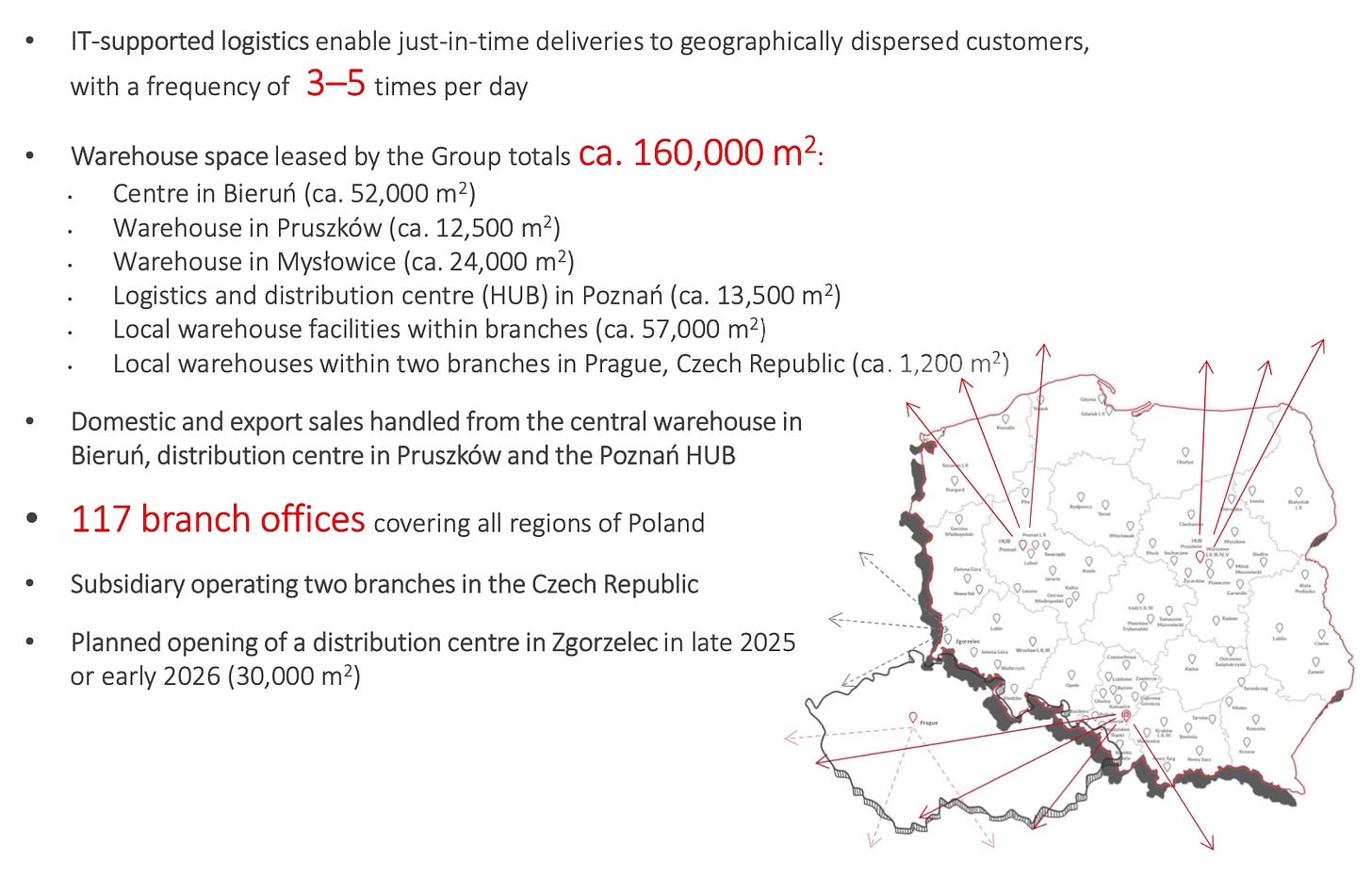

APR’s main distribution center is located in Bierun, with two additional hubs in Pruszkow and Poznan. A new hub is currently under construction in Zgorzelec, expected to open in late 2025 or early 2026. This strategic move places APR near Poland’s western border, enhancing the company's competitiveness in international markets. As of the end of Q2 2024, APR operates 117 branch offices across all regions of Poland, an increase of 1 from Q1 2024 and 3 from Q2 2023.

Market Environment

The 16% rise in new passenger car registrations in Poland, alongside a 4.5% increase in the EU, reflects a strong automotive market. This growth suggests heightened consumer confidence and spending on vehicles, which could lead to greater demand for auto parts.

The average age of imported cars in both Poland and the EU is 12.3 years, highlighting significant potential for maintenance and repair services. Older vehicles typically require more frequent servicing and replacement parts, which aligns well with Auto Partner’s business model.

The rise in new car registrations has led to a 6% decrease in the median price of pre-owned cars. This may stimulate the used car market, potentially boosting demand for aftermarket parts as consumers maintain these vehicles.

With unemployment rates at 4.9% in Poland (down from 5.3% in Q1 2024) and 6% in the EU, consumers are more likely to have disposable income for vehicle maintenance and repairs.

Poland’s strong GDP growth of 3.2%, four times higher than the EU average of 0.8%, indicates a more favorable economic environment in APR’s home market. Given these stronger economic indicators, APR may find opportunities to expand its export business to other EU countries.

3. Financial Analysis

Revenue

APR grew revenue by 13% in Q2 2024, reaching PLN 1.062 billion. This growth was driven by several key factors:

Expansion into new export destinations and routes

Further diversification of the product mix, better aligned with customer needs across different price segments

The opening of three new branch offices in Poland compared to Q2 2023

During the conference call, in response to a question from yours truly, management confirmed that the revenue growth was entirely volume-driven. In fact, they suggested that volume growth was closer to 14%, as there was a deflation impact of approximately 1%. Last quarter, I proposed that the revenue growth was likely volume-based, and this has now been confirmed.

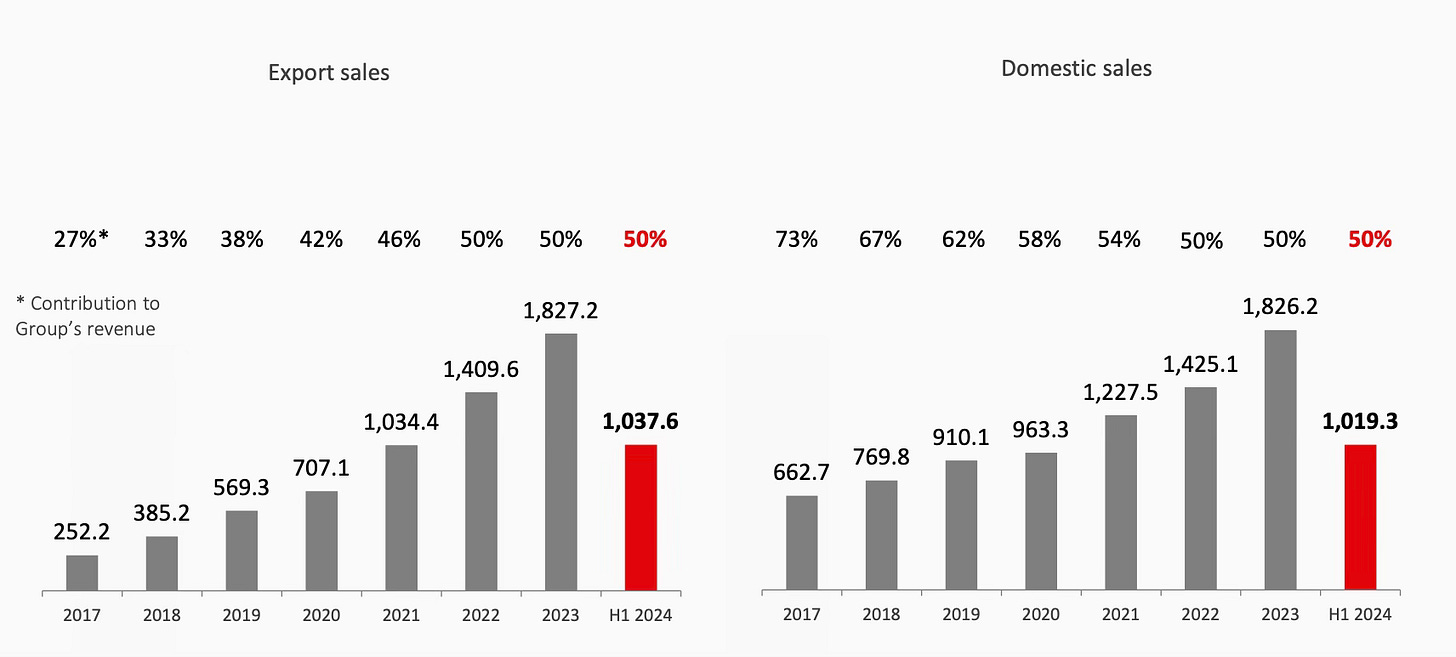

Looking at the first half of the year combined, APR’s revenue grew 16% YoY. Export sales to international markets contributed half of the total revenue, also growing by 16% in H1. Domestic sales saw a similar 16% growth over the same period.

A key element of APR’s business model is the use of its branch network. Products are shipped from central warehouses to branch offices, which then deliver directly to customers. While APR did open three new branches compared to the same time last year, the more significant impact on revenue came from how it utilized its existing branches. APR’s average monthly revenue per branch increased by 13% YoY in H1, reaching almost PLN 3 million. Since 2018, APR has nearly tripled its average monthly revenue per branch, up from PLN 1.2 million.

Gross Margin

APR achieved a gross margin of 27.9% in Q2 2024, up from 26.2% in Q1 2024 and 26.9% in Q2 2023. After two consecutive quarters of declining margins, it is encouraging to see this trend begin to reverse.

Management revealed that export sales have a lower gross margin than domestic sales, suggesting that APR is unlikely to achieve gross margins above 30% again in the future. This is due to exports now accounting for 50% of sales, compared to just 27% in 2018. However, while export sales generate lower gross margins, they also come with reduced operating expenses, meaning the net impact on APR’s bottom line from exports should still be positive.

Additionally, the negative currency impact from products purchased in late 2023, when the Polish złoty was weak, has diminished. The current lower EUR/PLN and USD/PLN exchange rates also affect the value of sales, particularly exports, when translated into PLN for reporting purposes.

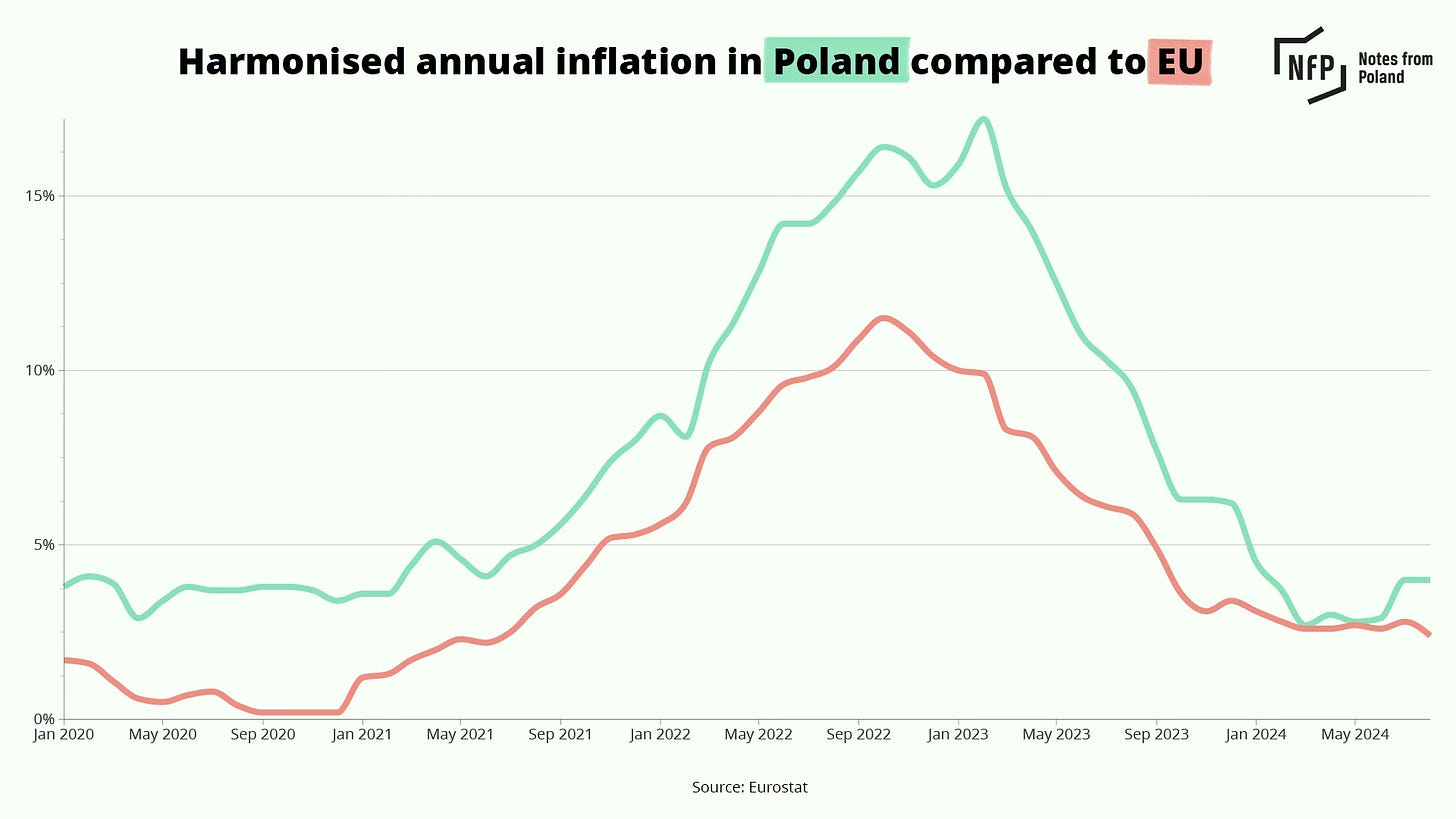

Offsetting these factors is the impact of deflation on the gross margin. During inflationary periods, APR benefits because its inventory turnover is about five months. When suppliers raise prices, APR follows suit, selling products it bought earlier at relatively higher prices, which boosts the gross margin. The reverse occurs during deflationary periods, where goods purchased last year are sold at relatively lower prices, negatively impacting the gross margin.

Operating Margin

Like the gross margin, APR saw an improvement in its operating margin on a sequential basis, despite a continued challenging environment. In Q2 2024, the operating margin increased to 7.4%, up from 5.6% in Q1 2024, though it remains below the 9.0% reported in Q2 2023. This margin pressure is primarily due to wage increases following an 18% hike in the minimum wage.

APR continued to expand its headcount in the first half of 2024, but at a much slower pace than in recent years. Full-time equivalent (FTE) employees increased by 12% YoY, the slowest growth rate since 2020, which included COVID lockdowns.

One possible reason for the slower hiring pace is the sharp increase in costs per FTE, which rose by 14% in H1 2024 to nearly PLN 8k, driven by the minimum wage hikes in Poland. According to data from Statistics Poland, average wages in the country increased by almost 13%, with APR closely tracking this trend. On the conference call, management mentioned they are looking to automation and robotics as potential solutions to wage inflation.

Cash Flow Analysis

APR reported operating cash flow of PLN 226 million in H1 2024, representing a more than 9% increase compared to H1 2023. This improvement is partly attributed to effective management of working capital, particularly inventory. Inventory turnover decreased from 136 days at the end of Q2 2023 to 128 days at the end of Q2 2024. Despite the YoY decline in net profit margin, APR’s operating cash flow has increased due to less cash being tied up in inventory.

4. Guidance

The preliminary revenue for July and August 2024 was PLN 709.4 million, reflecting a 14% YoY increase. However, it is highly unlikely that APR will achieve +20% revenue growth in 2024.

5. Conclusion

APR delivered a solid quarter, especially considering the challenging market environment. A key highlight was the sequential margin improvement after consecutive periods of margin erosion. It appears that management is gaining control over its cost structure, particularly in response to the sharp rise in labor costs. This will remain a key challenge, as labor costs are set to increase by another 8% in 2025, at which point the minimum wage will surpass those of 18 U.S. states.

Cost pressures have also led to better inventory management, which has boosted operating cash flow—an encouraging sign for the future. Additionally, export sales have remained resilient despite the delay in the new distribution centre on the western border, which is still twelve to eighteen months away from completion.

One potential tailwind for APR is data from Eurostat, released this week, which revealed that Poland had the EU’s third-highest inflation rate in August. Although inflation eased in the first half of 2024 despite wage increases, we observed deflation from APR's suppliers.

Following the unfreezing of energy prices by the Polish government in July, inflation could ramp up again in Poland. This presents a potential net positive for APR, as it can raise prices on pre-purchased stock, thereby increasing both revenue and gross margin. It's worth considering this scenario, especially given that inflation could rise as Poland's GDP grows four times faster than the rest of Europe, driven by increasing demand or reduced supply.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great article as always.

I would like to add some nuance to something in the write-up: You say that GM are unlikely to go over 30% in the future bc the lower current GM of export sales. Let me argue that GM could improve over 30% in the long term:

The reason why GMs are currently lower in the export segment is because APR relies on third party distributors for those sales. As APR expands outside of Poland and supply those customers without using 3rd party resellers, the gross margins might improve, as the outside-of-Poland operations would resemble more the currently Polish operations

Are they closing DCs on the west coast?