Auto Partner: The Impact of Poland's New Minimum Wage Laws

Auto Partner (APR.WA) Q1 2024 Earnings Analysis

Executive Summary

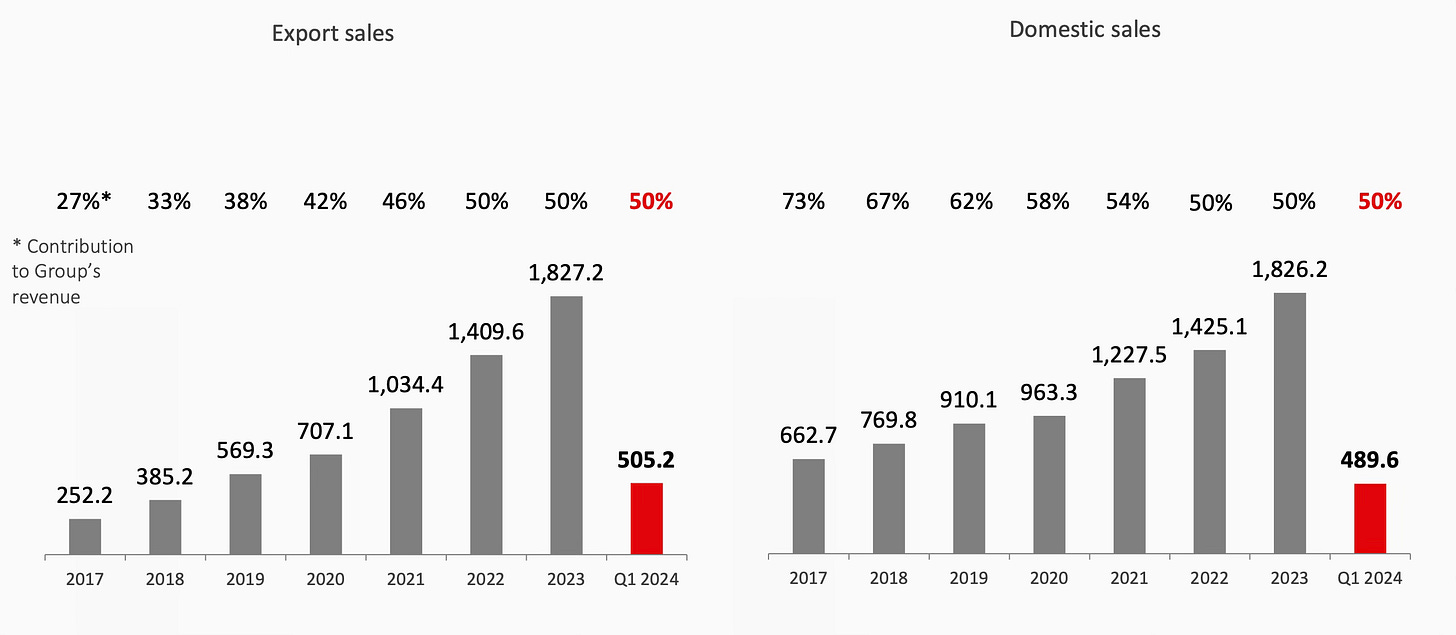

Auto Partner's revenue grew by 19% to PLN 994.8 million, driven by expansion into new export destinations and an enhanced product mix. Export sales contributed half of the total revenue with a 17% growth, while domestic sales grew by 21%, outpacing international growth. The need for a new distribution centre in the west of the country is emphasised to address potential export sales slowdowns.

Auto Partner faced margin pressure, with both gross and operating margins declining compared to Q1 2023. This decline is attributed to various factors including inflated transport costs, inflation, business expansion, and significantly higher finance costs due to interest rate hikes. Notably, new minimum wage laws in Poland, which increased by 18% from January 2024, caused the average real wage to increase by 12.8% which will have significantly impacted Auto Partner’s operating expenses, potentially contributing to the margin compression.

Auto Partner achieved an operating cash flow of PLN 171.8 million, marking a growth of over 6% compared to Q1 2023. This increase is attributed to effective management of working capital, notably a reduction in inventory turnover from 141 days in Q1 2023 to 127 days in Q1 2024. Looking towards Q2, preliminary revenue for April 2024 increased by 23% year-on-year to PLN 353.2 million.

Contents

Financial Highlights

Business Activity

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: PLN 994.8 million +19% year-over-year (YoY)

Gross Profit: PLN 260.9 million +18% YoY

Operating Profit: PLN 56.1 million -10% YoY

Net Profit: PLN 40.3 million -6% YoY

2. Business Activity

Customer Base

Auto Partner’s (APR) market share of the auto parts market in Poland remains unchanged at 10%. International markets account for 50% of sales. About 70% of APR’s orders are placed online, but for international markets, 99% of orders are placed online.

In the domestic market in Poland, repair workshops account for almost two-thirds of all revenue. Specialized stores and non-specialized repairers and retailers account for 30% and 8% of revenue, respectively.

APR’s own brand, MaXgear, contributes 20% to total sales.

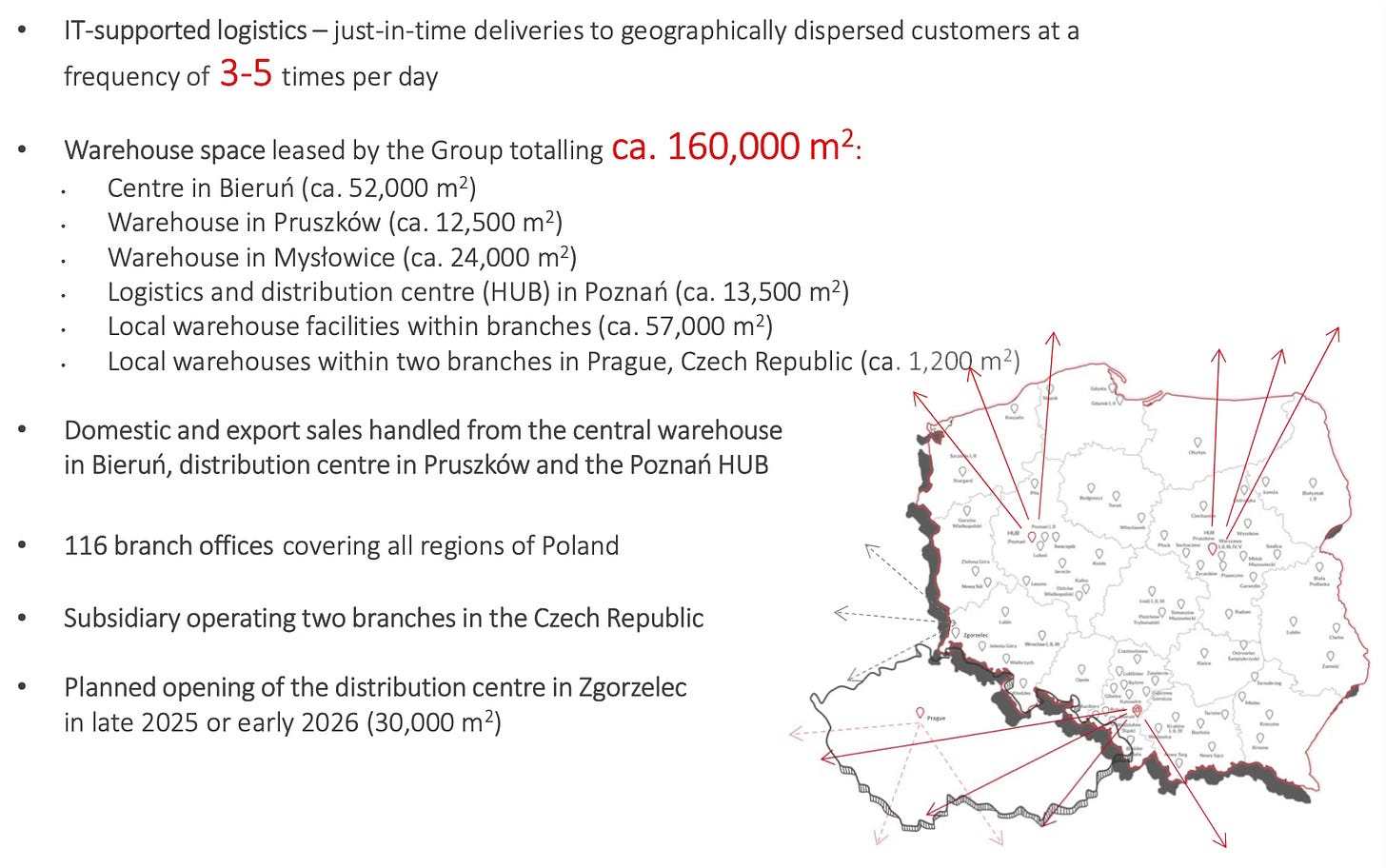

Logistics Network

APR's main distribution center is in Bierun, along with two hubs in Pruszkow and Poznan. Another hub is being built in Zgorzelec and will open in late 2025 or early 2026. This is a strategic move as it is located near the western border of Poland and will enable APR to be even more competitive in international markets.

Market Environment

With the average age of imported passenger cars in Poland increasing to 13 years and the average age of passenger cars in the European Union at 12.3 years, there is a growing need for maintenance and repair services. Older vehicles typically require more frequent servicing and repairs to remain roadworthy.

Despite the increase in the number of new passenger car registrations, the median price of pre-owned cars in Poland declined slightly in Q1. This suggests that there is a steady demand for used cars, particularly older models, which will continue to contribute to the need for maintenance and repair services.

With relatively low unemployment rates in both Poland (5.3%) and the European Union (6%), consumers are more likely to have disposable income to spend on vehicle maintenance. APR can target these employed individuals who rely on their vehicles for daily transportation and are willing to invest in keeping their cars in good condition for longer periods.

Poland’s strong GDP growth (+1.9% y/y) is almost four times the European Union GDP growth (+0.5% y/y), indicating sustained consumer spending on vehicles and related services.

3. Financial Analysis

Revenue

APR grew revenue by 19% to PLN 994.8 million. This growth continues to be attributed to a couple of key drivers:

Expansion into new export destinations and routes.

Further expansion of the product mix and better alignment with customer needs across different price segments.

Unfortunately, management did not host a Q1 earnings call this year, similar to previous years, due to the close proximity to the Q4 earnings call last month in April. As a result, it is not possible to determine the revenue growth driven by volume and inflation. Given that the price of pre-owned cars declined slightly in April, my suspicion is that the revenue growth is almost entirely from volume.

Export sales to international markets contributed half of the total revenue, with a 17% growth in Q1. Domestic sales grew by 21% during the same period, outpacing international growth for the first time in several years. Without the earnings call, it is not possible to determine the reason for this, but it highlights the need for the new distribution center in the west of the country to be opened as soon as possible. Clarity is required to determine if the slowdown is due to the overall economic situation in Europe or increased competition.

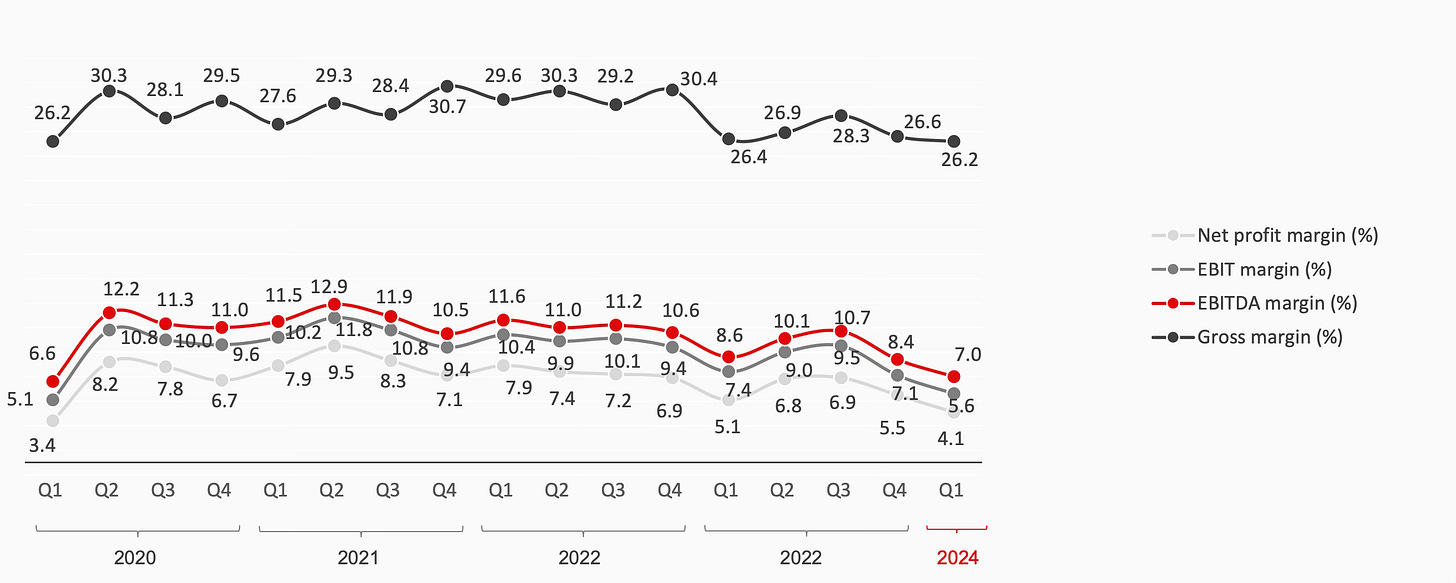

Gross Margin

APR achieved a gross margin of 26.2%, consistent with 26.4% in Q1 2023. Previous management commentary noted that the drop in 2023 (from a 29% gross margin in 2022 and 2021) was a result of currency exchange headwinds. These headwinds led to more expensive products being bought in 2022 during a period of PLN depreciation, which then had to be sold at a lower price in 2023. This was followed by a strengthening trend that continued until the end of 2023.

Operating Margin

APR reported weak margins due to a challenging market environment. During Q1 2024, the operating margin fell to 5.6% from 7.4% in Q1 2023, aligning with the pre-pandemic level of 5.7%. The decline is attributed to several key factors:

Inflated transport costs

Inflation (including wage pressure) and business expansion

Significantly higher finance costs due to interest rate hikes

In particular, I would draw the reader's attention to the new minimum wage laws in Poland, which increased by 18% from January 2024. At the end of 2023, APR had an average of 2,765 FTEs at a cost of over PLN 227 million. According to data from Statistics Poland (GUS), the average wage rose by 12.8% YoY in January 2024, the fastest increase in 16 years. This means that APR’s operating expenses could have risen by PLN 29 million in Q1 without hiring any new employees, significantly contributing to the margin compression.

Cash Flow Analysis

APR recorded an operating cash flow of PLN 171.8 million, representing an increase of over 6% compared to Q1 2023. Part of this increase is attributed to the effective management of working capital requirements, particularly inventory. The inventory turnover decreased from 141 days at the end of Q1 2023 to 127 days at the end of Q1 2024. At the end of Q4 2023, the inventory turnover was 137 days.

4. Guidance

The preliminary revenue for April 2024 was PLN 353.2 million, an increase of 23% YoY. Management does not provide full-year financial guidance, but the target remains a growth of +20%.

5. Conclusion

Overall, this was a rather weak quarter for APR. Looking at the positives, domestic growth remains strong and continues to grow above 20%, despite the leveling of pre-owned car prices.

The slowing of export sales is a concern. Time is needed to determine if this is a one-off event or if it proves to be a recurring theme. Continued growth internationally is a core part of my long-term thesis, especially considering the opening of a new distribution center on the western border.

Last quarter, I commented that Auto Partner’s margins are likely to face continued pressure in 2024 and this has materialised, particularly from personnel expenses and currency exchange headwinds. While both are largely outside of management's control, they will need a plan to mitigate these factors in order to preserve margins. During the Q4 earnings call, management targeted a 6% net profit margin for 2024, but Q1 has come in lower at 5.6%.

Can the sharp rise in labor costs arising from the new minimum wage be offset by higher prices, or can the company automate more of its processes to reduce reliance on labor? This is one of the key challenges facing management.

This was one of those quarters where it would have been really helpful to have had an earnings call. Quite a few questions have arisen this quarter that did not exist previously. I have contacted the investor relations team with a couple of questions, and hopefully, they provide some responses. They have been very helpful during previous interactions.

A good company does not become a bad one after a single disappointing quarter. Investors should focus on the trend over the coming quarters.

Rating: 2 out of 5. Below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Very helpful. Where can I find the recordings/transcripts of past earnings calls for Auto Partners?