Datadog, Inc. (Ticker: DDOG) went public on September 19, 2019, raising over $640 million through an initial public offering (IPO) that valued the company at $10.7 billion. Interestingly, before its IPO, Datadog reportedly rejected an acquisition offer of more than $7 billion from Cisco (Source: Bloomberg). Since its IPO, Datadog's market capitalisation has doubled to $21.8 billion.

What makes Datadog such a highly sought-after investment in the cloud technology industry, that it could reject a multi-billion dollar acquisition offer and is it worth investing in today?

Contents

Executive Summary

Overview

Customer Base

Financial Analysis

Competitive Landscape

Management and Ownership

Risks

Opportunities

Valuation

Investment Outlook

1. Executive Summary

Datadog's success can be attributed to its early entry into cloud-based monitoring, offering a unified view of infrastructure, applications, and logs. Additionally, the company's diverse customer base, impressive retention rate, and increasing platform adoption demonstrates its ability to serve multiple industries and continue its growth trajectory.

Substantial investment in R&D, which has steadily increased over the years, reflects its commitment to enhancing its platform and providing its customers with new and improved features. This has resulted in a self-selling product that continues to drive revenue growth, while also allowing the company to rapidly innovate ahead of competitors and maintain a strong market position.

The cloud monitoring industry is a rapidly evolving and fast-paced environment, which poses several risks for Datadog, including disruption from emerging technologies, potential consolidation in the industry, increased competition, and the risk of customers switching to other solutions. Moreover, Datadog faces the risk of IT rightsizing leading to revenue growth slowdown and squeezed margins, which could result in reduced demand and surplus personnel.

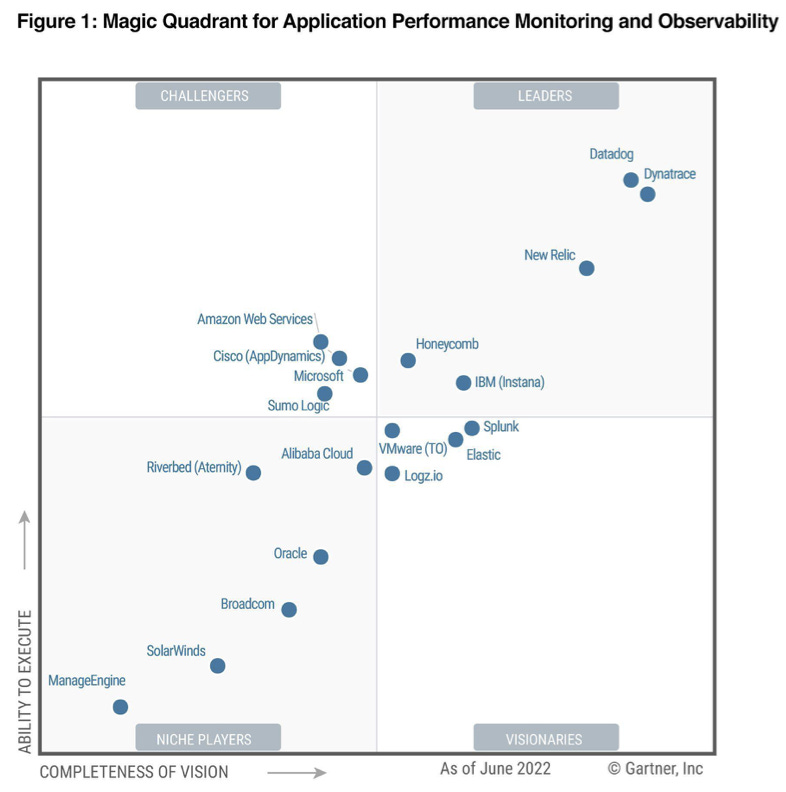

Market leadership position as acknowledged by Gartner and The Forrester Wave, underscores the competitive advantage. Datadog is well-positioned to benefit from the ongoing growth in cloud computing spend and the expanding observability market, with a significant opportunity to capture a larger share of the market.

2. Overview

Datadog is a cloud-based monitoring and security platform that integrates infrastructure monitoring, application performance monitoring, and log management. It provides real-time observability of an organisation's entire technology stack, enabling digital transformation and cloud migration. The platform is used by organisations of all sizes and across various industries to drive collaboration among development, operations, security, and business teams, accelerate time to market for applications, reduce time to problem resolution, secure applications and infrastructure, understand user behaviour, and track key business metrics.

Datadog was founded in 2010 with the goal of breaking down silos between Dev and Ops teams and facilitating collaboration. Since then, the platform has continuously expanded to unify separate tools into an integrated monitoring and analytics platform. Datadog's platform combines metrics, traces, logs, and other data from over 500 integrations to provide a unified view of infrastructure, application performance, and real-time events impacting performance. The platform is designed to be cloud agnostic and easy to deploy, with hundreds of out-of-the-box integrations and extensive customisations. Datadog's business model is centred around offering easy-to-adopt products that have a short time to value, and the company grows with its customers as they expand their workloads in the public and private cloud.

I can appreciate that much of the audience reading this report might not be from a technology background. In layman's terms, Datadog is a platform that helps businesses monitor their computer systems, networks, and applications. It collects and analyses data from different sources such as servers, cloud services, and databases to provide insights on the performance, security, and availability of these systems. Essentially, Datadog helps businesses keep their technology running smoothly and alerts them to potential problems before they turn into major issues.

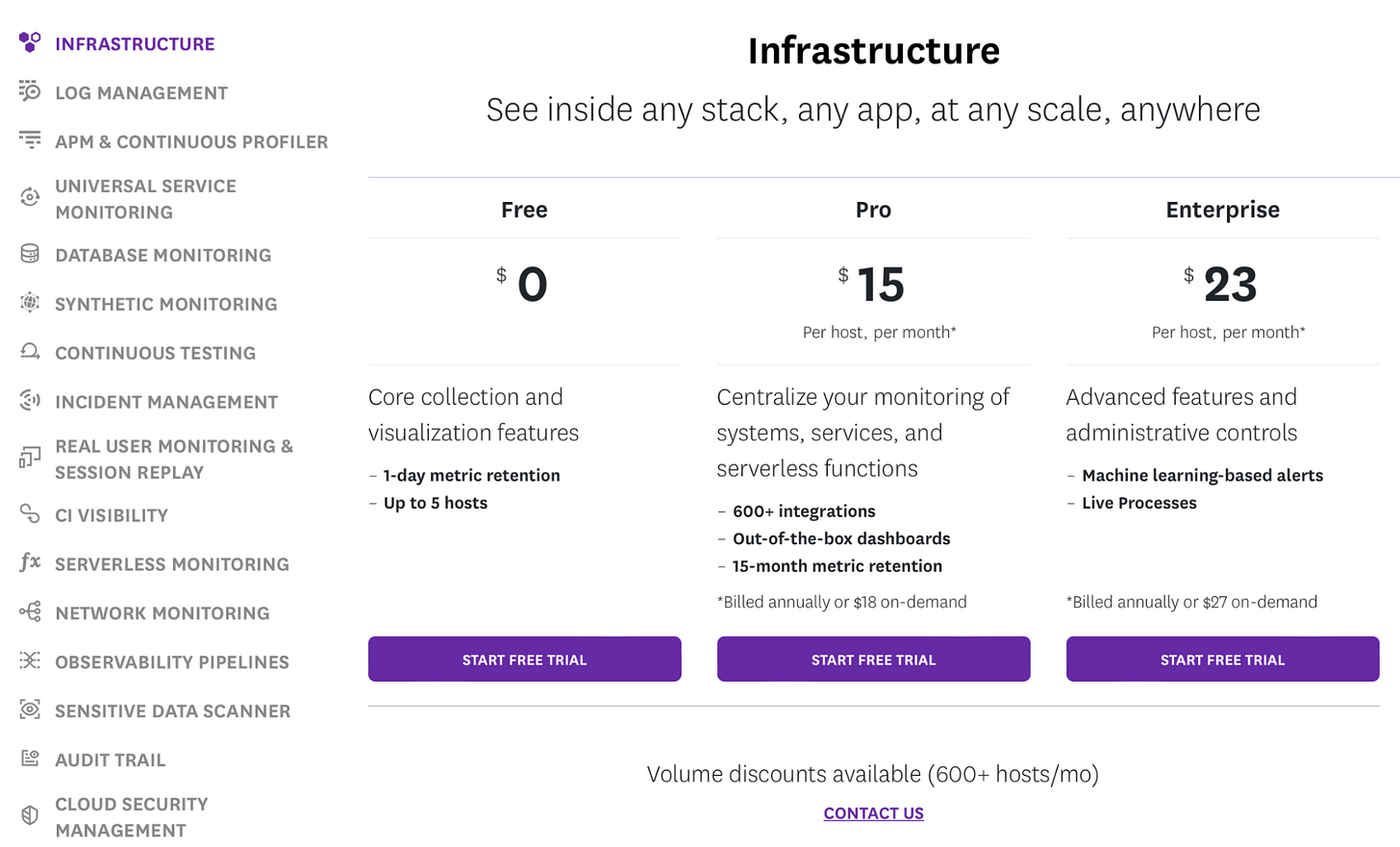

In terms of the costs, you can sign up to use a number of the platform features for free. For example, the infrastructure product can be used for free albeit with limited capability compared to the Pro and Enterprise licences.

Datadog offers a consumption-based pricing model allowing customers to pay only for the amount of data they store, the number of hosts they monitor, or the number of requests they make to the Datadog API. This pricing model is advantageous for customers with dynamic workloads or those who do not need to monitor a large number of resources continuously.

3. Customer Base

Datadog’s consumers consist of organisations of all sizes, in all industries, both private and public.

Some key metrics related to Datadog's customer base as of the end of 2022:

Total Customers: Datadog has been able to maintain a high rate of customer growth which is a positive indicator for the company's ability to attract new customers and expand its user base.

Annual Recurring Revenue (ARR): Datadog's ARR has seen significant growth in both the number of customers with high ARR and the total ARR value. The increase in the number of customers with ARR of $100,000 or more indicates a trend of strong growth in the high-value customer segment.

Customer Retention Rate: Datadog has a high customer retention rate, with a dollar-based net retention rate (DBNRR) of above 130% for each of the past three years. For context, a DBNRR above 100% indicates that the company is generating more revenue from its existing customers than it lost from churn and contraction. The Datadog DBNRR means the company's strategy for upselling and cross-selling to existing customers has been effective, resulting in increased revenue per customer.

Platform adoption: Platform adoption is increasing, and customers are using more products on the platform. This indicates that the platform is becoming more valuable to customers, and they are finding more ways to use it to meet their needs. Customers are not only using more products but are also becoming more deeply engaged with the platform, which could have positive implications for customer retention and loyalty.

4. Financial Analysis

Datadog’s growth and expansion of its customer base has resulted in growing revenue at a phenomenal rate over the past number of years.

Datadog has been able to maintain a high gross margin while experiencing rapid growth, which suggests the company has been successful in managing its costs. As a software company, Datadog's main cost of sales comes from third-party cloud infrastructure hosting and software costs. These costs can be difficult to manage as the company grows, which makes the improvement in gross margin noteworthy.

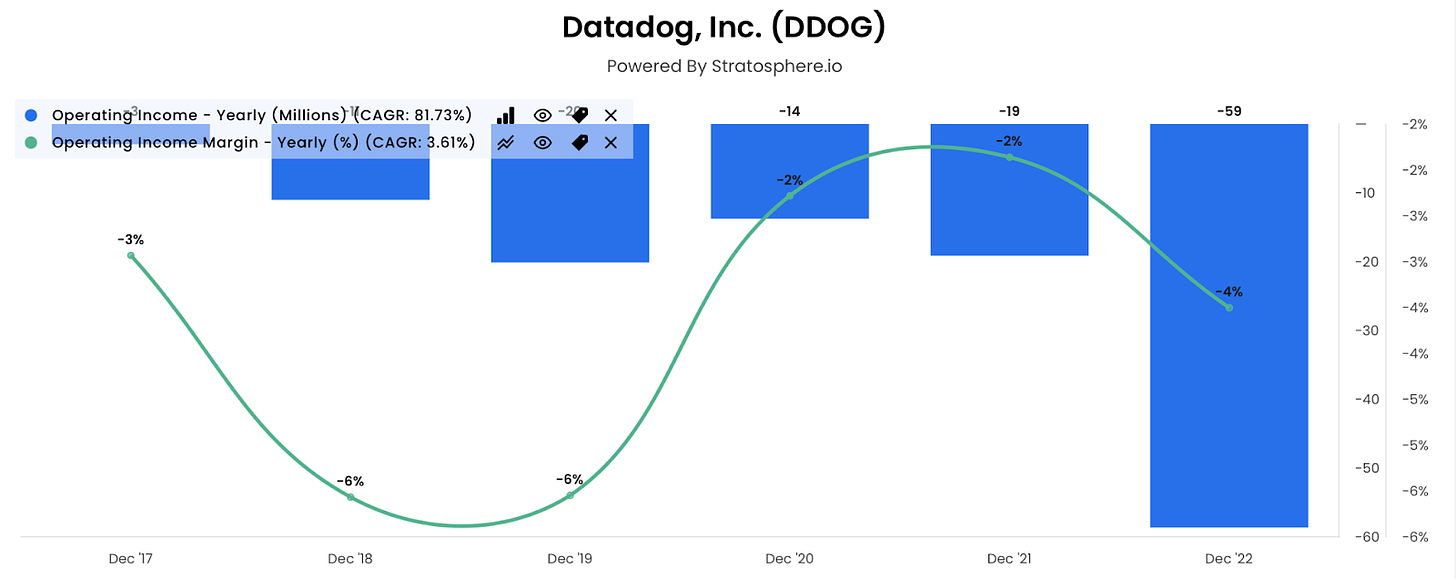

On a GAAP basis, Datadog is not yet profitable. During 2022, the company recorded an operating loss of $59 million compared to a loss of $19 million in 2021. Operating expenses in 2022 amounted to $1.387 billion representing an operating margin of -4%.

Datadog invests heavily in research and development (R&D) to maintain its position as a market leader. In fact, R&D expenses represent the most significant component of Datadog's operating expenses.

R&D as a percentage of revenue increased from 23% in 2017 to 45% in 2022. This demonstrates Datadog’s commitment to maintaining its competitive edge by continuing to invest in the development of new products and features, and shows the importance that Datadog places on innovation, and how it values staying ahead of the curve.

The increase in R&D expenses over the past six years mirrors the increase in new platform products.

Sales & Marketing (S&M) expenses amounted to 36% of operating expenses in 2022. This represents an increase of 65% YoY and broadly follows the increase in revenue of 63%. More importantly, the S&M expense as a percentage of revenue has been trending downwards over the past five years.

The S&M expense as a percentage of revenue trending downwards in tandem with the R&D expense as a percentage of revenue trending upwards suggest that Datadog’s products sell themselves. Instead of spending dollars convincing customers to use its products, Datadog is ploughing its gross profit into R&D for additional product features to serve its existing (and prospective) customers.

Financial Position

Total Liabilities as percent of Total Assets is 53% improving from 56% YoY

Accounts receivable increased 49% YoY to $400 million but slower than the revenue increase of 63%

Modest level of debt (convertible senior notes) amounting to $738 million making up 25% of total assets

Goodwill balance making up almost 12% of total assets arising from a series of acquisitions including Screen SAS for a reported $220 million in 2021 (Source: Marketscreener)

Cash Flow Analysis

Datadog’s operating cash flow increased significantly in 2022 (+46% to $418 million), but a significant portion of this increase can be attributed to the sharp rise in stock-based compensation (SBC) expenses. The fact that SBC has increased by over 120% in 2022 to $363 million, which is twice as fast as revenue growth, suggests that the company has been quite generous in awarding stock-based compensation to its employees.

This is concerning because of the amount of shareholder dilution that it is causing. At the end of 2022, there were 317.6 million shares outstanding compared to 312.0 million at the end of 2021. This represents shareholder dilution of 1.8% in 2022. Since the end of 2019, an extra 21.8 million shares outstanding are in circulation representing total dilution of over 7% in 3 years.

Datadog recorded free cash flow of $354 million in 2022 which grew over 41% YoY. This represents a FCF margin of 21% down from 24% in 2021 but above 14% in 2020.

Return on Invested Capital (ROIC)

Datadog has posted a negative ROIC for the past four years. This is driven by the fact that Datadog has not recorded an operating profit. Quality investors would view anything above 10% as an indicator of capital allocation.

It is my view that investors can only evaluate management's capital allocation skills after Datadog finishes its current period of intense R&D.

Rule of 40

Datadog significantly outperforms its competitors according to the Rule of 40, which is a comparison metric for high-growth SaaS companies that are not yet profitable. The Rule of 40 states that a company's revenue growth rate plus FCF margin should be equal to or greater than 40%.

Datadog is growing faster and has a higher FCF margin, except for Dynatrace, whose FCF margin of 27% is slightly higher than Datadog's 21%. This demonstrated Datadog's strong financial performance and that it is managing to balance its growth and profitability effectively, even though it is not yet GAAP profitable.

5. Competitive Landscape

Datadog is a leader in the Artificial Intelligence for IT Operations (AIOps) report compiled by The Forrester Wave (Source: Datadog Investor Relations). The research identifies, evaluates and scores the 11 top vendors offering products with AIOps capabilities.

Whilst Datadog is a leader in its field, it competes with several companies that offer similar solutions. Some of the main competitors include:

Dynatrace is a cloud-based observability platform that provides AI-powered monitoring and analytics for applications, infrastructure, and logs. The company offers solutions for monitoring performance, optimising user experience, and accelerating digital transformation.

New Relic is a cloud-based observability platform that provides real-time monitoring and analytics for applications, infrastructure, and logs. The company offers solutions for monitoring performance, optimising user experience, and troubleshooting issues.

Splunk is an enterprise-grade data analytics platform that provides real-time insights into machine-generated data. The company offers solutions for IT operations, security, and business analytics.

Elastic is a search and analytics platform that provides real-time insights into structured and unstructured data. The company offers solutions for logging, monitoring, and security analytics.

AppDynamics is a cloud-based application performance monitoring and analytics platform that provides real-time insights into application performance, user experience, and business impact. The company offers solutions for monitoring cloud-native applications, microservices, and containerized environments.

1. Revenue TTM = Revenue Trailing Twelve Months

2. Revenue FY1 Est = Revenue Growth Estimate for next Financial Year

3. R&D ratio = R&D expenses as a percentage of revenue

4. SG&A ratio = Sales, General & Admin expenses as a percentage of revenue

Compared to its competitors, Datadog is prioritizing R&D investments over S&M, allocating 45% of its revenue to R&D, which is significantly higher than its nearest competitor's 30%. Instead of relying on marketing campaigns like its competitors, Datadog is focusing more on its technology and product offerings to attract and retain customers.

6. Management and Ownership

Datadog was founded in 2010 by Olivier Pomel and Alexis Lê-Quôc. The two co-founders were previously working together at Wireless Generation, a company that provided educational software and services to K-12 schools. While working at Wireless Generation, Pomel and Lê-Quôc became frustrated with the existing tools available for monitoring and troubleshooting the company's infrastructure and applications. They found that the available tools were too complex and didn't provide the level of insight they needed to quickly identify and resolve issues.

To solve this problem, Pomel and Lê-Quôc decided to develop their own monitoring and analytics platform. They envisioned a platform that would be easy to use, offer real-time visibility into the entire stack of infrastructure and applications, and provide powerful analytics and alerting capabilities. In 2010, the two co-founders left Wireless Generation and founded Datadog. They started by building a simple prototype of their monitoring platform and began testing it with a few early customers. The platform was quickly embraced by customers, who appreciated its ease of use, real-time visibility, and powerful analytics.

Olivier Pomel and Alexis Lê-Quôc currently serve as the CEO and CTO, respectively. Oliver Pomel is the largest individual shareholder in Datadog, with a 7.40% stake whilst Alexis Lê-Quôc holds 4.6% (Source: Fintel). The company's largest institutional shareholder is The Vanguard Group, which owns a 8.4% stake. Other major institutional shareholders include Morgan Stanley and Blackrock.

Oliver Pomel appears to be well received at Datadog with a 92% approval rating on Glassdoor with the company overall scoring 4.0 out of 5 by its own employees.

The 2022 annual report is not available yet so I have used the 2021 version to appraise the incentive scheme for management which is determined by the compensation committee. The Executive Compensation program includes a fixed base salary and annual performance-based cash bonuses. The bonus is determined by the achievement of pre-established company-wide priorities, set by the compensation committee, and reflects the executives' results and achievements in a given year. The compensation committee determined the size of the named executive officers' target bonus opportunities based on a review of various factors.

For 2021, the performance goals were based on the attainment of new ARR, with certain decelerators applied for all named executive officers if non-GAAP operating income fell below a target amount. The performance target for ARR was 100% of Datadog's fiscal year 2021 operating plan. The executives will only earn a bonus if the new ARR attainment is at least 80% of the performance target. In February 2022, the corporate performance goals for fiscal 2021 were determined to be 163% of the target, resulting in a bonus payout equal to approximately 243% of the named executive officers' annual target bonus opportunities. The realised value of equity awards is also a significant part of the executive compensation package.

It appears that Datadog management is incentivised to build shareholder wealth, as their annual performance-based cash bonuses are tied to the achievement of pre-established company-wide priorities, including the attainment of new ARR and non-GAAP operating income targets.

7. Risks

1. Rapidly Evolving Industry

The cloud monitoring industry is a rapidly evolving and fast-paced environment, which poses several risks for Datadog. The company operates in a highly dynamic market that is subject to constant change due to emerging technologies, changing customer needs, and evolving industry standards. This makes it challenging for Datadog to keep pace with the latest trends and maintain its competitive position in the market.

One of the key risks associated with the fast-paced nature of the cloud monitoring industry is the potential for disruption. New technologies, products, and services are constantly emerging, and it can be difficult for companies like Datadog to stay on top of these developments. This requires a deep understanding of the market, as well as a commitment to ongoing research and development to stay ahead of the competition.

Another risk is the potential for consolidation in the industry. The cloud monitoring market is highly fragmented, with many small players competing for market share. As the market matures, it is likely that larger players will emerge, which could lead to consolidation through mergers and acquisitions. This could pose a threat to smaller players like Datadog, which may struggle to compete with larger, more established players with greater resources.

In addition, the cloud monitoring industry is seeing increased competition from new entrants. For example, Google-backed competitor Chronosphere has emerged as a potential disruptor in the market (Source: The Information). Distribution is key, as demonstrated by Microsoft's successful integration of Teams within the Office suite to compete with Zoom. The Hyperscalers could follow suit by bundling monitoring tools with their cloud platforms to make them more attractive and easily accessible than Datadog's offerings. This poses a risk for Datadog, which may struggle to maintain its market share in the face of increased competition.

The durability of Software-as-a-Service (SaaS) businesses is also a concern. While the recurring revenue model that underpins SaaS businesses like Datadog is attractive, there is always the risk that customers may switch to competitors or switch to other solutions altogether. This could lead to revenue churn and reduced profitability for the company.

To mitigate these risks, Datadog will need to remain agile and adaptable in the face of a rapidly evolving industry. This will require ongoing investment in research and development, as well as a commitment to staying ahead of emerging trends and technologies. The company may also need to explore strategic partnerships and collaborations to strengthen its competitive position in the market.

The rapidly evolving nature of the cloud monitoring industry can pose a risk for Datadog investors who may not have the necessary subject matter expertise to stay up-to-date on industry trends and developments. Investors who are not familiar with the nuances of the cloud monitoring market may find it difficult to fully evaluate the company's competitive position, growth prospects, and overall business strategy.

As part of my research process, I was fortunate to be able to discuss Datadog with Francis from the Software Analyst Newsletter. I recommend following him and checking out his work around Cybersecurity and DevOps.

2. IT Rightsizing

While Datadog has experienced strong growth in recent years, the company's latest earnings report suggests that it may be facing a risk of IT rightsizing. IT Rightsizing is the process of optimising IT resources to match business needs. This can involve reducing or increasing the amount of IT resources allocated to specific functions or departments to ensure that they are aligned with the organisation's goals and objectives.

One key factor contributing to this risk is the slowdown in Datadog's revenue growth. While the company's revenue is still growing, it is doing so at a slower rate than analysts had predicted. For context, Datadog is expected to grow revenue by 24% in 2023 down sharply from 63% achieved in 2022. Datadog attributes this to macro headwinds affecting its lower-end customers and more conservative cloud spending across the enterprise market. This suggests that Datadog's customers may be looking to optimise their cloud workloads and normalise spending, which could result in reduced demand for Datadog's services.

Another factor contributing to the risk of IT rightsizing is Datadog's expectation that its margins will be squeezed as its near-term growth cools off. While the company has been able to expand its operating margins in recent years, it expects that figure to drop as growth slows. This could make it more difficult for Datadog to maintain its current level of investment in R&D, which could in turn make it more difficult for the company to stay competitive in the long term.

To address these challenges, Datadog is planning to increase its headcount by a mid-20s percentage in 2023. While this may help the company to continue innovating and developing new services, it could result in an excess of personnel and resources relative to the company's actual needs, which could lead to inefficiencies and waste if growth does not pick up as expected.

Overall, the risk of IT rightsizing for Datadog appears to stem from a combination of factors, including slower revenue growth, squeezed margins, and a potential excess of personnel and resources. To mitigate this risk, Datadog will need to continue innovating and developing new services that meet the evolving needs of its customers, while also keeping a close eye on costs and avoiding excessive investment in areas where demand may be limited.

8. Opportunities

1. Land and Expand

The Land and Expand model is a business strategy where companies initially introduce their products to a smaller segment of the market, and then expand their offerings within that market over time. Datadog has been successful in implementing this model, and it has become a significant driver of their growth.

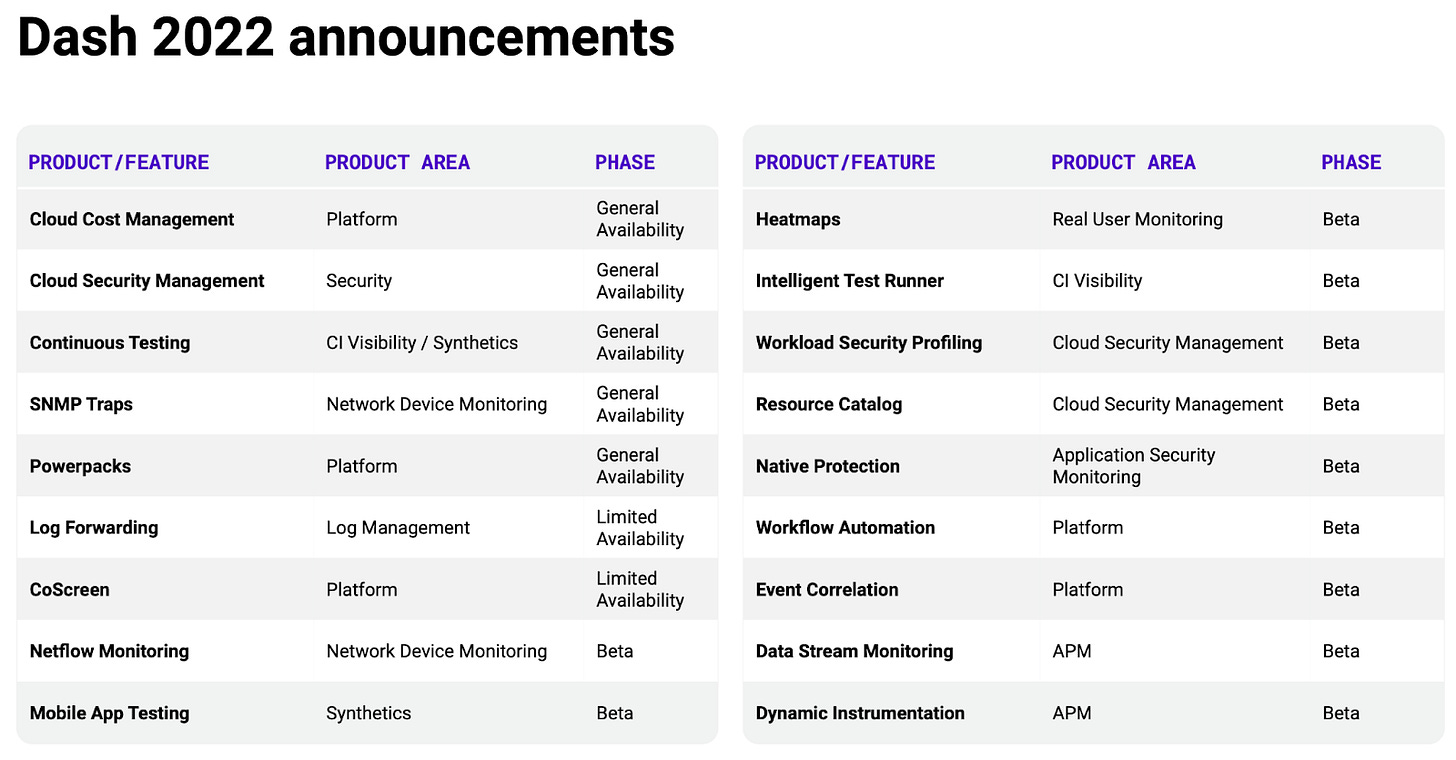

One of Datadog's competitive advantages is their rapid and efficient product development process. They can build and release new product offerings faster than their competitors, which allows them to continuously offer new and relevant modules to their existing customer base. This strategy has proven successful as Datadog's annual user conference, Dash, highlights the number of new product releases they have planned, which has increased by 80% compared to the previous year. This demonstrates their commitment to offering new solutions to their customers, which in turn, helps increase revenue from existing customers.

Datadog's Land and Expand model has proven successful as it allows them to grow with their customers. As their customers' businesses grow, they add new modules which results in incremental revenue growth for Datadog. Additionally, as Datadog continues to develop new product offerings, their customers have more options to choose from, which creates more opportunities for revenue growth.

Furthermore, Datadog's position as a market leader in the Magic Quadrant for Application Performance Monitoring and Observability by Gartner reinforces their potential to expand their customer base. This recognition highlights the quality of their product offerings and their ability to compete effectively in a rapidly evolving industry. Leveraging research from subject matter experts like Garnter is one way for investors to navigate the risk of a rapidly evolving industry.

Datadog's Land and Expand model has been a significant driver of their growth. Their rapid and efficient product development process allows them to offer new and relevant solutions to their existing customer base, resulting in incremental revenue growth. As they continue to develop new product offerings, they have the potential to expand their customer base and become an even more dominant player in the cloud monitoring industry.

2. Cloud Computing Adoption

Datadog stands to benefit from the ongoing growth in cloud computing spend, which is expected to continue over the coming years. As more businesses adopt cloud-based infrastructure and services, the demand for cloud monitoring and observability tools like Datadog is likely to increase.

According to research by Gartner, global cloud computing spend is projected to reach $1 trillion by 2026 with the cloud spend as a percentage of total IT spend increasing from 10% to 17%. This growth is being driven by the increasing adoption of cloud-based technologies by businesses of all sizes.

In addition to the growth in cloud computing spend, Datadog also has a significant opportunity in the observability market. According to Gartner, the observability total addressable market (TAM) is expected to reach $62 billion by 2026. As a leader in the observability space, Datadog is well-positioned to capture a significant share of this growing market. The company's ability to rapidly develop and release new product modules gives it a competitive advantage, allowing it to meet the evolving needs of its customers and stay ahead of its competitors. Additionally, Datadog's reputation as a market leader in application performance monitoring and observability, as recognised by Gartner, further enhances its potential for growth in the market.

The growth in cloud computing spend and the expanding observability TAM represent significant opportunities for Datadog to continue its growth trajectory and capture a larger share of the market.

I recently published a primer article on cloud computing for those interested in reading more about this area.

9. Valuation

Discounted Cash Flow

I have projected the future cash flows over 5 years using a discount rate of 10% and a terminal value of 12. I am opting to use a terminal value on the lower end of the range due to the risk factors identified. I believe that it is difficult to project the future cash flows with a great level of certainty.

I have used management guidance as the baseline for 2023 and modelled the FCF to be slightly above adjusted EBIT margins per the historic trend. From 2024 to 2026, I estimate that revenue growth will reaccelerate back to the low 30% and EBIT margins to creep north.

In 2022, Datadog posted revenue of $1.76 billion which represented 4% of the observability TAM per Gartner. By 2026, I project Datadog revenue of $4.87 billion or almost 8% of the Gartner TAM which seems reasonable for the category leader. In 2027, I estimate revenue growth to fall back to the mid twenties.

Earlier analysis identified significant shareholder dilution over the past number of years. In 2022, the dilution rate was 1.8% (2021 2.5%, 2020 3%) and I have assumed the dilution rate to incrementally fall to 1% by the fifth year of the projection.

Based on these assumptions I believe that the fair value of Datadog is close to $77 per share suggesting a potential upside of 13% based on the share price on 13 April 2023.

Price-to-Earnings Ratio (P/E)

Datadog trades at a forward P/E ratio of 63. While the ratio has improved significantly, it can appear a bit misleading as Datadog is not optimised for profitability. The company is investing heavily in R&D to prioritise long-term over short-term profitability

Datadog trades at a premium to most of its competitors, except for one, which is expected given its status as a category leader, its faster growth rate and potential growth opportunities that it’s R&D investments could generate in the future.

10. Investment Outlook

So far, the execution from Datadog has been flawless. It has achieved category leader recognition from both Gartner and The Forrester Wave. While growing faster than its competitors, it has also accelerated product development which is showing no signs of slowing down. The number of customers that are using more products is increasing in each cohort and this is indicative of a competitive advantage driven by switching costs.

However, the durability of this competitive advantage is uncertain due to the rapidly evolving nature of the industry. While Datadog is currently at the top, identified risk factors indicate that this cannot be taken for granted. In my view, it is difficult to predict who will be the top dog (pun intended) in the observability market in ten years time with any degree of certainty. One thing I can say is that I think the market will be much, much bigger than it is today.

The absolute valuation appraisal implies that the company is undervalued with a modest margin of safety. I have used conservative assumptions but if Datadog can reaccelerate growth at a faster rate than assumed and increase its market share the upside could be even more favourable to investors. Relative valuation analysis indicates that the stock is trading at a premium to its peers and that the market has priced in much of this growth.

Disclosure: At the time of writing, the author holds a long position in Datadog, Inc.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

It would be interesting to see a short thesis on this

Fascinating company, enjoyed reading.