DocuSign: From Overpriced Growth to a Value Play?

DocuSign (DOCU) Q1 FY 2024 Earnings Analysis

Executive Summary

DocuSign reported better-than-expected billings of $674.8 million, surpassing management's guidance by 9%. This positive performance was driven by a higher rate of on-time renewals, which resulted from improved execution within the installed base and fewer early renewals in the macro environment.

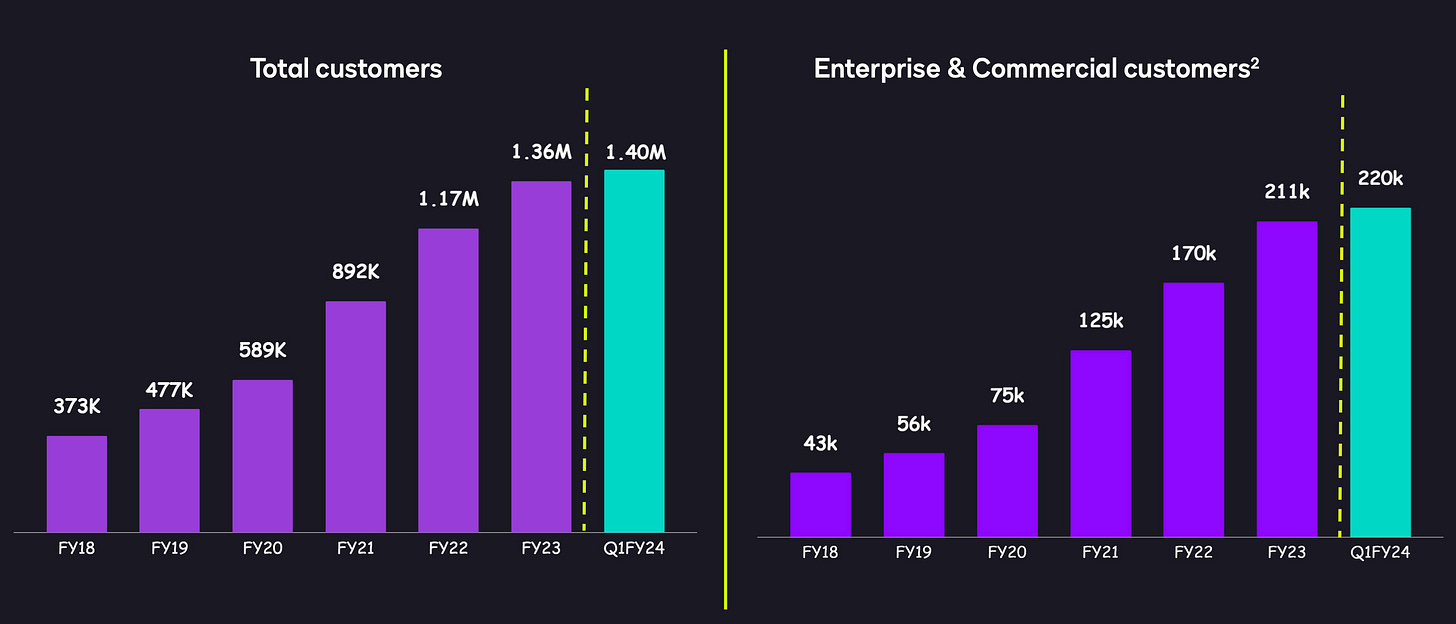

DocuSign reported a 13% YoY increase in total customers, reaching 1.4 million. They added over 45,000 new customers during the quarter, showing continued growth in their user base. The number of customers with an annual spend greater than $300,000 grew by 20% YoY to a total of 1,063. However, there was a slight decrease of 1.5% QoQ in this segment, which can be attributed to customer buying patterns, lower expansion rates, and partial churn.

Management raised the guidance for billings and revenue for the full year of FY 2024. The increased guidance indicates optimism and confidence in the company's performance. The addition of Blake Grayson as the new CFO, with his impressive finance leadership background at The Trade Desk and Amazon, is seen as a valuable addition to the company's leadership team.

Contents

Key Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: $661.4 million +12% year-over-year (YoY)

Subscription: $639.3 million +12% YoY

Professional services and other: $22.1 million +14% YoY

Gross Profit: $524.9 million +15% YoY

Net Income: $0.5 million compared to a loss of $27.4 million YoY

2. Wall Street Expectations

Revenue: $641 million (beat by 3%)

Earnings per Share: 0.53 (beat by 36%)

Source: Zachs

3. Business Activity

Billings is one of the most important metrics I look for when analysing DOCU as it is a key indicator of future demand. Going into this quarter, DOCU had guided for billings of $620 million. This would have equated to growth of 1% YoY, the slowest growth in the company’s history. The slowdown in billings has resulted in the DOCU share price trading down 35% over the past twelve months and 80% from its all time high two years ago.

During this quarter, DOCU reported billings of $674.8 million, an increase of 10% YoY. This is significant for two reasons. Firstly, it beats managements guidance by 9% which the market had priced and it means that billings growth is flat QoQ (10% billings growth in Q4 FY 23) rather than in decline.

In the software industry, companies with subscription models experience different types of renewals, including on-time renewals, early renewals, and late renewals, which can impact quarterly performance. During this quarter, DOCU observed a higher rate of on-time renewals. The factors contributing to the on-time renewals in Q1 are attributed to better execution by the team focusing on the installed base and a macro dynamic of fewer early renewals.

At the end of Q1 FY 2024, DOCU reported 1.4 million total customers, an increase of 13% YoY and 3% quarter-over-quarter (QoQ). Over 45,000 new customers were added during the quarter.

Customers with an annual spend greater than $300,000 grew 20% YoY to a total of 1,063. This represented a decrease of 1.5% QoQ primarily due to customer buying patterns, lower expansion rates and partial churn.

Dollar net retention was 105% and continues to slide from the peak of 123% in FY21. Management explained that they continue to see headwinds impacting their expansion rates coupled with muted customer buying patterns as budgets continue to remain under scrutiny as customers optimise existing spend. The downward pressure on dollar net retention is expected to continue into Q2.

DOCU announced new product capabilities in the following areas:

Web Forms: Interactive Webforms that capture data and create dynamic agreements for signature. It offers customization options and seamless integration with other systems.

EHR Interoperability: Integration between DOCU eSignature and certified EHRs like Epic and Cerner, enabling automatic uploading of patient forms to EHRs. This eliminates manual handling of forms and improves the patient and staff experience.

ID Verification for EU Qualified: Released AI-enabled remote identity verification that meets EU Qualified Electronic Signature standards. It includes features like liveness detection and selfie comparisons, eliminating the need for in-person appointments and improving the signer experience.

Document Generation for eSignature: Feature that allows senders to generate personalized agreements directly within eSignature, ensuring professional-looking documents with dynamically inserted information.

DocuSign CLM Essentials Conditional Logic: Enhanced CLM workflows by enabling easy customization of agreement templates using conditional logic. This saves time, offers flexibility, and ensures compliance across agreements.

4. Financial Analysis

During the quarter, DOCU grew its top line by 12% YoY. Subscription revenue is the most significant area of the business and accounts for 97% of all revenue. International business revenue grew 17% YoY driven mainly by the Asia Pacific region. In total, international revenue accounts for 25% of total revenue.

Gross profit is following a similar trajectory to revenue and increased by 15%, with gross margin also improving from 78% to 79% YoY. The SaaS (Software-as-a-Service) model means that DOCU can generate extremely attractive gross margins in an asset-light fashion.

Operating expenses (OpEx) increased by 11% to $530 million during the quarter. The most significant component of OpEx is sales and marketing expenses which actually decreased by 7% to $281 million. At one stage, DOCU was spending 123% of its revenue on sales and marketing expenses alone, which meant that it was arguably subsidising sales. The trend is moving in the right direction and has reached a new low of 42%

DOCU incurred $29 million related to Restructuring and other related charges during the quarter. This related to significant layoffs that the company made over the past twelve months. The company finished this quarter with 6,586 employees compared to 7,642 YoY. DOCU has reduced its workforce by 14%, the majority of which were in sales and marketing which lines up with the decrease in sales and marketing expenses this quarter.

DOCU recorded a loss from operations of $4.6 million compared to a loss of $19.2 million YoY. However, the company was able to post net income of $0.5 million due to $12.2 million of net interest income. DOCU has got over $940 million worth of cash on its balance sheet and has benefited from the increase in interest rates in this regard.

Cash Flow Analysis

DOCU’s operating cash flow has continued to increase. At Q1 FY 2024, quarter to date (QTD) cash flow from operations increased by 14% from $196 million to $234 million. This equates to an operating cash flow margin of 35%.

One of the main items in the operating cash flow is stock-based compensation (SBC) expense which increased by 31% YoY. This expense is growing far too fast particularly when revenue only grew 12%. An extra 8 million shares (4% increase) are in existence as a result of SBC over the past 12 months despite the efforts of $40 million worth of share repurchases to counteract this.

Overall, DOCU produced free cash flow (FCF) of $215 million compared to $175 million YoY, an increase of 23% YoY. This is resulting in a very healthy FCF margin of 32%.

5. Guidance

Management expects Q2 FY 2024 revenue between $675 million and $679 million. The mid point of this range would represent growth of 9% YoY. Q2 FY 2024 billings are expected to be between $646 million and $656 million. The mid point of this range would represent growth of 1% YoY impacted by lower early renewals.

Management raised the guidance for billings for the full year of FY 2024 to between $2.737 billion and $2.757 billion. The previous guidance was between $2.705 billion and $2.725 billion. Revenue guidance for the full year of FY 2024 was raised to between $2.713 billion and $2.725 billion. The previous guidance was between $2.695 billion and $2.707 billion.

Any raised guidance is always welcome, particularly in this environment. It is important to note that the higher rate of on-time renewals in Q1 resulted in less spillover of renewals into the following quarter. This timing of deals influenced the Q1 performance and is factored into the company's full-year guidance.

6. Conclusion

DOCU reported solid results that exceeded their guidance across all key financial metrics.

Still, DOCU faces challenges such as smaller deal sizes, lower expansion rates, and budget scrutiny affecting buying patterns, highlighting potential headwinds at the customer level. The quarter saw a trend of IT rightsizing, with cloud stocks like Datadog and Cloudflare experiencing similar patterns. This context suggests a broader market trend impacting DOCU.

The management team is committed to profitability and investing in transforming agreement workflows. Share repurchases and a strong balance sheet demonstrate confidence in the durability of the business.

The addition of Blake Grayson as the new CFO, with his impressive finance leadership background at The Trade Desk and Amazon, is expected to bring valuable expertise. CEO Allan Thygesen, who himself joined recently, along with the new leadership team, offers potential for positive changes after disappointing years under the previous leadership.

Looking further ahead, management reaffirmed its goal is to become a double-digit revenue growth company again. While the current guidance for billings indicates 3% to 4% growth, the company is focused on setting the foundation for growth and has initiatives in product innovation, self-service, and AI that could contribute to achieving double-digit revenue growth in the future. Product innovation is a top priority for reinvigorating growth, followed by AI monetization and self-serve/product-led growth. DOCU has been using AI for some time now but the next generation of AI has the capability to unlock the potential of agreement workflow.

The once overvalued growth stock now trades at an EV/EBITDA multiple of 17 and a Price/FCF multiple of 27. For context, Adobe trades at EV/EBITDA multiple of 20 and a Price/FCF multiple of 27.

While growth might have slowed considerably, DOCU is a very profitable company as observed by its FCF margin of 32%. With some positive catalysts brewing, could DOCU be a prime candidate for a turnaround play?

Rating: 4 out of 5. Exceeds expectations.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com