DocuSign: The Beat and Raise Playbook

DocuSign (DOCU) Q2 FY 2024 Earnings Analysis

Executive Summary

DocuSign reported billings of $711.2 million, a 10% year-on-year increase driven by a higher rate of on-time renewals. This outperformance beat market expectations and management guidance, marking the third consecutive quarter of 10% billings growth, following a period of sequential decline.

DocuSign added approximately 37,000 new customers in the quarter, bringing the total customer base to 1.44 million. More than 50% of these customers have adopted five or more features, increasing product stickiness. Customers with an annual spend exceeding $300,000 increased by 6% year-on-year to a total of 1,047. However, this number decreased by 1.5% quarter-on-quarter due to customer buying patterns, lower expansion rates, and partial churn.

DocuSign's total revenue increased by 11% year-on-year to reach $688 million, with subscription revenue growing at a similar rate of 11% to $669 million. International revenue experienced strong growth, up by 17%, and now represents 26% of the company's total revenue. Operating expenses increased by only 2%, with a notable decrease of 9% in sales and marketing expenses, leading to a reduced S&M ratio from 52% to 43% year-on-year.

Management raised the guidance for billings and revenue for the full year of FY 2024 for the second quarter in a row. The company is actively returning excess capital to shareholders through a share repurchase program, having repurchased 583,000 shares for approximately $30 million during the quarter. They have increased the size of the program to $500 million.

Contents

Key Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: $687.7 million +11% year-over-year (YoY)

Subscription: $669.4 million +11% YoY

Professional services and other: $18.3 million +8% YoY

Net Income: $7.4 million compared to a loss of $45.1 million YoY

2. Wall Street Expectations

Revenue: $667 million (beat by 3%)

Earnings per Share: 0.66 (beat by 9%)

Source: Zachs

3. Business Activity

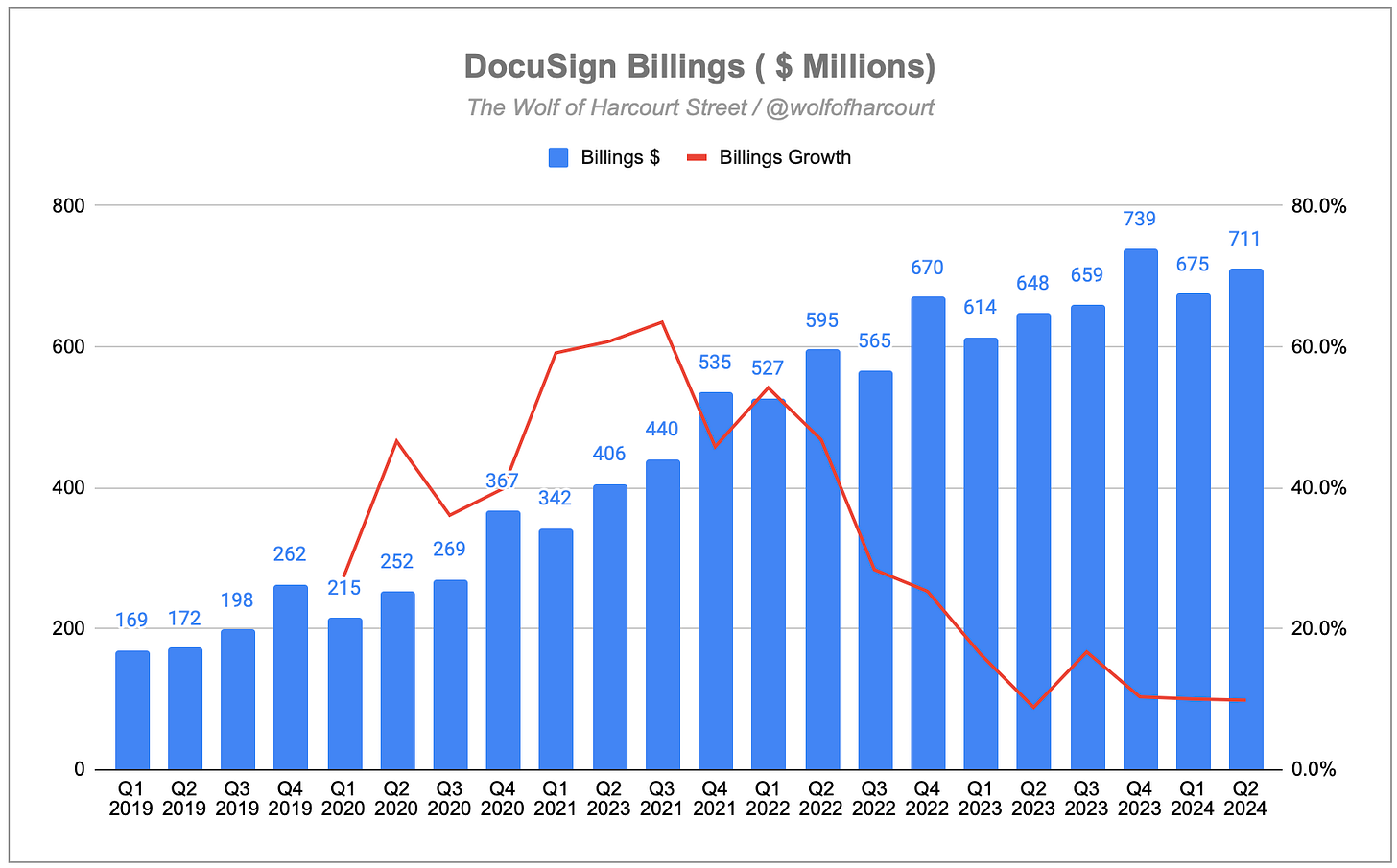

When analysing the health of DocuSign’s (DOCU) business, one of the top metrics I pay close attention to is billings. It's like a crystal ball that gives us a peek into future demand. Before this quarter, DOCU had told us to expect billings of $651 million. That would have been a pretty modest growth of just 0.5%.

During this quarter, DOCU reported billings of $711.2 million, an increase of 10% YoY. This is significant for two reasons. Firstly, it beats managements guidance by 9% which the market had priced and it means that DOCU has achieved three consecutive quarters of 10% billings growth after periods of sequential decline.

In the software industry, companies with subscription models experience different types of renewals, including on-time renewals, early renewals, and late renewals, which can impact quarterly performance. During this quarter, DOCU observed a higher rate of on-time renewals. However, management anticipate a deceleration in billings growth in the latter half of the year due to macroeconomic factors and challenges in expansion metrics.

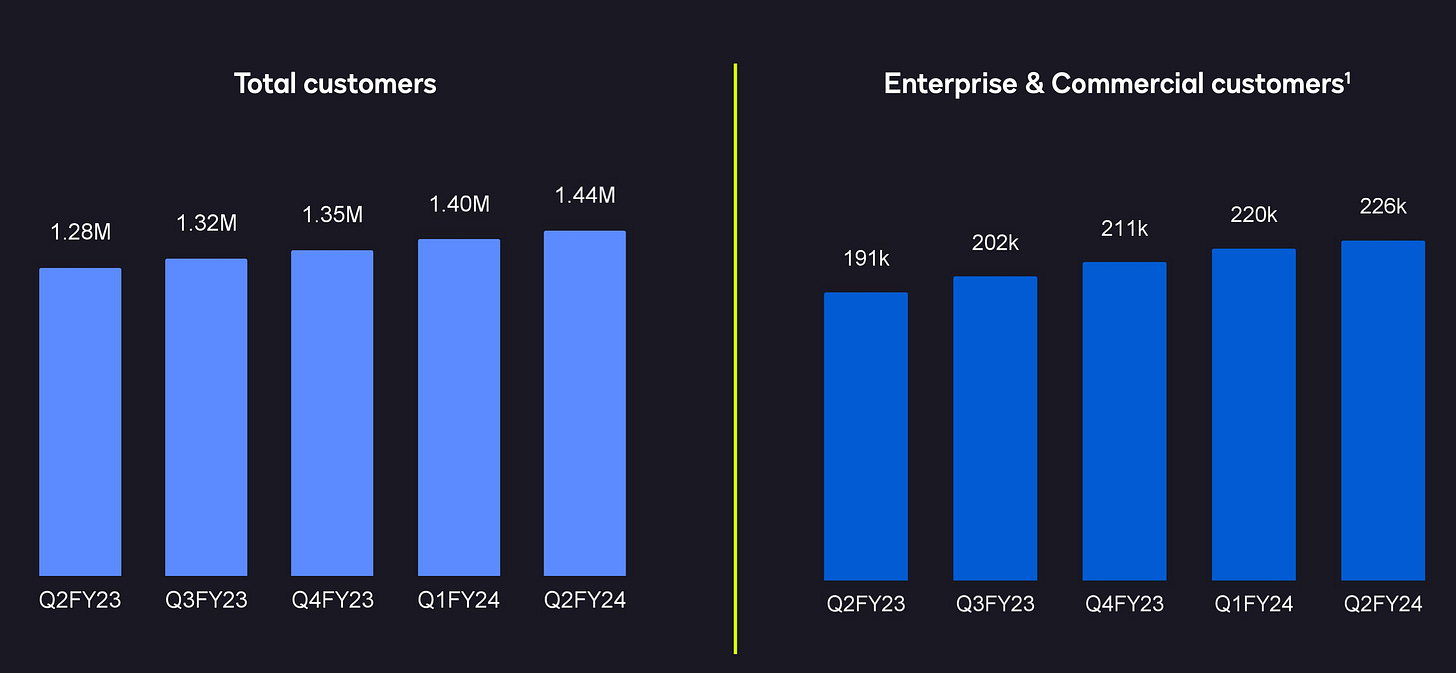

DOCU added approximately 37,000 new customers in the quarter, bringing the total customer base to 1.44 million. Management noted growth in the direct customer base, and over 50% of these customers have adopted five or more features, which increases product stickiness.

Customers with an annual spend greater than $300,000 grew 6% YoY to a total of 1,047. This represented a decrease of 1.5% QoQ primarily due to customer buying patterns, lower expansion rates and partial churn.

Dollar net retention was 102% and is expected to continue facing pressure into Q3 due to a challenging macro environment, which is causing smaller expansion opportunities. The focus on product development and roadmap is crucial to address this trend.

The key operational highlights were as follows:

Identity Verification: DOCU is expanding its identity verification portfolio with the global launch of Liveness Detection for ID Verification. This technology uses AI-powered biometric checks to enhance verification accuracy and reduce the time required for signing agreements.

Web Forms and Data Insights: DOCU is improving its Web Forms offering by introducing advanced reporting capabilities, allowing users to extract actionable insights from their agreements.

CLM (Contract Lifecycle Management) Growth: DOCU is seeing growth in its CLM business, particularly in large organizations across various industries. CLM is helping automate complex agreement processes and improve security.

AI Labs and Co-Innovation: DOCU is engaging with customers through AI Labs, where customers can test and provide feedback on developing technology. This co-innovation approach strengthens the company's position as a trusted partner.

4. Financial Analysis

Total revenue increased by 11% YoY to $688 million, with subscription revenue growing similarly by 11% to $669 million. Notably, international revenue saw strong growth of 17%, outpacing the domestic business and now accounting for 26% of total revenue. Management noted the significant untapped market opportunity internationally and emphasizes it as a key pillar for future growth. The company has recently opened offices in Germany and is making investments in international markets, such as Japan.

Gross margin improved from 78% to 79% YoY with DOCU benefiting the the asset-light nature of its business model.

Operating expenses (OpEx) increased by 2% to $535 million during the quarter. The most significant component of OpEx is sales and marketing (S&M) expenses which decreased by 9% to $295 million. The S&M ratio (Sales and marketing as a % of revenue) has decreased to 43% from 52% YoY.

DOCU recorded operating profit of $6.6 million compared to a loss of $41 million YoY. In addition to this, DOCU was able to post net income of $7.4 million due to $17.4 million of net interest income. DOCU has got over $1 billion worth of cash on its balance sheet and has benefited from the increase in interest rates in this regard.

DOCU is continuing its disciplined investments to drive growth in its top line. While management expect to increase investment in the second half of the year, they anticipate exiting the year with operating margins better than before their restructuring efforts.

Cash Flow Analysis

DOCU’s operating cash flow has continued to increase. At Q2 FY 2024, quarter to date (QTD) cash flow from operations increased by 75% from $121 million to $211 million. This equates to an operating cash flow margin of 31%.

One of the main items in the operating cash flow is stock-based compensation (SBC) expense which increased by 7% YoY. This is a significant achievement for DOCU as this expense had been growing at an average of 35% over the past two years despite revenue growth falling to low single digits. SBC as a percentage of revenue is around 22% in Q2, and it has increased YoY due to the addition of new leadership personnel to the team. Share dilution should be significantly less going forward as a result.

Overall, DOCU produced free cash flow (FCF) of $184 million compared to $105 million YoY, an increase of 75% YoY. This is resulting in a very healthy FCF margin of 27%.

5. Guidance

Management expects Q3 FY 2024 revenue between $687 million and $691 million. The mid point of this range would represent growth of 7% YoY. Q3 FY 2024 billings are expected to be between $668 million and $678 million. The mid point of this range would represent growth of 2% YoY impacted ? by lower early renewals.

For the second quarter in a row, management raised the guidance for billings for the full year of FY 2024 to between $2.804 billion and $2.824 billion. The previous guidance was between $2.737 billion and $2.757 billion. Revenue guidance for the full year of FY 2024 was also raised to between $2.725 billion and $2.737 billion. The previous guidance was between $2.713 billion and $2.725 billion.

If we take the mid point of management guidance, in two quarters DOCU has raised FY 2024 billings and revenue guidance by $100 million and $30 million respectively. DOCU has been consistently revising its financial forecasts upward for FY 2024. This suggests that the company is experiencing stronger growth or market conditions than originally anticipated.

6. Conclusion

For the second quarter in a row, DOCU reported solid results that exceeded their guidance across all key financial metrics. In fact, DOCU has beaten Wall St EPS estimates four quarters on the bounce.

It is very positive to see the progress DOCU has made in relation to sales and marketing expenses and SBC. On the conference call, management revealed that they are focusing on product-led growth, but emphasize that their primary go-to-market strategy remains dependent on their direct sales channel. They are also making efforts to make their products more valuable and sticky for customers. This is part of an ongoing transformation of its sales organization to match the expanding breadth of its product offerings. This includes a focus on pre-sales, sales, and post-sales efforts, as well as driving adoption of features.

With over $1.5 billion in cash, cash equivalents, and investments, DOCU is actively returning excess capital to shareholders, as evidenced by the repurchase of 583,000 shares for approximately $30 million during the quarter. They have increased the size of their share repurchase program to $500 million, up from $200 million, to reduce dilution and return capital to shareholders opportunistically.

There are still challenges to deal with. The macroeconomic environment remains uncertain, with different verticals showing varying levels of strength and demand. CFOs are scrutinizing investments more closely, which influences decision-making in the business environment. Specifically, there is work to be done on retention rates and driving future growth.

As profitability continues to improve, the valuation for DOCU has been getting better and better. DOCU now trades at and EV/EBITDA multiple of 14x. For context, Adobe trades at EV/EBITDA multiple of 25.

While there is work to be done on retention rates and driving future growth, DOCU is starting to reap the rewards of some organisational changes including leadership hires over the past year.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com