Today, I analyse the Q3 Fiscal Year (FY) 2022 earnings report of DocuSign, Inc. (Ticker: DOCU), which was released on 2 December 2021. On Friday, 3 December, the day after earnings were released, DocuSign closed the session down 42%. Let’s unravel why this might have happened.

In this report, I will cover the following:

Key Highlights

Wall Street Expectations

Business Activity

Income Statement

Balance Sheet

Cash Flow

Guidance

Conclusion

1. Key Highlights

Revenue: $545.5 million +42% year-over-year (YoY)

Subscription: $528.6 million +44% YoY

Professional services and other: $16.9 million +4% YoY

Gross Profit: $429.5 million +51% YoY

Net Loss: $5.7 million compared to a loss of $56.6 million YoY

2. Wall Street Expectations

Revenue: $533 million (beat by 2%)

Adjusted Earnings per Share: 0.46 (beat by 26%)

Source: CML

3. Business Activity

At the end of Q3 FY 2022, DocuSign reported 1.11 million total customers, an increase of 35% YoY. Over 59,000 new customers were added during the quarter including UPS and Solarity Credit Union. Customers with an annual spend greater than $300,000 grew 45% YoY to a total of 785.

For the sixth quarter in a row DocuSign exceeded the high end of their historical range of dollar net retention, landing at 121% as existing customers expanded their deployments of product offerings.

DocuSign reported billings of $565.2 million, an increase of 28% YoY. Last quarter management estimated billings of $585 million to $597 million. If we take the midpoint of $591 million then this equates to a miss of $26 million or over 4%. Billings is an important KPI as it can signify future demand and revenue. On the conference call, CEO Dan Springer said:

‘the market dynamics that we saw in the third quarter were markedly different from what we experienced in the first half of this year. With the boost from COVID-19 over the past year and a half, we experienced exceptionally high growth rates at scale as we captured customer demand at an unprecedented pace. As we moved through Q3 and into the second half of the year we saw demand slow and the urgency of customers’ buying patterns temper’

DocuSign Notary was enhanced so administrators can manage the availability of first-part notaries. A number of financial institutions, including Fidelity, added the service in Q3.

ID Verification (IDV) was enhanced to enable customers to add SMS reauthentication to IDV envelopes. After signers pass an initial IDV, they enter a passcode delivered via SMS text to access the envelope, adding an extra layer of security and convenience.

Following the eSignature integration with Microsoft Teams earlier this year, DocuSign is now also an official electronic signature provider in the Microsoft Teams Approvals app.

DocuSign is not resting on its laurels and is clearly making significant investment in both product and platform innovation.

4. Income Statement

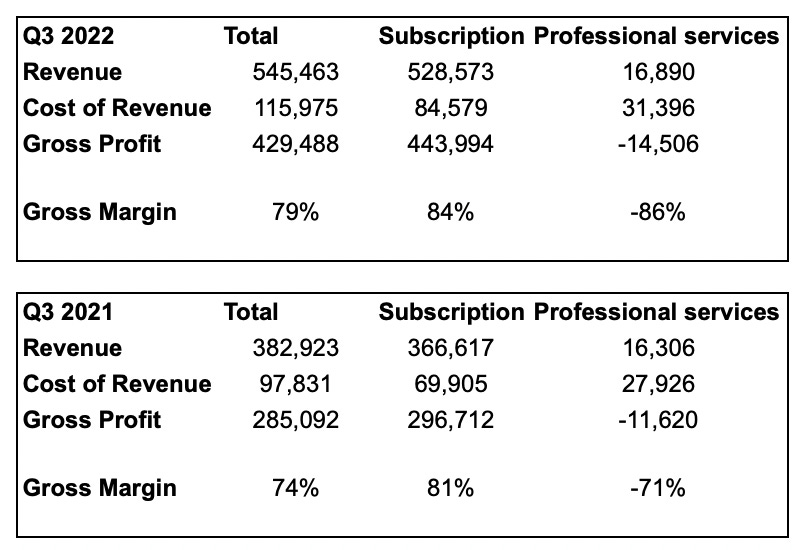

During the quarter, DocuSign grew its top line by 42% YoY. Gross profit is following a similar trajectory and increased by 50%, with gross margin also improving from 74% to 79% YoY.

Subscription revenue is still the most significant area of the business and accounts for 97% of all revenue. International business revenue grew 68% YoY driven mainly by the Asia Pacific region. In total, international revenue accounts for $128 million or 23% of total revenue.

The increase in gross margin from 74% to 79% is a result of an increase in subscription gross margin.

The SaaS (Software-as-a-Service) model means that DocuSign can generate extremely attractive gross margins in an asset-light fashion.

Operating expenses increased by 30% to $433 million during the quarter. The main driver here was sales and marketing expenses which increased by 31% to $276 million. At one stage, DocuSign was spending 123% of its revenue on sales and marketing expenses alone, which arguably meant that it was subsidising sales. The trend is moving in the right direction and has remained at 51% for the past four quarters.

5. Balance Sheet

Observations

Over $503 million in cash and cash equivalents down from $566 million at Q4 FY 2021

Total Liabilities as percent of Total Assets is 90% up from 86% at Q4 FY 2021

Current Assets to Current Liabilities ratio of 0.96 down from 1.06 at Q4 FY 2021

Goodwill balance making up 15% of total assets, no significant movement since Q4 FY 2021

Long-term debt (convertible notes) has increased by over $167 million during FY 2022

6. Cash Flow

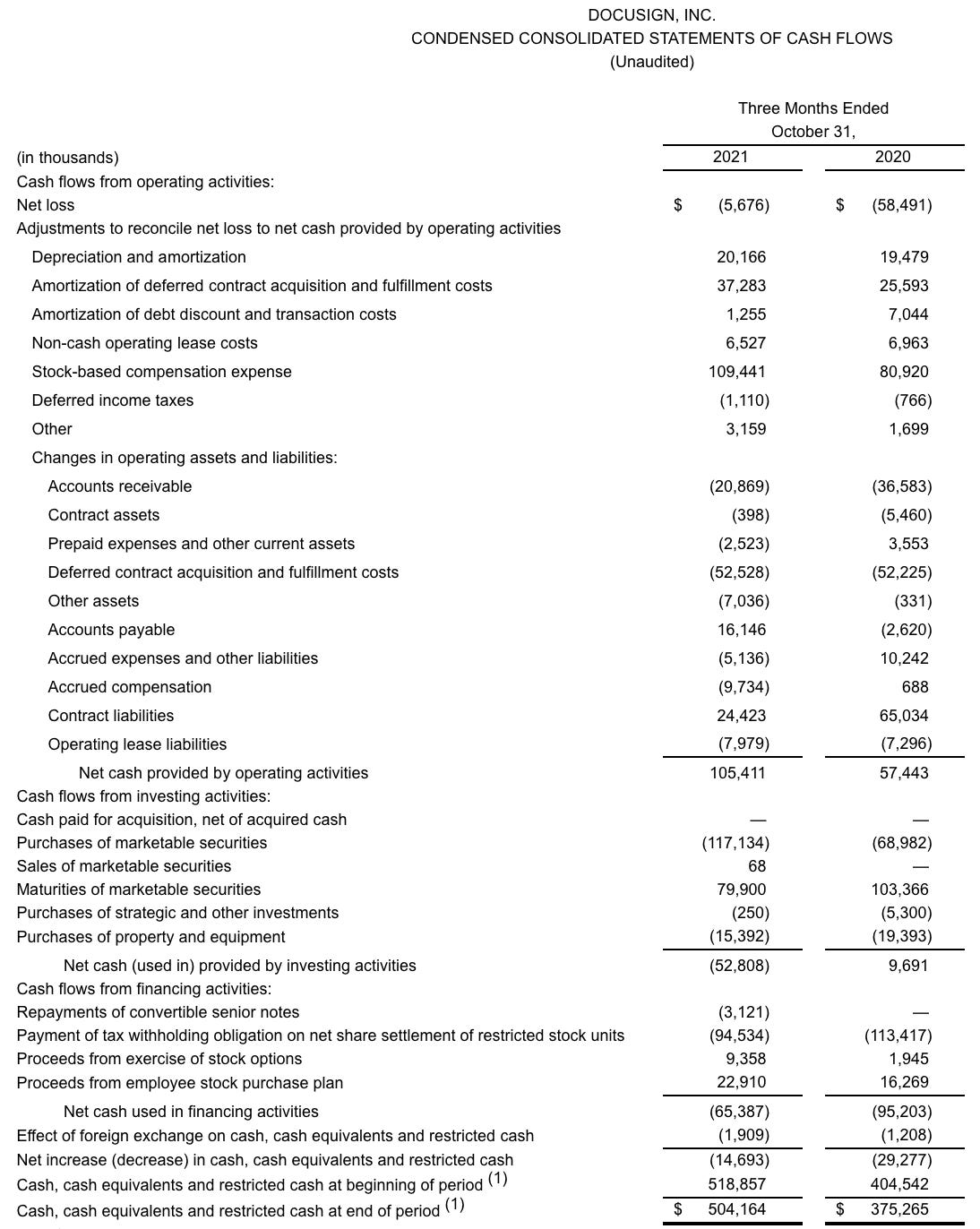

DocuSign’s operating cash flow is improving. At Q3 FY 2022, quarter to date (QTD) cash flow from operations increased by 84% from $57 million to $105 million.

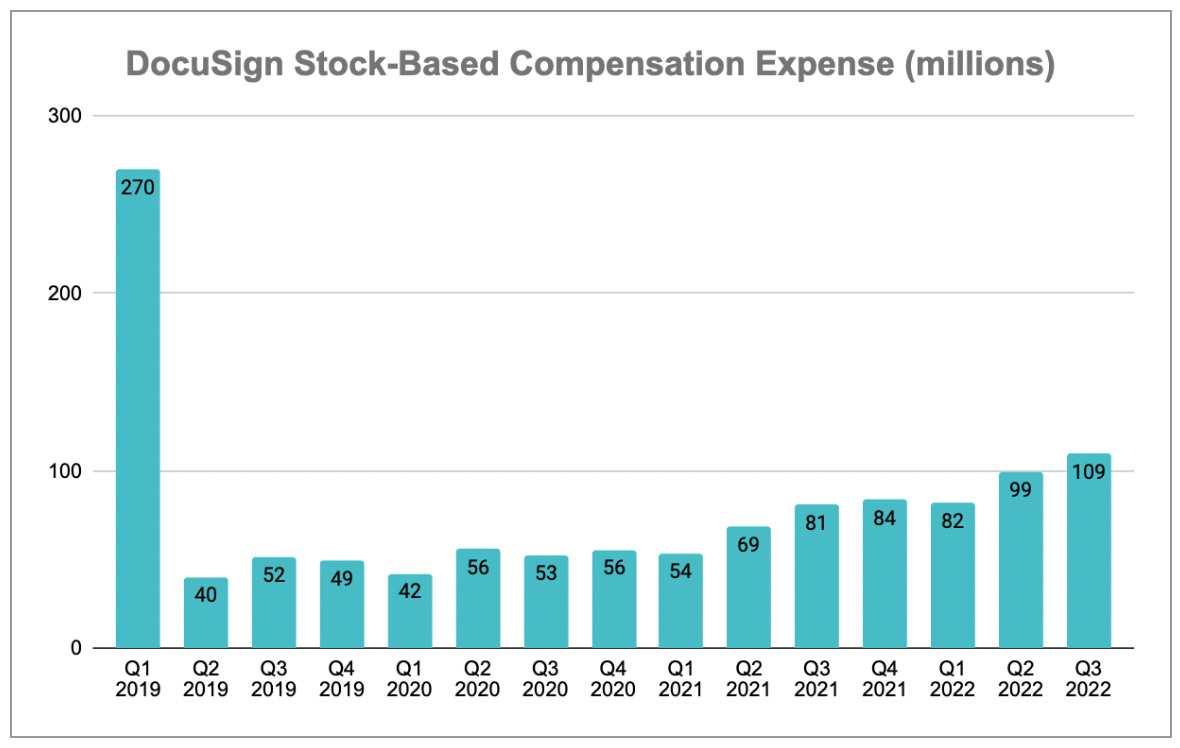

One of the main items in the operating cash flow is stock-based compensation (SBC) expense which increased by 35% YoY. This expense is common in high-growth companies as it allows them to compensate employees without any cash changing hands. Whilst there is no cost to the company, it does dilute shareholder returns. An extra 11 million shares (6% increase) are in existence as a result of SBC over the past 12 months.

Talent retention is really hard at the moment. We’ve all probably heard of the great resignation. SBC is a way for DocuSign to retain talent and align employee incentives with shareholders interests. If DocuSign or other companies instead paid higher salaries it would mean less cash to invest in other areas of the business and does not guarantee long term retention. Employees could still leave when the cash dries up. SBC means that the employee has an incentive to stay with the company and share in it’s growth.

DocuSign’s QTD investing cash flow resulted in a deficit of $53 million compared to a surplus of $10 million YoY. The key driver here is the significant investment in marketable debt securities which ties in with the increase we see on the balance sheet.

DocuSign’s QTD financing cash flow resulted in a deficit of $65 million compared to a deficit of $95 million YoY. The key driver here is the payment of tax on restricted stock units.

Overall, DocuSign produced QTD free cash flow of $90 million compared to $38 million YoY. This is a healthy trend.

7. Guidance

Management lowered the guidance for billings for the full year of FY 2022 to between $2.335 billion and $2.347 billion. The previous guidance was between $2.409 billion and $2.429 billion. The rationale is similar to the Q3 FY 2022 billings miss discussed earlier.

However, management actually raised the guidance for revenue for the full year of FY 2022 to between $2.083 billion and $2.089 billion. The previous guidance was between $2.078 billion and $2.088 billion. The lower end of this revenue range would represent an increase of approximately 43% from FY 2021, while the higher end of this range would represent an increase of approximately 44%.

8. Conclusion

This was a solid quarter from DocuSign. Looking at the top line, DocuSign beat estimates and also raised forward guidance. This does not appear to have been widely acknowledged. Obviously the miss on billings and the lowering of guidance was not what investors wanted to see. 6% share dilution, missing billings by 4% and lowering guidance by 3% does not warrant a 42% sell off in my opinion. There is nothing fundamentally wrong or broken with the company.

Heading into earnings the valuation was probably a bit rich and comes at a time when the market is experiencing a sell off in growth stocks. At its peak, DocuSign traded at a Price/Sales multiple of 37 in July 2021. After earnings, DocuSign trades at a Price/Sales multiple of 13 which is the lowest it’s been since November 2019. On 7 December, CEO Dan Springer purchased 33,675 shares for $4.8 million. To quote Peter Lynch: “insiders might sell their shares for any number of reasons, but they buy them for only one”.

Rating: 3 out of 5. Meets expectations.

Disclosure: The author holds a long position in DocuSign.

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week.

All previous posts are viewable on the website.

If you enjoy what you see, please give it a like, comment below and share.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.