Executive Summary

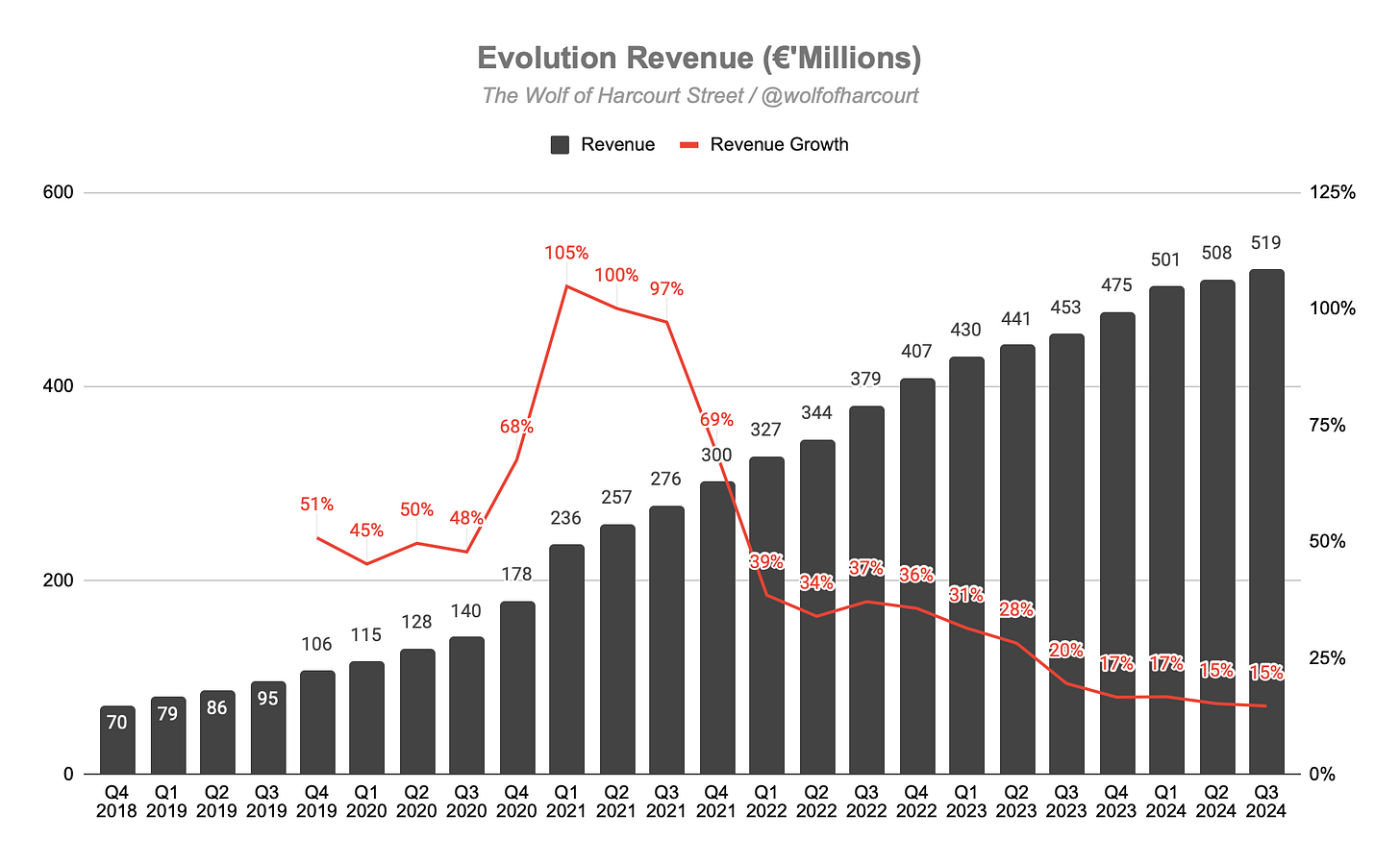

Evolution reported 15% net revenue growth for the second consecutive quarter, with underlying growth of 19% adjusted for foreign exchange headwinds. The Live segment, accounting for 86% of revenue, grew 16% YoY, driven by increased commissions from existing and new customers. The RNG segment (14% of revenue) saw 9% YoY growth, its strongest since Q1 2023, signaling stabilization after challenges in the U.S. market earlier in 2024.

Evolution’s operating margin improved slightly to 62% sequentially, despite a 21% YoY increase in operating expenses to €200 million, driven primarily by personnel costs. Labor disruptions in Georgia, where operations are now at 60% capacity, caused a 7% sequential decline in FTEs and increased costs as capacity shifted to higher-cost regions. While the cost per FTE rose 10% YoY to ~€8k per quarter, revenue per FTE increased to €36k, demonstrating the scalability of Evolution’s business model by serving more players with fewer staff.

Evolution expanded its global footprint by launching a second studio in Colombia, positioned as a key hub for the Latin American market, and opened a new studio in the Czech Republic to serve local and future European demand. Further expansion is planned into 2025, with new studios in Brazil and the Philippines, the latter marking a strategic shift due to favorable regulatory conditions. However, operations faced disruptions, including labor strikes in Georgia, and a surge of cyber-attacks in Asia that impacted revenue. Evolution is leveraging other studios and strengthening cyber defenses to mitigate these challenges and ensure continued growth.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Net Revenue: €519 million +15% year-over-year (YoY)

Live: €447 million +16% YoY

RNG: €72 million +9% YoY

Operating Profit: €379 million +32% YoY

EBITDA: €415 million +30% YoY

Free Cash Flow: €325 million +33% YoY

2. Wall Street Expectations

Net Revenue: €516 million (beat by 0.5%)

Earnings per Share: 1.28 (beat by 23%)

3. Business Activity

New Studios

Evolution launched new tables at its studio in Colombia during the quarter and in the Czech Republic in October. This marks the company’s second studio in Colombia, which will serve as the main hub for the rapidly expanding Latin American market. The Czech studio will primarily focus on the domestic market but will eventually expand to serve additional European capacity.

Management confirmed that investment in new studios will continue into 2025, including launches in Brazil and the Philippines—both regarded as long-term growth drivers. Previously, management had expressed hesitation about opening an Asian studio but explained the change in strategy during the recent conference call:

“The change is simply that the Philippines regulate, and they do it in a good way with a serious regulator. And we are then obliged to have a studio in the Philippines. After careful evaluation, we have taken that step.”

Martin Carlesund, CEO

Labor Disruptions in Georgia

A strike involving approximately 550 employees began in mid-July following two years of stalled negotiations. Initially, the impact on operations was limited, but it escalated due to illegal activities by a small group of union-affiliated activists.

The activists blocked entrances, vandalized property, harassed employees, and disrupted operations. Evolution claims that false information was spread by these individuals, and the company is pursuing legal action for defamation. As a result, operations in Georgia have been scaled back to 60% of original capacity. Evolution is leveraging its other studios globally to mitigate the disruption’s impact on customers.

While the situation in Georgia is now stable, Evolution does not plan to fully restore capacity there, instead capping it at 60%. The company intends to expand operations in other regions to support future growth.

Cyber-Attacks in Asia

During the quarter, Evolution faced a surge in advanced cyber-attacks targeting its video distribution network in Asia, negatively impacting revenue. Management highlighted that when a product is highly valued, competitors may attempt to intercept, manipulate, and redistribute it:

“Simply put, someone else is selling our product”

Martin Carlesund, CEO

Although Evolution has deployed countermeasures, the attacks still affected third-quarter performance. The company remains committed to aggressively scaling up its defenses to prevent further disruptions.

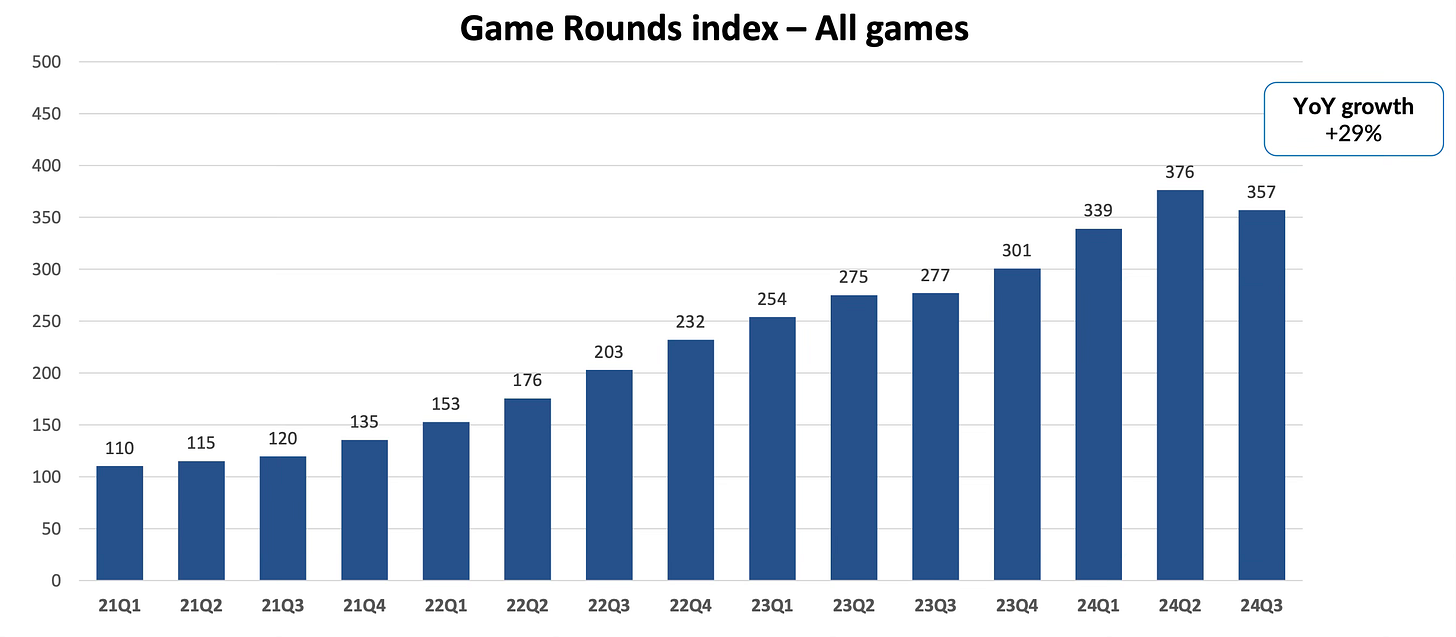

Game Rounds Index

The game rounds index, which measures overall activity across Evolution’s network, was impacted this quarter by the disruptions in Georgia. To manage the situation, Evolution prioritized key parts of the network, which reduced the number of bets placed but had a limited effect on revenue. The company plans to expand capacity outside Georgia to serve lower-value player segments in the future.

Measures to prevent unauthorized use of its products in Asia also affected the game rounds index. Despite these temporary setbacks, the underlying activity remains strong, and Evolution expects the index to grow from the adjusted Q3 baseline going forward.

New Games

New Product: Social Gaming with Influencers

Evolution is introducing a new feature allowing players to engage with streamers, brand ambassadors, and influencers, offering a more interactive and social gaming experience. This initiative aims to increase player engagement and excitement, helping operators boost retention.

Deal or No Deal Live Slot – Upgraded Version

This version introduces RNG qualification, a 15-segment money wheel (with 5x to 50x multipliers), and a live bonus game, providing an enhanced gameplay experience. The release is scheduled for October 30.

Bet Stacker Blackjack

An advanced version of Infinite Blackjack, this game allows players to stack bets for higher potential winnings. New rules and bonus elements further elevate the excitement.

Crazy Balls Live

Combining the bonus games from Crazy Time with a bingo-style main game, this innovative title is set to launch in November 2024, promising a unique gaming experience.

RNG

The company released 20 new high-quality RNG titles across its key brands, including Red Tiger, NetEnt, and Big Time Gaming.

4. Financial Analysis

Revenue

Evolution’s net revenue grew by 15% for the second consecutive quarter. Foreign exchange headwinds have been a challenge throughout the year, with underlying revenue growth at 19% compared to the 15% reported.

Evolution’s business performance presents a mixed picture but appears to be improving. The Live segment, which accounts for 86% of total revenue, grew 16% YoY, driven primarily by increased commission income from existing customers and, to a lesser extent, new customers.

Meanwhile, RNG (14% of total revenue) grew by 9% YoY—its best performance since Q1 2023. The RNG segment had struggled throughout 2023, losing market share in the U.S. earlier in 2024, but it now seems to have stabilized. Management noted that new features, such as BetWithStreamer, SpinGifts, and the AI Slot Recommender, are being rolled out to enhance product value.

Mobile usage continues to be a key driver of growth, with 71% of operators' gross gaming revenue generated through mobile devices in Q3. While RNG is the largest vertical in the online casino market, Live has become increasingly important for gaming operators, evolving into a strategically essential product.

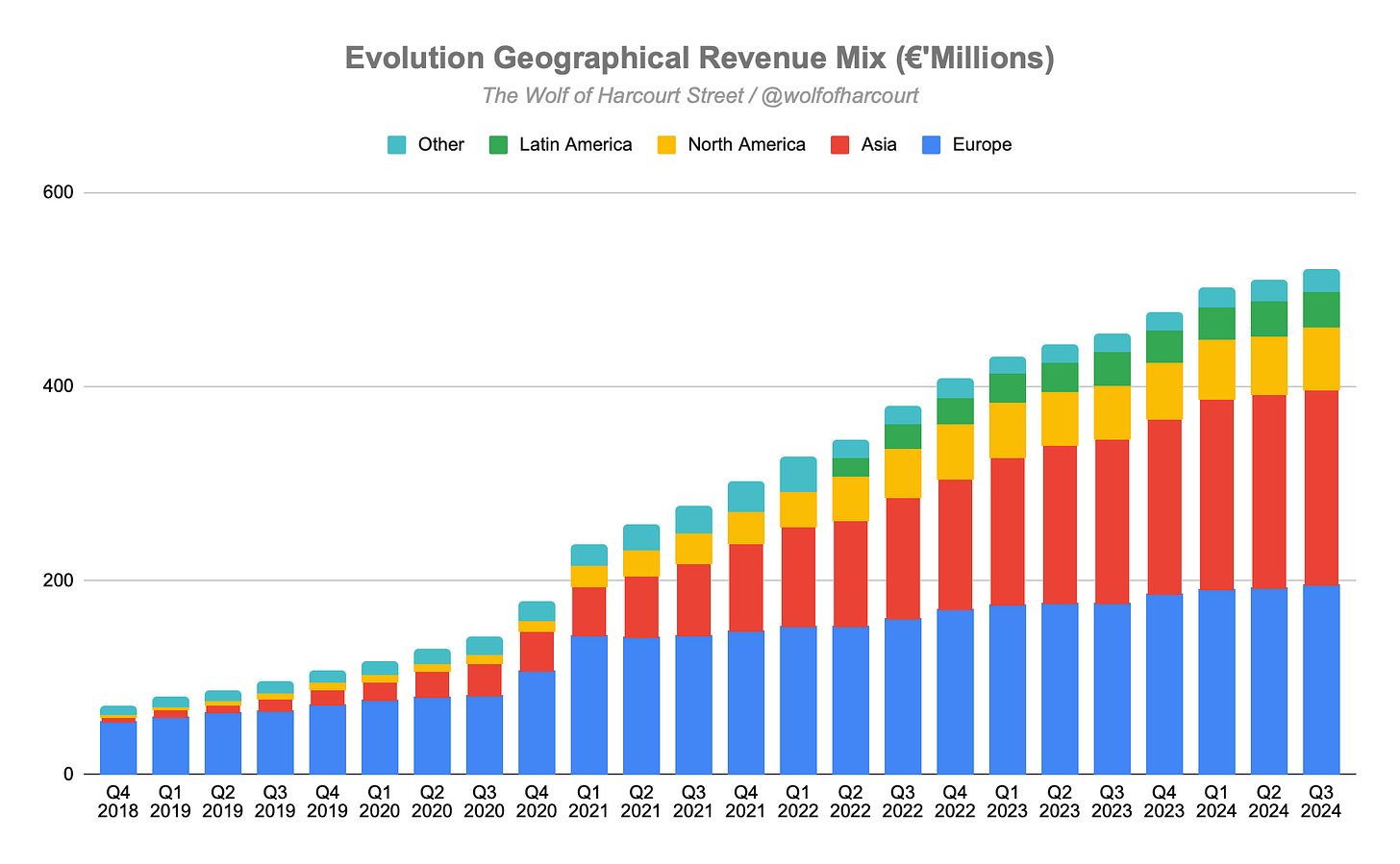

Regional Performance

Asia (39% of total revenue) grew 17% but slowed from 22% in Q2 due to cyber-attacks. Management expects gradual recovery in 2025.

Europe (38%) grew 11%, accelerating from 9% in Q2, marking the region's fastest growth since Q2 2023.

North America (12%) grew 18%, driven by the Live segment and the recovery of RNG. Evolution expanded its portfolio with new titles such as Crazy Coin Flip, Super Sic Bo, Video Poker, and Crazy Time in several states.

Latin America (7%) posted slower 9% growth, but the region’s outlook is positive, with Brazil’s regulation in 2025 expected to be a key growth catalyst.

An additional line item in Evolution’s financials this quarter was €60 million under ‘Other operating revenues,’ related to a reduced earn-out liability from the €450 million acquisition of Big Time Gaming in 2021. A reduced earn-out liability results in a gain on the income statement for the acquiring company, as the expected future payment decreases, effectively reducing the total cost of the acquisition.

With this item included, Evolution reported total operating revenue of €579 million, implying 28% YoY growth. While this boosts the bottom line, it is important to separate it from the results as it is non-recurring.

Operating Margin

Excluding the non-recurring item, Evolution’s operating margin improved marginally on a sequential basis to 62%, as total operating expenses grew 21% YoY to €200 million.

Personnel expenses, the largest component of operating expenses, increased 21% YoY to €111 million. The main driver was a hiring ramp-up, with average full-time equivalents (FTE) rising by 11% YoY to 14,366. However, FTEs declined 7% sequentially due to labor disruptions in Georgia, which is now operating at 60% of its original capacity. Management noted plans to increase staff through the rest of the year to support newly opened studios and expand operations elsewhere.

The labor disruptions in Georgia caused capacity to shift to other studios, which increased the cost per average FTE by 10% YoY to ~€8k per quarter. Georgia is one of Europe’s lowest-cost countries, so reallocating capacity to other regions resulted in higher costs.

Despite the disruptions, Evolution’s revenue per average FTE increased to €36k from €35k in Q3 2023 and €33k in Q2 2024, underscoring the scalability of its business model. Evolution managed to serve more players with fewer FTEs, with revenue per average FTE now 4.7 times greater than the cost per average FTE.

Due to the Georgia disruptions, the EBITDA margin (excluding the non-recurring item) declined YoY to 68% but remained flat sequentially. Management subsequently revised Q4 guidance and expects full-year 2024 margins to be slightly below the previous 69%-71% range.

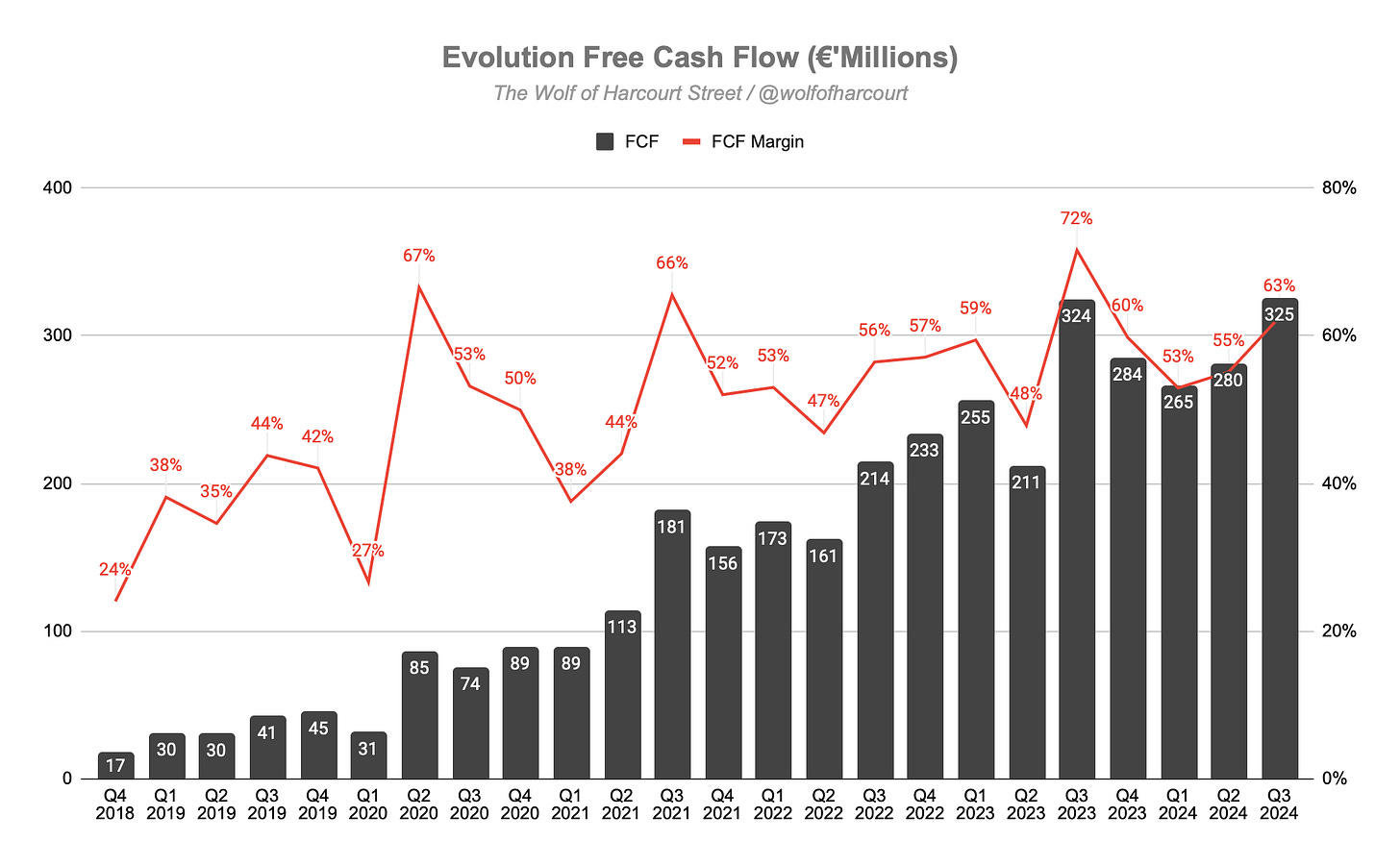

Cash Flow Analysis

Evolution is in a heavy expansion phase, with investments in new studios, gaming tables, servers, and other computer equipment to meet technical demands. This drove capital expenditures (CapEx) higher, resulting in a CapEx ratio exceeding 6%. While the company initially estimated €120 million in CapEx for the year, it is ahead of schedule, having already spent €101 million. I estimate total CapEx could reach €135 million given ongoing studio development.

Despite these investments, cash flow remains robust, with a Free Cash Flow (FCF) margin of 63%. Even after executing €244 million in share repurchases this quarter, Evolution closed with a cash balance of €664 million. The cash conversion ratio is over 80% for the rolling 12-month period.

5. Conclusion

Coming into this quarter, market sentiment toward Evolution was extremely negative, with the stock down 19% YTD before earnings were released. While some concerns were understandable, much of the pessimism was short-sighted. The non-recurring item gives the appearance of a stronger report, so it’s essential to strip it out to assess the underlying business performance.

On an underlying basis, net revenue grew 19%—an impressive outcome given the headwinds from labor disruptions in Georgia and cyber-attacks in Asia. Could underlying growth have surpassed 20% without these challenges? We’ll never know, but I believe it was highly probable.

It was also encouraging to see the RNG segment, which had experienced several quarters of market share losses, return to growth. In the U.S., live casino gaming continues to expand across all states, making it the company’s fastest-growing region. With online casinos legalised in only seven states so far, there is still a long runway for future growth.

While the disruptions affected profitability, it was reassuring to see margins stabilize sequentially, excluding the non-recurring item. Given the shift away from Georgia, it is unlikely that EBITDA margins will return to 71% anytime soon.

Let’s address the elephant in the room regarding the €60 million gain from the reduced earn-out liability. This reduction indicates that the acquired company failed to meet performance targets. While it provides a short-term boost to Evolution’s earnings, it also signals that the acquisition may not have been as successful as initially anticipated.

This was a quarter where Evolution faced many questions, but the company demonstrated resilience and the strength of its scalable business model. Not many companies with over 55% of their expenses tied to personnel can reduce headcount and still grow revenue.

Evolution’s stock surged 15% on the day of the earnings release.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

3 out of 5 is a good result. I wouldn’t say they fell short. To score a 4 the company needs to go above and beyond expectations. This was always going to be a challenging quarter for Evolution given the labour disruptions.

Nice summary. Where did Evolution fall short on getting just a score of 3?