Evolution AB (Ticker: EVO.ST, EVVTY) trades on the Nasdaq Stockholm having gone public via an initial public offering (IPO) in March 2015. The IPO valued the company at approximately €260 million. Fast forward to today, Evolution’s valuation has soared to over €20 billion, delivering a remarkable return of more than 6,000% over the course of eight years.

What fueled Evolution’s astounding growth to transform itself from a niche provider into a major player in the online casino industry?

Contents

Executive Summary

Overview

Customer Base

Financial Analysis

Competitive Landscape

Leadership and Incentive Structure

Risks

Opportunities

Valuation

Investment Outlook

1. Executive Summary

Evolution's success in the online casino industry is driven by its ability to solve key problems for gaming operators. They provide a comprehensive live casino solution that covers all operational aspects, recruit and train skilled game presenters, offer customization options for operators, maintain a diverse game portfolio, and integrate with land-based casinos. This approach streamlines operations, enhances player engagement, and supports the growth of online casinos.

Evolution’s revenue model primarily relies on commission fees, where they earn approximately 10% of the operators' profits from using their casino games. Additionally, they offer customization options for operators, including dedicated tables for which they charge monthly fees. Set-up fees for new customers also contribute to their revenue. The combination of fixed and variable revenues allows Evolution to benefit from customer growth without being directly impacted by end user wins or losses.

Evolution has leveraged the benefit of economies of scale effectively in its operations to achieve an EBITDA margin of 70%. Their games are highly scalable, accommodating an unlimited number of players simultaneously, which reduces overhead costs compared to traditional casinos. The fixed cost of live dealers can be spread across numerous players, resulting in more favorable unit economics. Unlike casino operators, Evolution doesn't incur customer acquisition costs, as their games remain consistent across various operators, enabling them to benefit from newly acquired players.

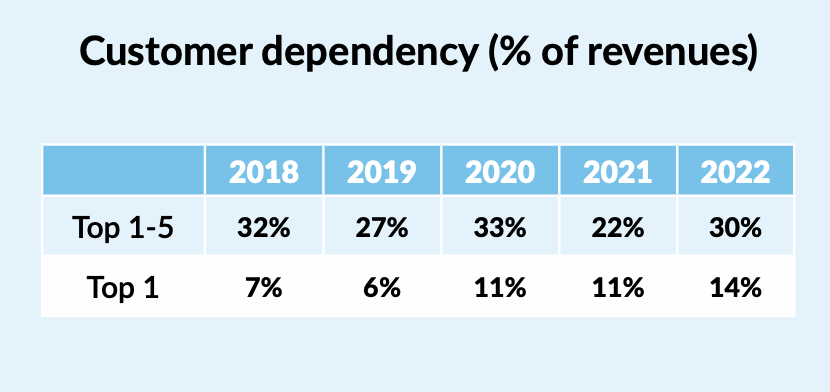

Regulatory risk is a significant challenge for Evolution's business. Evolution utilizes an MGA license to operate in all EU countries but regulators may impose specific requirements, such as locating equipment within a jurisdiction. This could necessitate setting up studios in multiple countries or locations which is costly and would erode economies of scale benefits. Evolution's revenue heavily depends on its top five customers, contributing 30% in 2022, up from 22% the previous year. The rising concentration emphasizes their importance, but it also poses a concentration risk.

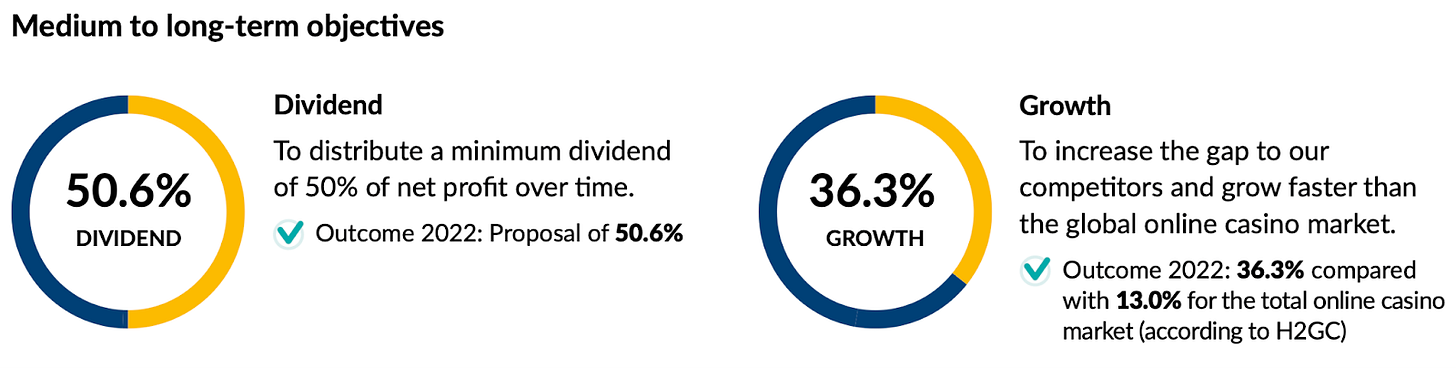

Evolution's durable competitive advantages include strong intellectual property, scalability, network effects, and high switching costs, all of which contribute to its leading position in the live casino market and make it challenging for competitors to compete effectively. The global online gambling market is expected to reach $153.57 billion by 2030, with a projected CAGR of 11.7% from 2023 with Evolution management setting the strategic objective of outpacing global market growth in order to increase the gap to its competitors.

2. Overview

Evolution specializes in the innovation, development, and production of content for online casinos, primarily catering to business-to-business (B2B) clients. Their content can only be accessed through an operator's platform, which includes crucial elements like player authentication, account management, and user interface.

Evolution's business strategy centers on providing tailored online casino services to gaming operators in regulated markets across digital platforms. Its mission is to enable operator success while delivering an exceptional gaming experience to end users. The company's vision is to become the foremost online casino provider in the world, signifying its ambition to lead the industry and shape its future.

What is an Online Casino?

Online casinos offer players a realistic casino experience from their homes through live casino games. These games are hosted by qualified dealers and feature real-time play via high-quality video streaming. Specialized live game studios equipped with advanced technology and professional dealers create an immersive and interactive gaming environment. Players can interact with dealers through live chat, and a variety of classic casino games are available, including blackjack, roulette, baccarat, and poker. The games undergo regular third-party audits for transparency and integrity. This combination of technology and human interaction delivers an exciting and genuine casino experience to online players.

A casino makes money by leveraging the "house edge," which is a built-in advantage in all casino games. Return to Player (RTP) represents what a game pays players over time. For instance, if 10,000 players bet a total of €100,000, and players receive €96,000 in winnings, the game's RTP is 96%. RTP influences players to spend time and money on these games. Online games typically have RTP in the mid-to-high 90%, while land-based casinos range from 70% to 90% due to fixed costs.

The Ecosystem

Evolution has evolved significantly since its inception in 2006, starting with a basic Live Casino Roulette game and now offering a diverse ecosystem of Live Casino games tailored to various player preferences.

Central to this ecosystem is their smart lobby, introduced to players in 2022, inspired by platforms like YouTube and Netflix, driven by an artificial intelligence (AI) recommendation engine that becomes more intelligent with each user visit.

The primary goal of this smart lobby is to help players quickly discover games they will enjoy. It achieves this through AI recommendations, videos, filters, recently played options, and search functionality. This personalized approach enhances the player experience and increases player engagement. The lobby represents a significant long-term investment in enhancing the user experience and personalizing it for each player.

Evolution offers a comprehensive live casino platform, the One Stop Shop (OSS), which covers hardware, software, video, employees, and user data, providing operators with a complete live casino solution and users with a unique gaming experience. OSS integrates Evolution, NetEnt, Red Tiger, Big Time Gaming, Ezugi, and Nolimit City brand games which were strategic acquisitions, simplifying and accelerating the integration process for casino operators. This platform offers quick access to a wide range of games, reduces time to market, and supports unified management of new casinos and regulated market changes. OSS also provides access to a single Back Office and a unified set of promotional tools.

The platform is continually improved for robustness, scalability, and support for regulated markets and concurrent users. Evolution's technical system is stable, reliable, and capable of handling large volumes of data while remaining scalable. The company has developed its own video coding solution to ensure continuous HD video streaming or other formats suitable for end users. In 2022, the system's availability was an impressive 99.88%, excluding scheduled maintenance, demonstrating its reliability.

Product Offerings

Evolution's game portfolio covers a wide spectrum of player preferences, from classic table games in Live Casino to visually captivating and feature-rich slot games.

Live Casino: Evolution is renowned for its Live Casino games, which recreate the real casino experience through high-quality video streaming. Live Casino includes classic table games like Blackjack, Roulette, Baccarat, and Poker, with various versions and tables catering to different player preferences. Evolution also offers unique live games, such as MONOPOLY Live and Dream Catcher, which combine elements of traditional gaming with interactive entertainment. Game variants like Lightning Roulette and Infinite Blackjack introduce innovative features, enhancing gameplay and excitement.

RNG Slots: Evolution provides a selection of slot games, including both classic and modern video slots. Their portfolio encompasses a diverse range of themes, from ancient civilizations to fantasy worlds, offering something for every player's taste. Games like Gonzo's Quest and Starburst provide unique and engaging slot experiences that are not easily replicated by other providers. Evolution's slots are designed to be visually appealing, with immersive graphics and animations, along with exciting bonus features.

Game Shows: Evolution has expanded its offerings to include exciting Game Shows that blend elements of traditional game shows with live casino entertainment. Games like Crazy Time, Mega Ball, and Deal or No Deal Live provide a dynamic and interactive gaming experience. These games often feature hosts who engage with players in real-time, adding a social and immersive dimension to the gameplay. Game Shows offer players a chance to participate in thrilling live events and potentially win substantial prizes.

What Problem Does Evolution Solve?

Evolution solves several key problems for gaming operators through its development and provision of fully integrated live casino and slots solutions.

Comprehensive Live Casino Solution: Many gaming operators may struggle to provide a comprehensive and high-quality live casino experience to their players. Evolution's solution covers all aspects required by a gaming operator, including game presenters, streaming, production, supervision, and customer services. The Mission Control Room is central to Evolution's operations, focusing on operational excellence, system availability, security, and regulatory compliance. This eliminates the need for operators to manage multiple aspects of the live casino operation themselves, saving them time and resources.

Recruitment and Training: Finding and training skilled game presenters (dealers) and other staff can be a significant challenge for gaming operators. Evolution takes on the responsibility of recruiting and training these personnel, ensuring that operators have access to well-trained professionals who can provide an engaging and authentic gaming experience.

Customization and Adaptability: Different gaming operators have unique branding and customer preferences. Evolution's platform offers a high degree of adaptability, allowing operators to customize their live casino environment, including standard and VIP tables, the overall look of the environment, and dedicated dealer teams. This customization helps operators tailor the gaming experience to their specific audience.

Broad Game Portfolio: Keeping a diverse and engaging game portfolio can be challenging for operators. Evolution offers a broad portfolio of core games, including classic table games and innovative casino games. This variety keeps players engaged and attracts a wider audience.

Land-Based Casino Integration: Evolution also offers on-premise studios at land-based casinos in several countries. This integration allows land-based casinos to expand their online presence and leverage their existing infrastructure while offering a seamless gaming experience to their customers.

3. Customer Base

Evolution's customer base includes a wide range of global online operators, platform providers, and an expanding number of land-based casinos. The company's growth strategy is centered around its existing customer portfolio, as operators typically expand their live offerings. Additionally, Evolution can follow its existing customers into new markets, further fueling growth.

As of the end of 2022, Evolution's customer portfolio comprised over 700 customers, consisting of both online operators and land-based casinos. These online operators typically offer various gaming verticals, including RNG (Random Number Generator) games like slots, live casino games, sports betting, poker, and bingo. Some of Evolution’s notable customers include DraftKings, Paddy Power, FanDuel, MGM Resorts and Wynn Resorts.

In 2022, Evolution entered agreements with several notable entities, such as Italy's Sisal for online slots and jackpots, Holland Casino Online for a full catalog of NetEnt and Red Tiger online slots, Soaring Eagle Gaming for online casino content in Michigan, and PlayStar for online Live Casino and RNG-based casino games in New Jersey. Additionally, Evolution renewed its agreement with FanDuel Group to provide live dealer table games across the entire regulated US online gaming market. The company also expanded existing agreements to cover additional services and tables.

Revenue Model

Evolution generates its revenue primarily through commission fees and dedicated table fees in its live and RNG casino offerings.

Commission Fees: The majority of Evolution's revenue comes from commission fees. These fees are ~10% of the operators' winnings generated from Evolution's casino offerings. This means that Evolution shares a portion of the profits earned by the casino operators who use their live and RNG casino games. Commission fees provide the company with exposure to the overall growth of the global online casino market.

Live Casino Customization: Evolution offers various levels of customization to casino operators. The most basic agreements typically grant access to and streaming from generic tables. However, more complex agreements can include dedicated tables, custom environments, VIP services, native-speaking dealers, and other personalized features. These customized solutions help operators differentiate themselves in the market and cater to specific player preferences.

Dedicated Table Fees: Operators who opt for dedicated tables pay monthly service charges to Evolution of ~€20,000 per table. Dedicated tables are exclusively reserved for the operator's use and can be fully customized to meet their requirements, including studio environment, graphics, branding, and language. The fee for dedicated tables varies from customer to customer and depends on factors such as the type of game, the number of tables, and the hours of operation.

Other Sources of Income: In addition to commission and dedicated table fees, Evolution also generates revenue from other sources, including set-up fees. Set-up fees of ~€50,000 are charged to new customers when they launch their casino offerings with Evolution. These fees are invoiced in conjunction with the onboarding process and contribute to the company's overall revenue.

Evolution's revenue model is noteworthy because it consists of fixed and variable consideration from the gaming operators. Evolution benefits from the operator's customer growth without facing any direct impact from end user wins or casino losses.

Customer Due Diligence

Evolution has established due diligence processes for signing new agreements and continuously evaluating existing customers. Evolution can discontinue its services to operators that fail to comply with relevant regulations or jeopardize Evolution's market position and gaming licenses.

Evolution provides its products exclusively to customers with valid licenses for online casinos granted by relevant regulatory jurisdictions. The company supplies licensed business-to-consumer (B2C) casino operators who, in turn, offer the games to players. Additionally, Evolution serves licensed B2B actors who supply games to B2C licensed operators, who then provide them to players. Regulatory authorities issue licenses and monitor compliance, and Evolution conducts Know Your Customer (KYC) checks on its contractual partners, both B2C and B2B.

Due diligence is performed before accepting a new customer and is conducted annually. It includes checks on governance structure, customer licenses, and, for B2B customers, reporting of new operators and their licenses. Evolution also performs a Business Risk Assessment on each customer, rating them against a risk matrix. The company maintains an ongoing dialogue with regulators and undergoes regular audits.

4. Financial Analysis

As touched on earlier, the majority of Evolution’s revenues consist of commission fees for both live and RNG casinos. Evolution’s Live and RNG segments have completely different performance profiles. Live Casino is Evolution’s core competency and grows almost completely organically. Live makes up 84% of revenue and is growing 34% YoY as per Q2 2023. On the other hand, RNG makes up 16% of revenue predominantly through acquisitions and declined 4% YoY in Q2 2023 based on pro-forma figures. Management's goal for the RNG segment is double-digit growth but the segment has been losing market share.

During the second quarter of 2023, Evolution recorded total revenues of €441.1 million, representing an increase of 28% year-over-year (YoY). This growth can be attributed to increased commission income from existing customers and from new customers.

Evolution has grown revenue at a five-year CAGR of a staggering 52%. Evolution's live casino offerings are clearly in high demand. The company’s strategy of continuously launching new games and variations of traditional games has contributed to the growing demand for online casino games. This approach helps the company cater to evolving player preferences and maintain a competitive edge in the market.

Evolution's revenue by region showed growth double-digit across all regions in Q2 2023. LatAm experienced the fastest growth at 61% followed by Asia at 48%, North America at 20%, and Europe at 15%.

In LatAm, the company is witnessing an increase in player numbers. To support this growth, it has initiated studio expansion by establishing its first studios in LatAm in Argentina and Colombia. Looking at North America, the company is actively expanding its Live game portfolio. This expansion strategy aims to increase the share of Live Casino in the online gaming market in North America. Finally, in Europe, there is a high demand for new dedicated tables, surpassing the company's current delivery capacity. Management has emphasized its intention to address this issue in the coming quarters, indicating its commitment to meeting the growing demand in the region.

We are a little bit undersupplying the market in several regions, as mentioned, Europe, and that's a lot connected with the headcount growth. So we hope that we can increase a little bit more on headcount during the second half of the year - Jacob Kaplan, CFO, Q2 2023 Earnings Call

Evolution's major cost components are personnel expenses, facility and studio costs, and product development. Personnel costs encompass operations, IT, and recruitment. Expanding the Live Casino platform for new or existing operators incurs varying expenses, including set-up fees for new studios. Product innovation and development are significant costs, both as direct operating expenses and through the depreciation of development investments.

Evolution reported operating expenses amounting to €159.6 million for Q2 2023, an increase of 23% YoY. These expenses were primarily driven by higher personnel costs, attributed to the launch of new tables and studios. As of 30 June 2023, Evolution had 17,447 employees, an increase of 14% YoY.

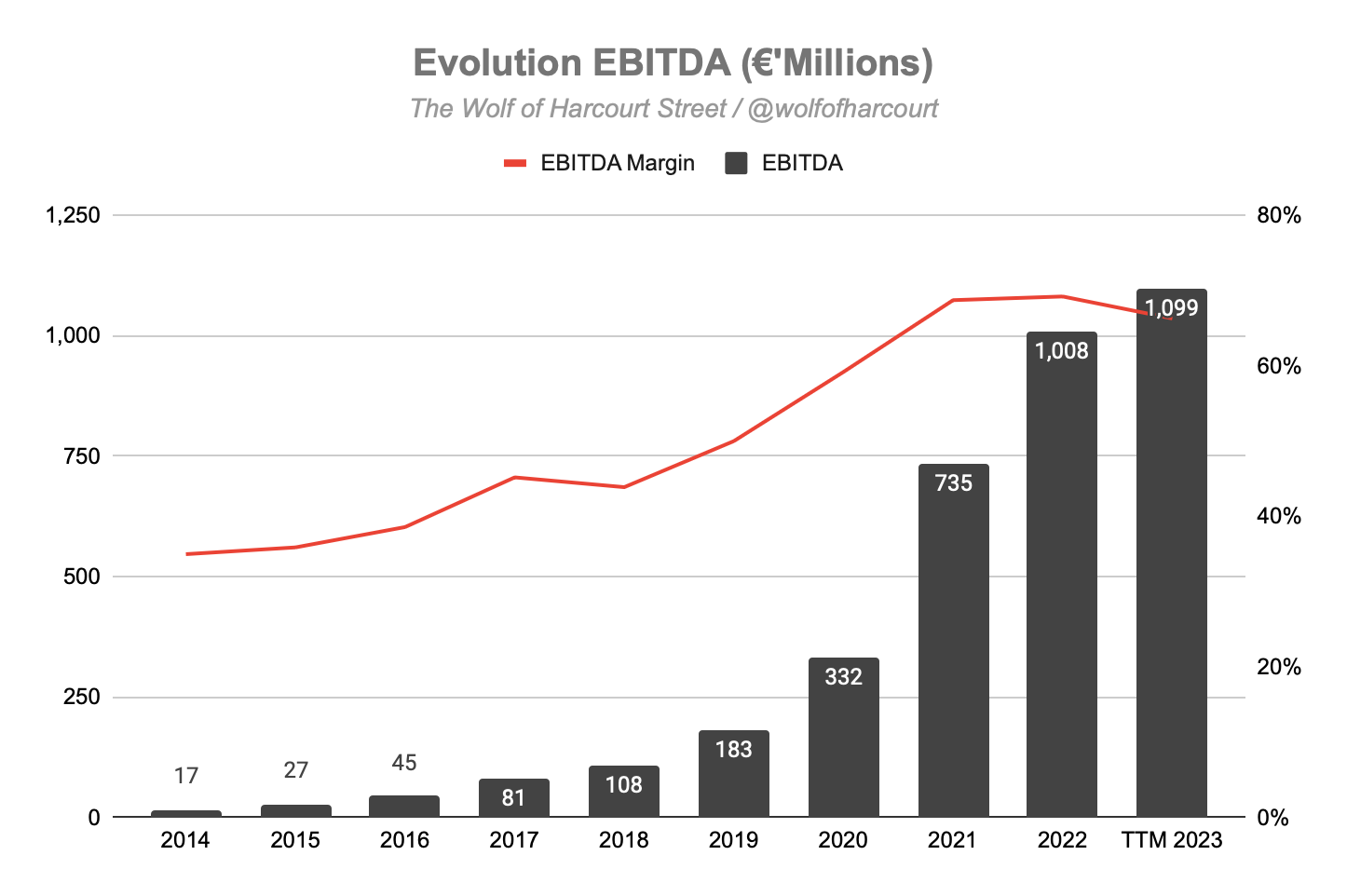

Over the years, Evolution has demonstrated significant improvement in its operating margin. This margin has increased from 27% in 2014 to an impressive 63% in trailing-twelve-months (TTM) 2023. Evolution has benefited immensely from economies of scale in several ways:

Scalability of Games: Unlike traditional casino games which can only accommodate a fixed number of players at a time, the majority of Evolution's games can support an unlimited number of players betting simultaneously. This scalability allows them to serve a much larger player base without incurring additional overhead costs that brick-and-mortar casinos face, such as providing free drinks and casino maintenance.

Fixed Cost of Live Dealers: In Evolution's model, the live dealer salary becomes a fixed cost that can be leveraged across hundreds of potential concurrent players. This efficiency is in contrast to traditional casinos where live dealers serve only a few players at a physical table. Evolution's ability to spread this cost across a larger player base results in more attractive unit economics.

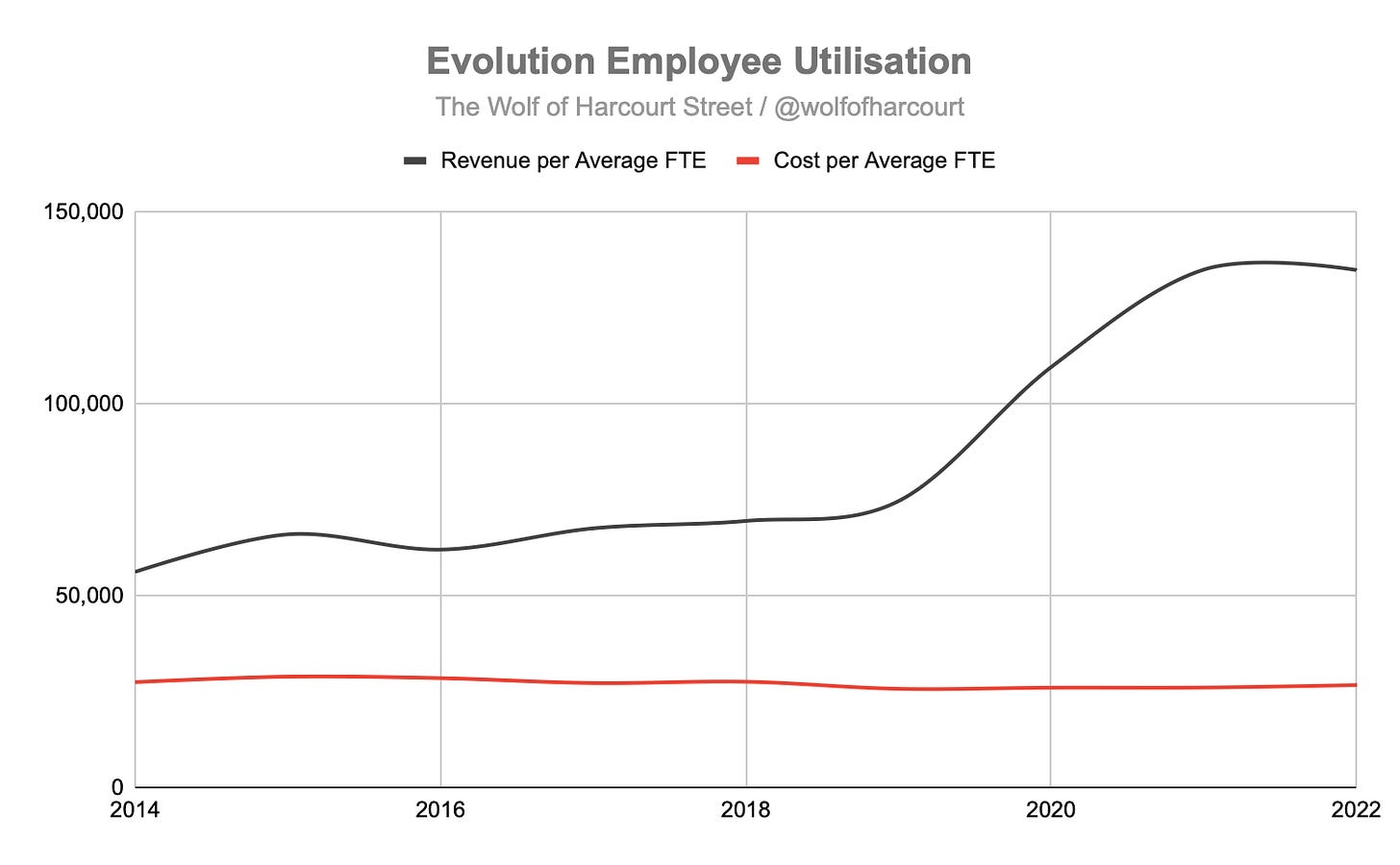

In 2022, Evolution’s revenue per average full-time equivalent (FTE) of €135k is five times greater than the cost per FTE of €27k.

Zero Customer Acquisition Costs: Evolution's business model differs from casino operators in that it does not incur customer acquisition costs. While casino operators spend on marketing to attract players, Evolution's games remain consistent across various operators. As players switch between operators, they continue to play Evolution's games. This unique advantage allows Evolution to capitalize on the upside from newly acquired players without significant marketing expenses.

In Q2 2023, Evolution achieved its highest-ever EBITDA margin of 70.7%. The company has navigated challenges such as price increases while maintaining operational efficiency and is actively working to minimize the impact of price increases on its operations. It continually seeks ways to enhance efficiency as it strives to sustain its growth trajectory.

One of the financial objectives set during the IPO was to achieve an EBITDA margin of over 35%. Evolution has not only met this objective but has significantly surpassed it, reporting a margin that is double the initial target.

Financial Position

Over €541 million in cash and cash equivalents

Positive working capital of €753 million

Debt to Asset ratio of 80%

Over €2.2 billion of Goodwill comprising 52% of total assets

Zero debt

If it weren’t for the significant Goodwill balance, this would be an A+ balance sheet. The Goodwill is a result of a number of acquisition most notably:

This level of goodwill makes me a little uneasy because the risk of impairment, which would not affect cash flow, could significantly impact the company’s earnings. The goodwill balance is greater than the combined operating profit for the past seven years. The significance of this will be revisited below.

Cash Flow Analysis

For the twelve months up to the end of Q2 2023, Evolution generated over €900 million in free cash flow (FCF), representing a FCF margin of 55%. This is one of the most highly cash-flow-generative companies on the public markets.

Given the cash-rich nature of the business coupled with no debt, Evolution returns excess cash to shareholders through a dividend. The Company’s dividend policy is to distribute a minimum of 50% of its net profits over time. While the current dividend payout ratio is around 46%, if the risk of goodwill impairment comes to fruition and impacts profitability, this could impact the dividend based on the existing policy.

Return on Capital

Between 2013 and 2020, Evolution consistently achieved a Return on Capital (ROC) ranging from 35% to 45%. During this period, the company was very efficient at generating returns from its invested capital for two main reasons:

High operating margin: Evolution benefits from significant economies of scale. Their large scale operations allow them to spread costs efficiently, increasing profitability.

Reinvestment runway: The live casino market is still experiencing growth and Evolution’s ability to expand into new markets, increase its client base, and introduce new games have contributed to its ability to generate higher returns on the capital it employs.

In 2021, Evolution's acquisition of NetEnt through share issuance had a notable impact on its ROC. Initially, ROC dropped significantly from its historical levels to 12%, but it gradually increased to approximately 16% by 2023. This decline in ROC during acquisitions is due to the immediate reflection of costs, while the benefits accrue over time. As a result, even deals that ultimately create substantial value for the acquirer may initially seem unattractive when viewed from this perspective.

5. Competitive Landscape

The live casino industry is a dynamic sector within the broader online gambling industry, offering players an immersive and interactive gaming experience with real dealers and authentic casino settings. The key competitors include:

Playtech: Playtech is a publicly traded player in the interactive gambling industry with a history of providing high-quality gaming products. Initially focusing on RNG-based products like video slots, table games, bingo, and video poker, the company's success has been driven by innovation. Playtech was a pioneer in introducing the live dealer format in 2003, offering an immersive casino experience online. Today, they offer a diverse range of live dealer tables with games like blackjack, roulette, poker, baccarat, and dice. Playtech's client list includes well-known brands such as Betfair, Ladbrokes, Mansion, bet365, and William Hill. Playtech received the EGR Poker Supplier of the Year award in 2022.

VIVO Gaming: VIVO Gaming, established in 2010, is a privately-owned creator of live-dealer gaming solutions with studios in various locations, including Bulgaria, Costa Rica, London, Miami, Manilla, and Buenos Aires. They have formed strong partnerships with leading casino operators and offer technology that replicates the atmosphere of land-based casinos on players' computers and mobile devices. Their platform allows players to engage in real-time interactive gaming with options like roulette, blackjack, baccarat, craps, poker, Dragon Tiger, Sic Bo, Live Bingo, and sports betting. VIVO Gaming received the prestigious EGR Live Casino of the Year award in 2022, a title which Evolution had held for twelve consecutive years.

Pragmatic Play: Founded in 2015, Pragmatic Play is a privately-owned leading provider of premium gaming content for the gambling industry, specializing in delivering an excellent mobile gaming experience. They offer a wide range of innovative games, including video slots, table games, scratchcards, bingo, and live dealer tables. With offices in multiple locations, including Gibraltar, Malta, Isle of Man, Romania, and Germany, they serve various regulated markets. Pragmatic Play is known for creating HTML5 gaming content accessible on all devices, supporting over 150 currencies and 31 languages. Pragmatic Play received the EGR Casino Software Supplier award in 2022.

The graphic above includes Ezugi which is part of the Evolution Gaming group after it was acquired in 2018 for €16 million. Evolution has a dominant market position as evidenced by it being ranked top in five of the seven categories globally.

The comments from Evolution's CEO, Martin Carlesund, are fascinating in regards to competition:

everything we do is about one thing: to expand the gap to competition and strengthen our market leadership

This mindset reflects the company's commitment to maintaining its position as a market leader. In fact, Evolution doesn't limit its competitive outlook to traditional peers in the gaming industry. They also consider major entertainment companies like Disney and Netflix as competition. This broader perspective has driven Evolution to be the first to release successful game show hits, showcasing their innovative approach to stay ahead. This has led to Evolution significantly outperforming listed competitor Playtech when it comes to revenue CAGR and EBITDA margin expansion over the past five years.

The advantage that Evolution holds over its rivals is underscored by the insights gathered by BWG Strategy through discussions with industry experts:

Evolution is widely considered the best in the business for live dealer products. They have the infrastructure and experience. Live dealer has many advantages and I think it will be quite big in the U.S. Market. Having robust infrastructure allows them to scale and manage the growth much better than their competitors - President at Casino Games Co.

Evolution Gaming - live table games are very popular in the few regulated states that are online today. They will benefit from market growth. Everyone likes Evolution’s games; they’ve figured out the community & connection aspect better than anyone else - Director of Loyalty at Betting Company.

Evolution, they essentially own the live dealer space already, and that format of online play sort of bridges the gap between table games online and table games on the casino floor. I know it has a ton of people on the land based side excited about the potential - Product Director, Digital Gaming at Connecticut Casino.

6. Leadership and Incentive Structure

Evolution was founded in 2006 by Jens von Bahr and Fredrik Osterberg in Stockholm, Sweden. The founding story revolves around the vision of Jens von Bahr and Fredrik Osterberg to revolutionize the online casino gaming experience. They recognized the potential for live dealer games to bridge the gap between the convenience of online gambling and the authentic atmosphere of a physical casino. This led them to establish Evolution Gaming and embark on a journey to develop cutting-edge live dealer casino technology.

Evolution Gaming's early years were marked by intense research and development efforts to create a platform that could seamlessly stream live casino games to players' devices. They focused on recruiting skilled dealers and developing state-of-the-art studio environments to replicate the ambiance of a traditional casino. One of the key milestones in Evolution's history was the launch of their first live casino studio in Riga, Latvia, in 2007. This studio became the foundation for their live dealer operations, offering a range of popular casino games like blackjack, roulette, and baccarat. The company's innovative approach, including features like real-time interaction with dealers and other players, quickly gained popularity among online casino operators and players.

Over the years, Evolution continued to expand its portfolio of live dealer games, introducing new variations and unique offerings to cater to a global audience. In 2021, the company rebranded as Evolution, dropping "Gaming" from its name to reflect its broader scope within the gaming and entertainment industry.

Jens von Bahr is Chairman of the Board having served as Chief Executive Officer (CEO) until October 2016 and Fredrik Osterberg sits on the Board having served as Chief Strategy Officer until April 2018. Martin Carlesund was appointed CEO in October 2016. Prior to joining Evolution, Carlesund served as CEO for Eniro Sverige, CEO for Highlight Media Group, Chairman at 24 Solutions, CEO at 3L System AB and CEO for Eniro Finland Oy.

The company's largest shareholder is Capital Group, which owns a 15.1% stake. Next is Österbahr Ventures AB which is a joint venture between Jens von Bahr and Fredrik Österberg, with a 10.4% stake. Blackrock and WCM Investment Management both hold a 5.1% stake.

Evolution’s management is incentivized through guidelines designed to attract, motivate, and retain senior executives, including the Group CEO, Group management, and members of the Board employed by the company. The key components of the incentive structure:

Fixed Salary: Senior executives' fixed salaries are competitive and based on individual competencies, responsibilities, and performance. The fixed salary is subject to an annual review.

Variable Compensation: Senior executives may receive variable remuneration in addition to their fixed salaries. Annual variable remuneration is cash-based and tied to predetermined and measurable performance criteria aimed at promoting the company's long-term value creation.

Incentive Program: Shareholders' meetings have the authority to establish long-term share and share-price related incentive programs for senior executives. These programs are designed to align the interests of participating individuals with those of the company's shareholders and encourage personal shareholding.

In addition to the above, Evolution has implemented incentive programs that involve the issuance of warrants to key employees. These programs aim to align the interests of employees with those of the company's shareholders. The 2023/2026 incentive plan was initially put before the Board in February amd has yet to be approved per the below timeline:

February 2023 Proposal: Evolution initially proposed an incentive plan involving 500 individuals and 5 million warrants. This plan had a maximum dilution rate of 2.32%, which caused concerns among shareholders. Additionally, there were unclear criteria for the allocation of these incentives.

June 2023 Revised Plan: Evolution made adjustments to the incentive plan in response to the earlier criticisms. The plan was scaled down to involve 300 individuals and 2.5 million warrants, reducing the maximum dilution to 1.16%. Moreover, this revised plan introduced performance metrics tied to revenue growth, EBITDA margin, and ethics compliance to address transparency and accountability concerns.

July 2023 Cancellation: Evolution announced the cancellation of the incentive program. This decision stemmed from changes in Evolution's share price during the program's implementation period, which no longer aligned with the original conditions of the proposal. As a result, the Board of Directors opted not to proceed with the program, pledging to collaborate with shareholders to develop a more suitable program for motivating the company's employees.

This ongoing situation is concerning, and as it rumbles on, it raises further doubts about the possibility of something more serious occurring behind the scenes.

7. Risks

1. Regulation

Regulatory risk poses a significant challenge to Evolution's business. The company's revenue primarily comes from licensing and supplying gaming software to operators, making it highly dependent on the ever-changing and complex laws and regulations governing the gaming industry across various jurisdictions.

A. Malta Gaming License

Evolution is licensed and regulated by the Malta Gaming Authority (MGA). Evolution is also licensed and regulated in many other EU jurisdictions as well as the United Kingdom, Canada, South Africa, and others. With an MGA license, Evolution can operate in all EU countries. The introduction of new online gaming regulations in various European countries may necessitate specific licenses, curtailing the opportunity to leverage the single EU license and increase administration expenses.

B. Studios in Multiple Locations

Courts or regulators may impose specific requirements, such as locating equipment within a jurisdiction, which could disrupt Evolution's operations and potentially require the company to set up studios in multiple countries. Setting up studios in multiple countries is a costly endeavor. It involves expenses related to real estate, technology infrastructure, hiring and training staff, and ensuring compliance with local laws and regulations. These added costs can erode the economies of scale benefit that Evolution currently enjoys. Evolution's current business model relies on operating just seventeen studios worldwide to serve a global market. This concentration of resources and expertise allows for cost efficiencies and quality control. It is worth nothing that while this would reduce economies of scale it would increase barriers to entry for competitors.

A significant portion of Evolution's workforce, about 62%, is located in the low-cost economies of Georgia and Latvia. Expanding into the United States has led to increased studio presence but also higher employee costs due to higher average salaries. In 2022, Evolution substantially grew its U.S. workforce from 845 to 1,841 employees.

C. Income Tax Rate

Evolution has benefited from low corporate income tax rates by channeling revenues through its Malta operation. However, as new revenue sources in North America emerge and global minimum tax initiatives come into play, these rates are anticipated to double. In 2022, Evolution's total tax rate was 7%, but the impending 15% global minimum tax could potentially double the company's overall tax rate, which would impact its net profits and cash flow.

2. Customer Concentration

While Evolution’s revenue is diversified geographically, it is significantly concentrated among its top five customers, who collectively contributed 30% of the company's total revenue in 2022. This represents a notable increase from the previous year when these top customers contributed 22%. The largest customer alone contributes approximately 14% or €204 million of the company's revenues, up from 11% in 2021. This increasing concentration underscores the importance of these key customers to Evolution's financial health.

Relying heavily on a small number of major customers for a substantial portion of revenue poses a significant risk. If the business of any of these five customers deteriorates or declines, it could directly impact Evolution's revenue stream. Another significant risk is the possibility that one or more of these top customers might opt to switch to a competitor for their live casino solutions. Given the competitive nature of the gaming industry, losing a major client to a rival could lead to decreased revenue, lower profits, and potential financial challenges.

Another potential concern tied to the significant customer concentration is whether, given that a single customer is spending more than €204 million on Evolution's product, there is a risk that the casino might choose to bring the live casino solution in-house as a cost-saving measure.

Similar to computer manufacturers using the Windows operating system, casinos benefit from cost-effectiveness when they rely on existing third-party solutions:

Leverage years of expertise: Building an in-house solution requires significant investment in development and maintenance, which can be costly. By using a fully integrated solution like Evolution, the operator can leverage seventeen years of compounded industry experience at a fraction of the time and cost.

Lower operational and capital expenses: Developing and maintaining a full technology stack, including game presenters, streaming, production, supervision, and customer service demands a large and specialized workforce. This results in substantial fixed operational costs. When casinos use third-party providers, they pay a percentage of their revenue in exchange for access to the solution. While this involves sharing revenue, it can be more cost-effective than bearing the full expense of developing and managing the end-to-end solution in-house. This also enables casinos to sidestep substantial ongoing capital expenses related to software development, infrastructure, and technology upgrades, particularly when creating new games.

Risk management: Developing casino games or technology in-house carries a significant risk. If a game or technology project fails to perform as expected, the casino would incur substantial losses. By partnering with external providers, casinos can mitigate this risk and avoid costly failures.

Quality and innovation: In-house development may lead to a focus on cost control, potentially resulting in the creation of simpler, budget-conscious products. These products may lack the depth, features, and innovation found in offerings from specialized providers. Using third-party solutions ensures access to high-quality, feature-rich, and innovative games and technology.

This is supported by the input received from a traditional casino operator in response to BWG Strategy's inquiry about the competitive advantages of third-party suppliers compared to in-house game development by brick & mortar (B&M) operators:

They have the experience and the decade of R&D; they have all the mistakes and the learning curve. B&M casinos are not agile - compliance, budget issues, etc. Time is the biggest hurdle - there will be a lot of misses before they are successful - Former Vice President of Online Gaming Operations at Hard Rock International

8. Opportunities

1. Durable Competitive Advantages

Evolution has an opportunity to harness its enduring competitive advantages to further solidify its market position, expand its offerings, and continue setting industry standards. The following factors have been identified as to why Evolution can continue to lead the live casino market for the years ahead:

A. Intellectual Property

Evolution has a competitive advantage through its exclusive portfolio of proprietary games, such as Monopoly Live and enhanced classics like Lightning Roulette, which are difficult for rivals to duplicate. Casino operators must license Evolution's live casino solution to offer these games, creating a significant barrier to entry.

Evolution's large player base provides cost efficiency similar to the "Netflix advantage”. With most player traffic on their platform, Evolution's per-player investment in creating new intellectual property (IP) is lower than competitors, allowing more resources for innovation and game development. The success of games like Crazy Time, despite being expensive to create, showcases how Evolution can balance innovation with profitability.

Evolution’s traditional casino games, like Blackjack, offer a high RTP, attracting and retaining players while satisfying casino operators. Evolution's unique game show-style offerings typically have a lower RTP compared to traditional games. This lower RTP allows Evolution to recoup the costs associated with developing these complex and entertaining games.

Evolution's commitment to developing new games is evident from its announcement to launch over 100 new games in 2023. In 2022, the company launched 88 new games. This continuous innovation keeps players engaged and interested in their offerings while expanding their IP portfolio. As they introduce more proprietary games, it becomes increasingly challenging for competitors to catch up or replicate their success.

B. Scalability

Unlike land-based casinos that are limited by physical space, Evolution operates in the digital realm, allowing them to break free from such constraints. This scalability advantage means that they can accommodate a virtually unlimited number of players at their casino tables without the need for additional physical infrastructure, such as expanding the casino floor or hiring more dealers. This results in higher returns on their investment (ROI) and margin expansion. In traditional casinos, adding more tables and dealers would directly increase costs, but Evolution can accommodate more players without significantly increasing expenses. Since 2014, Evolution has been able to more than double revenue per live table from €404k to €914k.

Evolution's vast network of 1,300+ tables, as of the end of 2022, demonstrates their dedication to maximizing capacity utilization. They provide hundreds of games in multiple languages around the clock and strategically leverage their global network for capacity management. This proved crucial during events like the COVID-19 pandemic, ensuring uninterrupted service to players. Their flexibility in managing capacity allows them to optimize ROI by reallocating resources as demand changes.

Evolution’s scalability acts as a competitive barrier. Potential competitors must replicate Evolution's global studio presence, develop unique games, and manage capacity effectively to be a meaningful competitor. Their large geographic footprint allows them to cater to diverse markets and players worldwide. This adaptability enhances the customer experience and broadens their global reach. This high barrier to entry makes it challenging for subscale competitors to gain a foothold in the market.

C. Network Effects

Evolution Gaming has established a strong Network Effects competitive advantage driven by the interplay of player engagement, social interaction, game variety, and market dominance.

The more players engage with a live casino game, the more immersive it becomes. Evolution enhances this social aspect, making players feel part of a vibrant community. They recognize social interaction's importance, allowing players to connect with friends and others in real-time, reinforcing the network effect and attracting players to their games.

Evolution's extensive game portfolio not only appeals to players but also attracts operators. Online casinos are always seeking to provide a variety of games to their customers. The more games Evolution offers, the more operators it can partner with, creating a direct network effect. This, in turn, leads to a better overall casino experience for players who have access to a diverse selection of games in one place.

Evolution enjoys a substantial traffic advantage over its competitors. This traffic dominance not only reflects the popularity of Evolution's games but also contributes to the Network Effects advantage by ensuring a larger player pool. Once players enter the Evolution ecosystem, they are more likely to stay within it. Evolution employs unique game exit and lobby redirection practices that encourage players to remain within their ecosystem. This makes games from other providers less accessible, reinforcing player loyalty and network effects.

D. Switching Costs

The substantial one-off setup fees of up to €50,000 for dedicated tables represent a significant upfront investment for casino operators. These fees, coupled with high margins, incentivize operators to stay with Evolution. Once a casino operator has invested in dedicated tables, it becomes reluctant to switch to another provider, as it would mean abandoning a sunk cost. This financial commitment acts as a strong deterrent to switching to a different live casino game provider.

In addition to the setup costs, casino operators must pay monthly fees of up to €20,000 per table. These ongoing costs further lock operators into their relationship with Evolution. With contracts typically running for three years, operators are financially committed to Evolution for an extended period, making it less appealing to switch to a competitor.

Evolution owns or leases the facilities where the dedicated tables are hosted. This adds to the switching costs because if an operator were to leave Evolution, it would not only lose access to the games but also the physical infrastructure. Evolution can potentially rebrand or repurpose these facilities, making it even harder for operators to switch providers.

Certain dealers become popular with players, and players develop comfort and loyalty to them. If a casino operator were to switch away from Evolution, it would not only lose access to the platform but also the dedicated and non-dedicated dealers. Losing these dealers could lead to player churn as they may seek out their favorite dealers on other platforms. This loyalty factor increases the switching costs for operators.

2. Online Gambling Market Expansion

The global online gambling market is expected to reach $153.57 billion by 2030, with a projected compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. This growth is attributed to factors such as smartphone and internet penetration, freemium models and cultural and legal approval. This presents a significant expansion opportunity for Evolution.

Advancements in the digital space are fueling the expansion of online casinos, focused on building trust in the online gambling sector. Virtual reality (VR) technology is playing a key role in creating immersive gambling experiences, allowing users to interact realistically with the hardware, other players, and dealers, while also improving sound quality and game design.

Online casino developers are emphasizing solutions that support gamblers, ensure the authenticity of gambling activities, and prevent fraud. Many platforms offer free-play versions of games to attract new users, generating revenue through in-app and website advertisements.

In 2022, desktop devices accounted for around 48% of online gambling revenue. Desktops offer advantages such as a larger screen size, which allows players to enjoy game details and graphics fully. Additionally, desktops provide superior performance features like audio and picture quality, as well as customizable storage capacity, enhancing the overall gaming experience.

Advanced technologies in mobile phones have led to realistic gaming visuals, making smartphones a popular choice for accessing online gambling. The mobile device segment is expected to experience the highest CAGR from 2023 to 2030. This growth is driven by the emergence of immersive betting applications and the convenience of gambling via mobile devices. Evolution is well positioned for the increase in mobile device usage. Their mobile games are built in HTML5, ensuring seamless integration with operators' mobile websites and apps. In 2022, 68% of Evolution's revenue came from mobile gaming, highlighting the company's success in the mobile segment.

Europe held a dominant position in the online gambling market in 2022, commanding a market share of over 41%. This growth can be attributed to the legalization of gambling in several European countries, including Italy, Spain, France, and Germany. The region benefited from factors such as high-speed broadband internet availability, the rising popularity of online casinos, and increased smartphone usage. Despite this growth, the larger gambling markets in Europe have relatively lower online market shares which presents a further opportunity for Evolution given 65% of the total gambling market remains land-based.

While Europe dominated in 2022, the Asia Pacific region is poised for substantial growth. The increased use of internet services and the relaxation of restrictions related to online gambling and betting are anticipated to drive market development in the Asia Pacific in the coming years. The Asia Pacific region benefits from increased spending on leisure activities from robust economic growth.

Evolution recognizes the potential offered by the global expansion of the online casino market. It is rare to witness a company with a strategic objective of outpacing global market growth in order to increase the gap to its competitors.

9. Valuation

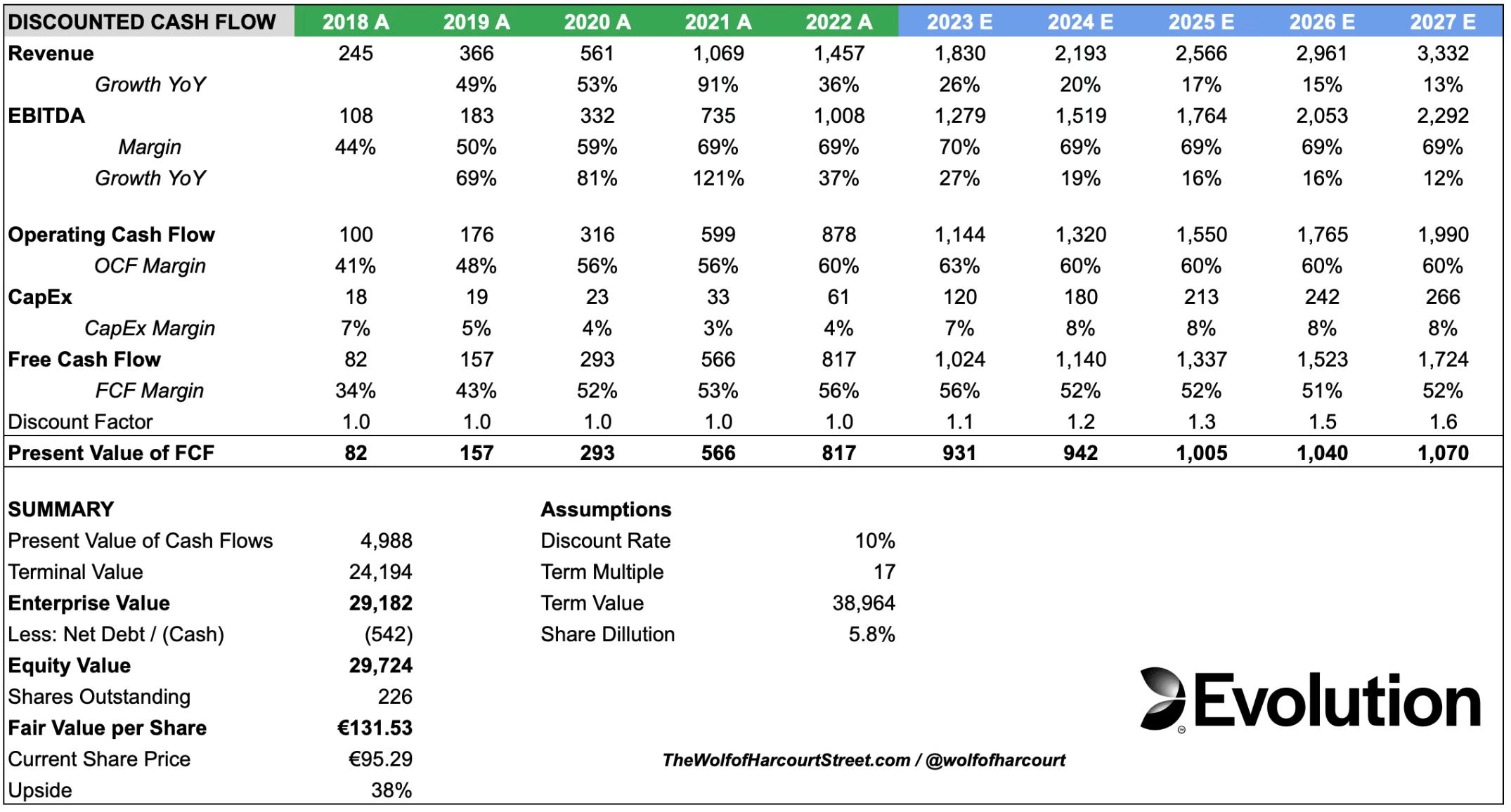

Discounted Cash Flow

Future cash flows have been projected over five years using a discount rate of 10% and a terminal EBITDA exit multiple of 17. For context, Evolution currently trades at an EV/EBITDA multiple of 17 which is on the low end given the quality of the underlying Evolution business notably its durable competitive advantages and stellar unit economics. A conservative approach will be maintained with the current market multiple.

A revenue CAGR of 18% is projected from 2022 to 2027. In the global online gambling market, which is anticipated to grow at an 11% CAGR during the same timeframe, Evolution has consistently outpaced the market, with a growth rate of 36% compared to the market's 13% in 2022.

The EBITDA margin has been forecast to reach its highest point at 70% in 2023, after which it will level off at 69% for the next five years. This projection includes accounting for the additional studios needed in each U.S. state as part of the global expansion opportunity.

Management set a CapEx guide of €120 million for 2023 which would equate to a CapEx margin of 7%. This has been bumped up to 8% from 2024 to 2027 to align with global studio expansion. This results in the FCF margin reaching a peak of 56% before levelling off to 52%. Despite uncertainty regarding the management incentive plan, a maximum annual dilution of 1.16% has been assumed for this analysis.

Based on these assumptions, the fair value of Evolution is close to €131.53 per share suggesting a potential upside of 38% based on the share price on 11 October 2023 of €95.29. The EVO.ST SEK share price has been converted to EUR using the closing fx rate for that date.

Price to Earnings Ratio

Evolution trades at a forward P/E ratio of 17x which is at a premium to its other publicly listed competitor Playtech which trades for 8 times forward earnings.

Evolution commands this premium relative valuation for obvious reasons: growing four times as fast and almost three times as profitable. A company with a 70% EBITDA margin and a 26% growth rate appears undervalued at 17 times forward earnings.

10. Investment Outlook

The investment outlook for Evolution is promising due to its durable competitive advantages. Evolution's strengths lie in its intellectual property, scalability, network effects, and switching costs, which position it favorably within the growing online casino industry. Notably, the high demand for new dedicated tables in Europe, exceeding the company's current capacity, highlights the opportunity. These custom-branded tables incur significant upfront costs, creating higher switching costs for operators, implying higher value customers.

The outlook is not without its risks which include regulatory risks outside of Evolution’s control that could materially impact margins in the future. Additionally, concerns arise regarding the management incentive program tied to warrants issuance.

Evolution's potential for future acquisitions is a strategic move that could make sense, provided fair prices are paid. The platform facilitates seamless integration of acquired brand games into the Evolution ecosystem, potentially increasing their value through synergies. Lessons from the acquisition of NetEnt, which may have been overpriced, can guide future acquisition strategies.

Evolution benefits from being a crucial infrastructure provider in an industry shifting from land-based to online casinos, which still account for 65% of the European market. This migration is driven by the significantly better RTP offered by online live casinos, thanks to their lower fixed costs compared to land-based alternatives. An investment in Evolution hedges bets on the dominant ‘pick and shovel’ play in the online casino industry at a very reasonable valuation.

Disclosure: At the time of writing, the author holds a long position in Evolution AB.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

If I could seek one clarification. On this point that you mentioned ‘the live dealer salary becomes a fixed cost that can be leveraged across hundreds of potential concurrent players. This efficiency is in contrast to traditional casinos where live dealers serve only a few players at a physical table’

Isn’t the dealer still limited to the number of players at the table at any one point in time. Or in the case of a ‘live casino’ a dealer can dealer on multiple tables at the same time?

Congratulations on your analysis of Evolution Gaming and the excellent work you contribute to the community. I would like to share some reflections and doubts about this company. The success of Evolution depends largely on the continuity and work of Todd Haushalter, who is the key figure behind all of this. His enthusiasm for his work and his constant focus on what players really want are essential to the company’s success.

The true power of Evolution lies in its negotiating ability with operators, who must give a higher commission for their games. As long as these games remain the most popular and Todd Haushalter maintains the freedom and resources needed to innovate and create new titles, the company's moat will remain intact.

However, there is one part of your thesis with which I disagree: the margins, particularly regarding the expansion into the U.S. and the regulations being implemented in other countries, similar to those in the U.S. The need to build studios in each of these countries will likely reduce the company’s margins (though it’s hard to predict by how much). This presents a short- and medium-term risk that will directly affect Evolution’s profits.

Despite this risk, in the long term, if these regulations are established, Evolution will be the only company with the ability to compete globally in each geography. In summary, Evolution Gaming is an excellent company, with very promising prospects and attractive prices currently.