Evolution: Are Asia’s Problems Becoming Unfixable?

Evolution AB Q3 2025 Earnings Analysis

Executive Summary

Cybercrime headwinds intensified in Q3 and drove a sharp revenue hit in Asia, not because of new attacks but because Evolution’s own countermeasures unintentionally blocked legitimate users. Management admitted they “over-extended”. The dilemma is unchanged: clamp down too hard and real players are hurt, clamp down too softly and pirates win. The company is deploying resources and believes it found a better balance late in the quarter, but the situation remains volatile and there is still no clear path to a full fix.

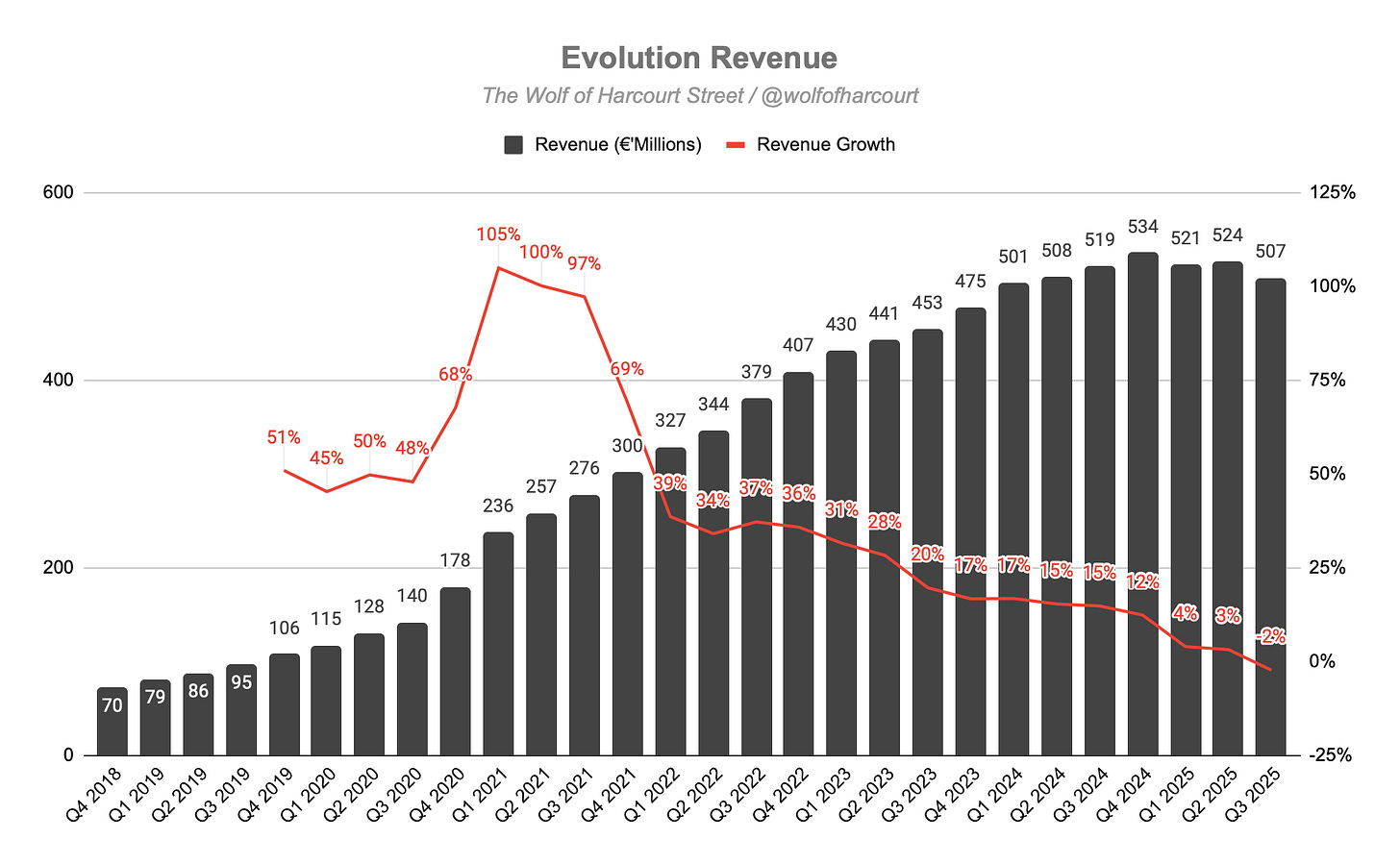

Evolution posted its first ever YoY decline in net revenue, down 2%. FX-adjusted growth was modest at 4%. The core Live segment shrank 3%. RNG grew 4% and, for the first time, outpaced Live. Asia fell 6% YoY and 10% sequentially amid cyber countermeasures and regulatory shifts in markets such as the Philippines and India. Europe declined 7% YoY but returned to sequential growth.

Operating margin fell to 58% from 63% as operating expenses rose 5% to €211 million, although the margin held sequentially. For the first time in recent memory, management stressed cost control rather than “grow to gain share”. Operating expenses fell 3% QoQ, suggesting a cost base reset. Personnel costs rose 6% YoY to €118 million on higher headcount but fell 5% sequentially. FTEs increased 11% YoY to 15,996 but were flat QoQ. Revenue per FTE fell to €32k, a five-year low. Operating leverage has been negative for three straight quarters, explaining the hiring pause.

Free cash flow margin improved to 67% from 63% and cash conversion reached 83%. Management stated that cash generation is back on track after a seasonally weak Q2 when free cash flow fell to 37% due to timing effects. The company returned €187 million via buybacks in the quarter, bringing year-to-date buybacks to €406 million, and still ended with €656 million in cash. Evolution has many problems at the moment, but cash is not one of them.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Net Revenue: €507 million (-2% YoY)

Live: €432 million (-3% YoY)

RNG: €76 million (+4% YoY)

Operating Profit: €297 million (–7% YoY)

EBITDA: €337 million (-5% YoY)

Free Cash Flow: €342 million (+5% YoY)

2. Wall Street Expectations

Net Revenue: €536 million (miss by 5%)

Adjusted EPS: €1.33 (miss by 6%)

3. Business Activity

Cybercrime Headwinds

Cybercrime issues intensified in Q3 2025 and led to a sharp revenue drop in Asia. The decline was driven by the unintended fallout from aggressive countermeasures taken earlier in the quarter. This marks a clear change in tone. Until now, management had been cautiously optimistic about resolving the issue.

Management described the core challenge as a balancing act. Measures that are too strong hurt legitimate users. Measures that are too soft fail to stop pirates. In Q3 the company admits it “over-extended” and “did too much”, which directly harmed revenue because real users were affected.

Management said they are using “top-notch” resources and will spend whatever is required. The constraint is not money. They believe they found a better balance late in the quarter, but the situation remains volatile and unpredictable in the near term. The most concerning takeaway is that management does not yet know how to fully fix the issue and is effectively throwing resources at a problem that may not be fully solvable.

Ring-fencing Update

Revenue in Europe returned to sequential growth, indicating that the ring-fencing and regulatory adjustment phase is mostly complete and now supports growth.

Management believes they are in a “very good position” in Europe and do not expect further ring-fencing actions. One major European regulator singled out the company as one of the best B2B suppliers.

Separately, the UK Gambling Commission review of Evolution Malta Holding Limited continues. A conclusion is expected before year-end 2025. Management maintains that they have the “most sophisticated compliance framework” for the UK market.

Capacity

North America. Strong customer investment led to several large dedicated studios going live across the USA and Canada. Ezugi launched as the second Live Casino brand in the US. A second Michigan studio will open in H1 2026.

Latin America. The São Paulo Live Casino studio, opened in July, is scaling ahead of plan and already being expanded.

Asia. The new Philippines studio is off to a strong start. It suffered minor building damage due to an October earthquake, but operations continued.

Game Rounds Index

Despite capacity build-out, overall activity declined. The Game Rounds Index fell by 1 percent YoY.

New Games

The company continues to deliver on its full-year pipeline of more than 110 releases. Twenty-two new titles were launched on the RNG side in Q3.

Several notable late-2025 titles are still to come:

Red Baron A hybrid Live and RNG title where players cash out before the “Red Baron flies away”, with winnings increasing the longer a player waits.

Insurance Baccarat A Baccarat variant with an insurance mechanic designed to reduce loss severity.

Playtech Unmasking

After nearly four years of legal process, Playtech has been identified as the client that funded the defamatory smear campaign launched in December 2021. Playtech paid Black Cube, an intelligence firm, to produce the false report that harmed Evolution and its shareholders.

With the source now confirmed, litigation will proceed and is expected to run through 2026. The immediate step is to replace “Joe Roe” with Playtech in the lawsuit, followed by depositions and potential information disclosures.

The CEO emphasised that the objective is to protect shareholder value and seek “fairness and justice”. While damage estimates were not disclosed, the CEO described the amount sought as “a severe amount”.

4. Financial Analysis

Revenue

For the first time in its history, Evolution reported a year-on-year decline in net revenue, down 2%. The collapse in revenue momentum has been astonishing, marking the twelfth consecutive quarter of deceleration. The CEO again said management is “not satisfied with the growth so far this year”. Adjusted for foreign exchange, revenue grew 4% YoY. FX is simply the price of admission for international expansion and I do not expect it to reverse.

The Live segment (85% of revenue), shrank 3% YoY. RNG (15% of revenue) grew 4%. For the first time, RNG outgrew Live. When RNG is no longer the problem child, you know performance has shifted in a historic way.

Regional Performance

Asia (36% of revenue): Declined 6% YoY and 10% QoQ. Management described performance as “still very far from satisfactory” and “a bit worse” than expected. The decline was driven by “over-extended” cyber countermeasures and regulatory volatility in markets like the Philippines and India.

Europe (35%): Declined 7% YoY, grew 1% QoQ, returning to sequential growth after the ring-fencing impact in Q2. Management saw “good momentum” despite summer seasonality.

North America (14%): Grew 15% YoY but slowed from 23% in the prior quarter. Still one of the report’s bright spots, supported by customer investment in dedicated studios.

Latin America (8%): Grew 6% YoY. This was underwhelming given Brazil’s new regulatory framework. Management said growth is “once again picking up” as the market adjusts.

Operating Margin

Operating margin fell to 58%, down from 63%, as operating expenses rose 5% to €211 million. Sequentially, margin was stable for the third quarter. For the first time I can recall, management emphasised cost control and discipline, a sharp pivot from its prior “grow to gain share” approach. Operating expenses declined 3% QoQ which management cited as evidence of cost base adjustment to weaker revenue.

Personnel expense rose 6% YoY to €118 million on headcount growth, but fell 5% QoQ. FTEs rose 11% YoY to 15,996 but were flat sequentially. Management repeated its principle “we do not hire unless we grow”. It is a chicken or egg question: do they grow because they hire, or hire because they grow..

Revenue per FTE fell to €32k, a five-year low. Operating leverage, once the hallmark, has been negative for three consecutive quarters. No surprise hiring paused. Cost per FTE held at €7k. The revenue-to-cost ratio held at 4.3 times QoQ, down from 4.7 times YoY.

EBITDA margin fell to 66% to 68%, leaving EBITDA flat. The 66% is within the full-year range of 66 to 68 percent. Management is clearly fighting costs to defend the bottom of that range.

Cash Flow Analysis

CapEx held at 6% of revenue, in line with recent quarters. Management now expects full-year CapEx to come in “slightly lower” than the €140 million forecast, another sign of tighter spending.

Free cash flow margin rose to 67% from 63%, with cash conversion at 83%. Management said Evolution is “back on track” after a “seasonally and unusually weak second quarter” when FCF margin dropped to 37%. Timing effects matter.

After €187 million in buybacks in the quarter (€406 million year-to-date), cash ended at €656 million. Evolution has many problems, but cash ain’t one.

5. Conclusion

I have been following Evolution for over two years and I can honestly say this is the worst quarter I have seen from the company in that time. Just when it looked like the business might have turned a corner last quarter, it now feels like one step forward, three steps back.

The key focus this quarter is Asia. The question is whether this is becoming an unfixable problem. Management adjusted its near-term outlook meaningfully and sounded far more cautious and frustrated than in prior quarters. The CEO acknowledged that Asia’s poor performance is a recurring theme and noted that this time it looks a bit worse. Last quarter they were “very cautiously optimistic” about the rest of the year. Now the CEO says they are being realistic and keeping expectations low. When asked for a recovery timeline, he said he cannot share any time frame and cannot comment on potential Q4 impacts given the volatility.

While management is cautious on timing, they do not suggest that the core cybercrime and technical issues are unfixable. This is where I have a problem. Evolution has been dealing with these cyberattacks for a year now since they first surfaced in Q3 2024. If they have not fixed them despite throwing all available resources at the issue, what evidence is there that they can fix them? At this point, it is a clear case of show me, not tell me.

Any company can experience issues like this, but when they persist for this long you have to question whether this is solvable or simply the new normal. Is this now the equivalent of pirated Sky Sports or Netflix streams that are widely accessible online? If so, there is very little Evolution can do to protect itself, especially in unregulated markets.

There are still some positives. The company is not at risk of bankruptcy, not even close. If management can stabilise the business, the valuation is undemanding. The cash pile is large and the combination of dividends and buybacks could deliver an 8-10% floor-type return, all else equal. Famous last words of course.

Over the past couple of quarters, I have maintained that Evolution would not return to double-digit growth until Q1 2026 at the earliest. That view was based on the impact of ringfencing measures and cyberattacks in Asia. Fundamentally, nothing has changed in Europe, so this part of the thesis is still on track. However, given the uncertainty in Asia, mid-single-digit growth in Q1 2026 now looks more realistic.

Asia is believed to be Evolution’s most profitable market, while North America is the main growth driver but at much lower margins. If Asia continues to face issues, earnings growth is likely to lag even the already reduced revenue outlook.

With no clear near-term catalyst, the stock is likely dead money for the next six months. The Evolution investment thesis today is meaningfully different to what it was twelve months ago.

A stock that was long considered a growth darling is now firmly in turnaround or value territory.

Rating: 1 out of 5. Significantly below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great summary!

I'm also really on the fence here with Evolution. On the one hand it seems like a lot of the bad sentiment and news is priced in. On the other hand, management seems to have simply lost control. They guided for a better H2, and this is not it. They struggle on many fronts, and it seems like there is no clear solution for a lot of their problems.

If there's one thing I do not like, is constant negativity and new reasons for bad performance. And then also the lack of guidance and clear solutions.

I think you might be right in the dead money for the next upcoming quarters, and maybe even longer. Tough!

I understand is not the growth investment now that it once looked like. But do you think is a good dividend one with 46.1% div growth (CAGR in 5 years) and 4.8% yield and less than 50% pay-out? I suppose the dividend growth will be reduced if things continue this way, but if not, in 5 years that would be 60% of the initial investment in dividends.