Evolution: "not happy with our current growth"

Evolution AB Q1 2025 Earnings Analysis

Executive Summary

Evolution’s net revenue growth slowed to 4%, reflecting ongoing FX headwinds and the impact of ringfencing, which has accelerated the shift toward regulated markets. These now account for 45% of total revenue, up from 39% a year ago. While regulated revenue rose 19% YoY, unregulated revenue declined 6%, contributing to a deceleration in overall growth for the tenth consecutive quarter.

The operating margin declined to 58% due to rising costs, particularly a 12% YoY increase in personnel expenses stemming from headcount growth following labor disruptions in Georgia. Although cost per employee remained flat, productivity fell, as revenue per FTE declined, highlighting a less efficient resource mix caused by the partial relocation of operations out of Georgia. This shift, along with continued ringfencing and cyberattack-related costs, compressed margins in H1 2025, though management reaffirmed full-year EBITDA margin guidance, anticipating a stronger second half.

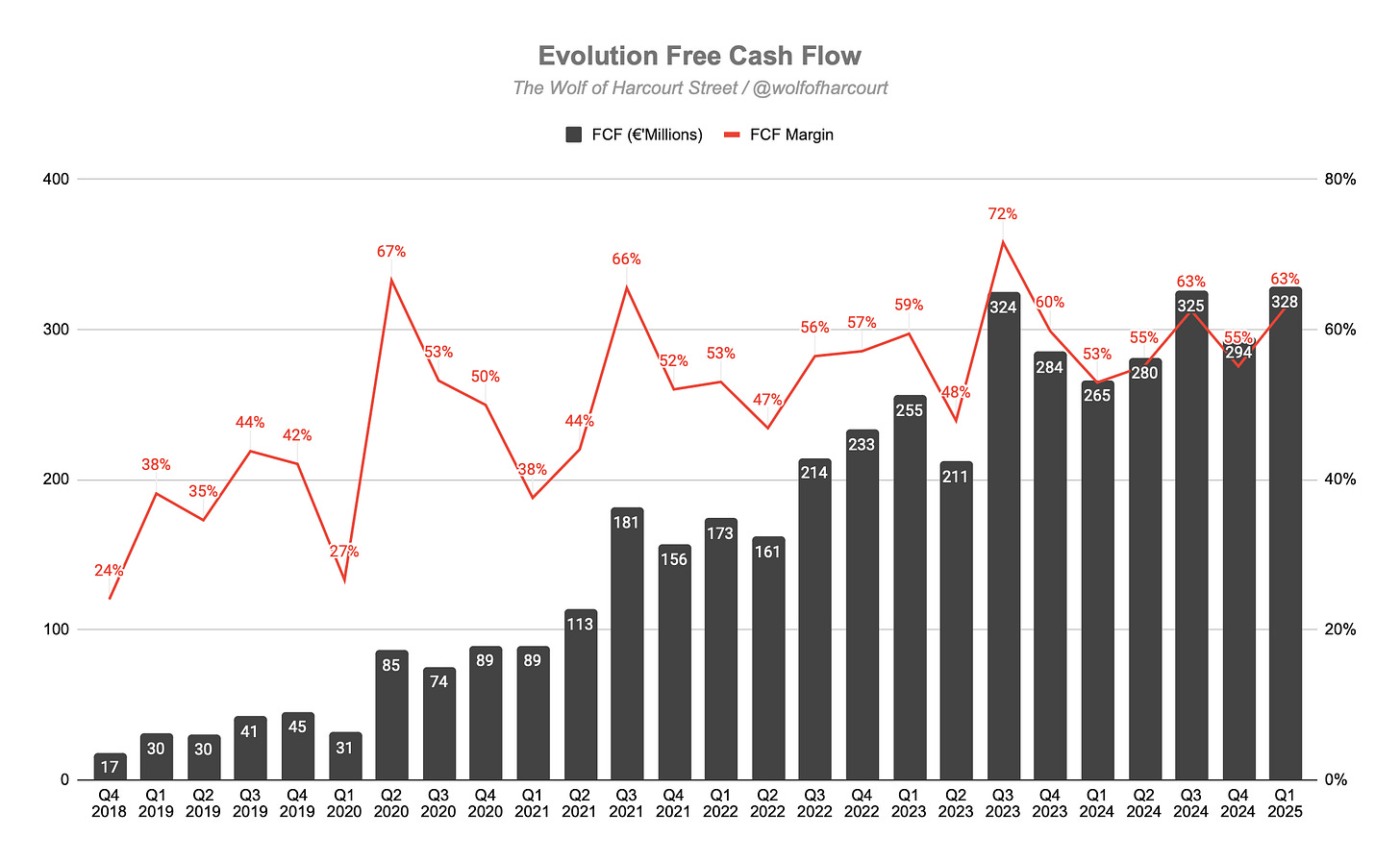

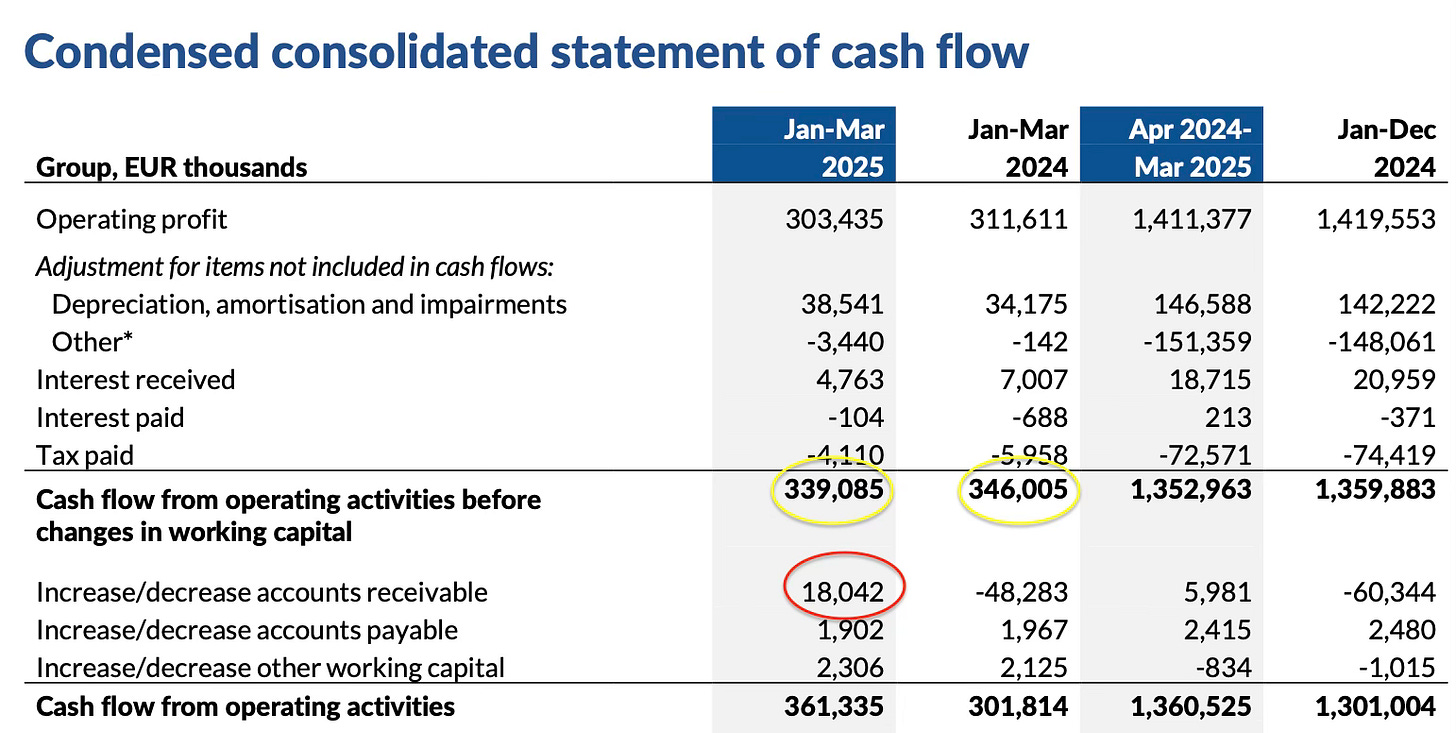

Free cash flow margin expanded to 63%, up from 53% YoY, despite ongoing investment and margin pressure. This increase was entirely driven by favorable working capital movements, specifically an €18 million reduction in accounts receivable. Excluding these effects, operating cash flow actually declined 2% YoY. CapEx remains elevated at 6% of revenue, split evenly between game development and platform upgrades, with full-year guidance unchanged at €140 million. Despite repurchasing €154 million in shares, Evolution ended the quarter with a robust €958 million cash balance, earmarked for dividends and further buybacks.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Net Revenue: €521 million (+4% YoY)

Live: €449 million (+4% YoY)

RNG: €72 million (+3% YoY)

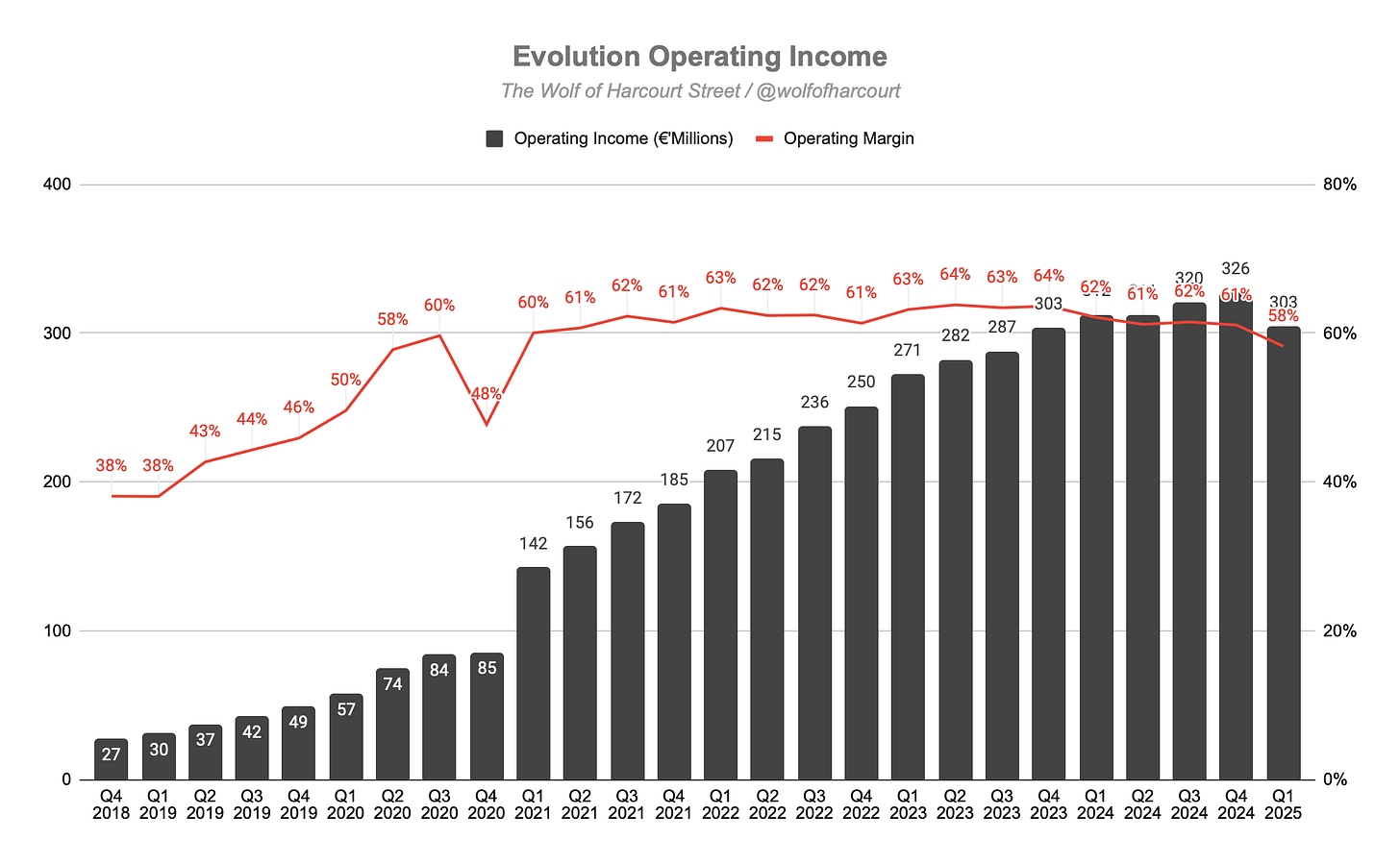

Operating Profit: €303 million (–3% YoY)

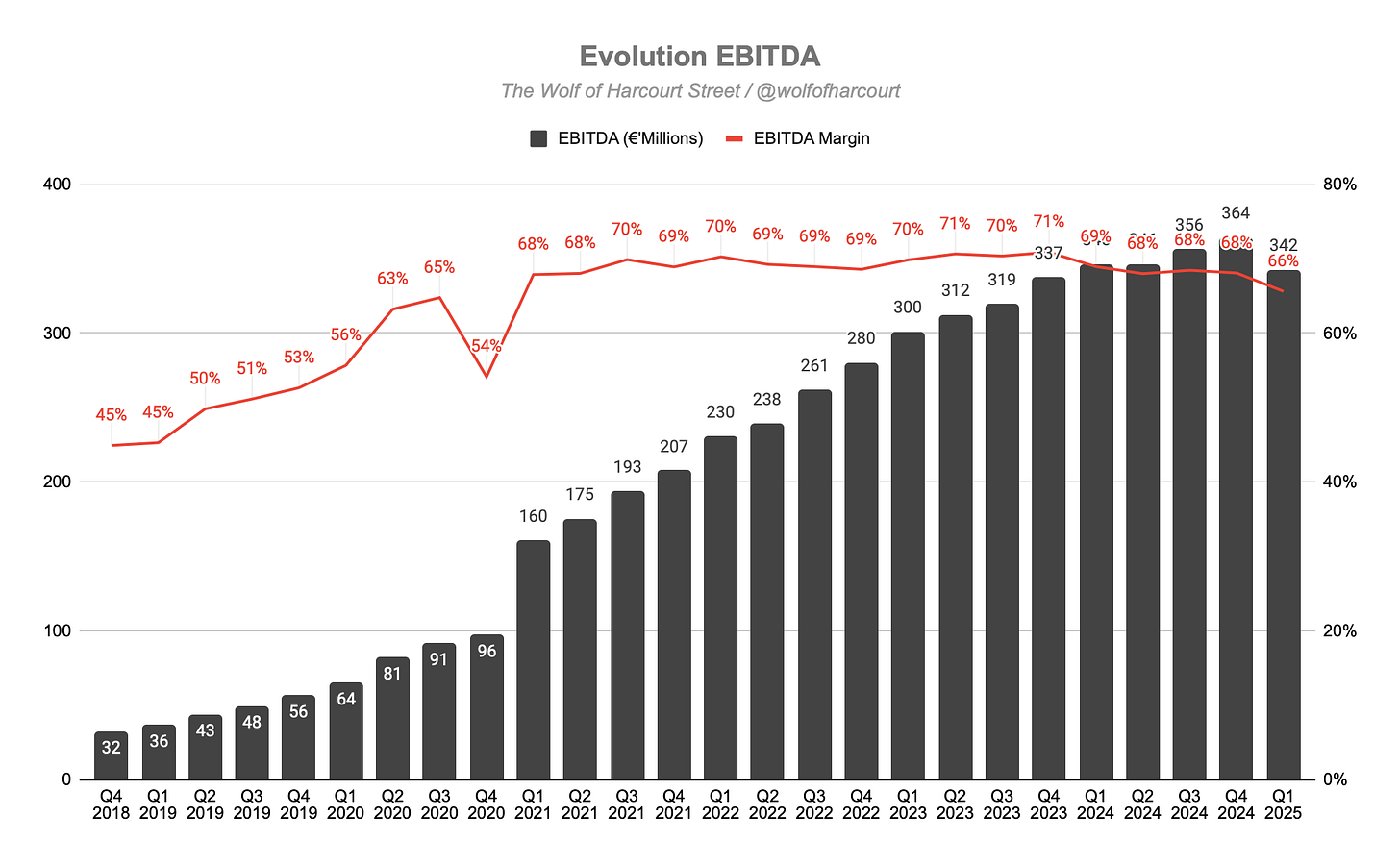

EBITDA: €342 million (–1% YoY)

Free Cash Flow: €294 million (+23% YoY)

2. Wall Street Expectations

Net Revenue: €543 million (miss by 4%)

Adjusted EPS: €1.38 (miss by 10%)

3. Business Activity

Proactive Ringfencing Measures

Evolution has implemented new technical controls to ensure that its games are only accessible via locally licensed operators in regulated markets, beginning with the UK and expanding across Europe.

While there was limited impact in high-channelization markets, revenue declined in low-channelization markets where regulation tends to discourage legal play (e.g., due to high taxes or complex rules).

Evolution continues to support regulation, asserting that it is beneficial over the long term. However, the company emphasises that channelisation effectiveness is determined more by the regulatory framework than by the supplier's efforts.

Capacity

A new studio in Romania opened during the quarter, with additional studios planned in Brazil, the Philippines, and a second location in Michigan. Expansion is also ongoing in Malta, Colombia, Argentina, New Jersey, and Philadelphia.

An intentional decision was made not to expand capacity in Georgia to reduce over-reliance on the Georgian studio. A review by one of the Big Four accounting firms confirmed that:

Salary levels are competitive

Past workplace issues were addressed promptly

Code of conduct violations were appropriately handled

Media reports overstated strike participation

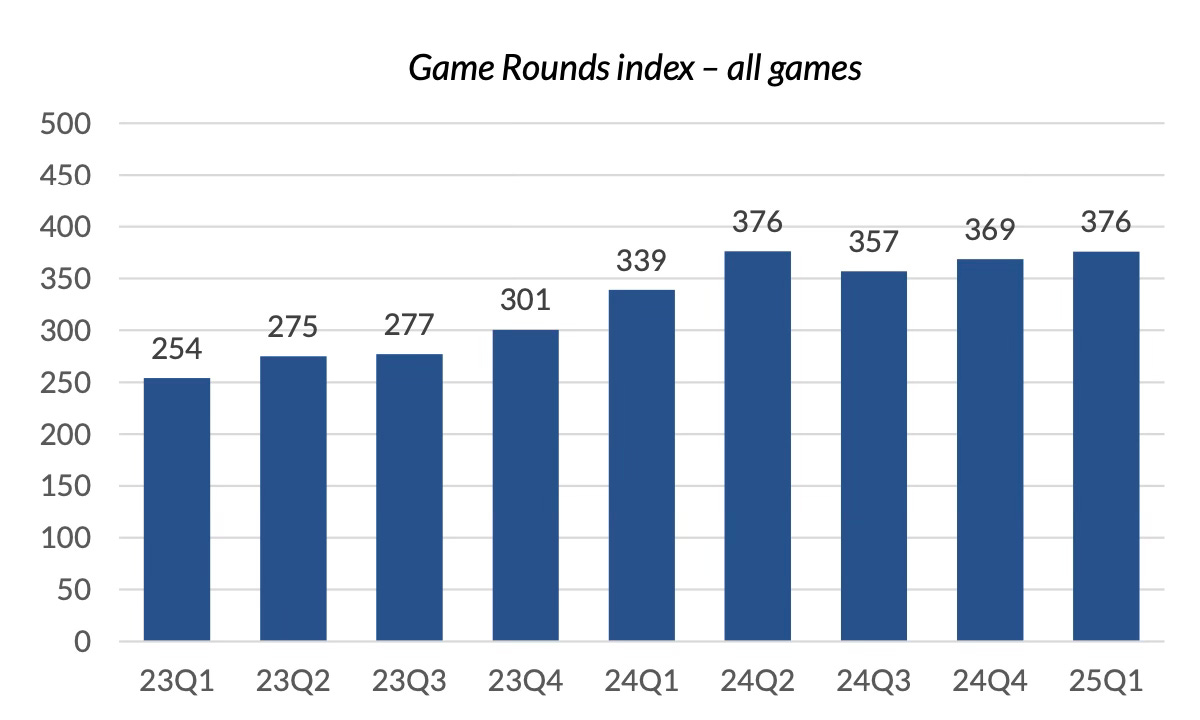

Game Rounds Index

The Game Rounds Index, which tracks total activity across Evolution’s network, increased by 10.9% in the quarter driven primarily by continued growth in game shows, which remain highly popular.

New Games

Evolution is entering what it calls its "product-led years," marked by a heightened focus on innovation and new releases. More than 110 games are planned for launch in 2025 across the full portfolio.

Early 2025 saw the debut of several standout titles:

War – A modern take on Casino War

Race Track – An RNG game with a live host

Bet Stacker Blackjack – A creative twist on the classic

Marble Race – Launched in April, a fast-paced, engaging title with strong early reception

4. Financial Analysis

Revenue

Evolution’s net revenue grew by 4%, reflecting a material slowdown due to the practice of ringfencing. Foreign exchange headwinds persist, with underlying revenue growth at 6% versus the reported 4%. This marks the tenth consecutive quarter of revenue growth deceleration.

As a result of ringfencing actions, revenue from regulated markets now accounts for 45% of total revenue, up from 41% in Q4 2024 and 39% in Q1 2024. Regulated revenue increased 19% YoY, while unregulated revenue declined 6% YoY.

The Live segment (86% of total revenue) grew 4% YoY, while RNG (14% of total revenue) grew 3% YoY.

Regional Performance

Asia (39% of revenue) grew 2% YoY but was flat sequentially, impacted by ongoing cyber-attacks that continue to affect video distribution. Mitigation measures are progressing but continue to weigh on network performance and revenue, consistent with recent quarters.

Europe (36%) was flat YoY and down 6% QoQ due to ringfencing activities during the quarter. Management emphasized that underlying demand remains strong in the region.

North America (14%) grew 15% YoY, marking the third consecutive quarter of mid-teens growth, driven by expanded table capacity and new game launches in Live.

Latin America (7%) grew 10% YoY. The outlook remains positive, bolstered by Brazil’s 2025 regulation, despite initial teething problems affecting Q1 performance.

Operating Margin

Evolution’s operating margin declined to 58%, down from 62% a year earlier, as total operating expenses rose 15% YoY to €218 million.

Personnel expenses, the largest cost category, increased 12% YoY to €120 million due to headcount growth. Average full-time equivalents (FTEs) rose 10% YoY to 16,368, surpassing the Q2 2024 record, following labor disruptions in Georgia.

The cost per average FTE remained flat at €7k, but the revenue per FTE declined to €32k, from €34k in Q1 2024 and €36k in Q4 2024. Due to ringfencing, Evolution served a similar number of players with more employees, resulting in lower productivity. The revenue-to-cost ratio fell from 4.9x in Q4 2024 to 4.3x in Q1 2025..

“It's also worth while reminding that compared to last year, we are now running our studios with a less favorable, more costly resource mix as a consequence of the measures we took last year in connection with the strike in Georgia. This partial move of operations out of Georgia is having a negative impact when comparing the cost base and profitability year-on-year.”

- Joakim Andersson, CFO

The EBITDA margin declined to 66%, down from 69% in Q1 2024, resulting in a 1% YoY drop in EBITDA. In Q4, management guided for a 66%–68% EBITDA margin for FY 2025. On the Q1 call, they reiterated that margins would be softer in H1 due to ringfencing and cyberattack-related costs but maintained full-year guidance, expecting stronger H2 performance.

Cash Flow Analysis

Evolution remains in a heavy investment phase, which pushed the CapEx ratio to 6%. CapEx was evenly split between new game development and platform/studio upgrades (including tables, servers, and equipment). Full-year CapEx guidance of €140 million remains unchanged.

Despite margin compression, free cash flow (FCF) remained strong, with a 63% margin, up from 53% YoY, a counterintuitive result.

On closer inspection, this free cash flow (FCF) boost was driven entirely by working capital movements. Accounts receivable declined by €18 million due to improved collections. Excluding working capital changes, operating cash flow actually declined 2% year-over-year.

Typically, one would expect accounts receivable to increase in line with revenue. In this case, however, revenue increased while receivables decreased, due to the timing of FY 2024 collections.

As such, this elevated FCF margin should not be extrapolated into future periods.

Even after €154 million in share repurchases, Evolution ended the quarter with a cash balance of €958 million, allocated as follows:

€573 million for dividend payments

€385 million for the buyback program (targeting €500 million in 2025 repurchases)

5. Conclusion

On the face of it, this was an ugly quarter for Evolution, so let’s start with the negatives:

Revenue growth decelerated for the tenth straight quarter, with higher-margin unregulated revenue being forfeited.

Profit margins compressed due to cyber-attacks in Asia and a costlier resource mix post-Georgia strike.

Employee utilisation hit a four-year low, with more staff serving roughly the same number of players.

What about the positives?

Management’s candor was refreshing as they acknowledge the issues and are committed to fixing them.

“I'm, of course, not happy with our current growth, but the measures behind it are important for our overall work to increase the gap to competition. We face challenges that we meet. Any issues we see, we fix.”

Martin Carlesund, CEO

Regulated revenue growth of 19% indicates the long-term opportunity is intact as markets mature and regulations solidify.

The cash balance has swelled to nearly €1 billion, or 8% of Evolution’s market cap.

I’ve been an Evolution investor for almost two years. I’ll admit: my thesis hasn’t played out yet. If you told me in 2023 that revenue growth would fall to 6% by 2025, I wouldn’t have even considered it a bear-case scenario. For context, revenue grew 31% in Q1 2023.

Of course, few could’ve predicted a labor strike in Georgia, persistent cyber-attacks in Asia, material FX headwinds, and the deliberate pivot to regulated markets. As they say: "Risk is what’s left over after you think you’ve thought of everything."

That’s all in the past. What matters now is the forward return.

I don’t believe the thesis is broken, but I now have one key question: With unregulated revenue down 6% this quarter, how much of that segment could Evolution ultimately lose?

This is critical, as 55% of current revenue still comes from unregulated markets. Even if regulated revenue grows at a mid- to high-teens pace, continued erosion in unregulated markets would weigh on total growth and shareholder returns.

This reminds me of how Meta cannibalized its own ad revenue in 2022 by promoting Reels, which reduced time spent on Feed and Stories. For a time, revenue declined but by focusing on long-term strategy, Meta returned to 20%+ growth as Reels monetisation improved.

Evolution’s decision to ringfence unregulated markets is a similarly strategic move. Growth hasn’t slowed due to competition, it’s slowed because they chose to exit those markets.

The question now is: Can Evolution weather this storm and return to double-digit growth, or is low-single-digit growth the new normal?

Rating: 2 out of 5. Below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

“Even if regulated revenue grows at a mid- to high-teens pace, continued erosion in unregulated markets would weigh on total growth and shareholder returns.”

I find this comment very interesting and could go both ways. While I agree slower growth in total could harm shareholder returns. I question if Evolution would trade back to a 20+ P/E multiple IF their regulated revenues become a majority of their revenue / profits. I tend to believe the high risk unregulated market revenue is what scares investors and is suppressing their multiple. If investors see consistency and decrease of risk from unregulated markets Evolution may become an investable asset for more institutions.

Echo the above. It is important to distinguish the certainty aspect of regulated markets commanding a higher multiple but the lower growth and margins as detrimental to multiples. I think the latter will have a stronger impact - increasing share of revenues from mature markets with increasing gambling protections limiting market growth rates