Evolution: Revenue Growth Slows, but Shareholder Returns Set to Soar

Evolution AB Q2 2024 Earnings Analysis

Executive Summary

Evolution's revenue growth, while still in double digits, is trending downwards. In Q2, underlying revenue growth was 19%, but only 15% in reported currency, impacted by foreign exchange headwinds. A record payout of €35 million to Crazy Time players also affected short-term revenue sharing.

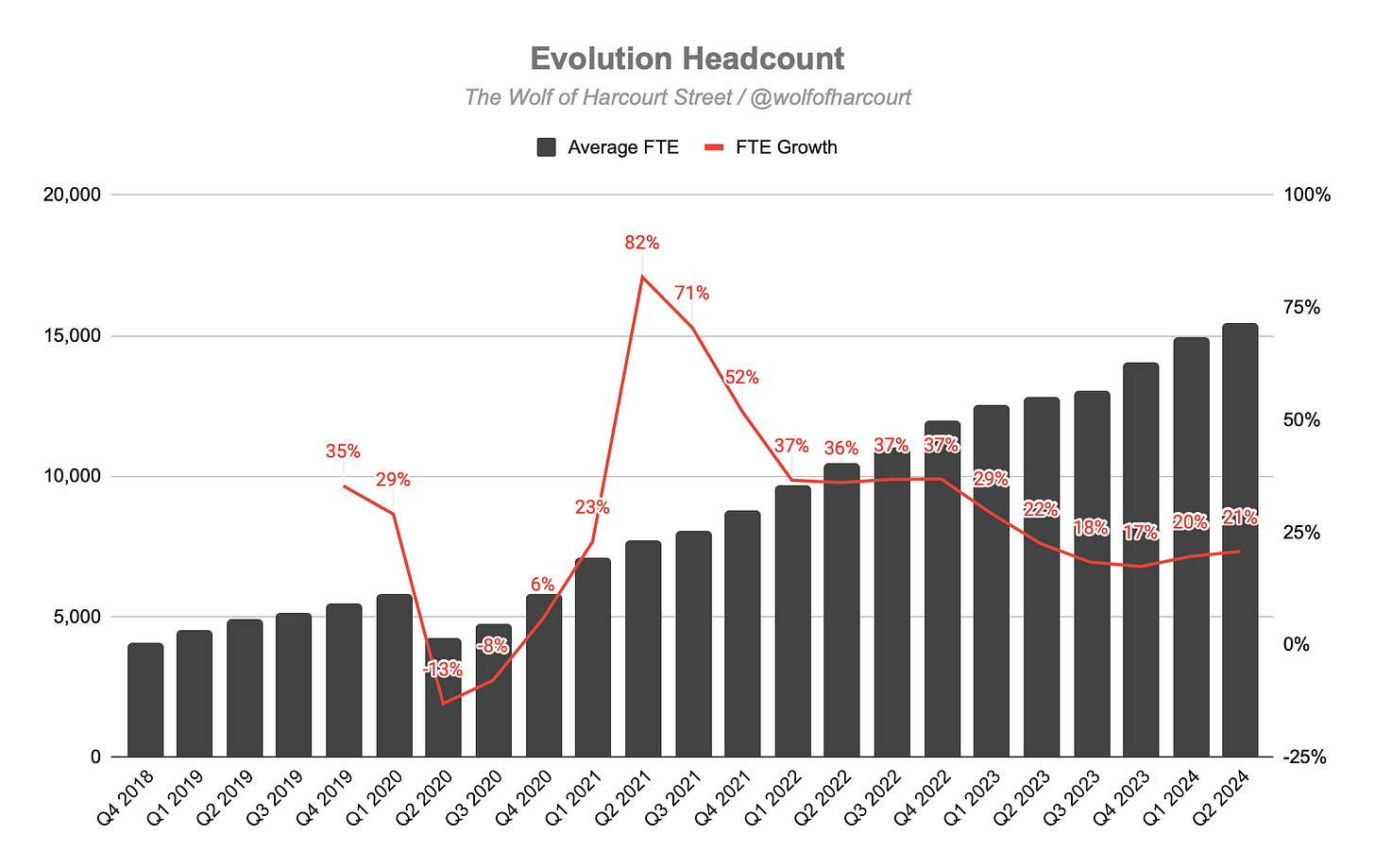

The operating margin dipped to 61% due to a 24% year-over-year increase in total operating expenses, reaching €193 million. Personnel expenses rose by 27% year-over-year to €111 million, driven by a significant increase in hiring as average full-time equivalents (FTE) grew by 21% year-over-year to 15,395. The cost per average FTE remained stable at approximately €7k per quarter, while revenue per average FTE decreased from €35k in 2023 to €33k in Q2 2024 due to the integration period for new hires.

Evolution's Board of Directors announced a new framework focusing on investment and cash distribution priorities. 100% of excess net cash flow (after investments and M&A) will be distributed. 50% of annual net profits will continue to be paid as dividends. Remaining funds will be used for share repurchases unless an extraordinary dividend is more beneficial. A new €400 million share repurchase program was also approved. The framework positions Evolution to be a share cannibal due to high cash flow generation and low CapEx intensity.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

Discover Winning Investments with Yellowbrick

Yellowbrick is your ultimate tool for finding the next big stock investment. Here's why savvy investors choose Yellowbrick:

Extensive Tracking: Yellowbrick tracks thousands of investors who share stock pitches via Twitter, fund letters, analyst reports, blog posts, podcasts, and more.

Comprehensive Summaries: Yellowbrick’s AI, coding, and manual efforts summarize these stock pitches and add essential info, including company details, price targets, sentiment, and ticker.

Performance Tracking: Yellowbrick monitors the returns of all stock pitches to identify the most profitable investors, ensuring you get the best ideas.

Sign up for the free newsletter to start getting stock pitches sent straight to your inbox each morning.

1. Key Highlights

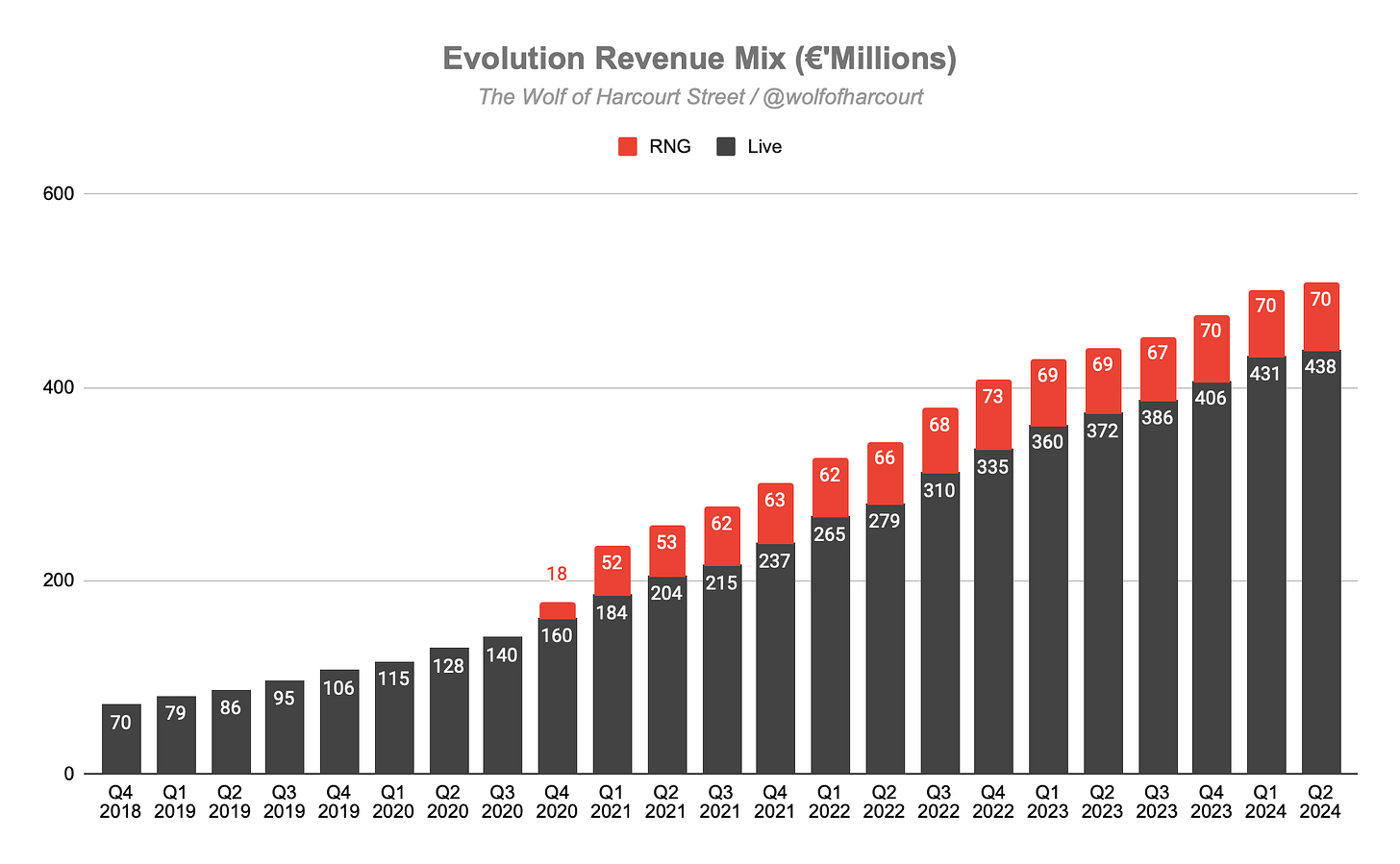

Revenue: €508 million +15% year-over-year (YoY)

Live: €438 million +18% YoY

RNG: €70 million +1% YoY

Operating Profit: €311 million +11% YoY

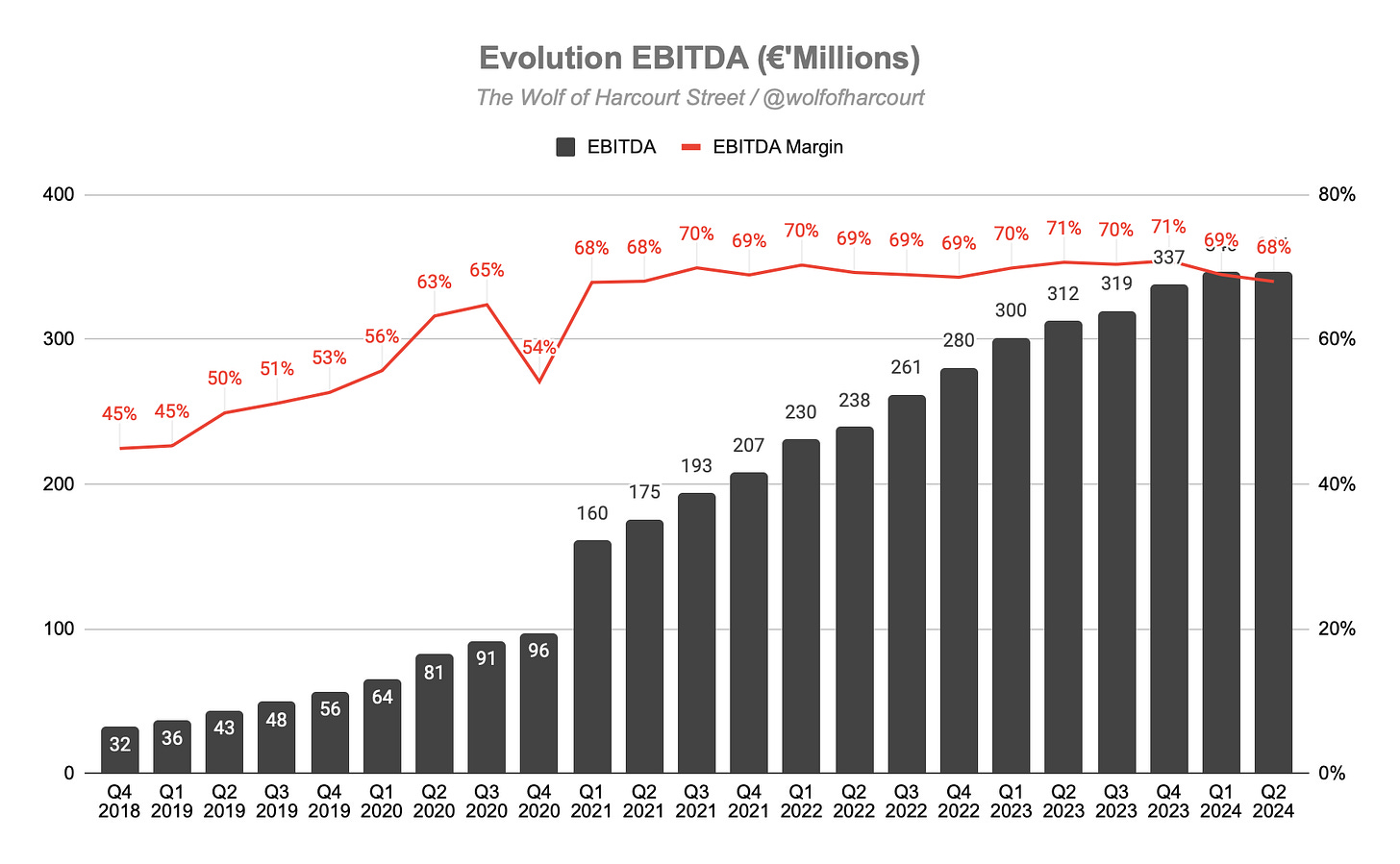

EBITDA: €346 million +11% YoY

Free Cash Flow: €280 million +33% YoY

2. Wall Street Expectations

Revenue: €521 million (miss by 2%)

Earnings per Share: 1.32 (miss by 3%)

3. Business Activity

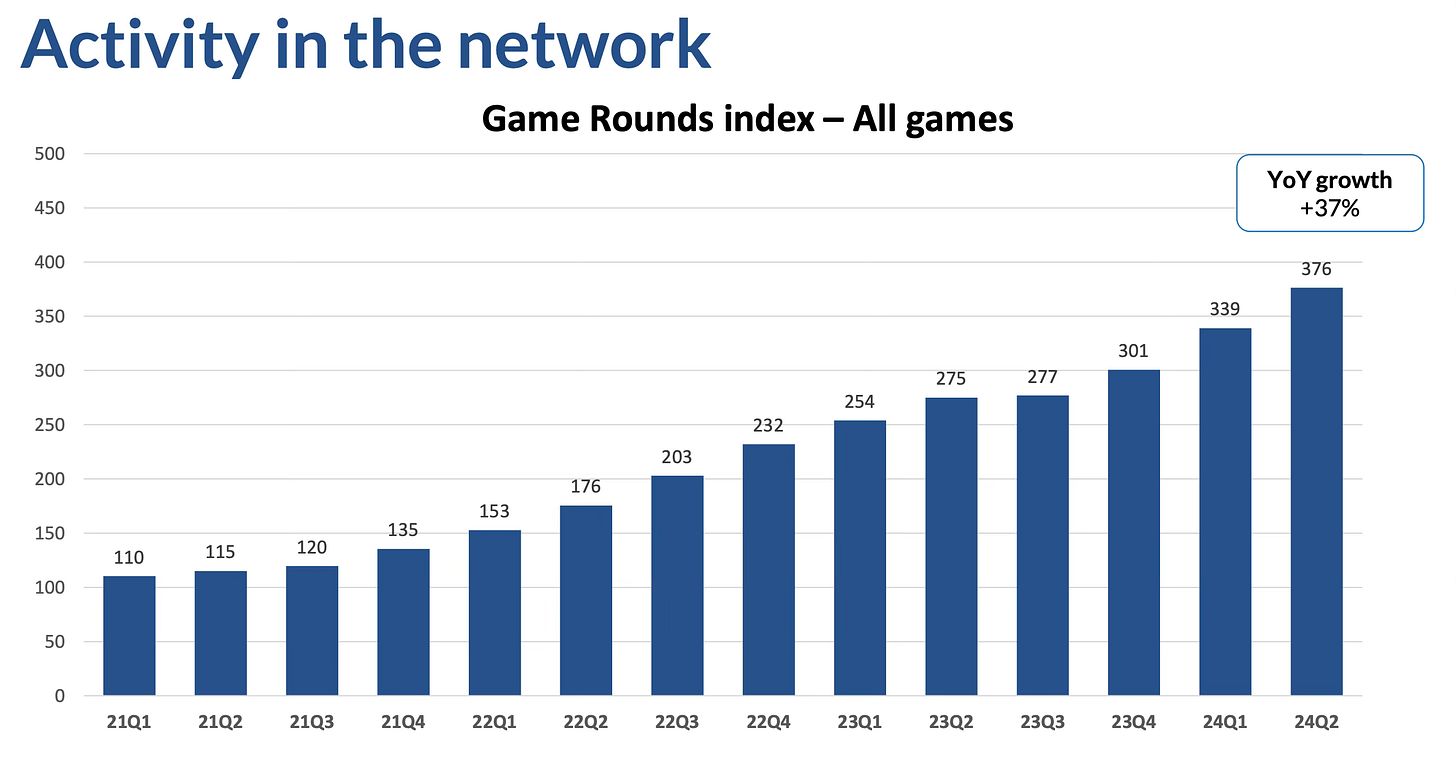

Game Rounds Index

This index reflects the overall activity and development within the Evolution network, covering all games. There was a rise in activity during the quarter, continuing the positive trend from the first quarter. This increase was supported by efforts to expand table capacity and ensure high-quality delivery from studios.

Expansion into New Markets

Evolution is increasing its presence in newly regulated or soon-to-be-regulated markets such as the Czech Republic, Brazil, and the Philippines, which is viewed as a positive long-term growth driver.

Evolution expanded its U.S. offerings by launching live casino games in Delaware and adding successful games in several other states.

Acquisition of Galaxy Gaming

Evolution has entered into an agreement to acquire Galaxy Gaming for an enterprise value of €124 million, with the transaction expected to close in 12 to 15 months, subject to closing conditions.

Galaxy Gaming is a premier provider of table games and side bets for both online and land-based casinos. Notable games include 21+3, Lucky Ladies, and Perfect Pairs. Galaxy holds over 130 licenses worldwide, including licenses in 28 out of 29 possible U.S. states and several private licenses.

The acquisition will enhance Evolution's presence in the U.S. market and expedite future licensing by leveraging Galaxy's established relationships with regulators and its extensive licensing portfolio. Galaxy will continue to operate independently, contributing to the group’s growth and solidifying its game portfolio.

Capital Allocation Framework

Evolution's Board of Directors announced a new capital allocation framework that clarifies investment and cash distribution priorities. 100% of excess net cash flow, after investments and M&A, will be distributed. 50% of annual net profits will continue to be paid as dividends. The remaining funds will be used for share repurchases unless an extraordinary dividend is deemed more beneficial. The Board believes share buybacks enhance shareholder value and has approved a new €400 million share repurchase program.

Future Game Releases

Evolution is focusing on releasing more games earlier in the year, with significant launches like the "Lightning Storm" game show and the wide release of "2 players."

4. Financial Analysis

Revenue

Evolution's revenue growth continues to trend downwards despite still growing double digits. Foreign exchange has been a material headwind for revenue growth over the past few quarters. In Q2, underlying revenue growth was 19%, compared to 15% in reported currency. Another reason for the slower revenue growth was the record payout of €35 million to more than 5,000 Crazy Time players in a single game. Although this had a short-term impact on revenue share, it ultimately increases player engagement. Larger wins can attract many players who often place smaller bets, which doesn't immediately boost revenue.

Evolution’s business is a tale of two stories. Live, which accounts for 86% of total revenue, grew 18% YoY. This growth was driven primarily by increased commission income from existing customers. On the other hand, RNG, which accounts for the remaining 14%, grew only 1% YoY and remained flat quarter-over-quarter (QoQ).

After surpassing Europe in Q1 2024, Asia is now the largest geographical source of revenue for Evolution, accounting for 39% of the total and growing at 22% during the quarter. Management views Asia as a region of high potential due to its large population and favorable online market statistics. Europe, which now accounts for 38%, grew 9%. North America, which grew 8%, accounts for 12%, but management noted that they are losing market share in RNG in the region compared to last year. Latin America, which accounts for 7%, also posted solid double-digit growth of 17% despite pending regulatory changes in Brazil.

Operating Margin

Evolution’s operating margin dipped to 61% as total operating expenses increased by 24% YoY to €193 million.

Personnel expenses, the primary component of operating expenses, increased 27% YoY to €111 million. The key driver of this increase was the ramp-up in hiring, with average full-time equivalents (FTE) growing by 21% YoY to 15,395. Evolution has accelerated headcount growth in the first half of 2024 and plans to continue staff increases throughout the year, particularly with new studio openings in Latin America and other expansions.

While the cost per average FTE has remained consistent at around €7k per quarter, the revenue per average FTE has decreased from €35k in 2023 to €33k in Q2 2024. During a period of accelerated hiring, it is expected that the revenue per average FTE would fall as new hires require training to gradually get up to speed. Evolution's revenue per average FTE is currently 4.6 times greater than its cost per average FTE.

As a result of the faster expansion during the first six months of the year, the EBITDA margin came in lower at 68%. Management has maintained the full-year 2024 guidance of a 69%-71% EBITDA margin.

Cash Flow Analysis

Evolution is in a heavy expansion phase, leading to an increase in capital expenditures (CapEx), resulting in a CapEx ratio of over 6%. CapEx spend is split evenly between tangible assets, such as expansion in existing studios and new projects, and intangible assets for developing new games and features. Estimated CapEx for the year is €120 million, and Evolution is currently ahead of that pace. This is not a surprise because in 2023 Evolution did not expand as fast as it would like, but it has rectified that in 2024.

Overall cash flow is very strong, resulting in a Free Cash Flow (FCF) margin of 55%, with a cash balance of €689 million on the balance sheet at the end of Q2. The cash conversion ratio is over 80% for the rolling 12-month period.

5. Conclusion

Revenue growth was on the light end, and even when looking at the growth on an underlying currency basis, I expected it to be greater than 20%, but it has dropped below this threshold, which was the biggest disappointment. FX and the record payout are cited as the main reasons for this, along with another reason mentioned on the conference call.

sports book margins in some regions have favored operators in this quarter, which tend to be negative for casino

My take is that one-off sporting events such as Euro 2024 were more popular for gambling activity than online casinos, which is an interesting development. The RNG business continues to be a concern, and while growth has essentially plateaued, the revelation that it is now losing market share in North America has compounded matters.

Regarding profitability and margins, these were also on the lower end but are not as much of a concern. It is clear that Evolution is investing heavily in growth initiatives, including studio expansion, hiring more staff, and developing new games. This is reminiscent of the hiring spree that Adyen went on in 2023, which was initially punished by the market before reverting spectacularly.

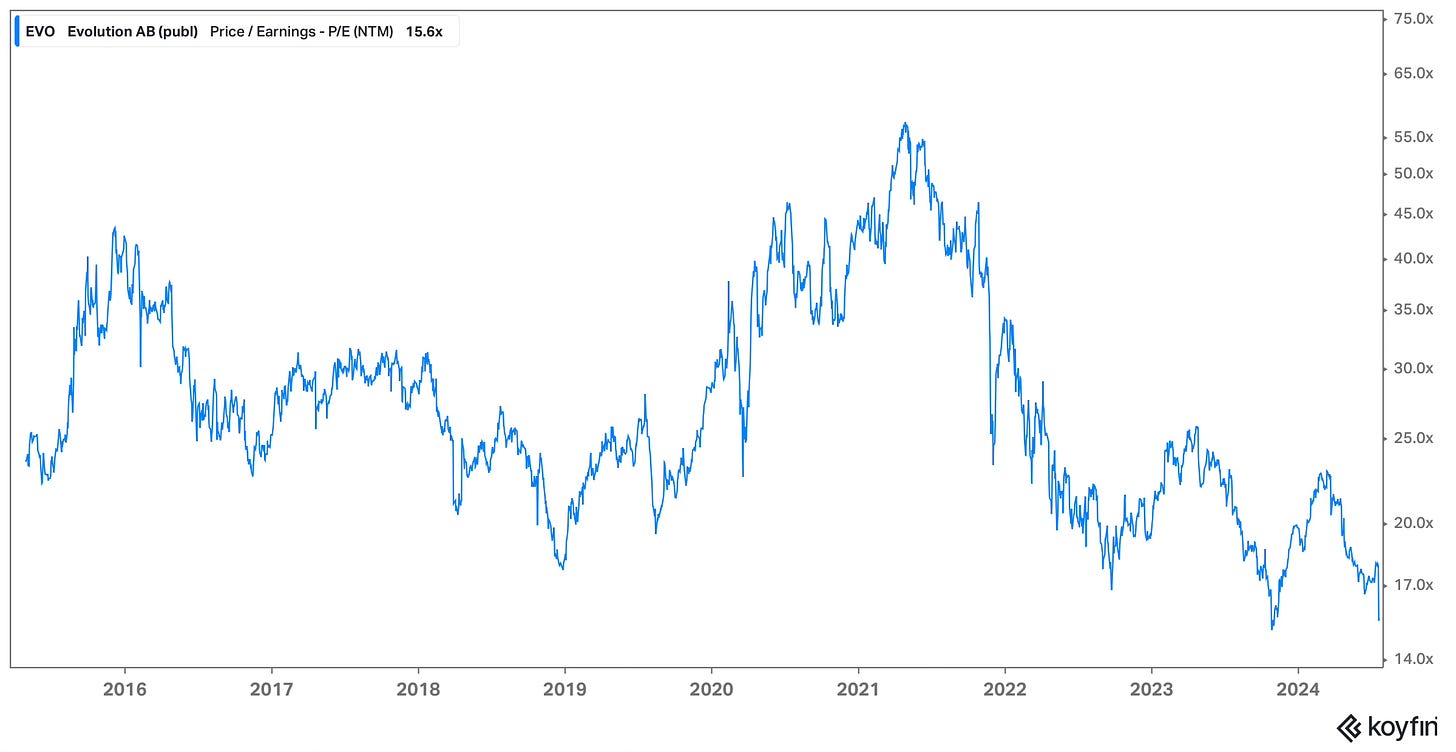

Finally, the highlight for me was not any of the numbers but rather the new capital allocation framework. This provides certainty to shareholders and, in my mind, positions Evolution to be one of the best share cannibals over the next decade, given the high cash flow generation and relatively low CapEx intensity. When the stock sold off by 8% after reporting earnings, it resulted in a valuation of just 15 times forward earnings. This historically low valuation provides the ideal opportunity to commence buying back shares. The €400 million program would enable Evolution to retire over 2% of all shares outstanding based on the current market cap.

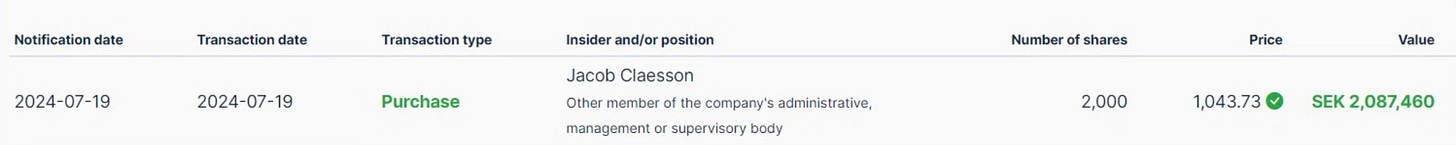

While the quarter was overall weaker than expected, I do not believe this impacts the long-term thesis. The market reaction could present a buying opportunity given the low valuation. On Friday, Evolution's North America CEO, Jacob Claesson, took advantage of this opportunity and bought 2,000 shares.

Rating: 2 out of 5. Below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you!

You did an amazing job! Great post