Executive Summary

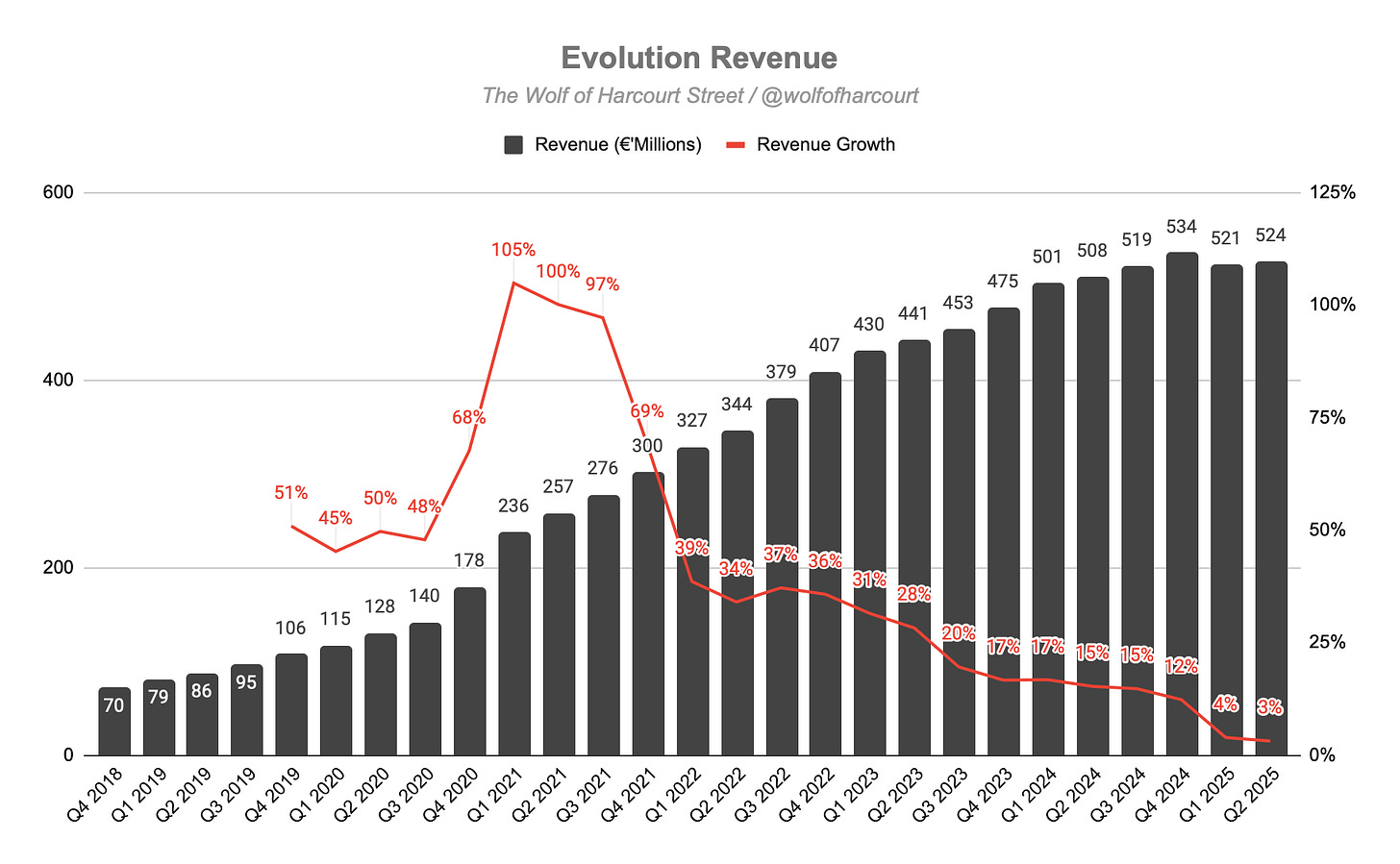

Net revenue grew 3% YoY, with underlying growth of 9% excluding FX headwinds. This marks the 11th consecutive quarter of revenue growth deceleration, driven by increased ring-fencing that is accelerating the shift toward regulated markets. Segment-wise, Live grew modestly (4% YoY), while RNG remained weak. Regionally, Asia rebounded with 4% QoQ growth despite cyberattacks, North America posted its strongest growth since Q1 2023, and Europe underperformed with steeper-than-expected declines.

Operating margin declined to 58%, down from 61% YoY, due to a 10% increase in operating expenses, largely driven by an 11% rise in personnel costs amid headcount growth. However, the sequential margin deterioration was arrested after two quarters of decline. Revenue and cost per FTE remained stable, keeping the revenue-to-cost ratio steady at 4.2x. While EBITDA margin softened slightly to 66%, management maintained its full-year guidance of 66%–68%, expecting margin improvement in H2 as cost pressures ease.

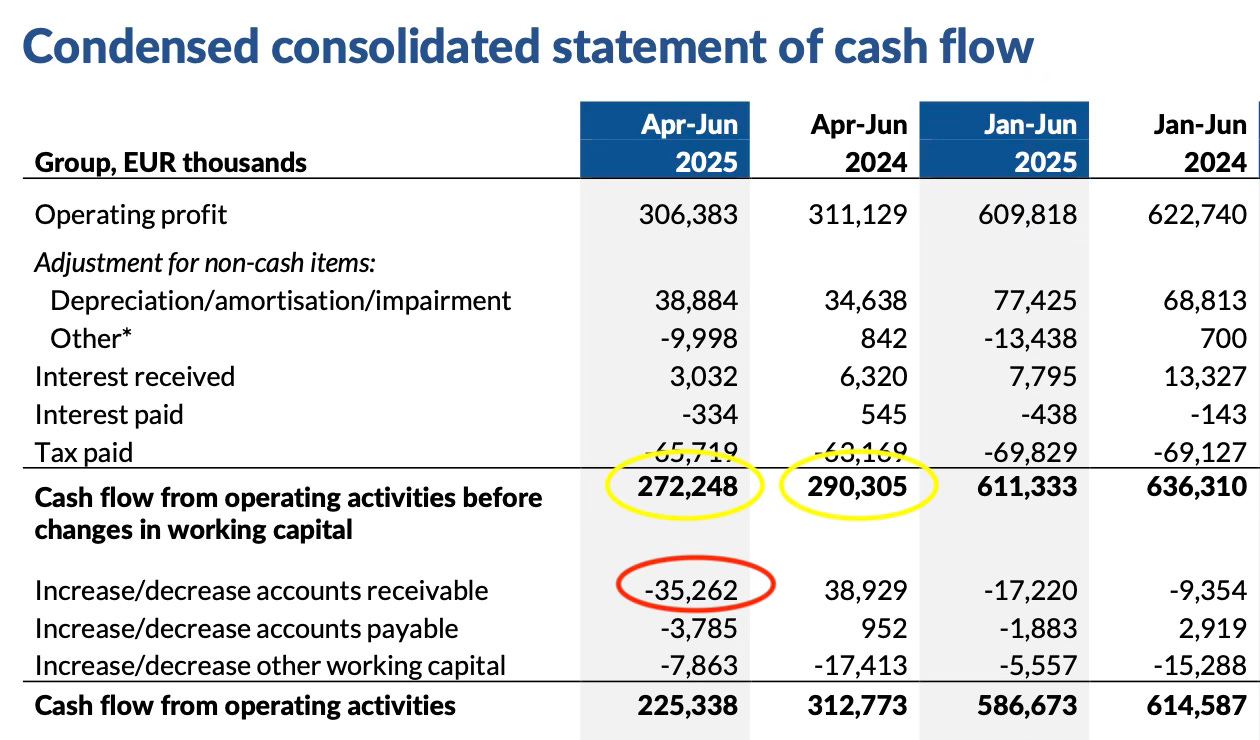

Free Cash Flow margin dropped to 37%, down from 55% YoY, primarily due to higher tax payments and a €35 million increase in receivables, which reversed the timing-related benefit seen in Q1. CapEx remained stable at 6% of revenue, with full-year guidance unchanged at €140 million. Following significant shareholder returns, €572 million in dividends and €65 million in buybacks, Evolution still holds €505 million in cash, suggesting potential idle capital, especially given that its €500 million buyback program is already 44% complete.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Net Revenue: €524 million (+3% YoY)

Live: €454 million (+4% YoY)

RNG: €71 million (flat YoY)

Operating Profit: €306 million (–2% YoY)

EBITDA: €345 million (flat YoY)

Free Cash Flow: €192 million (-31% YoY)

2. Wall Street Expectations

Net Revenue: €517 million (beat by 1%)

Adjusted EPS: €1.26 (miss by 3%)

3. Business Activity

Asia Cybercrime Challenges

Evolution continues to face cybercrime issues in Asia, particularly the hijacking of its video streams. The company is deploying advanced technologies and ongoing protective measures to safeguard its intellectual property. While progress requires time and resources, early signs of success are emerging as regional revenue returns to growth. Evolution remains cautiously optimistic about the remainder of 2025 and is committed to being fairly compensated for its innovations.

European Ring-fencing Impact

In Europe, Evolution recorded another quarter of negative growth due to ring-fencing measures, especially outside the UK. Although the financial impact was greater than expected, the company continues to view regulation as a long-term positive. However, it cautions that overly restrictive frameworks may reduce player protection and shrink the regulated market. Evolution believes its proactive regulatory compliance puts it ahead of peers and positions it well as the industry evolves

Capacity

Evolution launched two state-of-the-art studios in June, one in the Philippines and one in Brazil. The Philippine studio, the company’s first in Asia, marks a key milestone targeting the region’s first licensed iGaming market. The Brazilian studio is larger and supports the country’s newly regulated market. Both openings reflect Evolution’s global expansion strategy and growing studio network.

Game Rounds Index

The Game Rounds Index rose 2.7% YoY, primarily driven by continued growth in game shows, which remain highly popular.

New Games

Evolution plans to release over 110 new games in 2025, its most ambitious product roadmap to date. In Q2, it launched four new Live Casino titles, Super Color Game, Lightning Bac Bo, War, and First Person Bac Bo, designed to deliver high-quality, immersive entertainment. Additionally, 20 new slot games were launched during the quarter.

Looking ahead to Q3, three more Live Casino titles will be introduced, including Ice Fishing, which has attracted strong interest from operators due to its unique concept.

Hasbro-Evolution Agreement

Evolution secured an exclusive worldwide agreement with Hasbro to develop online gaming content based on iconic brands like Monopoly. The deal builds on the success of MONOPOLY Live and MONOPOLY Big Board, two of the industry's top-performing games.

Starting January 1, Evolution will be the exclusive provider of Hasbro gaming content. This is a major milestone and a clear competitive differentiator.

4. Financial Analysis

Revenue

Net revenue grew 3%, a continuation of the slowdown driven by ring-fencing. Importantly, revenue did not decline sequentially for the second consecutive quarter, alleviating investor concerns. Underlying revenue growth, excluding FX headwinds, was 9%.

This marked the 11th consecutive quarter of revenue growth deceleration. Regulated markets now account for 44% of total revenue (up from 39% in Q2 but down slightly from 45% in Q1). Regulated revenue rose 16% YoY, while unregulated revenue fell 6% YoY. Much of the regulated growth likely stemmed from Brazil’s full market regulation as of January 1.

The Live segment (87% of revenue) grew 4% YoY. RNG, which accounts for 13% of revenue, was flat YoY but declined 2% QoQ. RNG remains a disappointing segment, with management attributing the decline to the largest payout in its history. However, details were limited.

Regional Performance

Asia (40% of revenue): Grew 4% YoY and 4% QoQ despite ongoing cyberattacks. After a flat Q1, this sequential rebound in its largest market is a positive signal.

Europe (33%): Declined 6% YoY and 5% QoQ due to ring-fencing. Given last quarter’s guidance, this sharper-than-expected drop is surprising. Management admitted the financial impact outside the UK was larger than anticipated.

North America (14%): Grew 23% YoY, its fastest rate since Q1 2023. This was one of the bright spots in the report, supported by expanded offerings and studio plans in Michigan.

Latin America (7%): Grew 3% YoY, which was underwhelming considering Brazil's new regulatory framework. Management acknowledged a gradual ramp-up as operators and players adjust to the changes.

Operating Margin

Operating margin declined to 58%, down from 61% YoY, as operating expenses rose 10% to €218 million. Still, the sequential decline was stemmed after two quarters of deterioration.

Personnel expenses rose 11% YoY to €124 million due to headcount growth. Average FTEs rose 4% YoY to 15,965, a new record.

Revenue per FTE and cost per FTE held steady at €33k and €8k respectively. The revenue-to-cost ratio held at 4.2x, stabilising after Q1’s decline.

EBITDA margin dropped to 66% from 68% last year, resulting in flat EBITDA YoY. Management reaffirmed FY 2025 EBITDA margin guidance of 66%–68%, expecting improvement in H2 following H1 cost pressures.

Cash Flow Analysis

CapEx held steady at 6% of revenue, in line with recent quarters. Full-year CapEx guidance remains at €140 million.

Free Cash Flow margin fell to 37%, down from 55% YoY. This quarter’s result was impacted by tax payments and higher working capital needs.

As noted last quarter, Q1’s elevated FCF margin was due to timing-related receivables collections. This quarter saw the reverse, with receivables increasing by €35 million.

Excluding working capital changes, operating cash flow declined 6% YoY, compared to a 31% drop in FCF. This is a timing issue, not a structural concern, and should normalise in coming quarters.

After €65 million in share repurchases and €572 million in dividends, Evolution ended the quarter with €505 million in cash. Interestingly, the company clarified that the €500 million share buyback approved earlier was for the entirety of 2025. With €219 million already deployed, Evolution may end the year with excess idle cash.

5. Conclusion

Last quarter was an ugly one for Evolution. Coming into this quarter, there was a lot of pessimism around the stock, much of it justified. If I had to describe this quarter in one sentence, I’d say it was the quarter that Evolution stopped the rot. The following positive outcomes were achieved:

Revenue returned to growth, avoiding a second consecutive quarterly decline. Underlying revenue growth was 9%.

Asia, Evolution’s largest and most profitable market, resumed sequential growth.

North America grew over 20%, its fastest rate in more than two years.

Operating and EBITDA margins held steady, avoiding further decline from Q1.

That said, several negatives remain:

Europe declined sequentially for a second straight quarter. Management admitted the ring-fencing measures had a larger financial impact than expected. This either reflects a lack of deep understanding of the business or that management was deliberately misleading last quarter.

RNG revenue declined, and while management attributed this to a payout event, they failed to provide enough data to quantify it.

Latin America remains sluggish, showing little momentum despite the newly regulated market in Brazil.

Low single-digit revenue growth was not part of my original investment thesis, and trying to suddenly pass this off as a positive feels disingenuous at best.

I did, however, find management’s candor refreshing again this quarter, which is rare from the CEO of a publicly listed company:

“To be clear though, we are not satisfied with this quarter’s growth, and we are working hard to increase the pace. However, operationally speaking we are where we set out to be at the beginning of the year.”

Martin Carlesund, CEO

Speaking of the CEO, on June 13, he made a significant open market purchase of €6 million. At the time, I speculated that, with just two weeks left in the quarter, he may have had visibility into something positive before the blackout period began.

Fast forward to today, and the stock is up 25% since that purchase, meaning his €6 million is now worth over €7.5 million in just over one month. Insiders can sell for many reasons, but they only buy for one, they think the price will rise. And they usually know.

While this report did not meet my long-term expectations, or management’s, the difference between this quarter and last is that I can now see a corner being turned. The company appears to have reassured investors that the slide is over and Q1 marked the bottom. What’s in the rear-view mirror no longer matters for forward returns. All that matters now is the future.

Evolution is not out of the woods yet, and there’s much more work to do, but I can at least see a path back to double-digit growth in 2026.

Rating: 2 out of 5. Below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Do you think the UK regulatory investigation would wrap this quarter and do you the stock rising more than 5% due to this if its just a fine.

Also do you have information on when Capital Groups or Kevin Darts holdings in EVVTY is next reported as I believe this information will cause a small spike as-well?

Nice analysis! Thx I bought you a coffee for it. Looking forward, I think things will only get better with the new studio’s

and progress in Asia and America and Europe will grow again from 2026 onwards