Executive Summary

Evolution’s net revenue grew 12% YoY, with underlying growth at 16% when adjusting for FX headwinds. The Live segment (86% of revenue) grew 13%, driven by higher commission income, while RNG (14%) grew 7%, stabilizing after previous struggles.

Regionally, Asia (38%) grew 11% YoY but was flat sequentially due to cyberattacks. Europe (38%) maintained steady 9% YoY growth, while North America (13%) accelerated to 19%, driven by Live expansion and RNG improvements. Latin America (7%) led with 20% growth, supported by Brazil’s upcoming 2025 regulation.

Evolution’s operating margin declined slightly to 61% in Q4, as operating expenses rose 20% YoY to €208 million. Personnel costs, the largest expense component, increased 16% YoY, driven by a 6% rise in average FTEs. However, headcount remained below its Q2 2024 peak following labor disruptions in Georgia.

Cost control improved, with cost per FTE falling from €8K in Q3 to €7K in Q4, though management expects this to rise in 2025 due to expansion and a shift toward regulated markets. Despite these pressures, revenue per FTE increased to €36K, with a strong revenue-to-cost ratio of 4.9x, reflecting operational efficiency.

Evolution closed 2024 with over 1,700 tables, adding a net 100 tables despite labor disruptions in Georgia that reduced capacity. While operations there have stabilized, the company is maintaining lower capacity as it optimizes its global footprint. This scalability drove Live revenue per table above €1 million for the first time. To meet strong demand, Evolution plans to open three to four new studios in 2025, expanding in Brazil and the Philippines, with CapEx projected at €140 million.

Management views increasing regulation as a long-term growth driver, despite near-term challenges. National regulations present an opportunity to attract new users and support B2C operators. To adapt, Evolution has ring-fenced regulated markets, restricted game access to licensed operators, and implemented technical compliance measures.

These steps have lowered EBITDA margin guidance to 66-68%, but management sees this as necessary for growth in a more regulated—and potentially larger—market. While regulated markets yield lower margins, they are more valuable, with the key focus being absolute free cash flow per share rather than margins alone.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Net Revenue: €534 million (+12% YoY)

Live: €459 million (+13% YoY)

RNG: €74 million (+7% YoY)

Operating Profit: €417 million (+38% YoY)

EBITDA: €455 million (+35% YoY)

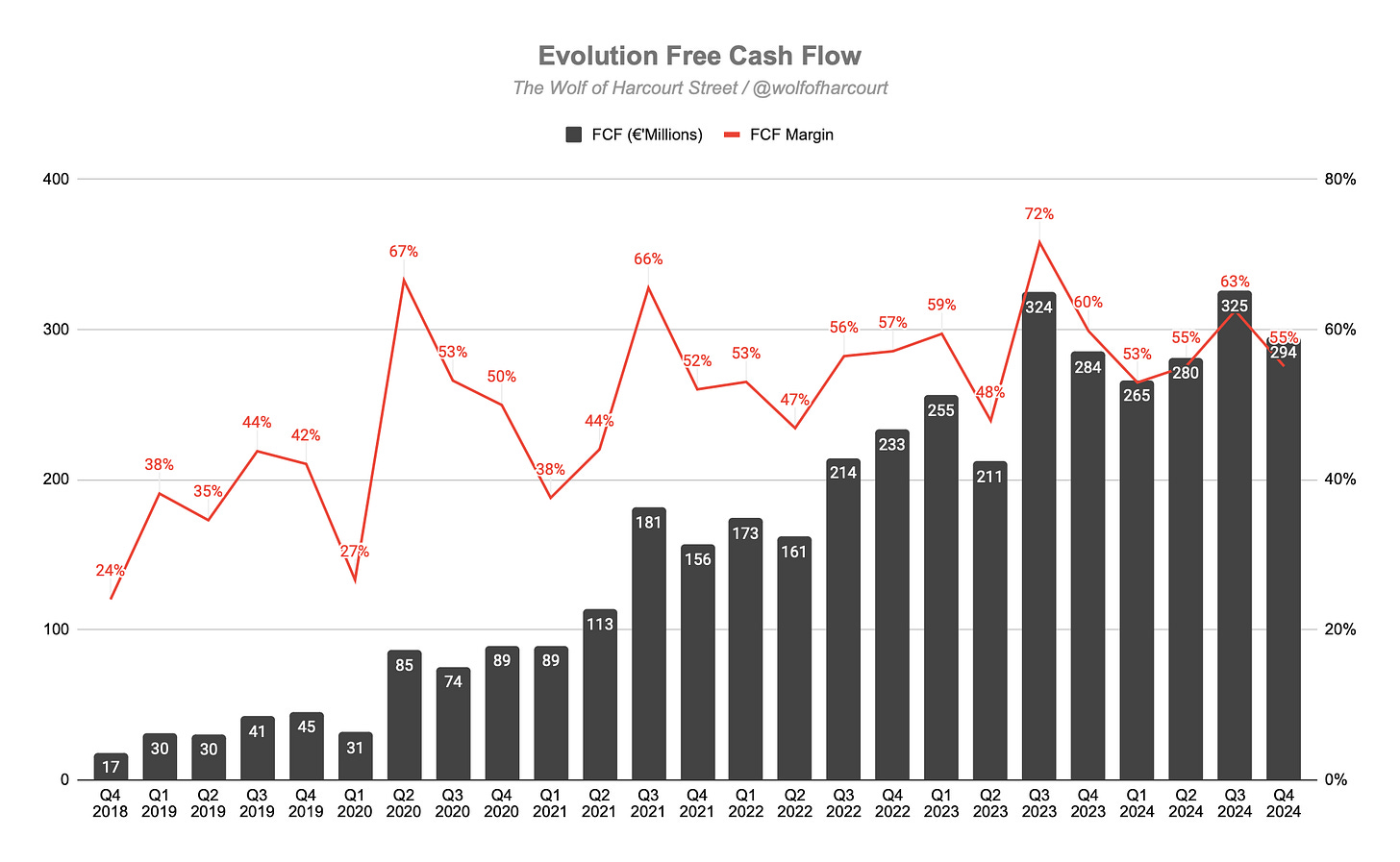

Free Cash Flow: €294 million (+3% YoY)

2. Wall Street Expectations

Net Revenue: €537 million (miss by 0.5%)

Adjusted EPS: €1.36 (beat by 1%)

3. Business Activity

Capacity

Evolution ended 2024 with over 1,700 tables, a net increase of about 100 tables during the year. While the company added over 300 tables, this was partially offset by significantly reduced capacity in Georgia following labor disruptions in July.

Although operations in Georgia have since stabilized, Evolution expects to maintain this lower capacity as it optimizes its large-scale footprint and expands elsewhere. This scalability resulted in Live revenue per table exceeding €1 million for the first time.

One has to wonder how much higher revenue might have been if the company had operated at full capacity. To meet strong demand for Live Casino, Evolution will continue investing in growth throughout 2025. With new studio projects in Brazil and the Philippines, management expects to open three to four new studios in 2025. CapEx for 2025 is estimated at €140 million, in line with 2024.

Regulatory Adaptation

Management views the evolving regulatory landscape as a long-term growth driver, despite short-term challenges. They see increasing national regulations as an opportunity to attract new end-users and provide clarity for B2C operators.

As a B2B game provider, Evolution has proactively adapted by:

Ring-fencing regulated markets

Restricting game access to locally licensed operators

Implementing technical compliance measures

These adaptations have led to lowered EBITDA margin guidance (66-68%), but management sees this as a necessary step for future growth in a more regulated and potentially larger market.

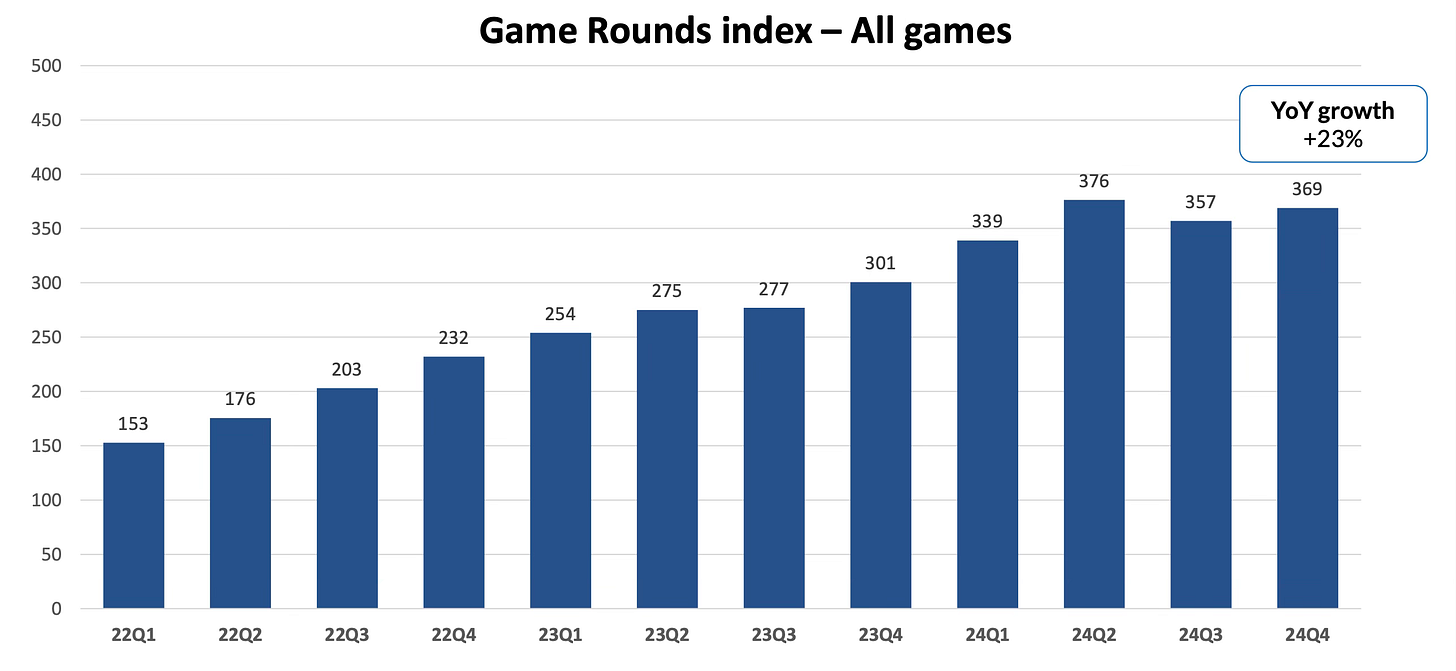

Game Rounds Index

The game rounds index, which tracks overall activity across Evolution’s network, was impacted in Q3 by disruptions in Georgia and strategic actions in Asia. The sequential decline was primarily due to capacity constraints rather than weakened demand.

Activity improved in Q4, though it remains below the Q2 2024 high. Management expects this trend to revert to the mean over time.

New Games

Evolution continues to strengthen its market leadership through innovation and expansion of its product portfolio. Looking ahead to 2025, the company will continue its "Product Leap" strategy with over 110 new games in the pipeline.

Notable upcoming releases include:

Marble Race

A new Fishing game

A Crash game

Fireball Roulette

Expansions to the Blackjack portfolio

Additionally, market-specific releases are planned, such as RNG games tailored for the U.S.

Capital Allocation

The Board of Directors proposes a dividend of €2.80 per share for 2024, a 6% increase from 2023.

Additionally, the Board intends to repurchase up to €500 million in shares during 2025. Based on the current market capitalisation of €15.8 billion, Evolution could retire 3.2% of outstanding shares in 2025 alone.

4. Financial Analysis

Revenue

Evolution’s net revenue grew by 12%, reflecting a continued slowdown. Foreign exchange headwinds persist, with underlying revenue growth at 16% compared to the 12% reported.

The Live segment, which accounts for 86% of total revenue, grew 13% YoY, driven primarily by increased commission income from existing customers and, to a lesser extent, new customers.

Meanwhile, RNG (14% of total revenue) grew 7% YoY. The segment struggled throughout 2023, losing market share in the U.S. earlier in 2024, but has now stabilized with solid growth over the past two quarters. Management noted that platform improvements made during the year are starting to show results.

Mobile usage remains a key driver of growth, with 72% of operators' gross gaming revenue generated through mobile devices in Q4. While RNG is the largest vertical in the online casino market, Live has become increasingly important for gaming operators, evolving into a strategically essential product.

Regional Performance

Asia (38% of total revenue) grew 11% YoY but was flat sequentially due to cyber-attacks affecting video distribution in the region.

Europe (38%) grew 9% YoY, maintaining steady growth of 10% overall in 2024.

North America (13%) grew 19% YoY, marking the second consecutive quarter of accelerated growth, driven by expanded table capacity and new game releases in the Live segment. Additionally, continued improvement in RNG suggests the region has turned a corner.

Latin America (7%) grew 20% YoY, its fastest rate since Q3 2023. The region’s positive outlook is reinforced by Brazil’s 2025 regulation, expected to be a key growth catalyst.

A notable line item in Evolution’s financials this quarter was €91 million under ‘Other operating revenues’, related to a reduced earn-out liability from the €450 million acquisition of Big Time Gaming (2021). A lower earn-out liability results in a gain on the income statement, as the expected future payment decreases, effectively reducing the total acquisition cost.

With this item included, Evolution reported total operating revenue of €625 million, implying 32% YoY growth. While this boosts the bottom line, it is essential to separate it from recurring results.

Operating Margin

Excluding the non-recurring item, Evolution’s operating margin declined slightly on a sequential basis to 61%, as total operating expenses grew 20% YoY to €208 million.

Personnel expenses, the largest component of operating expenses, increased 16% YoY to €109 million, primarily due to headcount growth. Average full-time equivalents (FTEs) rose 6% YoY to 14,882 but remained below the Q2 2024 high, following labor disruptions in Georgia.

The cost per average FTE reached a record €8k in Q3, but declined to €7k in Q4, indicating improved cost control and resource management. However, this metric is expected to increase again in 2025, based on CEO Martin Carlesund’s comments:

“Expansion will continue in 2025 - with a slightly more expensive resource mix, taking into account the situation in Asia and a strengthened focus on regulated markets we expect to see an effect on margin.”

Despite these disruptions, Evolution’s revenue per average FTE rose to €36k, up from €34k in Q4 2023, aligning with Q3 2024 levels. The company served more players with fewer FTEs, achieving a revenue-to-cost ratio of 4.9x.

Due to Georgia’s labor disruptions and cyber attacks in Asia, the EBITDA margin (excluding non-recurring items) declined YoY to 68% from 71% in Q4 2024, but remained flat sequentially. The estimated EBITDA margin for FY 2025 is projected to be 66%–68%, compared to 68.4% in 2024.

Cash Flow Analysis

Evolution remains in a heavy expansion phase, investing in:

New studios

Gaming tables

Servers & computer equipment

These investments drove CapEx higher, resulting in a CapEx ratio of 7%. While the company originally projected €120 million in CapEx for the year, it finished at €140 million, slightly above my €135 million estimate from last quarter.

Despite this, cash flow remains robust, with an FCF margin of 55%. Even after €150 million in share repurchases this quarter, Evolution closed with a cash balance of €801 million.

Of this:

€578 million will be used for dividend payments.

€220 million will be available for the buyback program.

5. Conclusion

There was a lot to unpack in this earnings report, but the most important disclosure was the company’s clear shift toward regulated markets. Management has made a deliberate decision to ring-fence regulated markets and restrict game access to locally licensed operators.

“We want it to be 100% where there's local licenses and so on. And historically, there hasn't been blocking of internet from a regulator. Whatever regulation there is, internet has been open. And now regulators are pushing a little bit to block internet and we are following through with that and we're listening to everyone and we want to do that. That is a change of the landscape and that's good. The end goal needs to be high channelization. The end goal needs to be that anyone in a regulated market wants to play on a regulated product or anyone in any other regulated market in a country wants to buy from the regulators, regulated shops or whatever it is.

Martin Carlesund, CEO

All of this quarter’s growth came from regulated markets in Europe, North America, and Latin America, while Asia was flat sequentially as the share of revenue from regulated markets rose from 39% in Q3 to 41%. While margins in regulated markets are lower, they are arguably more valuable. The key takeaway: incremental margins will be lower going forward, but what matters to shareholders is absolute free cash flow per share—not margins alone, as margins themselves cannot be returned to shareholders.

The new studios in Brazil and the Philippines had been disclosed earlier this year, but management also revealed plans to open one or two additional studios in 2025. While the locations were not specified, the strong revenue growth in North America, Latin America, and Africa ("Other") provides clues as to where new capacity may be needed. Notably, the Colombian studio is being expanded to cater to Spanish-speaking demand beyond its home market—a scale advantage that Evolution enjoys and one that sub-scale competitors will struggle to replicate.

It was also encouraging to see the RNG segment—which had suffered several quarters of market share losses—return to growth. Meanwhile, in the U.S., live casino gaming continues to expand across all states, making it the company’s fastest-growing region. With online casinos legalized in only seven states so far, there remains a long runway for future growth. Partnerships, such as the FanDuel expansion and new agreements with Atlantic Lottery, provide solid momentum heading into 2025.

Evolution is on track to return well over €1 billion to shareholders in 2025, via €578 million in dividends and €500 million in share repurchases. While I would prefer Evolution suspend the dividend and allocate the full €1 billion toward buybacks, this clear capital return policy provides certainty to shareholders.

2024 could be described as a year from hell for Evolution. Everything that could go wrong, did—labour strikes at the Georgian studio, cyber-attacks in Asia, an increased tax rate, and significant foreign exchange headwinds. Despite all of this, Evolution still managed to grow revenue by 15% while maintaining a 64% operating margin—an impressive feat given the headwinds.

Looking ahead to 2025, the Georgia studio capacity, currently running at 60%, should be offset by capacity from other studios, while the negative tax-rate impact will normalize. However, Asia remains the biggest ongoing concern. It is unlikely that growth in regulated markets will fully offset the loss of high-margin, unregulated revenue in Asia—especially in the short term. Ironically, the previous market narrative was that unregulated revenue growth in Asia was unsustainable—yet now, the concern will likely shift to regulated growth producing lower incremental margins.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for saving me some time!

Thanks for the breakdown. I think long term EVO will do great!