How Mercado Libre’s Founders Built a $100B Business

Lessons from the climbers & scalers podcast — Part 1

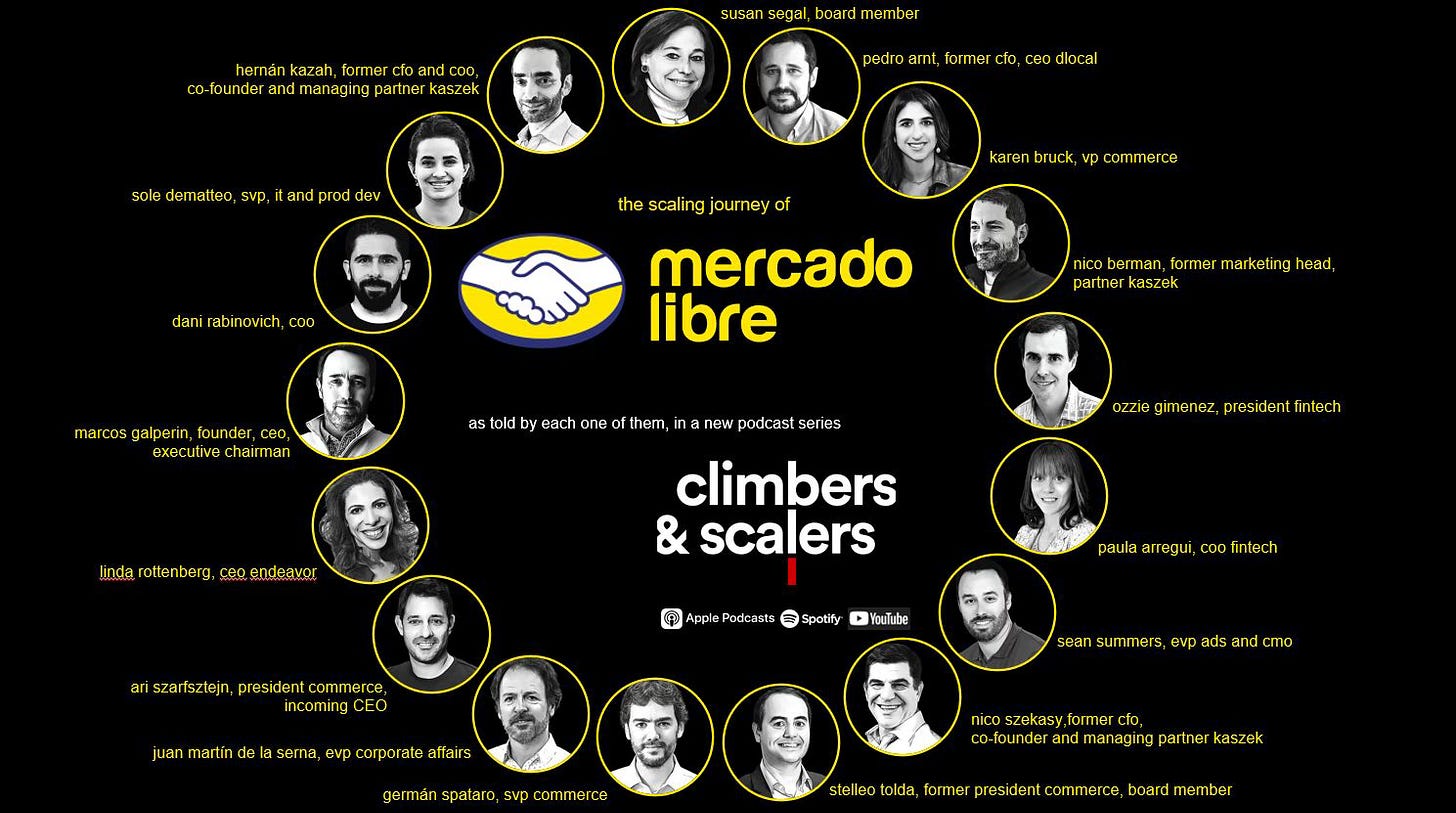

A couple of weeks ago, a new podcast series called climbers & scalers was released. The 28-episode series, which chronicles Mercado Libre’s (MELI) journey through the voices of its protagonists, was originally recorded in Spanish a few years ago. Produced independently by Federico Eisner, the series uses AI to clone the original voices in English.

I have followed the company for many years, so this release got me very excited. And I was not disappointed. Very early into the first episode, I realised I needed to sit down with a pen and paper to take notes. Each podcast is so rich in detail that I decided to write a three-part series sharing my key learnings and insights.

These insights fall into two categories: company-specific takeaways that reframe MELI’s competitive advantages, and universal business principles that apply across all organisations. Even if you are not interested in MELI, there are lessons every investor can apply to their own universe. Part 1 covers episodes 1 to 9.

Mercado Libre-Specific Insights

Platform-First

The most striking revelation from Chief Operating Officer Dani Rabinovich concerns MELI’s fundamental technology philosophy. His assertion that “we are not a technology company, we are a product company” may sound counterintuitive for a firm trading at technology multiples. Yet this distinction reveals a deeper insight: MELI’s technology exists only to solve user problems, never as an end in itself.

This philosophy manifested most dramatically during the “Ground Zero” project, when MELI rebuilt its entire platform from scratch while being a public company, spending nearly two years without releasing new features. The courage to prioritise scalability over short-term metrics explains their current ability to handle massive transaction volumes that would have been impossible with their original architecture.

The transition from closed, monolithic systems to open, loosely coupled platforms enabled both technological and organisational scaling. Rabinovich noted that “the hiring curve looks completely flat for 10–13 years, and starts an exponential curve since we finished New World.” This connection between technology architecture and human capital efficiency is rarely discussed, yet it is critical for understanding MELI’s operating leverage.

The Amazon Paradox

Perhaps the most counterintuitive insight comes from Rabinovich’s assertion that “Amazon was the best thing that ever happened to us.” While conventional analysis views Amazon’s Latin American presence as a threat, MELI’s leadership suggests the opposite. Competing against Amazon forced MELI to pursue operational excellence that might not have emerged otherwise.

This explains MELI’s seemingly irrational investments in logistics infrastructure that analysts often questioned. By benchmarking every operational decision against Amazon, MELI created an internal discipline rare among Latin American companies. As former CFO Pedro Arnt emphasised, the “build to scale” mentality requires designing every system for 100x growth if you want to compete with global leaders.

Network Effects

Rabinovich’s tennis metaphor, “to win Wimbledon you have to beat everyone, not almost everyone,” illustrates why MELI has maintained market leadership despite well-funded competitors. Network effects are winner-take-all. Second place has little value.

This insight explains MELI’s aggressive market share defense and willingness to sacrifice short-term profitability for dominance. Their strategy prioritises position over immediate returns, recognising that in network-effect businesses, being number two is close to being irrelevant.

Learning From eBay

The partnership with eBay provided MELI with an invaluable case study of what not to do. Former CFO and COO Hernán Kazah described the “Lake Como moment” when eBay shifted from startup mentality to corporate complacency. That lesson continues to influence MELI’s culture today.

Arnt’s observation that “Amazon should never have happened the way it did, if eBay had done things right” reflects MELI’s deep understanding of competitive dynamics. The company learned that technical superiority and market position mean nothing without continuous innovation and user focus. This underpins their perpetual beta mentality, even as market leader.

Talent Philosophy

The Sole Dematteo mobile app story reveals MELI’s approach to talent development. Instead of punishing employees who built competing products, management acquired the application and promoted its creators. This unconventional response rewarded initiative while building loyalty and capturing innovation.

Rabinovich’s hiring philosophy, preferring problem-solvers over domain experts, explains MELI’s success in new verticals. Adaptability is prioritised over narrow expertise, which is essential for a platform expanding across multiple business lines.

Universal Business Principles

Obsession

The most powerful universal insight concerns sustainable competitive advantage. Rabinovich distinguishes between those who “like to have read” and those who “like to read.” The latter embodies obsession, which drives excellence.

He cites guitarist Paco de Lucia’s 12-hour daily practice as an example of obsession translating into mastery. Companies that enable employees to channel this kind of drive into their work will outperform those optimising only for balance.

Rabinovich’s “journey versus destination” mentality, described through his tango practice, underscores the value of enjoying the process of improvement. Teams that thrive on progress rather than outcomes sustain performance longer.

Communication

The 80-15-5 communication framework, 80% smooth operations, 15% tension, 5% rough discussions, offers a practical approach to team dynamics. High-performing groups require occasional conflict to maintain standards while preserving relationships.

Sole Dematteo’s testimony about working with Rabinovich confirms the framework’s effectiveness. By ensuring that criticism targets ideas, not people, MELI fosters direct communication and faster resolution.

Focus

Hernán Kazah’s insight that “good management is excluding, it’s leaving out” highlights the importance of saying no. In environments with infinite opportunities, success depends more on what you avoid than what you pursue.

This discipline was evident during the dot-com crash when MELI closed its Miami offices despite ample capital. Focus enabled survival.

Exponential Thinking

Kazah’s Stanford experience, which exposed him to thinkers who “disrespected the linear process and encouraged exponential thinking,” reveals why MELI designed for scale from day one.

Rather than expanding gradually, MELI launched as a regional player, reflecting the mental model of exponential leaps over incremental steps.

Paranoia and Happiness

Rabinovich’s claim that “paranoid can be extremely happy” challenges traditional leadership wisdom. He distinguishes clinical paranoia from operational paranoia, the constant drive to improve and fix problems.

Happiness, in this view, comes from enjoying improvement itself. Teams that thrive on identifying weaknesses rather than avoiding them build durable competitive advantages.

Ecosystems

The move from closed to open systems reflects not just technology but business philosophy. When companies position themselves as platforms that empower others, they create ecosystems that scale beyond their direct control.

This principle extends beyond tech. Any business that enables third-party success while capturing value gains an edge over vertically integrated competitors.

Conclusion

The climbers & scalers podcast highlights how Mercado Libre’s success comes from principles that challenge conventional business wisdom. Their emphasis on long-term thinking over quarterly optimisation, obsessive improvement over outcome celebration, and systematic paranoia over comfort offers a blueprint for enduring competitive advantage.

For investors, this suggests MELI’s premium valuation reflects more than financials, it represents systematic advantages in decision-making, talent, and strategy that compound over time. For business leaders, it offers practical frameworks for building cultures that sustain growth over decades.

Without MELI’s use of AI voice cloning, English speakers like myself would not have been able to enjoy this masterpiece. We are lucky to have access.

This article is Part 1 of a three-part series on key insights from the climbers & scalers podcast. Future installments will cover MELI’s expansion strategies and fintech evolution.

If you’d like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today’s edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Wonderful writing! Looking forward to the part 2 and 3. A minor correction: the podcast - both original and AI translation - was produced independently by me, with no involvement from MELI team. Obviously, the value of it all comes from their extraordinary scaling journey and the privilege of having had each one of them sitting down for the conversations.

This is a fantastic post. Loved it. Thanks for sharing.