Executive Summary

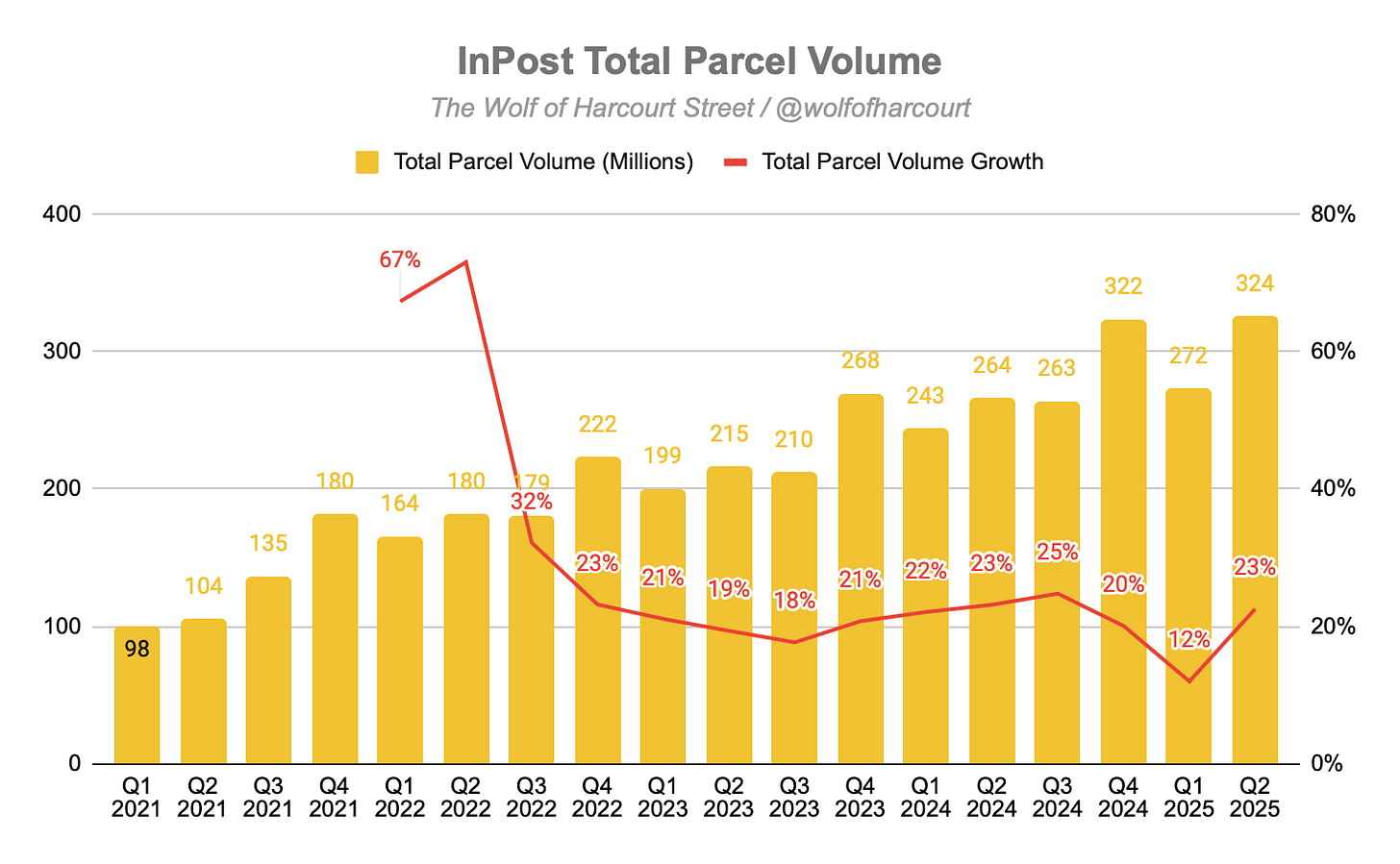

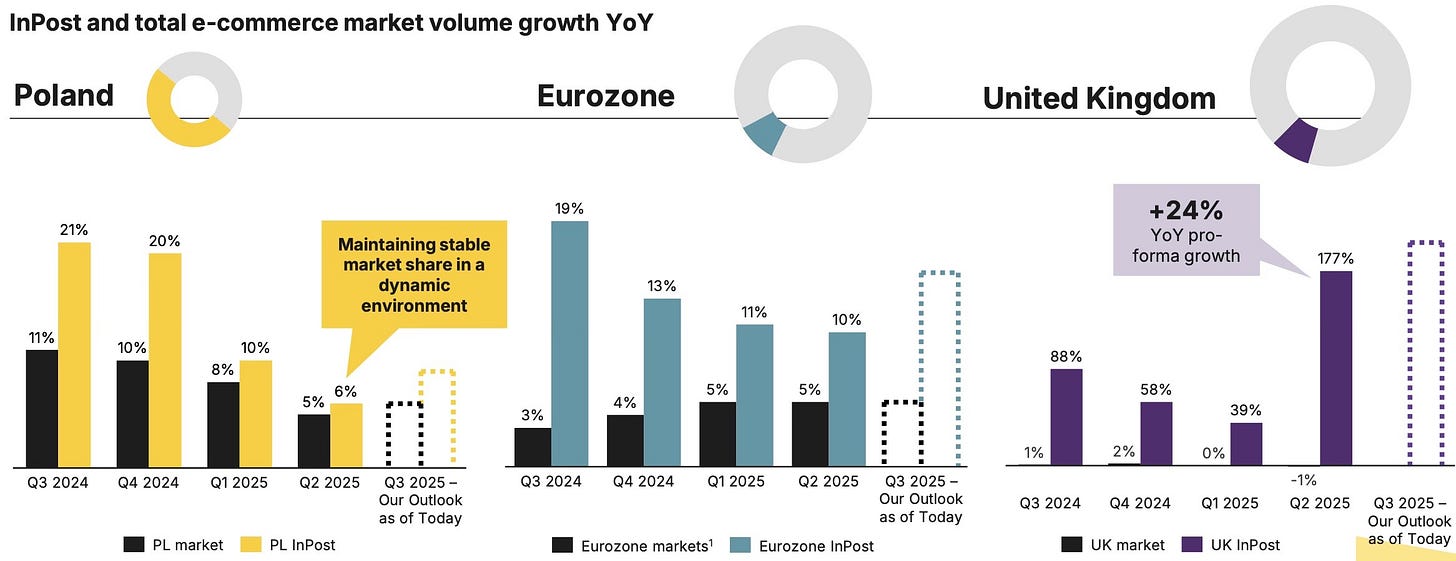

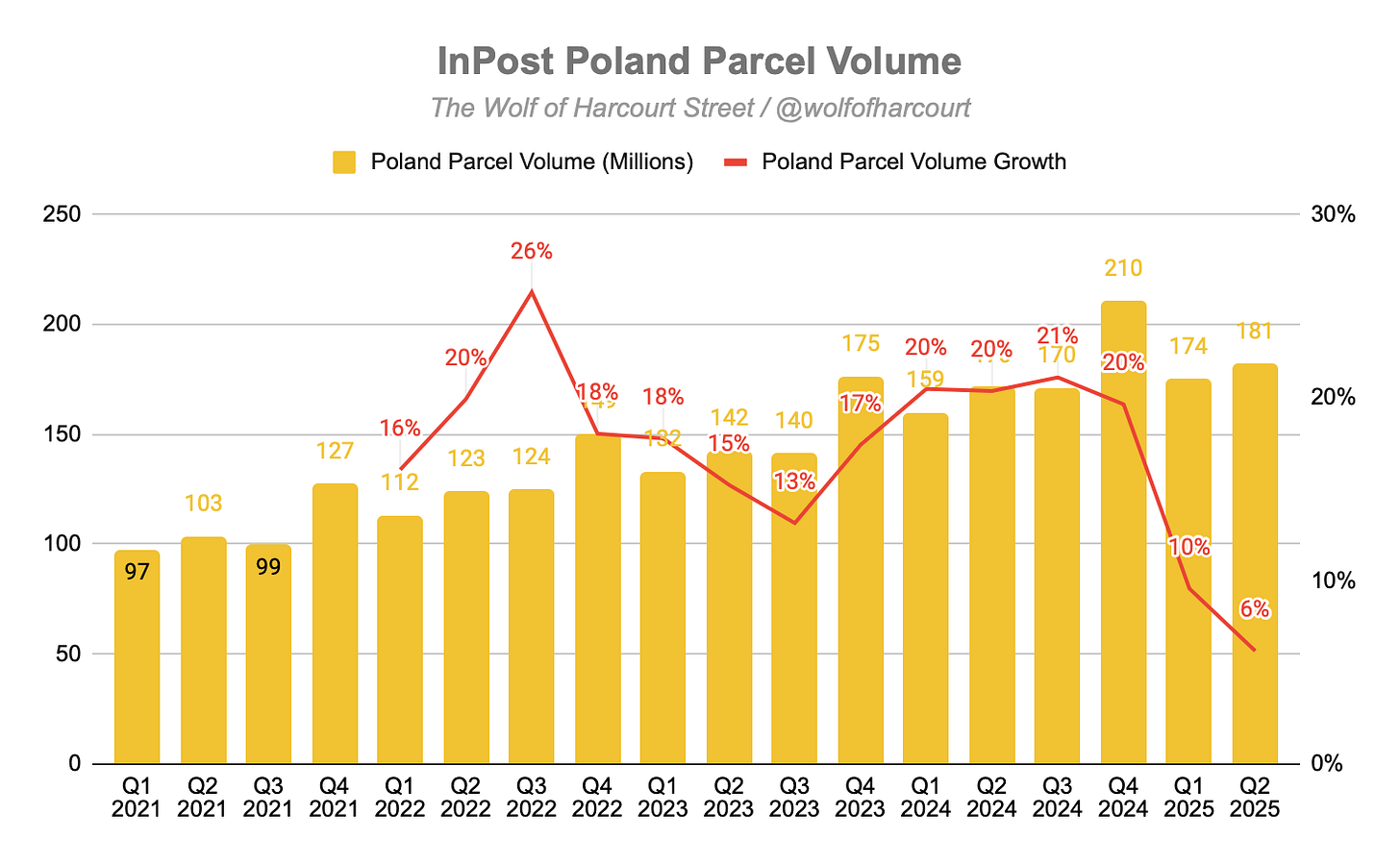

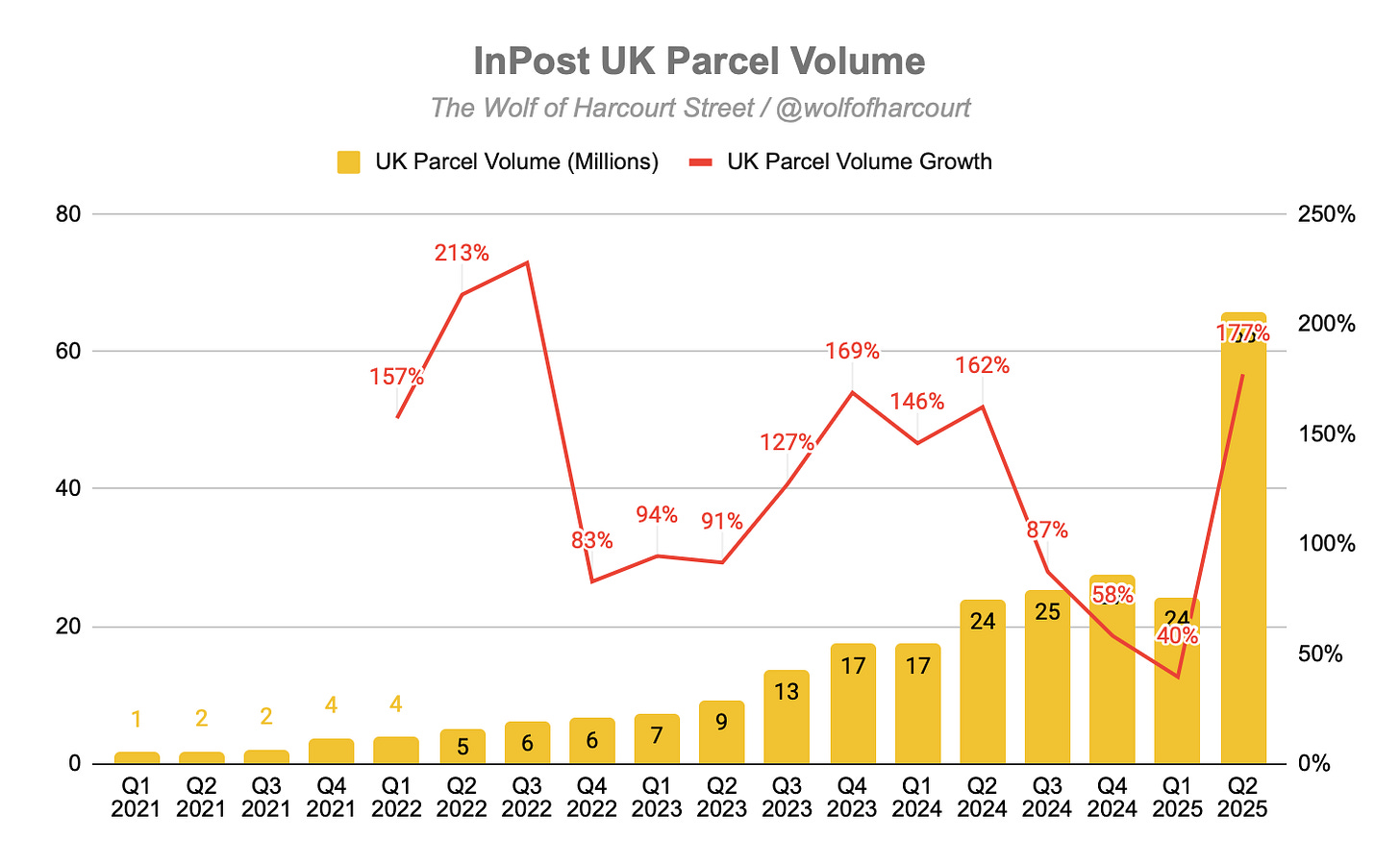

InPost delivered 324 million parcels, up 23% YoY, continuing to outpace e-commerce market growth across its core regions. In Poland, volumes rose 6% to 181 million, the slowest rate since the 2021 IPO, though diversification was evident with non-marketplace parcels up 17%. In the Eurozone, volumes increased 10% to 78 million, driven by B2C growth and 59% YoY APM adoption. The UK was the standout, with volumes up 177% to 65 million, largely due to Yodel’s integration. On a pro-forma basis, growth was 24% against a contracting market.

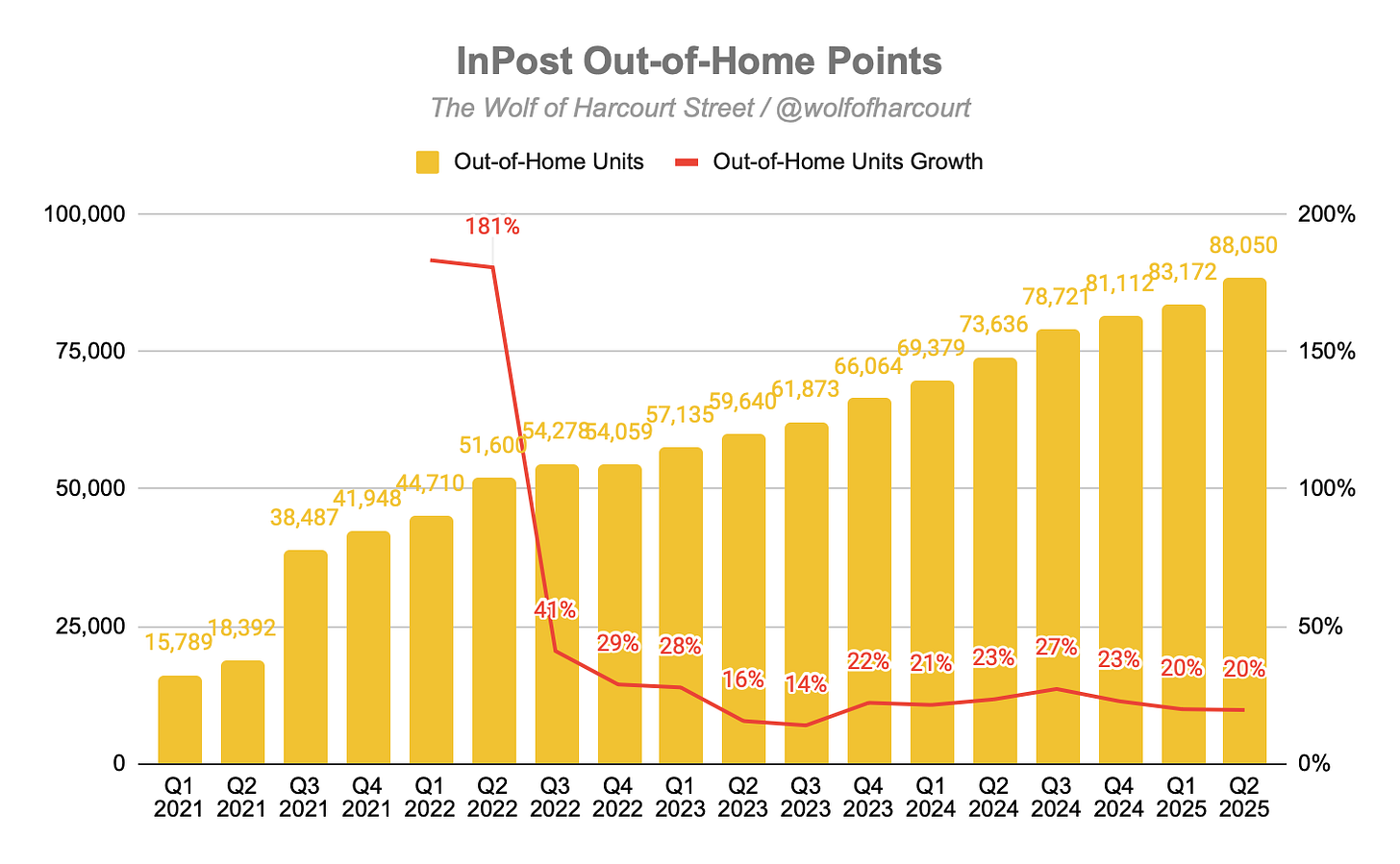

InPost achieved record network expansion in Q2 2025, cementing its position as Europe’s leading OOH delivery provider. The total network grew 20% YoY to over 88,000 points, with APMs up 31% to 53,287. For the first time, international lockers surpassed those in Poland. Alongside organic expansion, InPost advanced internationally through acquisitions and partnerships. The Yodel integration has made the UK InPost’s second-largest market, while the Sending acquisition in Iberia adds full-service logistics capabilities. A minority stake in Bloq.it supports further growth, with battery-powered lockers enabling flexible deployment, 2,000 targeted by end-2025 and 20,000 within five years.

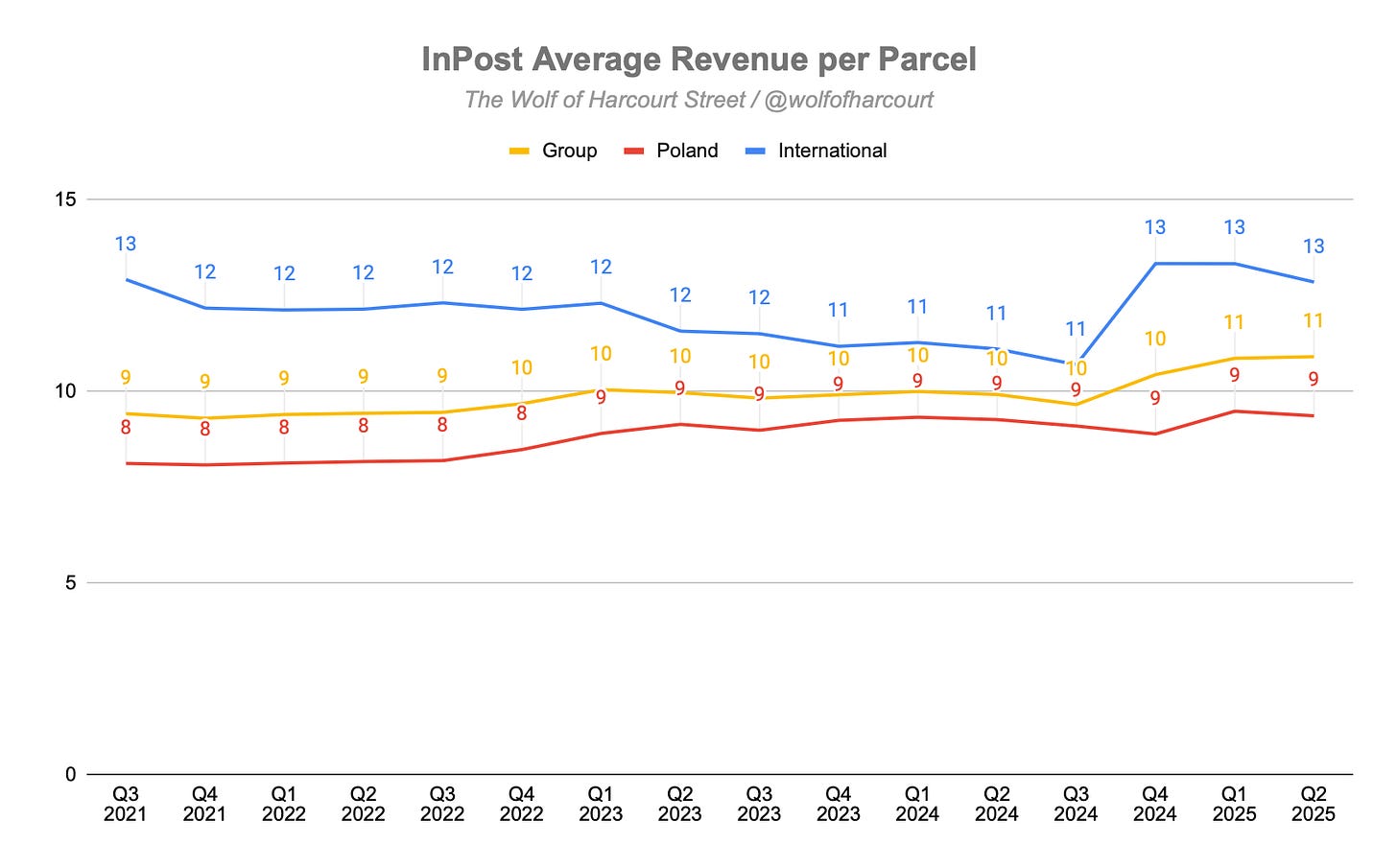

Revenue rose 35% YoY to PLN 3.5 billion, with more than half now coming from outside Poland, highlighting the success of international expansion. In Poland, revenue increased 7% to PLN 1.7 billion, supported by repricing and a favorable parcel mix. The Eurozone grew 10% to PLN 885 million, driven by cross-border and to-door deliveries. The UK stood out with a 303% surge to PLN 954 million, now accounting for 27% of Group revenue, thanks to Yodel’s consolidation and network growth. International operations are boosting unit prices, with average revenue per parcel rising to PLN 10.91 from PLN 9.92 a year earlier.

Adjusted EBITDA increased 13% YoY to PLN 1.0 billion, with a 28% margin, or a record ~35% margin excluding Yodel. Poland remained the standout, with EBITDA up 12% and margins improving to 49% on better cost control and mix shift. However, Group profit per parcel fell 8% to PLN 3.08, with a 25% international decline reflecting the trade-off between rapid expansion and near-term profitability. Net profit dropped 60% YoY to PLN 133 million, as integration costs, higher depreciation, financing expenses, and FX impacts outweighed operating gains. Management emphasised these headwinds are front-loaded and tied to Yodel integration, rebranding, and automation, with profitability expected to normalise by Q2 2026 as synergies take hold.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: PLN 3.53 billion (+35% YoY)

Adjusted EBITDA: PLN 1.00 billion (+13% YoY)

Operating Profit: PLN 382 million (-21% YoY)

2. Wall Street Expectations

Revenue: PLN 3.47 billion (beat by 2%)

Net Profit: PLN 303 million (miss by 56%)

3. Business Activity

Parcel Volume

InPost delivered 324 million parcels, a 23% YoY increase.

This growth once again outpaced the general e-commerce market across its key regions.

Poland

Parcel volumes grew 6% YoY to 181 million, slightly above the local market growth of 5%. However, this marked the third consecutive quarter of deceleration and the slowest growth rate since the 2021 IPO. Growth was driven primarily by a 17% YoY increase in non-marketplace volumes, highlighting successful diversification.

The company added about 2,500 new merchants YoY, bringing the total to over 55,000. These merchants contributed more than half of the non-marketplace growth.

Management noted a wave of attempted delivery preference changes on marketplaces in Q2 2025. For Allegro, most parcels were redirected to Allegro OneBox. Over 30% of Allegro volume was initially subject to these changes, with more than 80% of redirections going to Allegro OneBox and smaller portions to Orlen and DHL. Despite this, the estimated impact on InPost’s Q2 2025 volume was less than 2%, thanks to a loyal user base.

InPost Pay expanded to more than 9 million registered users and integrated with over 2,400 merchants by Q2 2025. The loyalty program grew to 12.4 million users, adding about 14 million incremental parcels since launch. NPS remains strong at 50 for merchants and 77 for customers, well ahead of competitors. Heavy users who order from more than 10 or 20 shops drive a significant share of Automated Parcel Machine (APM) volume.

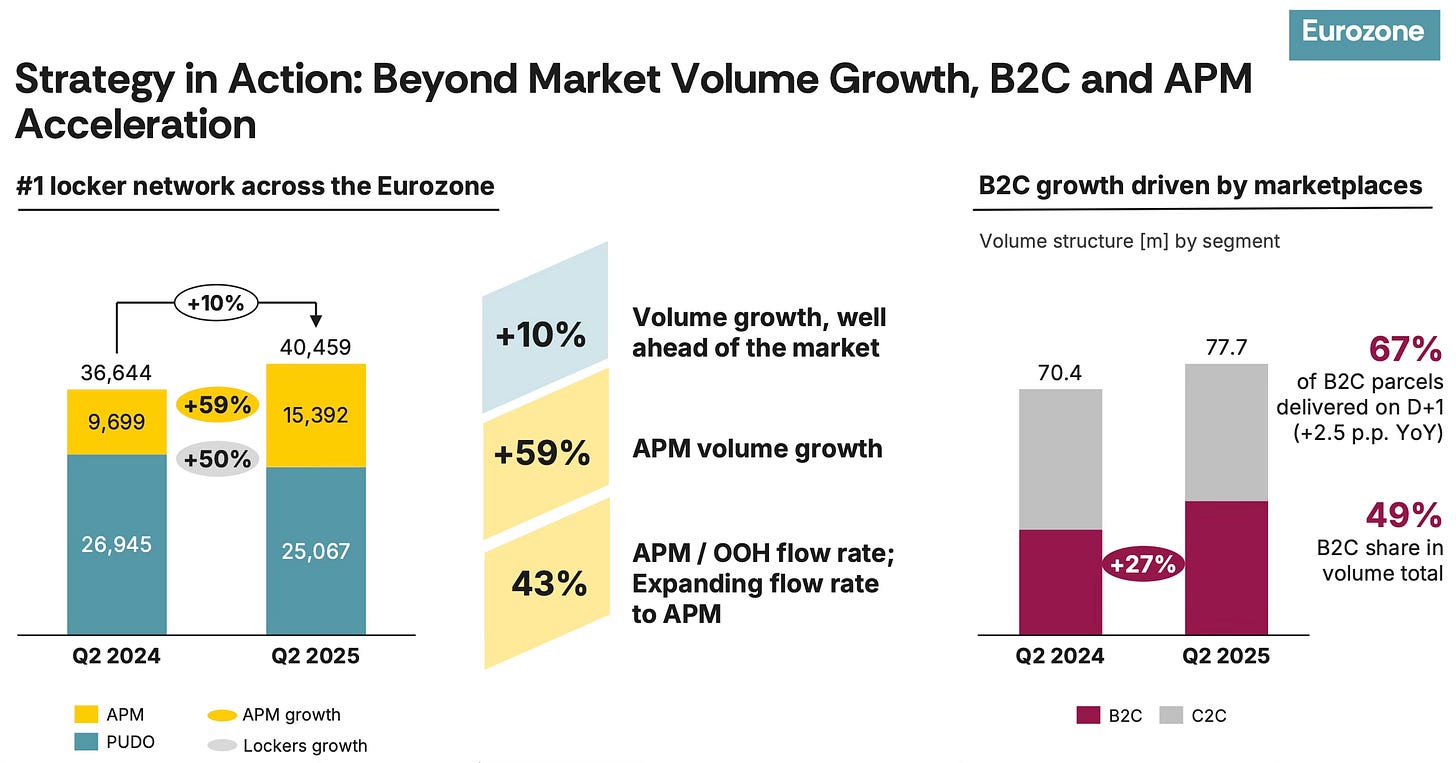

Eurozone

Volumes increased 10% YoY to 78 million, double the e-commerce market growth of 5%. Growth came mainly from a 27% YoY increase in B2C, now 49% of total Eurozone volumes.

APM adoption continued to rise, with APM volumes up 59% YoY, while PUDO volumes declined after a strategic cut in pick-up points. Mobile app downloads reached 4.9 million, with launches planned in Spain (Q4 2025) and Italy (2026).

UK

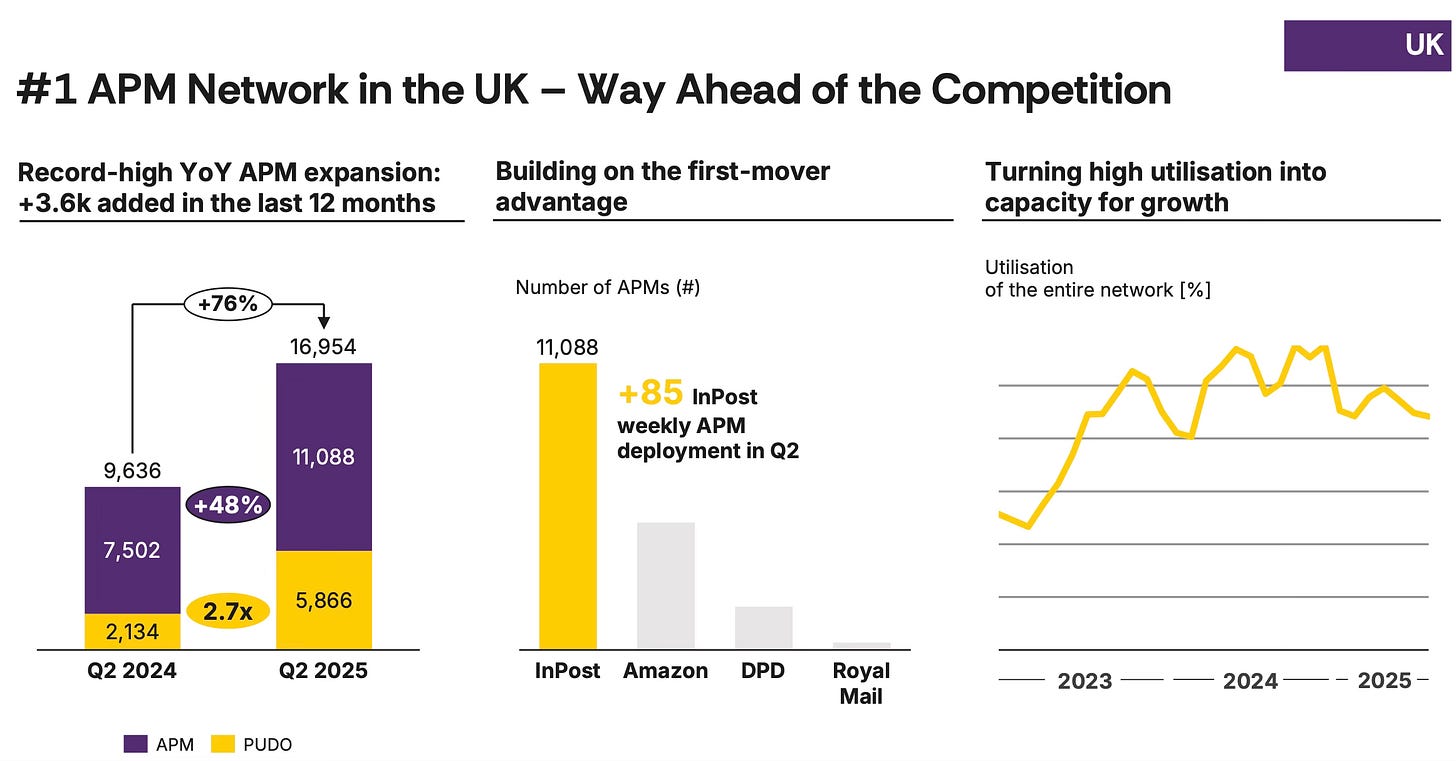

The UK delivered the fastest growth, with volumes up 177% YoY to 65 million. This surge was largely due to the integration of Yodel in May and June 2025. On a pro-forma basis, organic UK volumes grew 24% YoY, far above the market decline of -1%.

With Yodel, to-door and B2C volumes now represent over 50% of UK volume, creating a major opportunity for Out-of-Home (OOH) conversion. InPost already holds the highest NPS among UK peers. A pilot program redirecting Yodel parcels to InPost APMs has been launched to accelerate OOH adoption.

Network Development

InPost achieved record expansion in Q2 2025, reinforcing its position as Europe’s OOH delivery leader. The OOH network grew to 88,000+ points, up 20% YoY from 73,636. APMs reached 53,287, up 31% YoY from 40,671. For the first time, international APMs outnumbered those in Poland.

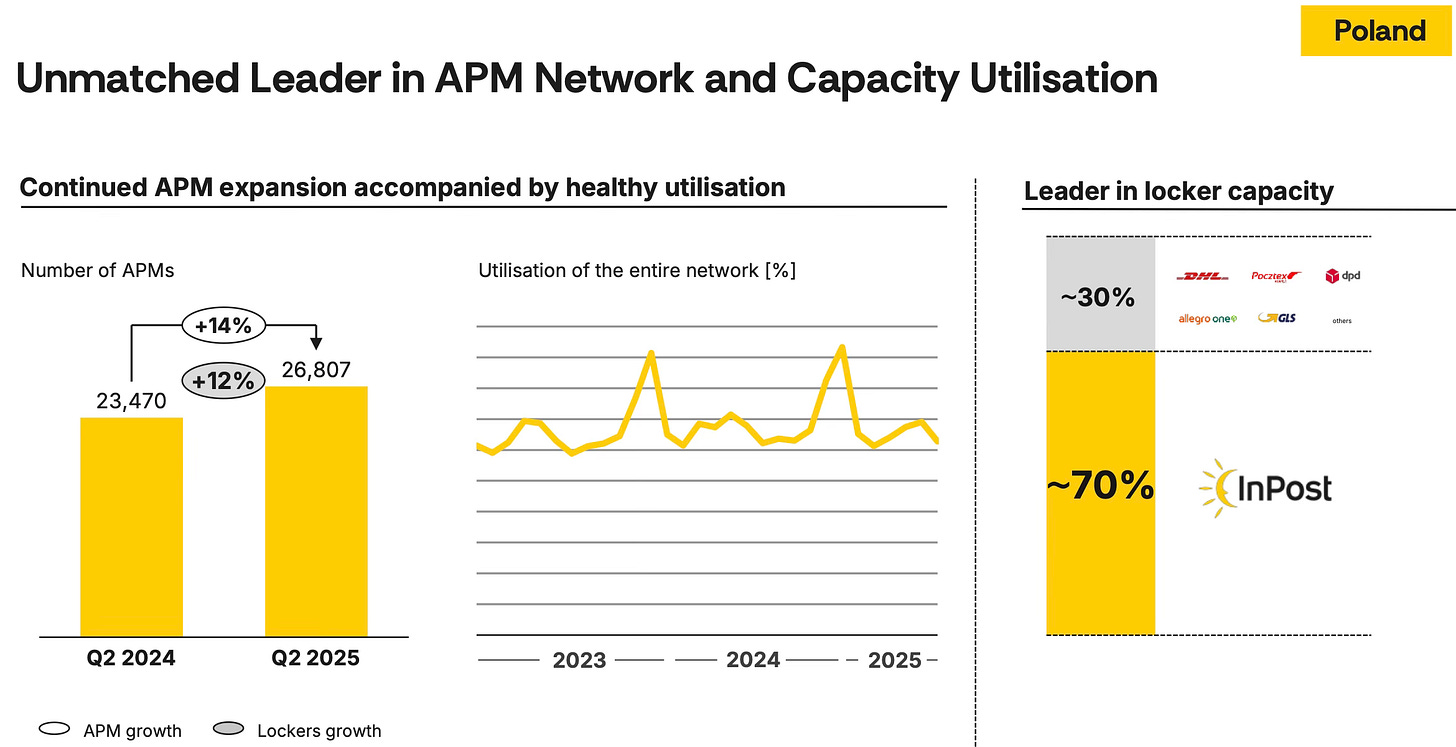

Poland: The APM network expanded to 26,807 units (14% YoY growth), equal to about 70% market share. Pick Up Drop Off (PUDO) points declined slightly by 1% to 3,830.

Eurozone: APMs rose 59% YoY to 15,392, while the broader OOH network reached 40,459 points (10% YoY growth). PUDO declined 7% YoY to 25,067 as focus shifted toward lockers. APM share of OOH volumes rose to 43% from 28% a year earlier.

UK: PMs surpassed 11,000, a 48% YoY increase, with +3.6k added in 12 months (about 85 per week in Q2). Coverage now reaches over 50% of the UK population, and in the top three cities, 75% of residents are within a 7-minute walk of an InPost OOH point. PUDO points increased 175% YoY to 5,866.

Acquisitions and Partnerships

Management described 2025 as a year of strategic acquisitions and investments to strengthen InPost’s international reach.

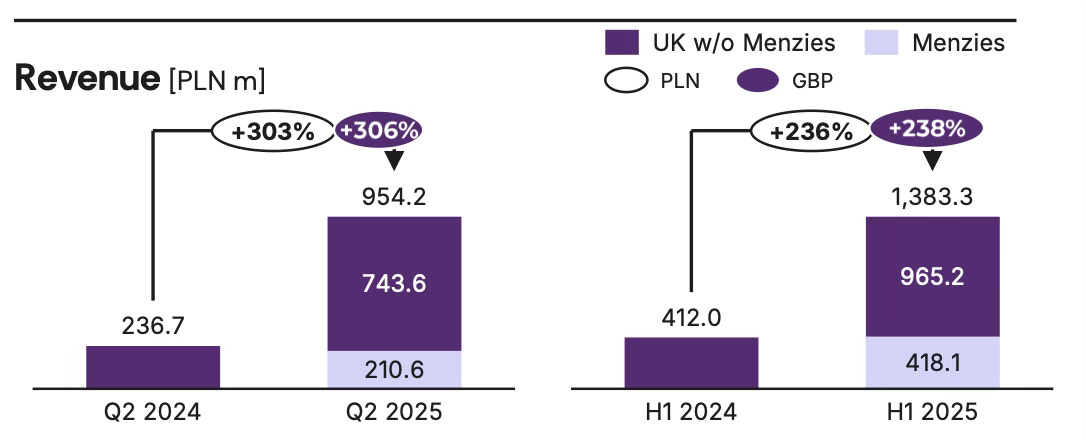

Yodel (UK): Integration was a key milestone, boosting UK volumes and making the market InPost’s second largest. Work continues on last-mile upgrades, process alignment, and depot consolidation (16 closed so far), with completion expected in 2026.

Sending (Iberia): Acquired in July, this Spanish to-door logistics company adds a full-service offering in Iberia, including OOH, to-door, fulfillment, and cross-border solutions, along with valuable merchant relationships.

Bloq.it (Battery-powered APMs): InPost took a minority stake in Bloq.it, whose lockers require no infrastructure or solar panels and last 6–12 months on battery power. Plans call for 2,000 new lockers by end-2025 and 20,000 within five years, enabling deployment in previously hard-to-reach urban areas.

4. Financial Analysis

Revenue

InPost’s revenue reached PLN 3.5 billion, a substantial 35% YoY increase. Notably, more than half of the Group's Q2 2025 revenue was generated outside Poland, underscoring the success of its international strategy.

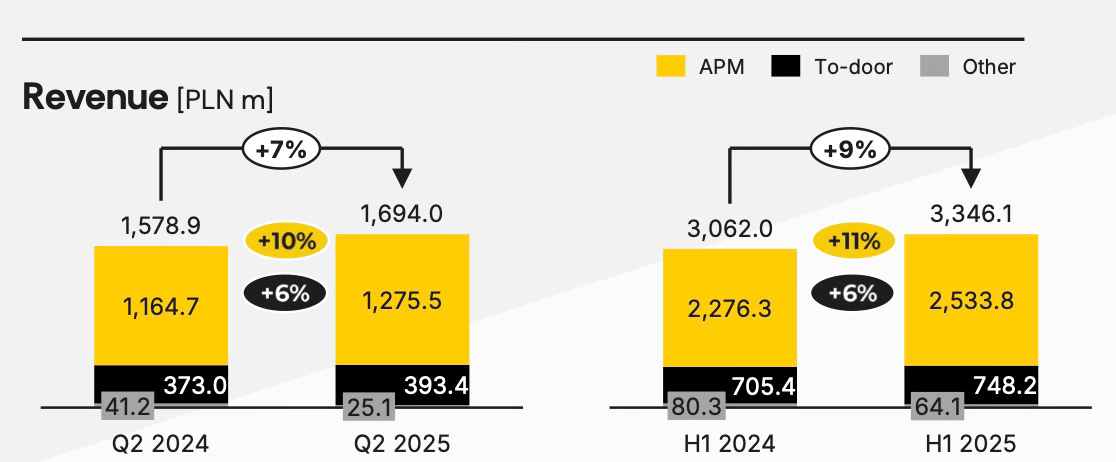

Poland

Revenue in Poland grew 7% YoY to PLN 1,694 million in Q2 2025. This outpaced parcel volume growth, supported by single-digit repricing and a favorable shift in volume mix.

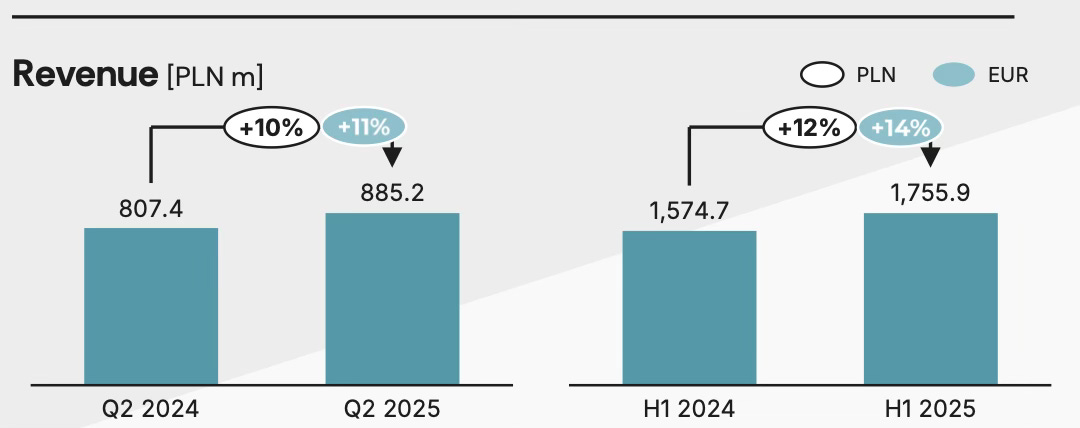

Eurozone

Revenue rose 10% YoY to PLN 885 million in Q2 2025, or 11% YoY in local currency. Performance was driven by a favorable volume mix, including more cross-border and to-door deliveries, partly offset by higher returns.

UK

The UK posted the strongest growth, with revenue surging 303% YoY to PLN 954 million in Q2 2025. This made the UK the Group’s second-largest revenue contributor at 27% of total sales. Growth was fueled by the Yodel consolidation and continued network expansion.

There is a clear gap in average revenue per parcel (RPP) between Poland and international markets. In Q2 2025, Poland’s RPP was PLN 9.36 (up from 9.27 in Q2 2024). Internationally, RPP reached PLN 12.85 (up from 11.11). As a result, the Group’s average RPP rose to PLN 10.91 from 9.92 a year earlier, reflecting the strategic shift toward higher-priced international services.

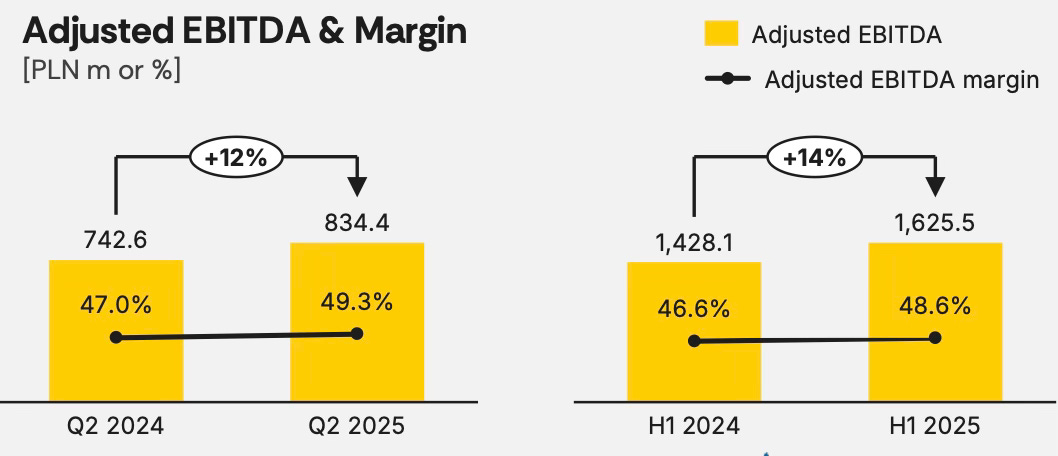

Adjusted EBITDA

Adjusted EBITDA increased 13% YoY to PLN 1.0 billion in Q2 2025, with a margin of 28%. Excluding Yodel, the Group achieved a record-high margin of ~35%, a 120 bps YoY increase.

Poland

Adjusted EBITDA grew 12% YoY to PLN 83 million, with margin up 220 bps to 49%. Gains came from effective cost-per-parcel management (-2% YoY) and a greater share of non-marketplace volumes.

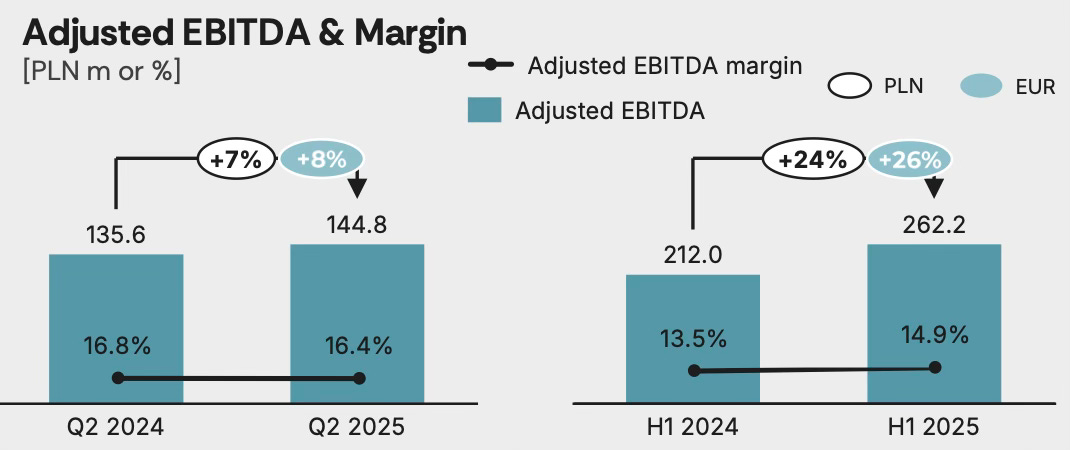

Eurozone

Adjusted EBITDA rose 7% YoY to PLN 145 million, with margin steady at 16%. Adoption of APMs reduced cost-per-parcel, though this was partly offset by higher SG&A expenses in sales and IT.

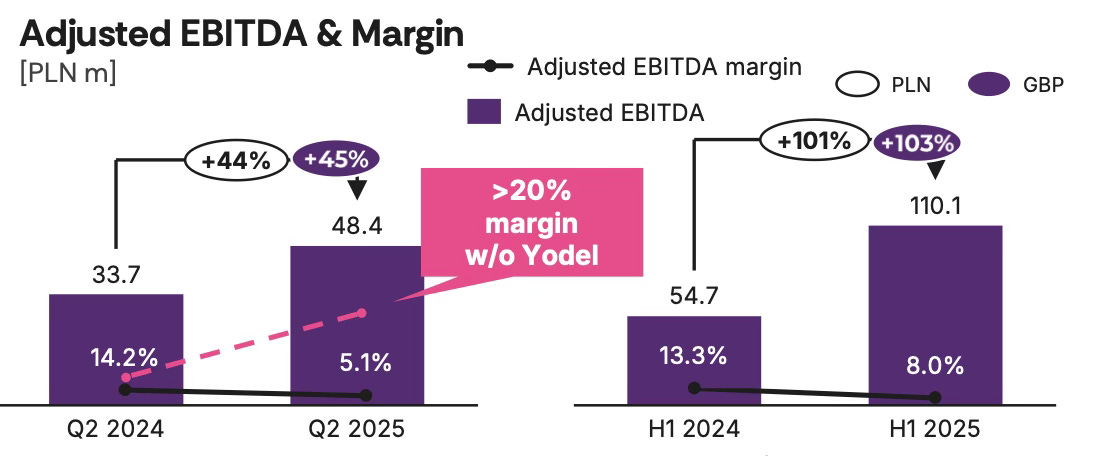

UK

Adjusted EBITDA increased 44% YoY to PLN 48 million. However, margin fell to 5% (down 920 bps YoY) due to transitional Yodel consolidation impacts. Excluding Yodel, the core UK business achieved a record-high margin above 20%.

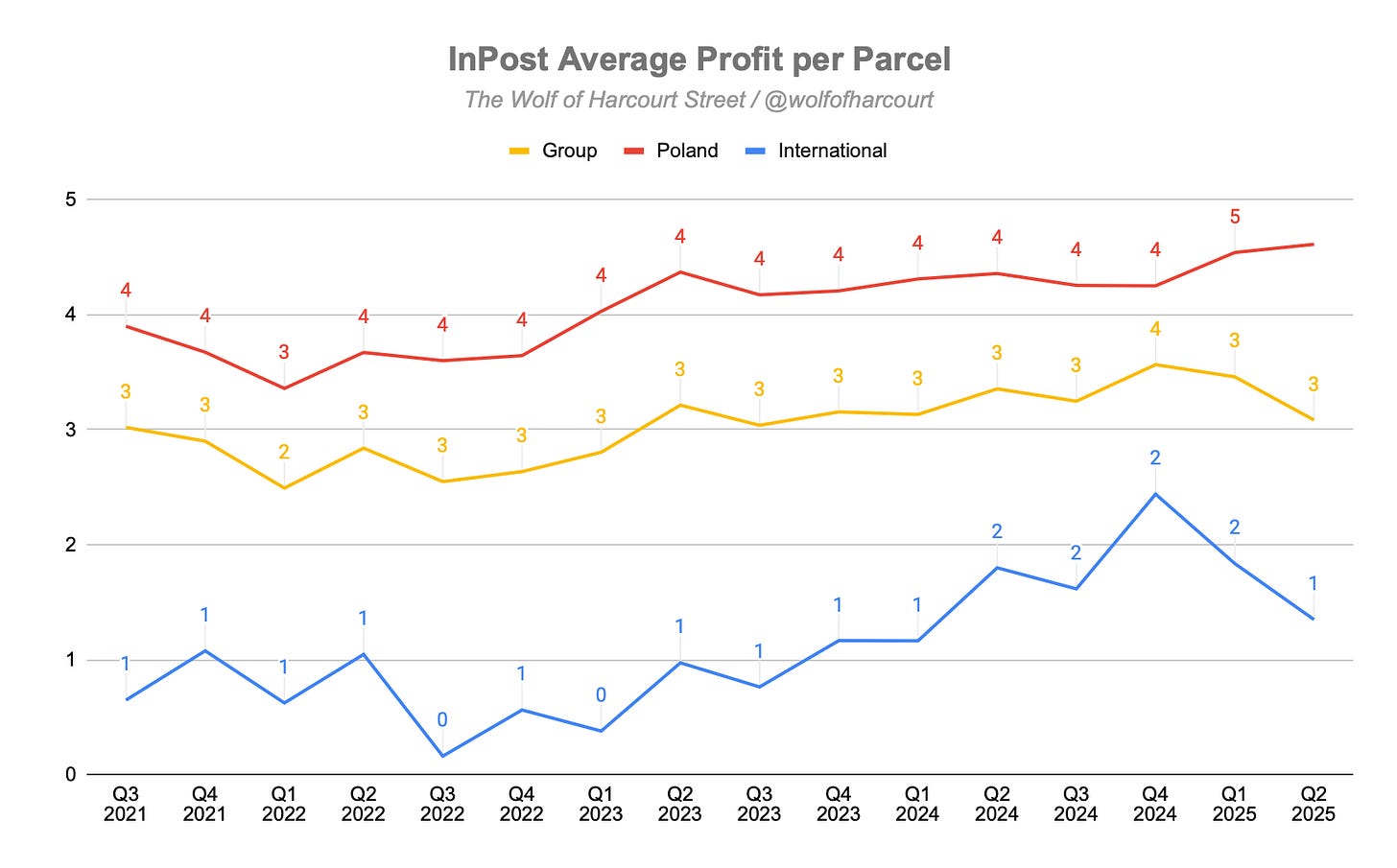

Using Adjusted EBITDA as a proxy for average profit per parcel (PPP) shows that the Group's average PPP declined by 8%, from PLN 3.36 in Q2 2024 to PLN 3.08 in Q2 2025. The International segment saw a 25% decrease, falling from PLN 1.80 to PLN 1.35. This sharp decline reinforces the narrative of aggressive international expansion and the impact of the Yodle acquisition, which added significant volume but also brought initial losses in the UK. In contrast, Poland's average PPP increased by 5.7%, from PLN 4.36 to PLN 4.61. This highlights the continued strength and efficiency of InPost's mature Polish market.

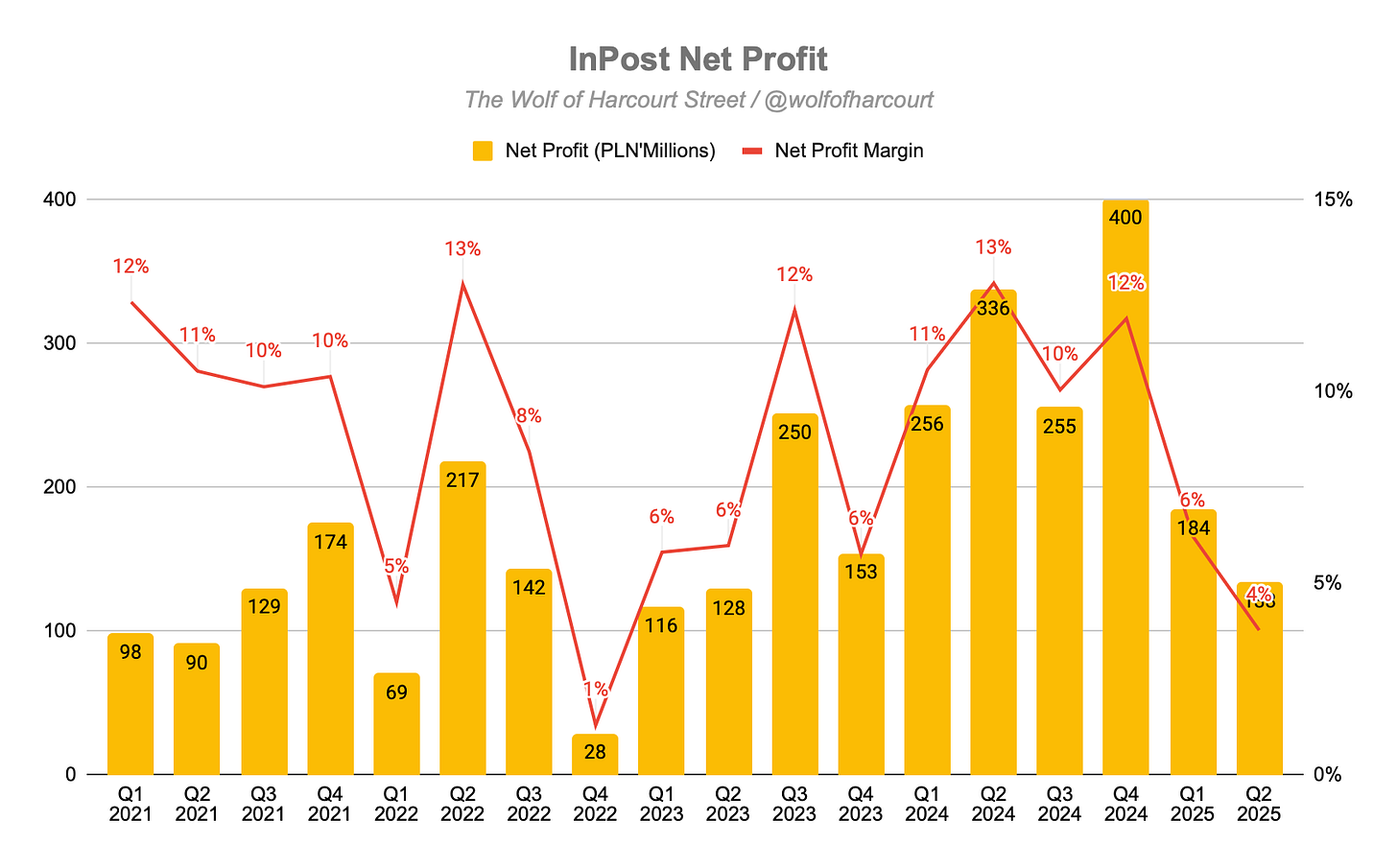

Net Profit

Net profit from continuing operations was PLN 133 million, a 60% YoY decline (vs PLN 336 million in Q2 2024). The margin dropped to 4%, down from 13% a year earlier.

This sharp decline occurred despite Adjusted EBITDA growth and caught the market off guard, with consensus estimates more than double the actual result. The drivers included:

Heavy investments in international expansion (notably Yodel)

Integration and restructuring costs

Higher depreciation and amortisation

Adverse FX movements

Depreciation and amortisation rose to PLN 528 million (from 354 million) due to Yodel consolidation, APM network expansion, and automation.

Net financial costs increased to PLN 130 million (from 74 million), driven by higher interest expenses and unrealized FX losses. A stronger PLN against the EUR also weighed on intercompany loan valuations at the Luxembourg parent level.

Additional non-cash and one-off costs also pressured results:

Incentive programs: PLN 17 million (vs 1 million in Q2 2024)

Restructuring: PLN 41 million (vs 23 million) from UK integration and Yodel

M&A costs: PLN 7 million (vs 1 million)

Management noted these costs are front-loaded, tied to rebranding, operational rationalisation, and redundancies.

While the accounting impact is severe, the underlying operations remain solid. InPost is absorbing integration costs now, while benefits will accrue over the next several quarters. Management expects net profit margins to recover to pre-acquisition levels by Q2 2026.

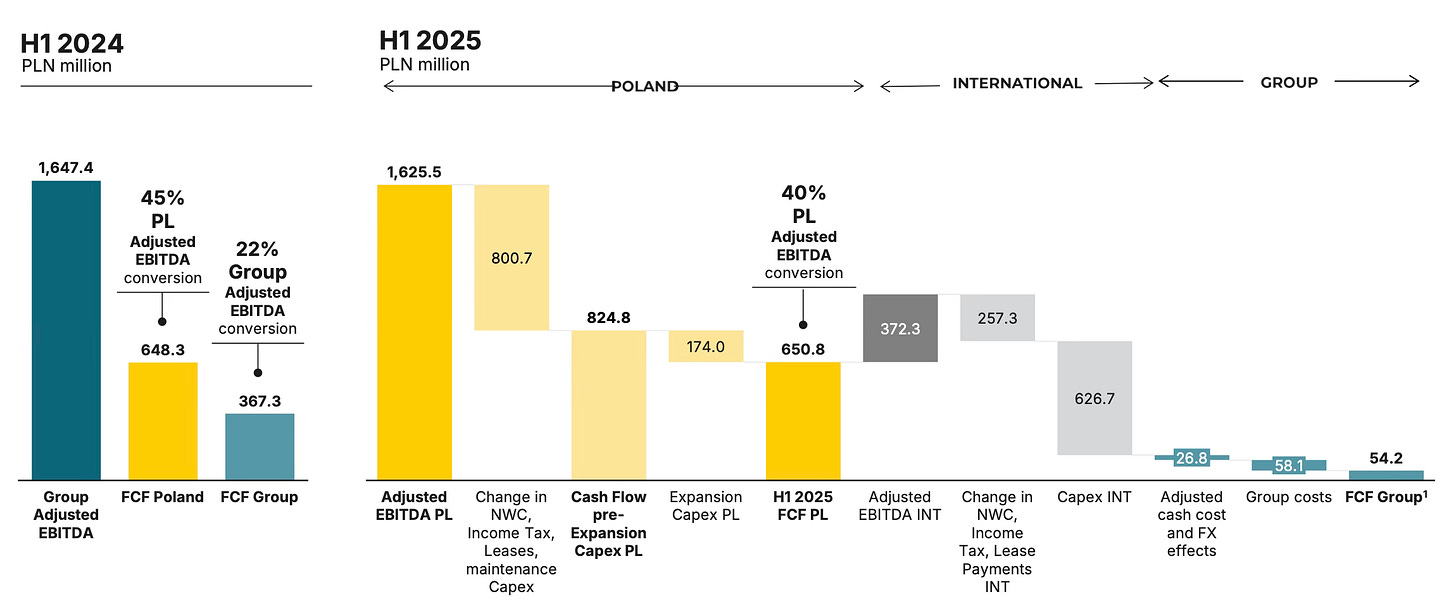

Cash Flow

In H1 2025, InPost delivered positive free cash flow (FCF) of PLN 54 million, despite elevated Capex. However, in Q2 alone, FCF was negative PLN 9 million, compared to positive PLN 154 million in Q2 2024, reflecting intense investment activity.

Total Capex in Q2 2025 was PLN 471 million (+38% YoY). For H1 2025, Capex reached PLN 812 million (+38% YoY). Roughly 60% of FY 2025 Capex (~PLN 1.9 billion) is earmarked for APM production and deployment.

Poland: Generated strong FCF of PLN 477 million, a 170% YoY increase, with FCF-to-EBITDA conversion of 57%.

International: Recorded negative FCF of PLN 421 million, reflecting heavy upfront investment in network buildout, operations, and IT.

5. Guidance

Management provided an updated outlook for FY 2025 and a trading update for Q3 2025, which includes revisions to prior guidance.

Parcel volume growth in the high 20s percent range for FY 2025 (+25–30% YoY).

High single-digit growth in Poland.

Mid-double-digit growth in Eurozone markets.

UK volumes to almost triple, driven by Yodel consolidation and APM expansion.

Revenue growth in the high 30s percent range for FY 2025 (+35–40% YoY).

Adjusted EBITDA increase in the low to mid-20s percent range (+20–25% YoY). Overall margin will be lower YoY due to the rising share of UK operations.

Poland margins at a high 40s level.

Eurozone margins higher YoY due to core business profitability, slightly offset by Sending consolidation.

UK margins temporarily lower YoY due to Yodel consolidation.

Management also plans to accelerate deployment of 15,000 new APMs across all markets.

In summary, guidance reflects dynamic market conditions and the push for international expansion, particularly the impact of Yodel and continued network rollout. While these investments weigh on margins and cash flow in the short term, underlying profitability in Poland and the Eurozone remains strong, and international growth is accelerating.

6. Conclusion

Having reviewed countless earnings reports over the years, InPost’s Q2 2025 results tell a familiar story: strategic investment for future dominance at the expense of near-term profit.

The company delivered robust growth with group volume up 23% and revenue up 35% YoY. For the first time, more than half of revenue originated from its international business, underscoring the success of diversification efforts. Adjusted EBITDA reached PLN 1 billion. However, reported net profit fell sharply, down 60% YoY, reflecting front-loaded integration costs from the Yodel acquisition, along with higher depreciation and amortisation from aggressive network expansion and acquisitions.

Management reiterated confidence in restoring profit margins to pre-acquisition levels by Q2 2026. Strong underlying performance in Poland (49% Adjusted EBITDA margin) and across the Eurozone suggests these short-term sacrifices are the foundation for long-term leadership and profitability. Mature margins in Poland hint at what could be achieved as international operations scale, which is the key reason investors should remain excited about InPost.

Taking a step back, InPost is clearly executing a consumer-centric strategy, built on brand loyalty, innovative technology, and a measurable unit cost advantage that enables rapid pan-European expansion:

Loyalization as a Core Asset: Management views loyalization as the company’s real asset and the foundation of growth, profitability, and long-term leadership. This is a sharp contrast to traditional logistics providers that prioritize B2B relationships. The metrics are striking: APM NPS of 77, an internal NPS of 96, and 14.6 million loyal app users who represent over 70% of APM customers and drive roughly 80% of total volume. These users are highly engaged, and their loyalty is a competitive edge.

Innovative Network Expansion via Battery-Powered APMs: InPost’s minority investment in Bloq.it, a battery-powered APM technology company, is described as an “offensive play.” This removes infrastructure and solar panel constraints, unlocking highly attractive yet previously inaccessible urban locations in the Eurozone and UK. Deployment costs also fall significantly. InPost plans to roll out 20,000 units in the next five years, with 2,000 scheduled for this year.

Focus on Out-of-Home Conversion: The Yodel acquisition is not about building a traditional to-door business in the UK. Instead, the strategy is to convert existing to-door volume into APM deliveries, which offer both higher customer satisfaction and lower costs. Integration has been swift, with logistics networks being consolidated into “one network,” operational discipline tightened, and 16 depots closed since the deal.

Quantifiable Unit Cost Advantage: InPost highlights the significant unit cost gap between APM and to-door delivery. In Poland, APM is roughly 30% cheaper; in the UK, the gap is 20–25%. This structural cost advantage fuels the company’s aggressive rollout and provides confidence in its ability to disrupt mature markets. It not only supports competitive pricing but also strengthens profitability as volumes scale.

InPost is prioritizing market disruption and customer loyalty over short-term profitability. While this approach depresses earnings today, history shows that such strategies often lay the groundwork for outsized long-term success. Encouragingly, InPost’s organic growth already outpaces market growth in every region where it operates.

After falling 13% following the earnings, the stock now trades at a forward EV/EBITDA multiple of just 6. The implied expectations are consequently very undemanding, and with the business less reliant on Allegro due to its diversification efforts, the residual risk feels more than compensated for. From here, not much has to go right for the stock to perform.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Excellent in-depth update. The one I just never have enough patience to do myself lol, though I did come to the same conclusions yesterday. The way this company scales, where they are way ahead of even Amazon, in the UK, is incredible. Laser-focused. I'll happily trade today's (in the large scheme of things, irrelevant) profits of today for the economic moat of tomorrow.

The business is growing well, most margins expanding. Expecting to see some bottom line hit while it digests, integrates and extracts economies from Yodel.