Rather than a full investment thesis, this post serves as a 'Quick Pitch' for a new stock I’ve recently added to the portfolio. I'd like to give a shoutout to regular reader Laurent, who first brought this company to my attention. If you'd like to see more Quick Pitches like this, please hit the like button. Also, feel free to suggest other stocks I should check out by commenting below or replying to this email.

Contents

Introduction

Moat Analysis

KPI & Financial Snapshot

Growth Opportunity

Risks

Valuation

Investment Outlook

1. Introduction

InPost is a Polish e-commerce delivery company listed on the Euronext Amsterdam. It operates as an out-of-home (OOH) e-commerce platform, providing parcel locker services across Europe.

InPost’s operations span the entire e-commerce value chain, creating synergies in first- and middle-mile logistics that enhance the experience for both merchants and consumers. Their services cater to both business-to-customer (B2C) and customer-to-customer (C2C) deliveries.

The practicality and cost-efficiency of deliveries to Automated Parcel Machines (APMs) and Pick-Up Drop-Off Points (PUDOs) have made these options popular with customers. APMs and PUDOs are strategically located in high-traffic areas such as local businesses, supermarkets, convenience stores, and transport hubs like train and metro stations, ensuring easy accessibility.

Irish readers may recall a similar service called Parcel Motel, which was later discontinued after its acquisition by UPS in 2017. Interestingly, Parcel Motel's founder, John Tuohy, was inspired by InPost lockers in Poland. In fact, InPost CEO Rafał Brzoska supplied the lockers to Parcel Motel and helped organise financing through a Polish bank, as Irish banks were initially unwilling to provide it.

2. Moat Analysis

InPost has established itself as a leading player in the parcel delivery industry, particularly in Poland, with several key competitive advantages:

1. Efficient Scale

InPost is the largest locker network in Europe, having achieved efficient scale with its extensive network of APMs. The company operates 23,470 APMs, 85% of which are within a 7-minute walk for Poland's urban population. This scale enables InPost to deliver up to 1,500 parcels per courier per day, which is 10 times more efficient than traditional door-to-door delivery.

2. Network Effects

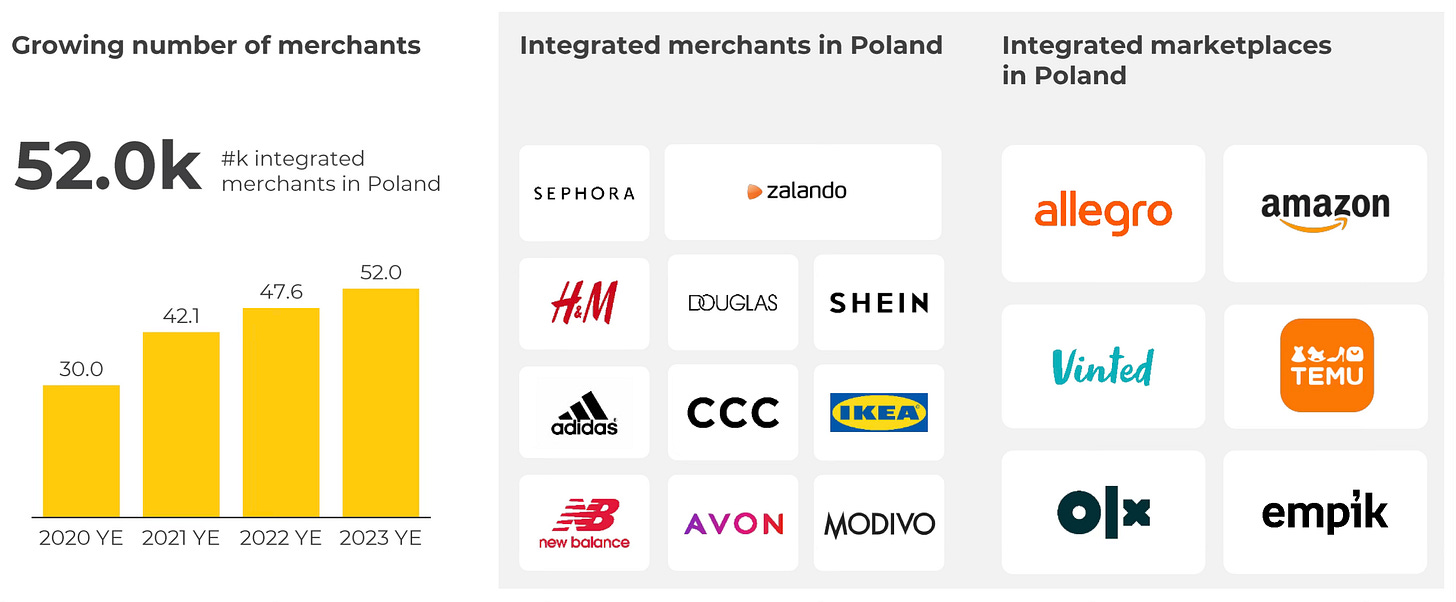

InPost benefits from strong network effects that enhance its market position and drive growth. The company has integrated with more than 52,000 online merchants in Poland. As more merchants join, the service becomes more valuable to consumers, reinforcing its dominance. InPost’s mobile app has 12.6 million active users in Poland, creating a loyal user base. Around 20% of the most loyal users generate 68% of the APM volume. Additionally, InPost Pay simplifies the shopping experience with a one-click process, boosting purchase conversions by 30-70%, depending on the online store.

3. Cost Advantages

InPost's business model delivers significant cost advantages. Last-mile delivery typically accounts for 53% of total shipping costs, but using APMs reduces these costs by 80% compared to traditional methods. These savings are passed on to consumers, making online shopping more affordable. InPost’s largely fixed cost base also allows for operating leverage as volumes grow, enabling it to offer lower prices while maintaining higher profit margins.

Customer-Centric Culture

A cornerstone of InPost’s success is its customer-centric approach. The company has an impressive Net Promoter Score (NPS) of 80, reflecting high customer loyalty and satisfaction. Key aspects of its service that delight users include:

99% of parcels are delivered within one day of purchase.

Customers have full control over pickup times, allowing flexibility.

81% of customers consider InPost Parcel Lockers the most environmentally friendly delivery method.

Label-free returns simplify the process using QR codes on smartphones.

In one notable case, more than 400 residents in a small village petitioned to prevent the removal of an InPost Locker, which the council deemed an "eyesore." The locker was highly valued for its convenience, especially by busy parents and nighttime users, serving 50-60 people daily.

This customer-centric model has created a self-reinforcing cycle of growth. InPost’s overall success stems from its integrated ecosystem, with physical lockers being just one key component.

3. KPI & Financial Snapshot

Key Performance Indicator (KPI)

InPost's Parcel Volume is a KPI that highlights the company’s growth and market penetration. In Q2 2024, InPost’s total parcel volume grew by 23% year-over-year to over 264 million parcels.

InPost’s parcel volumes are consistently growing at a much faster pace than the overall e-commerce market in its key regions. This indicates that the company is not only benefiting from market growth but is also increasing its market share.

Financial Snapshot

InPost’s revenue growth closely mirrors its parcel volume trend: the more parcels it delivers, the more revenue it generates. As volumes rise, operating leverage emerges in two distinct ways:

The fixed cost of deploying APMs, approximately €30,000 per machine, is spread over a larger number of deliveries, reducing the per-unit cost.

Delivery workers become more efficient by delivering more parcels per route, which reduces the labor cost per parcel.

Despite heavy investment in expansion, particularly in markets outside Poland, InPost’s free cash flow (FCF) margin has been steadily increasing due to the operating leverage achieved as it scales.

Building out an APM network is capital-intensive, requiring significant upfront capital expenditure and time. InPost enjoys a clear first-mover advantage over its competitors. For competitors to catch up, they would need to operate at a cash flow deficit for some time without guaranteed success. Meanwhile, InPost is already FCF positive and self-sufficient, having reached a critical mass of parcel volumes. It would also take years for competitors to match InPost's scale, as deploying 20,000 APMs in a single year is unrealistic. For context, the most APMs InPost deployed in a year in Poland was 6,000.

4. Growth Opportunity

According to the Out of Home Delivery in Europe 2024 report, the European e-commerce market is showing signs of recovery after a downturn in 2022, with 4.9% growth in 2023. This recovery is largely driven by the rise of OOH delivery solutions and PUDO points. Sustainability is a major concern, with green last-mile delivery solutions gaining momentum. In 2023, APMs grew by 29%, and PUDO points by 6%, with key markets including Poland, the UK, France, and Germany.

InPost has a clear reinvestment runway focused on expanding its APM network across Europe and building a pan-European locker system. The company is actively expanding beyond its core Polish market into other European countries. The e-commerce market in the rest of Europe is 40 times larger than in Poland. InPost has established a strong presence in France following its acquisition of Mondial Relay for €513 million in 2021. In the UK, InPost already leads the APM market with 8,000 machines. Recently, Shopify announced that InPost UK parcel locker delivery will be available to all its merchants.

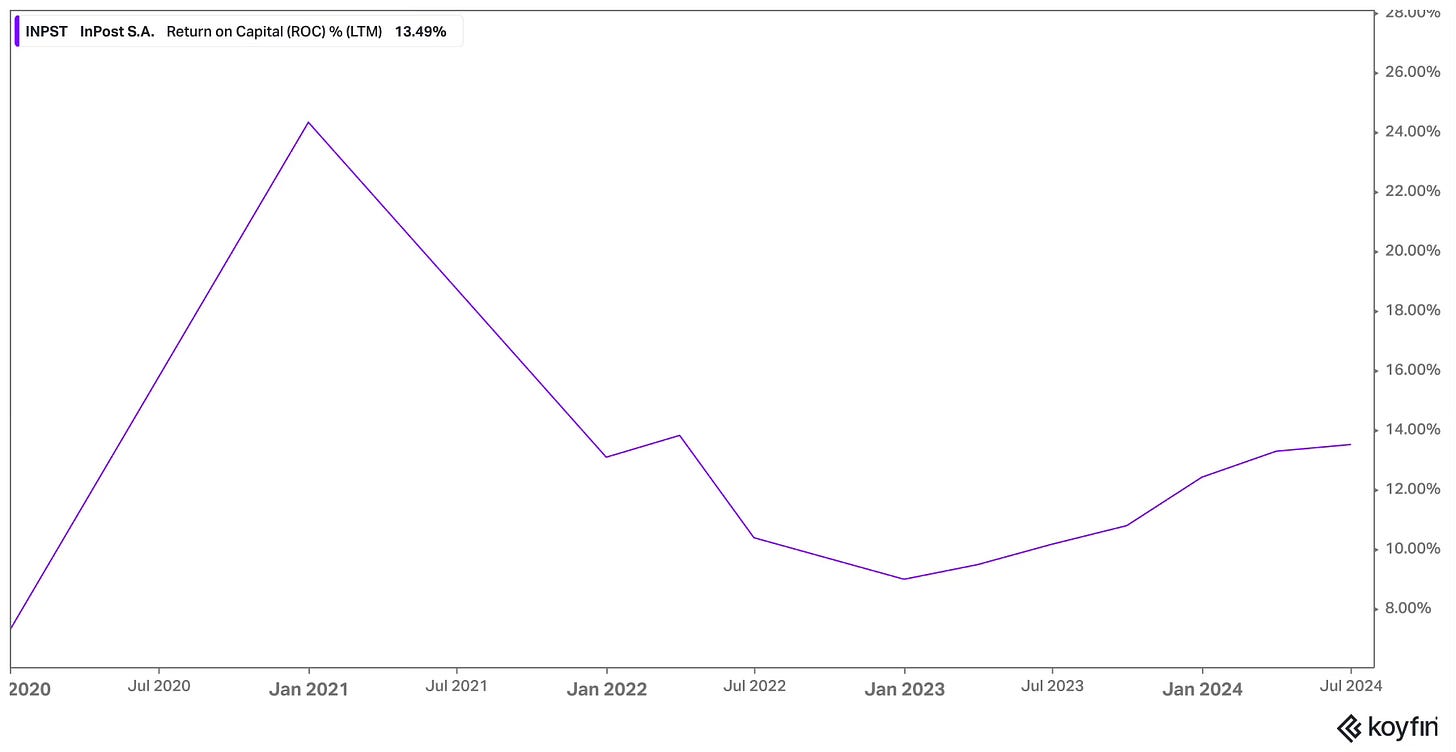

Another key mission for InPost is to create a pan-European locker network. The ability to drop off a package at a locker in Lisbon and have it delivered to another locker in Berlin for a fraction of the cost holds significant value for customers. This service doesn’t currently exist, but based on a quick Google search, it costs approximately €18 to do this via traditional door-to-door delivery, with a minimum delivery time of three days. This type of service would be impossible for local players to replicate. As a result, InPost, with its multi-country coverage, is uniquely positioned to achieve this. This reinvestment runway has driven an improving return on capital over the past 18 months, following the impact of the Mondial Relay acquisition.

5. Risks

The main risk of competition facing InPost comes from two sources:

Traditional logistics players, including both established companies and new entrants.

E-commerce marketplaces like Amazon and Allegro, which have their own parcel volumes and could potentially develop their own APM networks given their financial resources.

However, I don't see e-commerce marketplaces as a significant threat to InPost due to its counter-positioning. InPost is merchant and marketplace agnostic, meaning it can spread the cost of its APM network across its entire user base. In contrast, Amazon and Allegro can only distribute costs over their specific user bases, giving InPost a lasting cost advantage. This also ties back to the failure of Parcel Motel, which began when it was acquired by UPS and became a fully closed network, used exclusively by UPS. Additionally, Amazon’s Prime service has conditioned customers to expect door-to-door delivery.

7. Valuation

Price-to-Earnings Ratio

In terms of valuation, InPost is currently trading at 24 times forward earnings, which I believe is reasonable. The company is well-positioned to continue growing revenue by over 20% annually for the next several years due to international expansion opportunities outside Poland and increasing volumes within Poland, where GDP growth is four times faster than the rest of Europe. As people become wealthier, they tend to buy more, which should drive further growth. Additionally, InPost is poised to benefit from increased operating leverage as it scales, meaning earnings should grow faster than revenue.

Reverse DCF

By reverse engineering InPost's current share price of €17.00 (€8.5 billion market cap), the market seems to be pricing in a growth rate of just 9.2% annually over the next 10 years. This assumption appears conservative given InPost's rapid market share growth and the operating leverage it stands to gain. The current share price seems to reflect only the value of InPost's Polish operations, with little to no consideration for its international business.

8. Investment Outlook

InPost is a fascinating company, well-positioned to capitalize on the rise of e-commerce in Europe with a business model focused on efficiency, cost advantages, and customer satisfaction. With a clear path for reinvestment and expansion into new markets, InPost offers strong long-term return potential. For more insight into InPost, I recommend checking out the Quality Investing podcast by Jake Barfield featuring CEO Rafał Brzoska.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

I live in Poland, and I admit that ever since InPost appeared, I have no desire or need to use other courier companies. If they maintain their high level of service in other markets as well, they will soon become a true monopolist in this industry.

Thanks for posting!

I'm thinking about building a position, but my problem with the case is that I find it difficult to see what’s unique about it. Seems very easy to copy. Very volatile quarterly reports. High debt ratio. Requires large investments to continue expansion at the previous pace. I’m concerned they may be spreading too much geographically. The question is how far we are from drone deliveries? Technological changes could disrupt existing infrastructure.

My opinion is that Inpost is well-positioned to capitalize on the continued growth in the e-commerce sector and delivery market. I’m missing something unique to make my investment. I think any current logistics company could set up parcel lockers. However, I must admit they are performing exceptionally well, so maybe I’m missing something.