Lessons Learned From A Failed Investment

I Bought DocuSign in 2021 and Sold at a 70% Loss: Here’s What I Learned

In early 2021, I purchased shares in DocuSign (Ticker: DOCU), only to sell them less than three years later in 2023 at a painful 70% loss. In this article, I’ll share the lessons I learned from this failed investment to help you avoid making similar mistakes.

Original Investment Thesis

Before analyzing what went wrong, it’s important to revisit the original reasons for investing. My investment thesis for DocuSign centred on two key pillars:

1. Market Leadership

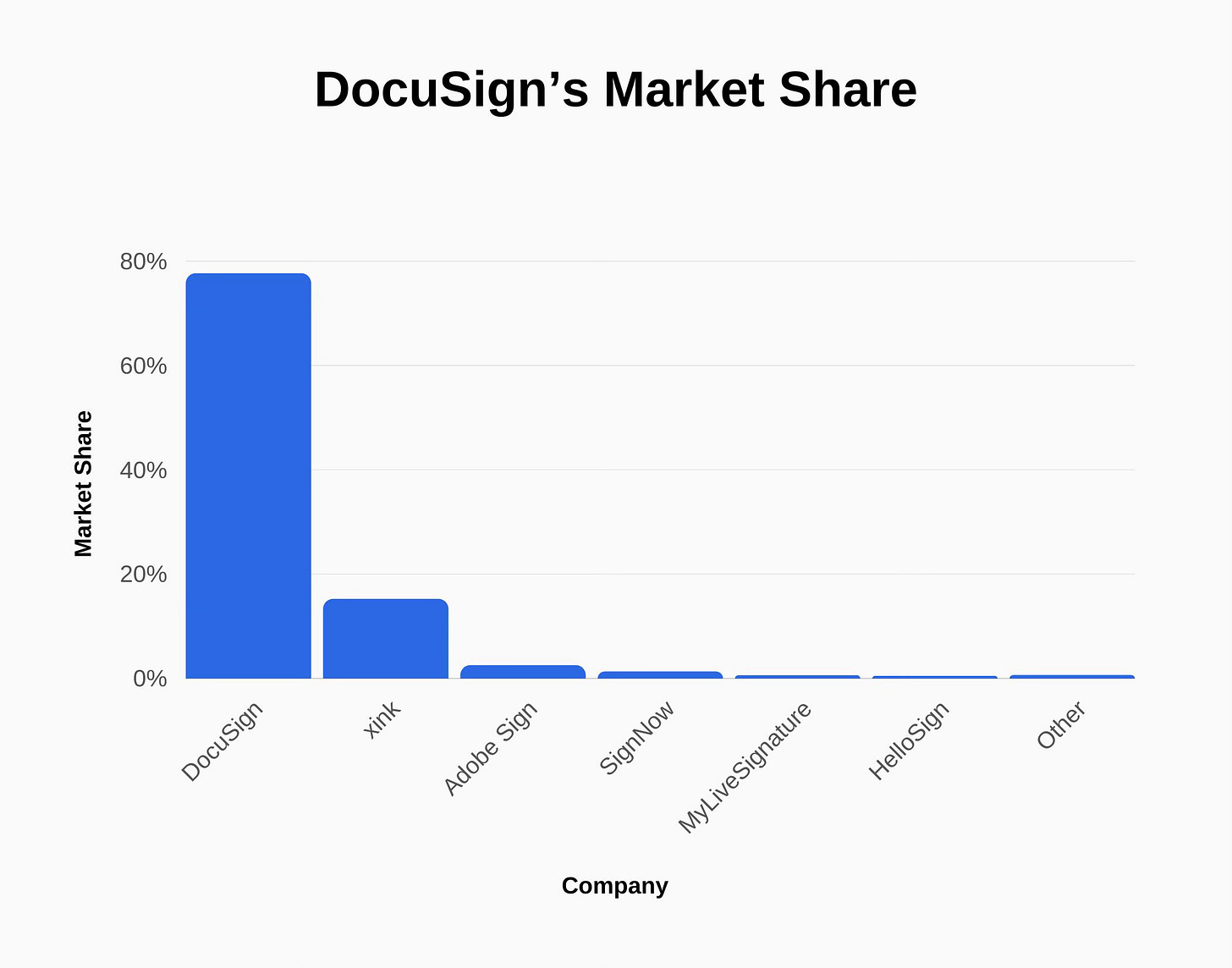

At the time, DocuSign was the clear market leader in the e-signature industry, commanding almost 80% of the market share.

The company boasted over 800,000 individual customers, including top-tier brands such as Netflix, Microsoft, and Apple. Operating as a SaaS platform, DocuSign achieved gross margins north of 75%, with revenue growth accelerating at 49% due to the pandemic-fueled shift to remote work.

2. Market Opportunity

The e-signature market was projected to grow to $25 billion, with DocuSign’s broader "Agreement Cloud" potentially doubling the addressable market to $50 billion. I saw e-signature as a Trojan horse, enabling DocuSign to onboard customers and upsell additional services in the Contract Lifecycle Management (CLM) market.

Signing contracts was just one small part of a much larger process, involving numerous pre- and post-signing activities. With digital transformation accelerating, demand for online, automated agreement processes was surging. Additionally, DocuSign’s leadership position in Gartner’s Magic Quadrant for CLM reinforced my confidence in its ability to execute and innovate.

Moat Analysis

With the investment thesis established, let’s examine why it ultimately failed. The primary issue was a lack of a durable competitive advantage—or "moat." DocuSign’s business fell short in four key areas: switching costs, network effects, intangible assets, and cost advantages.

1. Switching Costs

DocuSign’s user-friendly platform made it easy to adopt, but also easy to leave. Customers could switch to competitors like Adobe Sign, signNow, or Dropbox without incurring significant financial or operational disruption. This lack of substantial switching costs undermined customer loyalty and left DocuSign vulnerable to competitors.

2. Network Effects

Although DocuSign had a large user base, its platform didn’t benefit from network effects in the same way social media platforms or marketplaces do. The value of using DocuSign didn’t increase with more users; it depended primarily on the service’s reliability and features. Competitors could easily replicate its functionality without needing to build a massive network, limiting DocuSign’s edge.

3. Intangible Assets

DocuSign’s strong brand reputation for security and ease of use was a competitive advantage, but not a unique or defensible one. Many competitors built comparable reputations, offering similar levels of security and functionality. This diluted the impact of DocuSign’s brand strength.

4. Cost Advantages

While DocuSign’s subscription-based model delivered consistent revenue, the company lacked meaningful cost advantages. The e-signature market is highly competitive, with multiple players offering similar services at comparable prices. Established competitors like Adobe could leverage their existing distribution networks to bundle services and undercut DocuSign’s standalone pricing.

Investment Outcome

Despite being a leader in the e-signature market and experiencing pandemic-driven demand, DocuSign lacked the competitive advantages necessary to sustain long-term success. I failed to appreciate the vulnerabilities in its business model. As competition intensified, revenue growth plummeted from 49% to less than 8% in the past year as e-signature market share declined.

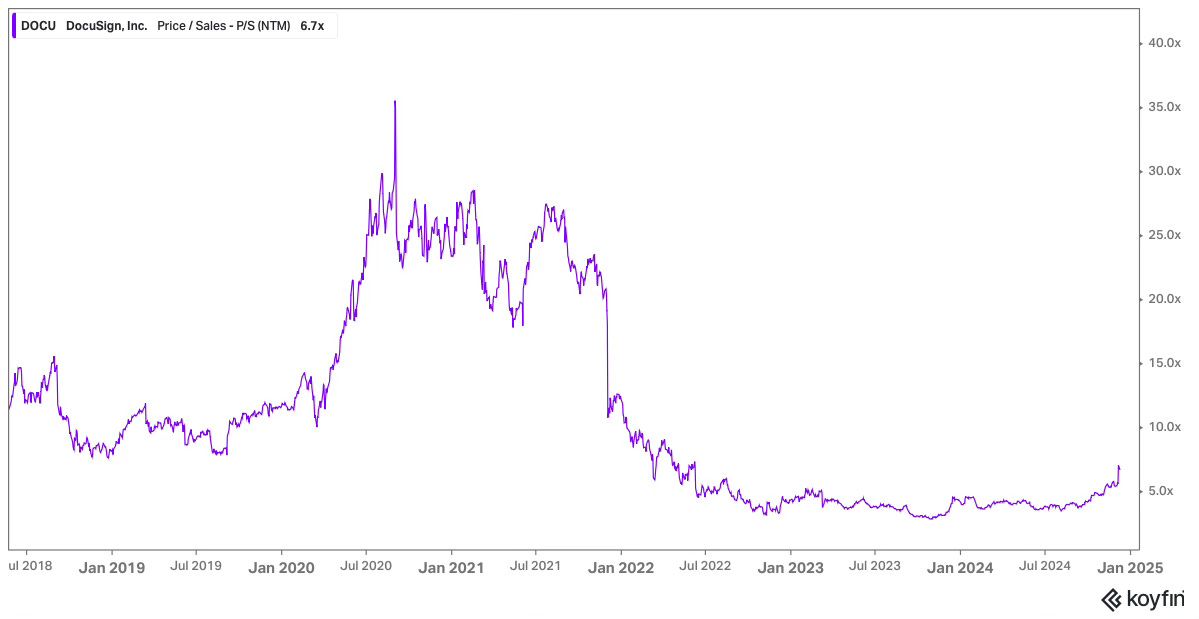

In 2021, the market priced DocuSign for hyper-growth. Wall Street analysts projected FY25 revenue of $3.88 billion, but the company is now on track to generate just $2.96 billion—a 31% shortfall. This gap led to significant multiple compression: DocuSign’s Price-to-Sales ratio fell from a lofty 25x in 2021 to far more modest levels.

Conclusion: Lessons Learned

Reflecting on this investment, here are the key takeaways:

1. Focus on Future Potential, Not Current Performance

Where a company is headed matters more than where it stands today. The stock market is forward-looking, and evidence of a durable moat provides confidence in a company’s future prospects. Great current results don’t guarantee sustained success.

2. Always Consider Valuation and Margin of Safety

Valuation is critical. Even if your thesis plays out as expected, overpaying for a stock can erode returns. In this case, the entry point offered no margin of safety; the stock was priced to perfection and punished severely when expectations weren’t met.

3. Practice Position Sizing

One thing I got right was position sizing. I limited DocuSign to 3% of my portfolio, ensuring the broader portfolio was insulated from a major drawdown. Even the best investors make mistakes, but proper position sizing can mitigate the damage when they do.

Investing is a continuous learning process. This experience reinforced the importance of rigorous due diligence, thoughtful valuation, and disciplined risk management. I hope these lessons help you avoid similar pitfalls in your investing journey.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Nice article. I think the same conclusion can be reached with ZM (and Slack if CRM hadn’t bought them), as initial Zoom adopters switch to Teams for cost savings. MSFT office dominance is so great it looks silly to retain both Zoom and Slack when Teams does the same thing. Our small company (<100 people) expects to save $20k+ next year converting.

Great piece sir, thanks for putting together and for sharing.