Welcome back to the Wolf of Harcourt Street Newsletter.

Earlier this week, we launched the new Community Chat feature, and it’s already proving valuable to our members. For example, we recently heard from an investor based in Poland who shared that InPost is being used to send luggage on domestic flights, as it's significantly cheaper than checking bags directly onto the plane. This is a use case I hadn’t considered before and wouldn’t have discovered without the community.

You can join the conversation below.

With all that being said, let’s dive into today’s edition!

Todays Agenda

Mercado Libre Consumer Trends in Argentina & Colombia Digital Wallet

Nubank Expands Nu Limite Garantido

InPost Gemius Market Data & Opening Largest Logistics Hub in Poland

Evolution Digital Industry Supplier of the Year

Meta Instagram is the Most Used Social Media App

Auto Partner September Sales Update

1. MercadoLibre (MELI)

Consumer Trends Report in Argentina

MercadoLibre reviewed consumption trends on its platform in Argentina to analyze user behavior during a year of significant economic transition. The company shared the results in a report this week. Key insights include:

After a decline in the early months of 2024, consumption has been steadily recovering since May.

This recovery is evident in both the growth of products sold on the platform and the total transaction volume in dollars. In August, MercadoLibre reached a historic record with 20 million products sold, amounting to $916 million.

More people are buying, and more SMEs are selling on MercadoLibre.

From January to September, over 1.5 million new buyers and 28,000 new sellers joined the platform. Additionally, in the first nine months of the year, sellers increased their average number of units sold by 30%.

The availability of credit is growing on both MercadoLibre and MercadoPago.

The credit portfolio, which includes consumer financing and working capital for sellers on the platform, grew by 69% year-on-year in September, measured in dollars. That month, 11.5 million consumer loans were granted to more than 4.1 million people, representing a 40% increase over the same period last year.

The end of the rental law and an uptick in mortgage credit revitalized a previously stagnant real estate sector.

From December 2023 to September 2024, the supply of rental properties tripled. In the Greater Buenos Aires Area, over 20,000 houses and apartments are now available on MercadoLibre’s real estate section. The demand for houses and apartments for sale increased by more than 43% between July and September 2024, compared to the same period in 2023.

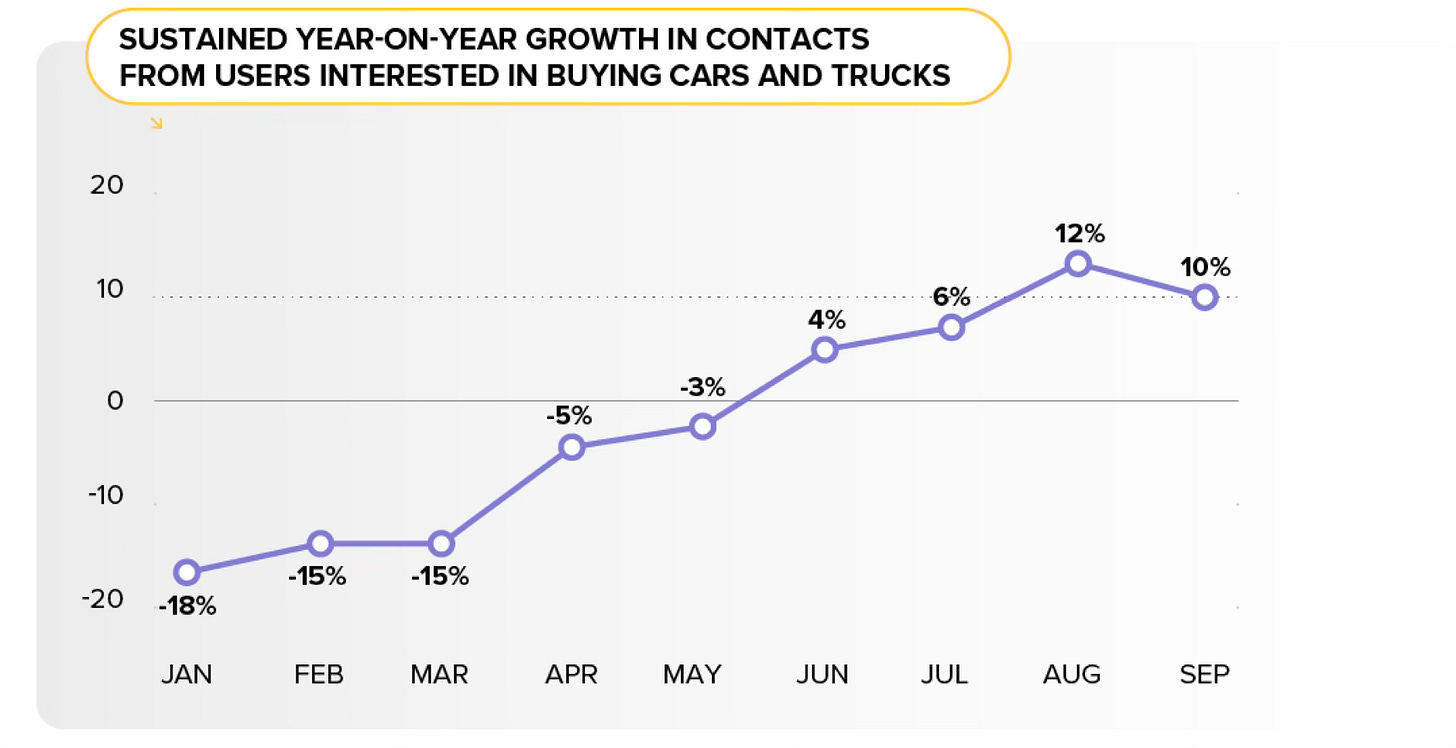

More users are looking to buy vehicles on MercadoLibre.

After a slow start to the year, interest in vehicle purchases began picking up in June, with a 10% year-on-year increase in the number of users contacting sellers by September.

Source: Mercado Libre

My Perspective: These indicators suggest the beginning of an economic recovery in Argentina’s consumption patterns. Another key takeaway is the vast amount of economic data that MercadoLibre possesses, which will become increasingly valuable as advances in AI continue. To truly benefit from AI, a company needs to collect and own large volumes of data—something MercadoLibre clearly excels at.

Mercado Pago Launches new Digital Wallet in Colombia

MercadoPago is launching a new digital wallet in Colombia starting in October, aiming to strengthen its position in the country’s fintech sector. The wallet will allow users to recharge balances via Pago Seguro en Línea (PSE), use it at partner stores, and access exclusive discounts. Users will also be able to link credit and debit cards from any local bank, track expenses, and reinvest balances on MercadoLibre or at other affiliated stores.

Source: LatAm Fintech

My Perspective: With this move, which has already been implemented in Mexico and Argentina, MercadoPago is positioning itself as a key player in Colombia’s digital payment ecosystem. The app has already been downloaded more than 600,000 times in the country.

2. Nubank (NU)

Expansion of Nu Limite Garantido Feature

Nubank has expanded its Nu Limite Garantido feature, allowing clients to use Tesouro Direto (Brazilian government bonds) held with Nubank as collateral to increase their credit card limits.

Initially launched in 2023, Nu Limite Garantido enabled customers to boost their credit limits using investments held with Nubank, previously limited to a dedicated savings product called Caixinha, which yields 100% of the CDI (Interbank Deposit Certificate).

This feature allows customers to increase their purchasing power while keeping their money invested and earning returns. With a few clicks, clients can select the amount of government bonds to convert into an additional credit limit.

Currently, over 6.7 million customers use Nu Limite Garantido through Caixinha, and the maximum combined credit limit (pre-approved and Nu Limite Garantido) is set at R$150,000.

Source: Nubank

My Perspective: This expansion is a win-win for customers, offering more credit flexibility while promoting the use of Nubank’s investment products. It should also continue to strengthen Nubank’s competitive position.

3. InPost (INPST)

Gemius 2024 Report

The latest Gemius 2024 data reaffirms InPost’s strong presence in the Polish logistics market, where it dominates both the parcel locker and door-to-door delivery segments. Key insights include:

InPost holds an 88% market share for deliveries to parcel machines and 45% in door-to-door deliveries in Poland, leading in both categories.

Parcel machines are the preferred option for online shopping deliveries (81%) and returns (36%), with InPost’s Paczkomat dominating both (88% for deliveries and 82% for returns).

Important factors for customers include proximity of parcel machines (84%), the ability to track parcels (83%), and weekend delivery options (73%).

Innovations like InPost's mobile app (with 13 million users), contactless parcel locker opening, and label-free shipping have distinguished it from competitors.

A large majority (93%) of InPost customers use the contactless delivery option.

Source: ISB

My Perspective: Third-party data like this is crucial for validating an investment thesis. The Gemius report provides strong support for InPost shareholders, highlighting its market dominance and innovation.

Opening Largest Logistics Hub in Poland

InPost has opened the largest logistics hub in Poland, located in Wola Bykowska near Warsaw and Łódź. The facility, spanning 36,000 square meters, can handle up to 85,000 packages per hour, underscoring InPost’s rapid growth and expanding logistics capabilities.

This new center is double the size of the existing facility, which opened in 2016, and reflects the significant increase in demand for logistics services in Poland. InPost is now the second-largest operator in the country in terms of warehouse and logistics space.

Source: Manager+

My Perspective: Building a competitive moat takes time and investment, and that's exactly what InPost is doing. By the end of Q2 2024, InPost had over 73,000 out-of-home points across nine countries, including more than 40,000 parcel machines and nearly 33,000 PUDO points. This extensive network positions InPost as a leader in out-of-home delivery solutions across Europe.

4. Evolution (EVO)

Digital Industry Supplier of the Year

The eleventh annual Global Gaming Awards Americas took place at The Venetian Las Vegas, hosted by Today Gaming America and Gambling Insider. These prestigious awards recognize outstanding companies and individuals in the gaming industry. Winners were selected through a rigorous shortlisting and voting process by 100 senior industry executives with extensive experience in the Americas.

Evolution was crowned Digital Industry Supplier of the Year and also earned second place for Digital Product of the Year for Crazy Time.

Source: Gaming America

My Perspective: Despite Evolution's market leadership in a growing industry, the company is trading at rock-bottom valuations. Either the market is wrong, or the industry experts are.

5. Meta (META)

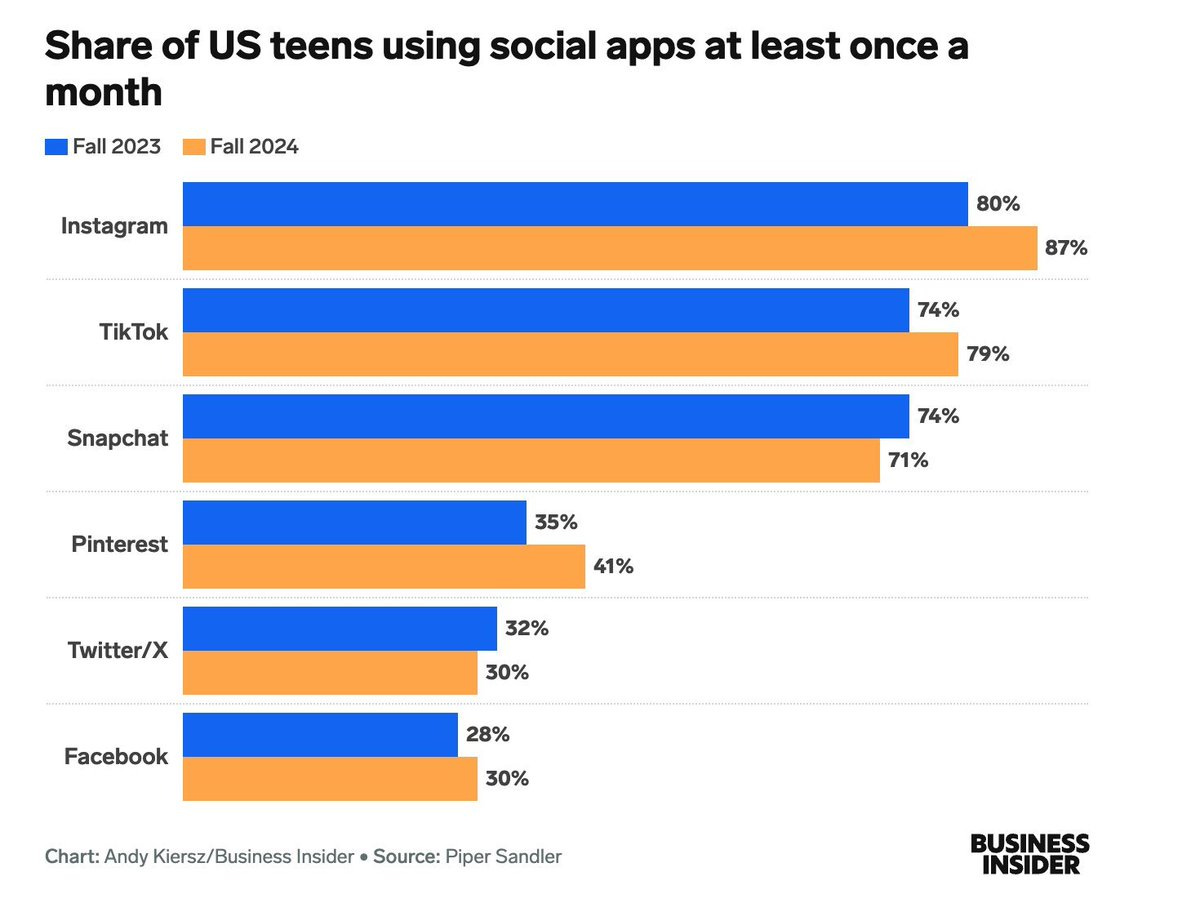

Instagram Remains the Most Used Social Media App

Piper Sandler's latest survey of U.S. teenagers shows that Instagram is the most used social media app, with 87% of teens reporting monthly usage—an all-time high. TikTok ranks second at 79%, while Snapchat comes in third at 71%, showing a slight decline. Meanwhile, Facebook—once considered irrelevant by younger generations—is also gaining traction among teens.

Source: Business Insider

My Perspective: Not only has Instagram increased its share of U.S. teen usage from 80% to 87%, but it has also widened the gap over TikTok from 6% to 8%. As I’ve mentioned before, Meta could be one of the biggest beneficiaries of AI, given the vast amount of unique data it possesses. This survey suggests that this data volume is only going to keep growing.

6. Auto Partner (APR.WA)

September Sales Update

APR reported revenue of PLN 350.95 million for September 2024, a 5.5% YoY increase. Year-to-date revenue through September 2024 has grown by 14%.

Source: Bankier

My Perspective: APR’s monthly sales growth tends to be lumpy, especially in Q3. Revenue grew by 20% in July but slowed to 7% in August and 5.5% in September. Not much more can be interpreted from this data until the company reports Q3 earnings in November.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com