Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

The Nubank investment thesis will be released this Thursday 27 June. Make sure you’re subscribed so you receive it straight to your inbox.

With all that being said, let’s dive into today’s edition!

Todays Agenda

MercadoLibre Experiences Credit Card Reader Boom in Mexico

Evolution Latest Launches

Adyen Market Leadership and Latest Partnerships

Meta Reality Labs Update

Airbnb French Hotels Launch $10 Million Lawsuit

1. MercadoLibre (Ticker: MELI) Experiences Credit Card Reader Boom in Mexico

Mercado Pago's mobile credit card readers in Mexico have more than doubled in adoption over the past year. This surge is indicative of a growing shift towards digital payments in a market traditionally dominated by cash.

Mexico, despite being the second-largest economy in Latin America, lags behind Brazil in digitalization. Traditional banks and local competitors like Clip are being outpaced by Mercado Pago’s affordable and accessible card readers. The number of credit card readers in Mexico has increased from 2 million five years ago to over 4 million, largely driven by third-party providers like Mercado Pago.

At a price of 149 pesos ($8.07), Mercado Pago’s readers are easy for small businesses to acquire online, enhancing their payment capabilities. The success of Mercado Pago's card readers suggests a significant shift in Mexico’s payment landscape, with fintech solutions outperforming traditional banking devices.

Beyond card readers, Mercado Pago is broadening its services to include loans, credit and debit cards, and international transfers. They approved over 1 million small-business loans last year and aim to surpass 2 million in 2024. Mercado Pago is planning to apply for a banking license to offer additional services like savings accounts, CDs, commercial loans, and mortgages.

Source: Reuters

My Perspective: Mercado Pago is positioned to play a pivotal role in advancing Mexico’s financial digitalization. The opportunity for MELI and NU in Mexico is enormous. 51% of Mexico's population remains unbanked.

2. Evolution (Ticker: EVO) Latest Launches

Spanish Language Blackjack Live in New Jersey

Evolution has launched VIP Blackjack en Español is now live in New Jersey. This development allows the world-class VIP Blackjack to be available in Spanish in North America

Source: Evolution Social Media

My Perspective: Last year, I suspected that the undersupply, particularly in Europe, was due to the multiple language offerings. It is very positive to see Evolution already launching in Spanish in U.S. states where there is a large Hispanic population. By offering games in multiple languages, it makes it harder for sub-scale competitors.

New live slot Balloon Race Released

Evolution launched a new live slot, Balloon Race which offers a captivating blend of unique slots and an exciting live Bonus game.

Source: Evolution Social Media

My Perspective: Live casino is Evolution's core competence. It is fascinating to see Evolution bridging the gap between RNG slots and live casino by introducing games that are a hybrid of both. Evolution’s pace of innovation continues to be a real strength.

3. Adyen (Ticker: ADYEN) Market Leadership and Latest Partnerships

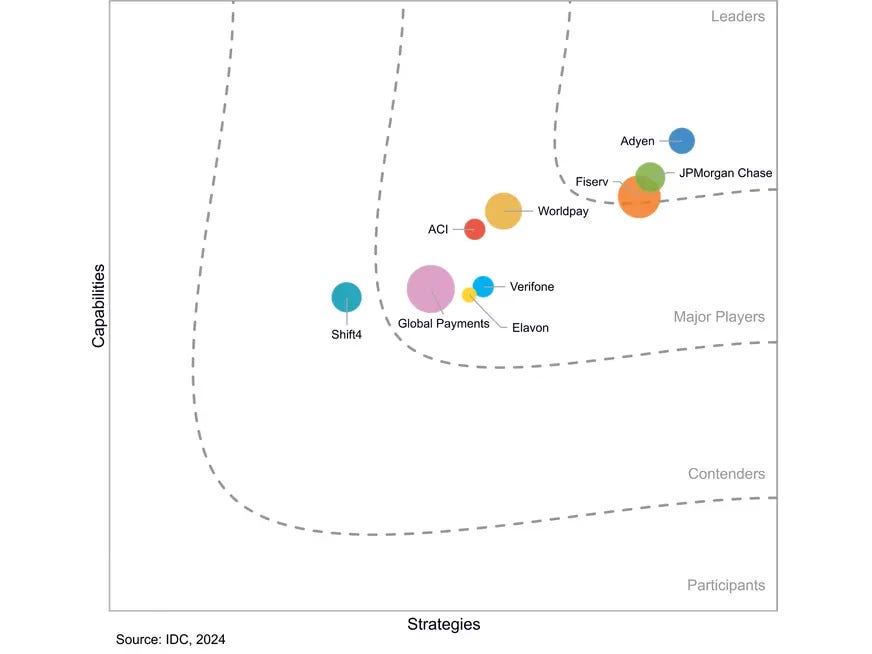

Recognized as a Leader by IDC MarketScapes

Adyen has been recognized as a Leader in the 2024 IDC MarketScape assessments for both Retail Online Payment Platform Software Providers and Retail Omnichannel Payment Platform Software Providers. This recognition highlights Adyen's comprehensive solution, innovation, and merchant focus.

Key insights include:

Comprehensive Solution: Adyen offers a single integrated platform that manages all payment processes (accepting, processing, settling) across various channels (online, mobile, in-person).

Innovation: Adyen focuses on innovation to enhance merchant outcomes, including faster, more accurate fraud detection and authentication using advanced AI/ML and biometrics.

Focus on Merchants: Adyen prioritizes customer feedback and evolving needs in developing new features and enhancements.

Source: Adyen IR

My Perspective: Adyen is the best in the business at what it does. You don’t just have to take my word for it; we can see how industry experts rank it compared to the competition.

The merchant processing landscape is more competitive than ever, and service providers today have to do so much more than was true just a few years ago. Adyen’s position as a Leader reflects their recognition of the challenges in the market and the work they have done to meet merchant needs.

- Aaron Press, Research Director, Worldwide Payment Strategies at IDC

Partnership with SumUp

Adyen and SumUp have entered into a strategic partnership to enhance the payment experience and accelerate settlements for small businesses globally. This collaboration aims to provide SumUp's merchants, particularly small and micro merchants in Europe and the UK, with faster access to their funds, enabling same-day settlements every day of the year.

The partnership addresses critical cash flow needs by allowing merchants to receive their payments within minutes rather than days, reducing the need for large working capital reserves. SumUp serves over 4 million merchants across 36 markets.

Source: Adyen IR

Partners with MECCA

Adyen has partnered with MECCA, Australia’s largest prestige beauty retailer, to enhance its payment systems both in-store and online. MECCA, which has been a leading beauty retailer for 27 years with over 110 stores and a strong e-commerce platform, aims to improve its customer experience and fraud protection through this partnership.

MECCA selected Adyen to streamline the payment process, ensuring reliability and simplicity for customers, whether they shop online or in-store. This includes the adoption of Adyen's Unified Commerce and Pay-by-Link technologies.

Source: Adyen IR

My Perspective: By partnering with companies in different industries, Adyen is diversifying its client base and expanding its reach across various sectors. Both partnerships showcase Adyen's ability to integrate its advanced payment technologies with different business models and needs.

4. Meta (Ticker: META) Reality Labs Update

Meta has announced a major restructuring of its hardware division, Reality Labs, aiming to sharpen its focus on augmented reality (AR) and the Metaverse. The restructuring consolidates Reality Labs into two main groups:

Metaverse: This group includes the Quest headset line, Horizon (Meta's social network), and related technologies.

Wearables: This new group covers the rest of Meta's hardware efforts, such as the smart glasses collaboration with Ray-Ban.

Source: Supreme Bagholder Social Media

My Perspective: The restructuring of Meta's Reality Labs division into Metaverse and Wearables groups signals that Meta is doubling down on its smart glasses technology, particularly after the unexpected success of its Ray-Ban Meta smart glasses. While the organisational structure is important and I think this move is a smart one, the success of Meta's initiatives will ultimately depend on execution.

5. Airbnb (Ticker: ABNB) French Hotels Launch $10 Million Lawsuit

A group of 26 hotels in France has initiated a lawsuit against Airbnb, alleging unfair trade practices and seeking €9.2 million ($9.9 million) in damages. Each hotel is claiming an average of €355,019. The hotels accuse Airbnb of allowing illegal ads on its platform and failing to pay tourist taxes for 2021 and 2022. They claim this has resulted in a loss of clientele and commercial disruption, as illegal ads avoid the costs associated with legal commercial activities.

Airbnb counters these claims by stating that the lawsuit is part of ongoing efforts by hotel lobbies to restrict its operations. The company asserts that it has paid over €187 million in tourist taxes to French communes and that it complies with French laws, which allow families to share their homes. The hearing is expected within a year. Airbnb indicates it will consider all legal avenues to protect its rights and the rights of its hosts if the lawsuit negatively impacts its business or host families.

Source: Morningstar

My Perspective: Regulation has always been the biggest risk facing Airbnb, and this is an extension of that risk. I don’t see Airbnb losing this, but the lawsuit highlights the growing tension between traditional hotels and short-term rental platforms like Airbnb. The lawsuit also signals a shift in the hospitality industry's approach to dealing with disruptive platforms, moving from competition to legal confrontation.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

How about ADYEN current valuation?