Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s edition!

Todays Agenda

Nubank Becomes Brazils Top Bank

Evolution October U.S iGaming Market Growth

NIO Q3 2024 Earnings

InPost Launches Locker Shops in the UK

Adyen Launches Tap to Pay in New Zealand

1. Nubank (NU) Becomes Brazils Top Bank

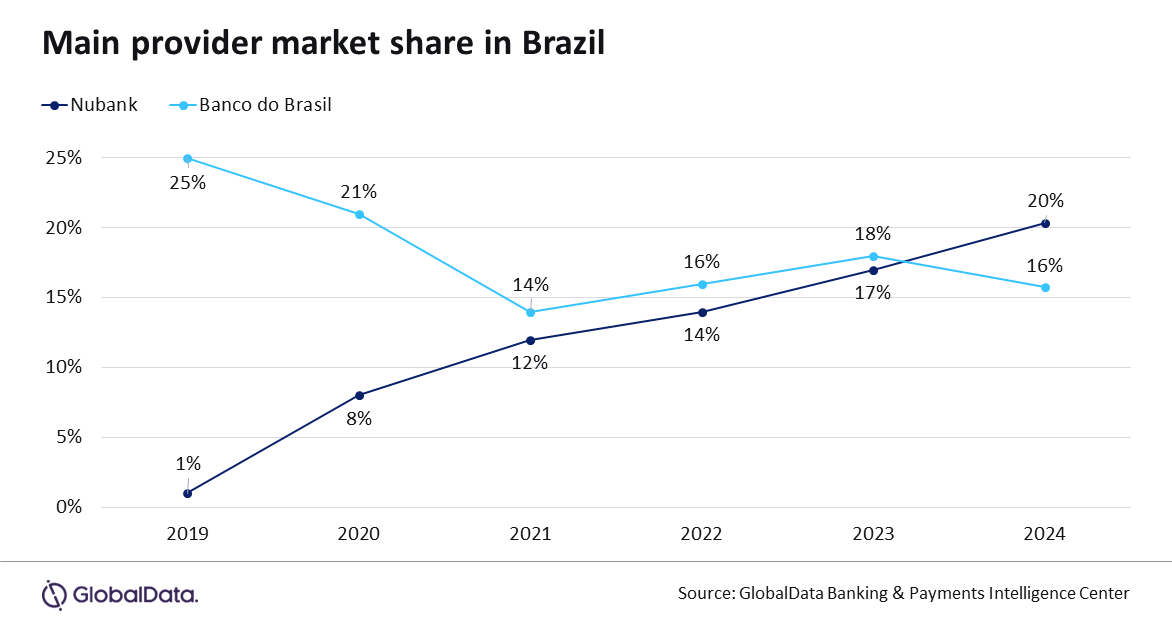

Nubank has surpassed Banco do Brasil, the nation's oldest bank, to become Brazil's leading main bank provider. As of November 2024, it boasts 100 million customers and a 20% market share. Over half of Brazilian adults use Nubank, and 20 million consider it their primary bank. This milestone makes Nubank the first digital-only bank in the world to achieve such dominance, underscoring the transformative impact of fintech on traditional banking.

Source: Global Data

My Perspective: This development should come as no surprise to regular readers, as Nubank's rise has been a recurring theme in my analysis. Its ascent highlights the challenges legacy banks face in adapting to shifting consumer preferences and the disruptive potential of fintech. A key driver of this shift in Brazil has been improved digital experiences, cited by 35% of bank switchers and an impressive 47% of those moving to Nubank.

2. Evolution (EVO) October U.S iGaming Market Growth

Pennsylvania

The Pennsylvania iGaming sector grew significantly, with revenue increasing 22.1% year-over-year (YoY) to $189.1 million, just 1.1% below the record $191.1 million achieved in March.

New Jersey

New Jersey iGaming revenue hit $213.6 million, marking a 28.1% YoY increase and a 2.8% rise from the previous record of $208.1 million in September.

Michigan

Michigan's iGaming market achieved a record-breaking $215.5 million in revenue, surpassing its previous high by 2.4%. This represented YoY growth of 37.7% and an 8.9% increase from September, demonstrating strong momentum.

Source: CDC Gaming

My Perspective: The U.S. iGaming market continues to demonstrate robust growth, presenting significant opportunities for Evolution. With no signs of slowing down, this market remains a key driver for the company.

3. NIO (NIO) Q3 2024 Earnings

Deliveries

Vehicle deliveries reached a record 61,855 units, marking a 12% year-over-year (YoY) increase and an 8% rise from Q2 2024. This solidifies NIO’s position with over 40% of China’s battery electric vehicle market for vehicles priced above RMB 300,000 ($42,350).

October deliveries reached 20,976 vehicles, suggesting another record-breaking quarter ahead, with expanding market share.

Revenue

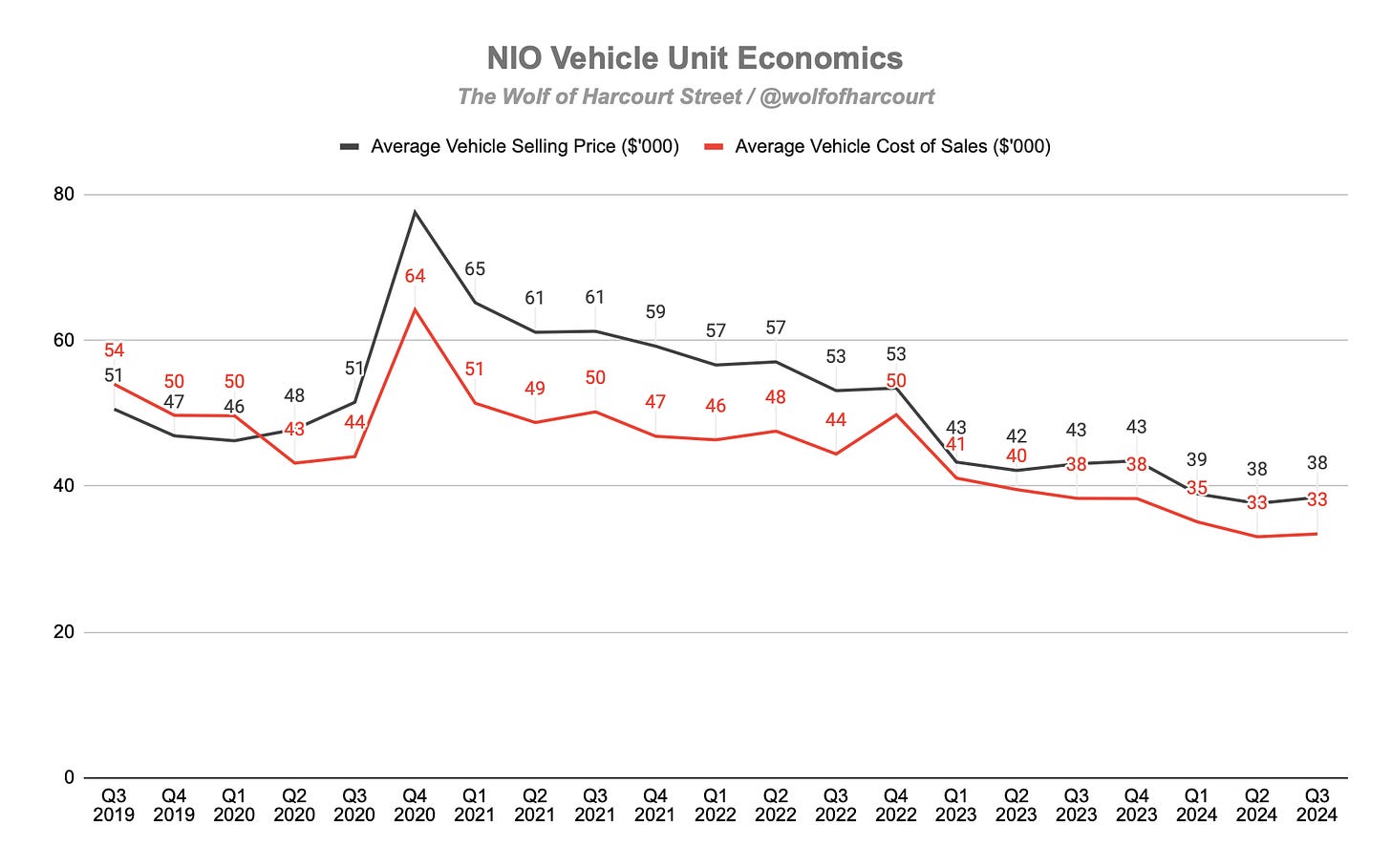

Total revenues were $2.66 billion, reflecting a 2% YoY decrease but a 7% quarter-over-quarter (QoQ) increase. Vehicle sales, comprising 89% of total revenue, amounted to $2.40 billion, down 4% YoY but up 7% QoQ.

The YoY revenue decline was primarily driven by a lower Average Selling Price (ASP) due to changes in the product mix, partially offset by increased delivery volume. As I’ve highlighted previously, the EV price war in China remains a significant concern. Although NIO’s ASP remained consistent QoQ, it declined by 11% YoY, meaning that despite selling more cars, revenue growth was constrained.

Profitability

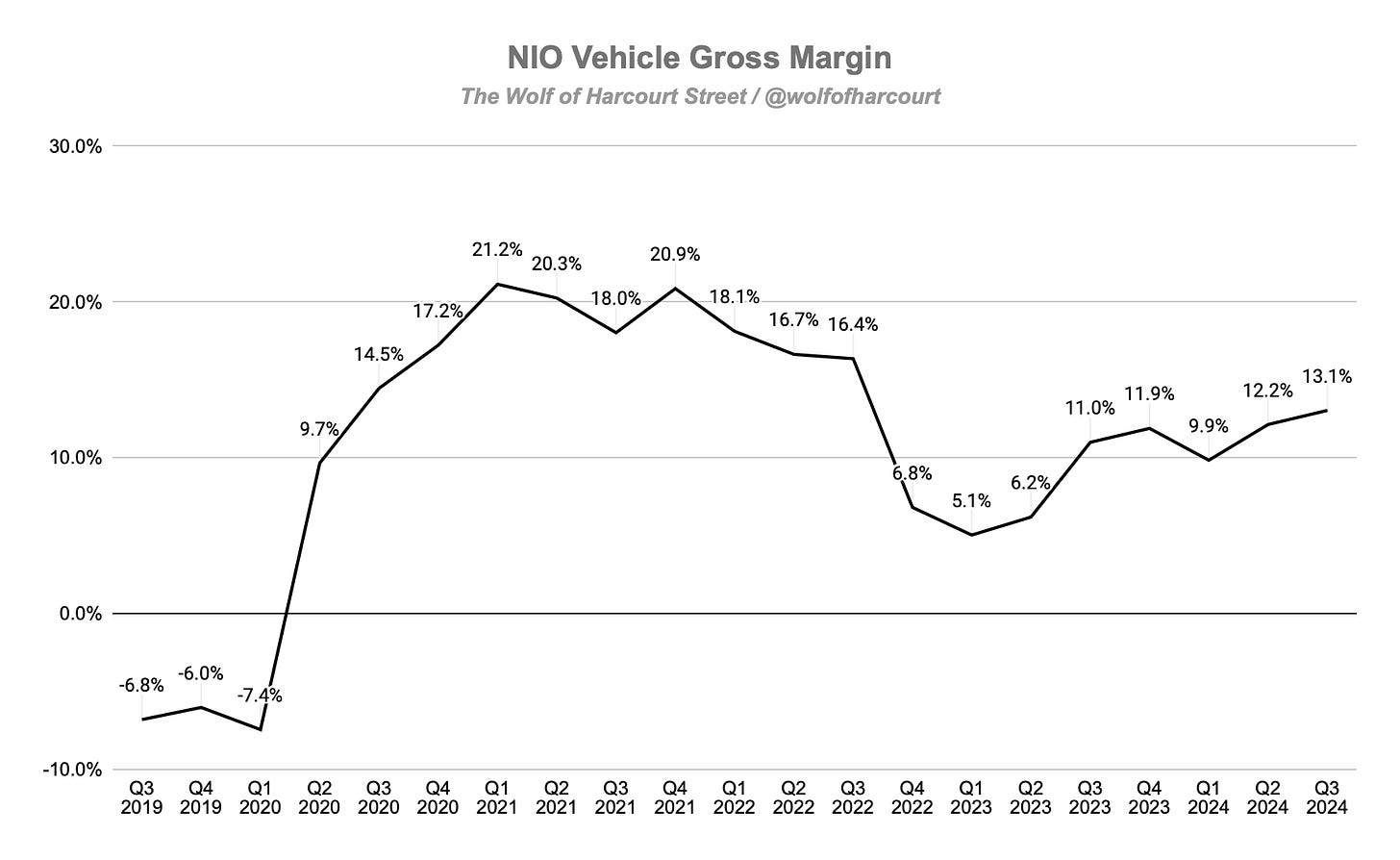

Gross margin improved to 10.7%, up from 8.0% in Q3 2023 and 9.7% in Q2 2024. This improvement was mainly due to higher vehicle margins, which increased to 13.1% from 11.0% YoY and 12.2% QoQ.

The higher vehicle margin resulted from reduced material costs per unit, partially offset by the decline in ASP discussed above.

Despite these improvements, net losses rose 11% YoY to $721 million.

Guidance

For Q4 2024, management expects:

Vehicle deliveries between 72,000 and 75,000 units, representing 44%-50% YoY growth.

Total revenues between $2.80 billion and $2.90 billion, a 15%-19% YoY increase.

Assuming 89% of revenue comes from vehicle sales, guidance suggests that the ASP will drop to around $35,000, representing a 10% QoQ and 20% YoY decline.

Source: NIO IR

My Perspective: The positives in this report include record vehicle deliveries and improved vehicle gross margins. However, ASP pressures remain a key challenge, significantly impacting revenue despite higher delivery volumes.

While YoY gross margin gains were achieved through faster cost reductions, this trend may reverse as ASPs continue to decline. With Q4 guidance indicating a potential 20% YoY ASP drop, margin pressures could intensify.

Although the EV sector has favorable tailwinds, it remains uncertain whether NIO can achieve the necessary scale and profitability to deliver sustainable value for shareholders.

4. InPost (INPST) Launches Locker Shops in the UK

InPost is accelerating its UK expansion with the launch of new Locker Shops in high-demand urban areas. Following the success of its Camden Locker Shop pilot in April 2024, which demonstrated strong consumer engagement and validated the concept of dedicated stores with multiple locker compartments, InPost is rolling out additional locations.

The next sites will include London’s Liverpool Street and London Bridge in late 2024, with further expansion to Manchester and additional London locations planned for 2025.

Source: Retail Technology Innovation Hub

My Perspective: InPost’s Locker Shops target hyper-urban areas to meet rising demand for its parcel locker network, providing convenient out-of-home delivery and return options. With over 8,400 lockers in the UK and increasing consumer adoption, this strategic rollout reinforces InPost’s leadership in the out-of-home delivery market.

5. Adyen (ADYEN) Launches Tap to Pay in New Zealand

Adyen has introduced Apple’s Tap to Pay on iPhone in New Zealand, partnering with NewStore to enable retailer customers like Lorna Jane and R.M. Williams to accept contactless payments using only an iPhone and a supporting iOS app—eliminating the need for additional hardware.

Merchants can now accept all contactless payments, including credit/debit cards, Apple Pay, and digital wallets, through NFC technology. Payments can be processed anywhere on the store floor, enhancing customer interactions and improving checkout efficiency. This mobile-first setup reduces reliance on hardware like payment terminals, streamlining workflows during high-traffic periods and events.

Source: Adyen IR

My Perspective: The continued global rollout of this technology aligns with Adyen’s commitment to driving digital payment innovation. By offering flexibility and scalability, it enables businesses to provide seamless shopping experiences that enhance customer satisfaction and boost brand loyalty. It’s a win-win for merchants and end customers alike.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com