Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s edition!

Todays Agenda

Nubank Mexico Reaches 10 Million Customers & UK Legal Domicile

Evolution Plans to Release +110 New Games in 2025

Uber Partnerships with Home Depot and Wegmans

Adyen Digital Payment Gateway Market Research Report

Texas Instruments Q4 2024 Earnings

Meta to Invest Up to $65 Billion in AI in 2025

1. Nubank (NU)

Mexico Reaches 10 Million Customers

Nu has achieved a significant milestone in Mexico, reaching 10 million customers—doubling its customer base within the last 12 months. This accomplishment means Nu now serves nearly 12% of the adult population in Mexico. Its 100% digital model ensures coverage of over 98% of municipalities, including areas without traditional bank branches.

Since its launch in Mexico in 2019, Nu has expanded its offerings from a credit card to include savings accounts, debit cards, personal loans, and a cash withdrawal/deposit network with over 30,000 points, including OXXO stores.

Nu has been pivotal in fostering financial inclusion, with 50% of its customers accessing credit and 63% earning yields on savings for the first time. By Q3 2024, Nu had 8.9 million Cuenta customers and $3.8 billion in deposits. The company has invested $1.4 billion in Mexico, solidifying its status as a significant foreign investor.

Nu is also pursuing a banking license to expand into payroll accounts and introduce new credit options.

Source: Nubank IR

My Perspective: Nu took approximately five years to reach 10 million customers in Brazil. Considering that Mexico's population is only 60% of Brazil's, Nu's penetration in Mexico is even stronger. In Brazil, 56% of the adult population are Nu customers. If Nu achieves a similar penetration rate in Mexico, it could potentially exceed 70 million customers. This is feasible given that 42% of Mexico's population currently lacks access to financial services.

UK Legal Domicile

Nu is exploring the possibility of relocating its legal domicile to the United Kingdom as part of its global expansion strategy. This move could significantly bolster the UK’s post-Brexit financial landscape.

"We are actively evaluating which jurisdictions make sense for us to consider as we plan for the next 10 years of global growth. The UK is one of the options we are exploring.”

David Velez, CEO

Nu aims to expand internationally over the next decade, potentially entering the U.S. market, which could offer a more favorable regulatory environment for fintech and cryptocurrencies. Simplified banking regulations in the U.S. might further enhance the country’s appeal for new entrants.

“With the U.S. showing renewed interest in fintech and crypto, the sector is gaining momentum again. When an administration starts viewing fintech as beneficial for consumers and promoting competition, it becomes a much more attractive market.”

David Velez, CEO

Source: Reuters

My Perspective: Social media speculated that this move indicated Nu’s imminent expansion into Europe. However, David Vélez clarified that launching services in Europe is not a priority due to regulatory and competitive challenges. Instead, a European domicile could serve as a legal hub for managing the group and recruiting talent. Nu, currently domiciled in the Cayman Islands, already has about 40 employees in Berlin since opening offices there in 2017. Don’t just read the headlines, folks.

2. Evolution (EVO) Plans to Release +110 New Games in 2025

At the ICE Barcelona 2025 event, Evolution unveiled plans to release 110 new games in 2025, showcasing innovations across its eight brands: Evolution, NetEnt, Red Tiger, Ezugi, Nolimit City, Big Time Gaming, DigiWheel, and Livespins.

Major live games include:

Ice Fishing: A speed game show featuring a virtual money wheel, real-time fishing mechanics, multiplier wins, and three bonus games.

Marble Race: A visually immersive, fast-paced marble racing game with custom tracks.

Race Track: An ’80s arcade-style RNG horse racing game with dynamic betting options.

Fireball Roulette: Builds on the Fireball bonus mechanic, delivering a high-energy roulette experience.

Todd Haushalter, Chief Product Officer, emphasised the diverse innovations and exciting roadmap for 2025:

“Yet again, our licensees can look forward to the very best of online gaming from our Group roadmap for 2025.”

Source: Evolution IR

My Perspective: After releasing a record 100 games in 2024, it’s great to see Evolution continuing to innovate with plans for even more releases in 2025. Friend of the newsletter Ali Gündüz attended the event in Barcelona, and I look forward to him sharing insights from the event soon.

3. Uber (UBER)

Partnership with Home Depot (HD)

Uber has partnered with Home Depot to provide on-demand and scheduled delivery of home improvement products. Customers can now order essential tools, supplies, and materials directly through the Uber app.

This partnership caters to both professional contractors and DIY enthusiasts, offering quick access to a wide range of products. Deliveries are available from over 2,000 Home Depot locations across the U.S.

Uber users can browse a curated selection of Home Depot products, including tools, building materials, gardening supplies, and more. Flexible delivery options and real-time tracking enhance the customer experience.

Source: PR Newswire

My Perspective: This is a smart partnership for Uber as it continues expanding into retail delivery, enhancing its platform’s utility beyond food and groceries. Much debate surrounds the potential existential threat of autonomous vehicles to Uber’s business model. However, nearly 40% of Uber’s revenue now comes from its delivery segment. Partnerships like this showcase Uber’s efforts to diversify its business and reduce reliance on mobility services.

Partnership with Wegmans

Uber has partnered with Wegmans Food Markets, a renowned supermarket chain with over 110 stores, to deliver groceries directly to customers' doors. This collaboration enhances consumer access to Wegmans' high-quality offerings via the Uber Eats and Uber apps.

The service is now live in Wegmans locations across Massachusetts, Maryland, Virginia, North Carolina, New Jersey, and Washington, D.C. Additional locations in New York, Pennsylvania, and Delaware will join the platform in February.

Source: PR Newswire

My Perspective: This partnership is another example of Uber diversifying its services as it continues to expand its grocery delivery offerings, reinforcing its mission to make shopping more accessible. Furthermore, as Uber broadens its service range, the value of its Uber One membership program becomes increasingly compelling. Uber One members enjoy benefits such as $0 delivery fees and a 5% discount on all Wegmans orders with a minimum purchase of $35.

4. Adyen (ADYEN) Digital Payment Gateway Market Research Report

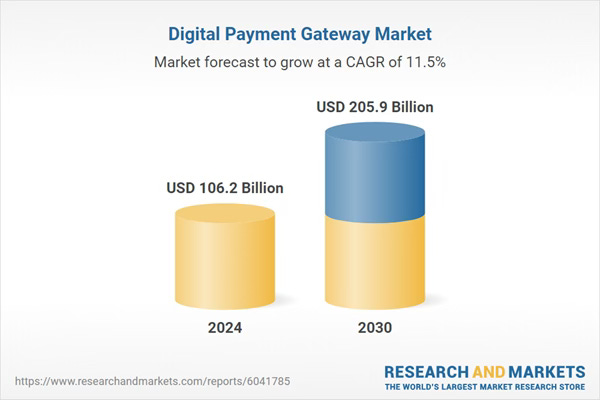

This week, Research and Markets released its Digital Payment Gateway Market 2025 report. Valued at $106.2 billion in 2024, the market is projected to reach $205.9 billion by 2030, growing at a CAGR of 11.50%.

Key drivers of this growth include:

E-commerce Expansion: Increased online shopping drives demand for seamless payment solutions.

Consumer Behavior: Growing preference for online and contactless payments.

Smartphone Penetration: Rising adoption of smartphones and internet access makes digital payments more accessible.

COVID-19 Impact: The pandemic accelerated the shift to digital and contactless payments.

Source: Research and Markets

My Perspective: Adyen continues to capture market share from incumbents, and the investment thesis is bolstered by the secular growth tailwinds in the digital payment gateway market. With its strong position, Adyen is well-placed to capitalise on this huge market opportunity and benefit from its long runway for growth.

5. Texas Instruments (TXN) Q4 2024 Earnings

Revenue

Total revenue: $4 billion, down 3% sequentially and 2% year-over-year (YoY).

Analog revenue, which accounts for approximately 80% of total revenue, grew 2% YoY after eight consecutive quarters of decline.

Embedded Processing, representing about 15% of revenue, declined 18%, while the Other segment grew 7% compared to the same quarter last year.

Profitability

Gross profit: $2.3 billion, resulting in a gross profit margin of 58%. Sequentially, gross profit and margin declined by 190 basis points, due to lower revenue, higher depreciation, and reduced factory loadings.

Operating profit: $1.4 billion, representing an operating margin of 34%, down 10% YoY.

Net income: $1.2 billion, or $1.30 per share.

Capital Management

Cash flow from operations: $2 billion in the quarter.

Capital expenditures: $1.2 billion.

Returned value to shareholders through:

$1.2 billion in dividends, including a 5% dividend increase in Q4, marking the 21st consecutive year of dividend growth.

$537 million in stock repurchases.

Q1 2025 Outlook

Revenue: Expected to be in the range of $3.74 billion to $4.06 billion.

Earnings per share (EPS): Forecasted between $0.94 and $1.16.

Source: Texas Instruments IR

My Perspective: TXN’s revenue and EPS exceeded consensus estimates by 4% and 9%, respectively. However, guidance fell short of market expectations.

As a highly cyclical business, TXN remains exposed to ongoing challenges. Management noted that some industrial markets, such as industrial automation and energy, have yet to stabilize. To manage inventory effectively, the company is reducing factory loadings. This downcycle is proving to be longer-lasting than many, including management, had anticipated.

On a positive note, TXN is nearly 70% through a six-year elevated CapEx cycle. Once completed, this investment will uniquely position the company with dependable, low-cost 300-millimeter capacity at scale, enabling it to meet future customer demand efficiently.

6. Meta (META) to Invest Up to $65 Billion in AI in 2025

Meta CEO Mark Zuckerberg has announced plans to increase the company’s capital spending to $60–$65 billion in 2025, representing a ~70% increase from 2024. This ambitious projection includes a $14 billion jump over 2025 analyst estimates, with 2024 spending already expected to rise 40% year-over-year to $38 billion.

The surge in investment is primarily driven by advancements in artificial intelligence (AI), including the development of cutting-edge AI models and the construction of massive data centres. Meta plans to bring one gigawatt of computing power online and significantly expand its GPU capacity, aiming to close 2025 with over 1.3 million graphics processing units (GPUs). Among the key initiatives is a $10 billion, 4-million-square-foot data center in Louisiana, which will rank among the largest in the world, underscoring Meta’s ambition to dominate AI infrastructure.

Zuckerberg described AI as a transformative technology, positioning Meta at the forefront of innovation while reinvigorating the company’s growth strategy. He emphasised that these investments are critical to transforming Meta’s core products and reinforcing America’s leadership in AI.

Source: Threads

My Perspective: This is a bold statement from Zuckerberg, especially within the broader AI narrative. While investors are generally optimistic about AI-driven growth, concerns remain about the profitability of such investments and the long-term sustainability of this spending surge.

Zuckerberg seems convinced that these investments will drive the development of essential products, fuel innovation, and ensure Meta maintains its competitive edge in the tech industry.

Meta’s plan to end 2025 with over 1.3 million GPUs highlights a major opportunity for hardware suppliers. Nvidia, as a leading provider of AI chips, stands to be a significant beneficiary of this initiative. Meanwhile, AMD, whose stock has been under pressure recently, could also benefit. Meta is AMD’s largest customer for its Instinct MI300 data center GPU accelerators, having purchased 173,000 units in 2024. This makes AMD a stock to watch in the context of Meta’s AI expansion.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

NU and UBER look promising.

Excellent read! Nu, Adyen, Uber & Meta excite me