Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s edition!

Todays Agenda

NIO Q2 2024 Earnings

Airbnb NYC Local Law Cause Rents to Rise

MercadoLibre to Invest $75 million in New Storage Centre

Sea Limited Shopee Malaysia to Support 100,000 Entrepreneurs

Nubank Lending Practices - Why Wall Street Analysts Wrong

Auto Partner August Sales Update

Meet Scrab – The Fastest Way to Research Stocks

Build personalised stock ranking models, score financial metrics, and quickly find undervalued stocks to get better results over other investors.

Powered by FactSet data, Scrab offers global coverage of over 400 financial metrics and 40+ years of data history.

Click the link below to explore Scrab’s tools: fundamental scoring, screener, charts, portfolio management, alerts, and more.

1. NIO (NIO) Q2 2024 Earnings

NIO reported a report breaking-quarter which was signposted given the company reports monthly delivery figures but very much welcomed after a very disappointing Q1.

Deliveries

Vehicle deliveries reached 57,373 units, marking a 144% year-over-year (YoY) increase and a 91% rise from Q1 2024. This resulted in NIO capturing over 40% of China's battery electric vehicle market priced above RMB 300,000 ($42,350).

July and August deliveries reached 20,498 and 20,176 vehicles, respectively, suggesting another record-breaking quarter in store and expanding market share.

Revenue

Total revenues were $2.40 billion, marking an increase of 99% YoY and 76% quarter-over-quarter (QoQ). Vehicle sales, comprising 90% of total revenue, amounted to $2.16 billion, reflecting an increase of 118% YoY and 87% QoQ. The YoY revenue increase was mainly driven by higher delivery volumes, though partially offset by a lower average selling price due to changes in product mix and user rights adjustments. As I discussed last month, the EV price war in China is a concern and this trend has continued into Q2 as NIO’s vehicle average selling price continues to head south.

Profitability

The overall gross margin improved significantly to 9.7%, up from 1.0% in the same quarter of 2023 and 4.9% in the first quarter of 2024. This increase was driven primarily by a higher vehicle margin, which rose to 12.2% from 6.2% YoY and 9.2% sequentially.

The higher vehicle margin was mainly due to reduced material costs per unit from ongoing cost optimizations. This was partially offset by the lower the average selling price discussed above.

The net loss decreased by 17% YoY to $694 million.

Guidance

For the third quarter of 2024, management expects:

Vehicle deliveries will range from 61,000 to 63,000 units, marking a growth of about 10% to 14% compared to Q3 2023.

Total revenues to be between $2.63 billion and $2.71 billion, reflecting an increase of approximately 0.2% to 3.2% from Q3 2023.

If we assume that 90% of NIO’s revenue will come from vehicle sales, the guidance suggests that the average selling price will remain around $38k. Although this is down from $43k in Q3 2023, it will not represent a sequential decline.

On the conference call, management reaffirmed the long-term guidance for 25% vehicle gross margin with monthly deliveries of 30,000-40,000 units.

Source: NIO IR

My Perspective: This was the best quarter NIO has reported in some time, and the market agreed, with shares increasing by 14% after the earnings announcement.

The standout aspect of the report, from my perspective, was not the record vehicle deliveries but rather the improvement in vehicle gross margin. Over the past three years, the average vehicle selling price has dropped by 38%, from $61k in Q2 2021 to $38k in Q2 2024. This decline significantly impacted NIO’s vehicle gross margin, which was 20% in Q2 2021 but fell to as low as 5% in Q1 2023. However, recent efficiency gains and economies of scale have helped NIO lower its average vehicle cost of sales by 30% from $48k to $33k, driving the margin improvement.

Despite the ongoing price war, demand for new-energy vehicles in China continues to grow. In July 2024, sales of these vehicles surpassed those of combustion-engine vehicles for the first time, which should further boost the demand for NIO’s vehicles.

2. Airbnb (ABNB) NYC Local Law Cause Rents to Rise

The first year of New York City's Local Law 18 (LL18), which introduced stringent short-term rental regulations, has sparked controversy and disappointment regarding its impact on both the housing crisis and tourism. Despite promises to increase housing affordability, the law has reportedly failed to deliver, with rental prices continuing to rise and vacancy rates remaining unchanged.

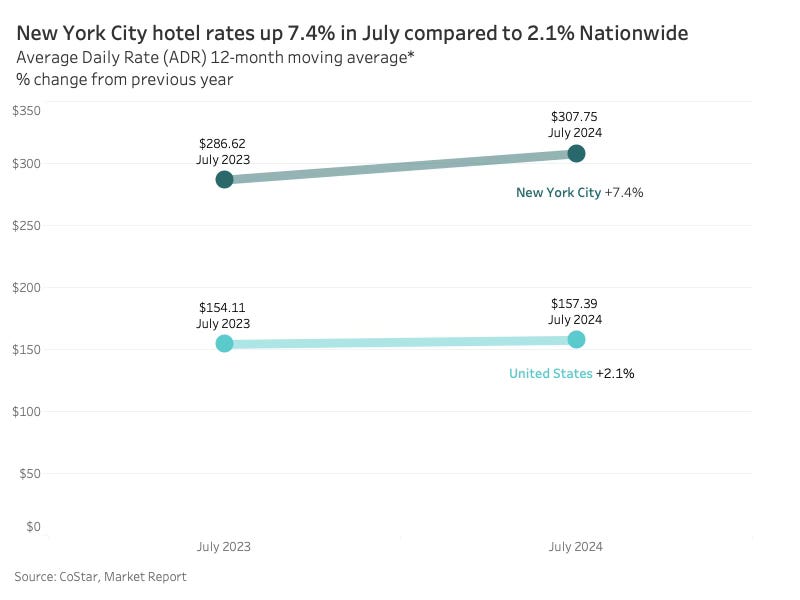

Hotel rates have surged by 7.4% over the past year in NYC, compared to only a 2.1% rise nationally, pushing travel costs to new highs. This has led to concerns that the city is becoming less accessible to everyday travellers.

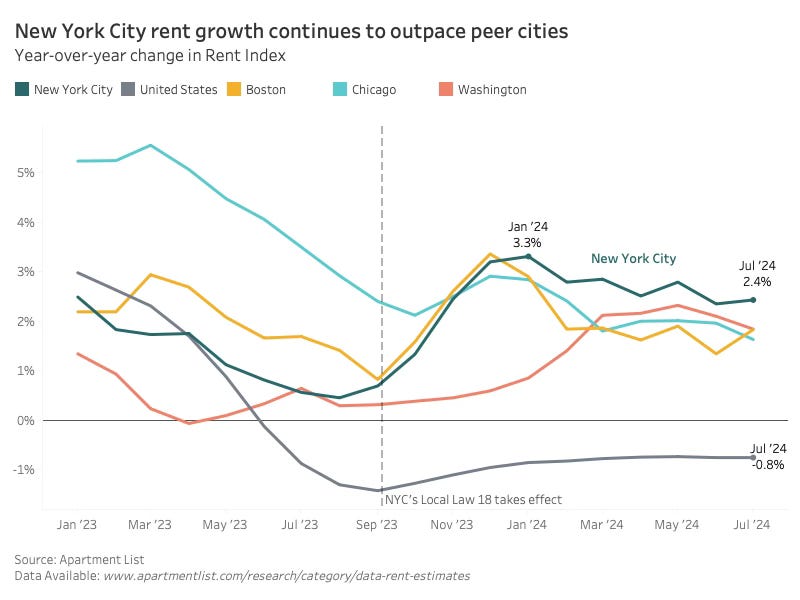

Rather than alleviating the housing crisis, rents in New York have risen by 3.4%, reaching a record high in areas like downtown Manhattan, where the median rent hit $5,000 for the first time.

The anticipated boost in housing availability has not materialized. Vacancy rates have remained stagnant at 3.4%, showing no significant improvement despite the crackdown on short-term rentals.

Source: Airbnb Newsroom

My Perspective: Critics, including Airbnb and local business advocates, are urging the city to reconsider LL18. They argue that the law should be amended to support homeowners, increase accommodation supply, and promote economic growth in outer boroughs while addressing the real drivers of the housing crisis by building more homes.

Who could have guessed that reducing supply would cause prices to increase?

3. MercadoLibre (MELI) to Invest $75 million in New Storage Centre

Mercado Libre has announced a $75 million investment to build a new 56,000 square meter storage centre in La Matanza, Buenos Aires, which will double its storage capacity, improve product processing, and reduce delivery times. Developed by Plaza Logística within Mercado Central, the facility will handle 200,000 to over 400,000 products daily, with space for bulky items and more product variety.

The project which is expected to be operational by the end of 2025, will create over 2,300 direct jobs and thousands of indirect ones, helping Argentine SMEs scale their operations. It is part of Mercado Libre’s broader strategy to enhance e-commerce growth, improve the user experience, and expand its business verticals.

Source: Bnamericas

My Perspective: Announcements about infrastructure investments are always positive. This is how building and strengthening a durable competitive advantage takes shape. MELI is developing a best-in-class logistics network that will soon make it impossible for smaller players to compete.

4. Sea Limited (SE) Shopee Malaysia to Support 100,000 Entrepreneurs

Over 100,000 entrepreneurs joined Shopee Malaysia in 2024, highlighting the increasing role of e-commerce in Malaysia's digital economy. Shopee Live saw a 113% increase in new sellers' live streaming in 2024, emphasising its growing importance in Malaysia's live commerce sector.

Shopee's interactive features, including live streaming, have enabled local entrepreneurs to connect better with customers, leading to over 1.4 million live streams and 27 million unique comments.

Petals Malaysia, a local hair care brand, successfully expanded its reach via Shopee Live, selling over 26,000 units of its halal hair dye, demonstrating the platform's impact on business growth.

Source: The Malaysian Reserve

My Perspective: Shopee's ecosystem, including resources like Affiliate Marketing Solutions and third-party logistics, is crucial for supporting local entrepreneurs in the competitive e-commerce market. In 2024, Shopee's top 500 locally owned enterprises saw an average growth of 50% YoY, demonstrating the platform’s role in driving business expansion. If you're aiming to grow an e-commerce business, you need to be on Shopee.

5. Nubank (NU) Lending Practices - Why Wall Street Analysts are Wrong

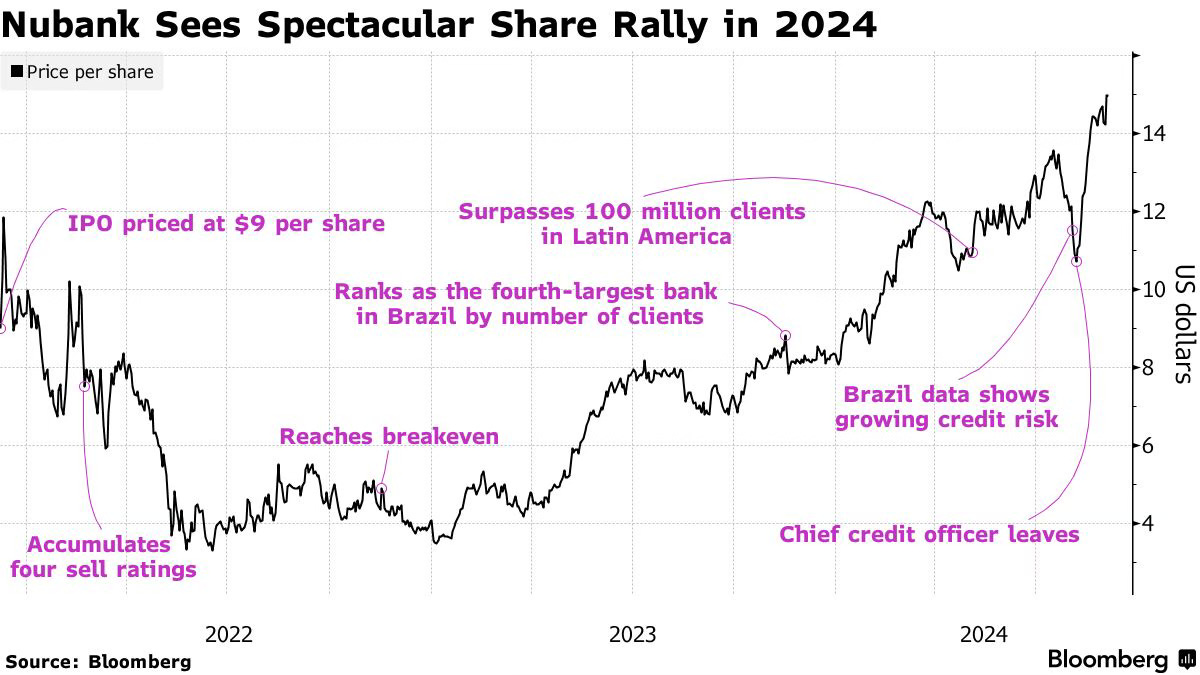

Nubank has rapidly grown into the most valuable bank in Latin America, driven by its focus on lending to low-income families, a market that traditional banks largely ignored. Nubank's growth is extraordinary, with 60% of Brazilian adults using its app. The company’s stock has surged by 36% over the past month and 214% in two years.

However, concerns are rising among investors and analysts regarding the sustainability of its growth. Non-performing loans have hit a record 7%, above the industry average of 5.5%, and Nubank's decision to reduce provisions for bad debts, instead of increasing them as forecasted, has sparked skepticism. Some, including JPMorgan and UBS, downgraded the stock due to worries about rising late payments and asset quality. Despite this, Nubank continues to expand, with its loan portfolio growing 28% YoY, and its net income more than doubling, surpassing expectations.

While concerns about defaults loom, Nubank’s high interest rates on loans help cushion the impact of late payments. The company’s ability to adapt quickly to changing credit environments is seen as a key advantage over more rigid traditional banks.

Source: Bloomberg

My Perspective: Despite concerns over rising loan defaults, Nubank's executives, including COO Youssef Lahrech, have emphasized the bank's commitment to long-term strategies over short-term non-performing loan metrics. Concerns over the bank's credit quality are not universally shared on Wall Street, with banks like Morgan Stanley showing confidence in Nubank's strategy.

Analyst Pedro Leduc from Itau BBA notes that Nubank's funding and lower expenses help it outperform competitors in the low-income credit sector, despite market concerns about its rapid growth. Itau BBA has maintained an "outperform" rating on Nubank's stock.

Nubank boasts one of the most advanced proprietary credit underwriting models globally, known as the NuX credit engine, which utilises over 30,000 unique data points on each active customer thanks to its digital-native approach. Nubank’s “low and grow” strategy involves customers starting with credit limits as lows as $10 that gradually increase based on positive payment behaviour. Compare this to the traditional credit underwriting models of legacy banks. The video below offers valuable insights into Nubank’s credit underwriting strategy.

6. Auto Partner (APR.WA) August Sales Update

APR reported revenue of PLN 332.9 million for August 2024, a 7% YoY increase. Year-to-date revenue through August 2024 has grown by 15%.

Source: Bankier

My Perspective: APR's monthly sales growth tends to fluctuate due to factors such as seasonality. For example, revenue grew by 20% in July but slowed to 7% in August. The company will report Q2 earnings on September 17, and I’m looking forward to joining the conference call—especially since there was no call for Q1.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com