Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s edition!

Todays Agenda

1. MercadoLibre’s Secret to a Record-Breaking Black Friday

2. Evolution Commences Buyback Program

3. NIO Q3 2023 Earnings

4. Sea Limited Tops App Charts

5. Adyen Extends Partnerships

1. MercadoLibre’s (Ticker: MELI) Secret to a Record-Breaking Black Friday

MELI reported a record-breaking Black Friday, with an 80% increase in Gross Merchandise Volume (GMV), marking the largest in the company’s history. When analyzing the performance during the month of November, the increase was 39% compared to the same period in 2022.

The sale of electronics, especially cell phones, notebooks, and TVs, grew by 140%. The total average number of items sold per day is 1.8 million, but on November 23rd, this volume peaked at 2.8 million items, surpassing last year's Black Friday even before Friday.

This growth is remarkable, especially as the overall market in Brazil experienced a contraction of 15% YoY, according to Bank of America. In Mexico, MELI disclosed a significant 40% GMV growth during its Buen Fin promotional event.

So, how did MELI achieve this?

According to research from Market Hub, the dynamics of the advertising landscape shifted, with Clear and MercadoLibre emerging as the leaders in the number of insertions related to Black Friday, surpassing Shopee and Amazon. The importance of online searches cannot be understated, with MercadoLibre standing out with a remarkable 22% uplift per insertion on Google searches.

Despite a more measured Black Friday in 2023, the study suggests that companies like MercadoLibre are transforming the date into a crucial event for retail in Brazil. The research indicates that advertising during Black Friday has evolved beyond a mere marketing strategy; it has become an imperative necessity for brands aiming to stand out and thrive in the competitive retail landscape.

This performance did not go unnoticed by Wall Street, with Bank of America and Susquehanna raising their price targets to $2,000 and $1,850, respectively.

2. Evolution (Ticker: EVO.ST) Commences Buyback Program

Evolution management has wasted no time with their buyback program and has already commenced repurchasing shares.

During the week ending December 1, 2023, they acquired 250,400 of their own shares, constituting 0.1% of the total outstanding shares. This resulted in the utilization of approximately €24 million or 6% from the approved €400 million program.

3. NIO (Ticker: NIO) Q3 2023 Earnings

NIO delivered 55,432 vehicles in the third quarter of 2023, comprising 37,585 premium smart electric SUVs and 17,847 premium smart electric sedans. These figures represent a 75% increase from the third quarter of 2022 and a 136% increase from the second quarter of 2023. While this marked a record quarter for NIO, it did not come as a surprise since NIO discloses delivery numbers at the end of each month.

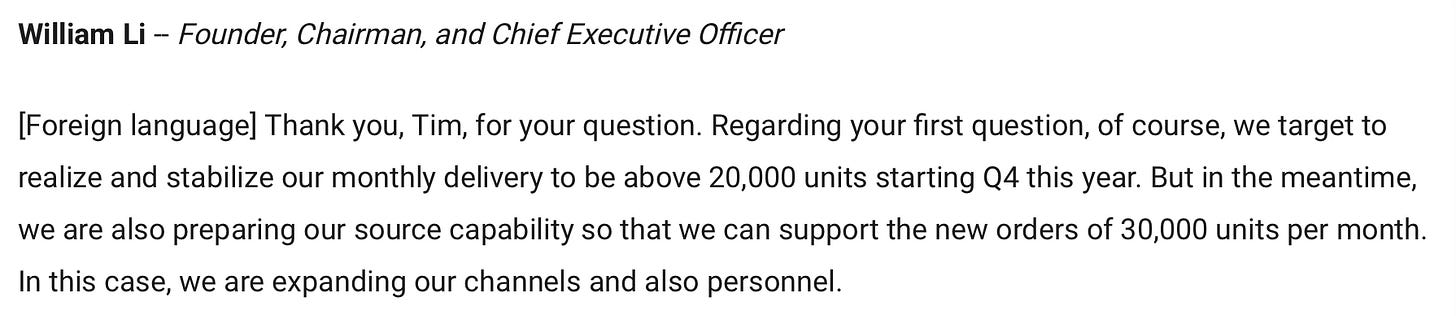

The Q3 delivery numbers imply an average monthly delivery of 18,447 vehicles. The trend for Q4 is not as positive, with NIO having delivered 16,074 vehicles in October 2023 and 15,959 vehicles in November 2023. The outlook for Q4 is 48,000 vehicles, which is once again well below the 20,000 monthly deliveries (60,000 for the quarter) forecast by management throughout 2023.

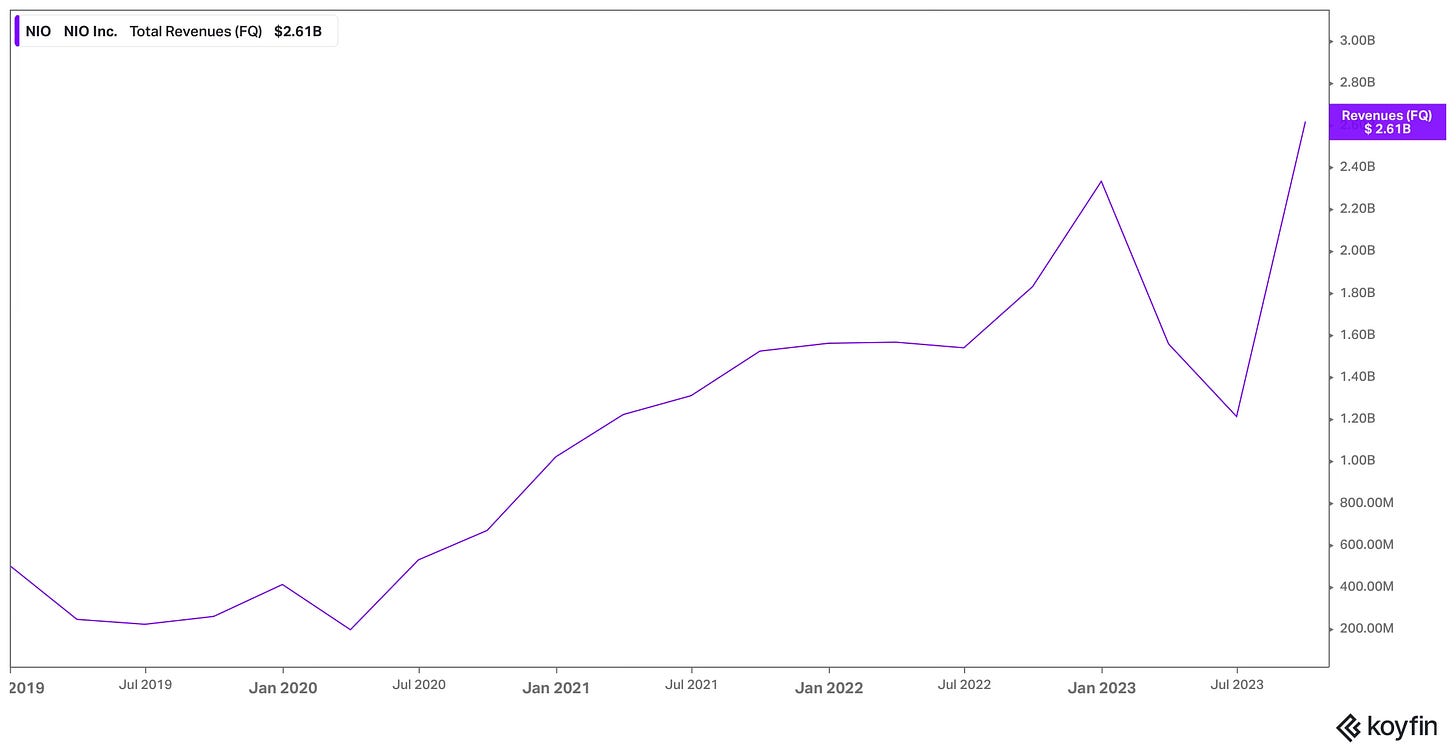

During the quarter, NIO’s total revenue was $2.61 billion, representing an increase of 47% compared to the third quarter of 2023 and an increase of 117% compared to the second quarter of 2023.

Vehicle sales in Q3 2023 accounted for $2.39 million of total revenues. This reflected a substantial increase of 46% from the third quarter of 2022 and an increase of 142% from the second quarter of 2023. The increase in vehicle sales was driven entirely by volume rather than price increases. In fact, the average selling price in Q3 2023 was $47k compared to $58k in the third quarter of 2022 and $51k in the second quarter of 2023. NIO is facing pricing pressure stemming from extreme competition.

The vehicle margin for the third quarter of 2023 was 11.0%, which is below the 16.4% reported in the same quarter of 2022 but higher than the 6.2% in the second quarter of 2023. The decrease in vehicle margin from the third quarter of 2022 is attributable to changes in the product mix, which is consistent with the lower average selling prices achieved during the quarter.

On the face of things, the Q3 results appear strong and are moving in the right direction with record quarterly deliveries and revenue. However, underneath the hood tells a different story. The vehicle margin has declined YoY due to lower average selling prices, and management has once again failed to achieve the 20k monthly delivery forecast that it reaffirmed as recently as August. The Q4 delivery guidance implies monthly deliveries of just 16k.

4. Sea Limited (Ticker: SE) Tops App Charts

Garena, the digital entertainment division of Sea Limited, has had a great start to December. Black Clover M and Free Fire are the first and third most downloaded gaming apps worldwide. Black Clover M is a new game released on November 30. Developed by VIC Game Studios and based on the hit anime series 'Black Clover,' this magic adventure RPG features stunning animation of iconic scenes in the anime, strategic turn-based combat, and a rich character system.

Shopee, the e-commerce division of Sea Limited, also continued its strong momentum into December. The app was the 3rd most downloaded shopping app worldwide, nudging ahead of Amazon.

When drilling down into the Brazil market, Shopee comes out in first place, with MercadoLibre coming in second. Market research from Conversion suggests that Shopee has a 10% share of the e-commerce market in Brazil, second only to MercadoLibre, which commands 14% of the market.

5. Adyen (Ticker: ADYEN) Extends Partnerships

Adyen is expanding its partnership with Klarna, the AI-powered global payments network and shopping assistant. The significant development in this partnership is Adyen taking on the role of one of Klarna's acquiring banks, starting in Europe, North America, and Asia in 2024. This means Adyen will facilitate card payments for Klarna's 150 million consumers and 500,000 retail partners globally. This strategic move aims to make payments more seamless for Klarna's users worldwide.

It's interesting to note how both companies recognize each other's strengths—Klarna's understanding of the modern consumer journey and Adyen's technology to simplify payments on a global scale.

Adyen also entered into a long-term partnership with S-Group, a Finnish retail market leader. By partnering with Adyen, S Group aims to bridge the gap between online and offline channels, offering omnichannel experiences and enhancing its loyalty program.

Adyen's platform will not only simplify operations at 1,900+ S Group locations but also provide deep insights into consumer payment behaviour across all touchpoints. The emphasis on gaining a comprehensive understanding of customer transactions signifies a data-driven approach to improve services and cater to evolving consumer preferences.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com