Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

There is a lot do discuss this week, let’s dive into today’s edition!

Todays Agenda

Airbnb at Bernstein Strategic Decisions Conference

Adyen Partnerships

Crowdstrike Q1 2025 Earnings

Lululemon Q1 2024 Earnings

NIO Q1 2024 Earnings

MercadoLibre Investments in Brazil to Exceed $4.35 Billion

Auto Partner May Sales Update

1. Airbnb (Ticker: ABNB) at Bernstein Strategic Decisions Conference

ABNB Chief Financial Officer, Ellie Mertz, was a guest speaker at the Bernstein 40th Annual Strategic Decisions Conference 2024. The following were my key highlights from the session:

Dynamic Pricing Implementation: Many properties maintain a static pricing model, not adjusting prices dynamically based on demand or market conditions. There's a roadmap for enhancing pricing strategies, aiming to eventually offer more dynamic pricing tools. The focus is on providing tools and suggestions rather than imposing dynamic pricing, allowing hosts to maintain control over their pricing.

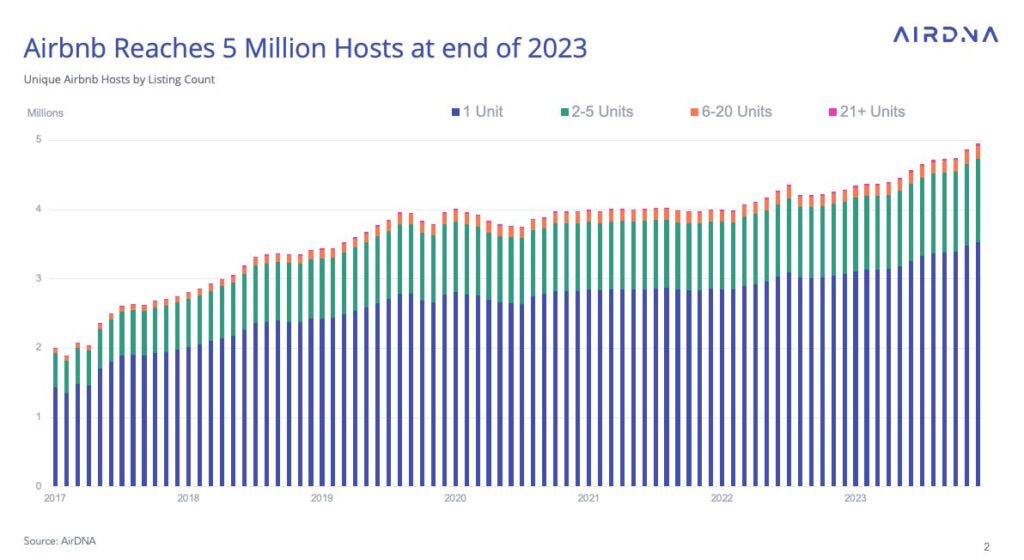

Unique Inventory: ABNB's inventory includes many individual hosts with unique listings, which are often exclusive to the platform. The platform is designed to support individual hosts, which differentiates Airbnb from competitors that focus more on professionally managed properties. This is supported by data from analytics firm AirDNA which found that at the end of 2023, 70% of Airbnb’s hosts or 3.5 million, had only one listing on the platform.

There's a common belief that professional hosts provide higher quality than individual hosts, but data suggests individual hosts often have higher ratings. Professional hosts are important, filling supply gaps in specific markets, but they are a minority of the business.

Take Rates: Historically, ABNB's take rates have been simple and not dynamic. Recent adjustments include lowering take rates for long-term stays (over 3 months) to increase volume. Testing small FX fees for cross-currency transactions is ongoing to see if it can drive incremental volume or monetization.

Potential Loyalty Program: ABNB is considering a differentiated loyalty program that might look different from traditional transactional models, possibly a subscription model offering incremental services.

Source: Koyfin

Koyfin is the financial tool I use to conduct research and screen for new ideas. The Pro version also includes transcripts from earnings calls and conferences, such as the Bernstein conference mentioned above, which are not often recorded. I have partnered with Koyfin to offer readers a 20% discount by clicking the button below.

2. Adyen (Ticker: ADYEN) Partnerships

Prada

Adyen announced a partnership with Prada Group to enhance in-store payment experiences and support the company's omnichannel commerce strategy. This collaboration will enable Prada Group to use Adyen's unified financial technology platform across all retail channels, providing a seamless and unique luxury customer experience.

Prada Group aims to integrate its sales channels to provide a consistent and seamless shopping experience. Adyen’s platform will help manage payments across all channels, giving Prada a single view of each customer. According to Adyen’s 2024 Retail Report, 55% of shoppers abandon their purchase if they can't pay as they prefer, and 27% no longer carry physical wallets. This underscores the need for flexible payment options.

Prada is leveraging Adyen’s Tap to Pay on iPhone technology in the U.S. and Milan stores, with plans to expand. This technology supports all forms of contactless payments without additional hardware, enabling sales associates to process payments anywhere in the store. By migrating to Adyen’s single platform, Prada Group can efficiently collect and manage payment data, enhancing customer interactions and personalizing experiences across all touchpoints.

Adyen has a longstanding relationship with Prada Group, initially supporting e-commerce and now expanding to omnichannel solutions globally. The Devil wears Prada, but he prefers to pay seamlessly!

Source: Adyen Press and Media

Nelly Solutions

Adyen has partnered with Nelly (no, not the rapper), a health and fintech company, to streamline payment management for medical practices. The partnership enables integration into practice software, allowing medical practices to handle all payment processes through a single, unified system.

Medical practices can use Nelly for digital payment processing and maintain a bank account with a local IBAN through Adyen's banking license. Issuance of both virtual and physical corporate credit cards is included.

Integration with Adyen simplifies financial administration, from patient admission to payment processing, and supports various payment methods, including digital payment links, POS terminals, and installment payments. The digital process simplifies payment acceptance and reduces administrative time for both patients and practices.

Source: Adyen Press and Media

My Perspective: Another week and more customer wins from Adyen. At this rate, this is going to be a recurring weekly section!

3. Crowdstrike (Ticker: CRWD) Q1 2025 Earnings

CRWD delivered exceptional Q1 results, setting records across multiple metrics. Key highlights include:

Financial Performance

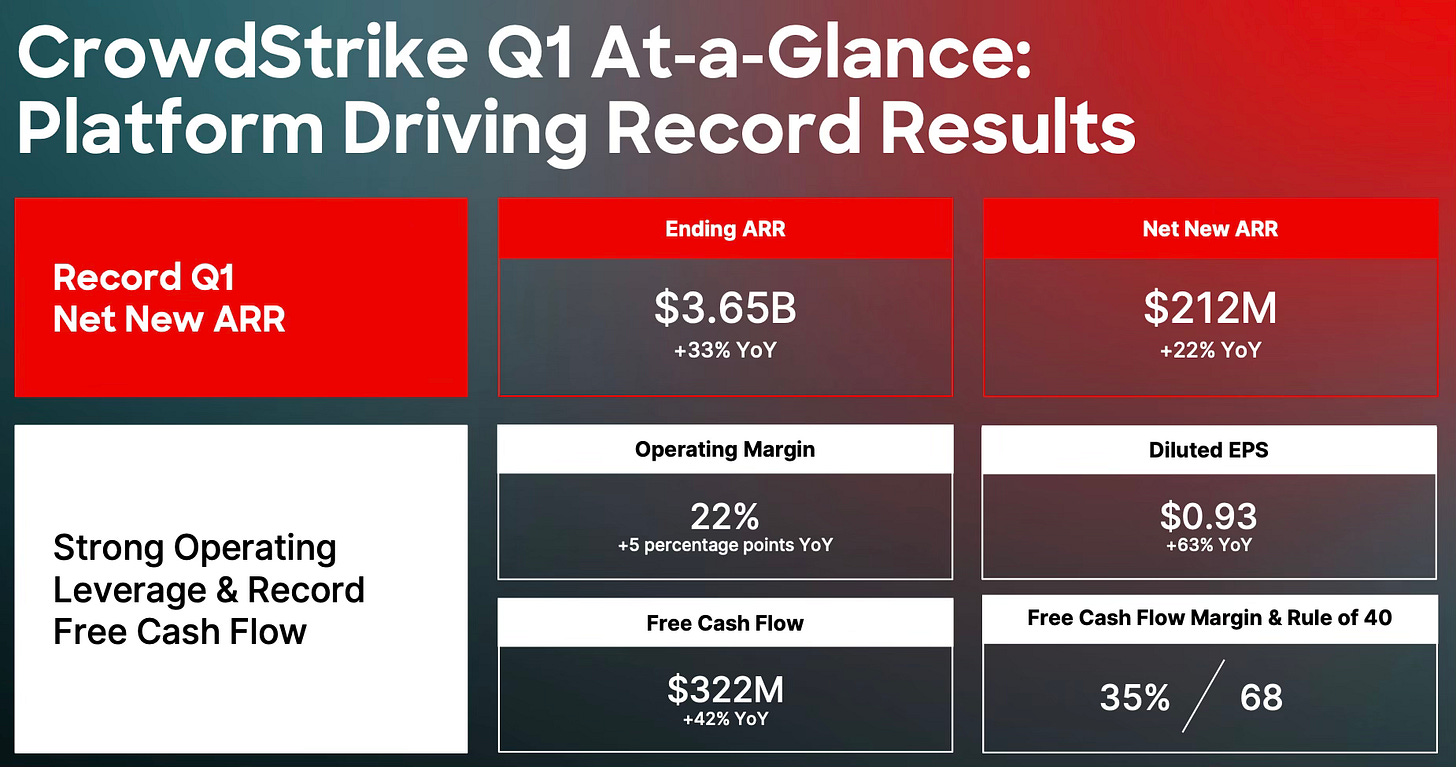

Total revenue grew 33% year-over-year (YoY) to $921 million. Net new Annual Recurring Revenue (ARR) reached $212 million, a 22% increase YoY. Ending ARR hit $3.65 billion, growing 33% YoY. Reported Free Cash Flow (FCF) of $322 million, equating to a 35% FCF margin. CRWD achieved significant YoY operating leverage and GAAP profitability for the fifth consecutive quarter.

Customer Adoption and Module Growth

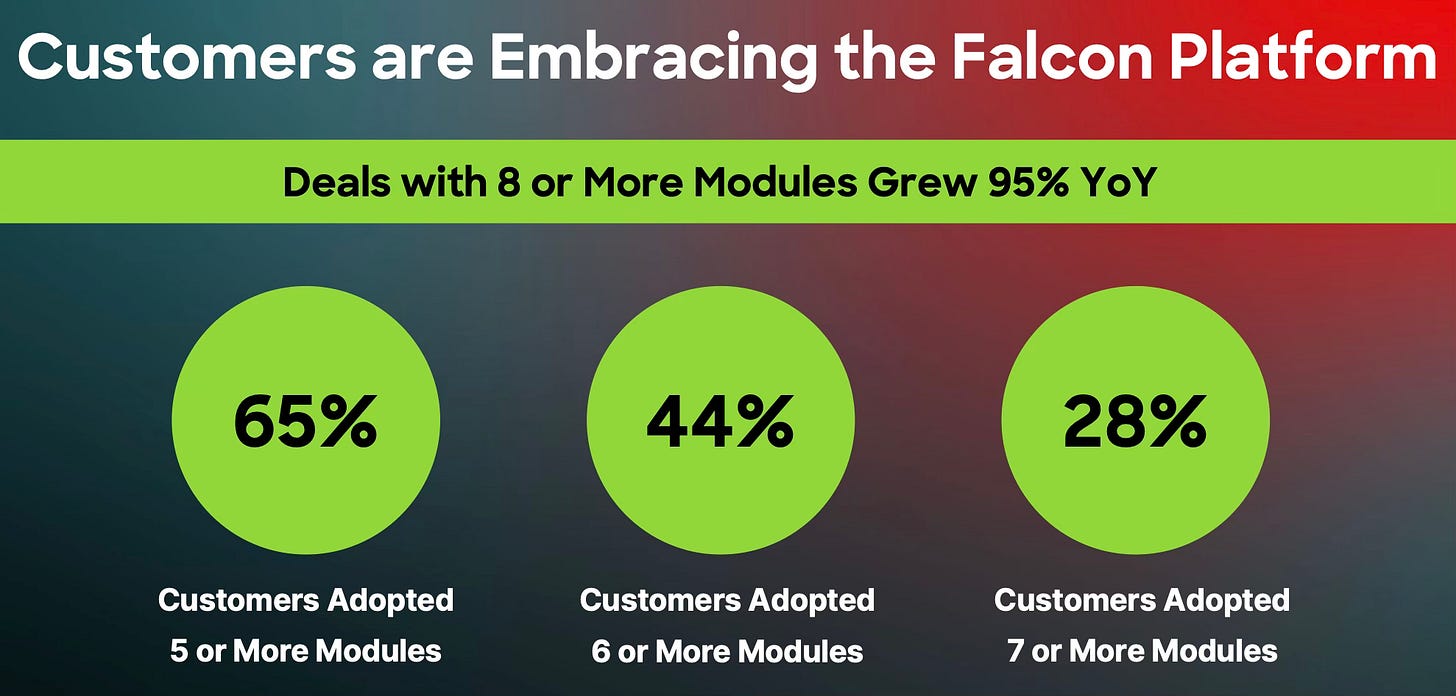

Customers are increasingly embracing CRWD's platform strategy, as indicated by a significant increase in deals with eight or more modules, growing by 95% over the previous year's Q1. Subscription customers with five, six, and seven or more modules have increased, with 65%, 44%, and 28% respectively, of subscription customers falling into these categories.

The number of deals involving cloud, identity, or Falcon Next-Gen SIEM modules more than doubled YoY.

Customer Success Stories

Management shared a notable case involving a breach at a leading healthcare company using Microsoft products. CRWD's Incident Response team swiftly intervened with 46,000 sensors, halting the breach and restoring operations. The healthcare company embraced various CRWD solutions, leading to the replacement of Microsoft security products, a legacy SIEM, and a vulnerability management vendor. Consolidating to CRWD's single agent reduced the agent footprint by 75%. Detection and response time improved by 700%, with average alert triage dropping from over four hours to minutes. This consolidation resulted in a lower Total Cost of Ownership and enhanced cybersecurity outcomes.

Source: Crowdstrike IR

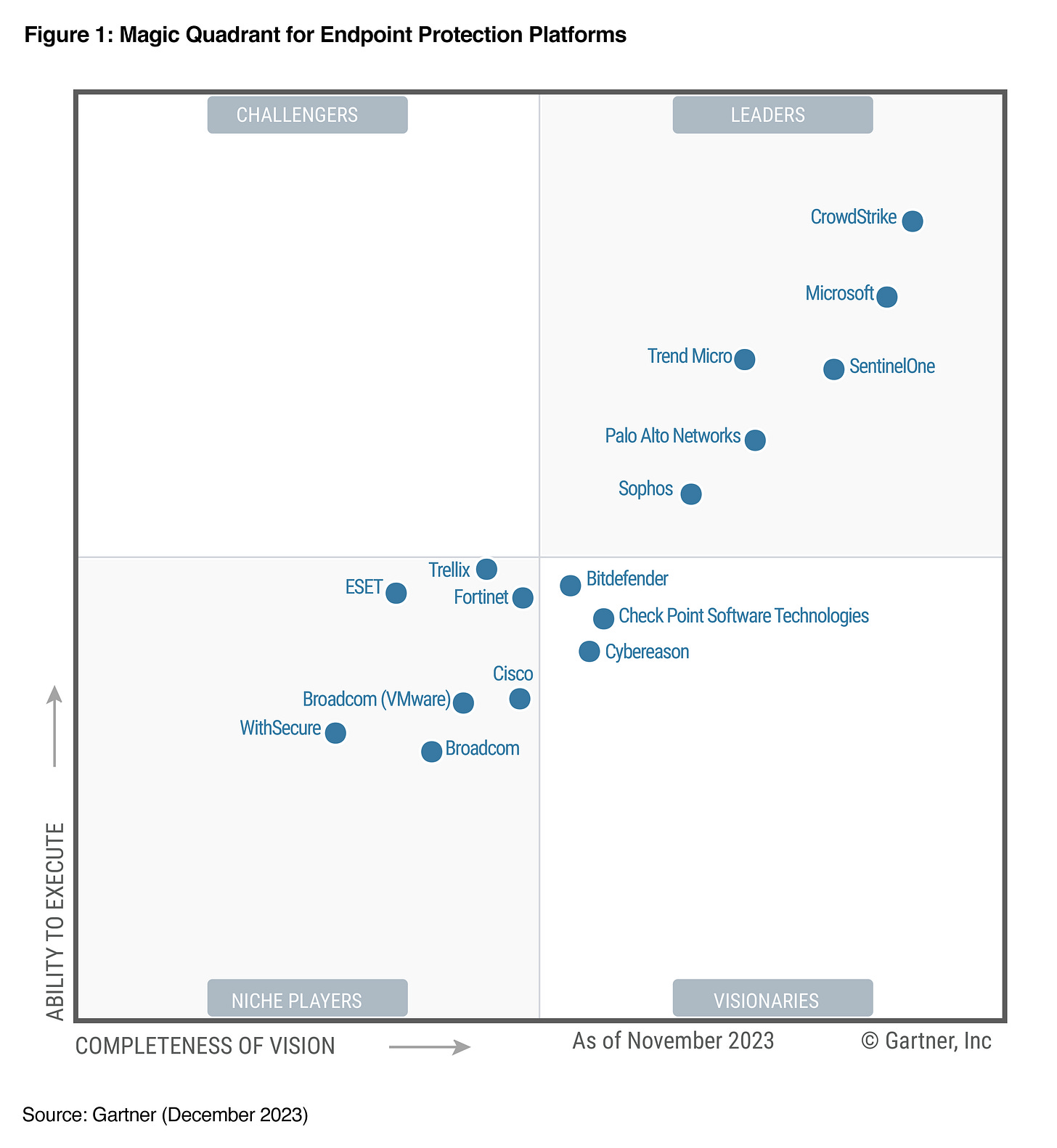

My Perspective: Expectations were high going into this quarter, but CRWD delivered. Few services are becoming as mission-critical as cybersecurity, given the strong financial impact of breaches on companies and the loss of customer trust. The failings apparent in Microsoft’s security solutions should also be noted, with CRWD being recognized as a leader in this area by Gartner.

CRWD is a stock that is high on my watchlist, and I would like to own it. Unfortunately, the stock remains richly valued, trading at a forward EV/Sales of 19 and 81 times forward earnings, so I remain on the sidelines for now. This is a company to keep on the radar. On Friday, it was announced that CRWD would be joining the S&P 500 index on 24 June as part of a rebalancing.

4. Lululemon (Ticker: LULU) Q1 2024 Earnings

LULU stock was down 40% YTD, so its Q1 2024 earnings were eagerly anticipated by investors. Key highlights include:

Revenue

Revenue rose by 10% overall to $2.2 billion, or 11% in constant currency, with significant growth in international markets. Mainland China saw a 52% increase, and the rest of the world grew by 30%. In the Americas, revenue increased by 4% in constant currency, with Canada up 12% and the U.S. up 2%. By category, women's merchandise grew by 10%, men's by 15%, and accessories by 2%. Store sales rose by 12%, and digital revenue increased by 8%.

Profitability

Gross profit reached $1.28 billion, with a slight gross margin increase to 57.7% due to lower costs and higher product margins. Earnings per share were $2.54, up from $2.28 the previous year.

Capital Allocation

The company also repurchased nearly $300 million of stock in Q1 and $230 million in Q2 so far, with an additional $1 billion authorized for future repurchases.

Guidance

Revenue guidance remains at 10% to 11% growth for the year. Management expects to open 35-40 new stores and maintain a steady gross margin. Full-year EPS guidance was raised to between $14.27 and $14.47.

Source: Lululemon IR

My Perspective: Despite a weak consumer market, LULU's business remains robust, supported by effective brand engagement and significant international growth potential. LULU has maintained its high margins, which means that it is not discounting its products, thereby maintaining a premium brand. The international segment, currently 21% of the business, is expected to grow to 50% over time. In the U.S., the slower start to the year was attributed to missed opportunities in women's apparel and bags, but strong performance in men's products. LULU trades at just 22 times forward earnings, which is very reasonable for a company growing its top line by over 10% with very healthy margins. This is another name high on the watchlist but already at an attractive valuation.

5. NIO (Ticker: NU) Q1 2024 Earnings

NIO reported another disappointing quarter, which was well signposted given the company reports monthly delivery figures. Key highlights include:

Deliveries

NIO delivered 30,053 vehicles in Q1, down 3% YoY. In the second quarter, the company's deliveries began to increase month by month due to the launch of new model year products and a more flexible sales policy. In April, NIO delivered 15,620 vehicles, and in May, this number rose to 20,544 vehicles. Consequently, NIO's market share in the premium battery electric vehicle segment grew significantly, with YoY growth surpassing the segment average.

Revenue

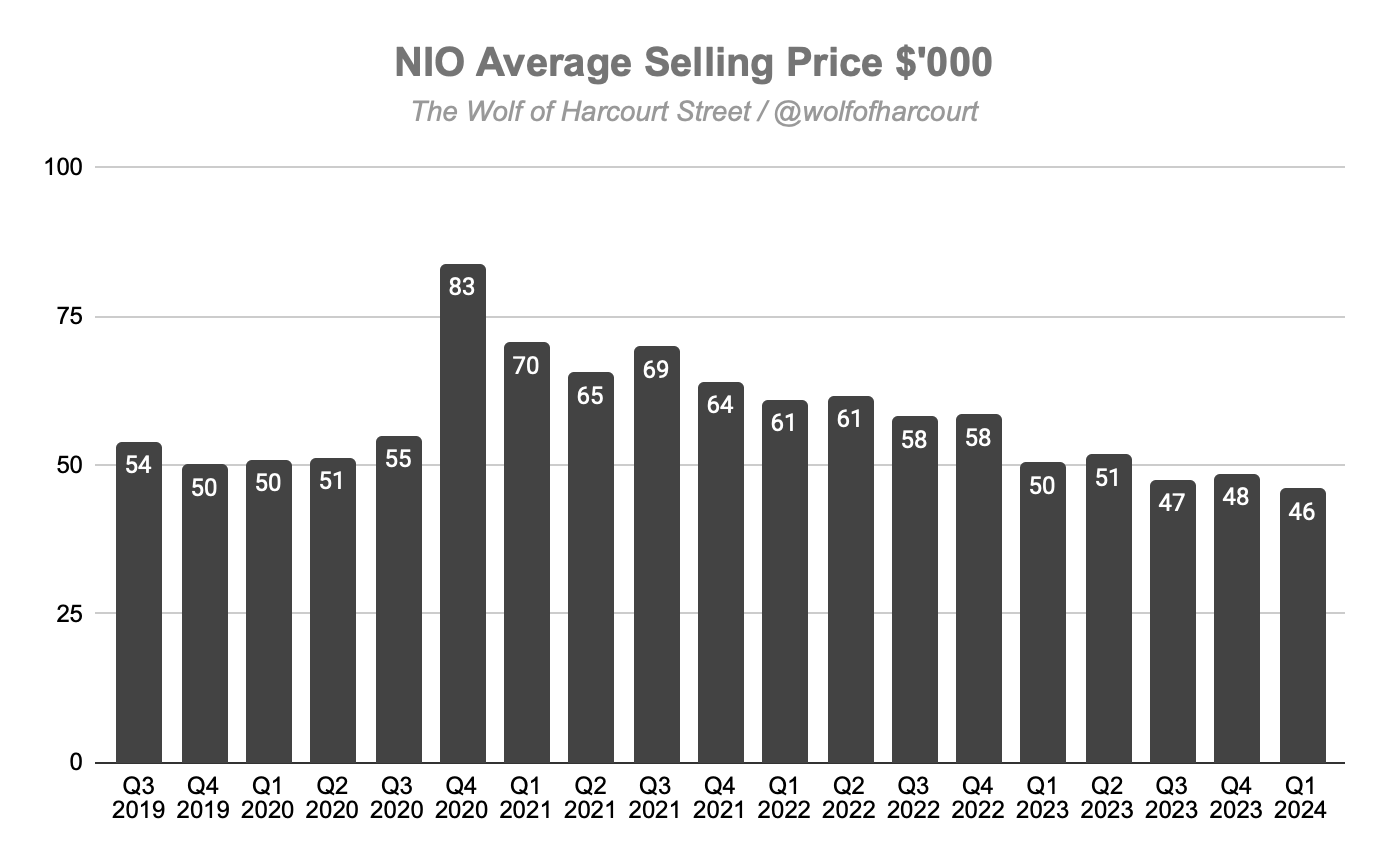

Total revenues were $1.37 billion, marking a decline of 7% YoY and 42% quarter-over-quarter (QoQ). Vehicle sales, comprising 85% of total revenue, amounted to $1.16 billion, reflecting a decrease of 9.1% YoY and 45.7% QoQ. The YoY revenue drop was primarily due to lower average selling prices following user rights adjustments in June 2023 and reduced delivery volumes.

Profitability

The overall gross margin improved to 4.9% from 1.5% the previous year but dropped from 7.5% in the prior quarter, influenced by vehicle margins. Vehicle margins were 9.2% this quarter, up from 5.1% a year ago but down from 11.9% last quarter due to lower average selling prices and increased promotions. The loss from operations increased by 6% YoY to $747 million.

Guidance

For Q2 2024, NIO anticipates vehicle deliveries between 54,000 and 56,000 units and total revenues between $2.3 billion and $2.4 billion, marking an increase of approximately 89% to 95% from Q2 2023.

Source: NIO IR

My Perspective: Q1 was really poor, but Q2 already looks far more promising. NIO has delivered over 36,000 vehicles, which is already more than Q1 with one month to go. The continual downward trend in average selling prices is the real concern. Based on the Q2 guidance, it appears that this could drop even lower.

The slowdown in China resulted in deliveries of pure electric and plug-in hybrid cars falling by 31% quarter-on-quarter to 1.76 million units in Q1, according to CPCA data. Competitor BYD slashed prices of nearly all of its cars by 5%-20% since mid-February. Since then, the prices of 50 models across a range of brands have dropped by 10% on average, according to Goldman Sachs. Price wars are never a good thing.

6. MercadoLibre (Ticker: MELI) Investments in Brazil to Exceed $4.35 Billion

MELI will exceed its initial investment of 23 billion reais ($4.35 billion) in Brazil due to higher-than-expected sales. The revised capital expenditure plan is not yet fully disclosed but the company plans to hire 11,000 people in Brazil this year, up from the previously estimated 6,500.

MELI also plans to open two new distribution centers in Porto Alegre and Brasilia, in addition to the previously announced center in Recife. The company currently has over 20 distribution centers in Latin America, with about half located in Brazil, its main market.

MELI is implementing a new strategy to enhance efficiency in its distribution centers using robots from Quicktron. This automation aims to reduce the time for picking and packaging products, potentially speeding up same-day delivery times by 30 minutes to one hour.

Source: Reuters

My Perspective: A company investing more money due to higher-than-expected sales is music to a growth investor's ears. MELI’s implementation of robotics and automation reinforces my belief that it is a technology-first company. It always has been and it always will be.

7. Auto Partner (Ticker: APR.WA) May Sales Update

APR reported May 2024 revenue of PLN 357.7 million, representing an increase of 7% YoY. On a cumulative basis, APR’s 2024 revenue is PLN 1.706 billion representing an increase of 17% YoY.

Source: Auto Partner IR

My Perspective: While the May number appears low, it should be noted that there was one fewer working day in Poland in May 2024 compared to May 2023. APR’s monthly revenue can be quite lumpy for a variety of reasons. For reference, March growth was 5%, while April was 23%. While I don’t believe a single month or quarter of data in isolation provides much value, APR will need to have a strong second half of the year to achieve management's target of +20% annual growth.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com