Executive Summary

MercadoLibre’s GMV reached $14.5 billion in Q4, surpassing $50 billion annually for the first time. Item sales grew 27% YoY, with strength across all markets. Unique buyers surged 24% YoY to 67 million, marking the fastest growth since Q1 2021, with over 100 million full-year active buyers.

Mercado Envíos saw strong growth in 2024, handling approximately 1.8 billion items (+44% YoY), with record fulfillment penetration in key markets, supported by new facilities. Faster delivery options continued to expand (+21% YoY), while on-time deliveries hit record highs, and costs declined due to improved productivity.

Mercado Pago experienced significant growth, with monthly active users up 34% YoY to 61 million. This growth was driven by strong user engagement, particularly through Mercado Pago’s market-leading deposit yields and access to credit lines, including a new credit card in Brazil and Mexico. Assets under management surged 129% to $10.6 billion, while total payment volume grew 20%, despite foreign exchange challenges.

Mercado Crédito experienced strong growth, with a 74% YoY increase to $6.6 billion, driven by robust performance across all regions. The company’s credit card portfolio became the largest segment, surpassing consumer loans. Financial performance showed sequential gains in Net Interest Margin After Losses (NIMAL), with risk management remaining a priority, as evidenced by stable asset quality.

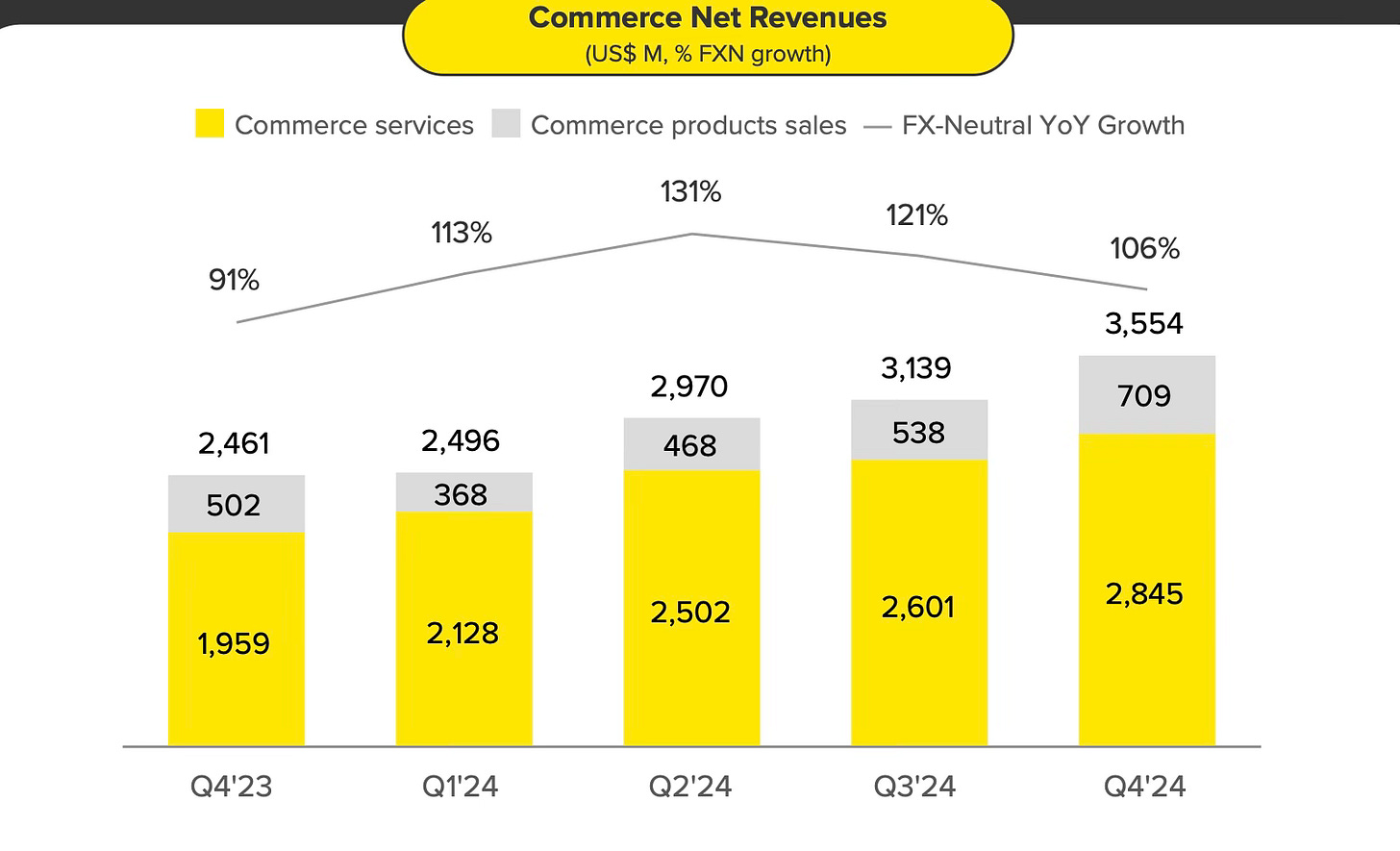

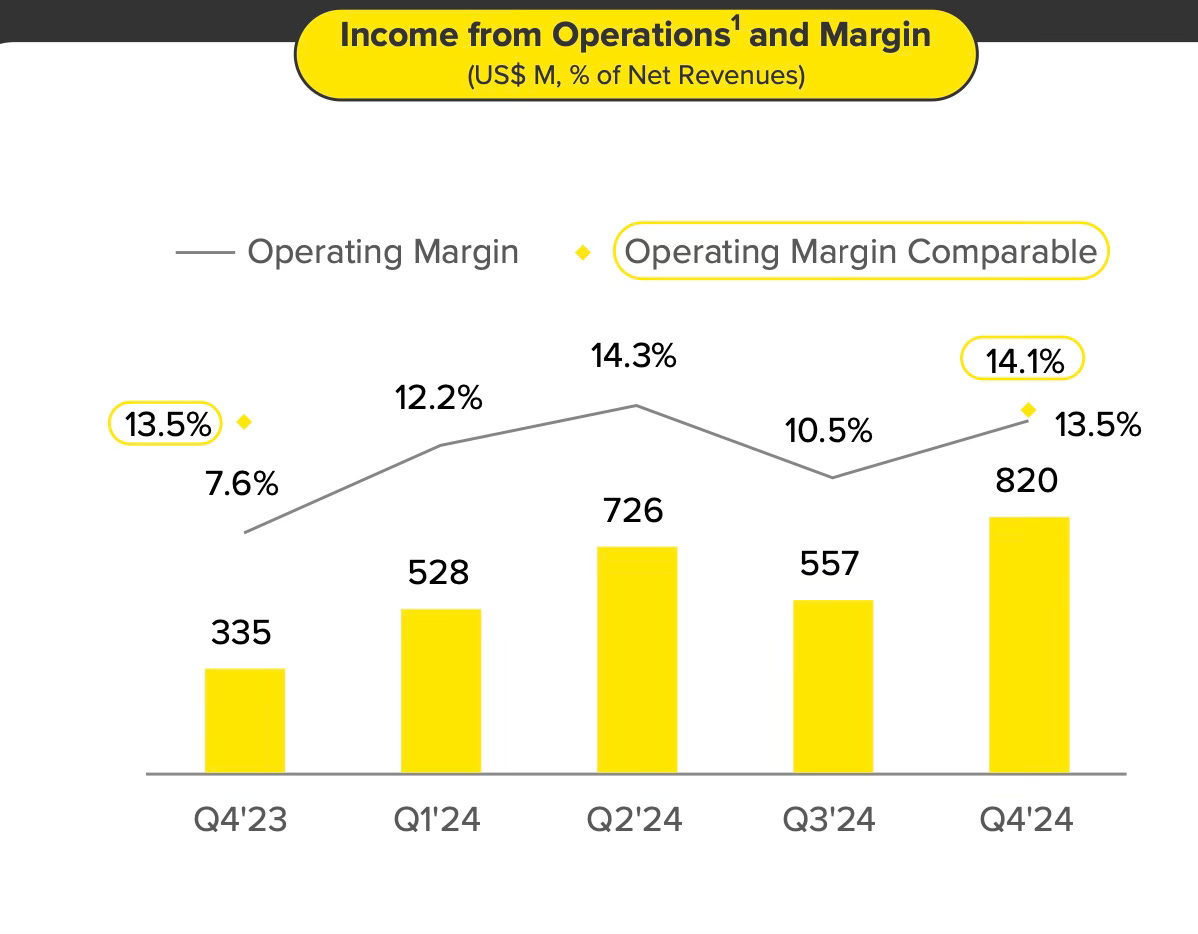

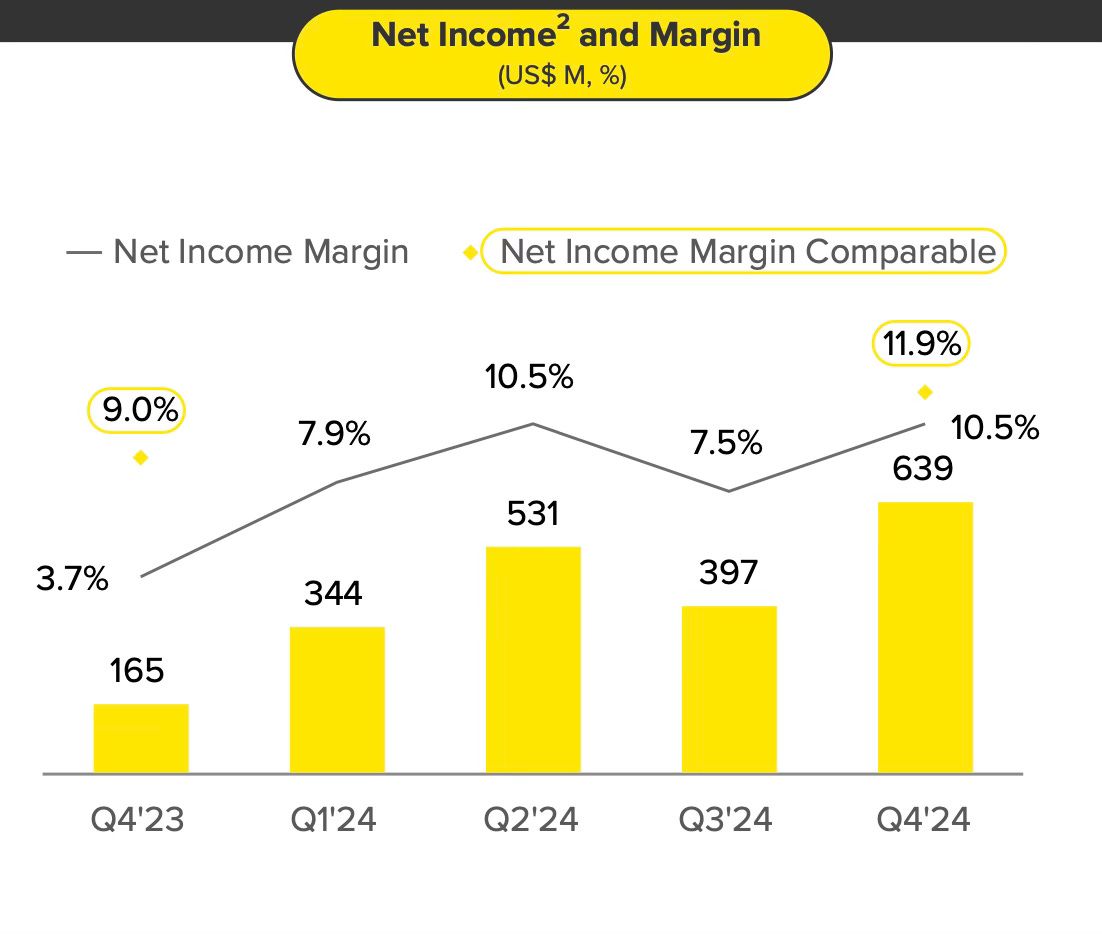

MELI reported a 37% YoY increase in net revenue to $6.06 billion. Commerce revenue rose 44% YoY, fuelled by a higher 3P take rate and increased advertising revenue. Fintech revenue grew 29% YoY, but the take rate contracted due to lower financial income and a shift upmarket in Brazil. Operating and net margins expanded significantly, driven by improved logistics, cost management, and FX loss reductions.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Crédito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $6.06 billion (+37% YoY)

Operating Income: $820 million (+145% YoY)

Net Income: $639 million (+287% YoY)

2. Wall Street Expectations

Revenue: $5.94 billion (beat by 2%)

EPS: $7.56 (beat by 67%)

3. MercadoLibre Marketplace

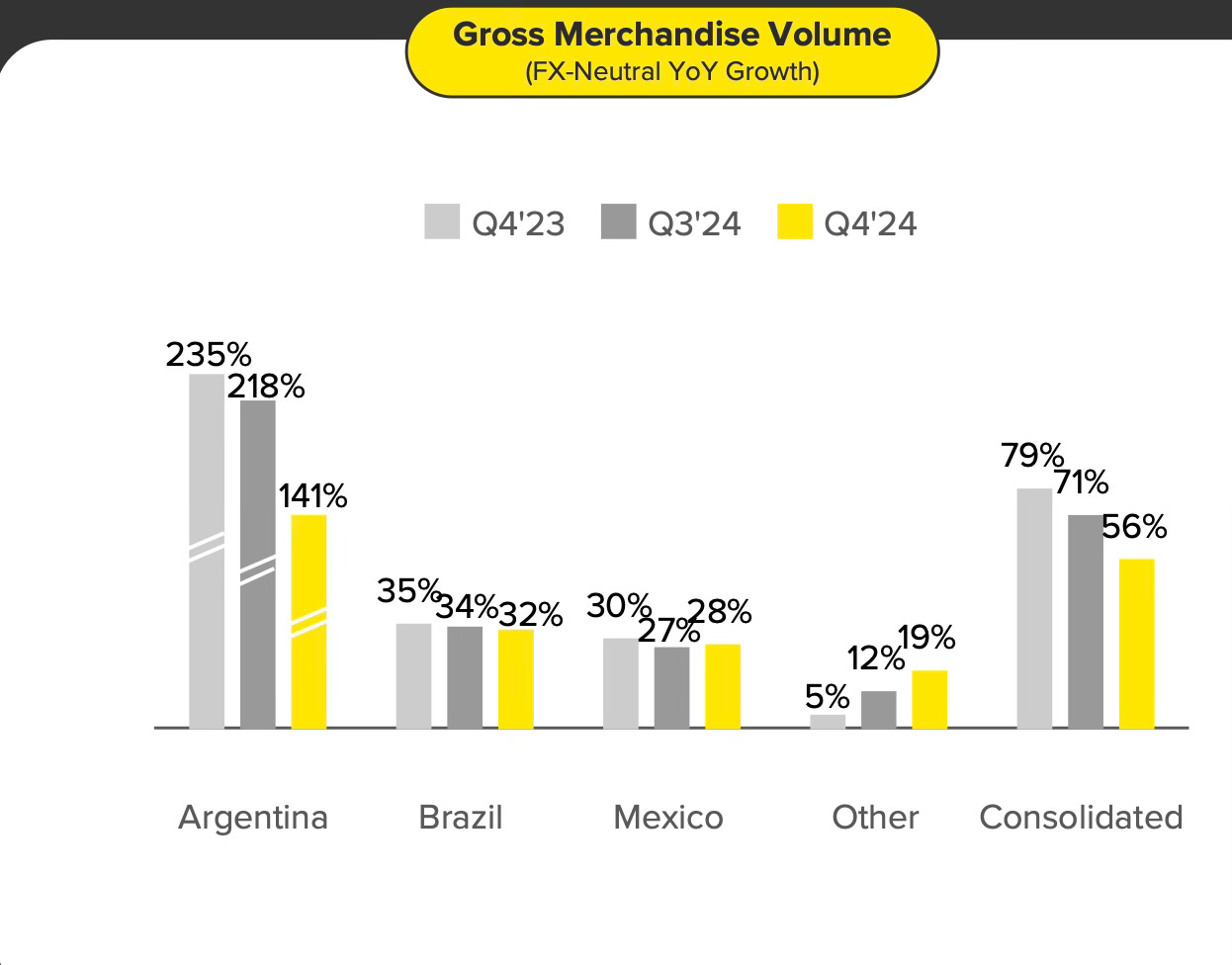

MercadoLibre (MELI) reported Gross Merchandise Volume (GMV) of $14.5 billion, reflecting 8% year-over-year (YoY) growth. On an annual basis, GMV surpassed $50 billion for the first time. While quarterly growth appears to have slowed, an FX-neutral perspective tells a different story.

GMV growth remains strong across markets:

Brazil: 32% YoY FX-neutral growth

Mexico: 28% YoY FX-neutral growth, with strong execution during peak season

MELI’s 1P (first-party) offering played a key role in driving results, accounting for eight of the top ten best-selling items during Black Friday in Brazil and all of the top ten sellers during El Buen Fin in Mexico. That said, most GMV growth—and nearly 95% of GMV in dollar terms—comes from third-party sellers. Growth was solid across all categories, with lower-priced items continuing to perform well.

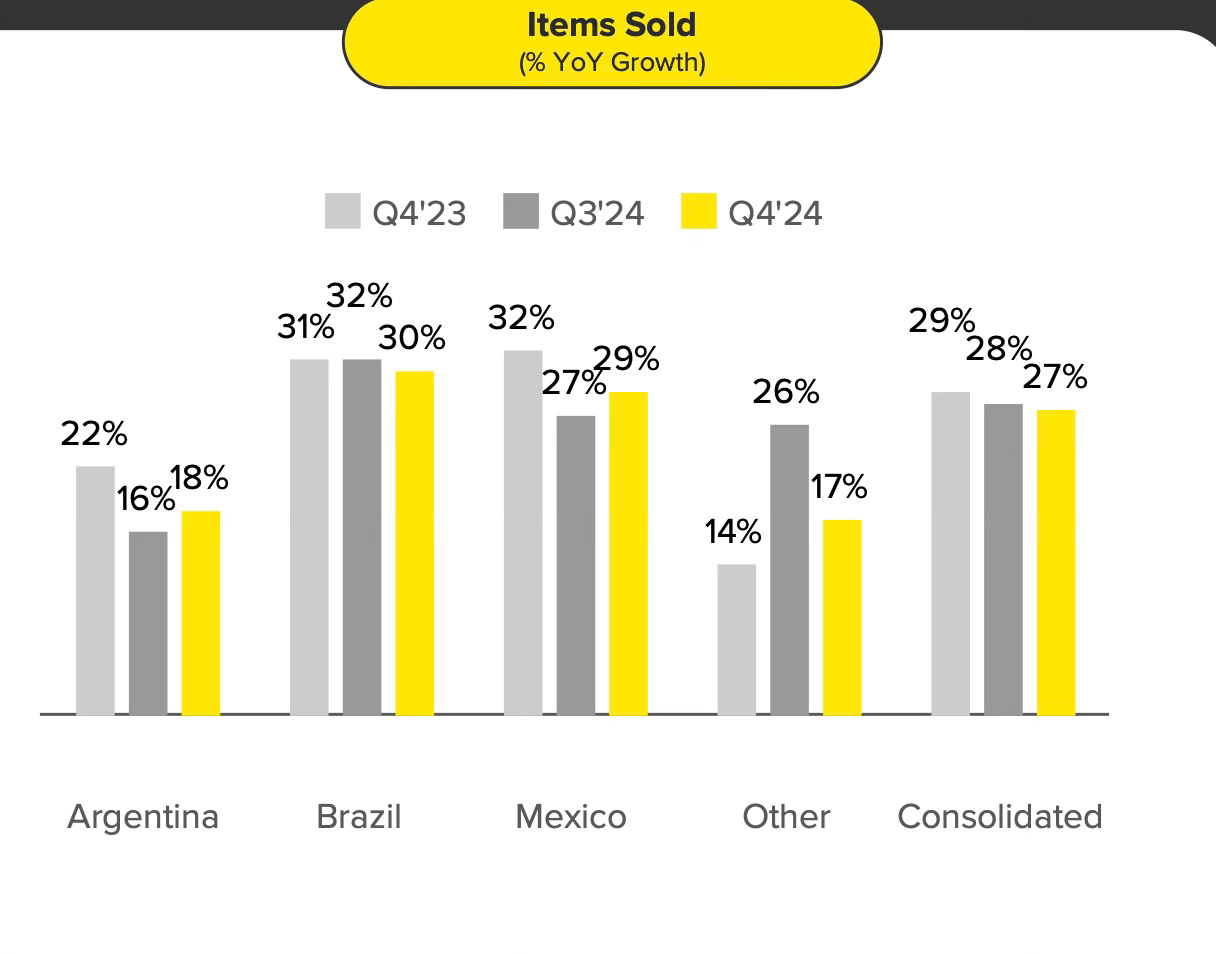

The number of items sold grew 27% YoY, sustaining momentum from 2024. Mexico & Argentina experienced accelerated growth, with Argentina overcoming a tough comparison due to last year’s demand pull-forward

Average Selling Prices (ASPs) are rising more slowly than inflation as the mix shifts toward staples, clothing, and beauty. This shift toward high-frequency categories is a long-term positive for MELI, reinforcing the transition from offline to online retail.

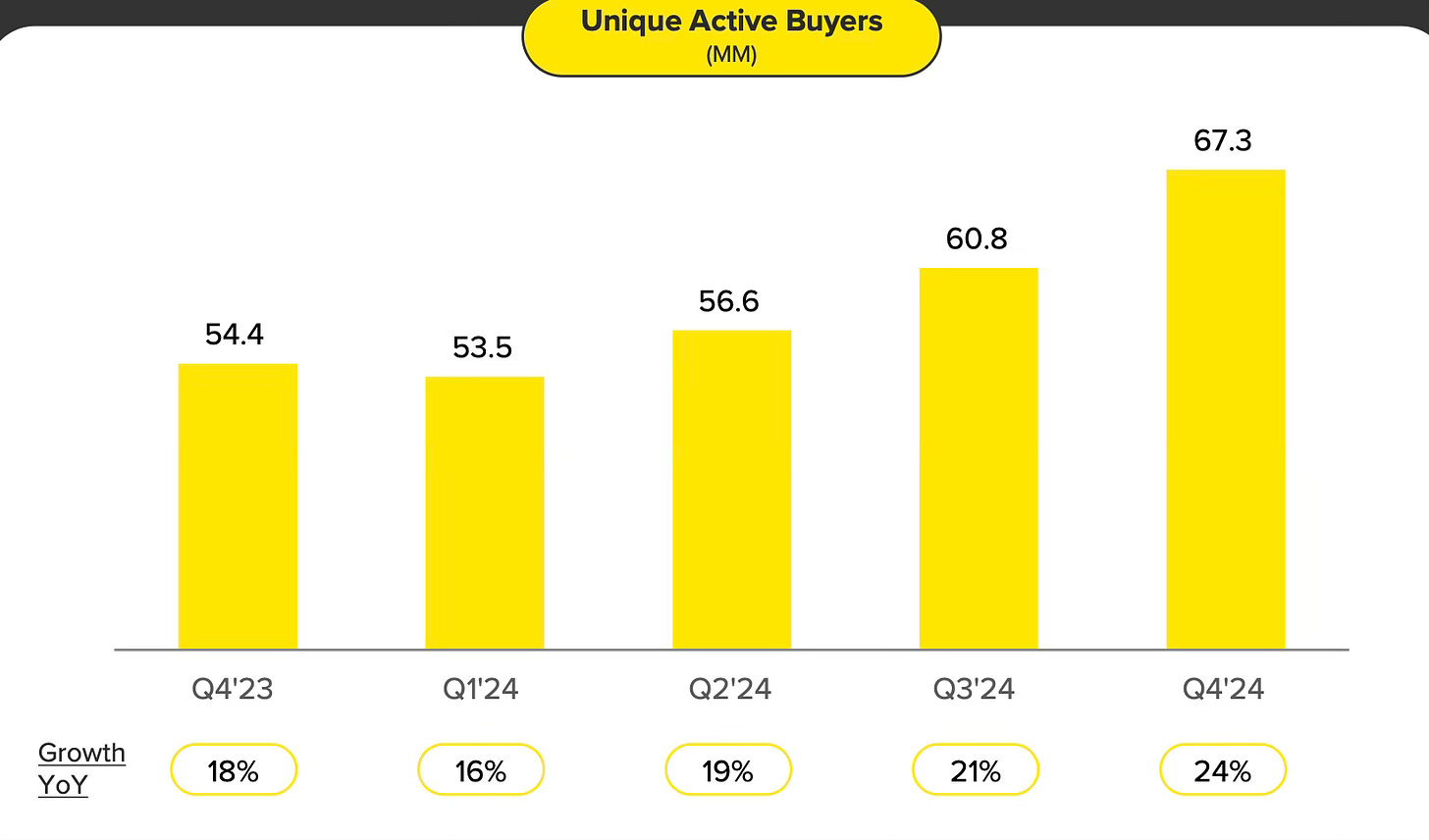

Unique buyers grew 24% YoY to 67 million, the fastest growth rate since Q1 2021. This marks the third consecutive quarter of accelerating unique buyer growth, with full-year active buyers surpassing 100 million for the first time.

Management believes this number can grow significantly in the long term. For context, Latin America’s total population is ~600 million, underscoring the vast potential for expansion. MELI’s long-term investments are driving more purchasing activity. The share of unique buyers purchasing three or more categories per month has increased by ~20 percentage points over the last five years, a trend management expects to continue.

4. Mercado Envíos

Mercado Envíos handled ~1.8 billion items in 2024, with 500+ million in Q4, reflecting a 44% YoY increase in fulfilled items.

Fulfillment penetration reached record levels in key markets (Brazil, Mexico, Argentina, Chile, and Colombia), supported by new facilities, including the Metro Fulfillment Centers in Brasília and Porto Alegre.

Same-day & next-day deliveries grew 21% YoY, accelerating for the second straight quarter.

On-time deliveries hit record highs, while late deliveries fell to record lows.

Fulfilment productivity improved, enabling cheaper & faster shipping.

Evolving buyer preferences led to increased adoption of Meli Delivery Day, which offers slower shipping in exchange for free shipping on a broader assortment. This slightly reduced same/next-day deliveries to 49%, but drove higher GMV and engagement.

5. Mercado Pago

Monthly active users (MAU) grew 34% YoY to 61 million. Beneath the surface, heavy users are growing even faster, driven by Mercado Pago’s strong value proposition, which offers market-leading yields on deposits and access to credit lines—including a credit card in Brazil and Mexico.

Cardholders benefit from extra installments on marketplace purchases, while MELI+ loyalty members receive cashback on both on- and off-platform purchases and enjoy a lower free shipping threshold. This differentiated value proposition contributed to record Net Promoter Scores (NPS) in Brazil and Mexico. It is also expanding Mercado Pago’s reach by attracting marketplace buyers who previously did not use its fintech services—a key opportunity to cross-sell financial products to Mercado Libre’s 100 million unique buyers.

The Mercado Pago credit card is at the core of MELI’s value proposition and customer loyalty strategy. This competitive edge stems from deep user insights and continuously improving underwriting models, leading to record-low first-payment defaults in Brazil. Mercado Pago’s ecosystem integration further strengthens its appeal, demonstrated by it becoming the most-used credit card on Mercado Libre’s Brazilian marketplace in Q4, just before Black Friday.

Assets under management (AUM) surged 129% YoY to $10.6 billion as consumers increasingly bring funds to the platform, driven by the success of Mercado Pago’s yielding account.

Acquiring total payment volume (TPV) grew 20% YoY to $41.9 billion, despite FX headwinds. FX-neutral growth accelerated across key markets, supported by an upmarket push in Brazil and increased cash digitization in Mexico.

MELI is positioning Mercado Pago as the top payment acquirer for Latin American merchants. Faster processing times, higher approval rates, wider credit availability, and access to merchant software are driving lower churn and higher NPS. MELI also took its first steps toward offering merchant software in Brazil, though significant development is needed to achieve its long-term vision. With a strong track record in payment acquiring, MELI leverages its expertise in fraud prevention and approval rate optimisation to enhance the product.

6. Mercado Crédito

Mercado Crédito grew 74% YoY to $6.6 billion, with robust growth across all geographies—particularly in Argentina, where improving macro trends support larger credit lines for more consumers. Both consumer and merchant loans contribute positively to profitability, offsetting investments in the credit card segment.

The credit card portfolio is now the largest, surpassing consumer loans for the first time in Q4. Financial performance continues to improve, with sequential gains in Net Interest Margin After Losses (NIMAL) driven by strong collections, favourable seasonality, and better risk model performance. The YoY decline was primarily due to a higher credit card mix and the move upmarket. All cohorts older than two years now have positive NIMAL spreads, with some reaching low double digits, and newer cohorts are following a similar trajectory toward profitability.

Risk management remains a top priority. While the portfolio continues expanding and shifting toward lower-risk products, asset quality remains stable and robust. The 15-90 day NPL and provisions remained broadly stable QoQ at 7.4% and 102%, respectively

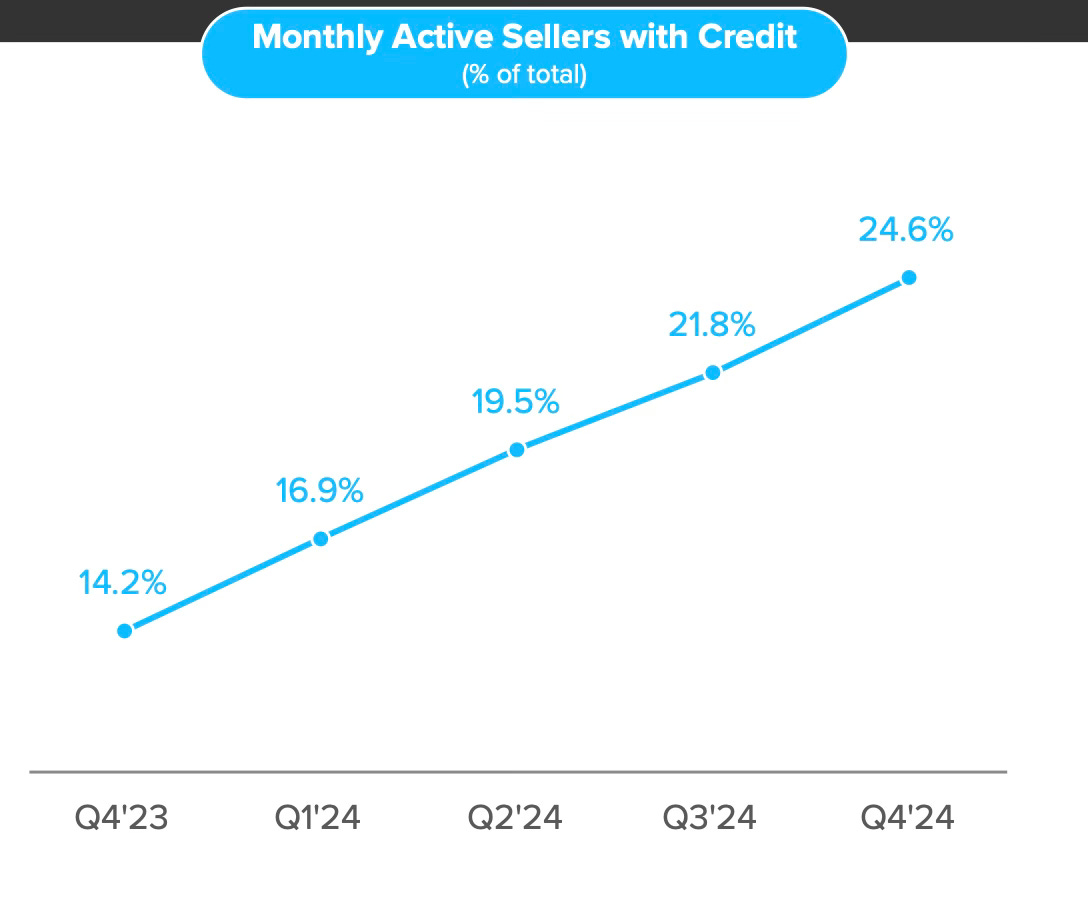

Cross-selling to merchants is a key pillar of MELI’s ecosystem strategy. Merchant credit penetration rose to 24.6%, driven by higher adoption among in-store merchants across all regions. Additionally, Insurtech active users surpassed 10 million for the first time, supported by effective cross-selling initiatives.

7. Financial Analysis

Revenue

Net revenue reached $6.06 billion, marking a 37% YoY increase on a reported basis, accelerating from 35% sequentially. The Q1 shipping reporting change contributed 12 percentage points to this growth. On an underlying basis, net revenue grew 25% YoY.

Brazil and Mexico experienced strong FX-neutral revenue growth, rising 62% and 64%, respectively.

Argentina achieved 212% FX-neutral revenue growth, outpacing inflation.

Commerce revenue grew 44% YoY (106% on an FX-neutral basis) to $3.6 billion as the 3P take rate rose to 20.8%, driven by higher shipping billings and increased ad penetration. Advertising revenue growth accelerated to 41% YoY(88% FX-neutral), reaching 2.1% penetration of GMV.

Fintech revenue reached $2.5 billion, reflecting an accelerated growth rate of 29% YoY (84% YoY FX-neutral), the fastest rate of growth in 2024. However, the take rate contracted to 4.25% due to:

Lower financial income in all countries.

A move upmarket in Brazil, which was only partially offset by higher credit revenue.

Gross Margin

The reported gross profit margin decreased to 45.4% from 46.5% YoY, though this figure is less meaningful due to reporting changes. In prior reports, MELI provided a gross margin walk for a comparable basis, but this was not included this quarter. As a result, we cannot conduct a direct like-for-like comparison.

That said, with the gross margin only down 0.9 percentage points, it is likely that the underlying margin actually increased. Last quarter, management highlighted its strategy of expanding product assortment at competitive prices, particularly in categories with gaps in 3P selection. As 1P scales, profitability continues to improve, with 1P no longer dragging on margins

Operating Margin

The operating margin increased to 13.5%, reflecting a 5.9 percentage point YoY expansion, as operating income hit a quarterly record of $820 million. Excluding reclassification and shipping updates, the operating margin increased by 0.6 percentage points on a comparable basis.

Key factors driving margin expansion:

+3.4 percentage points: Improved logistics execution, disciplined cost management, efficiencies in collection fees, and operating leverage in Sales & Marketing and Product Development.

-2.8 percentage points: Higher provisions for doubtful accounts due to rapid credit growth and the increasing share of credit cards in the portfolio. Credit growth is outpacing the rest of the business, leading to higher provisions, since credit is the only segment with material provision costs. Additionally, provisions are recognized upfront, while revenue accrues over time, creating a temporary mismatch.

Net Margin

The net margin increased to 10.5%, reflecting a 6.8 percentage point YoY increase, as net income also hit a quarterly record of $639 million. Excluding reclassification and shipping updates, the net margin increased by 1.9 percentage points on a comparable basis.

Key factors driving net margin expansion:

+4.2 percentage points: Operating margin expansion, significant FX loss reductions (particularly in Argentina), and lower income taxes.

-1.3 percentage points: Lower net interest income after expenses.

Cash Flow Analysis

MELI reported $680 million in adjusted free cash flow, driven by strong operational cash generation despite:

$655 million net investment in Fintech to grow the credit business.

$305 million in Capex.

For FY 2024, MELI generated $1.3 billion in adjusted free cash flow.

MELI’s balance sheet remains healthy, with:

$4.7 billion in cash and restricted cash

$4.5 billion in short-term investments

$2.9 billion in long-term debt

8. Conclusion

MELI does not provide quarterly guidance, as its focus remains on long-term growth and market leadership over short-term profits. As a long-term investor, this approach resonates deeply with me. Moreover, Wall Street analysts consistently struggle to grasp the business, given their reliance on short-term guidance—which MELI does not provide.

The result? Once again, analysts' consensus estimates were way off, as MELI smashed top- and particularly bottom-line expectations.

This earnings report underscores MELI’s growing dominance in Latin America’s e-commerce and fintech sectors, driven by:

Strategic investments in logistics, financial services, and technology while maintaining profitability and efficiency.

Significant growth across key metrics (GMV, acquiring TTV, credit portfolio, AUM), outpacing the market in Brazil, Mexico, and Argentina.

Record user engagement, surpassing 100 million unique buyers and 60 million monthly fintech users for the first time.

Expanded logistics infrastructure, including new fulfilment centres and an enhanced free shipping program, driving record new buyers.

5.9 million new credit cards issued, doubling the credit portfolio, reinforcing MELI’s ambition to become Latin America's largest digital bank.

However, MELI stock sold off at the end of 2024 due to concerns about elevated credit risk in Brazil. Given MELI's significant exposure to this market, this was a key focus in analyst discussions. Management, however, dismissed concerns, stating there are no signs of credit portfolio deterioration:

“So far, we have seen no signs of deterioration in our credit portfolio. And in fact, in Brazil, the credit card had the lowest first payment default on record in December.”

- Martin de Los Santos, CFO

Nonetheless, MELI has implemented risk reduction measures due to weaker macroeconomic conditions and rising interest rates:

“As of now, we are no longer issuing micro cards, which we have reduced significantly, I don't say 1 region, but we have really significantly the amount of macro cards we were issuing and also, we have tightened the payback periods on new issuance. So essentially, we're being a little bit more cautious. Nonetheless, we are very comfortable with the level of risk we are taking.”

- Martin de Los Santos, CFO

One of the most under-appreciated aspects of MELI’s credit strategy is its inherent flexibility. Given its short-duration credit portfolio, MELI can quickly adapt to market shifts—a strategy it has successfully executed in the past.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for the overview. You save me time every quarter ;)