MercadoLibre: Doubling Profits While Accelerating Growth

MercadoLibre (MELI) Q2 2024 Earnings Analysis

Executive Summary

MercadoLibre Marketplace reported an increase in GMV to $12.6 billion, reflecting a 20% YoY growth. Items sold grew by 29% YoY, marking the highest growth rate since Q1 2021. Brazil led with a 37% increase, Mexico saw a 30% growth, and Chile and Colombia hit their highest growth rates since 2021. Argentina also reversed earlier declines.

Mercado Envíos' same-day and next-day shipments grew by 15% YoY, with MELI setting a record for items delivered in this timeframe. In Brazil, fulfillment penetration rose by 8 percentage points YoY, improving delivery speed and seller conversion. The proportion of free shipping across MELI grew by 4 percentage points YoY, aided by the expansion of MELI+. MELI also opened a new fulfillment center in Texas to enhance cross-border sales, helping US sellers reach buyers in Mexico.

Mercado Pago's MAUs increased by 37% YoY to 52 million, with significant engagement in Argentina, Brazil, and Mexico. Growth is driven by higher user activity, more products per user, and improved retention rates. MELI’s remunerated account, offering immediate interest on deposits, has seen substantial success. In Argentina, user numbers tripled, and USD assets under management (AUM) more than doubled in 18 months. Brazil’s "conta turbinada" led to a 46% YoY increase in MAUs and contributed to an 86% YoY rise in total MELI AUM, reaching $6.6 billion in Q2 2024.

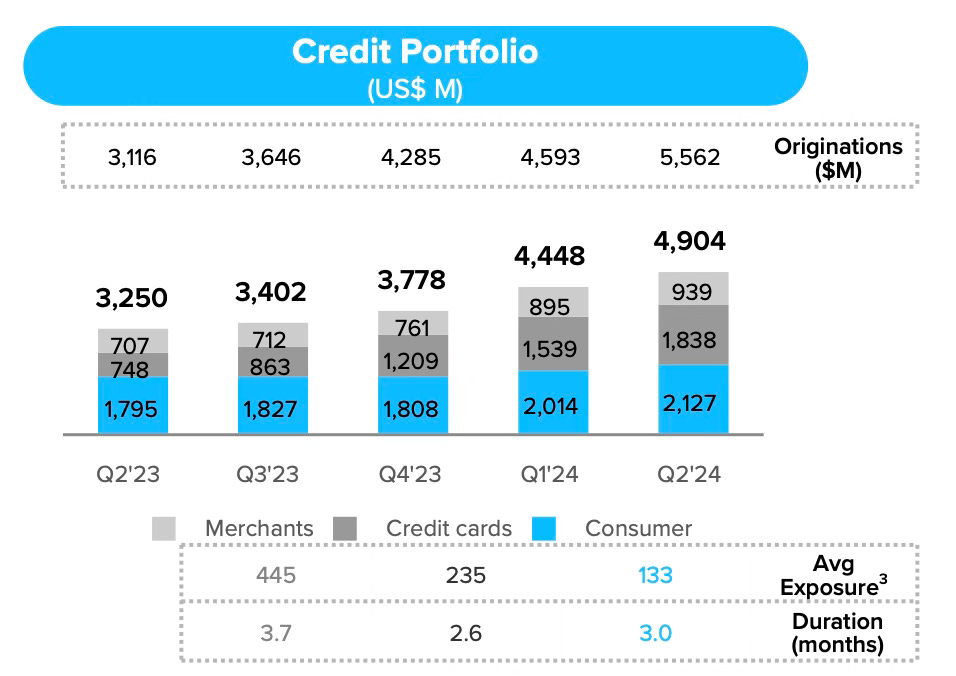

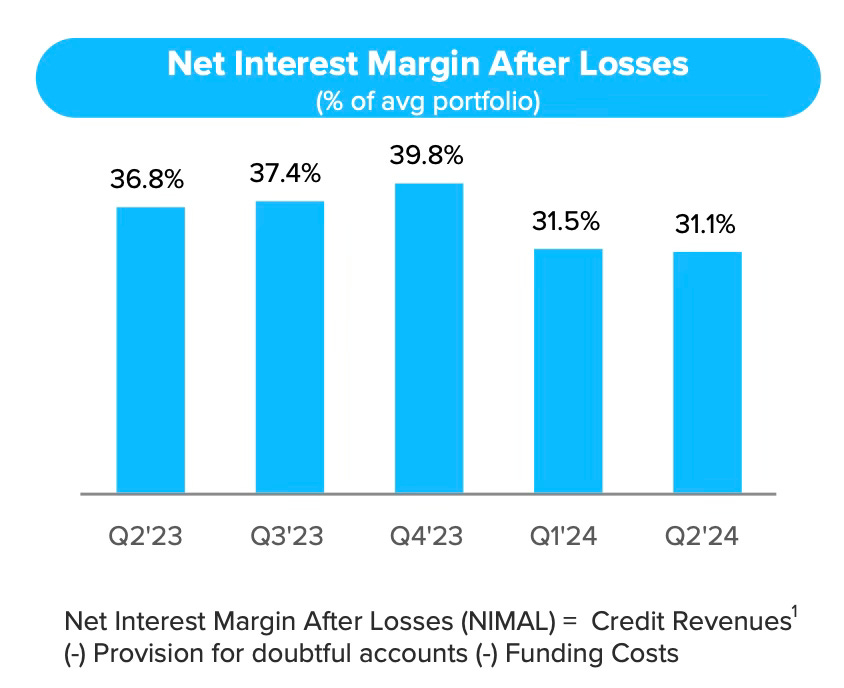

Mercado Crédito saw a 51% YoY growth, reaching $4.9 billion, largely due to a surge in credit card issuance in Brazil and Mexico. Credit card transaction volume grew 208% YoY, mostly from off-platform transactions, indicating a broader market impact. Despite a 5.7 percentage point drop in NIMAL to 31.1% due to the lower margins of credit cards, the margin remains solid across portfolios.

MELI’s net revenue for the period reached $5.07 billion, a 42% increase YoY, up from 36% in Q1. Net income surged 103% YoY to $531 million, bolstered by higher EBIT and reduced foreign exchange losses. The net income margin for Q2 hit 10.5%, the highest in eight years.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Crédito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $5.07 billion +42% year-over-year (YoY)

Operating Income: $726 million +9% YoY

Net Income: $531 million +103% YoY

Earnings per Share: 10.48

2. Wall Street Expectations

Revenue: $4.68 billion (beat by 8%)

Earnings per Share: 8.48 (beat by 24%)

3. MercadoLibre Marketplace

MercadoLibre (MELI) reported Gross Merchandise Volume (GMV) of $12.6 billion, representing growth of 20% YoY.

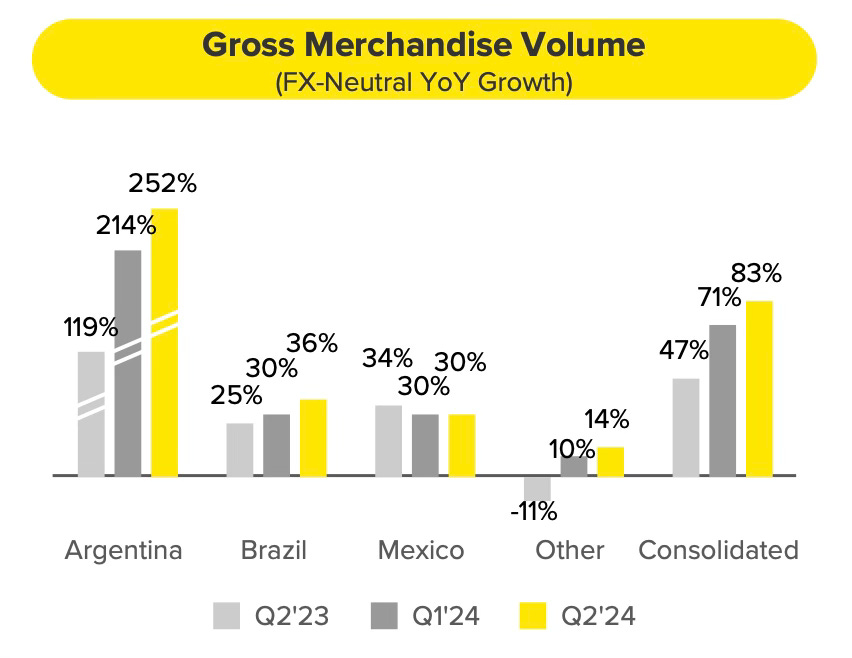

FX-neutral GMV growth in Brazil accelerated to 36% YoY, the fastest since Q2 2021, while Mexico maintained strong momentum with 30% growth. Argentina's growth improved to 252% due to effective consumption incentives.

Items sold grew by 29% YoY, the fastest rate since Q1 2021. Brazil led with a 37% growth, Mexico maintained a steady 30% growth, and Chile and Colombia saw their highest growth rates since 2021. Argentina also experienced positive growth, reversing the decline from Q1 2024.

MELI is driving offline retail online by creating a superior experience for buyers and sellers, leading to significant growth. Unique buyer growth reached 19% YoY, the fastest since Q2 2021, setting MELI up for future growth as buyers purchase more items across more categories. A record number of buyers purchased from three or more categories per quarter for the second consecutive quarter in Q2 2024. Brazil, with a 22% YoY growth rate, and Mexico and Argentina, both maintaining strong growth, were major contributors to this trend.

4. Mercado Envíos

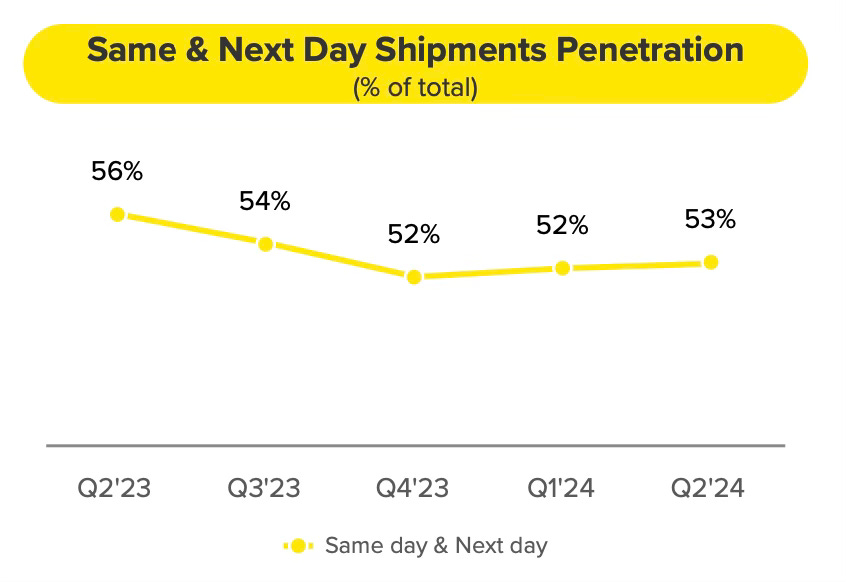

Same-day and next-day shipments grew by 15% YoY, with MELI achieving a record number of items delivered within this timeframe. Fulfilment penetration in Brazil increased by 8 percentage points YoY, enhancing faster delivery and higher seller conversion. Free shipping across MELI rose by 4 percentage points YoY, supported by the scaling of MELI+. Delivery speed promises reached record levels in Brazil and Colombia, with MELI offering the fastest delivery in major cities like São Paulo and Mexico City.

The YoY decline in same and next-day shipments is due to an increase in users opting for slower, more cost-effective shipping methods and capacity constraints in Mexico.

MELI also opened a fulfilment centre in Texas to facilitate cross-border sales, providing inventory from US sellers to buyers in Mexico.

5. Mercado Pago

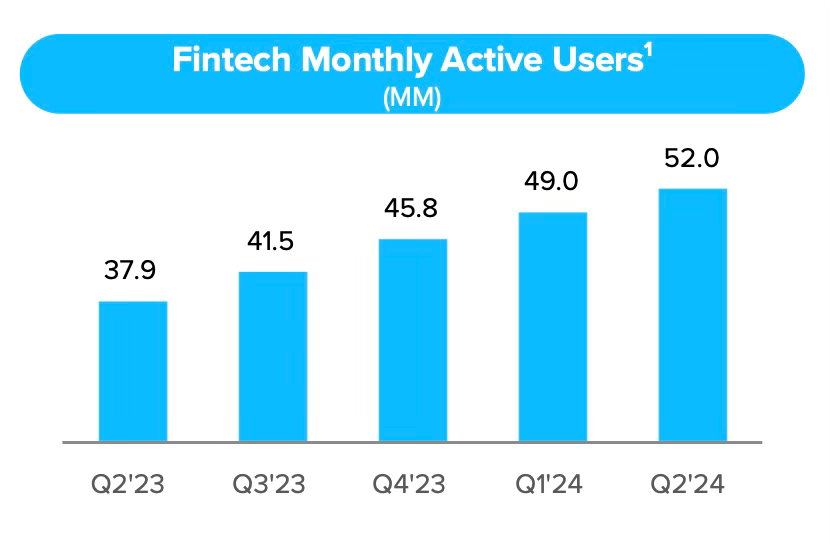

The significant increase in users for Mercado Pago, with monthly active users (MAU) up 37% YoY to 52 million, highlights its pivotal role in financial services. There is growing engagement in Argentina, Brazil, and Mexico, marked by faster growth among heavy users, a consistent rise in the number of products per user, and higher retention rates in recent cohorts.

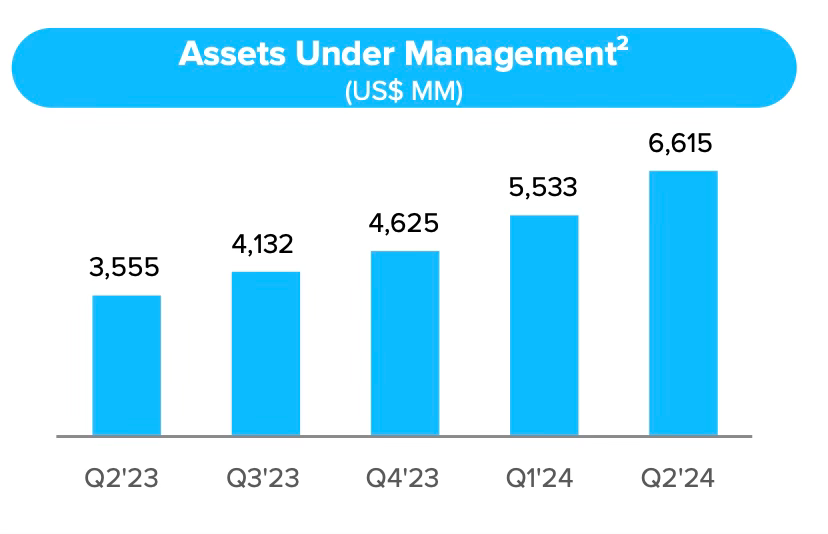

One of MELI's key value propositions is their remunerated account, which offers immediate interest on deposits. This has seen significant success in Argentina, with users tripling and USD Assets Under Management (AUM) more than doubling in 18 months. In Brazil, the "conta turbinada" has attracted millions of new users, leading to a 46% YoY increase in MAU and contributing to an 86% YoY rise in total MELI AUM to $6.6 billion in Q2 2024. Due to these positive results, MELI announced plans to extend this strategy to Mexico with 15% annual account remuneration.

Acquiring Total Payment Volume (TPV) reached nearly $34 billion, up 24% YoY and 75% on an FX-neutral basis, driven by a 26% YoY increase in off-platform transactions. Despite Argentina's peso devaluation, USD-denominated growth persisted. Brazil and Mexico contribute over 60% of Acquiring TPV, reflecting successful upmarket strategy implementation.

6. Mercado Crédito

Mercado Crédito growth accelerated to 51% YoY, reaching $4.9 billion, driven primarily by the credit card segment with 1.6 million new cards issued in Brazil and Mexico.

The credit card's TPV growth (FX-neutral) surged to 208% YoY, with most volume coming from off-platform, highlighting progress towards greater market influence. Robust asset quality and improved underwriting models support this growth. Additionally, strong demand for other loan products resulted in significant increases in users across both Consumer and Merchant portfolios.

While the consolidated NIMAL (Net Interest Margin after Loan Loss Provisions) decreased by 5.7 percentage points YoY to 31.1% due to a higher mix of lower-margin credit card products, it remains healthy across consumer, merchant, and credit card portfolios. Credit cards, though lower in margin, are strategically valuable for driving marketplace purchases and fintech engagement.

The 15-90 day NPL (Non-Performing Loans) ratio improved by 110 basis points quarter-on-quarter to 8.2%, reflecting strong asset quality in consumer and credit card portfolios. Provision coverage remains >100% for all buckets.

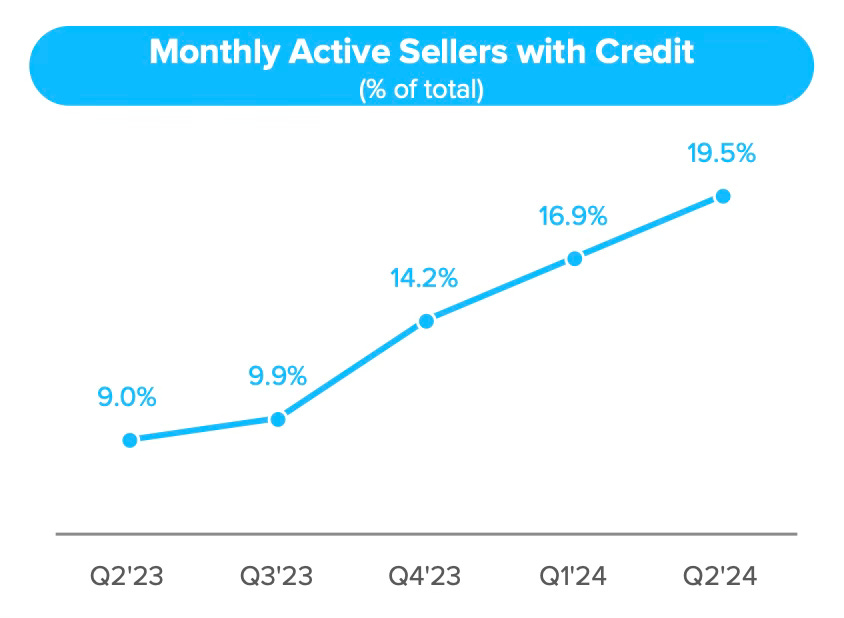

Cross-selling additional services, particularly credit, to merchants is a key strategy to leverage the MELI ecosystem. In Q2, the cross-sell of credit increased as a percentage of the merchant base, with significant growth driven by In-Store merchants across all regions.

7. Financial Analysis

Revenue

MELI's net revenue reached $5.07 billion, marking a 42% year-over-year increase on a reported basis, up from 36% in Q1. The change in shipping reporting for Q1 contributed 14 percentage points, or $484 million, to this growth. For new readers, I recommend checking out MercadoLibre Q1 2024 Earnings Analysis for more details on this change.

Revenue growth was strong across geographies: Brazil saw a 51% YoY increase (15 percentage points from shipping updates), Mexico had a 66% YoY increase (22 percentage points from shipping updates), and the Others segment grew 36% YoY (12 percentage points from shipping updates). Argentina's FX-neutral growth was 285% YoY (flat YoY in USD), reflecting a significant improvement due to stronger GMV trends.

Commerce revenue grew 131% YoY on an FX-neutral basis to $3 billion, driven by improved monetization through higher ad penetration and a reduced mix from Argentina.

MercadoLibre's Ads business is experiencing substantial growth, with revenue reaching 2.0% of GMV, an increase of 51% YoY. The expanding user base and increased marketplace activity is enhancing the effectiveness of targeted advertising using first-party data. The core on-platform ads, including product, display, and brand formats, are showing strong performance. Additionally, early signs for video ads are promising, with Mercado Play, the company's free streaming platform, growing its monthly active users by over 20% month on month. The development of an off-platform business began with a partnership for programmatic video ads on Disney+, marking the start of further external collaborations and expansion in the ad space.

Fintech revenue reached $2.1 billion, reflecting a 92% YoY increase on an FX-neutral basis, accelerating from 92% in Q1. This growth was driven by a higher take rate in Brazil, though it was partially offset by take rate pressure in Argentina.

Gross Margin

For Q2 2024, the reported gross profit margin decreased to 46.6% from 50.4% the previous year, but this figure is less meaningful due to reporting changes. On a comparable basis, the Gross Profit Margin actually increased to 51.5% from 50.4% YoY, demonstrating improved performance despite challenges in the Argentine market.

Shipping costs increased by 50 basis points (bps) YoY as a percentage of GMV, mainly due to strategic investments in fulfilment and MELI+, and higher short-term costs in Mexico. However, these costs improved sequentially due to productivity gains in fulfillment centers and managed carrier costs.

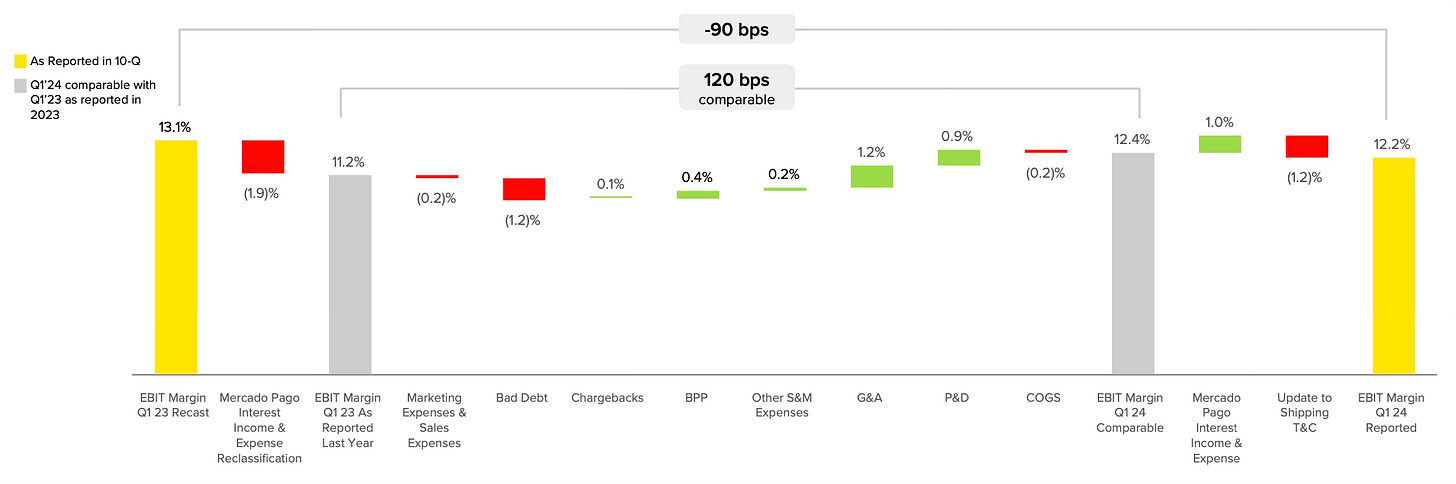

Operating Margin

The Q2 operating margin declined to 14.3%, down by 440 bps YoY. This decline was due to:

50 bps headwind from changes in shipping reporting.

240 bps impact from reduced margins and diminished revenue contribution in Argentina.

270 bps effect from provisions for doubtful accounts due to accelerated credit originations (+79% YoY) outpacing consolidated revenue (+42% YoY) and a higher proportion of the portfolio from credit cards, which require more provisions compared to other loan products.

Net Margin

Net income increased by 103% YoY to $531 million, driven by higher EBIT and reduced FX losses from Argentina. The reduction in FX losses was due to a smaller gap between official and blue chip swap exchange rates, a result of the Argentine Peso devaluation. Q2's net income margin reached 10.5%, the highest in eight years.

Cash Flow Analysis

MELI reported a significant increase in cash flow from operating activities in Q1 2024, reaching $1.88 billion compared to $1.41 billion in Q2 2023, growing 33%. This rise reflects strong cash generation while continuing to invest in growth.

Management introduced "adjusted free cash flow" as a new non-GAAP financial measure to provide better insight into cash generation.

For Q2 2024, adjusted free cash flow was $678 million, up significantly from $145 million in Q2 2023, despite higher capital expenditures and funding for the credit portfolio. This strong cash flow performance, along with reduced leverage ratios, contributed to S&P revising Mercado Libre's credit rating outlook to "Positive" in June.

8. Conclusion

MELI delivered another outstanding quarter with accelerating GMV in Brazil, Mexico, and a recovery in Argentina. In Fintech, monthly active users surpassed 50 million for the first time, showing strong growth in its remunerated accounts and credit offerings.

MELI's logistics network is crucial for driving e-commerce growth and is a key competitive advantage. Recent innovations include:

First Fulfillment Center in the USA: Opened in Texas to expand product offerings for Mexican consumers and enhance cross-border business with U.S. sellers. This improves shipping speed and offers free shipping with interest-free installments.

Robotics in São Paulo: Launched in June 2024, with over 300 robots planned by year-end. This initiative aims to optimize processing time by 20%, automate repetitive tasks, and increase storage capacity by up to 15%.

Slow Shipments and MELI Delivery Day: Slow shipments provide flexible shipping options and maximize network capacity by utilizing underused resources. MELI Delivery Day enhances last-mile efficiency by consolidating deliveries to single addresses, thereby reducing last-mile costs.

MELI is targeting significant growth in Mexico by applying for a banking license, aiming to become the country’s leading digital bank. The company’s existing ecosystem, which has established it as the largest fintech in Mexico with strong user engagement and a profitable credit portfolio exceeding $1.5 billion, will be central to this expansion strategy.

Insurtech also saw significant growth, with active policies nearly doubling year-over-year. Integrating extended warranties into the shopping cart has enhanced accessibility and cross-selling opportunities. This contributed to a record performance driven by the Hot Sale in Mexico and Argentina, resulting in 2.6 million policies sold. Additionally, the Net Promoter Score (NPS) is improving, and revenue from off-marketplace insurance products, such as card and personal accident insurance, reached record highs.

Wall Street analysts still do not fully understand or are underestimating the business, as evidenced by the revenue and EPS beats of 8% and 24%, respectively. I feel like I’m repeating myself every quarter, but I genuinely believe this is a generational company.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com