MercadoLibre, Inc. (MELI) is a Latin American e-commerce powerhouse that has captivated investors since its initial public offering (IPO) in 2007. Going public on August 17, 2007, MELI raised over $300 million and was valued at $1.9 billion. Today, the MELI share price trades at $1,191.55, representing a staggering return of over 4,000% in just 16 years.

What makes MELI such a dominant force in Latin America's e-commerce industry, and can it continue to achieve such an incredible return on investment for investors?

Contents

Overview

Customer Base

Financial Analysis

Competitive Landscape

Management and Ownership

Risks

Opportunities

Valuation

Investment Outlook

MercadoLibre, Inc.

Ticker: MELI

Sector: Consumer Cyclical

Market Cap: $59.9 billion

1. Overview

MELI is the largest online commerce ecosystem in Latin America, serving 18 countries. It provides six integrated e-commerce and digital financial services including Mercado Libre Marketplace, Mercado Pago Fintech platform, Mercado Envios logistics service, Mercado Credito, Mercado Ads solution, and Mercado Shops online storefronts solution.

Mercado Libre Marketplace is an online commerce platform accessible through website and mobile app. It allows sellers, merchants, and individuals to list and sell merchandise across various categories such as electronics, apparel, home goods, toys, books, and consumer packaged goods.

Mercado Envios is a logistics solution offered by MELI in several countries. It allows sellers on the platform to use third-party carriers and logistics services, as well as offering warehousing and fulfillment services. By using Mercado Envios, sellers can offer a streamlined shipping experience to buyers and may be eligible for shipping subsidies. The volume Mercado Envios manages through its network means that it can offer better prices to merchants on logistic services.

Mercado Pago is a digital payments solution developed by MELI initially to facilitate secure and easy transactions on its Marketplaces. It now has evolved to offer a financial technology ecosystem in the digital and physical worlds, including checkout and payment processes for merchants on their own websites and physical stores as well as credit offerings to scale their business. Mercado Pago is available in several Latin American countries and aims to provide end-to-end financial technology solutions to underserved individuals and businesses, including those operating in the informal economy.

Mercado Credito is a credit solution available in several Latin American countries. It leverages MELI's loyal and engaged user base, both offering credit lines to online merchants and mobile point of sale device users as well as to buyers on and off Mercado Libre’s marketplace. The credit solution is differentiated from traditional financial institutions by using proprietary credit risk models with unique data that differentiate their scoring. In addition to loans for MELI purchases, personal loans are also available. Mercado Pago credit card was launched in Brazil in 2021, allowing users to pay in installments and earn additional points from its loyalty program, Mercado Puntos.

Mercado Ads is an advertising platform that allows brands and sellers to display ads on MELI's webpages, increasing the likelihood of conversion. Mercado Ads enables merchants and brands to access the millions of consumers that are on its Marketplaces at any given time with the intent to purchase, which increases the likelihood of conversion.

Mercado Shops is a digital storefront solution that allows users to set up and manage their own digital stores, with integration with MELI's ecosystem.

Underpinning the entire MELI ecosystem is a loyalty program that offers benefits based on a point-generation system including discounts on shipping and access to third-party video content. Users can also subscribe for a monthly fee without having to reach the required points organically.

2. Customer Base

Given MELI's large customer base, it is diverse, and spans most age groups, income levels, and countries. However, certain trends and patterns can be identified. Here are some insights into MELI's customer base:

Geographic Distribution

As mentioned earlier, MELI operates in 18 countries across Latin America including Argentina, Brazil, Mexico, Uruguay, Colombia, Chile, Peru, Ecuador.

Brazil is the largest market for MELI, accounting for around 54% of the company's total revenue in 2022, followed by Argentina and Mexico.

Income Levels

MELI's customer base includes a wide range of income levels, from low-income to high-income earners. However, the company's growth has been driven in large part by the expansion of the middle class in Latin America in tandem with a significant increase in mobile phone penetration as well as the expansion of its logistics network. This has fueled demand for online shopping and created new opportunities for e-commerce companies like MELI.

Shopping Habits

MELI's customers have unique shopping habits, reflecting the diverse cultures and preferences across Latin America. For example, in Brazil, where cash is still widely used, MercadoPago has been instrumental in driving online sales by offering both cash-based payment options as well as electronic ones. It is important to highlight that as the Brazilian Central bank has launched its own payments platform, PIX, MELI should be a direct beneficiary of more and more people paying electronically and entering the financial system. In Argentina, where inflation is a significant issue, many consumers have turned to MELI as a way to protect their purchasing power by buying and selling goods and services online.

Now, let’s view the MELI customers through the key service offerings.

Mercado Libre Marketplace

In Q4 2022, MELI’s FX-neutral GMV growth accelerated to 35%, with Brazil and Mexico driving the acceleration on the back of higher items sold. Unique buyers reached its highest ever level of 46 million, up 13% year-on-year, driven by growth in Brazil and Mexico.

Mercado Envios

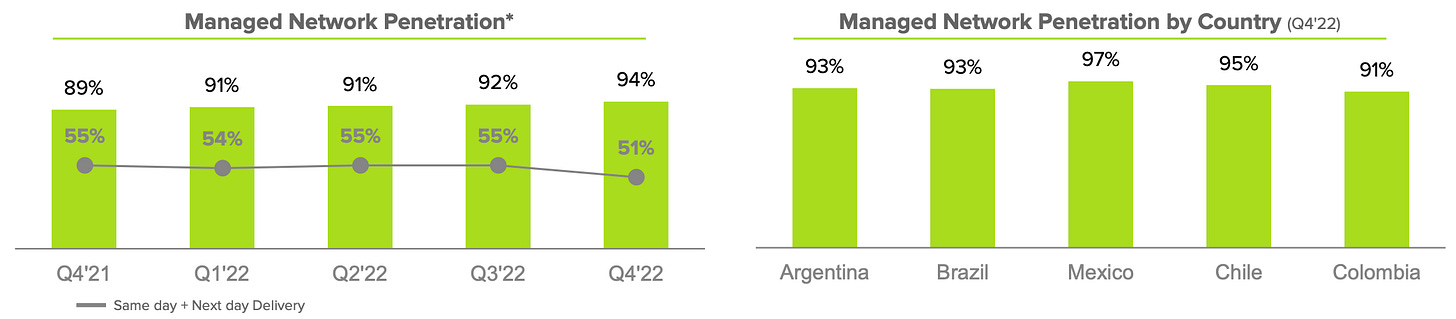

Almost 311 million items were shipped through Mercado Envíos in Q4 2022, taking the total for 2022 above 1 billion items for the first time. Fulfillment penetration reached a record high of 43%, with sequential gains in all of its major markets. Almost 76% of orders were delivered within 48 hours. Managed Network penetration reached almost 94%, with Mexico, Chile and Colombia posting the largest year-on-year gains.

Mercado Pago

Total Payment Volume (TPV) reached almost $36.0 billion dollars on a consolidated basis, with FX-neutral growth accelerating to 80% year-on-year. MELI processed almost 1.7 billion transactions in Q4 2022 representing 63% year-on-year growth. Unique Fintech Active Users reached almost 44 million in Q4 2022, a 27% year-on-year increase, driven by higher engagement in all digital account use cases in all key markets, particularly Argentina and Mexico.

3. Financial Analysis

MELI has two main revenue streams: Commerce and Fintech.

Commerce revenue includes Marketplace fees, classifieds fees, ad sales fees, and product sales revenue.

Fintech revenue includes revenue from commissions on payment volume away from MELI’s marketplaces, interest earned on loans, revenues from sales of mobile point of sales devices, and financing fees from factoring credit card receivables (MELI earns a spread by charging the merchant a higher fee for installment payments than the cost they incur to factor the receivable).

MELI has been growing revenue at an impressive rate over the past number of years. During its most recent financial results for Q4 2022 MELI recorded revenue of $3.0 billion, an increase of 41% YoY. In less than two years MELI has managed to double quarterly revenue from $1.4 billion in early 2021.

In Q4 2022, commerce revenue grew by 36% helped by stronger monetization. During the same quarter, fintech revenue grew 93% driven by strong TPV growth and a higher take rate.

During this period where MELI doubled its revenue, its also increased its gross profit margin from 43% to 49%.

The increase in gross profit margin resulted primarily from the decrease in shipping operating and carrier cost, cost of sales of goods and collection fees, as a percentage of net revenues.

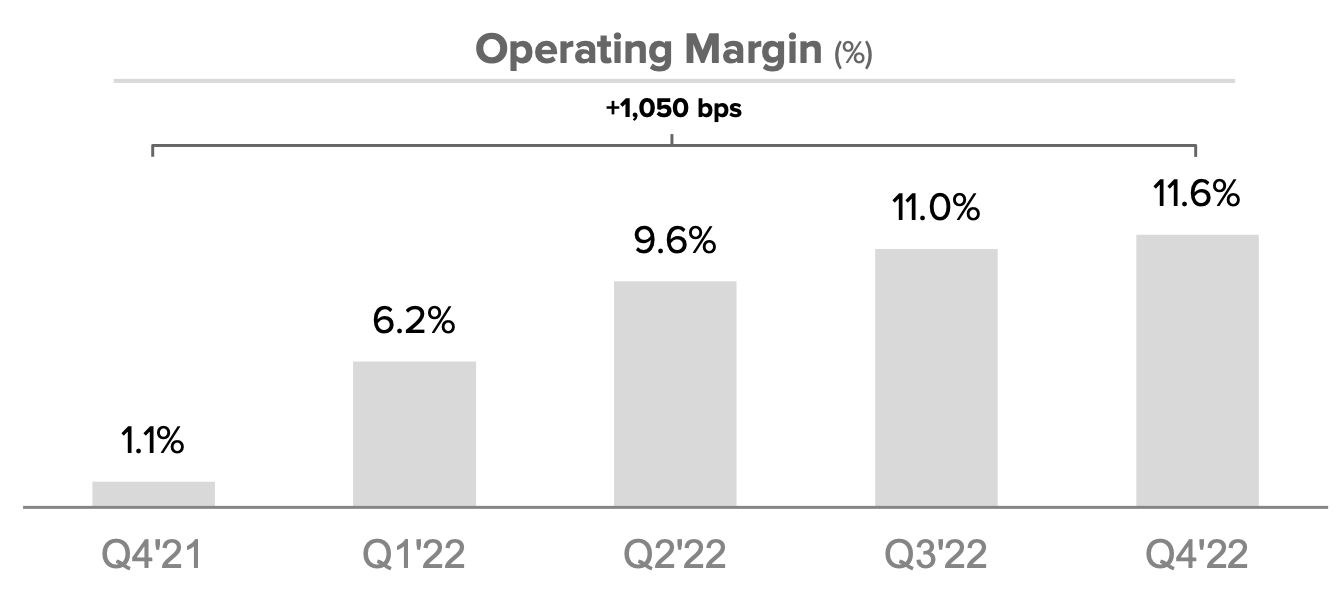

MELI has seen further expansion in its operating margin in 2022, increasing from 1.1% in Q4 2021 to 11.6% in Q4 2022. In addition to the gross margin benefits, this increase was driven by cost efficiency of sales and marketing expenses and strong profit growth in Fintech. Operating scale is beginning to kick in.

One area to pay close attention to is the non-performing loans (NPLs) in its portfolio. The provision for doubtful accounts increased by 147% in 2022. Whilst one would expect this provision to increase given the higher originations of loans, an increase of the non-performing ratio of the total portfolio relating to the over-90-day bucket was also a significant driver. During 2022, management revealed that they had slowed originations to contain the risks associated with a weaker lending environment, particularly in Brazil, which enabled them to maintain stable levels of early NPLs.

Financial Position

Over $3.3 billion in cash and cash equivalents

Total Liabilities as percent of Total Assets is 87%

Goodwill balance making up almost 1% of total assets

Modest level of debt amounting to $2.6 billion making up 19% of total assets

Loans receivable of $1.7 billion representing 12% of total assets

Note: MELI follows the U.S. Generally Accepted Accounting Principles (USGAAP). Under these standards, provisions for expected credit losses (which are net against loans receivable) are front-loaded, which means that they are recorded in advance rather than when they are actually incurred. This is different from the approach followed by traditional banks. As a result of this front-loaded approach, in periods of high loan growth, provisions for expected credit losses will also increase. However, this increase does not necessarily mean that credit quality is deteriorating.

Cash Flow Analysis

During 2022, cash flow from operating activities amounted to $2.9 billion, an increase of over 200% YoY. For the same period MELI recorded free cash flow of $2.5 billion which grew over 500% YoY. This represents a FCF margin of 24% for 2022.

It is worth nothing that capital expenditure (Capex) investments decreased by 20% in 2022. Most of the logistics spend by MELI is treated as operating expenditure (Opex) rather than Capex so flows through the Income Statement. Product & Technology Development expense increased 86% to $1.1 billion in 2022. I expect the FCF margin to fall back to the teens in 2023 as the company is showing signs of incremental investments in logistics in Brazil (Source: Reuters) and financial and e-commerce market development in Mexico (Source: Nasdaq).

4. Competitive Landscape

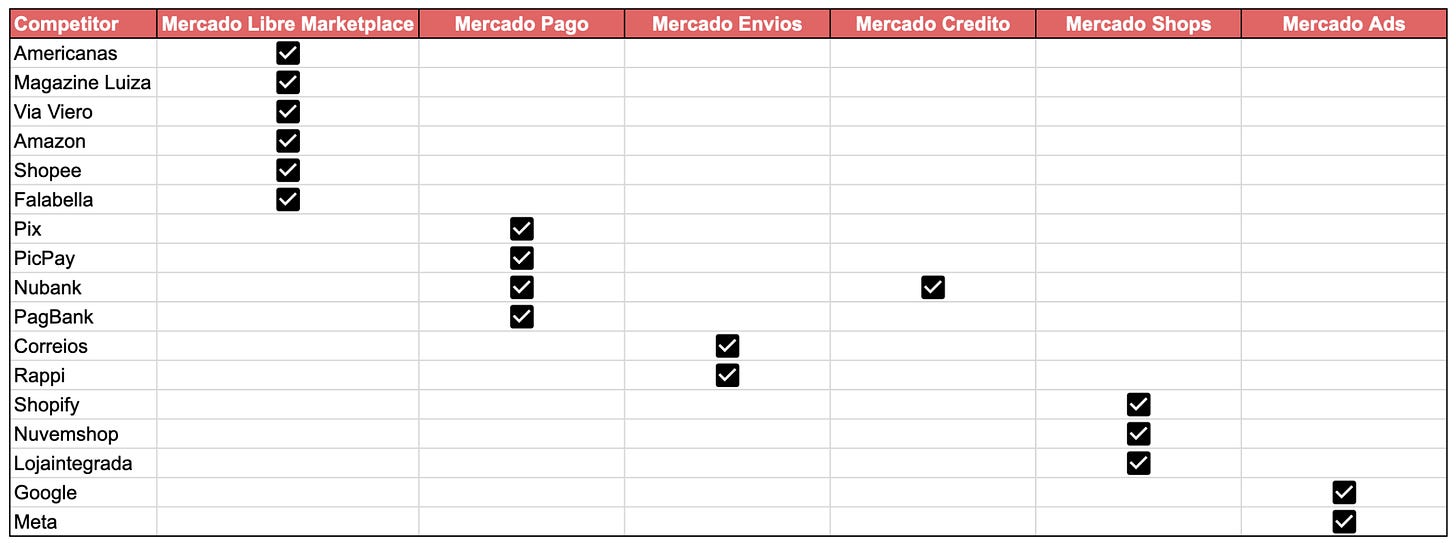

Given the amount of markets that MELI operates in, the list of competitors is almost endless. Each individual country that MELI operates in has local competitors in addition to global foreign players. Below is a summary of some of the key competitors that I have identified:

Americanas (Americanas.com) is run by Brazil retail giant Lojas Americanas. Founded in 1929, it’s also one of the oldest retail chains in Brazil operating over 1,900 physical stores around the country. The company also operates two other ecommerce sites aside from Americanas.com: Submarino and Shoptime. In January 2023, an audit revealed accounting inconsistencies in debt of about $8.3 billion, which led to the company going into receivership. The case is being investigated by Brazilian authorities to determine whether the issue was a gross error or fraud (Source: Reuters).

Amazon is one of the biggest e-commerce companies in the world and has a significant presence in Latin America. Although Amazon only launched its online marketplace in Brazil in 2019, it has quickly gained market share, mainly due to its fast shipping and vast product selection.

PicPay has over 65 million registrations and is the digital wallet with most users in Brazil. The company offers credit cards, investments, personal loans and business management tools. The company was granted a banking license in Brazil in 2022.

Nubank is a Brazilian neobank that offers a range of financial products, including credit cards, savings accounts, and personal loans, to individual customers. Nubank has a strong digital focus and operates entirely through its mobile app, which allows customers to manage their finances on the go. The company has grown rapidly since its founding in 2013 and is now one of the largest fintechs in Latin America.

Rappi is a Colombian delivery startup that has rapidly expanded across Latin America. While Rappi is primarily known for its food delivery service, it has also ventured into e-commerce. Rappi has a platform called RappiMall, which sells products ranging from electronics to groceries.

5. Management and Ownership

MELI was founded by Marcos Galperin in 1999 and received funding from various investors including J.P. Morgan, Goldman Sachs, and John Muse. In 2001, eBay acquired a 19.5% stake in the company, and in 2007, MELI became the first Latin American technology company to be listed on NASDAQ. The company expanded by acquiring 15 companies and in 2020, Galperin stepped down as president and was replaced by Stelleo Tolda.

Marcos Galperin remains the largest individual shareholder in MercadoLibre, with a 7.56% stake (Source: Fintel). The company's largest institutional shareholder is Baillie Gifford, which owns a 12.18% stake. Other major institutional shareholders include Morgan Stanley and Capital Group (Source: Fintel).

Marcos Galperin continues to serve as the CEO of MELI, and is widely regarded as one of the most successful tech entrepreneurs in Latin America. Under his leadership, the company has grown rapidly and expanded into new markets and business lines. In addition to Galperin, the MELI management team includes a number of seasoned executives with extensive experience in e-commerce, payments, and logistics. Many of them still at the company over twenty years since it was founded. Marcos Galperin appears to be well received at MercadoLibre with an 94% approval rating on Glassdoor with the company overall scoring 4.4 out of 5 by its own employees.

6. Risks

1. Regulatory and Geopolitical

One key risk that MELI faces is regulatory risk, which has the potential to disrupt its business operations and limit its expansion in certain markets.

For MELI, the risk of regulatory changes arises from its involvement in financial services, such as payments, loans, and insurance. In many countries, financial services are heavily regulated, and any changes in regulations could have significant implications for MELI's operations.

Latin American countries have a history of high inflation rates, which could lead to government intervention in the economy and negatively affect the results of operations. For example, in Argentina, where MELI is headquartered, the Central Bank introduced regulations in September 2020 that restricted access to foreign currency in an effort to curb hyper inflation (Source: Nasdaq). Extensive exchange controls restrict the ability to exchange Argentine Pesos for foreign currencies and remit foreign currency out of the country, leading to the development of trading mechanisms such as the Blue Chip Swap Rate. The spread between the Blue Chip Swap Rate and the official exchange rate has been significant in recent years, and there is uncertainty regarding potential increases or modifications to these regulations.

The depreciation of local currencies creates inflationary pressures and restricts access to international capital markets, while the appreciation of local currencies may lead to a deterioration of public accounts and reduce export growth. The company also faces exposure to adverse movements in currency exchange rates, as almost all of their revenues are in currencies other than the U.S. dollar and must be translated into U.S. dollars for reporting.

2. Global Competition

Another key risk facing MELI is the threat of increased competition in the region.

Currently, MELI dominates the e-commerce market in Latin America However, the company faces increasing competition from both local and international players. Amazon, for example, has been expanding its presence in the region in recent years and is now the second-largest e-commerce player in Brazil. The competitive landscape analysis detailed a whole plethora of competitors vying for market share.

This increased competition could lead to a price war, with companies offering deep discounts to attract customers. This, in turn, could lead to lower profit margins for MELI, which could impact its ability to invest in future growth. Additionally, as competition heats up, it could become harder for MELI to attract and retain customers, as they have more options to choose from.

The financial services market is also increasingly competitive, with several fintechs established in Latin America. Mercado Pago competes with existing digital and offline payment methods, including banks and other providers of traditional payment methods, as well as local and global players offering digital financial services.

Increased competition is facing MELI, and the company must continue to invest in innovation and expansion to stay ahead of its rivals. The company will need to stay nimble and adapt to changing market conditions to ensure its continued success.

7. Opportunities

1. Unbanked Market

One key growth opportunity for MELI is the expansion of its fintech services. The company has already established itself as a leader in the e-commerce market, but it has also been able to gain a foothold in the financial services industry through its MercadoPago payment platform. MercadoPago has become the preferred payment method for many online transactions in Latin America, with over 1.7 billion transactions processed in Q4 2022 alone.

This growth has been driven by the company's ability to successfully leverage its e-commerce platform to build out its fintech capabilities. MELI's management team has indicated that it plans to continue investing in its fintech business to further capitalize on this growth opportunity.

The potential for growth in digital payments in Latin America is significant. According to Statistica, total transaction value is expected to show an annual growth rate of 15% resulting in a projected total amount of $371 billion by 2027 (Source: Statistica).

Within digital payments, the mobile payments industry is expected to register a compounded annual growth rate (CAGR) of 24.5% between 2023 and 2028 (Source: Mordor Intelligence)

The region has a large unbanked population which is estimated to be 45% (Source: Begini), providing a significant opportunity for companies like MELI to provide financial services to underserved communities.

2. Logistics Leverage

MELI has already invested heavily in its logistics infrastructure, building out a network of fulfilment centers and partnering with third-party providers to offer fast and reliable delivery to customers across the region. Take a look at this video of a sorter fulfilment centre in Brazil:

Another key opportunity for MELI is to expand its logistics services beyond its own platform. The company already offers fulfilment services to third-party sellers on its marketplace, but there is potential to go further and offer these services to businesses selling through other channels as well. MELI's existing infrastructure and expertise in the region make it well-positioned to provide these services, potentially opening up a whole new revenue stream for the company.

MELI could also leverage its logistics capabilities to expand into new product categories. The company has already made moves in this direction with the launch of its Mercado Envíos Full service, which allows sellers to offer larger and heavier items for sale on the platform. By continuing to build out its logistics infrastructure and capabilities, MELI could potentially expand into new areas such as grocery delivery, furniture and appliance delivery, and more.

There is significant demand for these types of services in Latin America, where traditional retail infrastructure can be limited and inefficient. By offering fast, reliable delivery of a wider range of products, MercadoLibre could capture a larger share of the e-commerce market in the region.

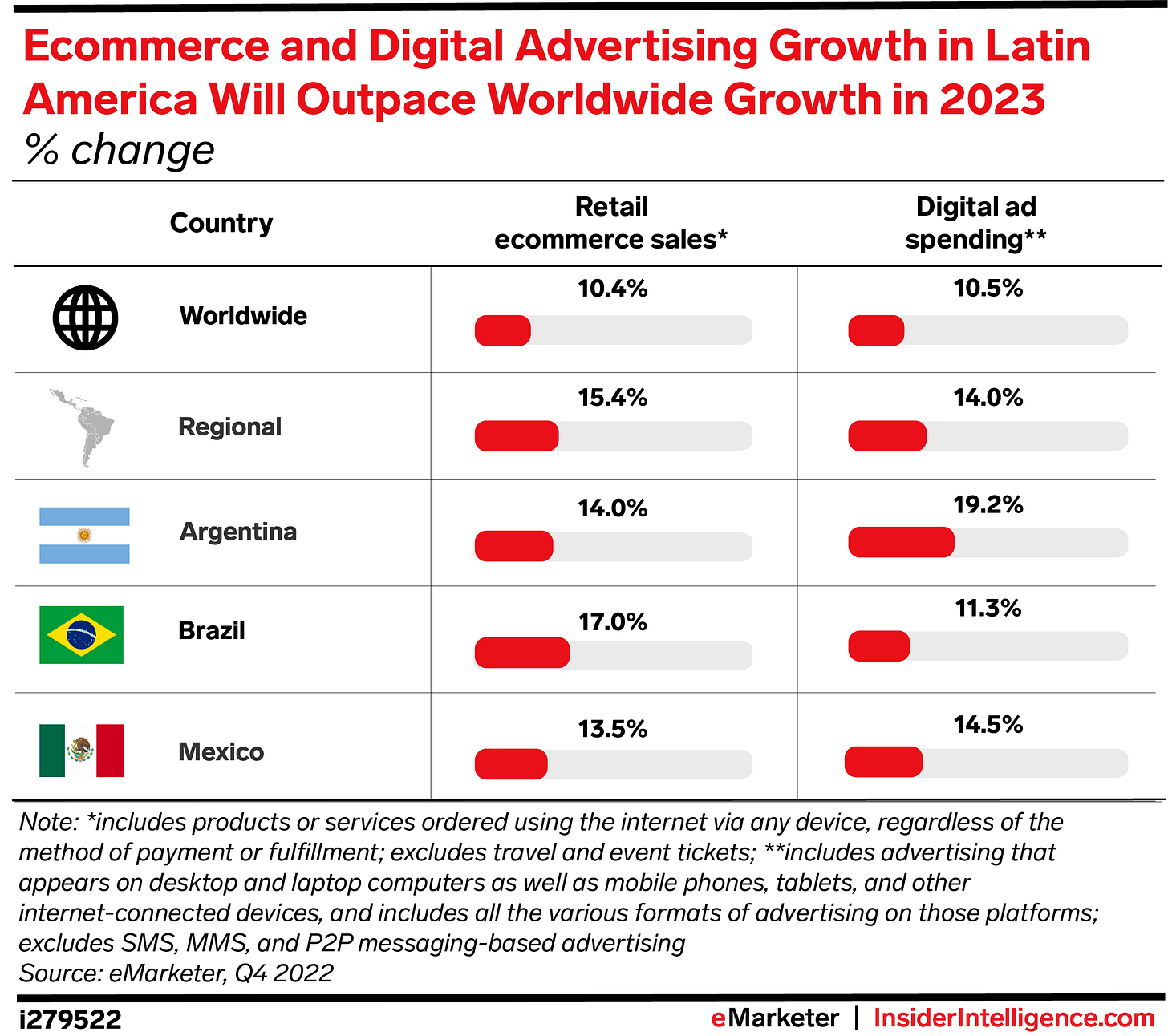

According to a report from eMarketer, e-commerce sales in Latin America will outpace worldwide growth in 2023 (Source: Insider Intelligence). This growth is being driven by factors such as increasing internet and smartphone penetration, as well as the COVID-19 pandemic, which has accelerated the shift to online shopping.

Data from Statistica suggests that this trend will continue for the next 5 years at least (Source: Statistica).

By continuing to invest in its logistics and fulfillment capabilities, MELI is well-positioned to capitalize on this growth and capture an even larger share of the e-commerce market in Latin America.

8. Valuation

Discounted Cash Flow

I have projected the future cash flows over 5 years using a discount rate of 10% and a terminal value of 14. Ultimately, the valuation hinges on normalising the 2022 FCF. I make two key adjustments:

reduction due to increased Capex/Opex

reduction due to provision for doubtful debts - NPLs greater 90 days

I believe the 24% FCF margin in 2022 should be more than halved in 2023 and going forward due to the above adjustments.

It should be noted that MELI management does not release any forward guidance meaning revenue and EBIT margins are entirely based on the authors estimates. Latin American e-commerce growth is expected to outpace the rest of the world and I expect MELI to increase its overall market share given the issues at Americanas and Shopee (Source: Reuters).

Based on these assumptions I believe that the fair value of MELI is close to $1,660 per share suggesting potential upside of 39% based on the share price on 23 March 2023.

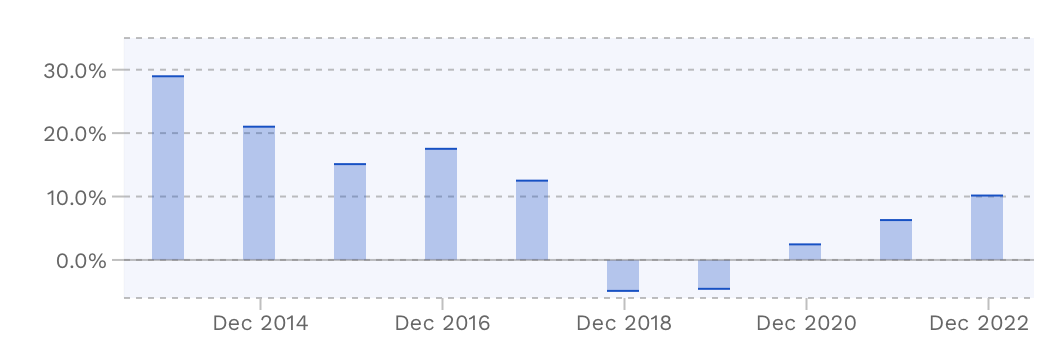

Return on Invested Capital (ROIC)

MELI achieved a ROIC of 10.2% in 2022, up from 6.3% in 2021. A return above 10% is a strong indicator of good capital allocation from management.

MELI has got a long reinvestment runway ahead of itself given the markets that it operates in. If it continues to achieve the current level of ROIC, it should be able to produce solid returns for shareholders.

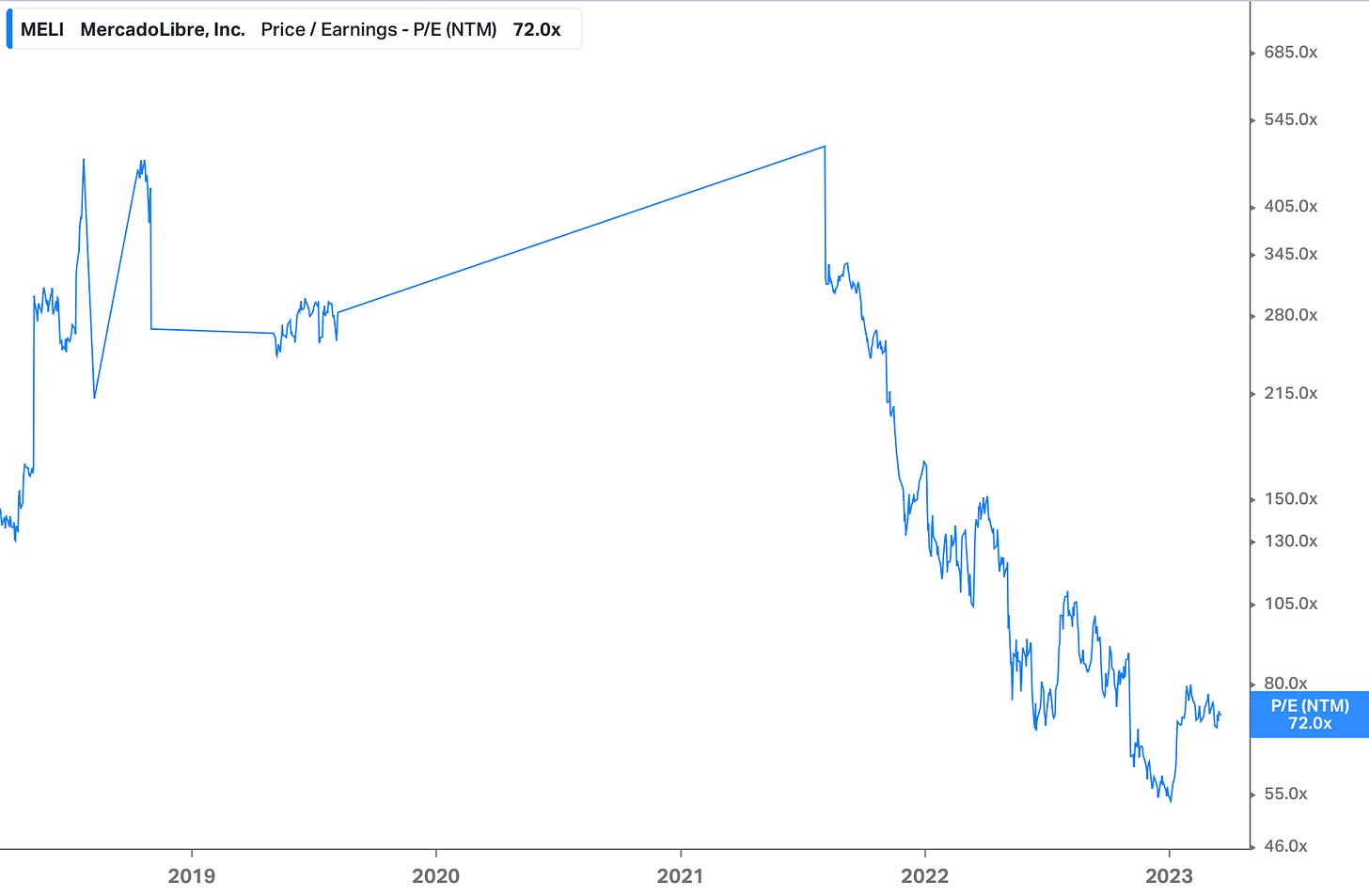

Price-to-Earnings Ratio (P/E)

MELI trades at a forward P/E ratio of 72. While the ratio has improved significantly, it can appear a bit misleading as MELI was not profitable until recent years be design.

From 2015 onwards, MELI ramped up investments in logistics to build out its infrastructure. This negatively impacts the short-term profit margins.

The high ROIC and P/E ratios are ultimately interlinked. As MELI can earn higher ROIC it can sustain higher levels of growth because it can reinvest earnings at a higher rate of return.

9. Investment Outlook

If you are not exposed to a company's products and services, you cannot get a true sense of it. Since MELI operates in Latin America, this would apply to most investors. In 2022, I had the opportunity to experience the offerings up close and personal. Here are a couple of quick anecdotes.

Firstly, Mercado Pago was absolutely everywhere. It is common to see signs in the western world displaying "Pay by Credit Card/Debit Card". In Argentina, it was “Pagar con Mercado Pago” (Pay with Mercado Pago). Secondly, while at a cafe in Buenos Aires, I witnessed a delivery person delivering a parcel directly to a customer, rather than to a cafe employee. This summed up the impressive level of efficiency and precision inherent in MELI's operations.

MELI's dominant market position, expanding fintech capabilities, and investment in logistics infrastructure make it well-positioned to capture a larger share of the growing e-commerce market in Latin America. It has proven its ability to defend its market position as demonstrated when Shopee shut operations in four Latin American countries in 2022.

In terms of valuation, the DCF analysis suggests that the company is undervalued based on assumptions including strong growth prospects and potential for future cash flows. However, the company's high P/E ratio implies that the market has already priced in high growth expectations and any deviations from those assumptions can have a significant impact on the stock price.

Disclosure: At the time of writing, the author holds a long position in MercadoLibre, Inc.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you for sharing. I really liked the report.

Although I live abroad for the last 10 years, I'm from Argentina and I can confirm they have an increasing strong presence in people's life. They are an unstoppable force and competitors will have to give their best to maintain their pace. Specially companies like Amazon that doesn't completely understand the nuance of how to operate in the region.

If they guide for 20m one-offs per quarter, are those really one-offs or rather recurring one-offs?