MercadoLibre: Investing For the Long-Term

MercadoLibre (MELI) Q3 2024 Earnings Analysis

Executive Summary

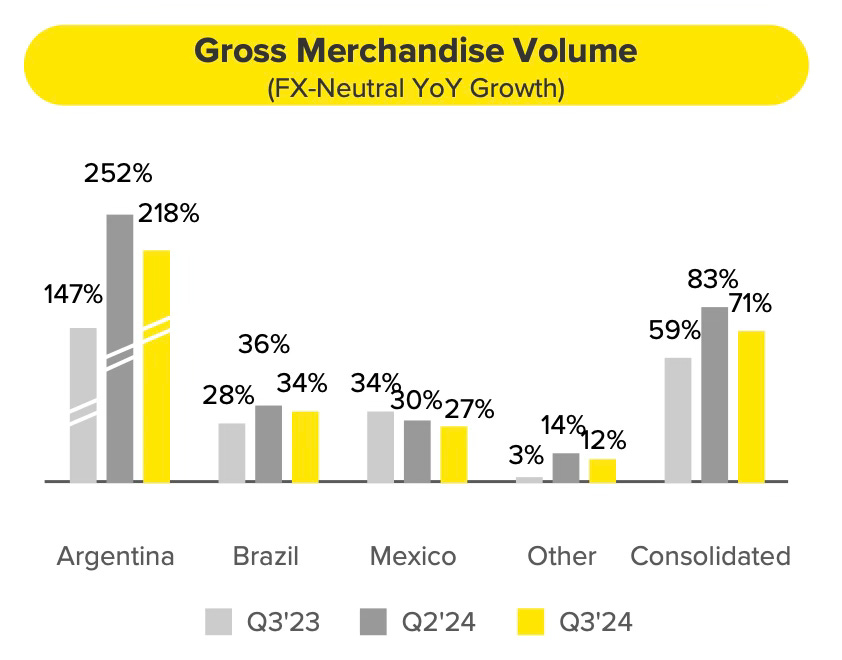

MercadoLibre Marketplace reported a GMV of $12.9 billion, reflecting 14% YoY growth, driven by a significant 34% FX-neutral growth in Brazil and 27% growth in Mexico. Additionally, unique buyers grew 21% YoY to 60 million, the highest level since the pandemic, underscoring MELI's ability to capture new users and expand its market share.

Mercado Envíos' fulfillment penetration increased by 4.5 percentage points YoY, while same- and next-day shipments grew by 16% YoY, setting a new record. Heavy investments in its logistics network, including the opening of five new fulfillment centers in Brazil and one in Mexico, are enhancing the online shopping experience by speeding up delivery.

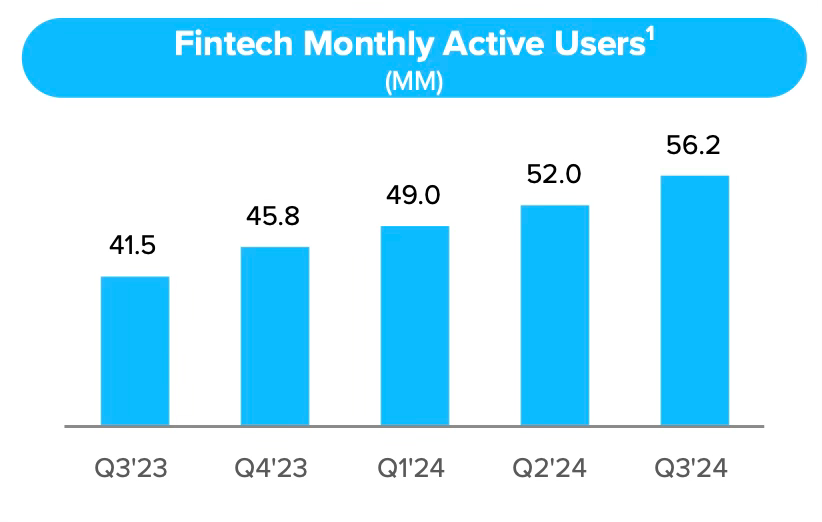

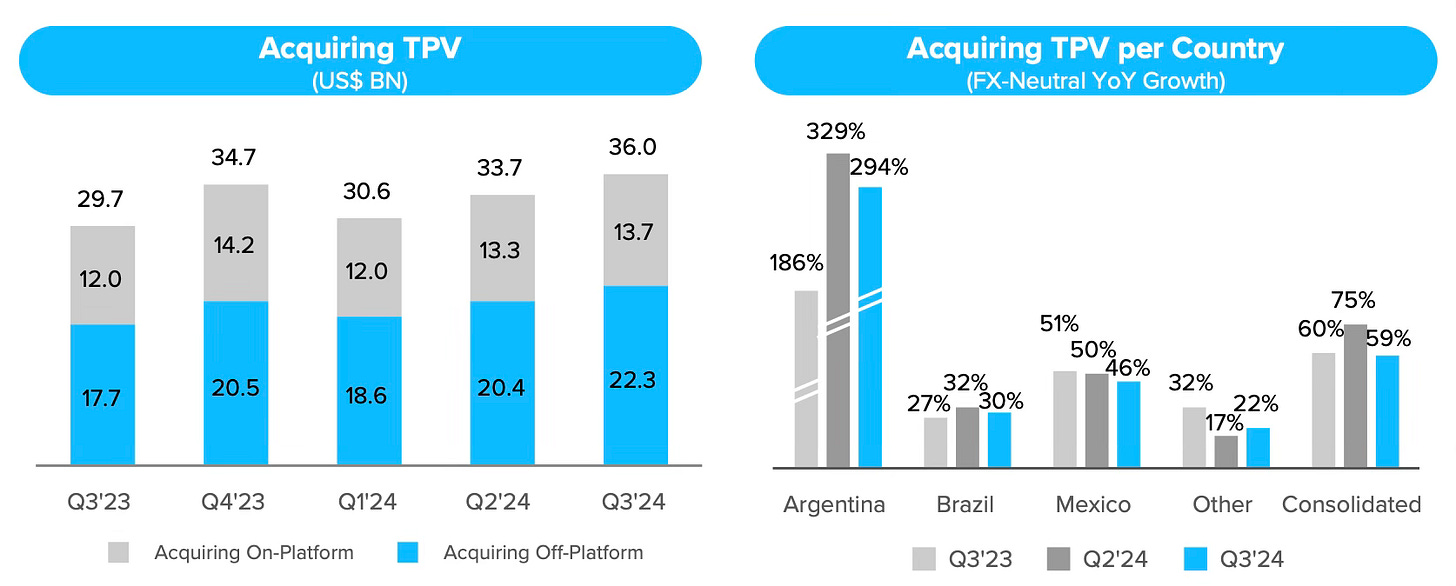

Mercado Pago saw substantial growth in both user engagement and financial metrics, with monthly active users up 35% YoY to 56 million. This growth was particularly driven by "power users" and increased transactions per user, with Brazil leading the way and Argentina benefiting from its appeal in an inflationary environment. Assets under management for Mercado Pago grew 93% YoY to $8 billion. Total payment volume from acquiring reached $36 billion, up 21% YoY despite FX challenges, with strong growth across key markets.

Mercado Crédito showed impressive growth, expanding 77% YoY to $6 billion, marking its fastest pace since Q1 2022. This growth was broad-based, with consumer loans up 37% YoY, driven by larger, longer-term loans targeting lower-risk users in Brazil, Mexico, and Argentina. Merchant loans also surpassed the $1 billion milestone regionally, with both consumer and merchant loans positively contributing to profitability, helping offset investments in MELI’s rapidly growing credit card segment. The credit card portfolio surged by 172% YoY to $2.3 billion, with MELI issuing 1.5 million new cards in the quarter.

MELI achieved strong revenue growth, with net revenue reaching $5.31 billion, a 35% YoY increase. However, MELI faced margin contraction, with the operating margin declining to 10.5%, largely due to strategic investments in expanding its credit portfolio, logistics, and shipping. These investments reflect management’s commitment to long-term growth, even as they weigh on short-term profitability.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Crédito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $5.31 billion +35% year-over-year (YoY)

Operating Income: $557 million -29% YoY

Net Income: $397 million +11% YoY

Earnings per Share: 7.83

2. Wall Street Expectations

Revenue: $5.28 billion (beat by 0.5%)

Earnings per Share: 9.85 (miss by 21%)

3. MercadoLibre Marketplace

MercadoLibre (MELI) reported a Gross Merchandise Volume (GMV) of $12.9 billion, reflecting 14% year-over-year (YoY) growth.

GMV growth remains strong across markets, with Brazil achieving 34% YoY FX-neutral growth and Mexico 27%. Despite MELI’s dominant market position, management noted in the conference call that MELI continues to increase its market share in both Brazil and Mexico.

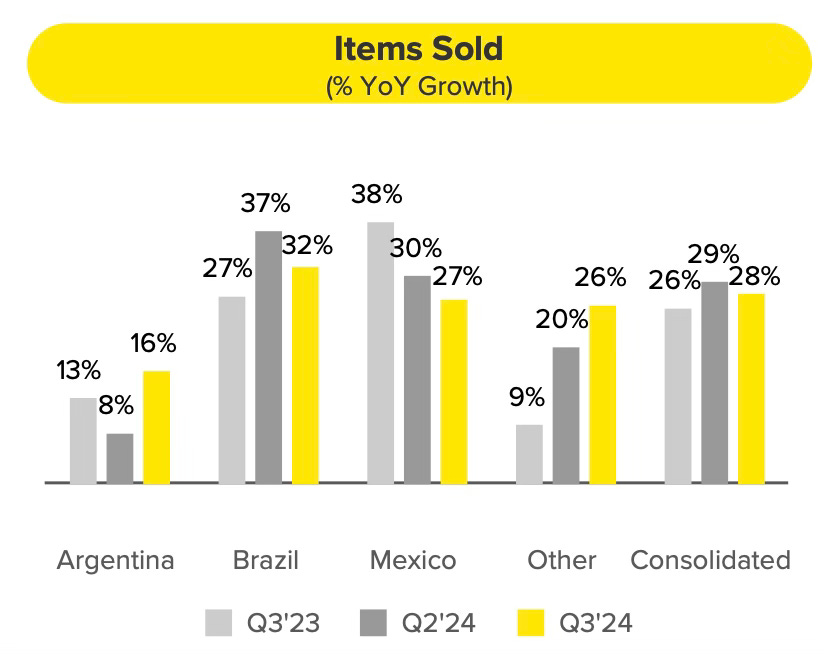

The number of items sold grew 28% YoY, maintaining momentum from Q2, which saw the fastest growth since Q1 2021. Brazil and Mexico are performing well, while Argentina shows significant improvement and growth acceleration due to new initiatives and better consumption trends.

Unique buyers grew 21% YoY to 60 million, marking the fastest growth since Q2 2021. This is the second consecutive quarter with accelerated growth in unique buyers, reaching a new post-pandemic high.

“This is a number higher than the number that we saw during the peak of the pandemic. So let me be clear on that, not even during the explosion of demand that we experienced in the pandemic, we saw a number of new users at this level.”

Marcos Galperín, CEO

MELI is driving offline-to-online growth by continuously enhancing the online shopping experience. Recent initiatives include installation appointments for auto parts, bulk purchase discounts in apparel, virtual try-on for makeup, and dynamic pricing tools for sellers. Despite a record number of new buyers during the quarter, items sold per buyer increased 6% YoY.

4. Mercado Envíos

MELI’s logistics network strengthens the online shopping experience by offering faster delivery, which boosts GMV, conversion rates, and buyer/seller satisfaction (NPS). This cycle supports further fulfillment expansion. MELI is heavily investing in logistics, especially in Brazil and Mexico, to support increased fulfillment penetration and commerce growth. During the quarter, MELI opened five new fulfillment centers in Brazil and one in Mexico, targeting long-term growth despite short-term margin impacts. Fulfillment penetration rose by 4.5 percentage points compared to a year ago.

Same- and next-day shipments grew 16% YoY, setting a record with growth accelerating since Q2. However, the percentage of these fast deliveries slightly declined as more users chose Meli Delivery Day, a slower, cost-effective option.

During the quarter, MELI+ was split into two tiers—"MELI+ Essential" and "MELI+ Total"—to offer more tailored benefits:

MELI+ Essential: Priced under $2 per month, this tier offers benefits like a lower free shipping threshold, extra installments on purchases, and cashback on and off MercadoLibre.

MELI+ Total: At approximately $5 per month, this includes all Essential benefits plus access to Disney+ and Deezer, along with discounts on other streaming services.

5. Mercado Pago

Monthly active users (MAU) rose 35% YoY to 56 million. Engagement also increased, with "power users" growing faster, and higher transactions and products per MAU. All major markets showed strong growth, led by Brazil. Argentina also showed positive momentum, benefiting from Mercado Pago's appeal in an inflationary environment. The expansion of Mercado Pago's credit offerings, especially the credit card, and growing awareness of its remunerated account are key contributors to user growth and engagement.

Mercado Pago’s assets under management (AUM) grew 93% YoY to $8 billion, with Brazil leading growth among major regions and strong inflows in Argentina. This growth underscores the appeal of its remunerated account as a key entry point for user engagement. Marketing campaigns in Brazil and Mexico have boosted awareness, user numbers, and account balances, fostering a cycle of growth and higher Net Promoter Scores (NPS), especially in Argentina and Mexico (345% YoY growth in Mexico).

Acquiring total payment volume (TPV) reached $36 billion, up 21% YoY despite FX headwinds, with strong FX-neutral growth across all key markets. In Brazil, acquiring TPV grew 30% YoY, driven by an accelerating POS business. To capture further growth, Mercado Pago launched new POS software for merchants, allowing inventory management, product catalog creation, and tax receipt issuance. The software integrates with Mercado Pago’s ecosystem, facilitating easy cross-selling of fintech services, including credit.

In Argentina, acquiring TPV grew in real terms, reflecting Mercado Pago’s strength in the payment space and its alignment with improved consumption trends. Acquiring TPV in Mexico grew 46% YoY, with in-store payments exceeding 100% growth, underscoring a significant opportunity for Mercado Pago to lead the shift to digital payments in the region.

6. Mercado Crédito

Mercado Crédito grew 77% YoY to $6.0 billion, its fastest pace since Q1 2022. Growth was robust across all products and geographies, with the consumer loan book up 37% YoY, driven by larger, longer-term loans to lower-risk users in Brazil, Mexico, and Argentina. Merchant loans surpassed $1 billion across the region, marking a significant milestone. Both consumer and merchant loans contribute positively to profitability, offsetting investments in the credit card segment.

The credit card portfolio grew 172% YoY and 28% QoQ, reaching $2.3 billion. MELI issued 1.5 million new credit cards during the quarter as it scales this segment, benefiting from improved scoring accuracy and profitable older cohorts with solid NIMAL spreads. Although margin pressure persists in the short term, credit card investments are strategically important, driving Mercado Pago adoption as a primary account and fostering positive ecosystem behavior.

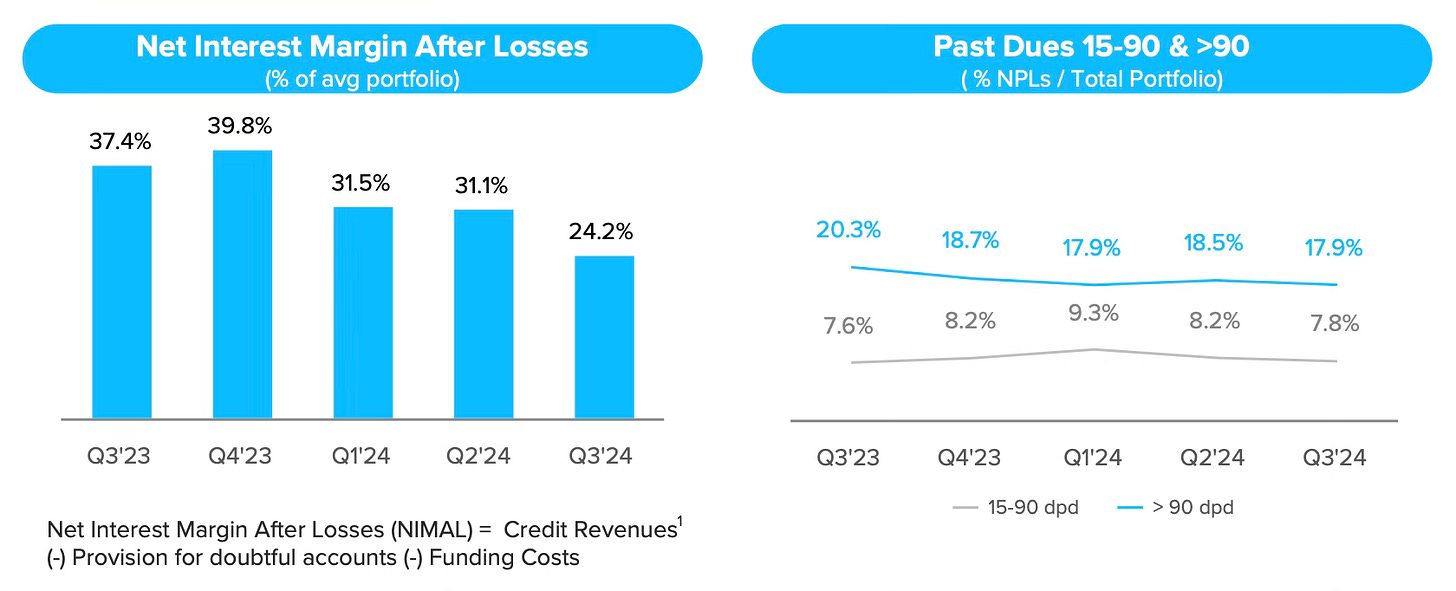

The NIMAL (Net Interest Margin after Loan Loss Provisions) spread dropped by 13 percentage points YoY to 24%, despite stable asset quality, with roll rates steady and a 15-90 day NPL at 7.8%. The reduction in NIMAL is due to three strategic reasons:

Credit Card Expansion: The credit card portfolio’s share rose from 25% to 39% over the year, introducing a negative mix effect on NIMAL due to its structurally lower spread.

Move Upmarket in Credit: The focus on lower-risk, higher-quality consumers and merchants with lower spreads contributed to the decline in NIMAL but boosted NPS.

Accelerated Credit Originations: Increased loan originations led to a rise in provisioning for expected losses, impacting NIMAL in the quarter.

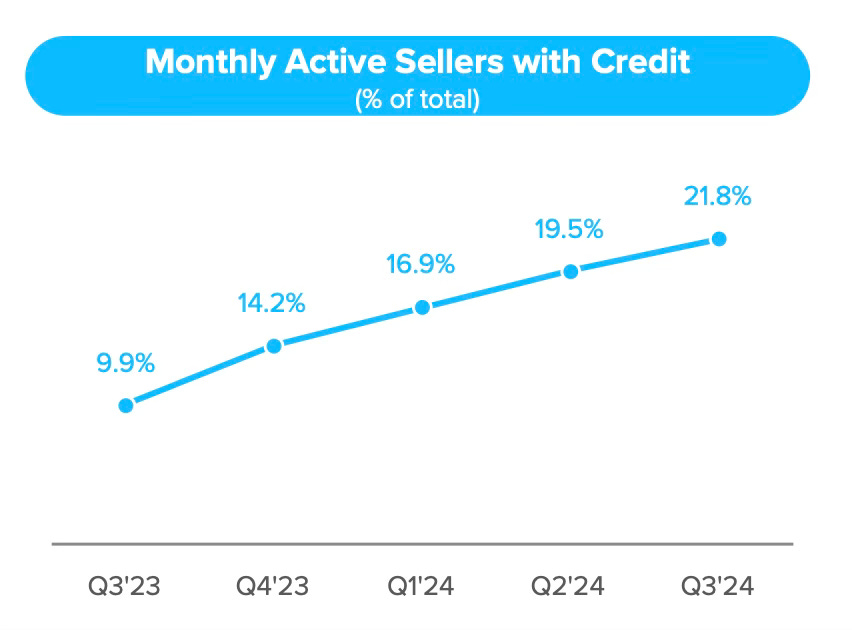

Cross-selling additional services to merchants is an important element of MELI’s strategy to leverage its ecosystem. The cross-selling of credit rose as a percentage of the merchant base, driven by in-store merchants across all regions. The insurtech business also grew revenues by 36% YoY, supported by effective cross-selling.

7. Financial Analysis

Revenue

Net revenue reached $5.31 billion, marking a 35% YoY increase on a reported basis. The Q1 shipping reporting change contributed 13 percentage points, or $513 million, to this growth. On an underlying basis, net revenue grew 22% YoY.

Brazil and Mexico showed strong FX-neutral revenue growth of 60% YoY, while Argentina achieved 245% FX-neutral revenue growth, outpacing inflation.

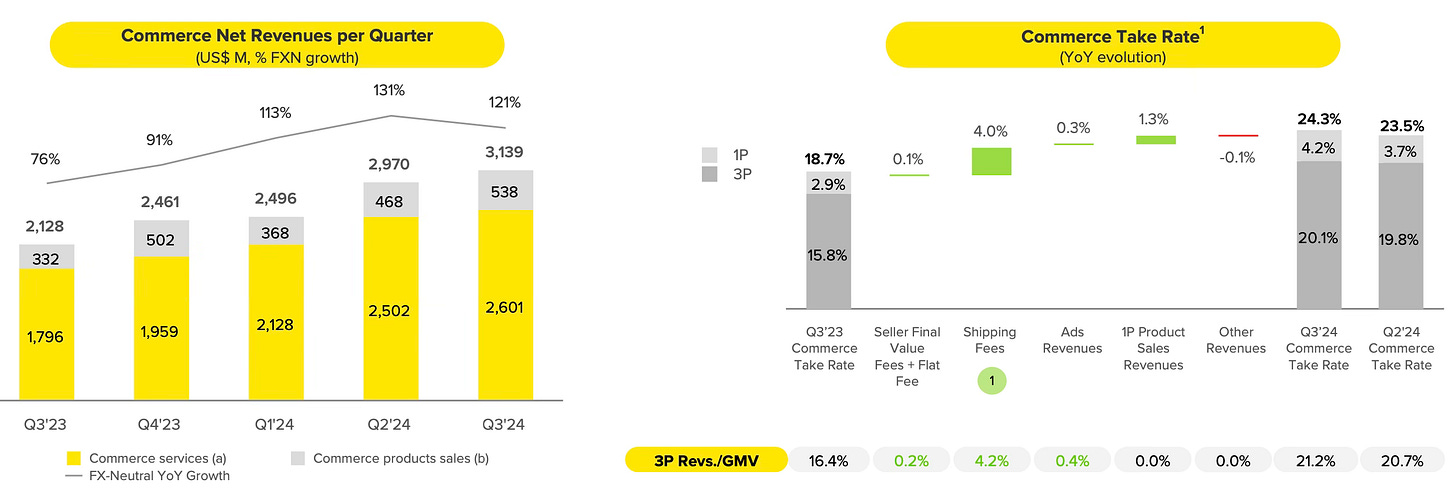

Commerce revenue grew 121% YoY on an FX-neutral basis to $3.1 billion, driven by improved monetization and higher ad penetration. Advertising revenue increased 37% YoY, reaching a 2% penetration of GMV. MELI aims to expand in digital retail media beyond product ads, leveraging first-party data to capture further growth.

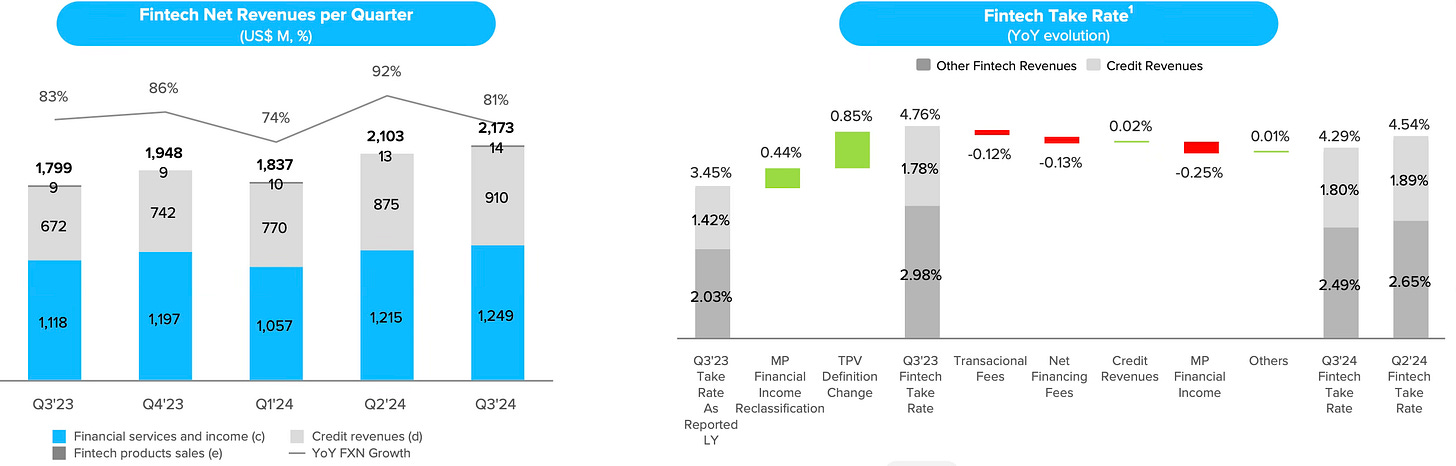

Fintech revenue reached $2.2 billion, reflecting an 81% YoY increase on an FX-neutral basis. Despite this growth, the take rate contracted due to lower rates in Argentina and a shift upmarket in Brazil, which pressured transactional and net financing fees.

Gross Margin

The reported gross profit margin decreased to 45.9% from 53.1% the previous year, though this figure is less meaningful due to reporting changes. On a comparable basis, gross profit margin declined to 50.8% from 53.1% YoY, primarily due to a 1P mix effect and investments in logistics.

MELI's strategy of expanding its product assortment at competitive prices, especially in categories with gaps in 3P selection, is driving growth. As 1P scales, profitability continues to improve, with 1P no longer dragging on margins.

“We know that having more volume shipped out of our own fulfillment facilities results in a much better user experience for buyers and sellers in faster and more reliable delivery speeds and a much better conversion of volume, in turn, results in further growth of the ecosystem.”

Marcos Galperín, CEO

Operating Margin

The operating margin declined to 10.5%, reflecting a 9.5 percentage point YoY decrease. Excluding reclassification and shipping updates, the operating margin contracted by 7.4 percentage points on a comparable basis.

This contraction was primarily due to the following factors:

Credit Business Investment: Contributing 3.4 percentage points to the YoY margin drop. This includes a 77% YoY growth in the credit portfolio and a shift toward higher-margin credit cards (from 25% to 39% of the credit portfolio). Rapid portfolio growth results in upfront provisioning for losses, increasing bad debt.

Shipping Investment: Investments in logistics and shipping led to a 0.8 percentage point YoY impact on the income from operations margin, though partially offset by higher GMV and productivity gains.

Variable Compensation: Accruals under the Long-Term Retention Plan (LTRP) increased by 0.7 percentage points, due to a larger share price increase in Q3 2024 compared to Q3 2023.

G&A Expenses: G&A expenses rose by 1.1 percentage points YoY, with 0.8 percentage points from a non-recurring customer refund expense.

In summary, MELI’s operating margin compression was primarily driven by strategic investments in the credit and shipping businesses, along with higher variable compensation costs and increased G&A expenses.

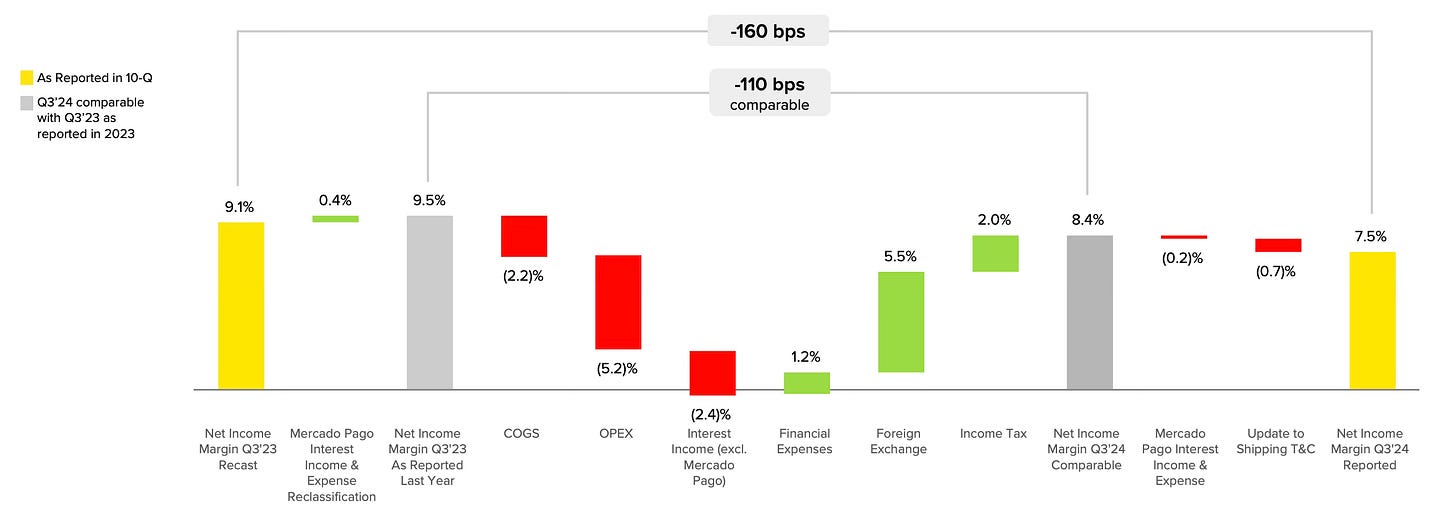

Net Margin

Net income increased by 11% YoY to $397 million, resulting in a net income margin of 7.5%. While EBIT declined, this was partially offset by a significant reduction in FX losses related to Argentina and lower income taxes. Despite a 7.4 percentage point contraction in the EBIT margin compared to the previous year, the net income margin only compressed by 1.1 percentage points.

Cash Flow Analysis

MELI reported an adjusted free cash flow of -$203 million, mainly due to the accelerated growth of its credit portfolio. However, year-to-date, the company has generated over $635 million in adjusted free cash flow. MELI’s financial flexibility, conservative capital structure, and positive long-term outlook led Fitch to upgrade its credit rating to Investment Grade (BBB-) in October.

8. Conclusion

MELI's earnings report reflects a clear focus on long-term growth and market leadership over short-term profits. Management is making significant investments in key areas essential for sustained success:

Customer Acquisition: Unique buyers climbed 21% YoY to nearly 61 million, emphasizing the company's commitment to user growth and setting the foundation for future revenue gains.

Technology and Logistics: MELI continues to enhance its logistics network, with five new fulfillment centers in Brazil and one in Mexico. The company plans to more than double fulfillment centers in Brazil by 2025, with many outside São Paulo to improve regional same-day delivery. This expansion aims to enhance delivery speeds and customer experience, with 75% of deliveries now made in less than 48 hours.

Credit Portfolio Expansion: The credit portfolio soared by 77% YoY, reaching $6 billion. This significant increase underscores MELI's commitment to growing its fintech ecosystem, even if it affects short-term profitability.

I have no issue with MELI prioritizing investments in user growth, infrastructure, and service diversification over immediate profitability. In fact, I welcome it. While Wall Street analysts might focus on short-term metrics , MELI’s management (which does not issue quarterly guidance) has emphasised long-term positioning over the past 25 years, aiming for sustained success in the Latin American e-commerce and fintech markets. It’s worth remembering that only 15% of commerce is currently conducted online in Latin America.

“Every time we have invested in enhancing our customer experience, in the past, we have been rewarded with strong growth and improvements in our market position.”

Marcos Galperín, CEO

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com