Microsoft: Revenue growth reaccelerates powered by the Cloud

Microsoft (MSFT) FY23 Q3 Earnings Analysis

Executive Summary

Productivity and Business Processes revenue grew by 11% due to strong growth in Office commercial and Dynamics, as well as positive momentum in Microsoft 365 subscriptions and LinkedIn revenue. The company is seeing strong adoption of its AI-powered business applications, including Dynamics 365 Copilot and Cloud for Sustainability, while Teams and LinkedIn continue to gain market share and record engagement levels.

Intelligent Cloud revenue increased 16% driven by Azure and cloud services, with growing demand for security solutions indicated by the enterprise mobility and security installed base. While on-premises server business faced challenges, demand for hybrid offerings was positive.

Azure is gaining market share with major customers like OpenAI, NVIDIA, Unilever, and IKEA Retail using its powerful AI infrastructure to train large models. Azure OpenAI Service has attracted over 2,500 customers representing a 10x increase quarter-over-quarter.

More Personal Computing revenue declined by 9% due to lower Windows OEM and Devices revenue. However, there was strong renewal execution leading to better-than-expected PC demand in the commercial segment. Search and news advertising revenue grew due to increased search volume and share gains for Edge browser and Bing. Over 90% of the Fortune 500 have either trialed or deployed Windows 11, and Bing has over 100 million daily active users. The gaming division achieved record numbers of monthly active users and devices, with subscription revenue reaching almost $1 billion.

Management anticipates 10-12% revenue growth ($17.9 to $18.2 billion) in Q3 2023 for Productivity and Business Processes, driven by Office 365, Microsoft 365 subscriptions, LinkedIn Talent Solutions, and Dynamics 365. In the Intelligent Cloud segment, 15-16% revenue growth ($23.6 to $23.9 billion) is expected, led by Azure and Microsoft 365 suite. More Personal Computing may decline by 4-7% ($13.35 to $13.75 billion), with Windows OEM and Devices revenue declining partially offset by growth in Search and News Advertising and Xbox content and services revenue.

Contents

Financial Highlights

Wall Street Expectations

Productivity and Business Processes

Intelligent Cloud

More Personal Computing

Cash Flow

Guidance

Conclusion

1. Financial Highlights

Microsoft reaccelerated revenue growth to 7% from 2% in Q2 2023 with 27% growth in Azure and other cloud services leading the charge.

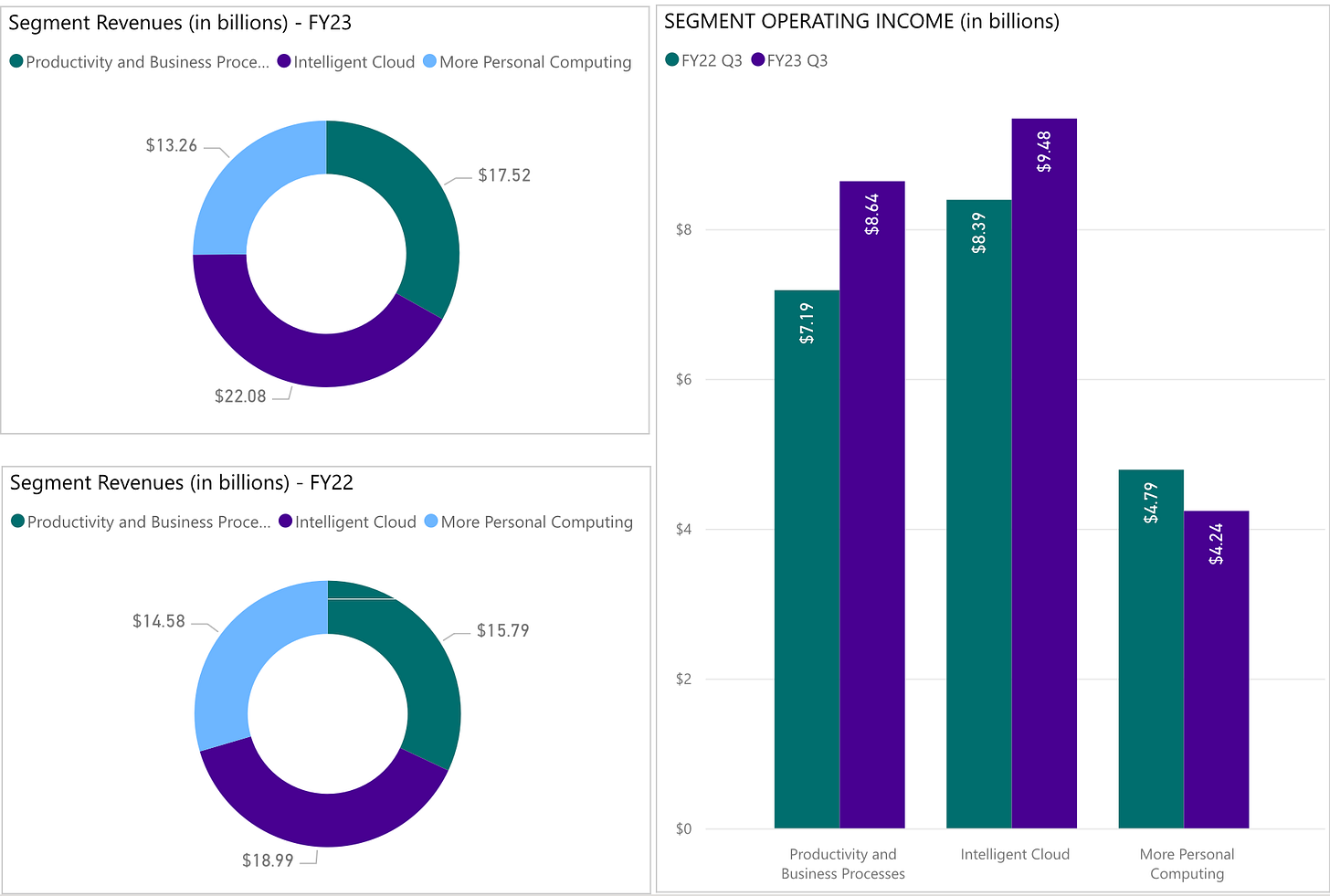

Revenue: $52.9 billion +7% year-over-year (YoY)

Productivity and Business Processes: $17.5 billion +11% YoY

Intelligent Cloud: $22.1 billion +16% YoY

More Personal Computing: $13.3 billion -9% YoY

Gross Profit: $36.7 billion +9% YoY (Gross Margin 69% vs 68% YoY)

Operating Income: $22.4 billion +10% YoY (Operating Margin 42% vs 41% YoY)

Net Income: $18.3 billion +9% YoY

2. Wall Street Expectations

Revenue: $50.95 billion (beat by 4%)

Adjusted Earnings per Share: 2.22 (beat by 10%)

Source: Zachs

3. Productivity and Business Processes

Productivity and Business Processes revenue reached $17.5 billion, which is an increase of 11% or 15% in constant currency. This growth was mainly due to the success of Office commercial products and cloud services.

Office Commercial products and cloud services revenue saw an increase of $1.3 billion or 13%, and the revenue of Office 365 Commercial grew by 14%. This was due to the increased number of small and medium-sized businesses and frontline workers using the product. However, the revenue of Office Commercial products declined by 1% due to customers' continued shift towards cloud offerings.

Office Consumer revenue increased by 1%, thanks to the continued momentum in Microsoft 365 subscriptions, which grew 12% to 65.4 million. Additionally, the paid Office 365 commercial seats grew 11% to over 382 million, with growth across all workloads and customer segments.

Dynamics revenue grew by 17%, primarily driven by Dynamics 365, which grew by 25% with healthy growth across all workloads. LinkedIn revenue also increased by 8%, driven by growth in Talent Solutions.

Gross profit increased by 14% with gross margin increasing roughly 2 points YoY. This was mainly due to improvements in Office 365, partially offset by sales mix shift to cloud offerings. Operating expenses increased by 4% driven by investments in LinkedIn, but operating income still increased by 20%, including 4 points due to the change in accounting estimate for useful lives. Operating margin for the division has increased to 49%, up from 46% YoY.

Microsoft's AI-powered business applications are seeing strong adoption across industries, with Dynamics 365 Copilot reducing manual data entry and notetaking, and Cloud for Sustainability driving adoption from companies like BBC, Nissan, and PCL to deliver on their environmental commitments. Teams usage has surpassed 300 million monthly active users, and Microsoft Viva has created a new suite for employee experience, bringing together goals, communications, learning, workplace analytics, and employee feedback.

LinkedIn has reached record engagement levels, with over 930 million members connecting, learning, selling, and getting hired on the platform. The platform has experienced member growth for the seventh consecutive quarter and has expanded to new audiences. LinkedIn Talent Solutions is helping hirers connect with job seekers and professionals to access opportunities, and its hiring business has taken share for the third consecutive quarter. The platform offers over 100 AI courses and new AI-powered features, including writing suggestions for profiles and job descriptions. LinkedIn Marketing Solutions is a leader in B2B digital advertising, and their partnership with Netflix brings differentiated, premium video content to the platform's ad network.

4. Intelligent Cloud

Intelligent Cloud segment revenue was $22.1 billion, which increased by 16% and 19% in constant currency. This growth was mainly due to the success of Azure and other cloud services.

Server products and cloud services revenue increased by $3.0 billion or 17% due to the growth of Azure and other cloud services. The revenue of Azure and other cloud services grew by 27% due to the rise in the consumption-based services. However, the revenue of server products declined by 2%.

Enterprise Services revenue increased by $116 million or 6%, thanks to the growth of Enterprise Support Services, despite a decline in Microsoft Consulting Services. Additionally, Microsoft saw a 15% growth in the installed base of Enterprise mobility and security, with nearly 250 million seats.

On-premises server business revenue decreased by 2% and was relatively unchanged in constant currency, with continued demand for hybrid offerings, including Windows Server and SQL Server running in multi-cloud environments, offset by transactional licensing.

Gross profit increased by $2.0 billion or 15%, driven by the growth of Azure and other cloud services and the change in accounting estimate. However, the gross margin slightly decreased. Excluding the impact of the change in accounting estimate, the gross margin decreased by 3 points due to the sales mix shift to Azure and other cloud services and reductions in Azure and other cloud services.

Operating expenses increased by 19%, including roughly 3 points of impact from the Nuance acquisition. Operating income grew by 13%, with roughly 6 points from the change in accounting estimate. Operating margin for the division has decreased to 43%, down marginally from 44% YoY.

Azure is rapidly increasing its market share, as more customers opt for its computing fabric from cloud to edge, particularly for AI-powered applications. The company's powerful AI infrastructure is being used by industry leaders, including OpenAI, NVIDIA, and startups such as Adept and Inflection, to train large models.

The Azure OpenAI Service, which combines advanced models such as ChatGPT and GPT-4 with Azure's enterprise capabilities, has experienced remarkable growth. It has attracted over 2,500 customers, including major brands like Coursera, Grammarly, Mercedes-Benz, and Shell, resulting in a 10x increase quarter-over-quarter.

Azure is also the go-to choice for many large enterprises, such as Unilever, IKEA Retail, ING Bank, Rabobank, Telstra, and Wolverine Worldwide. These companies are using Azure Arc to run Azure services across on-premises, edge, and multi-cloud environments. Microsoft has over 15,000 Azure Arc customers, with a growth rate of over 150% year-over-year.

In addition, Microsoft is extending its infrastructure to the 5G network edge with Azure for Operators and attracting large telcos like AT&T, Deutsche Telekom, Singtel, and Telefonica to modernize and monetize their networks.

Regarding security, Microsoft's AI-powered security solutions are giving defenders an agility advantage across all clouds and platforms. The company has added new governance controls and policy protections to secure identities and resources. Their Azure Active Directory is now used by almost 720,000 organizations, and the number of customers using four or more security workloads has increased by 35% year-over-year. Many organizations, including EY and Qualcomm, have opted for Microsoft's full security stack for protection and visibility.

5. More Personal Computing

More Personal Computing revenue decreased by 9% to $13.3 billion driven by a decline in revenue from Windows and Devices.

Windows OEM revenue decreased 28% as elevated channel inventory levels continued to drive additional weakness beyond declining PC demand.

Windows Commercial products and cloud services revenue increased 14% driven by strong renewal execution and an increase in agreements that carry higher in-period revenue recognition.

Devices revenue decreased $553 million or 30% as elevated channel inventory levels continued to drive additional weakness beyond declining PC demand.

Search and news advertising revenue ex-TAC increased 10%, including 2 points from the Xandr acquisition. Results were driven by higher search volume and share gains for Edge browser globally and Bing in the U.S.

Gaming revenue declined 4% YoY. While Xbox hardware revenue decreased by 30%, Xbox content and services revenue increased by 3% due to better-than-expected monetization from third-party and first-party content and growth in Xbox Game Pass.

Gross profit declined 9% YoY due to a decline in Windows, but gross margin percentage increased slightly YoY.

Operating expenses declined 5% YoY due to a decline in devices, even with 3 points of growth from the Xandr acquisition. Operating income decreased 12% YoY. Operating margin for the division has decreased to 32%, down marginally from 33% YoY.

Despite challenges in the PC market, Microsoft has seen an increase in the number of monthly active Windows devices and higher usage, compared to pre-pandemic. Furthermore, Windows 11 commercial deployments are rapidly growing, with over 90% of the Fortune 500 currently trialing or deploying it. The introduction of Windows 365 and Azure Virtual Desktop is transforming how companies such as Mazda and Nationwide access Windows.

Over one-third of the enterprise customer base has purchased cloud-delivered Windows to date, and the new Windows 365 Frontline extends the power and security of Cloud PCs to shift workers for the first time.

In addition, Bing boasts over 100 million daily active users, and daily installs of the Bing mobile app have grown four times since launch. Microsoft has been winning new customers on Windows and mobile, with Edge taking share for the eighth consecutive quarter. Bing has also grown its share in the United States. The company's innovative AI-powered features, such as the ability to set the tone of chat and create images from text prompts, have increased engagement with Bing and Edge.

Microsoft is focused on becoming the preferred choice for gamers, achieving record numbers of monthly active users and devices during the third quarter. The company is expanding its content and services business, offering more ways for gamers to experience their favorite games. Subscription revenue reached almost $1 billion, and PC Game Pass is now available in 40 new countries. The company has surpassed 500 million lifetime unique users across their first-party titles.

6. Cash Flow

Microsoft's cash flow from operations decreased by 4% to $24.4 billion due to tax payment related to R&D capitalisation provision and increased employee SBC partially offset by strong cloud billings and collections partially offset the decline. Despite the increase in SBC, the Microsoft share count declined during the quarter as a result of $5.5 billion worth of share buybacks.

After allowing for capital expenditures of $6.6 billion to support cloud demand, Microsoft posted free cash flow of $17.8 billion, declining 11% YoY. Excluding the impact of the tax payment, cash flow from operations increased by 1% and free cash flow declined by 5%.

Microsoft's remains financially strong and continues to invest in its growth initiatives.

7. Guidance

Productivity and Business Processes:

Revenue growth of 10-12% in constant currency, or $17.9 to $18.2 billion.

Office 365 will be a significant contributor to revenue growth, with seat growth across customer segments and ARPU growth through E5. On-premises business revenue is expected to decline, while Office Consumer and LinkedIn are expected to achieve mid-single digit revenue growth. Additionally, Dynamics is expected to achieve revenue growth in the mid to high-teens.

Intelligent Cloud:

Revenue growth of 15-16% in constant currency, or $23.6 to $23.9 billion.

Azure is predicted to have a 26-27% revenue growth rate fueled by the Azure consumption business and momentum from the Microsoft 365 suite. On the other hand, the Enterprise Services revenue is expected to remain relatively unchanged from the previous year, as the growth in Enterprise Support Services will be offset by a decline in Microsoft Consulting Services.

More Personal Computing:

Revenue of $13.35 to $13.75 billion, declining 4-7%.

Windows OEM and Devices revenue expected to decline in the low to mid-20s with Windows Commercial Products and Cloud Services revenue also expected to decline in the low to mid-single digits. However, healthy annuity billings growth is anticipated, driven by demand for Microsoft 365 and advanced security solutions. Search and News Advertising revenue is predicted to grow by approximately 10% ex-TAC revenue growth, while gaming revenue is expected to grow in the mid to high-single digits, with Xbox content and services revenue growth expected to be in the low to mid-teens, driven by third-party and first-party content as well as Xbox Game Pass.

8. Conclusion

Microsoft not only outperformed market expectations for the quarter but also exceeded the predicted revenue of $54.84 billion for Q3 2023 by forecasting $55.35 billion, indicating a growth rate of 6.7%.

In the previous quarter, revenue growth in nine out of ten product lines slowed down. However, in the current quarter, things have changed, with six out of ten product lines showing an increase in revenue growth.

On the conference call, CEO Staya Nadella stated that the company is focusing on three priorities:

helping customers get the most value out of their digital spend

investing to lead in the new AI wave

driving operating leverage

By focusing on helping customers, investing in new technology, and driving operational efficiency, Microsoft has been able to reaccelerate revenue growth in several product lines. This demonstrates the effectiveness of the company's approach and its ability to adapt to changing market conditions.

Finally, management alluded to an inflection point in cloud spending optimization where:

at some point workloads can’t be optimised much further

This indicates an easier set up against comparisons at the back half of 2023 and a possible short-term boost for other cloud-based stocks.

Rating: 4 out of 5. Exceeds expectations.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

The demand for the OpenAI service is through the roof