In this week's edition, I review the performance of my own portfolio for April 2021.

Transactions

Acquisitions

I added to my positions in the following companies:

Johnson & Johnson ($JNJ)

Disney ($DIS)

PaySafe ($PSFE)

Peloton ($PTON)

Fiverr ($FVRR)

I didn’t open any new positions this month.

Allocation

Portfolio by current market value weighting

Portfolio by sector weighting

Earnings Roundup

The highlights of earnings released over the past month with links to the source releases.

Johnson & Johnson reported revenue of $22.3 billion (+7.9% year-over-year), beating the consensus estimate of $22.0 billion. Net earnings were $6.2 billion, +6.9% year-over-year.

Microsoft reported revenue of $41.7 billion (+19% year-over-year), beating the consensus estimate of $41.0 billion. Net income was $15.5 billion, +44% year-over-year. All three segments namely Productivity and Business Processes, Intelligent Cloud and Personal Computing increased revenue by at least 15% year-over-year.

Shopify reported revenue of $988.6 million (+110% year-over-year), beating the consensus estimate of $875.6 million. Operating Income was $119 million compared to a loss of $73 million year-over-year. Q1 net income included a $1.3 billion unrealised gain on the equity investment in Affirm as a result of its IPO.

Facebook reported revenue of $26.1 billion (+48% year-over-year), beating the consensus estimate of $23.6 billion. Net income was $9.5 billion, +94% year-over-year. Daily Active Users were 1.88 billion on average for March 2021, an increase of 8% year-over-year.

Nio reported revenue of $1.22 billion (+481% year-over-year), beating the consensus estimate of $1.02 billion. Net loss was $68 million, a 73% decrease on the Q1 2020 loss. Vehicle deliveries were 20,060 in the first quarter of 2021 representing an increase of 423% year-over-year.

AbbVie reported revenue of $13.0 billion (+51% year-over-year), beating the consensus estimate of $12.8 billion. Net earnings were $3.5 billion, +18% year-over-year.

Performance

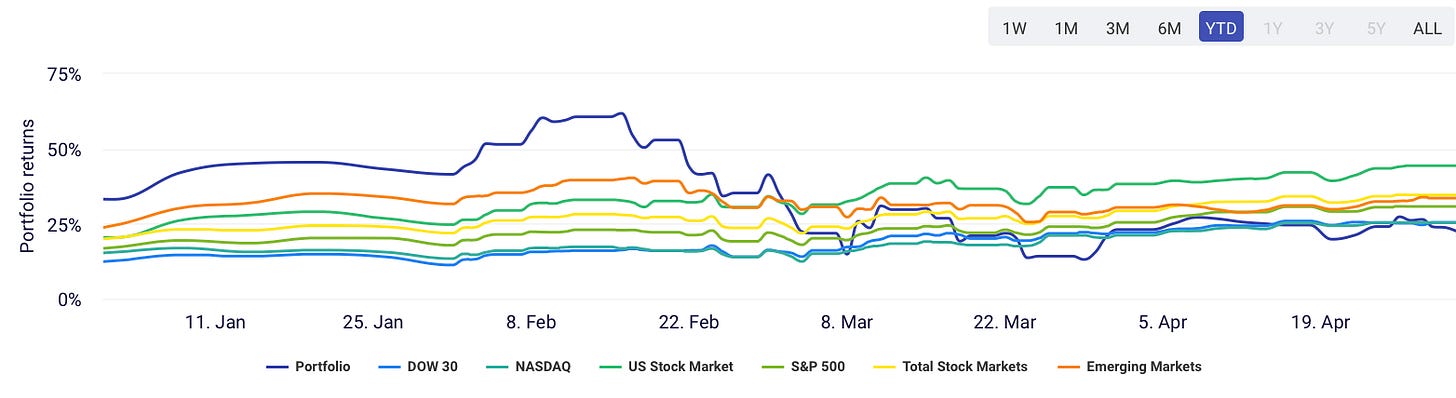

Monthly: +2.4% vs S&P +5.3%

YTD: -10.3% vs S&P +11.1%

Since inception June 2020: 23.6%

CAGR: 51.3%

Final Words

April saw a mini recovery in some of the growth stocks whilst the S&P hit a new all time high.

I recently decided to start building a cash position in my portfolio. I will slowly build this over the next number of months with the goal of having 10% of my portfolio value sitting as cash in my brokerage. The idea behind this position is to have extra cash immediately available for when there are periods of price volatility aka sell offs. I am not trying to time the market and will still continue to dollar cost average each month whilst building this cash position. What I have learned over the past couple of months is that with increased liquidity comes increased opportunity.

Check out last months portfolio review Monthly Portfolio Review - March 2021

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

Have you considered adding commodity related equities to your portfolio? Oil, uranium, coal, copper, nickel, silver, gold, rare earth metals .etc. Lots of talk of an impending commodity super cycle. Whether it's hype or not remains to be seen.