In this weeks edition, I will be reviewing the performance of my own portfolio for December 2020. I will detail all of the transactions I have made, analyse the current allocation and compare the performance versus the market.

Transactions

Dividends received

This month I received dividends from the following companies:

Johnson & Johnson ($JNJ) - Quarterly dividend - $1.01 per share

Microsoft ($MSFT) - Quarterly dividend - $0.56 per share

Realty Income ($O) - Monthly dividend - $0.23 per share

Brookfield Renewable Corporation ($BEPC) - Quarterly dividend - $0.43 per share

My policy is to reinvest all dividends received back into my portfolio.

Acquisitions

This month I added to my positions in the following companies:

Fiverr ($FVRR)

Realty Income ($O)

Shopify ($SHOP)

Square ($SQ)

In addition, I opened a starter position in Futu Holdings ($FUTU). This company operates in the financial services industry offering an online brokerage and trading platform in Hong Kong and China. Futu benefits from two main tail winds in my mind; the rise of the retail investor and an increasing affluent middle class demographic in Asia especially China.

In addition to its brokerage platform, Futu enables users to get all of the latest news on stocks and has integrated social media to create a network centred around its users tapping into the community effect. The company has experienced significant growth with revenue in Q3 2020 up 272% year-over-year. While very much in its early days, the initial signs are promising.

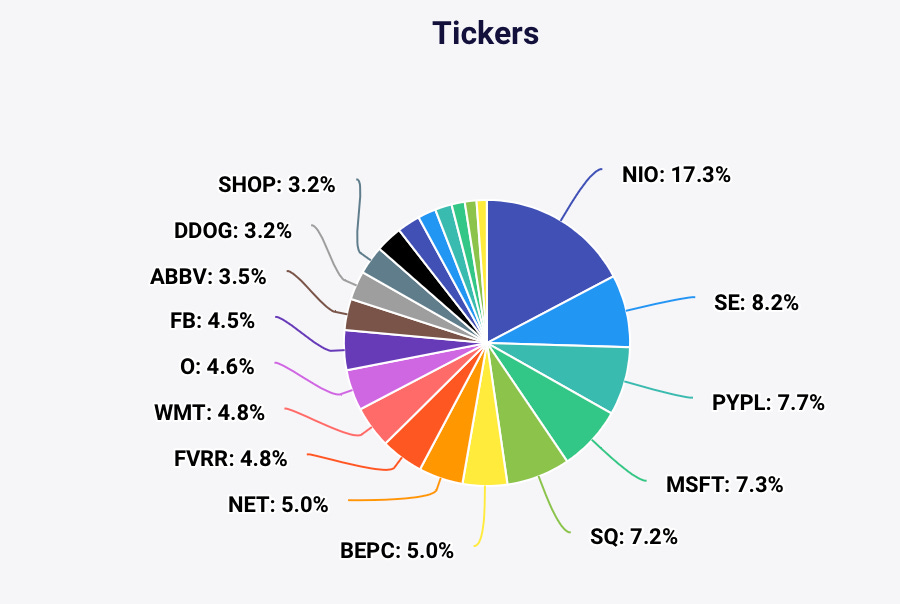

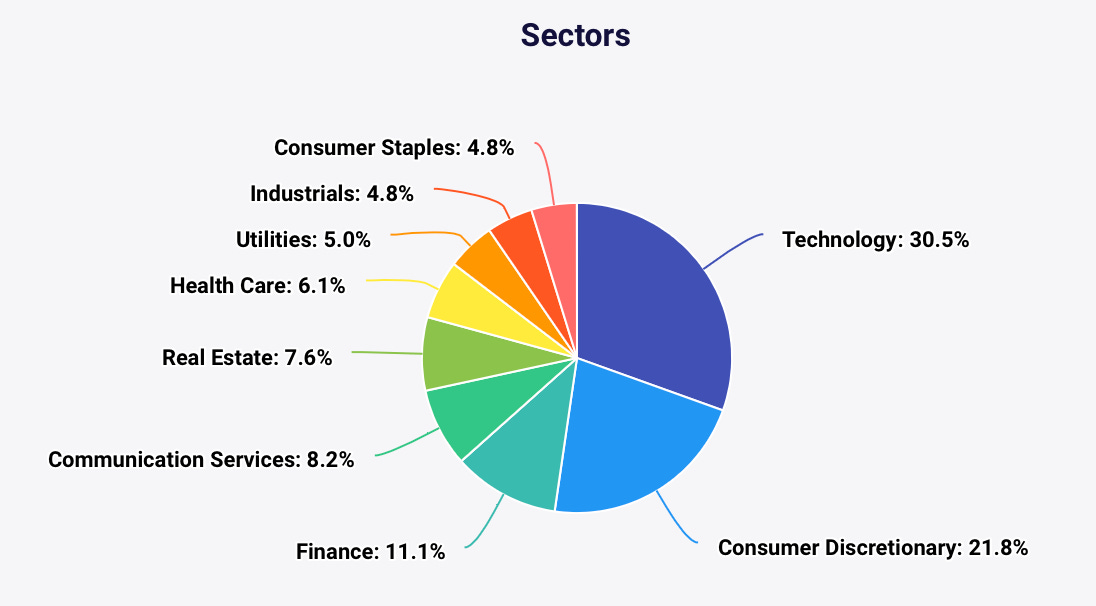

Allocation

Portfolio by current market value weighting

Portfolio by sector weighting

Performance

December was a period of consolidation for my portfolio in terms of investing returns

Monthly: -1.4% vs S&P 3.9%

Year-to-date: 33.9% vs S&P 16.0%

Final Words

Overall, I am very satisfied with how my portfolio has closed out its first year. This year was one that was unlike any other and I am very unlikely to earn similar returns next year. I spent the end of this year analysing my portfolio and adding weight to positions that I have high conviction in. I think it is important to zoom out and look at the overall picture of your portfolio, not just the returns on each individual stock.

Check out last months portfolio review Monthly Portfolio Review - November 2020

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

Hi, great post. Where do you get your charts from?