Transactions

Acquisitions

I added to my positions in the following companies:

Innovative Industrial Properties (IIPR)

NIO (NIO)

DocuSign (DOCU)

Microsoft (MSFT)

Airbnb (ABNB)

MercadoLibre (MELI)

I opened a starter position in Amazon (AMZN) this month using the remaining proceeds from the disposal of Disney (DIS) last month. I had not planned to open any new positions before the end of the year but when I started looking at the financials it appeared like a screaming buy to me. I shared some brief thoughts about Amazon on Twitter.

This time last year I had performed some analysis on Google (GOOGL) and the conclusion was that it was way undervalued relative to its peers. You can read the full analysis here. I failed to act on it and since then the stock is up 70%. Lesson learned: If a situation like this presents itself again grab it with both hands.

Allocation

Performance

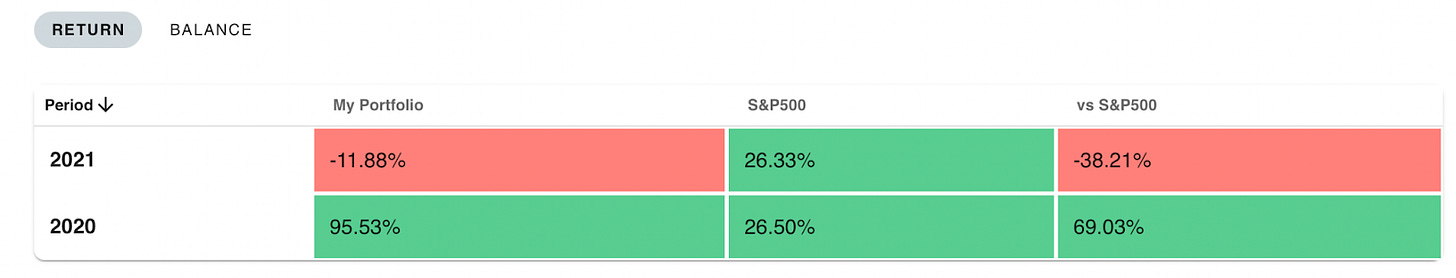

Q4: -11.2% vs S&P +10.8%

YTD: -11.9% vs S&P +26.3%

Buy List

Stocks that are on my radar to add this month:

Nvidia (NVDA) - Still on the buy list as a long term holding.

Facebook (FB) - I already added more Facebook this week in January. The Price/Sales ratio of 8 is very favourable compared to historic valuations.

Johnson & Johnson (JNJ) - One of the main value stocks in my portfolio. This portion of my portfolio needs to be topped up.

Amazon (AMZN) - If the valuation remains within the current range I will be increasing my position.

Final Words

December was a brutal month for growth stocks. Microsoft went from my 4th largest position to the number 1 in the space of a month primarily due to significant drawdowns in Sea Limited, NIO and Cloudflare.

The drawdown in Q4 means that I finish with a negative return for 2021. If you are an investor focused primarily on growth stocks you will probably have had a similar return. Famous investor Cathy Wood’s ARK Innovation ETF posted a return of -24% in 2021. It can be easy to become frustrated looking at short term returns and that's why perspective is so important. When I zoom out and look at the returns posted over the past two years I can see that my portfolio is still in good health. Periods of volatility are an opportunity if you have your homework.

Heading into 2022 it is clear that the market is favouring growth at a reasonable price over growth at any price. This is something I seek to remind myself each time I deploy new capital. The easy money has been made. Managing risk on entry is becoming far more important with the FED tapering.

In a separate post I will cover 2021 in full including the good, the bad, what I learned and the goals for 2022.

Check out last month's portfolio review

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week.

All previous posts are viewable on the website.

If you enjoy what you see, please give it a like, comment below and share.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

Did you stop this blog?