In this week's edition, I will be reviewing the performance of my own portfolio for March 2021.

Transactions

Dividends

Previously I have tracked the dividend payments that I receive as a Key Performance Indicator (KPI) for my portfolio performance. However, due to the recent Change to My Investing Strategy this is no longer something I am actively tracking so I will not be including this going forward.

Acquisitions

I was in a fortunate position to have extra cash available this month. As a result of this and the market correction in growth stocks, I invested significantly more capital than I have in previous months. I added to my positions in the following companies:

Sea Limited ($SE)

DocuSign ($DOCU)

Microsoft ($MSFT)

Futu ($FUTU)

Shopify ($SHOP)

Square ($SQ)

In addition, I opened starter positions in Roku ($ROKU) and The Walt Disney Company ($DIS).

Roku pioneered streaming for the TV and aspire to power every TV in the world. Roku connects users to the streaming content they love, enables content publishers to build and monetize large audiences, and provides advertisers with unique capabilities to engage consumers.

Roku originally set out as a hardware company but in recent times the platform side of the business is what is driving the growth. Roku has become the operating system of a lot of smart TVs too. Interestingly, if you look at the operating systems of computers, you see that Microsoft has done much better than hardware producer IBM.

Despite limited options here in Europe, I recently managed to purchase a Roku TV and have been very impressed with the experience. As the saying goes, invest in what you know.

Walt Disney is a company that should require no introduction. The mission statement is clear “to entertain, inform and inspire people around the globe through the power of unparalleled storytelling, reflecting the iconic brands, creative minds and innovative technologies that make ours the world’s premier entertainment company.”

What really interested me in Walt Disney is the recent shift to focus on “direct-to-consumer” which should enable them to capitalise on all of the brands. Disney+ surpassed 100 million paid subscribers in March 2021 just 16 months after its launch. The company's initial forecast had Disney+ landing between 60 million and 90 million subscribers by 2024. By contrast, it took Netflix 10 years to reach 100 million subscribers.

Additiontally, with economies reopening there is a pent up demand for tourism and activities which should flow into Disney World theme parks and resorts which were hit hardest during the pandemic.

Allocation

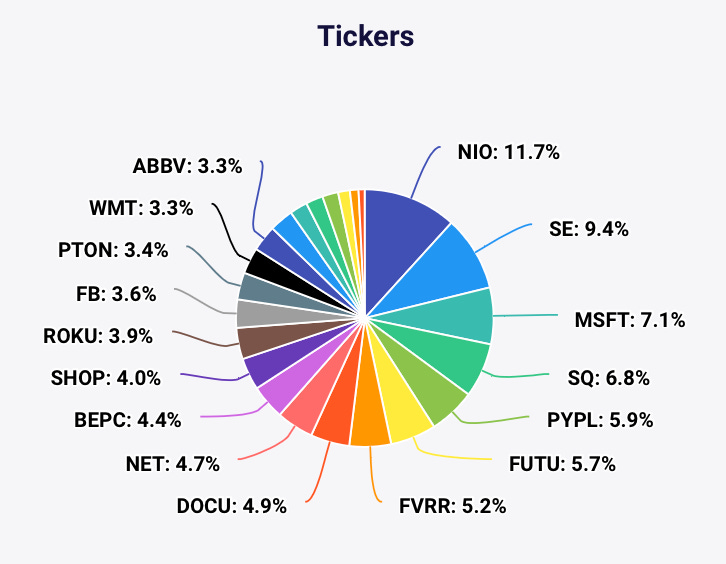

Portfolio by current market value weighting

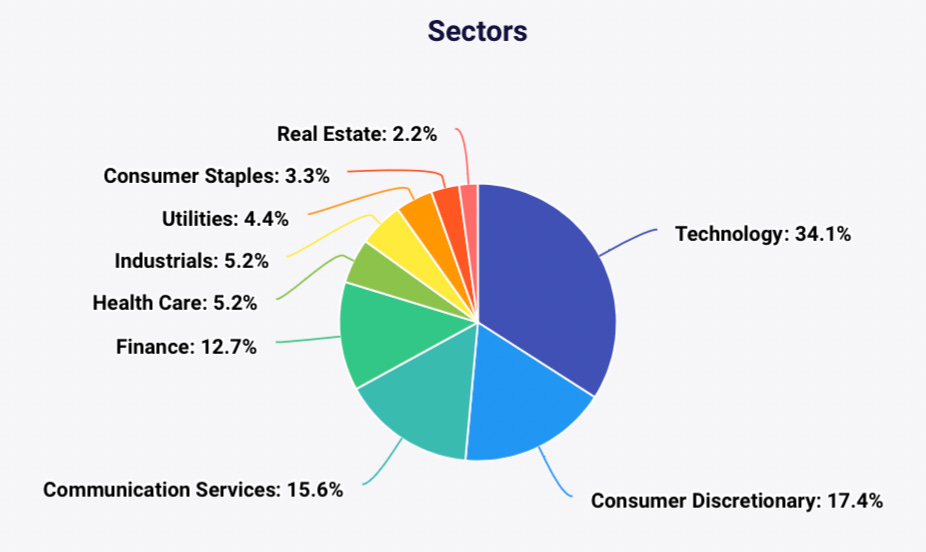

Portfolio by sector weighting

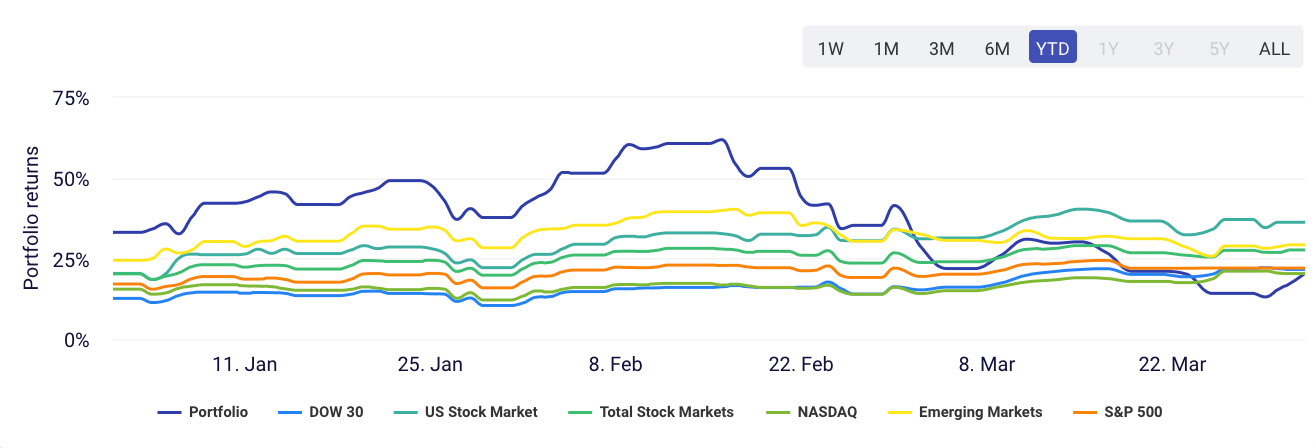

Performance

Monthly: -15.3% vs S&P +4.3%

YTD: -12.7% vs S&P +5.8%

Since inception June 2020: 21.2%

Final Words

March saw a significant selloff in growth stocks which had been overdue. Due to the fall in relative prices I added a significant amount of extra capital as mentioned above. I have received a few messages from investors who have started investing since the turn of the year, are experiencing overall negative returns and are worried about what to do. This portfolio update is to show those new investors that you are not alone with the negative returns and that this is all part of the process. Do your due diligence, buy right and sit tight.

One of the limitations of the above performance metrics is that they do not take into account the timing of cash deposits. When we add more cash to our portfolio it distorts the return. Let’s take the example of a portfolio with a market value of €12,000 and a cost of €10,000 resulting in a return of 20%. However, if we invest an additional €2,000 then the market value is €14,000 and the cost is €12,000 resulting in a return of 16.66% despite the share prices not moving at all. Here we can see that the extra cash added drags down the return.

The Compounded Annual Growth Rate (CAGR) is widely regarded as the most relevant portfolio metric as it takes into account the timing of cash flow. This is something I also track with my portfolio achieving a CAGR of 64.3% at the end of March 2021.

Check out last months portfolio review Monthly Portfolio Review - February 2021

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

You're horribly underperforming the market. You have no business giving financial advice. You're an amateur. Most professional fund manager can't beat the market. I doubt you will either.