Transactions

Disposals

This month I sold my position in Walmart which equated to about 3% of my portfolio. The original thesis was to include this stock as part of a dividend paying allocation in my portfolio. As I no longer invest for dividends alone, I believe that there are better opportunities available in terms of capital appreciation.

Acquisitions

I added to my positions in the following companies:

iRobot ($IRBT)

PayPal ($PYPL)

Facebook ($FB)

Innovative Industrial Properties ($IIPR)

Square ($SQ)

GAN ($GAN)

I opened a new starter position in Enthusiast Gaming Holdings ($EGLX). After reviewing my portfolio I identified that I was quite low on gaming exposure, particularly eSports. Total eSports viewership is expected to grow at a 9% compound annual growth rate (CAGR) between 2019 and 2023, up from 454 million in 2019 to 646 million in 2023, per Insider Intelligence estimates.

Enthusiast Gaming’s mission is to “build the world’s largest network of communities for gamers through multi-channel media, original content and events”. With a market cap of less than $800 million I expect this to be a volatile stock. The stock currently trades at a price/sales multiple of 7.9 and with revenue growing over 300% the potential upside from here outweighs the risk involved for me. There is also a common belief (and data to support it) that gaming is the new social media for Gen Z and Millenials. Small position to start with.

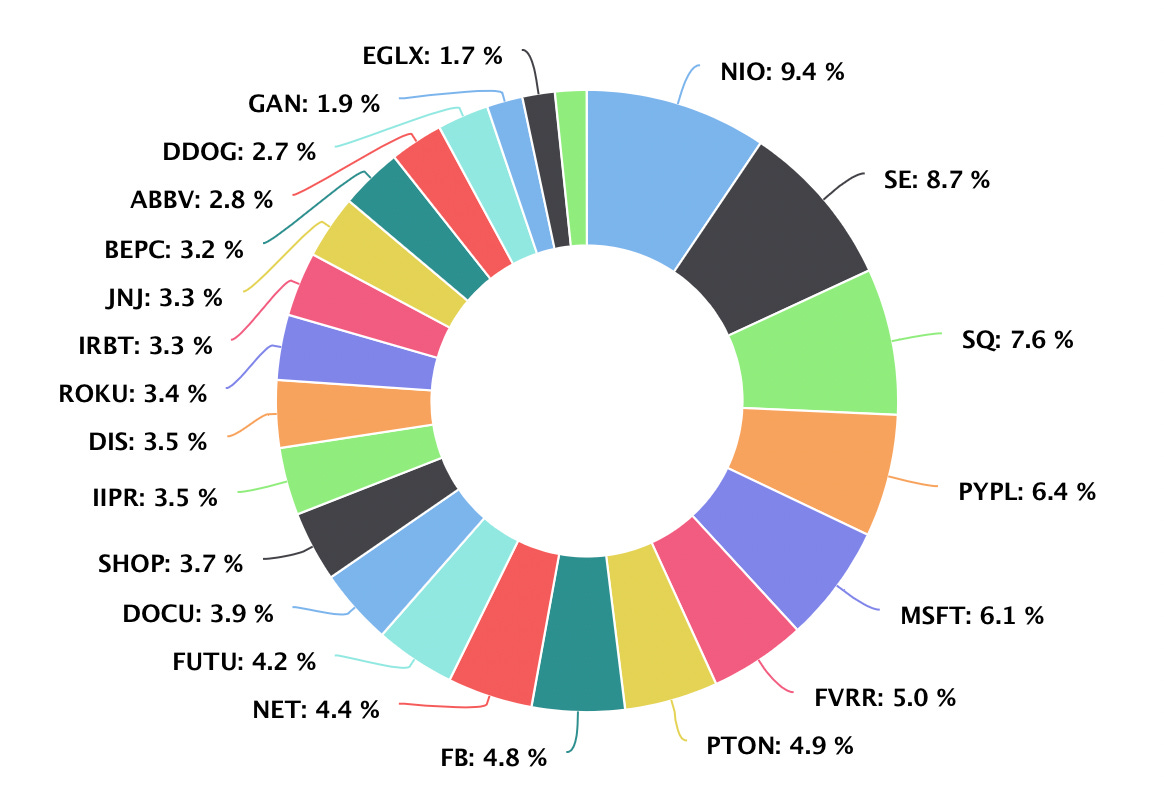

Allocation

The above graph is from Portseido. This is a new tool that I have started to use to analyse my portfolio, hat tip to @BornInvestor for the recommendation. So far I am enjoying the user experience.

Earnings Roundup

The highlights of earnings released over the past month.

iRobot reported revenue of $303 million (+58% year-over-year), beating the consensus estimate of $262 million. Net income was $7.4 million compared to a loss of $18.1 million year-over-year.

Innovative Industrial Properties reported revenue of $42.9 million (+103% year-over-year), beating the consensus estimate of $42.0 billion. Net income was $26.5 million, +122% year-over-year.

PayPal reported revenue of $6.03 billion (+29% year-over-year), beating the consensus estimate of $5.9 billion. Net income was $1.46 billion, +85% year-over-year. 14.5 million Net New Active Accounts (NNAAs) were added, ending the quarter with 392 million active accounts.

Fiverr reported revenue of $68.3 million (+100% year-over-year), beating the consensus estimate of $63 million. Net loss was $17.5 million compared to a loss of $6.2 million year-over-year. At the end of the quarter there were 3.8 million active buyers, +56% year-over-year.

Square reported revenue of $5.06 billion (+266% year-over-year), beating the consensus estimate of $3.36 billion. Net income was $39.0 million compared to a loss of $109.5 million year-over-year. Gross profit increased 79% year-over-year.

Roku reported revenue of $574 million (+79% year-over-year), beating the consensus estimate of $491 million. Net income was $76.3 million compared to a loss of $54.6 million year-over-year. At the end of the quarter there were 56.3 million active accounts, +35% year-over-year.

Peloton reported revenue of $1.26 billion (+141% year-over-year), beating the consensus estimate of $1.11 billion. Net loss was $8.6 million compared to a loss of $56.6 million year-over-year. At the end of the quarter there were 2.1 million connected fitness subscriptions, +135% year-over-year.

Cloudflare reported revenue of $138.1 million (+51% year-over-year), beating the consensus estimate of $131 million. Net loss was $39.9 million compared to a loss of $32.7 million year-over-year.

Data Dog reported revenue of $199 million (+51% year-over-year), beating the consensus estimate of $187 million. Net loss was $13.1 million compared to a profit of $6.5 million year-over-year.

Disney reported revenue of $15.6 billion (-13% year-over-year). Net income from continuing operations was $912 million, +95% year-over-year. Disney+ subscribers at the end of the quarter were 103.6 million, +209% year-over-year.

GAN Limited reported revenue of $27.8 million (+263% year-over-year), beating the consensus estimate of $24.8 million. Operating loss was $3.8 million compared to a profit of $800 million year-over-year. A record 10 client launches year-to-date surpasses 2020 total.

Sea Limited reported revenue of $1.76 billion (+147% year-over-year), beating the consensus estimate by $20 million. Operating loss was $348 million compared to a loss of $268 million year-over-year. Gross margin improved from 29% to 37% suggesting a clearer path to profitability.

Futu Holdings Limited reported revenue of $283.6 million (+349% year-over-year). Net income was $149.5 million up 6.5 times year-over-year. Total number of paying clients increased 231% year-over-year to 789,652.

Performance

Regular readers will recall that I have historically shared the performance of my portfolio each month. After some consideration, I have decided that the monthly performance of my portfolio is no longer a key performance indicator and instead I will be tracking my performance quarterly.

I came to this conclusion having realised that short-term metrics were having a negative effect on my long-term investing mindset. Subconsciously, when I was executing my buy orders each month I would fixate on how this would impact my short-term performance. This was also leading to confirmation bias, if the share price went up immediately it must have been a good investment.

Ultimately, your portfolio performance metrics and areas of focus should align with your investing strategy. I am not a trader so there is no need for me to focus on monthly returns. Think long-term, evaluate long-term.

Final Words

I spent much of May analysing my portfolio weighting and realised that I was underweight in some of my higher conviction stocks which I added to:

GAN and iRobot are still some of my smaller positions but I doubled down on both as they experienced a significant post-earnings sell-off.

I am working my way through developing a tier system for my portfolio. I currently have 23 stocks in my portfolio and this tier system would essentially divide the portfolio into four tiers. Tier 1 will represent my highest conviction stocks with Tier 4 representing my lowest conviction stocks or stocks that I deem more risky. Consequently, Tier 1 stocks should make up a higher weighting in my portfolio and Tier 4 should make up a lesser relative weighting. The idea behind the tier system is to ensure focus on adding to my highest convictions stocks especially during times of volatility. When the market sells off it can be quite easy to get distracted. This tier system will feature in a newsletter edition once finalised.

Check out last month's portfolio review Monthly Portfolio Review - April 2021.

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

Hey, the tier system has personally done me very well and exactly for the reasons you stated: Knowing what to focus on when the market crashes. That's how I got to increase my JNJ, UNA and MMM positions quite extensively last March and April.

Having said that, I enjoy these updates and I think once a quarter is indeed more than enough!

Love your posts, keep up the great work 👍

Love the fact that you are switching to quarterly performance. Makes total sense to me