In this weeks edition, I will be reviewing the performance of my own portfolio for November 2020. I will detail all of the transactions I have made, analyse the current allocation and compare the performance versus the market. Without further ado, lets get into it!

Transactions

Dividends received

This month I received dividends from the following companies:

Realty Income ($O) - Monthly dividend - $0.23 per share

Hasbro ($HAS) - Quarterly dividend - $0.68 per share

Abbvie ($ABBV) - Quarterly dividend - $1.19 per share

While the amounts may not appear significant, the power of compounding means that I am earning interest on the interest I receive, which multiplies my money at an accelerating rate. My policy is to reinvest all dividends received back into my portfolio.

Disposals

This month I decided to sell my position in Spotify ($SPOT). This was a strategic decision more than anything. Spotify was not a substantial position in my portfolio. As you will see later, I am quite heavy in the Technology/Communications sectors and I wanted to consolidate my exposures. While I do believe that the company has a positive future I believe that the upside from the current value is far less than some of the other options that I currently hold in this area. I sold the position for a 10% profit and reinvested the proceeds back into my portfolio.

Acquisitions

I had a bit more funds than usual to invest this month as a result of the 3 dividend payments received and the proceeds from the sale of Spotify, all of which was pooled together with my monthly cash contribution.

This month I added to my positions in the following companies:

Facebook ($FB)

PayPal ($PYPL)

Brookfield Renewable Corporation ($BEPC)

Walmart ($WMT)

In addition, I opened a starter position in Innovative Industrial Properties ($IIPR). The company is a Real Estate Investment Trust (REIT) focused on the acquisition, ownership and management of specialised properties leased for regulated medical-use cannabis facilities. During the recent US presidential election, a number of states also passed legislation to allow the use of marijuana for recreational purposes. North America accounted for 88.4% of the global market size for legal marijuana in 2019 at 17.7 billion and is expected to balloon to $73.6 billion by 2027.

This investment in Innovative Industrial Properties is how I have decided to gain exposure to this mega-trend. As opposed to pure-play marijuana companies, Innovative Industrial Properties focuses on buying properties and immediately leasing them back to the medical cannabis operator. This business model acts like a banking facility because it gives the cannabis operator an injection of cash so that they can sustain or grow and avoid loan repayments themselves. For me, this should avoid the supply/demand issues inherent in the actual production and sale of marijuana.

Allocation

Portfolio by current market value weighting

NIO makes up my largest position at 20.6%. However, on a cash invested basis, NIO is only my 6th largest position at 6.5%. I first invested in NIO at $8.98 per share and added more at $14.40. The share price closed out at the end of November at $50.53.

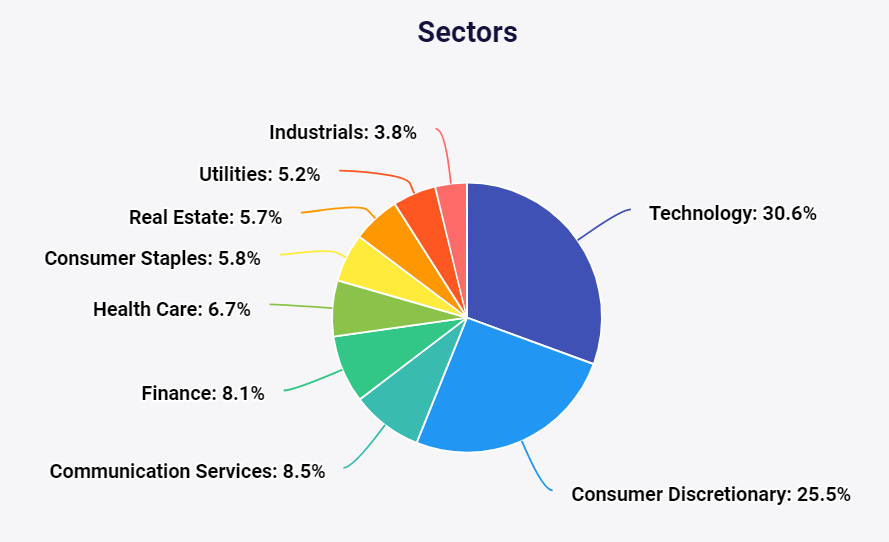

Portfolio by sector weighting

Performance

November was a very good month for my portfolio in terms of investing returns

Monthly: 22.9% vs S&P 10.8%

Year-to-date: 35.3% vs S&P 12.1%

Final Words

Overall, I am delighted with my returns so far. November was very choppy for the markets at the beginning of the month with the US election and the COVID-19 vaccine news. I didn’t make any knee jerk reactions and it paid off as I managed to beat the market during this time.

However, what really matters for me is that I can see that I am another step closer to achieving my own financial goals. I am continuing to add each month so the value of my portfolio in 10 or 20 years is what really matters.

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. Please also consider sharing with a friend if you find the content useful.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.