Dear reader,

I’ve been writing this newsletter every week for almost five years now, since November 2020, to be precise. Some of you may have been here from the early days, while many of you have likely joined more recently.

With that in mind, I want to share a comprehensive overview of my investment philosophy. There are two reasons for this. First, it’s important context for both current and prospective subscribers. I want you to have a clear understanding of the kinds of investment ideas I pursue. Second, it’s a valuable exercise for me personally. I’ve evolved as an investor over the years, and stepping back to clarify what I’m trying to achieve is a worthwhile reflection.

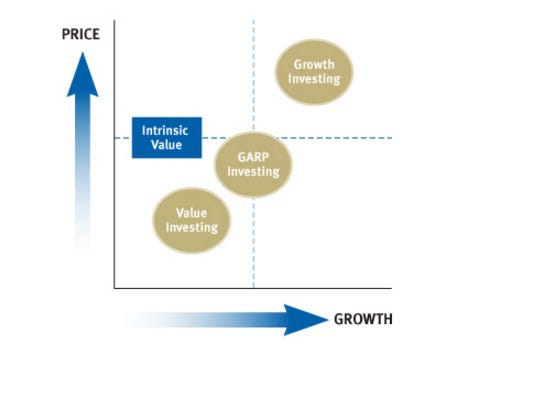

Investing in public markets isn’t about luck or following the latest trend. At its best, it’s a disciplined, repeatable process, one that combines analytical thinking, business insight, and emotional steadiness. My approach is grounded in the Growth at a Reasonable Price philosophy, originally popularised by Peter Lynch and refined for today’s technology-driven, platform-centric world.

This article outlines how I apply that approach through a framework built on company-level analysis, financial interpretation, and long-term conviction. While the businesses I study may span different industries and regions, they share certain traits: scalable models, strong growth potential, and the ability to compound value over time.

The Core Philosophy: Growth with Guardrails

Growth is critical, but it must be paired with discipline. Chasing rapid growth without regard for valuation often leads to disappointment. On the other hand, focusing solely on low valuation multiples can mean missing out on some of the best long-term opportunities.

The GARP philosophy finds a middle ground. I look for companies that are growing meaningfully and valued sensibly relative to their future prospects.

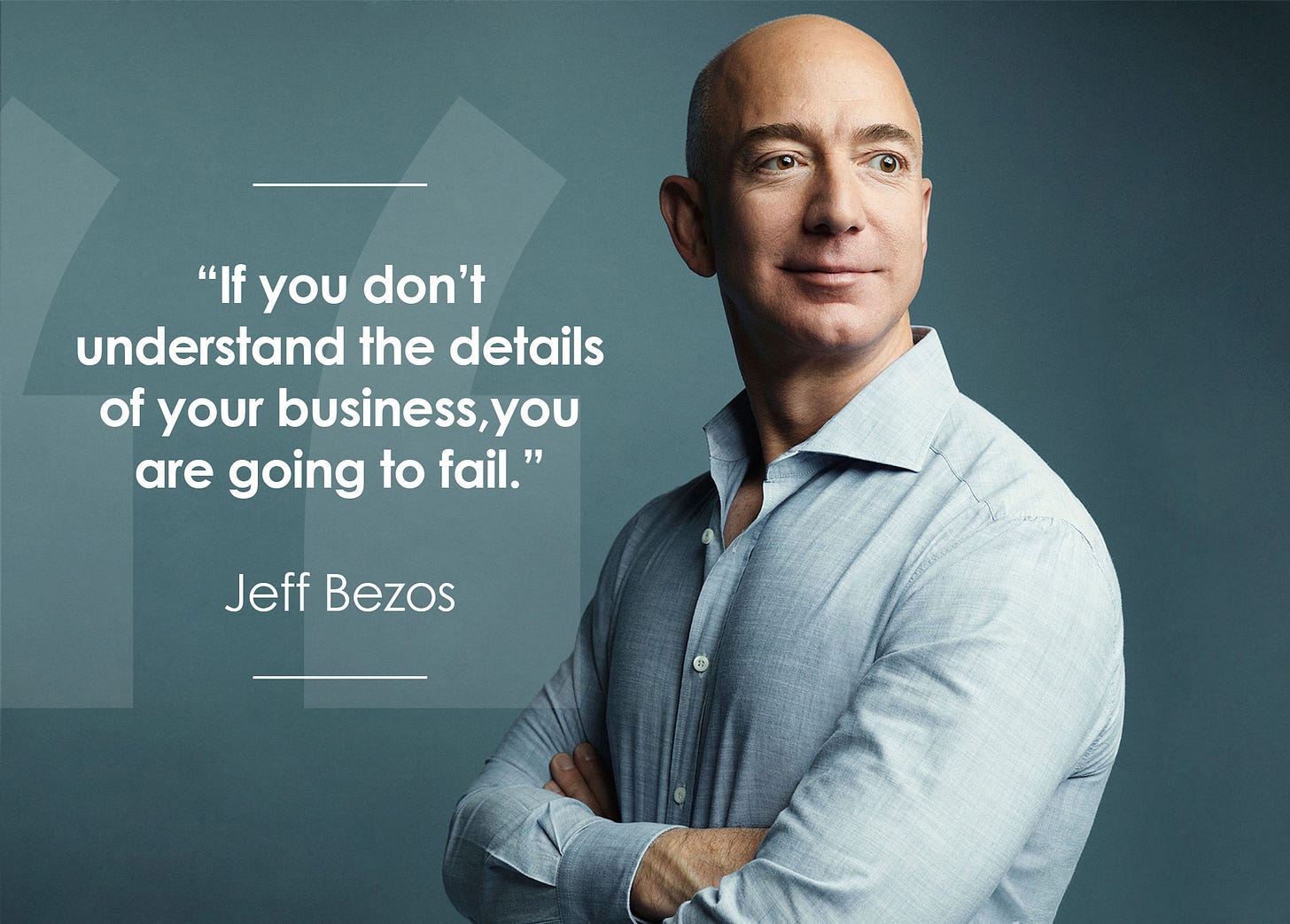

This involves looking beyond headline metrics. A business growing revenue at 30% annually might justify a much higher earnings multiple than one growing at 10%. The key is context, and that comes from understanding the business in depth.

Understanding the Business Comes First

Every investment begins with thorough research focused on understanding the fundamentals:

The core business model and customer segments

Revenue and margin drivers

Competitive advantages

Management's execution and capital allocation track record

Key risks and emerging opportunities

I don’t treat stocks as ticker symbols, I see them as ownership stakes in real businesses. My goal is to understand how a company makes money, how it plans to grow, and where it might face challenges. This is especially important in complex or fast-evolving industries where surface-level analysis is not enough.

Quarterly Results as Compass, Not GPS

Once I’ve built conviction, I treat quarterly results as a tool to monitor the thesis, not as trading signals. I focus on the trends and signals that help assess business quality and execution, such as:

Revenue and margin trends across segments or regions

Free cash flow generation and reinvestment patterns

User or customer metrics, engagement levels, and monetisation

Management commentary and changes in forward guidance

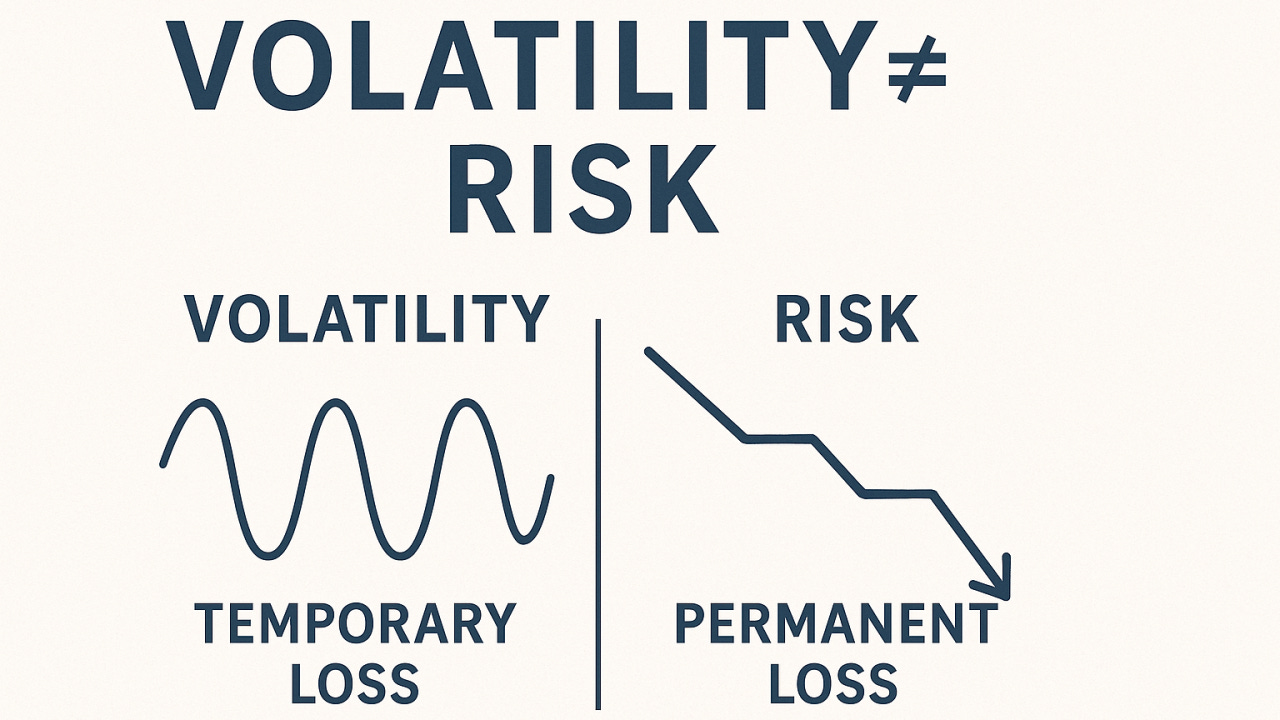

The goal is not to overreact to short-term fluctuations, but to refine my understanding. If the facts change, the thesis must adapt. If not, I stay the course.

Where I Focus: Platform Businesses with Structural Advantages

Over time, I’ve found that the most compelling long-term opportunities tend to share a few characteristics. These businesses often:

Operate as platforms or ecosystems

Benefit from network effects, switching costs, or proprietary infrastructure

Serve large, under-penetrated markets

Generate strong incremental margins at scale

Whether it’s digital commerce, payments, software, or infrastructure, I focus on models where the economics improve with scale, and where reinvestment can create a widening competitive moat.

The Analytical Framework I Apply

To tie everything together, I apply a structured and repeatable process:

Understand the Business

I believe that the key to long-term success is understanding the business behind the stock. For this reason, certain industries such as biotech and commodities are outside my investable universe.

Assess the Moat

Moats can stem from switching costs, network effects, cost advantages, efficient scale or intangible assets. I assess not just whether a moat exists, but how durable and expandable it is.Model Financials and Unit Economics

I forecast revenue growth, margin progression, and capital efficiency. For different models, I focus on relevant drivers, unit economics, user monetisation, customer acquisition costs, and retention dynamics.Run Valuation Checks

I use discounted cash flow models with conservative assumptions. While the output is useful, the real value lies in the process itself, it helps uncover subtle insights. I also run an inverse DCF and compare valuation multiples across peers to understand what the market might be pricing in or overlooking.Track Key Risk Factors

I consider macroeconomic variables, regulatory shifts, competitive threats, and internal execution risk. I aim to understand not just what could go wrong, but how likely it is and how it could impact the long-term thesis.

The Long-Term Mindset

I don’t try to time the market or chase short-term moves. My advantage lies in doing the deep work and holding through periods of volatility that shake out others.

I aim to own businesses that are not just growing in size, but becoming more efficient, resilient, and essential over time.

This requires:

Conviction to back my research

Patience to let compounding work

Humility to change my mind when new information warrants it

Final Thoughts

My investment philosophy is grounded in GARP and refined through years of experience tracking modern, high-growth companies across both emerging and developed markets. I apply a consistent, data-driven framework to identify companies with durable business models, attractive valuations, and long-term reinvestment opportunities.

Success in investing rarely comes from finding the next hype-driven winner. It comes from understanding great businesses, buying them at reasonable prices, and having the temperament to hold them through their journey.

If you can do that, you can beat the market over time.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great article. Thanks for sharing. I am curious on what's the strategy you follow on portfolio sizing

Thanks for sharing competitive differentials gives the edge, staying ahead is about first class customer support.