In this report, I will cover the following:

Overview

Customers

Capitalisation

Revenue and Margins

Valuation Multiples

Balance Sheet and Cash Flow

Stock Price History

Competitors

Management and Ownership

Risks

Opportunities

Investment Strategy

NIO Inc.

Ticker: $NIO

Sector: Consumer Cyclical

Market Cap: $65.9 billion

1. Overview

NIO is a pioneer and a leading manufacturer of premium smart electric vehicles (EV). Originally founded in November 2014, as Nextev Inc., the name was changed to NIO Inc. in July 2017. Their Chinese name, Weilai, which means Blue Sky Coming, reflects the commitment to a more environmentally friendly future.

NIO design, develop, manufacture and sell premium smart EVs, driving innovations in autonomous driving, digital technologies, electric powertrains and batteries. They differentiate themselves through continuous technological breakthroughs and innovations, such as their industry-leading battery swapping technologies, Battery as a Service (BaaS), as well as proprietary autonomous driving technologies and Autonomous Driving as a Service (ADaaS).

The company has launched the following vehicles to date:

EP9, an electric supercar, in 2016. The EP9 set a world record as the then fastest all-electric car at the Nürburgring Nordschleife “Green Hell” track in Germany in May 2017, finishing a lap in 6 minutes and 45.90 seconds.

ES8, a seven-seater flagship premium smart electric SUV, at their first NIO Day on December 16, 2017. According to JD Power’s 2019 China New Energy Vehicle Experience Index Study published in July 2019, NIO ranked the highest in quality among all electric vehicle brands, and the ES8 ranked the highest in quality among all mid-large battery electric vehicles.

ES6, a high-performance premium smart electric SUV, at their second NIO Day on December 15, 2018. According to JD Power’s 2020 China New Energy Vehicle Experience Index Study published in September 2020, NIO ranked the highest in quality among all battery electric vehicle brands, and the ES6 ranked the highest in quality among all midsize battery electric vehicles.

EC6, a premium smart electric coupe SUV, at their third NIO Day on December 28, 2019. Based on the results released by C-IASI (China Insurance Automotive Safety Index) in January 2021, the EC6 achieved the best safety rating among all models tested by C-IASI in 2020.

ET7, a flagship premium smart electric sedan, at their fourth NIO Day on January 9, 2021. The ET7 features NIO’s latest NAD (NIO Autonomous Driving) technology including NIO Adam, a super computing platform (in partnership with NVIDIA), and NIO Aquila, a super sensing system. NIO will begin making deliveries of ET7 in the first quarter of 2022 and will start at a price of around $69,000.

As of 30 September 2021, NIO has delivered a total of 142,036 vehicles cumulatively.

NIO offers comprehensive value-added services and a convenient and innovative suite of charging solutions to its users. These solutions include:

Power Home - home charging solution

Power Swap - innovative battery swapping service

Power Mobile - mobile charging service through charging trucks

Power Express - 24-hour on-demand pick-up and drop-off charging service

NIO believes these solutions and services will create a holistic user experience throughout the vehicle lifecycle.

NIO sells its vehicles through its own sales network, including NIO Houses and its mobile application. NIO Houses are not only the showrooms for vehicles, but also clubhouses for users with multiple social functions. The mobile application fosters a dynamic and interactive online platform. NIO believes their online and offline integrated community will retain user engagement and cultivate brand loyalty along with other successful branding activities such as the annual NIO Day.

2. Customers

NIO have historically sold their vehicles in the China market but have recently begun to expand into international markets to capture the fast-growing electric vehicle demand. In September of this year, NIO began deliveries of its ES8 large SUV in Norway which is its first market outside China. NIO chose Norway as its first European market because of the country’s commitment to sustainability with the electric vehicle market making up 77.5% of all vehicle sales in the country in September.

During Q2 2021, NIO delivered 21,898 vehicles which represented 112% growth year-over-year and also a new quarterly record.

NIO is far more than just an electric vehicle manufacturer as the company reaches out to and engages with their users directly through platforms including NIO app, NIO Houses and NIO Spaces, and aims to build a community of users.

NIO app is designed to be a portal not only for selling cars where users can place orders for and configure all NIO vehicles, but also for vehicle control, service access and NIO Life product purchase, and most importantly, an online platform for their community. The NIO app had over 1,600,000 registered users at the end of 2020 and approximately 168,000 daily active users on peak days in 2020.

NIO Houses have showroom functions while serving as a clubhouse for users and their friends. At the end of 2020, NIO had 23 NIO Houses in total.

NIO Spaces are mainly showrooms for the brand, vehicles and services. Compared with NIO Houses, NIO Spaces are generally smaller in scale, more delicate and sales-focused. At the end of 2020 NIO had 181 NIO Spaces in 113 cities.

The community building effort appears to be working because a massive 69% of Nio’s new customers in Q1 2020 came from customer referral according to a report released by Bain & Company.

3. Capitalisation

NIO went public on the 12th September May 2018 through an IPO raising an $1 billion valuing the company at $5.4 billion. Today the market market cap is $65.9 billion meaning if you had invested at the IPO date you would have over 6x your initial investment in just over 3 years when taking account of subsequent stock dilution. Despite this performance the company is still very much a growth stock.

4. Revenue and Margins

NIO has been growing revenues at an exceptional rate over the past couple of years whilst also improving its gross margins. During its most recent financial results for Q2 2021:

Revenue was $1.31 billion, an increase of 149% year-over-year.

Vehicle revenue was $1.23 billion, an increase of 148% year-over-year.

Other revenue was $83 million, an increase of 152% year-over-year.

Gross margin was 18.6% in Q2 2021 compared to 8.4% in Q2 2020. Since Q1 2020 when the gross margin was negative, NIO has been improving this margin each quarter. This level of growth is not a once off as NIO has a demonstrated track record when we look back over the last 2 years. The only blot on the copy book is Q1 2020 but was as a result of COVID-19 which is expected given China experienced the first outbreak.

NIO is not yet profitable on the bottom line having posted a net loss of $90.9m in Q2 2021. The loss has narrowed as the gross margin has improved with the net loss in Q2 2020 amounting to $166.5m. It is fair to say that NIO has been burning through cash in what is a very capital intensive industry which requires a lot of up front R&D.

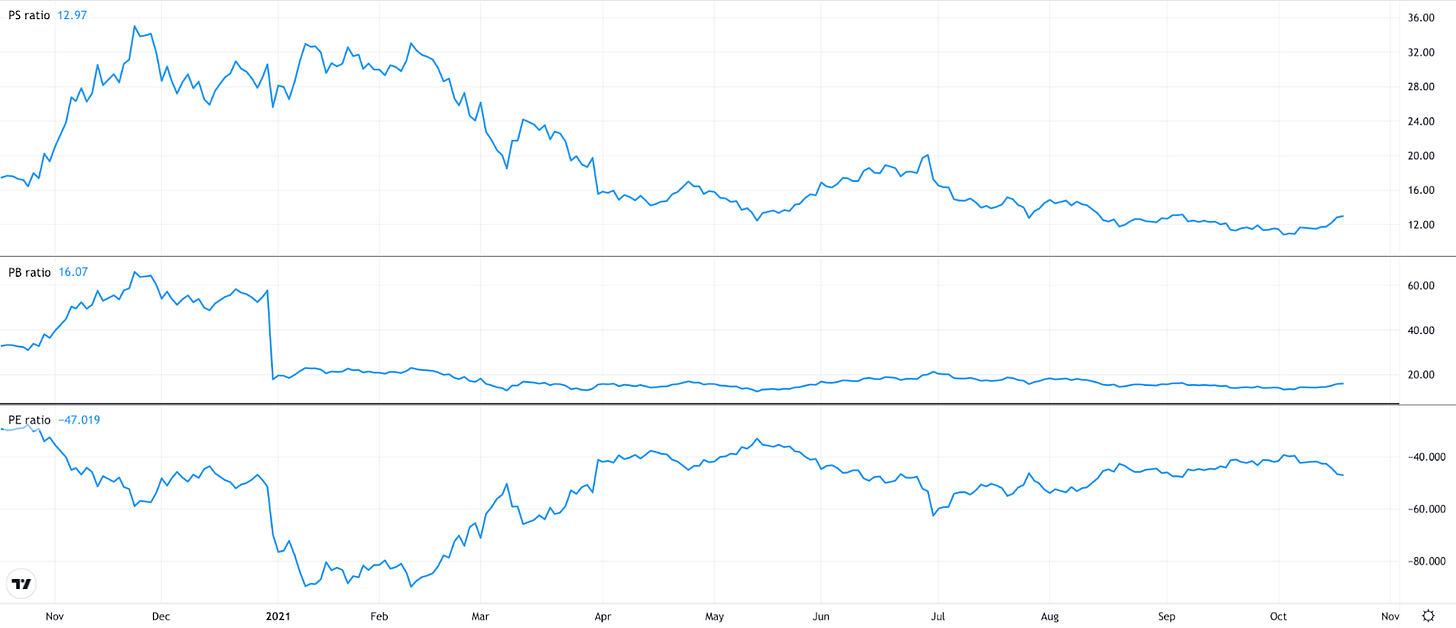

5. Valuation Multiples

NIO very much lives up to the characteristics of a growth stock and trades at high valuation multiples. Below are some of the key valuation metrics that I have identified. I have included the PE ratio below despite NIO not yet being profitable as this is not the focus for the business at this time.

When NIO hit an all-time high of $66 in February of this year, the P/S ratio was 32 on the back of revenue of $2.49 billion and vehicle deliveries of 43,729 for 2020. Gross margin for 2020 was 11.5%.

In advance of Q3 earnings, NIO trades at a P/S ratio of 14. Revenue for 2021 is expected to be $5.6 billion with vehicle deliveries of over 90,000. As of Q2 2021 the gross margin is 18.6%. As can be inferred, NIO is a better investment now than it was at the start of 2021 when peak EV mania was gripping the market. Let’s be clear though, its still expensive.

But, how does this valuation compare to competitors namely Tesla?

Tesla has a market cap of $895.6 billion (NIO $65.9 billion) and trades at a P/S of 23 (NIO 13). Tesla has a forward P/E of 122 (NIO 147). Tesla is expected to record revenue of $50.8 billion for 2021 (NIO $5.6 billion) with a gross margin of 24.1% (NIO 18.6%).

What does this all mean? In short, Tesla’s revenue for 2021 is expected to be 9x NIO but its market cap is 13x. As a further exercise, I reviewed the gross margin trend for Tesla and when it recorded $1.2 billion of revenue in Q4 2015 (similar to what NIO recorded in Q2 2021) it had a gross margin of 18.0% meaning NIOs current gross margin is 0.6 percentage points better than where Tesla was at a similar stage. Therefore, it is reasonable to expect NIOs gross margin to increase in line with the trend shown by Tesla even without considering the impact of higher margin services including BaaS.

6. Balance Sheet and Cash Flow

Commentary

Over $2.7 billion in cash and cash equivalents

Total Liabilities as % of Total Assets is 54%

Current Assets to Current Liabilities ratio of 2.48

Inventory balance making up 3% of total assets meaning the impact of the risk of impairment is low

Quite a bit of debt on the balance sheet with a combined $2.2 billion in short-term and long-term debt which has almost doubled since the end of 2020

7. Stock Price History

After the IPO in 2018 the share price traded downwards for the following year hitting as lows as $1.50 in October 2019. Following a change in fortunes, the stock went on a parabolic run in the second half of 2020 and hit an all time high of $61.95 in January 2021. The stock subsequently pulled back and has been trading sideways in the $30 to $40 range for the past 6 months.

8. Competitors

Competition in the automotive industry is intense and evolving. The impact of shifting user needs and expectations, favorable government policies towards clean energy vehicles, expanding charging infrastructure, and technological advances are causing the industry to evolve in the direction of electric-based vehicles.

The China automotive market is generally competitive. NIO management have stated that they have strategically entered into this market in the premium smart EV segment in which there is limited competition relative to other segments. However, they expect this segment will become more competitive in the future. It is also expected that they will compete with international competitors, including Tesla. Given the quality and performance of the ES8, the ES6, the EC6 and the ET7, and their attractive pricing, NIO believes that they are strategically positioned in China’s premium smart EV market.

When looking at 2021, Chinese consumers bought 1.79 million EV over the first eight months of 2021, up 194% from the same period last year. This increase compared with 14% growth for overall automotive sales. Some analysts have attributed the sales growth in part to new lower cost models, many with better design and range. The top-selling model for 2021 so far has been the Hongguang Mini EV, a basic compact priced from ~$4,500 and made by a joint venture between General Motors, state-owned SAIC Motor and local manufacturer Wuling Motors.

As NIO begins to enter the European markets it will not only face competition from Tesla but from the legacy automotive manufacturers including Renault, Volkswagen, Ford and Hyundai but to name a few.

9. Management and Ownership

William Li is the NIO founder and has served as chairman of the board since inception and chief executive officer since January 2018. In 2000, Li co-founded Beijing Bitauto E-Commerce Co. and served as its director and president until 2006. From 2010 to 2020, Li served as chairman of the board of directors at Bitauto Holdings Limited, a former NYSE-listed automobile service company and a leading automobile service provider in China. In 2002, Li co-founded Beijing Creative & Interactive Digital Technology Co. and has served as its chairman of the board of directors and chief executive officer since its inception. In addition, Li served as vice-chairman of China Automobile Dealers Association (CADA). Li received his bachelor’s degree in sociology from Peking University where he minored in Law.

William Li appears to be well received at NIO with an 92% approval rating on Glassdoor with the company overall scoring 3.9 out of 5 by its own employees. It should be noted that this is based on employees outside of China which means that is not an accurate overall representation given majority of employees are still based in China.

In William Li, NIO meets my criteria of being led by a visionary founder. It helps that he is often dubbed as the Elon Musk of China.

10. Risks

1. Chinese Owned Business

NIO was burning through so much cash at the start of 2020 that it almost went bankrupt and had to be bailed out by the Chinese government. The issue with how this bailout was structured is that all the assets of NIO in China were transferred to a new company called NIO China. NIO shareholders got 75.88% while the other strategic investors 24.115%. Since then, NIO has invested further into NIO China and the distribution of ownership is now 86.5% for NIO while other investors still have time to decide whether to increase their share of ownership.

As NIO China holds all the key assets and is likely going to continue to burn cash for the next 5 years as it grows (despite ever improving profitability metrics), will the government of China fund NIO China on their own terms or will they respect NIO’s valuation on the US stock market. Given that this is a long term financing agreement NIO made with the government, it is possible that US traded NIO shareholders might be regarded as secondary and get the short end of the stick.

Further to this, NIOs American Depositary Shares (ADS) may be delisted under the Holding Foreign Companies Accountable Act if the Public Company Accounting Oversight Board (PCAOB) in the US is unable to inspect auditors who are located in China. The delisting of their ADSs, or the threat of being delisted is inherent in all China owned companies given the nature of the relationship between China and the US.

2. Competition

As touched on earlier, the China automotive market is highly competitive. NIO has strategically entered into this market in the premium EV segment and expect this segment will become more competitive in the future as additional players enter into this segment. While NIO faces competition from local and international electric vehicle manufacturers, it also competes with internal combustion engine (ICE) vehicles in the premium segment. Many of the competitors, particularly international competitors, have significantly greater financial and other resources than NIO does and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale and support of their products.

Increased competition may lead to lower vehicle unit sales and increased inventory, which may result in downward price pressure and adversely affect the business, financial condition, operating results and prospects. The ability to successfully compete in the industry will be fundamental to future success in existing and new markets and our market share.

11. Opportunities

1. Large and expanding addressable market

The EV industry’s market size is anticipated to be bright on the back of various tailwinds. Stricter emissions targets are expected to boost the environment friendly EV market in addition to government subsidies and incentives. While China is the biggest and fastest growing EV market, developed western nations including the US, UK and Germany are actively encouraging the use of green vehicles to lower carbon emissions. According to Fortune Business Insights, the global electric vehicle market is anticipated to grow from $288 billion in 2021 to $1,318 billion in 2028 registering a compounded annual growth rate of 24.3%. Analysts believe the environmental effect of conservative gasoline automobiles and the rise in fuel prices have given novel prospects to alternative fuel vehicles in the market. Purchasers are progressively partial towards using battery-powered or hybrid vehicles, which is estimated to bolster the electric vehicle market growth and demand.

On top of this, China is prioritizing EVs in its plan to recover from COVID-19 having extended the subsidies for buying new electric vehicles to 2022. The EV industry is part of the Chinese government’s strategic initiatives. The country aims to control pollution and reduce its reliance on imported oil through this initiative. China wants to increase the share of EV vehicles in the overall auto market to 25% from 5% in 2020. In China’s New Energy Vehicle Industrial Development Plan for 2021 to 2035, the aim is “to position China to effectively meet future demand for autonomous, connected, electrified, and shared mobility. Its three overarching goals are to: (1) form a globally competitive auto industry with advanced NEV technologies and good brand reputation; (2) transition to an energy-efficient and low-carbon society with a convenient charging service network and battery electric vehicles as the mainstream in sales; and (3) improve national energy security and air quality, mitigate climate change, and stimulate economic growth in the automobile, energy, transportation, and information and communications industries.”

As a Chinese company, NIOs strong standing with the government of China offers massive advantages as well as disadvantages as touched upon earlier.

2. Battery As A Service and NIO Power

In August 2020, NIO first announced the launch of its Battery as a Service (BaaS) subscription. This service is available with a number of NIO’s models and featuring a 70 kWh battery pack, customers who subscribe to the BaaS program receive a deduction on the vehicle's purchase price of approximately ~$10,000, and pay a monthly subscription fee of about ~$140. In addition, customers are still able to receive tax incentives and government subsidies for EVs. The launch of the BaaS model enables NIO users to benefit from the lower initial purchase prices of its products, flexible battery upgrade options and assurance of battery performance. The advantages of its chargeable, swappable and upgradable battery swap technologies will continue to enhance competitiveness of NIO products.

Going one step further, earlier this year NIO unveiled “NIO Power 2025”, the battery swap station deployment plan. NIO Power, a power service system based on NIO Power Cloud, provides a holistic charging and swapping service experience to the users via its extensive power network encompassing battery swap stations, charging stations, Power Mobiles, and professional service teams. As of Q2 2021, NIO has built 301 NIO Power Swap stations, 204 Power Charger stations and 382 destination charging stations in China and completed more than 2.9 million swaps and 600,000 uses of One-Click-for-Power services. This year, NIO has raised its target of having over 700 instead of 500 battery swap stations installed by year end. From 2022 to 2025, NIO commits to installing 600 new battery swap stations in China. By the end of 2025, NIO will have over 4,000 NIO battery swap stations worldwide with around 1,000 outside of China. Furthermore, to share NIO’s achievements with the automotive industry and smart electric vehicle users, NIO announced that NIO Power's charging and swapping system, as well as BaaS , will be fully available to the industry.

This technology is a game changer and should provide an edge over its competitors.

12. Investment Strategy

The automotive industry is undergoing major changes and the first major trend is towards energy sustainability. Despite being an old, capital intensive business there is a large opportunity as we drive towards autonomous transportation.

The scale of the market opportunity means that there can and will be more than one winner. Many have suggested that NIO can become in EVs what Alibaba is to Amazon in ecommerce, the Chinese Tesla. This isn’t something I subscribe to personally. NIO very much has its own identity and has not resorted to being a copycat or a knockoff version of anything else on the market. NIO have deliberately pitched themselves as a premium brand and have built its own Innovation Stack when it comes to their technology. The long-term thesis involves NIO becoming a success outside of China and the expansion into Norway is the first phase of this. Investors should pay close attention to how NIO fares in Norway over the coming quarters as this will give a good indication of how well the company can do outside of China.

NIO is a very volatile stock and carries a number of very real risks that any prospective investor should be aware of. The stock price has halved from its peak at the start of this year. If you have got a low risk tolerance then an investment in NIO may not fit with your investing strategy. If you have got a higher risk threshold, believe that there can be more than one winner in the EV market and view NIO as automotive innovators then perhaps you should add NIO to your watchlist.

Disclosure: The author holds a long position in Nio.

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.