Executive Summary

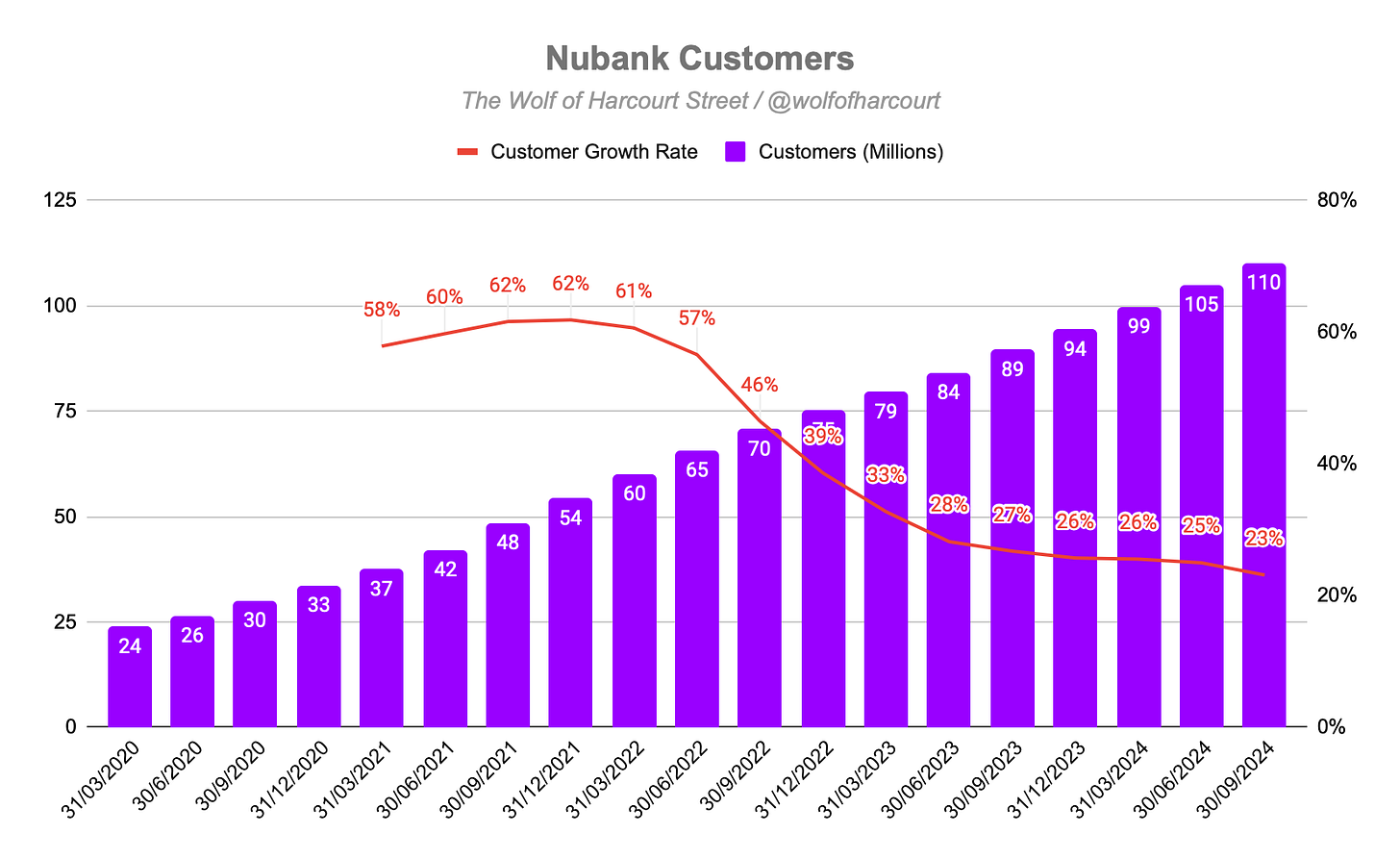

Nu added 5.2 million customers this quarter and 20.7 million YoY, bringing the total to 109.7 million. The activity rate reached a record 84%, marking the 12th consecutive quarterly increase and demonstrating strong customer engagement. Nu continues to add 1.1 million new customers monthly and surpassed 100 million customers in Brazil this week. Both Mexico and Colombia continue to experience growth rates above 100%.

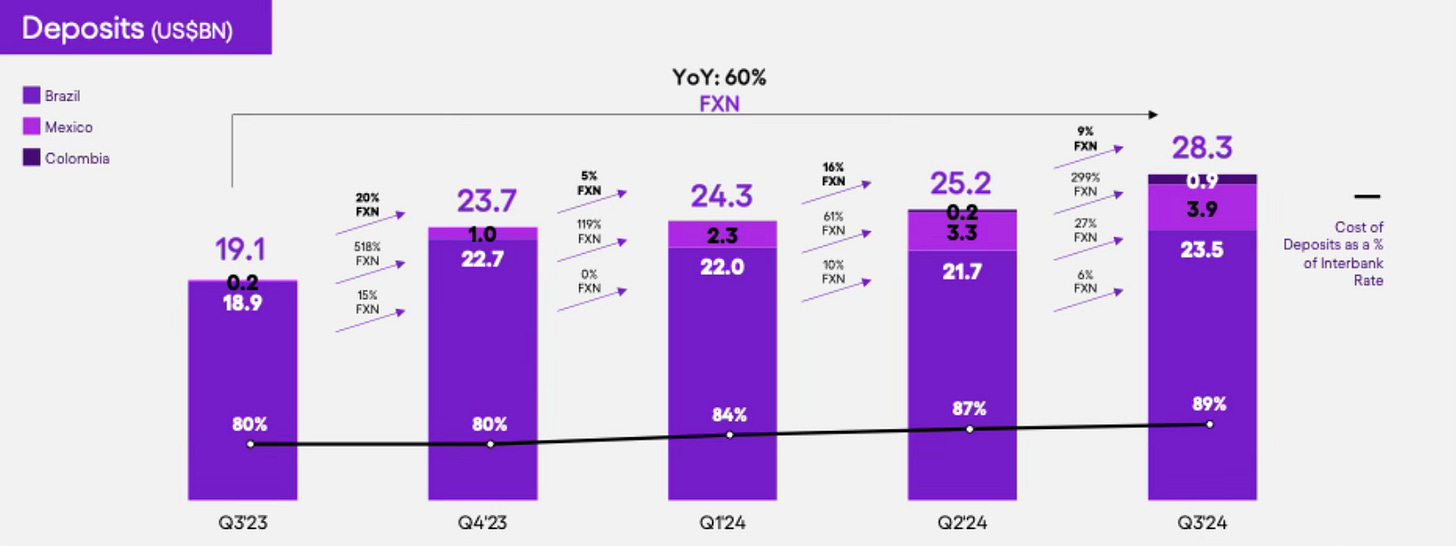

Deposits grew by 60% YoY, reaching $28.3 billion, with strong gains across all markets. Mexico saw particularly rapid growth, nearly quadrupling deposits in three quarters, while Colombia quickly reached $900 million in consumer deposits after launching a new checking account. Despite this expansion, Nu effectively managed deposit costs, keeping them at 89% of blended interbank rates, slightly higher than Q1’s 87%.

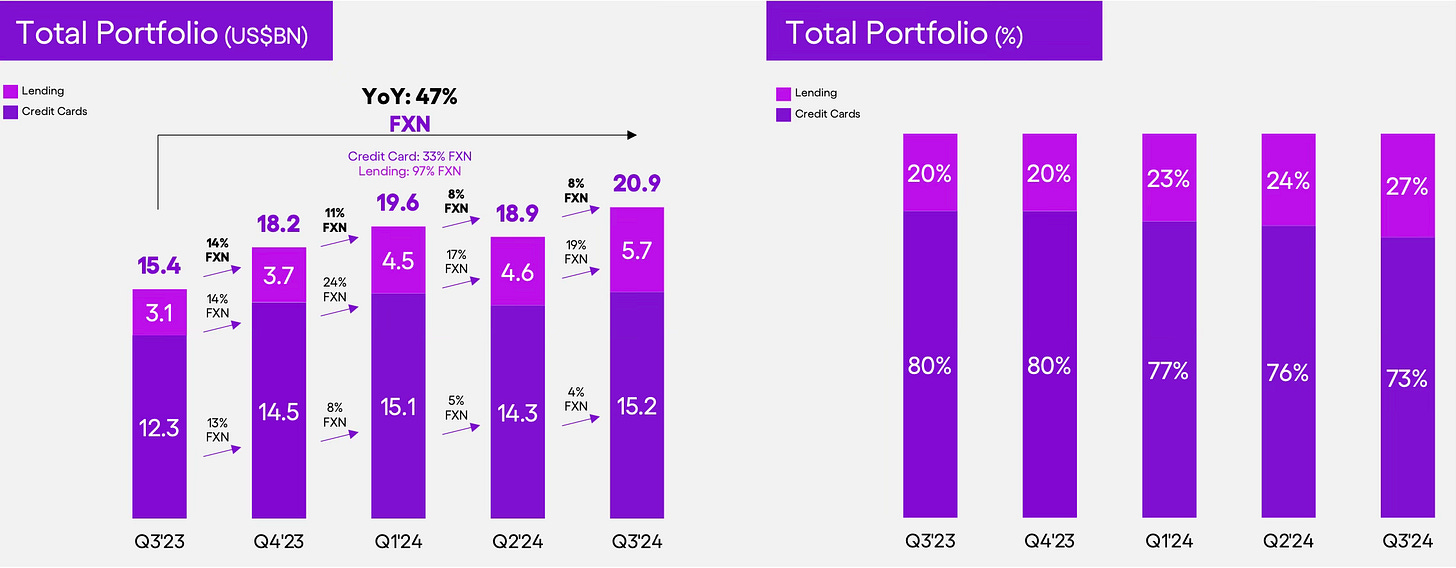

The consumer finance portfolio grew strongly, with a 47% YoY increase, reaching $20.9 billion. The credit card portfolio grew by 33% YoY, driven by increased wallet share, while the lending portfolio surged by 97% YoY to $5.7 billion. Lending growth was driven by public payroll loans and new collateral agreements, which expanded the addressable market.

Revenue reached a new quarterly record of $2.94 billion, reflecting a 38% YoY increase and 56% growth on an FX-neutral basis. This growth was driven by a combination of increased active customers, cross-selling, up-selling, and new product launches, which boosted the ARPAC. Although ARPAC slightly decreased from the previous quarter, it showed a 25% YoY increase on an FX-neutral basis. The decrease was attributed to Nu's accelerated growth in Mexico and Colombia, where new customers initially engage with lower-revenue products.

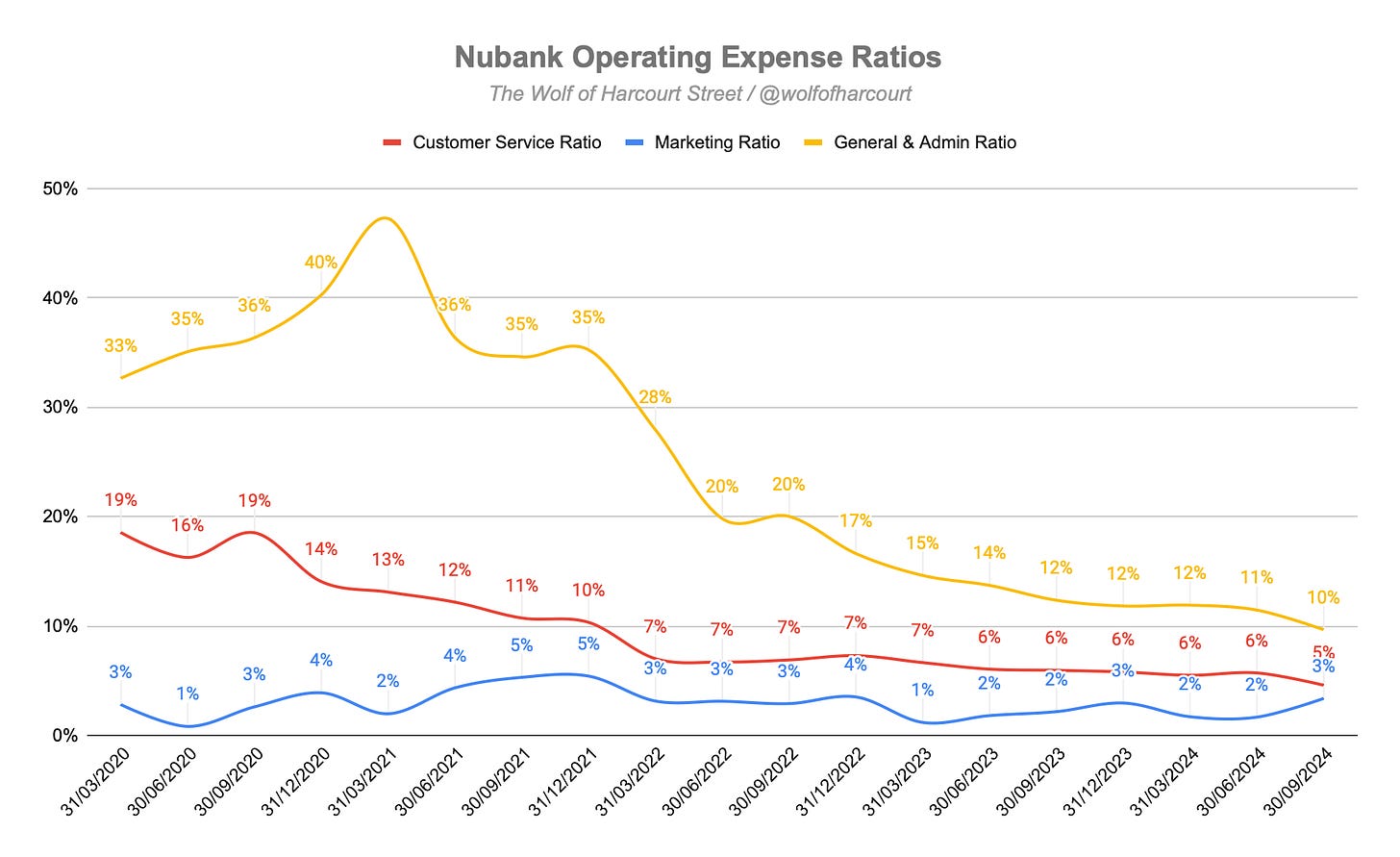

Operating profit increased by 76% to $724 million, with the operating margin expanding from 19% to 25% YoY. This growth reflects the company’s strong operational leverage, even amid ongoing investments in Mexico and Colombia. Key to this success is Nu's ability to grow revenue while keeping operating expenses in check. Nu maintained efficient cost management, with the average cost-to-serve per customer remaining well under $1, increasing only slightly by 2% YoY, even after accounting for one-off items such as FX impacts.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $2.94 billion +38% year-over-year (YoY)

Interest Income: $2.47 billion +43% YoY

Fees: $469 million +16% YoY

Operating Profit: $724 million +76% YoY

Net Profit: $553 million +83% YoY

2. Wall Street Expectations

Revenue: $2.95 billion (in line)

Earnings per Share: 0.10 (beat by 10%)

3. Business Activity

Customers

Nu’s rapid customer growth continues, adding 5.2 million new customers in the quarter and 20.7 million YoY, reaching a total of 109.7 million customers. Net customer additions have even exceeded management’s expectations, growing 56% from 70 million just two years ago. This cements Nu’s position as one of the largest and fastest-growing digital financial services platforms globally and one of the largest financial institutions in Latin America by customer count. The customer activity rate hit a record 84%, marking the 12th consecutive quarterly increase, underscoring Nu’s ability to consistently deliver a compelling value proposition.

Brazil: The customer base grew 18% YoY to 98.9 million, reaching 56% of the adult population. Despite high penetration, an average of 1.1 million new customers continue to join each month, with total customers surpassing 100 million earlier this week. Nu has already become the institution with the largest number of active customers in credit operations.

Mexico: With 107% growth, the rate has remained above 100% for a third consecutive quarter. The quarter added 1.2 million new customers, bringing the total to 8.9 million. Growth continues to be driven by higher deposit yields.

Colombia: Growth accelerated to 150%, up from 86% in Q2 2024, as the customer base reached 2 million. The positive momentum follows the successful launch of the Nu Cuenta product.

Deposits

Deposits increased by 60% YoY to $28.3 billion, reflecting strong growth across all three markets. Mexico reached $3.9 billion in deposits, nearly quadrupling in the past three quarters. In Colombia, consumer deposits reached $900 million just one quarter after the launch of NuColombia’s checking account product.

The cost of deposits was 89% of the blended interbank rates across Nu’s markets, up from 87% in Q1 2024. This demonstrates Nu’s effective management of deposit costs while expanding its operations, with sustained low-cost deposits being a key element of its growth strategy.

The loan-to-deposit ratio increased slightly to 40%, up from 39% last quarter, indicating that loan growth outpaced deposit growth.

Purchase Volume

Purchase volume grew 7% YoY to $30.9 billion, a deceleration from 19% in Q2 2024. On a foreign exchange-neutral (FXN) basis, growth was 21% YoY, compared to 29% in Q2 2024.

Monthly Average Revenue Per Active Customer (Monthly ARPAC)

Monthly ARPAC decreased slightly to $11.0 from $11.2 last quarter. However, on an FXN basis, ARPAC increased 25% YoY from $10.0. Management noted that ARPAC is affected by Nu’s accelerated customer growth in Mexico and Colombia. In these new markets, the deposits strategy attracts customers who initially engage with the low-revenue Cuenta product. However, Nu remains confident in the long-term value of this growth strategy, as evidenced by similar outcomes in Brazil over the past decade.

Primary Bank Account Usage: 60% of active customers use Nu as their primary bank, highlighting its ability to capture a larger share of customer wallet.

Products per Customer: The average number of products per active customer stands at 4, underscoring the success of Nu’s cross-selling efforts even as new customer acquisition accelerates.

ARPAC by Cohort: Nu’s mature customer cohorts generate a significantly higher ARPAC of $25 per month, reinforcing a clear path for ARPAC growth as the business matures.

Customer Finance Portfolio

Nu’s consumer finance portfolio, which includes credit cards and lending, grew robustly, up 47% FXN YoY and 8% FXN QoQ, totaling $20.9 billion.

Credit Card Portfolio: Grew 33% YoY and 4% QoQ to reach $15.2 billion, driven by increased wallet share across customer segments. Interest-earning installments remain steady at 28% of the portfolio, in line with last quarter’s expectations.

Lending Portfolio: Displayed impressive growth, up 97% YoY and 19% QoQ, reaching $5.7 billion, now 27% of the overall portfolio. Secured lending, accounting for 16% of originations, was bolstered by public payroll loans offering features like portability, top-ups, and refinancing. Nine new collateral agreements expand eligibility, covering over 70% of the total addressable market for public payroll loans in Brazil.

Delinquency

Nu’s non-performing loan (NPL) metrics show mixed trends:

15-90 Day NPL: This early-stage delinquency indicator declined by 10 basis points to 4.4%.

90+ Day NPL: The 90+ NPL ratio, which measures loans delinquent for over 90 days, rose by 20 basis points to 7.2%, as anticipated by management. The 90+ NPL ratio functions as a “stock” measure, reflecting accumulated delinquencies rather than new ones. This quarter’s 90+ NPL includes loans that entered the 15-90 day delinquency range one to three quarters ago.

To better interpret changes in the 90+ NPL ratio, examining 15-90 day NPL trends over the past four quarters is essential, as these trends indicate how early delinquencies develop and influence long-term delinquency dynamics.

4. Financial Analysis

Revenue

Nu achieved a new quarterly record with revenue of $2.94 billion, a 38% YoY increase and 56% on an FXN basis. While growth appears slower on a reported basis, the FXN growth rate aligns more closely with the 65% FXN growth seen in Q2 2024. This momentum was driven by a combination of increased active customers, cross-selling and up-selling efforts, and the launch of new products that boosted ARPAC.

Interest income, representing 84% of total revenue, grew by 62% YoY on an FXN basis, reaching $2.47 billion. This increase was primarily fueled by:

Strong performance from the consumer finance portfolio, supported by expansion in loans and credit card offerings.

A favorable credit mix, with a notable rise in installment-based credit card transactions.

Fees, which make up 16% of total revenue, rose by 32% YoY on an FXN basis, totaling $469 million. This growth was driven by higher interchange fees from increased credit and prepaid card purchase volumes, reflecting ongoing customer base and activity growth, as well as late fees tied to Nu’s expanding credit portfolio. This is the first time Nu has highlighted late fees as a revenue driver, an area worth monitoring.

Gross Margin

Nu achieved a gross profit of $1.35 billion, representing FXN growth of 67% YoY, with the gross profit margin improving to 45.8% from 42.8% in Q3 2023.

The interest income gross margin rose to 38%, up from 33% in Q3 2023, while the fees gross margin held steady at 87%, up slightly from 86% in Q3 2023. Despite higher costs in newer markets, gross margins improved, thanks to positive performance trends in Brazil, which helped offset investment expenses in Mexico and Colombia.

Operating Margin

Nu's operating profit surged by 76% to $724 million, with the operating margin expanding to 25%, up from 19% YoY. This operational leverage—a key feature of Nu's business model—continues to strengthen, even amid significant investments in Mexico and Colombia.

As revenue grows, operating expenses rise at a slower pace. This is evidenced by the decline in customer service, marketing, and general & administrative expenses as a percentage of revenue, which dropped from 24% in Q3 2023 to 21% in Q3 2024.

While Customer Service and General & Administrative expenses increased modestly by 6% and 8% YoY, respectively, Marketing expenses surged by 115%, reaching the highest level as a percentage of revenue since Q4 2022. Management explained that this rise reflects Nu's investments in building brand trust, though it could also signal an intensifying competitive environment. In September 2024, an additional $40 million was allocated to marketing to reposition Nucoins within a new loyalty program for Nubank customers.

Nu’s efficient cost management led to an average monthly cost-to-serve per active customer of $0.7, or $0.8 after accounting for one-off items. This remains under $1, with only a 2% YoY increase when adjusted for one-offs, mainly due to FX impacts. Notably, data and cloud costs, previously classified under customer services, have been reclassified under General and Admin expenses to better align with FX impacts.

Risk-Adjusted Net Interest Margin

Risk-Adjusted Net Interest Margin (NIM) reached 10.1%, down 90 basis points (bp), driven by a 140 bp decline in NIM, partially offset by a 50 bp improvement in the cost of risk. Three key factors influenced the NIM:

Credit Card Yields: Credit card yields decreased due to product enhancements and an improved customer risk profile.

Lending Yields: Lending yields declined as the loan mix shifted toward secured lending, which generally offers lower yields.

Funding Costs: Funding costs increased due to deposit growth in Mexico and Colombia, reflecting deposit rate strategies for new markets.

YoY, Risk-Adjusted NIM improved by 110 bp, underscoring Nu's efforts to optimize customer lifetime value.

Credit loss expenses rose to $774.1 million, a 6% QoQ FXN increase, aligning with the growth of Nu's credit portfolio and early delinquency trends.

5. Conclusion

This was a very solid quarter for Nu, as the company continues to add new customers at an impressive rate, even in its highly penetrated market of Brazil. Customer growth in Mexico and Colombia is doubling YoY, and management views Mexico as a market with the potential to rival Brazil, albeit with its own unique challenges and opportunities.

Mexico has a higher per capita income and significantly lower bank and credit card penetration than Brazil, creating a promising opportunity to serve the unbanked population. With only 12% credit card penetration, the potential to provide credit to the unbanked could offer a significant competitive advantage, given that Brazil's market is more saturated. However, reaching Brazil's level of market share in Mexico may take longer due to the complexities of underwriting for the under-banked and unbanked populations.

Despite strong operational metrics, reported revenue growth slowed noticeably this quarter, largely due to a nearly 20% depreciation of the Brazilian real against the U.S. dollar in 2024. On an underlying basis, Nu's growth remains robust, but this currency risk has a tangible impact and was flagged as a potential risk in my original investment thesis earlier this year.

Nu recently launched its mobile phone service, NuCel, and CEO David Velez shared interesting insights on this venture during the conference call. He noted that in Latin America, both telecom and banking have historically been disliked by consumers. While banking has become more competitive and consumer-friendly, telecom still suffers from low NPS and complex service offerings, presenting an opportunity for disruption. One major issue is the complexity of telecom services, with numerous plans, bonuses, and terms that make it challenging for consumers to understand their options. Simplifying this could significantly improve customer satisfaction.

Nu’s entry into telecom as a Mobile Virtual Network Operator required a partner with aligned incentives, resulting in a revenue-sharing arrangement rather than a fixed fee. This approach offers mutual benefits: Claro gains additional revenue with lower service costs, while Nu leverages Claro’s infrastructure efficiently. With 56% of Brazilian adults as customers, Nu can enter telecom with minimal customer acquisition costs, benefiting from the synergies within its existing customer base.

Nu's business model is driven by three core factors: customer growth, increasing revenue per customer, and controlling operating costs. This strategy creates a reinforcing cycle that enhances customer engagement, leading to strong, sustained revenue growth across customer segments. As cohorts mature, they tend to adopt more products—particularly through primary banking relationships—which increases ARPAC. Impressively, all customer cohorts acquired since 2020 have exhibited triple-digit compound annual revenue growth, showcasing the success of Nu's cross-selling and up-selling strategies.

Lastly, it’s worth noting that, in the third quarter, Nu’s return on equity exceeded 30% for the first time. This milestone was achieved while maintaining a robust excess capital position of $2.4 billion at the holding level, even as operations in Mexico and Colombia have yet to reach profitability.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Seems like Nu's robust growth strategy, driven by high customer engagement, increasing ARPAC, and impressive cohort performance with triple-digit revenue growth, suggests strong scalability and profitability potential. However, careful monitoring of operating costs and market risks is essential.

Great quarter from Nu, special company. Very good work here Wolf nice easy & engaging read👍