Executive Summary

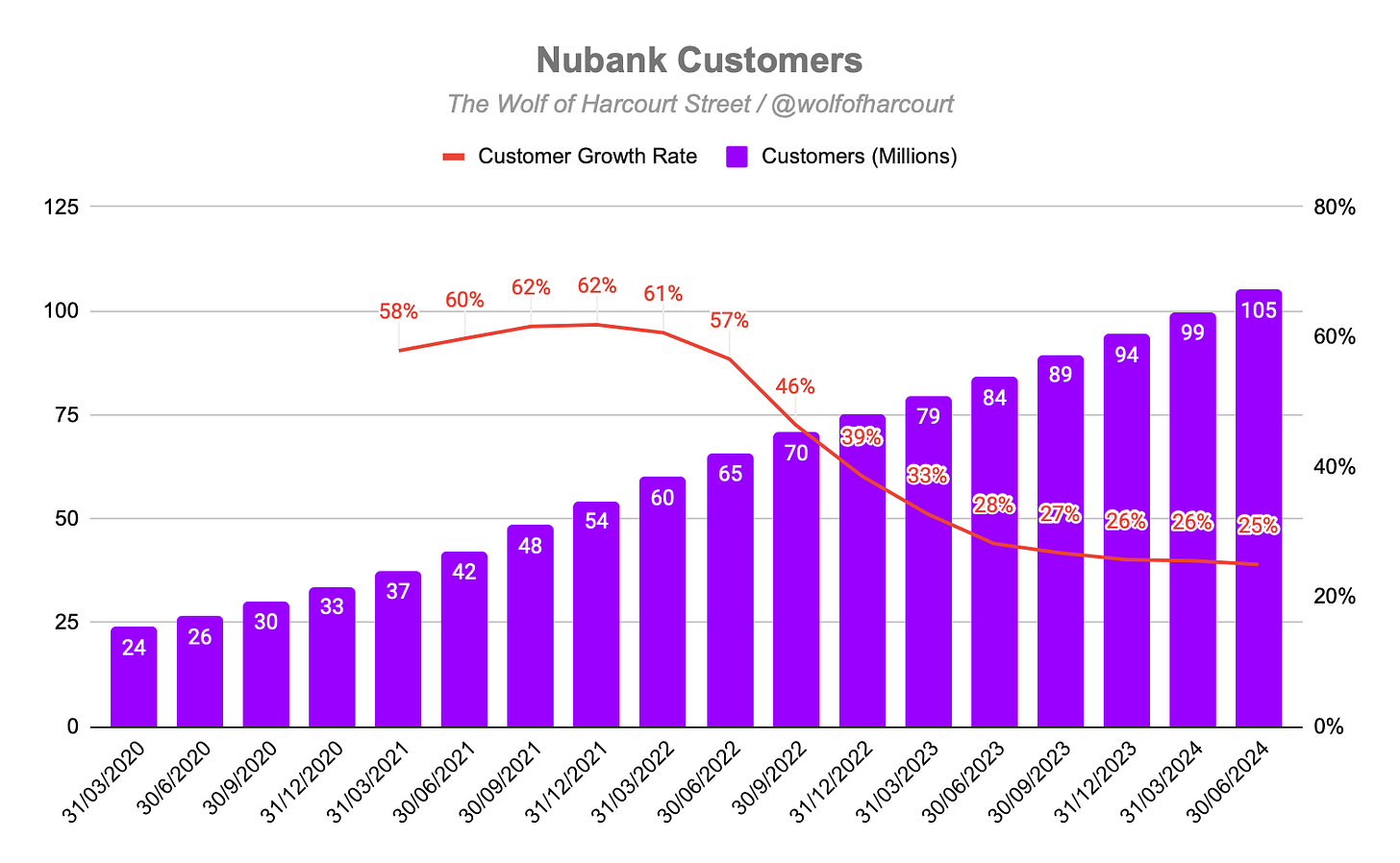

Nu added 5.2 million new customers in Q2, bringing the total to 104.5 million, a 20.8 million increase year-over-year. Currently, 56% of Brazil's adult population are Nu customers, with growth in Mexico and Colombia accelerating from Q1.

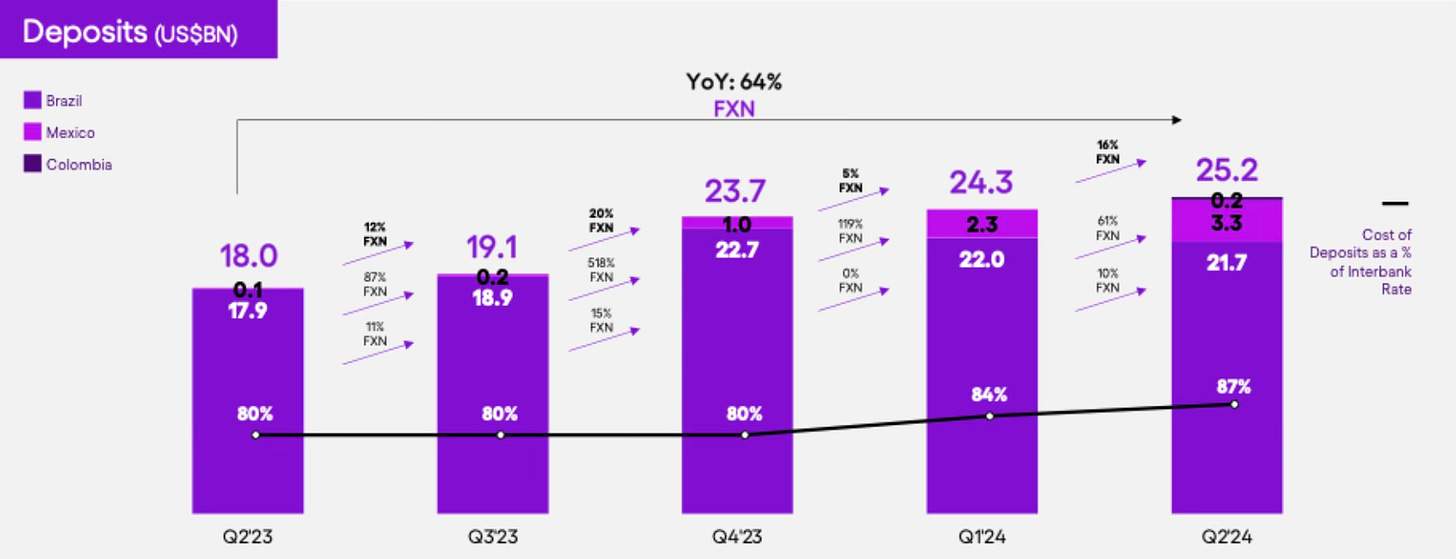

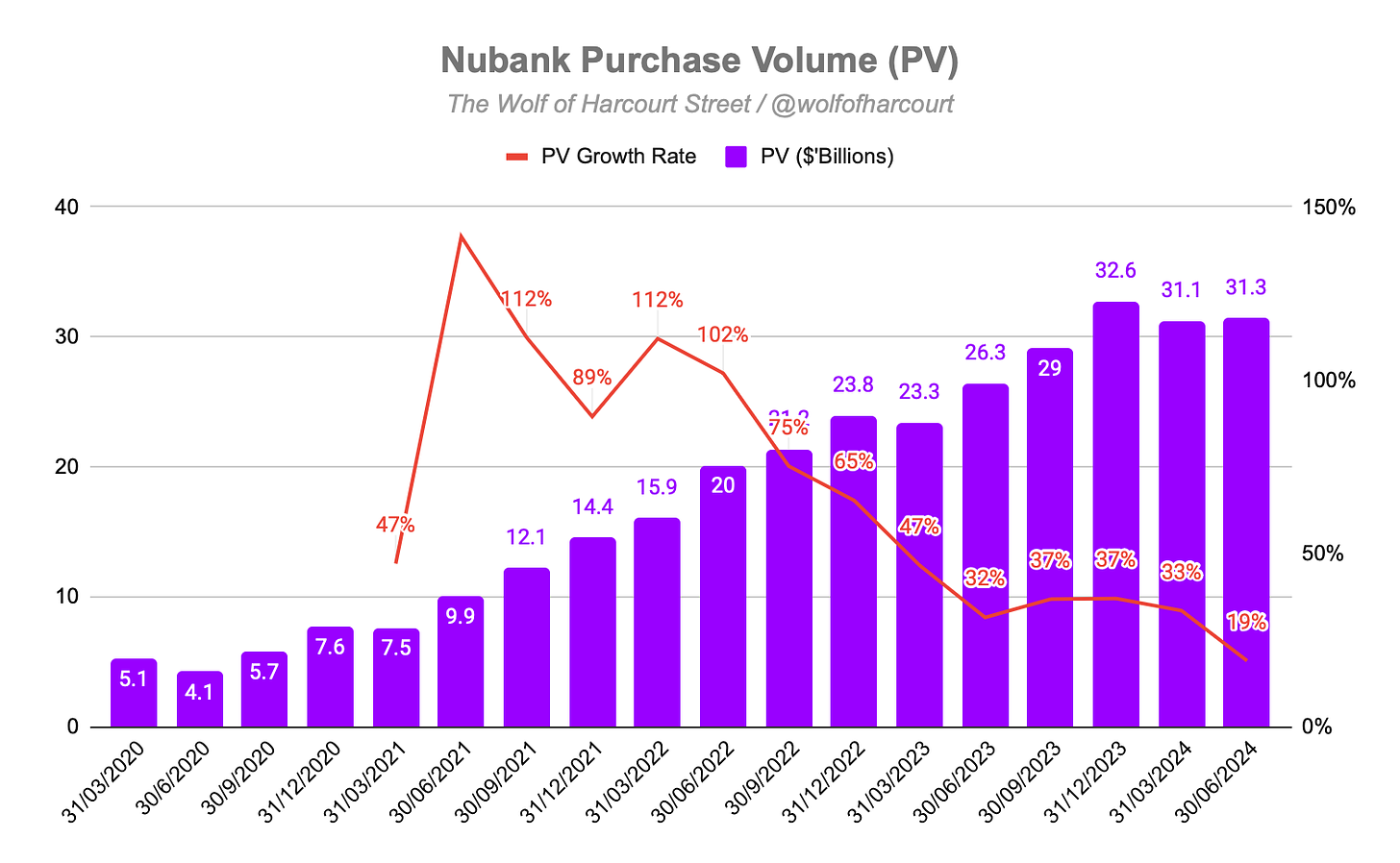

Deposits grew 64% year-over-year to $25.2 billion, with effective cost management keeping deposit costs at 87% of blended interbank rates. Purchase volume increased by 19% year-over-year to $31.3 billion, and 29% on a foreign exchange-neutral basis.

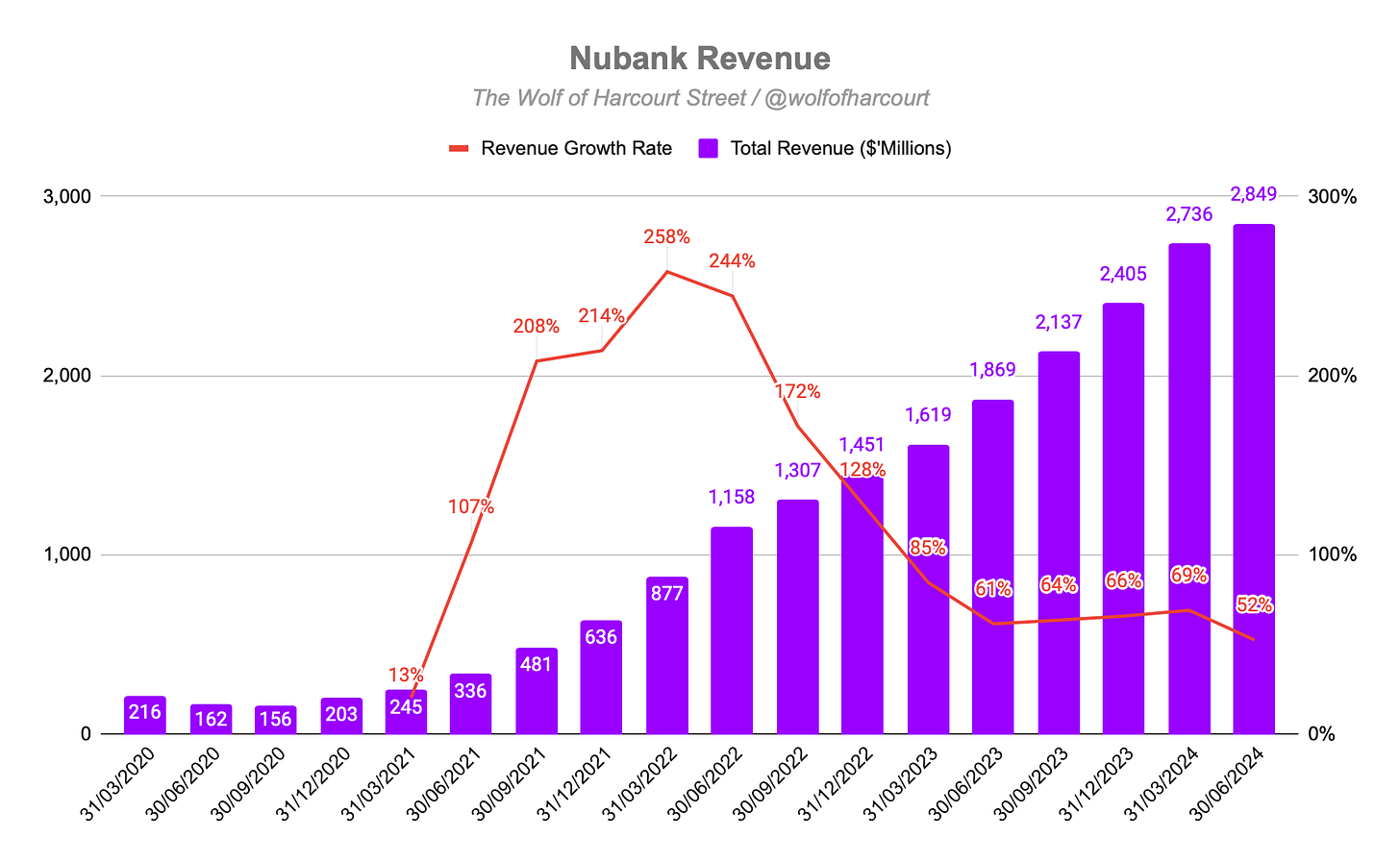

Nu achieved a record revenue of $2.85 billion, a 52% year-over-year increase, or 65% on a foreign exchange-neutral basis, driven by growth in active customers and higher average revenue per active customer. Gross profit reached a quarterly record of $1.36 billion, an 88% year-over-year increase on a foreign exchange-neutral basis, with the gross margin improving to 47.7%, up from 41.8% in Q2 2023.

Operating profit surged by 124% to $725 million, with the operating margin reaching a record 25%, up from 17% year-over-year. The monthly average cost to serve each active customer remains stable at $0.90, highlighting Nu's ability to scale profitably.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $2.85 billion +52% year-over-year (YoY)

Interest Income: $2.38 billion +59% YoY

Fees: $465 million +26% YoY

Gross Profit: $1.36 billion +74% YoY

Net Profit: $487 million +117% YoY

2. Wall Street Expectations

Revenue: $2.81 billion (beat by 1%)

Earnings per Share: 0.09 (beat by 11%)

3. Business Activity

Customers

Nu continues its rapid growth, adding 5.2 million new customers in the quarter and 20.8 million YoY, reaching a total of 104.5 million customers. This solidifies Nu's position as one of the largest and fastest-growing digital financial services platforms globally and the fourth-largest financial institution in Latin America by customer count. The customer activity rate hit a record 83.4%.

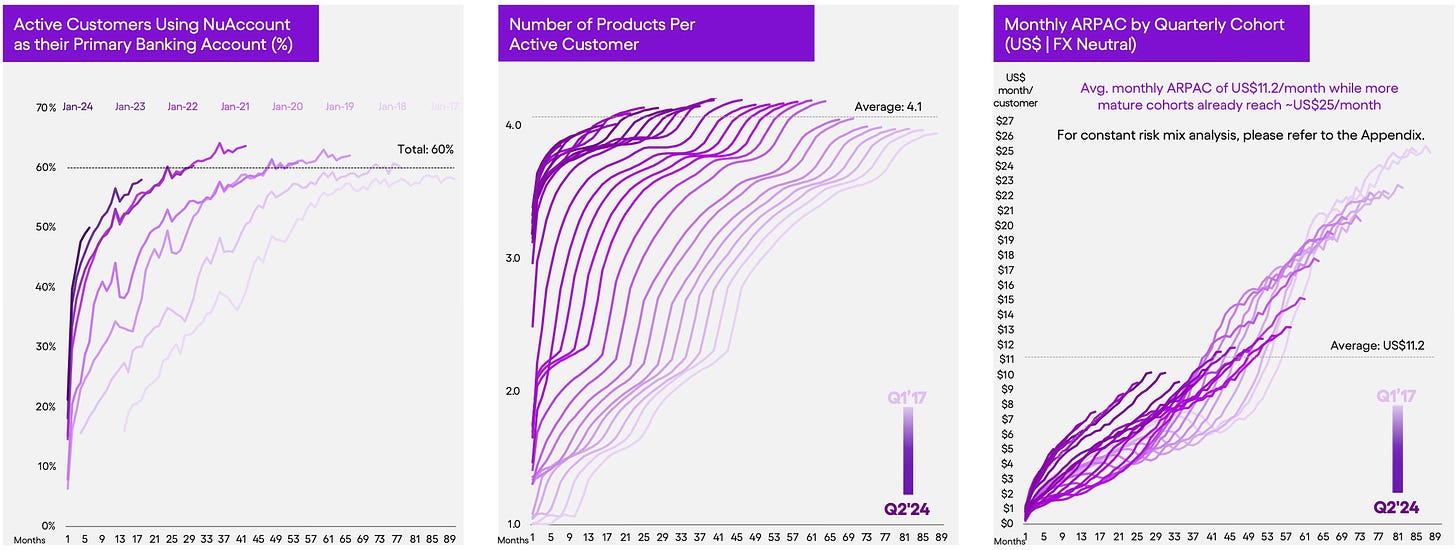

Brazil: The customer base grew by 20% YoY to 95.5 million, covering 56% of the adult population. Of these, 60% of active customers use Nu as their primary banking account.

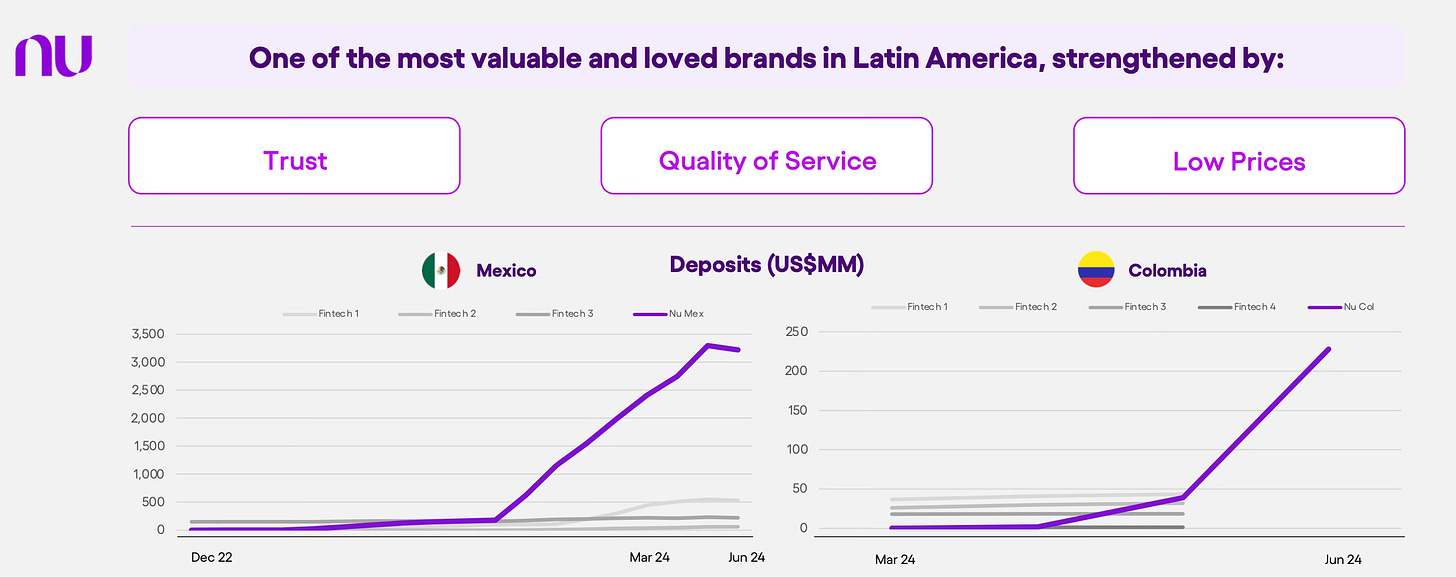

Mexico: Growth accelerated from 106% in Q1 2024 to 117% in Q2 2024, with 1.2 million new customers added in the quarter, reaching a total of 7.8 million. This growth was driven by increased deposit yields.

Colombia: Growth accelerated from 50% in Q1 2024 to 86% in Q2 2024, as the customer base surpassed 1 million, reaching nearly 1.3 million customers following the successful launch of the Cuenta product.

Deposits

Deposits increased by 64% YoY to $25.2 billion, highlighting strong growth in Nu's operations, particularly in Mexico. The cost of deposits reached 87% of the blended interbank rates in the countries where Nu operates. This indicates that Nu is effectively managing deposit costs while expanding its operations. The sustained low cost of deposits reflects Nu’s successful strategy in leveraging its liability franchise.

The loan-to-deposit ratio slightly decreased to 39% from 40% in the previous quarter, indicating that deposit growth outpaced loan growth. This points to Nu’s potential for further optimizing its balance sheet.

Purchase Volume

Purchase Volume grew 19% YoY to $31.3 billion. On a foreign exchange neutral (FXN) basis the growth was 29% YoY.

Over the past 12 to 24 months, Nu has made substantial gains in attracting high-income customers, with more than 60% of individuals earning over BRL 12,000 per month now being customers. On the conference call, management revealed that the premium-tier product, Ultravioleta, has seen over 70% growth in purchase volume over the past year, indicating strong traction in the high-income market. The focus will be on increasing the share of wallet and enhancing the primary banking relationship with high-income customers, as these have been steadily improving over recent quarters.

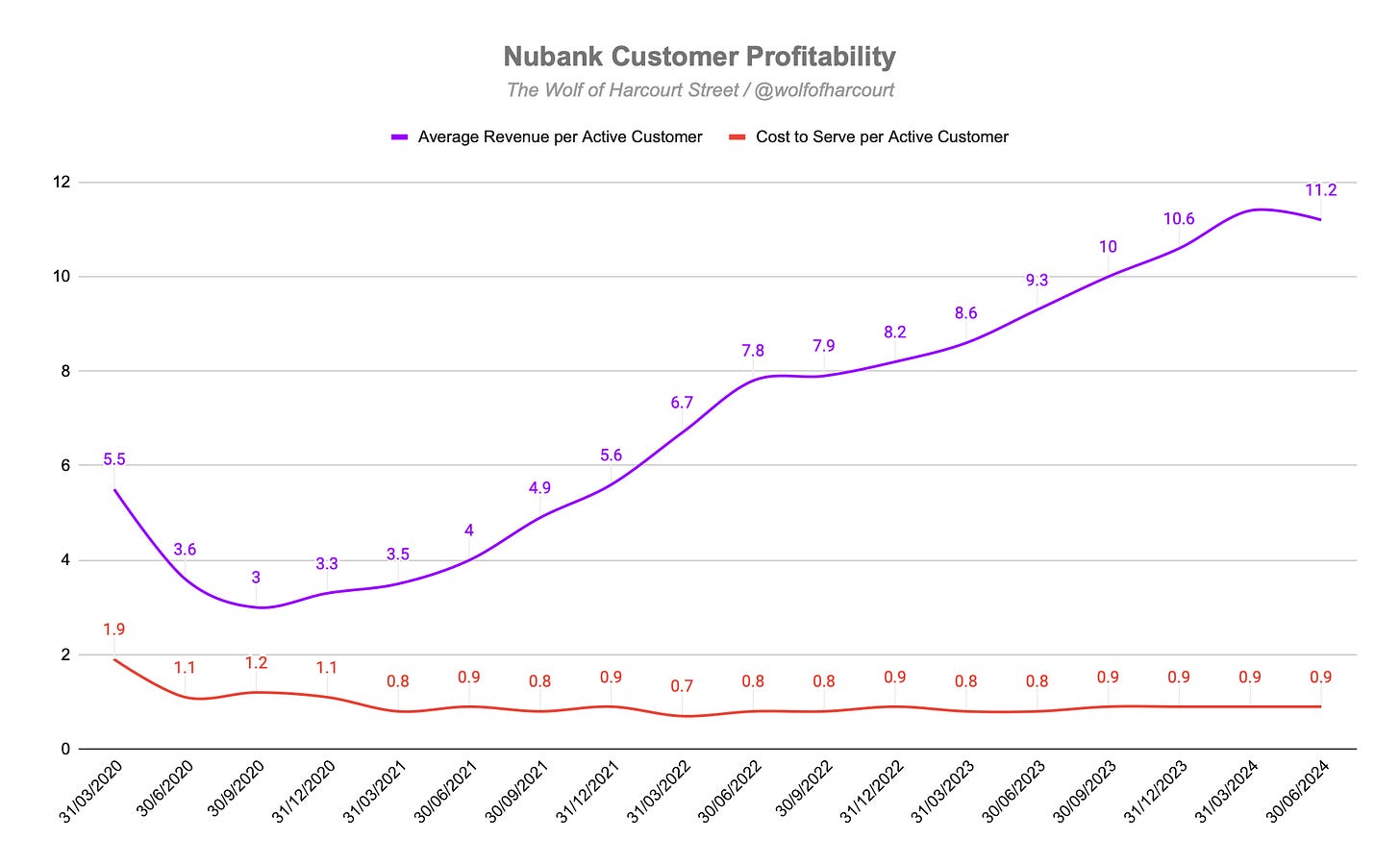

Monthly Average Revenue Per Active Customer (Monthly ARPAC)

Monthly ARPAC decreased slightly to $11.2 this quarter from $11.4 last quarter. However, on an FXN basis, ARPAC increased by 6% quarter-over-quarter (QoQ) and 30% YoY, rising from $9.30.

What is most interesting about the cohort analysis is that the more mature customer cohorts are generating a significantly higher ARPAC of $25 per month. This presents a clear roadmap for the monthly ARPAC to increase overtime as the business matures.

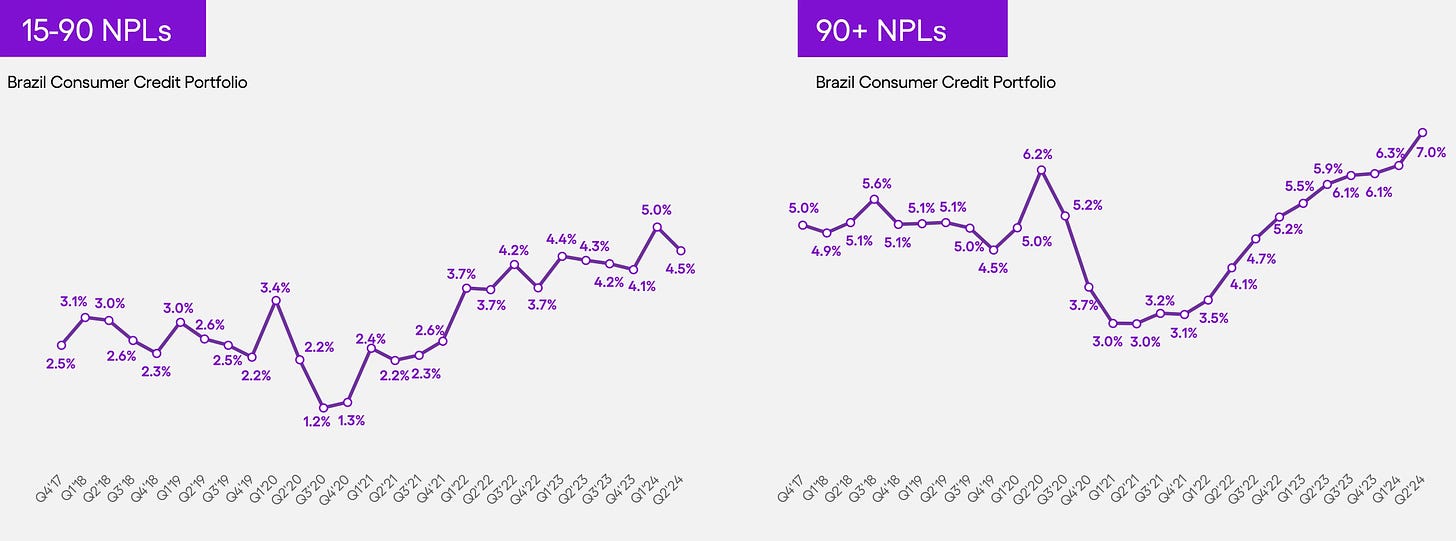

Delinquency

There was a typical seasonal rise in early-stage delinquencies (15 to 90 days past due) in the first quarter of 2024, but this has decreased to 4.5% in the current quarter. The 90-plus days NPL ratio increased to 7%, reflecting a previous quarter's seasonal increase in early-stage delinquencies.

Nu is intentionally expanding its lending book, targeting opportunities down the credit spectrum, which aligns with their long-term strategy. This approach focuses on optimizing long-term value rather than short-term delinquency metrics. This credit expansion strategy has led to increased revenue and greater resilience, which outweighs the higher delinquency rates associated with the expansion.

4. Financial Analysis

Revenue

Nu achieved a new record revenue of $2.85 billion, up 52% YoY, and 65% on a FXN basis. This growth was primarily driven by an increase in active customers and higher ARPAC.

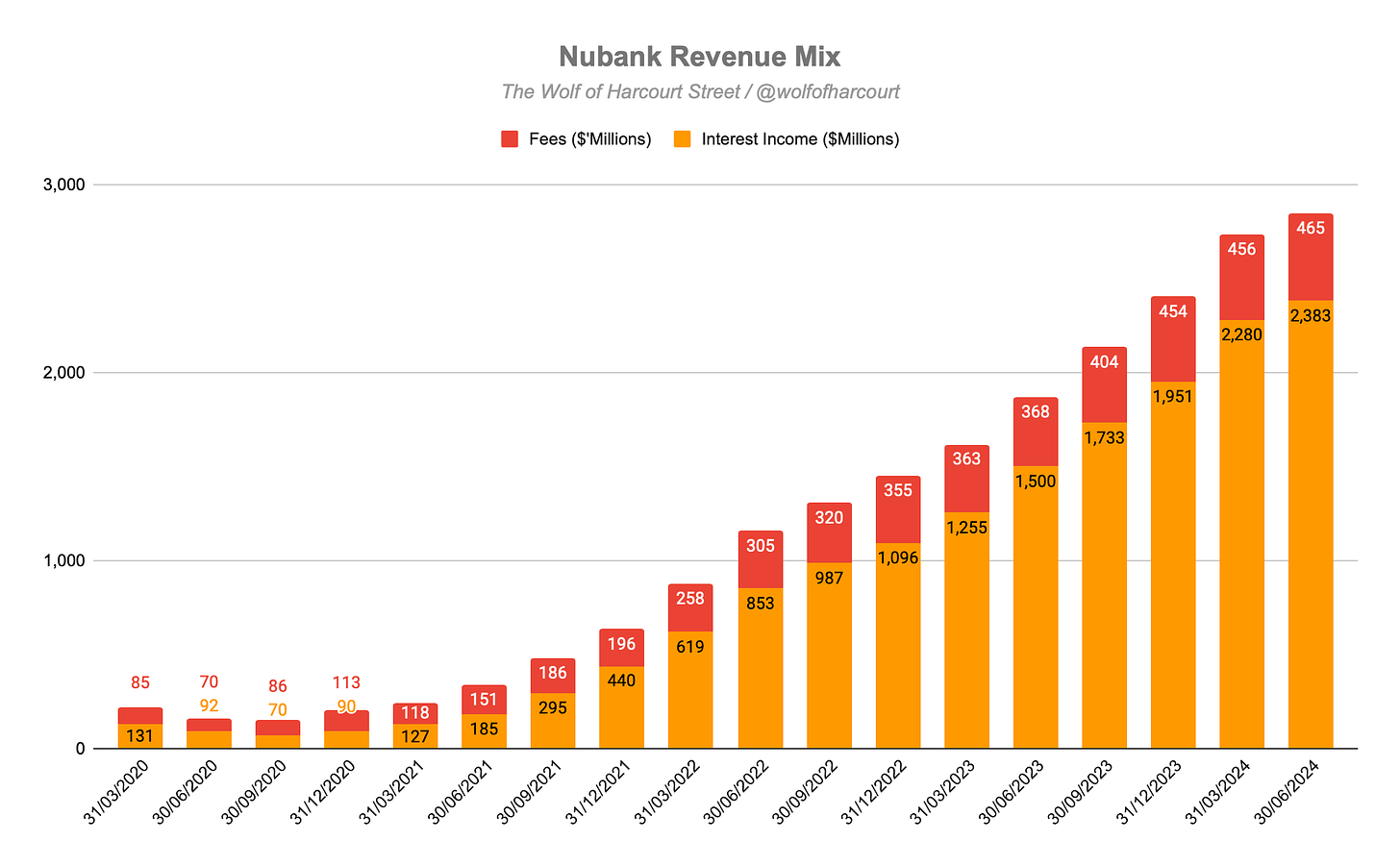

Interest income, which makes up 84% of total revenue, grew by 72% YoY on an FXN basis, reaching $2.38 billion. This increase was driven by:

Strong performance from the consumer finance portfolio, particularly due to the expansion of loans and credit card offerings. Total credit card and lending gross receivables grew by 49% YoY on an FXN basis, reaching $18.9 billion. The Interest-Earning Portfolio increased by 81% YoY on an FXN basis, to $9.8 billion.

A favorable credit mix, with a significant rise in instalments with interest within the credit card portfolio.

Fees, accounting for 16% of total revenue, grew by 37% YoY on an FXN basis, reaching $465 million. This growth was primarily driven by higher interchange fees, resulting from increased credit and prepaid card purchase volumes, reflecting continued growth in the customer base and activity rates.

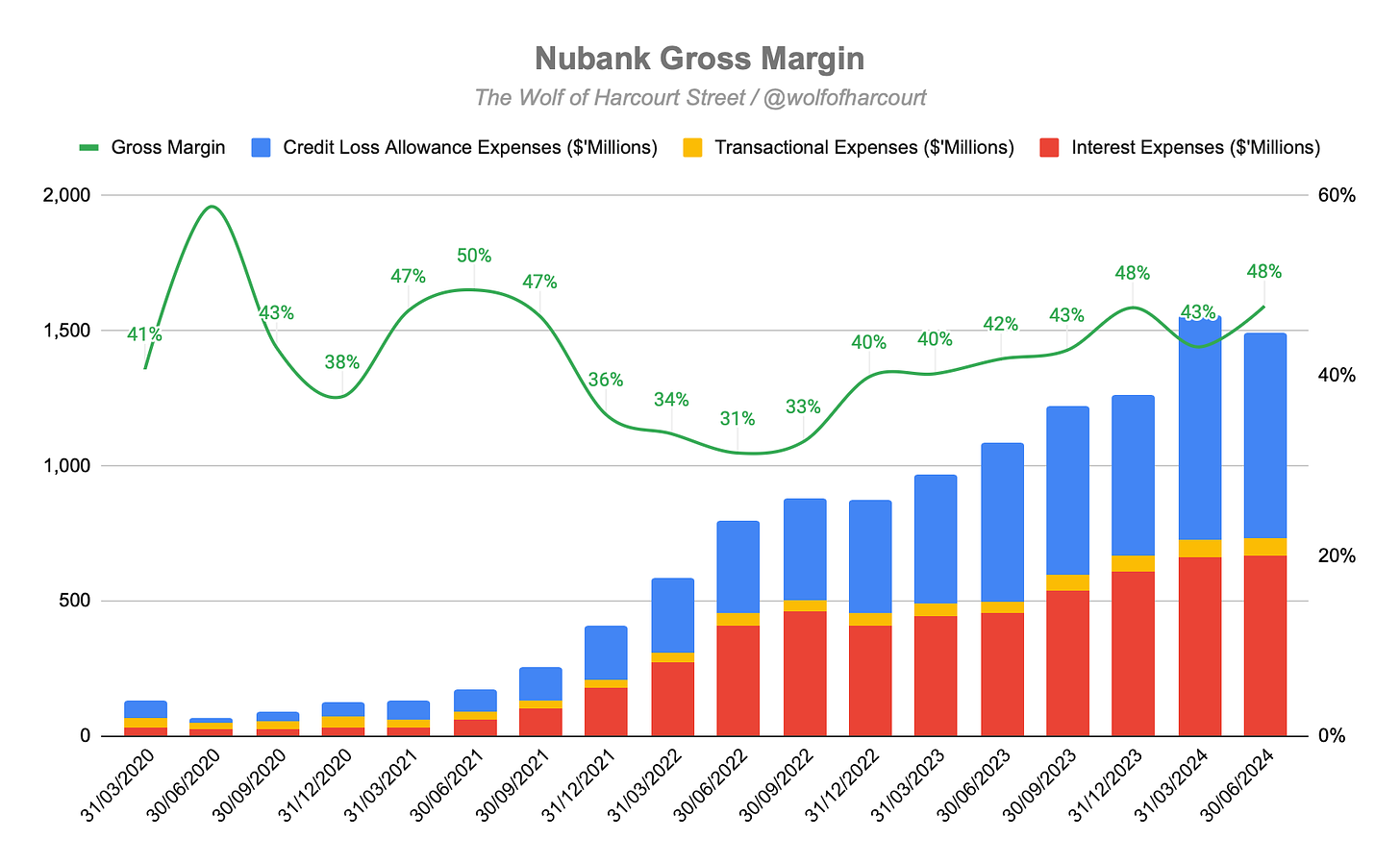

Gross Margin

Nu achieved a quarterly record high gross profit of $1.36 billion, representing an 88% YoY FXN increase. The gross profit margin rose to 47.7% from 41.8% in Q2 2023, marking a significant improvement.

Despite higher costs in new geographies, the annualized gross margin has rebounded to 2023 levels, thanks to positive trends in Brazil offsetting investments in Mexico and Colombia.

The interest income gross margin increased to 40% for the first time, up from 30% in Q2 2023 and 35% in Q1 2024 while the fees gross margin remained constant at 86% from Q1 2024 but dipped from 88% in Q2 2023.

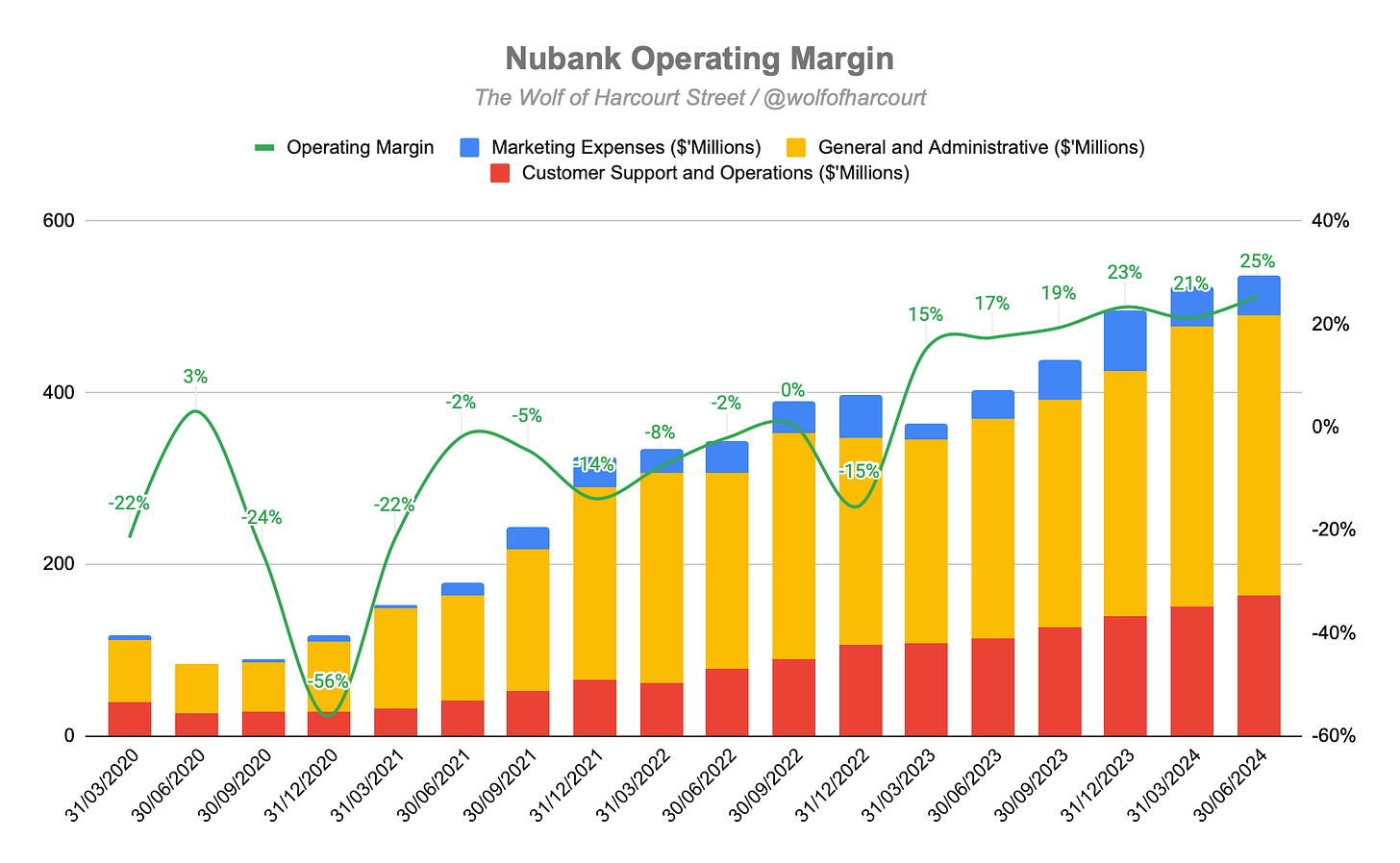

Operating Margin

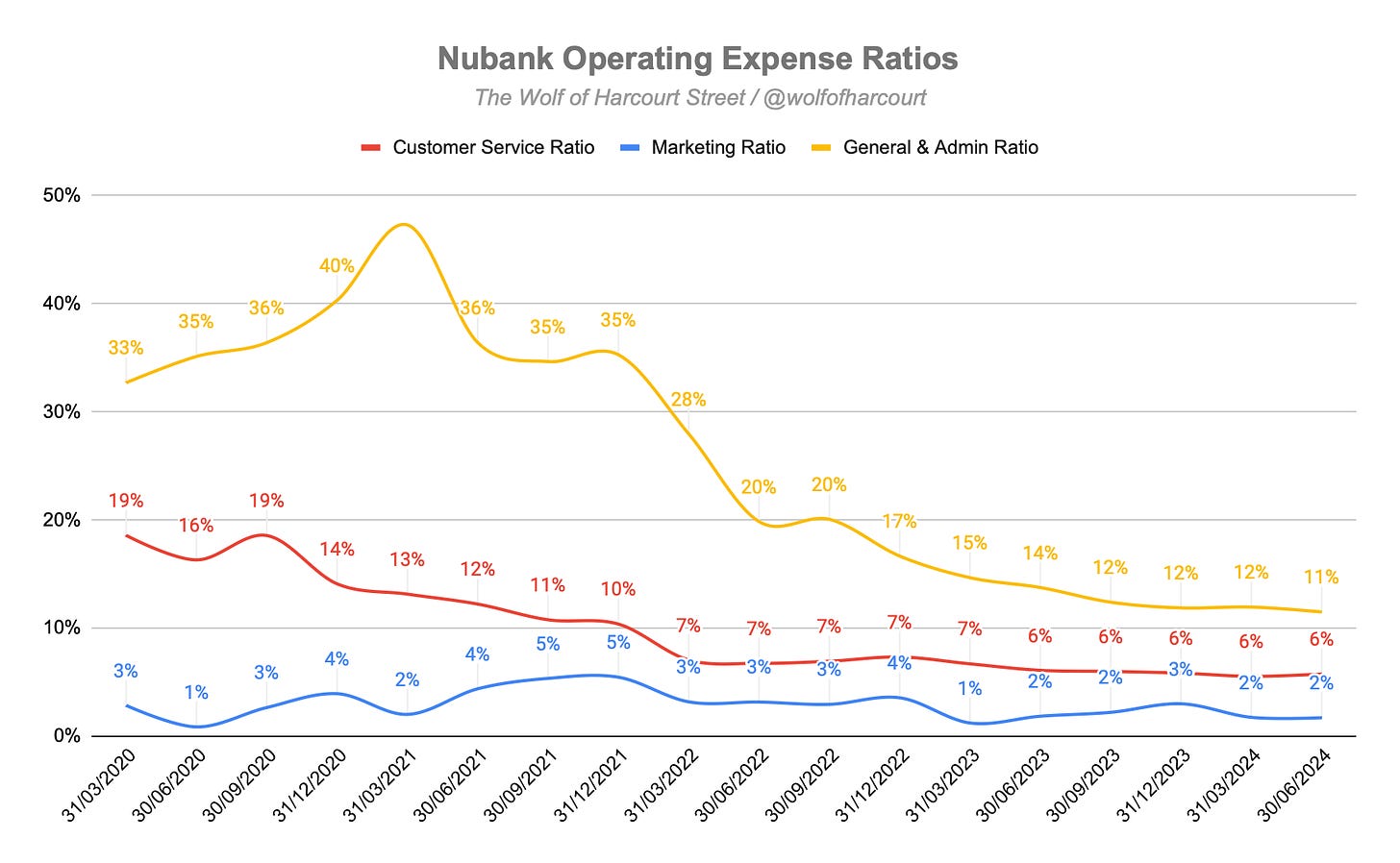

Nu's operating profit surged by 124% to $725 million, with the operating margin reaching a record 25%, up from 17% YoY. This demonstrates the strong operating leverage of Nu's business model, which is built on three core principles: customer expansion, increasing revenue per customer, and maintaining efficient operating costs.

As revenue grows, operating expenses rise at a slower pace, shown by the decreasing percentage of customer service, marketing, and general & administrative expenses relative to revenue.

This highlights Nu's ability to efficiently accelerate earnings power, as the monthly average cost to serve per active customer remains stable at $0.9, while ARPAC continues to grow.

As a result, Nu’s bottom line net income more than doubled to $487 million, up from $225 million in Q2 2023.

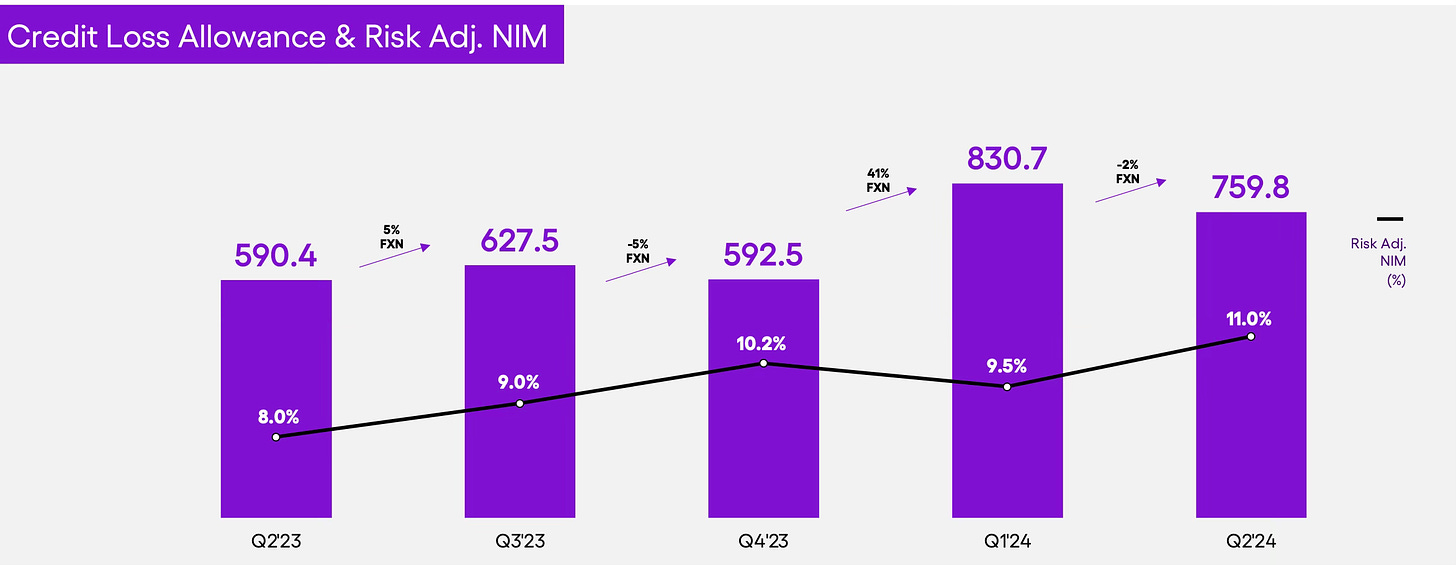

Risk-Adjusted Net Interest Margin

The Risk-Adjusted Net Interest Margin reached a record high of 11.0% this quarter, marking a 300 basis point increase from a year ago and a 150 basis point increase compared to the last quarter.

The credit loss allowance expense declined to $760 million this quarter, remaining mostly stable on an FX-neutral basis. This is likely due to:

A slightly slower pace of loan growth QoQ, as most credit loss allowances are linked to portfolio growth.

Better-than-expected early delinquency rates, outperforming historical seasonality, which positively impacted the credit loss allowance constitution under the expected credit loss methodology.

5. Conclusion

Nu delivered another record quarter, doubling its profits while growing its top line by 52%. Over half the adult population in Brazil now has a Nu account, yet customer growth continues at 20%. Expansion into Mexico and Colombia is ahead of schedule, with account growth accelerating since Q1 in both geographies.

Let's give credit where it's due—not just to CEO David Vélez and his leadership team, but to what’s truly driving Nu’s growth and profitability: its credit business, which accounts for 86% of total revenue.

By "giving credit where it's due" and serving populations often ignored by traditional banks, Nu has expanded financial inclusion and built a scalable business model focused on underserved customers. This is evident not only in new customer growth but also in the rapid expansion of its credit card and lending portfolios.

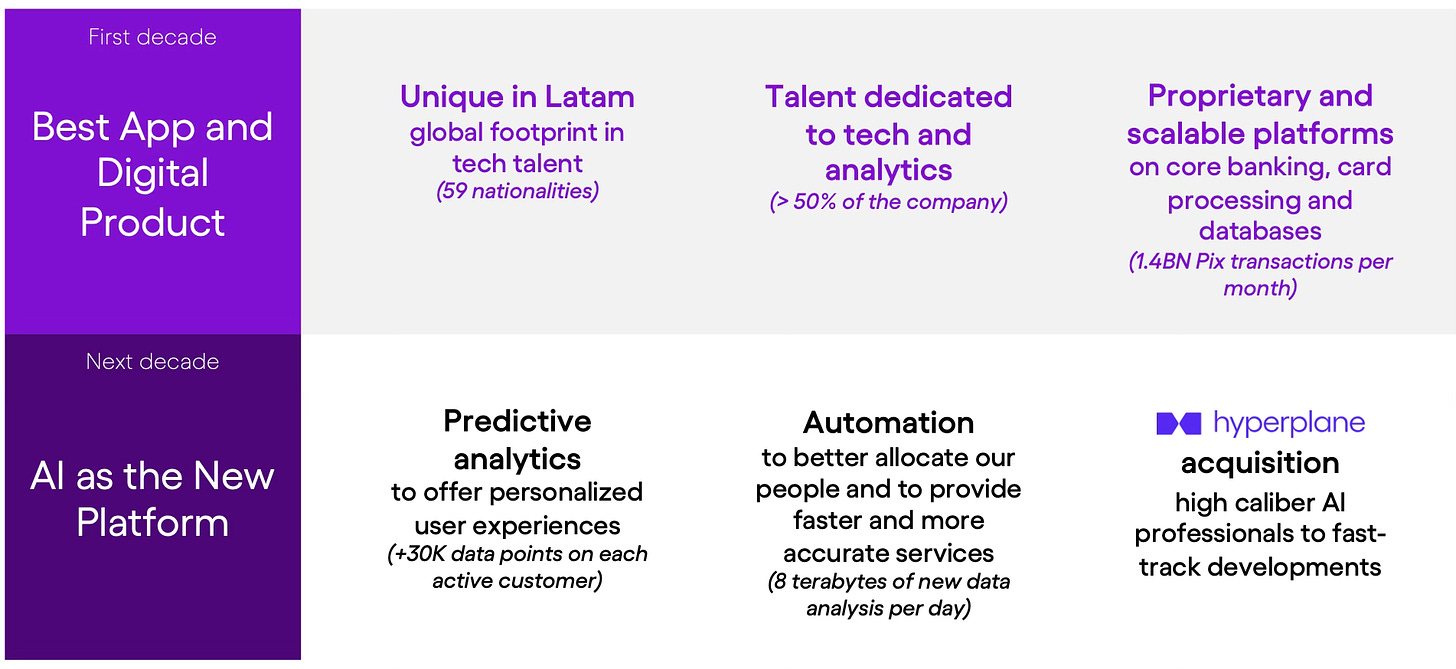

Nu has established itself as a leading consumer technology platform in Latin America, not just a financial institution, through a combination of unique strengths:

Brand: Nu has created a beloved and trusted brand in Brazil, with growing recognition in Mexico and Colombia, by simplifying complex processes and empowering customers.

Scale: Nu's significant presence in Brazil, covering 56% of the adult population, allows the company to offer superior products at lower prices, creating a powerful growth cycle.

Data: Nu leverages vast amounts of data, including over 30,000 data points on each active customer, along with advanced infrastructure for superior customer segmentation and credit underwriting.

Talent: Nu has one of the top technology and product teams globally, with over 50% of its workforce focused on technology and analytics.

Culture: Nu's values, centered on customer-centricity and operational excellence, drive long-term sustainable growth.

This is the first earnings update since I shared the comprehensive Nu investment thesis in June. For those who missed it, the thesis is linked below.

Rating: 4 out of 5 exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Nice write-up, thanks!

How do you conclude that: This credit expansion strategy has led to increased revenue and greater resilience, which outweighs the higher delinquency rates associated with the expansion?