Executive Summary

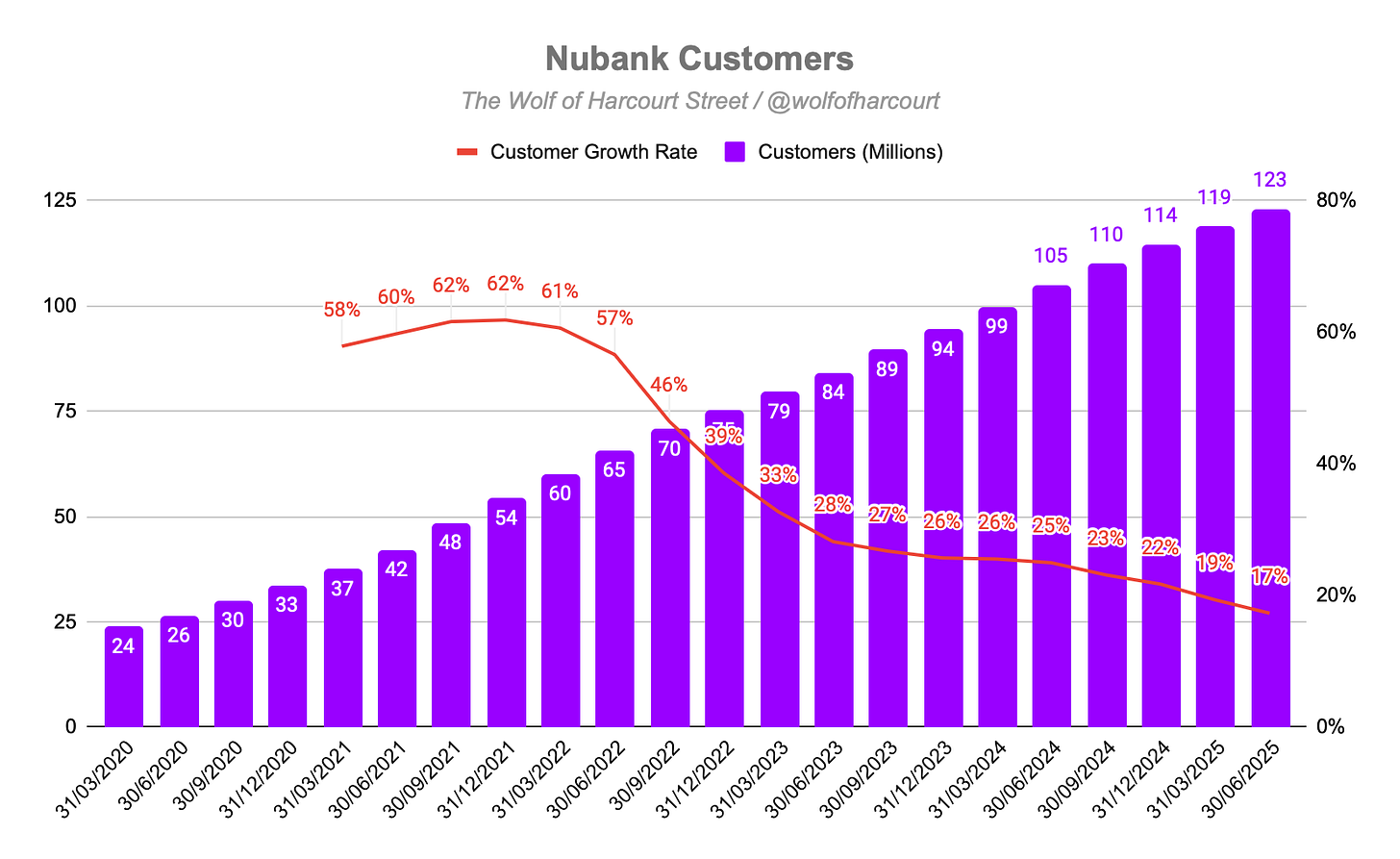

Nu added 4.2 million new customers in the quarter, bringing the total to 122.7 million, up 17% YoY. The activity rate held steady at 83%, pushing active customers above 100 million for the first time. In Brazil, the customer base grew 12% to 107 million, representing 60% of the adult population. Mexico added 1 million new customers, reaching 12 million (13% of the adult population) as Nu continues building a full-scale retail banking platform. Colombia remains the smallest but fastest-growing market, with customer numbers nearly tripling over the past year to 3.4 million, now approaching 10% market penetration and a key inflection point.

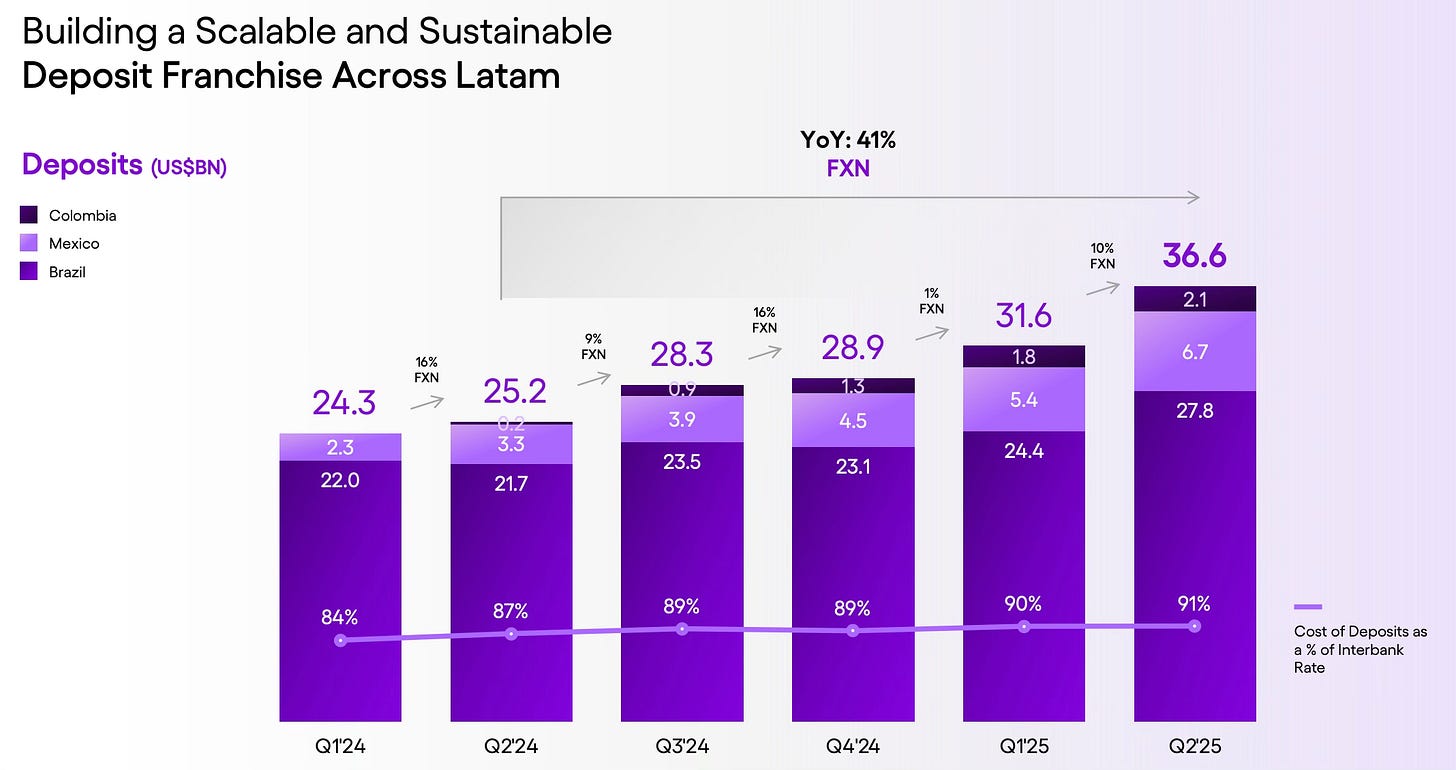

Total deposits rose 41% YoY (FXN) to $36.6 billion. Brazil remains the largest market at $27.8 billion, up 28% YoY and 14% QoQ. Mexico’s deposits doubled YoY to $6.7 billion, while Colombia’s deposits surged nearly tenfold to $1.3 billion within a year of launching checking accounts. The blended cost of funding rose to 91% of interbank rates from 87% last year, reflecting higher costs in Mexico and Colombia versus Brazil.

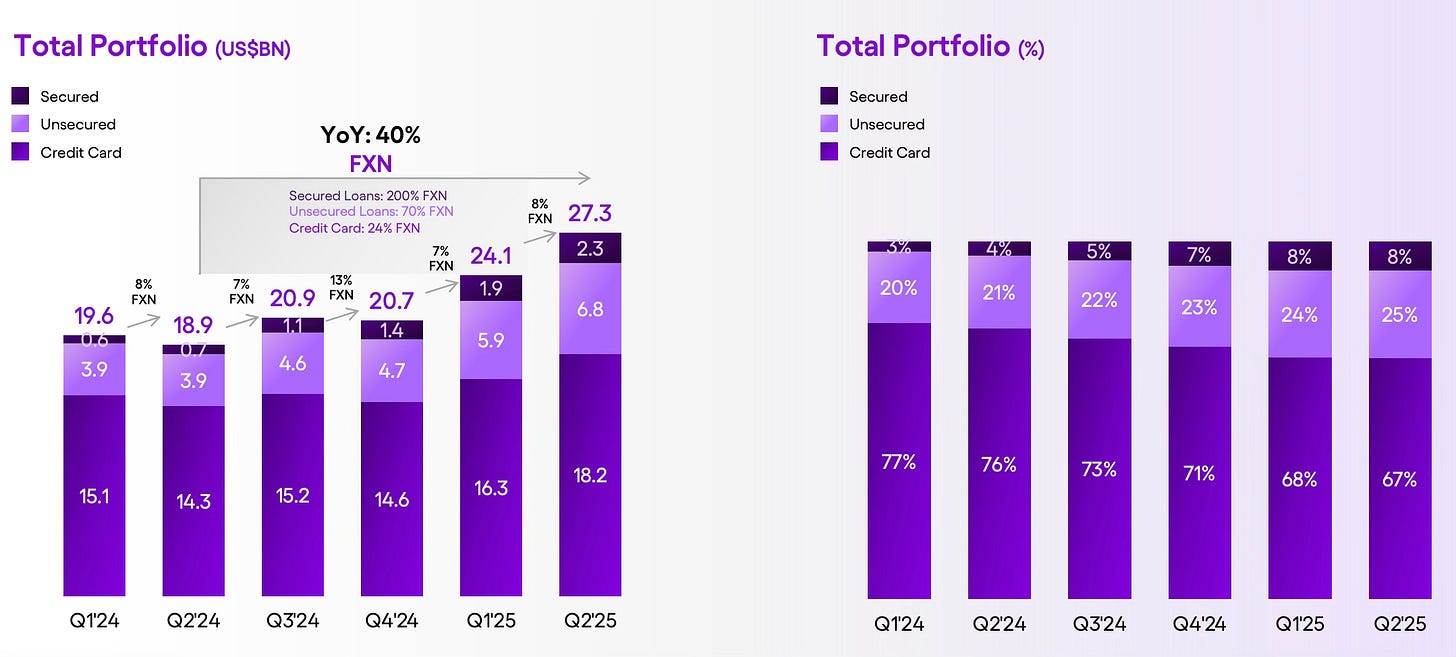

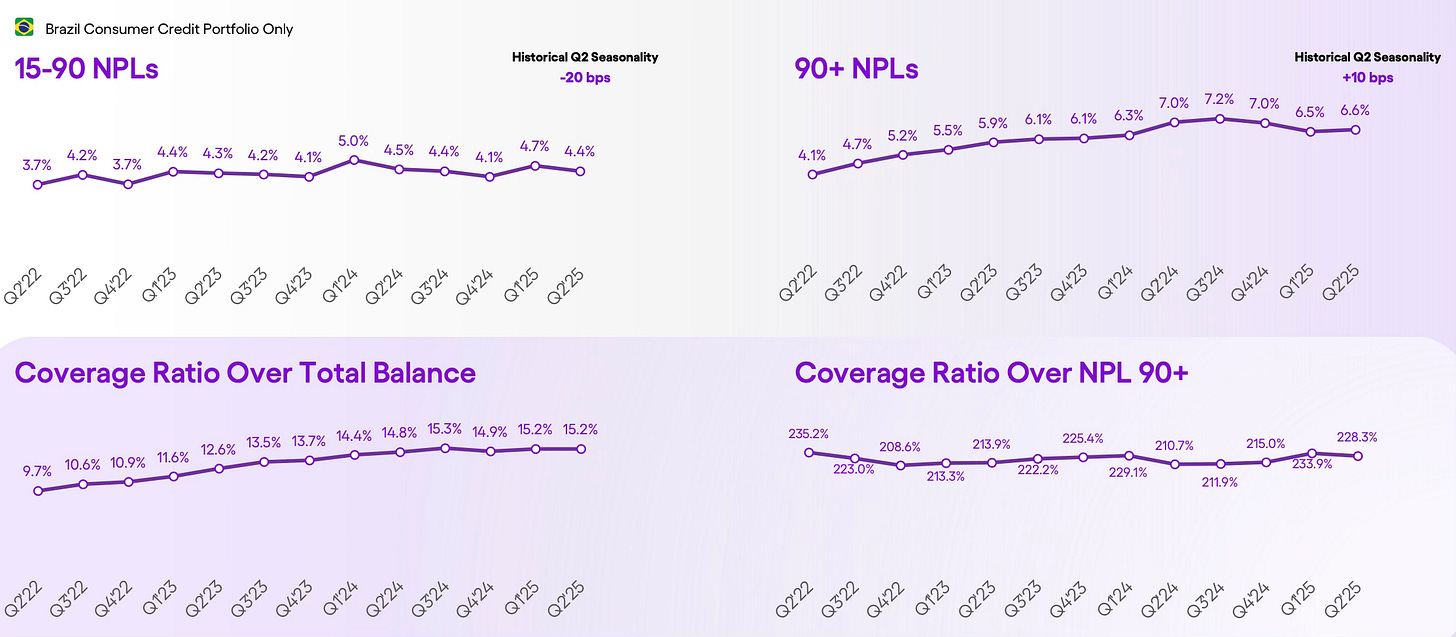

Nu’s total credit portfolio grew to $27.3 billion in Q2 2025, up 40% YoY and 8% QoQ FXN. Credit cards rose 24% to $18.2 billion, unsecured loans increased 70% to $6.8 billion, and secured loans jumped 200% to $2.3 billion. Delinquency in Brazil outperformed seasonal norms, with 15–90 day NPLs down 30 bps to 4.4% and 90+ day NPLs up just 10 bps to 6.6%, both in line with or better than expectations. Management highlighted that asset quality remains resilient despite macroeconomic concerns.

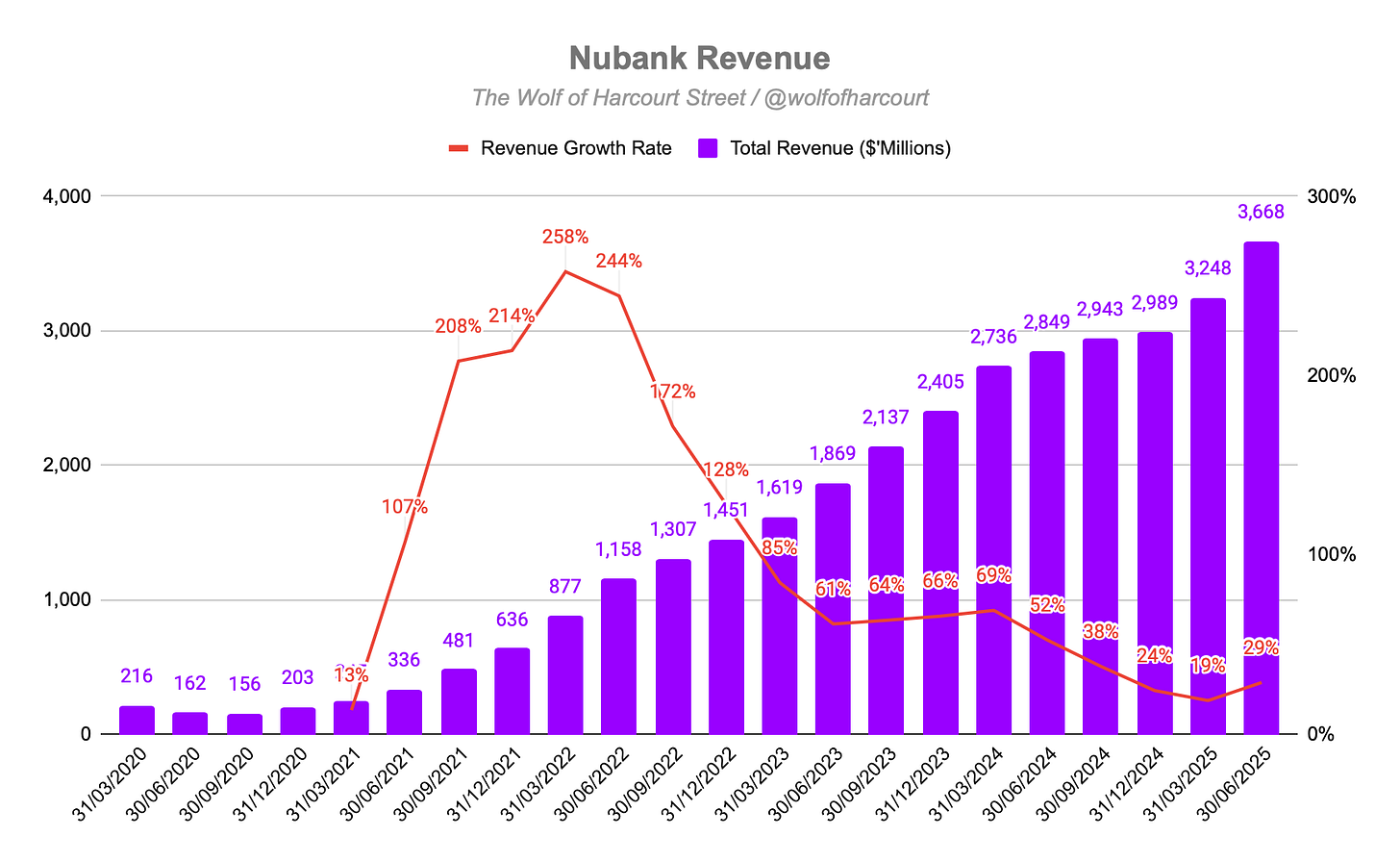

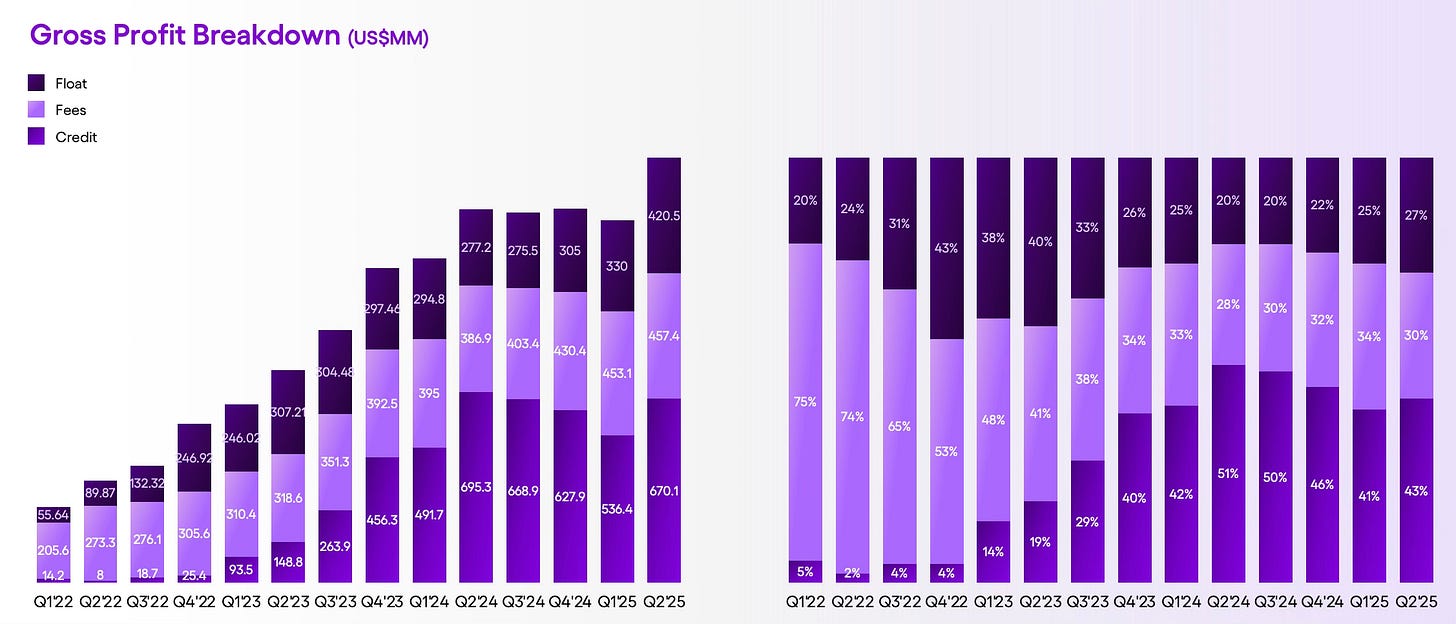

Revenue rose 29% to $3.67 billion, the fastest growth since Q3 2024, with FXN growth of 40% driven by customer expansion and a record ARPAC of $12.2, up 18% YoY. Gross profit reached a record $1.55 billion, up 24% FXN, with margin improving sequentially to 42%, though down from 48% YoY. Interest income margins fell to 35% due to higher deposit costs in Mexico and Colombia and a temporary impact from credit model upgrades in Brazil that front-loaded provisions ahead of related revenue.

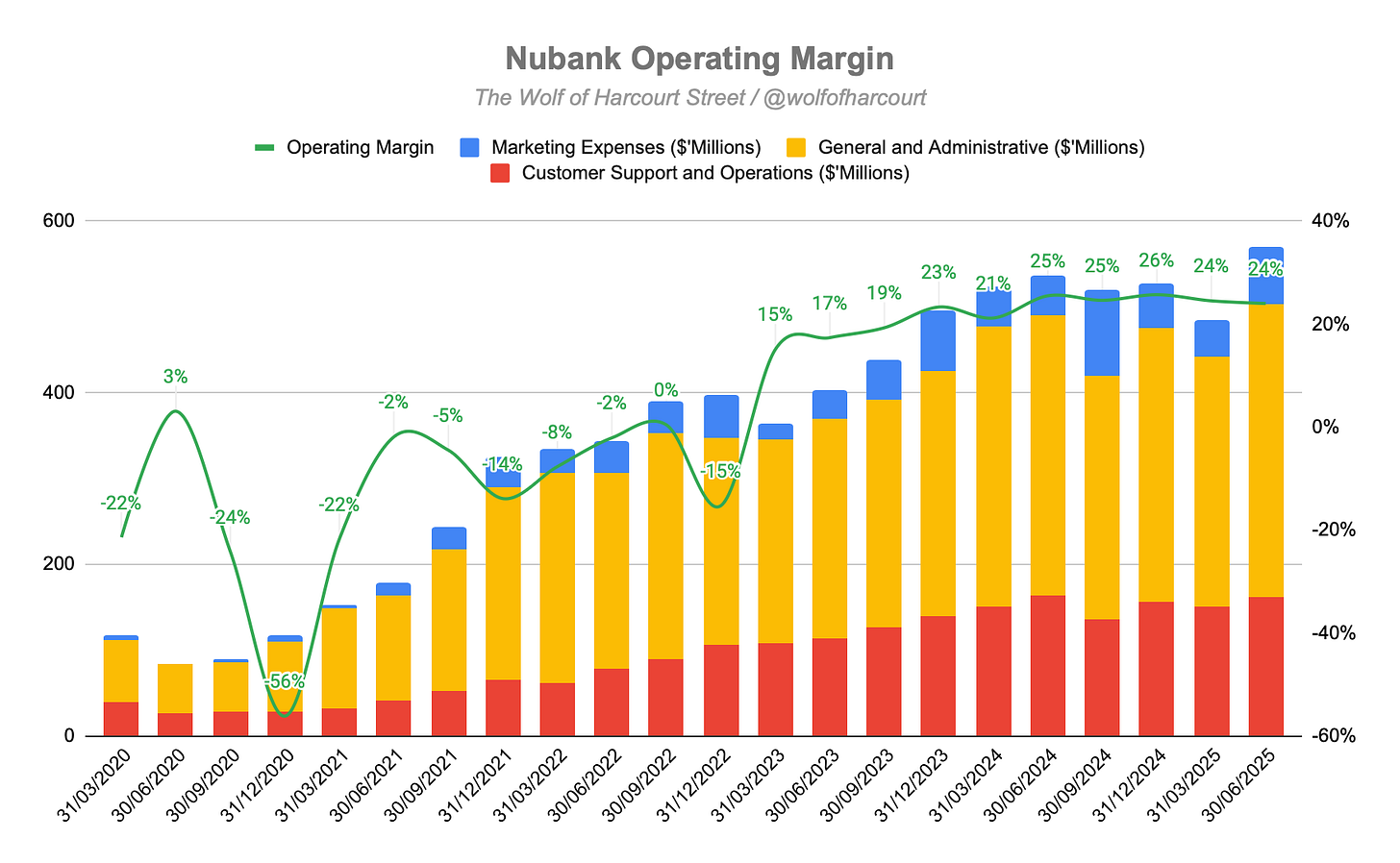

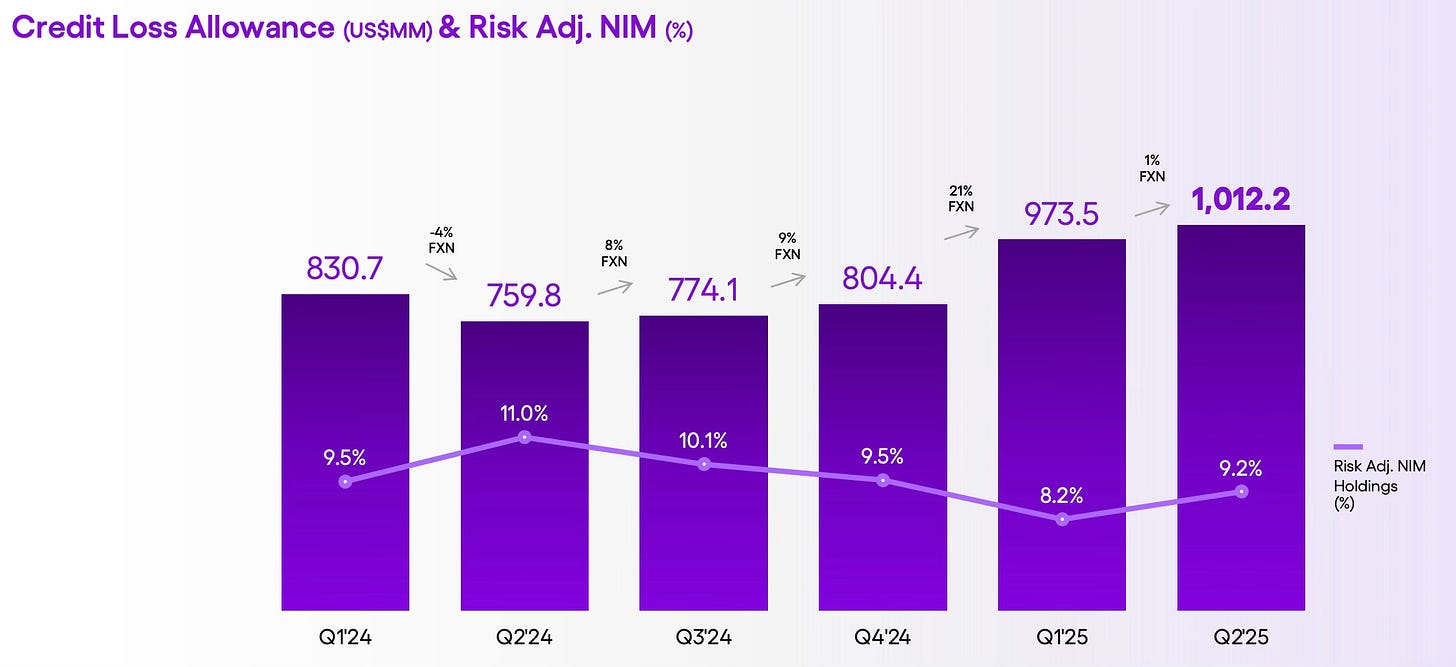

Operating profit grew 21% YoY to $879 million, with the operating margin slightly declining to 24% from 25% YoY but remaining flat sequentially. The margin dip was entirely due to lower gross margins, as operating expenses rose more slowly than revenue, demonstrating clear operating leverage. Customer service, G&A, and marketing expenses fell to 16% of revenue, down from 19% YoY. On the risk-adjusted side, Net Interest Margin (NIM) improved 100 bps sequentially to 9.2%, ending three quarters of contraction, driven by strong Net Interest Income that more than offset higher Credit Loss Allowances.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $3.67 billion (+29% YoY)

Interest Income: $3.13 billion (+31% YoY)

Fees: $540 million (+16% YoY)

Operating Profit: $879 million (+21% YoY)

Net Profit: $637 million (+31% YoY)

2. Wall Street Expectations

Revenue: $3.67 billion (in line)

EPS: $0.13 (in line)

3. Business Activity

Customers

Despite Nu’s scale, customer growth remains strong, with 4.2 million new customers added in the quarter, bringing the total to 122.7 million. Over the past 12 months, Nu has added 18.2 million new customers, representing 17% YoY growth.

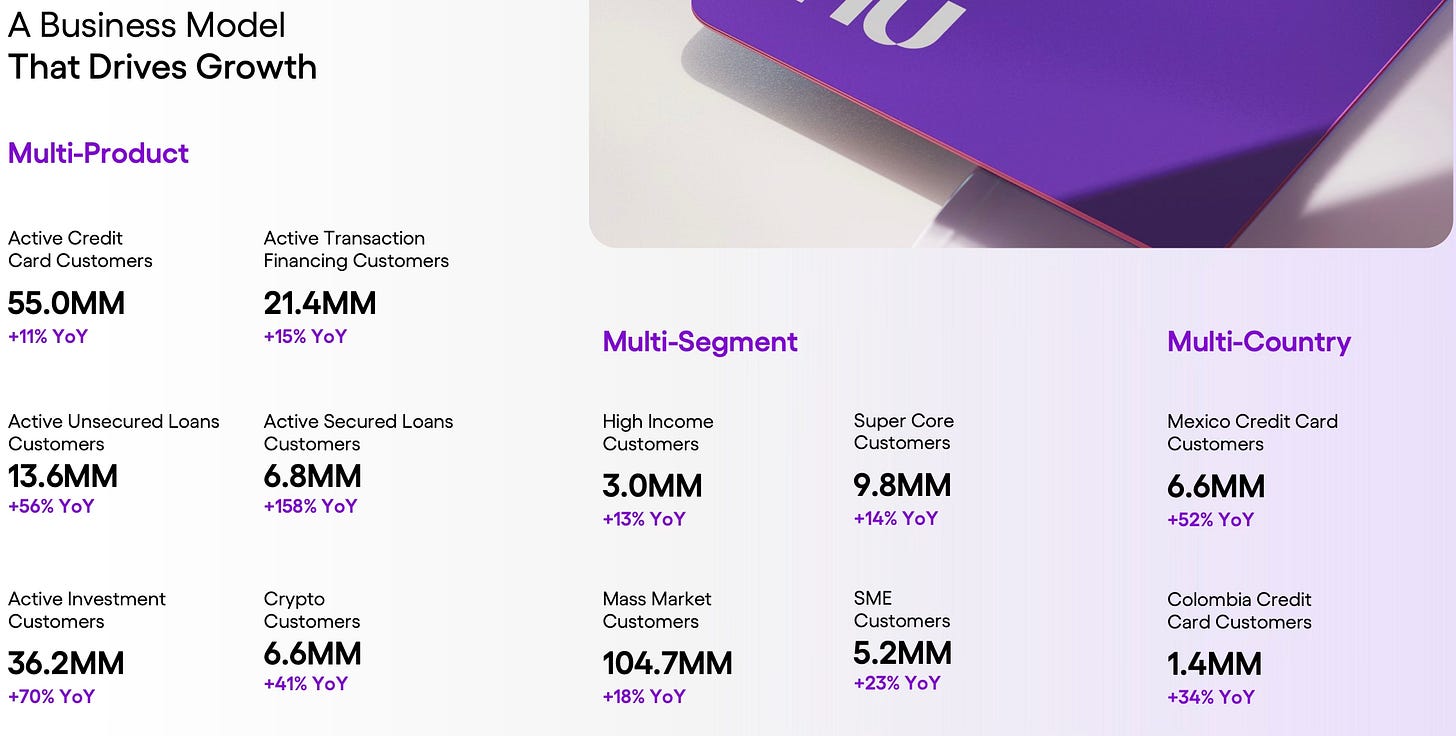

The customer activity rate remained stable at 83%, resulting in active customers surpassing 100 million for the first time. The Nu platform has evolved into a powerful multiproduct, multisegment, multi-geo growth engine.

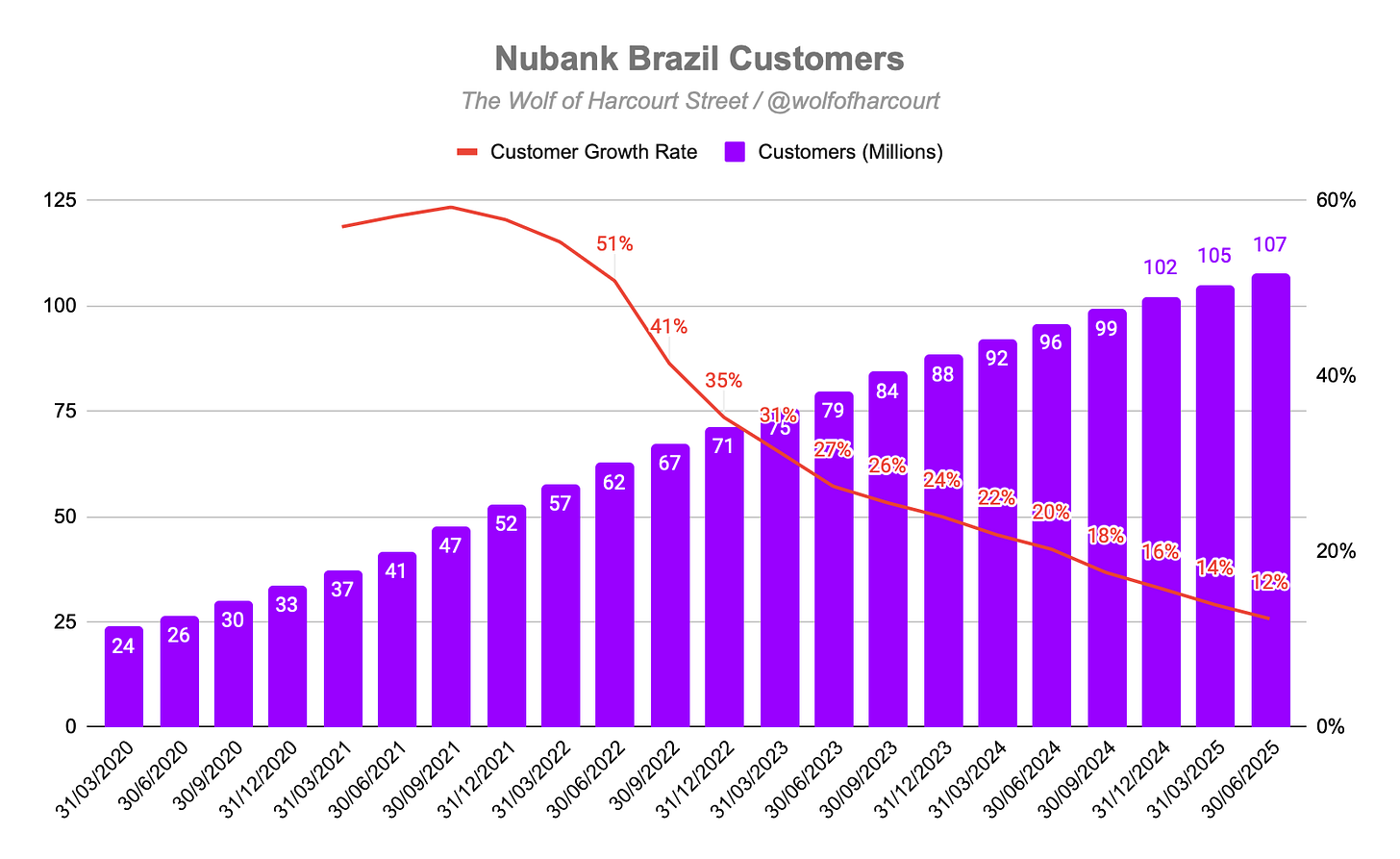

Brazil

The customer base grew 12% YoY to 107 million, reaching 60% of the adult population. Despite high penetration, almost 1 million new customers continue to join each month.

Mexico

Added 1 million new customers, bringing the total to 12 million, now covering 13% of the adult population. Nu is in the early stages of building a full-scale retail banking platform in Mexico.

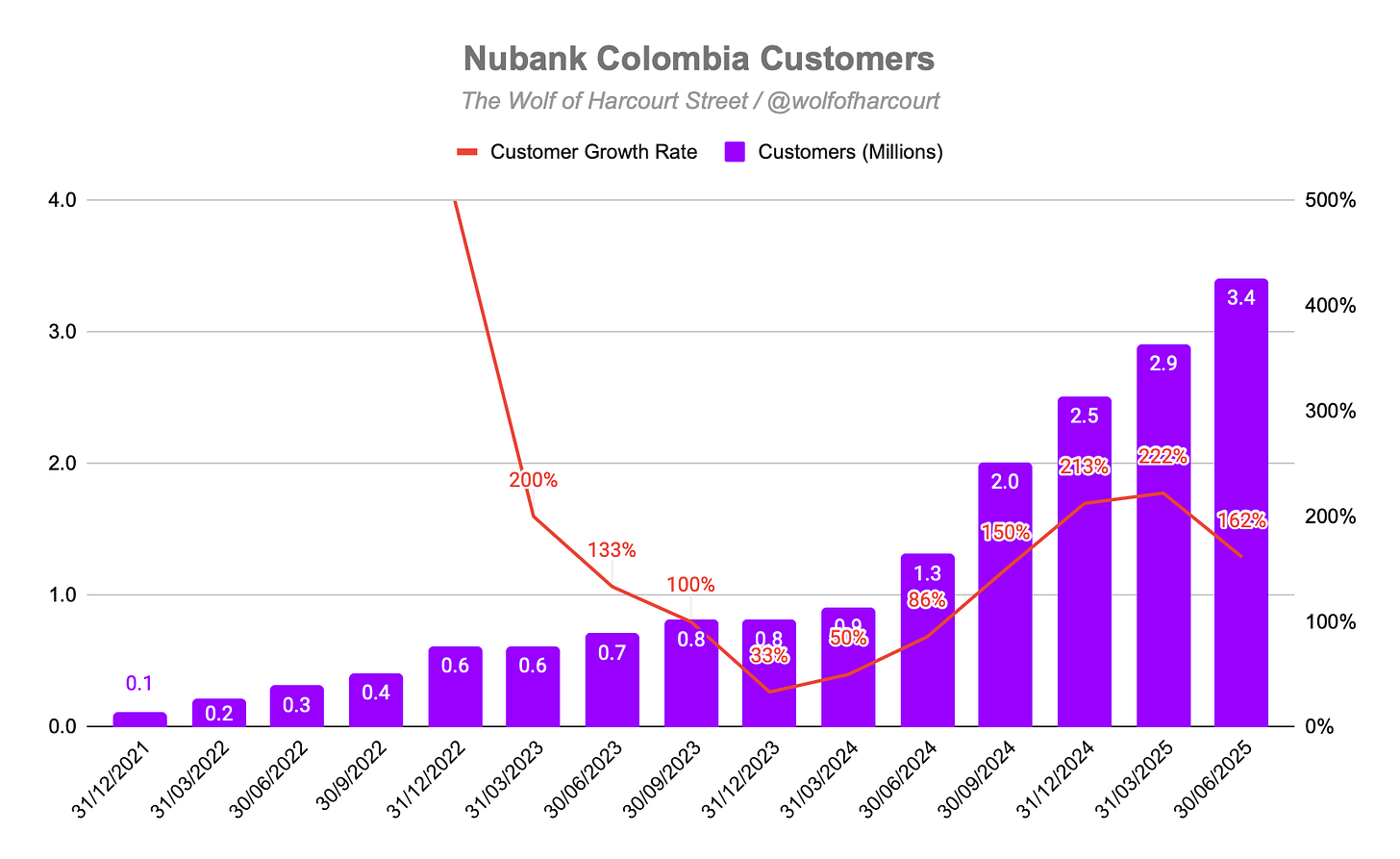

Colombia

Remains the smallest but fastest-growing market for Nu. Customer count has almost tripled over the past year, reaching 3.4 million at the end of Q2. Nu is nearing a major inflection point, with almost 10% of the adult population now using its services.

Deposits

Total deposits increased 41% YoY (FXN) to $36.6 billion, with strong growth across all three markets:

Brazil: Deposits reached $27.8 billion, up 28% YoY and 14% QoQ (FXN). Growth was driven primarily by higher customer engagement and share of wallet, rather than higher deposit rates. The cost of funding has remained largely unchanged at low 80s. Expansion into more affluent segments also contributed.

Mexico: Deposits doubled YoY and rose 24% QoQ to $6.7 billion, despite a reduced spread over the interbank rate. In early July 2025, Nu redesigned and repriced its deposits, aiming to gradually lower funding costs while adding new features (e.g., OXXO distribution, cash withdrawal).

Colombia: Deposits increased almost 10-fold YoY and 17% QoQ to $1.3 billion, just four quarters after launching NuColombia’s checking account. Like Mexico, Nu is gradually lowering yields, with the full impact expected over time.

The cost of funding for the quarter was 91% of the blended interbank rates, up from 87% a year ago. As noted in previous reviews, deposit costs in Mexico and Colombia are higher than in Brazil. The loan-to-deposit ratio fell slightly to 43% (from 44%), as deposit growth outpaced loan growth.

Management stated on the conference call that they are comfortable with this ratio across markets, given the resilience of retail deposits. Nu is actively reshaping deposit size and pricing in Mexico and Colombia to lift Net Interest Margin (NIM), while Brazil’s NIM is expected to remain stable.

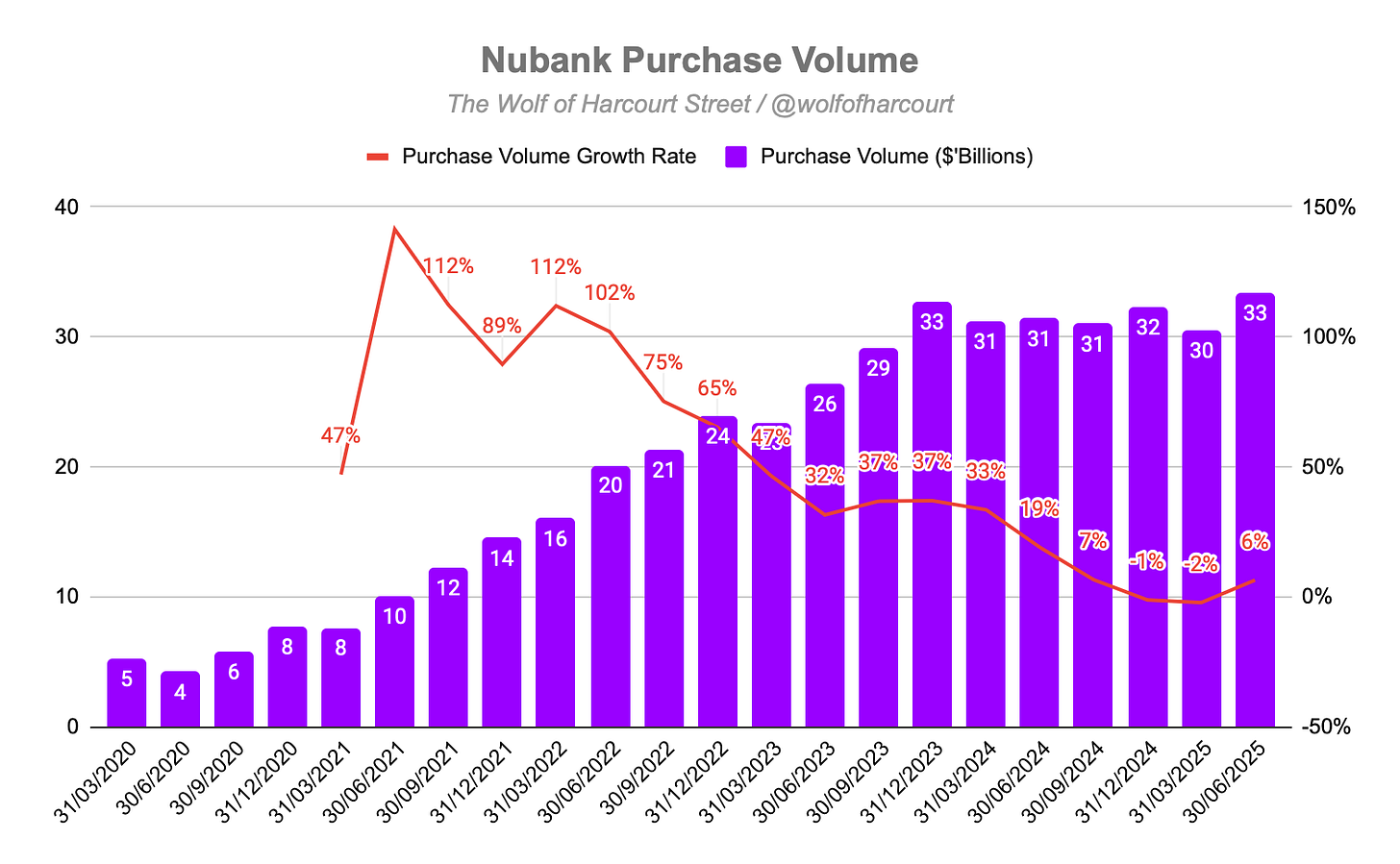

Purchase Volume

On a reported basis, Purchase Volume (PV) grew 6% YoY to $33.3 billion. On an FXN basis, growth was 3% YoY. QoQ growth was 10%. Note that PV excludes other payment methods Nu offers, such as PIX transfers, WhatsApp payments, and wire transfers.

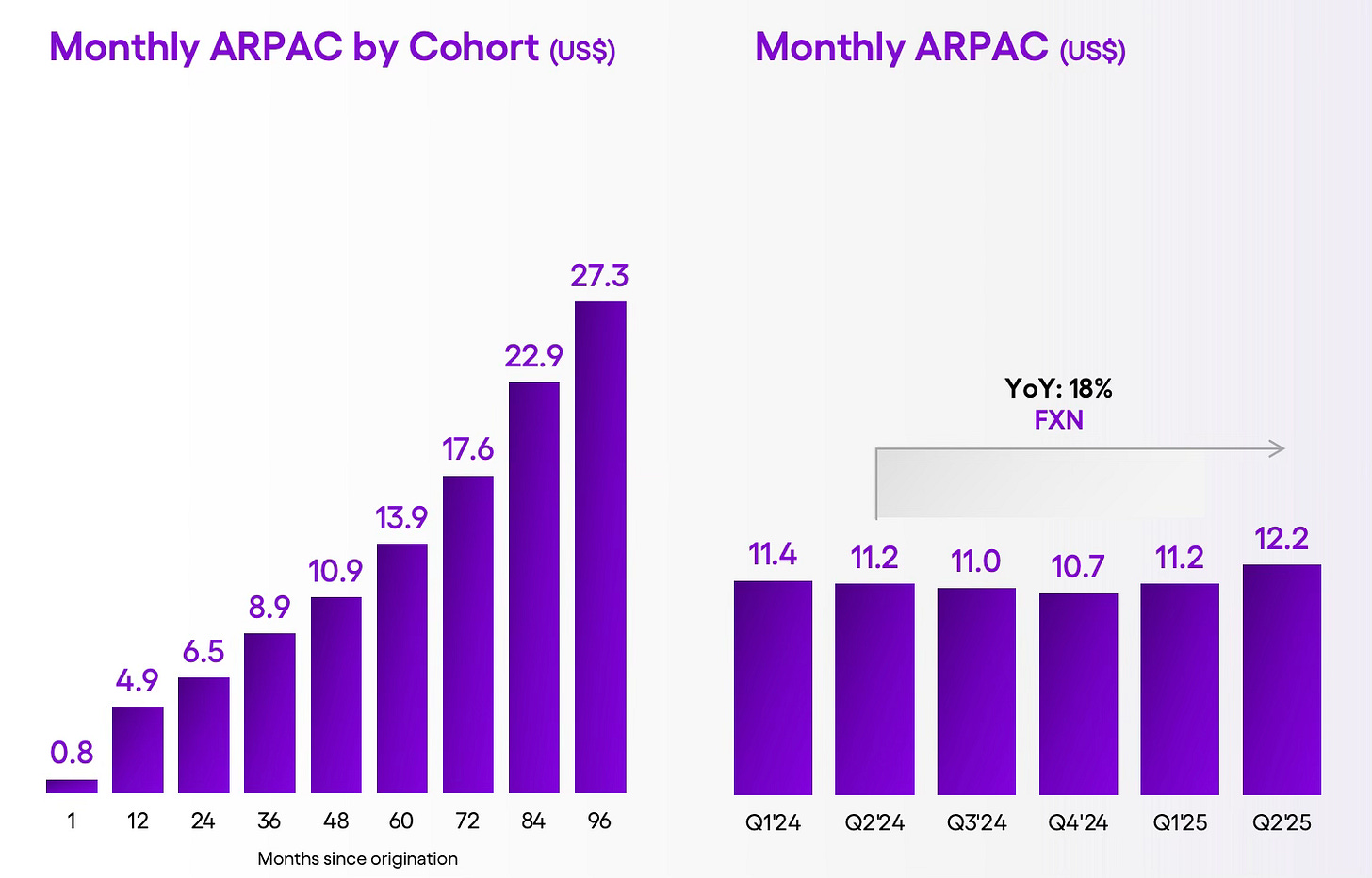

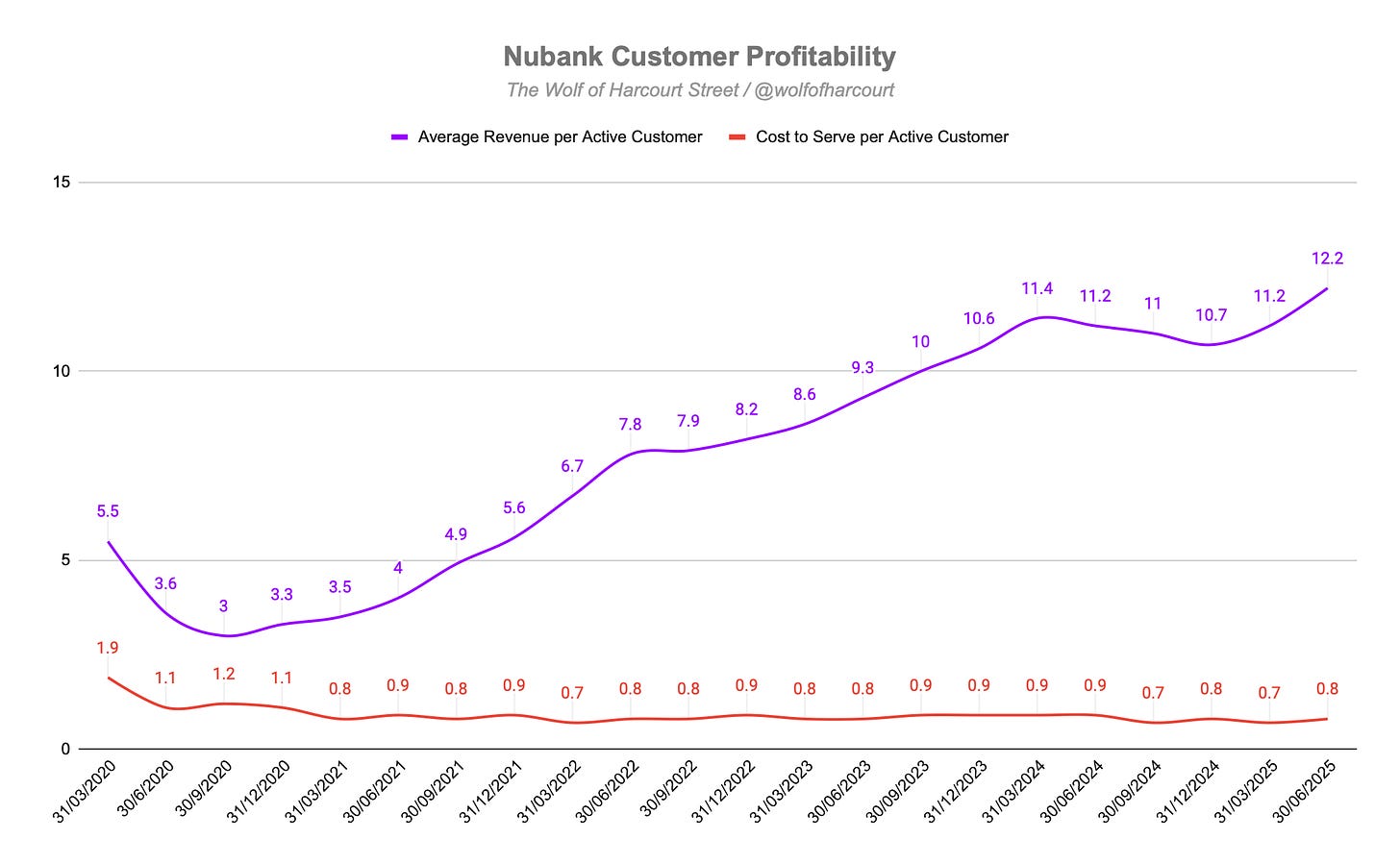

Monthly Average Revenue Per Active Customer

Monthly Average Revenue Per Active Customer (ARPAC) reached $12.2 in Q2 2025, up 18% YoY (FXN), marking a new record and the first time above $12. The CAGR since 2021 is 34% FXN. For long-tenured customers, ARPAC reached $27.3.

Nu aims to lift ARPAC toward $30–$40, closer to incumbent banks (~$45). Credit is expected to be the main driver, given it accounts for 65–70% of the retail banking profit pool in Latin America.

Credit Portfolio

The total credit portfolio reached $27.3 billion in Q2 2025, growing 40% YoY FXN and 8% QoQ FXN. Diversification continues, with secured and unsecured loans now making up over one-third of the portfolio, up from 25% a year ago.

Credit Cards: Grew 24% YoY to $18.2 billion. Brazil’s portfolio emphasizes instalment balances for more predictable returns, supported by new models and AI-driven risk tools. Nu gained over 100 bps of market share in Brazil’s credit card receivables during the quarter.

Unsecured Loans: Grew 70% YoY to $6.8 billion, holding over 20% market share in new originations in Brazil.

Secured Loans: Grew 200% YoY to $2.3 billion despite INSS disruptions that cut industry origination by 50%. Nu launched a private payroll loan product in April 2025, approaching the segment cautiously but with high long-term expectations.

Delinquency

Delinquency trends for Brazil’s consumer credit portfolio were better than seasonal norms:

15–90 Day NPL: Fell to 4.4% (down 30 bps QoQ), better than the typical 20 bps seasonal drop.

90+ Day NPL: Rose 10 bps to 6.6%, in line with expected seasonality.

Despite concerns among investors about the macro situation in Brazil, Nu emphasised that there was no material deterioration in asset quality. The company continues to underwrite assuming future conditions will be worse than past cycles, ensuring each unsecured credit cohort remains NPV-positive even under higher loss scenarios.

“So far, and I say so far until now, August 14, we haven't seen kind of that deterioration playing out materially in our asset quality figures. All of our asset quality figures are performing largely as expected.”

Guilherme Marques do Lago, CFO

4. Financial Analysis

Revenue

Nu’s quarterly revenue growth accelerated to 29%, the fastest rate since Q3 2024, reaching $3.67 billion. On an FXN basis, revenue grew 40% YoY, driven by continued customer growth and the compounding effect of rising ARPAC, which has grown at an 85% annualised rate since 2021.

Interest income (85% of total revenue) rose 31% YoY to $3.1 billion.

Fees (15% of total revenue) increased 16% YoY to $540 million.

Gross Margin

Nu posted a record gross profit of $1.55 billion, up 24% YoY FXN. The gross profit margin improved sequentially to 42% in Q2 2025 (from 41% in Q1), although it was down from 48% YoY.

Interest income gross margin fell to 35% (from 40% YoY).

Fees gross margin slipped slightly to 85% (from 86% YoY).

Two main factors drove the interest income margin decline:

Higher deposit costs in Mexico and Colombia reduce incremental gross margins compared to Brazil. While absolute profit dollars remain healthy, these markets will structurally carry lower margins.

Credit model upgrades in Brazil early in Q2 led to higher credit card limits and a front-loading of expected credit losses, creating a temporary mismatch where provisions were booked before the related revenue. Excluding this, credit loss allowance would have declined QoQ on an FXN basis.

A new disclosure highlighted that fees and float are now meaningful contributors to gross profit, adding resilience and consistency across economic cycles. Management described Nu’s “credit-first” model as fueling a “principality flywheel”, enabling cross-sell and broader gross profit diversification.

Operating Margin

Operating profit reached $879 million, up 21% YoY. The operating margin slipped to 24% (from 25% YoY) but was flat sequentially. This decline was entirely due to lower gross margin, as operating expenses rose more slowly than revenue, indicating operating leverage.

Customer service, G&A, and marketing expenses dropped to 16% of revenue, down from 19% YoY.

Marketing expenses were flat YoY but up sequentially, reflecting strategic investment to strengthen Nu’s brand leadership in Latin America.

The cost to serve per active customer remained extremely low at $0.80, down 3% YoY FXN. Nu’s average revenue per active customer is 15x its cost to serve, underscoring one of its most important competitive advantages.

Risk-Adjusted Net Interest Margin

Risk-Adjusted NIM rose 100 bps sequentially to 9.2%, breaking a three-quarter streak of contraction. This improvement came from strong Net Interest Income growth, which more than offset higher Credit Loss Allowances.

In Brazil, NIM continued to expand on healthy spreads and growing volumes.

In Mexico and Colombia, margins remain temporarily lower due to ongoing investments, which management views as essential to unlocking long-term value.

5. Conclusion

CEO David Vélez used this earnings call to introduce three major leadership hires:

Eric Young (Chief Technology Officer) and Ethan Eismann (Chief Design Officer) were brought on to prepare Nu for the “next stage” and its internationalisation plans over the next few years, helping the company “play in the big leagues.”

Roberto Campos Neto joined as Vice Chairman and Global Head of Public Policy. This is the most notable addition, as he previously served as Governor of the Central Bank of Brazil, bringing deep regulatory insight and strategic vision on how technology and policy can shape inclusive financial systems. Campos Neto played a pivotal role in implementing PIX, making him a highly strategic hire for Nu’s positioning in Latin America, particularly given its regulated entities in Brazil, Mexico, and Colombia, with more expected as Nu expands. Last week, Nu released a 40-minute interview between Vélez and Campos Neto, which is well worth watching.

Coming into this report, my two key watch points were NIM compression and the deliberate PIX financing slowdown. Both showed positive developments:

NIM Compression: Nu reversed the compression trend and is well-positioned going forward, even with this quarter’s front-loading of expected credit losses in Brazil, which created a temporary timing mismatch between provisions and revenue.

PIX Financing Slowdown: PIX financing, the largest part of Nu’s transactional financing products, resumed growth. As of Q1 2025, the PIX and transactional financing portfolio was already larger than in Q2 2024, and growth continued into Q2. Over 40% of Nu’s credit card customers are now active with some type of transactional financing, primarily PIX, indicating a very high and healthy attach rate.

I entered this earnings season slightly cautious, concerned that these two areas could again drag on revenue and earnings. That was not the case, Nu delivered a solid report with positive momentum in nearly every area.

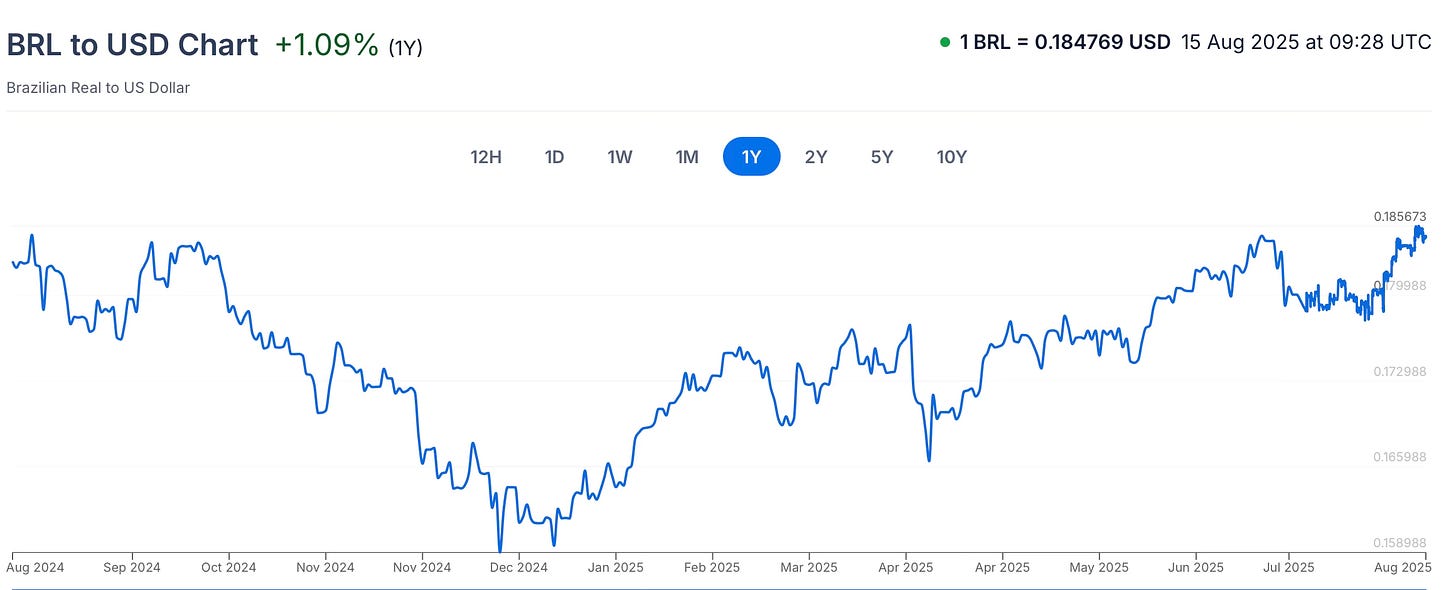

A previous headwind, FX pressure from the Brazilian Real’s depreciation in late 2024, is now turning favorable. For Q3, FX may be a minor tailwind, but by Q4 it could become a material tailwind if current levels hold. The Real is up 14% YTD in 2025.

Over the past five years, Nu’s revenue and earnings growth came largely from adding new customers, a 4x increase in that time. Over the next five years, growth will depend more on monetisation and wallet share. Nu’s model, acquire at scale, deepen engagement, and monetise as cohorts mature, positions it well to maximise lifetime value from its large and engaged customer base by expanding product usage, increasing wallet share, and leveraging its highly efficient digital platform.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

How do you think MELI and NU will compete?

The best analysis on Nu out there! However, I disagree on 2 things:

1. "new disclosure highlighted that fees and float are now meaningful contributors to gross profit" - Fees and Float were always meaningful contributors, credit is new within the mix.

2. "not as cheap as it was" - on forward earnings Nu is now the cheapest ever, compared to its listed history.