For years I managed my portfolio the same way many individual investors do, manually in Google Sheets, pulling data from separate brokerage statements. Every transaction meant multiple updates. Every month-end review meant reconciling numbers across platforms. Every allocation decision was clouded by fragmented data.

Brokerage statements were basically useless. If you hold the same stock across multiple accounts, those statements tell you nothing about your true position size or your portfolio-level allocation.

In 2021 after years of inefficiency I found Portseido. Four years later it remains the backbone of my portfolio management process and the source of the verified performance data I share each month in this newsletter.

What Portseido Actually Does

Portseido is a portfolio tracking and analytics platform for individual investors who want institutional-grade tools without institutional complexity. It solves a simple problem, it consolidates holdings across multiple brokers into one accurate real-time view.

The real value is not the consolidation itself, it is what you can do once the data is unified.

The platform connects to brokers directly or accepts spreadsheet upload. Once connected it tracks transactions, dividends, fees and performance across your entire portfolio. The interface is clean, the visuals are clear and the analytics run deeper than any free tool I have used.

The Features That Matter

After four years of use these are the capabilities I rely on most:

1. Effortless Transaction Management

Every buy or sell updates in seconds. No formulas to maintain, no broken links, no version control issues. This sounds trivial until you have done it the hard way.

2. True Portfolio Allocation View

Portseido displays both market value and cost basis allocation at the portfolio level. When I held 25 positions across three brokers this was transformative. What looked like a 3% position at Broker A and 2 percent at Broker B was in reality a 5% allocation. This clarity helped me consolidate down to 15 positions.

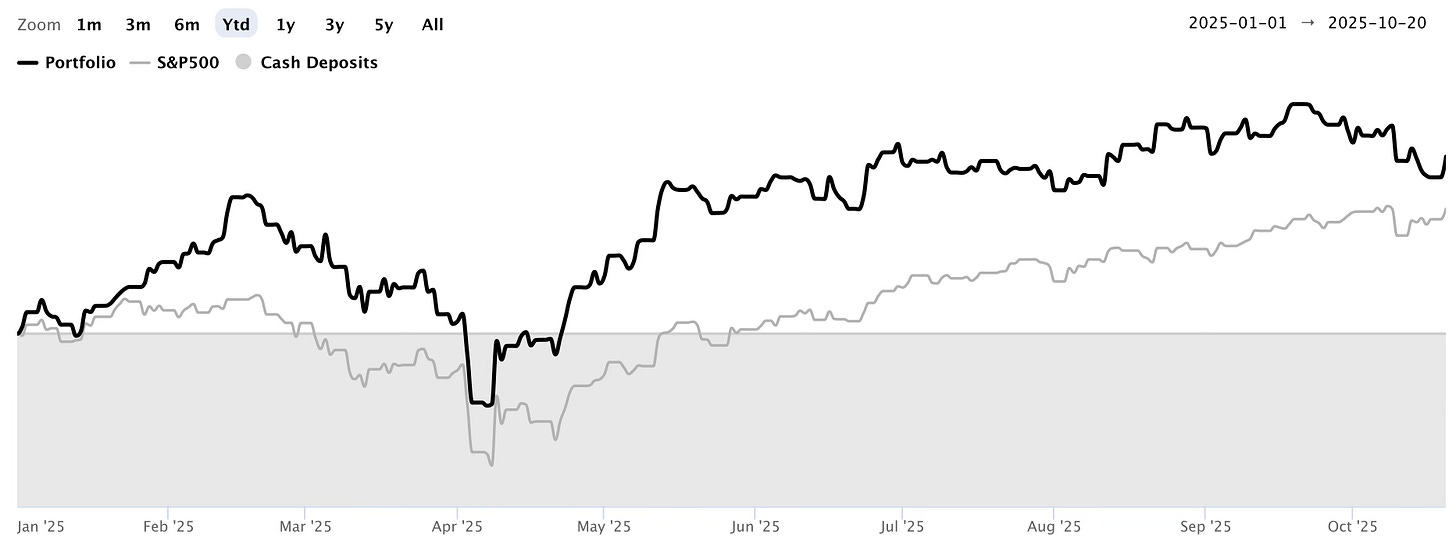

3. Verified Performance Data

As someone who publishes monthly portfolio reviews, I need performance numbers that are accurate, auditable, and presentation-ready. Portseido’s performance tracking accounts for cash flows, timing, and dividends automatically. The platform generates performance data I can share with confidence, benchmarked against the S&P 500.

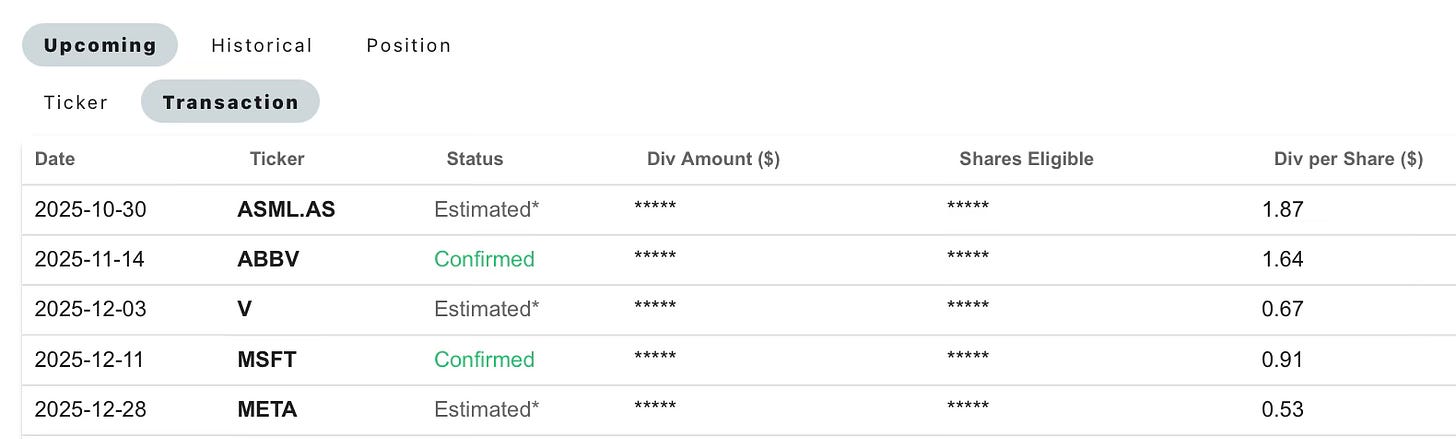

4. Automatic Dividend Tracking

Dividends are notoriously tedious to track manually, especially with reinvestment and timing considerations. Portseido automatically updates when dividends are declared and displays dividend yield, total dividend income, and projected future income. For income-focused investors, this feature alone justifies the subscription.

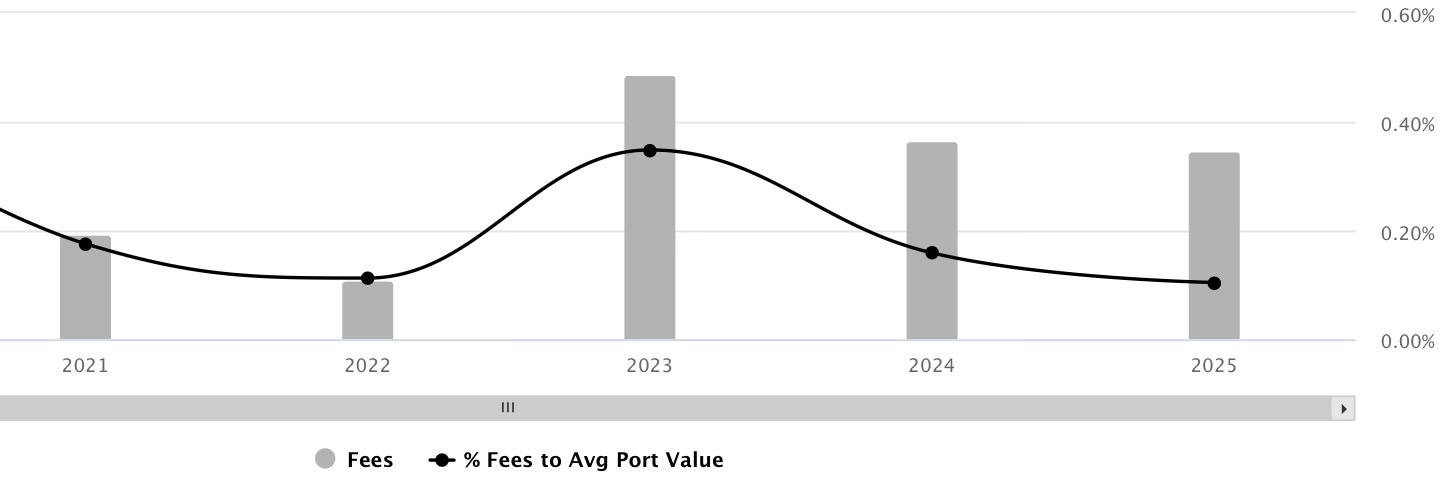

5. Fee Transparency

Portseido tracks fees as an absolute number and as a percentage of portfolio value. Seeing my annual fees as a percentage of AUM in 2023 prompted me to switch brokers. That single decision paid for the subscription several times over. Without this visibility I likely would not have noticed the fee drag until it compounded over years.

The Workflow in Practice

My typical workflow is straightforward:

Weekly check-ins: I log in to review allocation, performance, and any dividend updates. This takes 5-10 minutes.

Transaction updates: After any buy or sell, I update Portseido immediately, usually takes under a minute.

Monthly reviews: At month-end, I pull performance data, heat maps, and allocation charts for my newsletter. The visuals are export-ready.

The data visualisation tools are where Portseido truly shines. The charts I use most frequently include:

Market value allocation pie chart: Shows current position sizing across the portfolio.

Cost allocation pie chart: Reveals where my capital is actually deployed.

Sector allocation breakdown: Highlights sector concentration and diversification gaps.

Performance vs. S&P 500 benchmark: Tracks relative performance over time periods.

Performance heat map by stock: Instantly identifies winners, losers, and laggards.

Time Saved

Before Portseido, I spent 2 to 3 hours per week maintaining spreadsheets, reconciling data, and building charts. That is more than 100 hours per year that should have gone to research, not admin.

Now, portfolio administration takes less than an hour per month, a reduction of more than 90 percent. For anyone who takes portfolio management seriously, that time recapture is meaningful.

Cost

Portseido offers a free tier. The paid tier starts at $8 per month.

For context, if the fee transparency feature saves you even 10 basis points annually on a $100,000 portfolio, that is $100 per year. The tool pays for itself in the first month.

Who Should Use This

Portseido suits individual investors who:

Hold positions across multiple brokers

Want institutional-grade analytics without complexity

Track performance seriously, especially if publishing results

Need accurate dividend and fee tracking

Value their time and want to eliminate manual admin

If you manage a personal portfolio with any seriousness, it is worth evaluating.

Limitations

Portseido is not a financial planning tool. It does not offer tax optimisation features, and it is built around equities rather than multi-asset portfolios or alternatives. If you need derivatives tracking, you will need other tools.

However, the development team is highly responsive. When I have requested features or workflow improvements, they have been receptive and often implement suggestions. That responsiveness is rare and valuable.

There is also a mobile app for on-the-go monitoring.

Final Assessment

After four years and hundreds of hours of use, Portseido is now indispensable to my investment process. It turned portfolio tracking from a labor-heavy chore into a streamlined, insight-driven workflow.

The platform does not make decisions for you, it gives you the data infrastructure to make better decisions yourself. For disciplined, fundamentally driven investors, that is exactly what a tool should do.

If you are still using spreadsheets or relying on broker statements alone, you are operating with incomplete information. Portseido solves that cleanly and at low cost.

If you’d like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today’s edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Do you ever worry about a 3rd party having access to all your accounts or them getting hacked and breaching your accounts some how?

Does it incorporate your entire brokerage history upon connecting to the API (I assume that's how you plug in the data)?